Gelling Agent Market Size and Forecast 2025 to 2034

The global gelling agent market size is valued at USD 5.37 billion in 2025 and is predicted to increase from USD 5.64 billion in 2026 to approximately USD 8.28 billion by 2034, expanding at a CAGR of 4.92% from 2025 to 2034. The increasing demand for clean and plant-based additives from different industries is driving the growth of the gelling agent market.

Gelling Agent Market Key Takeaways

- North America dominated the global gelling agent market in 2024.

- Asia Pacific is projected to grow at a solid CAGR during the predicted period.

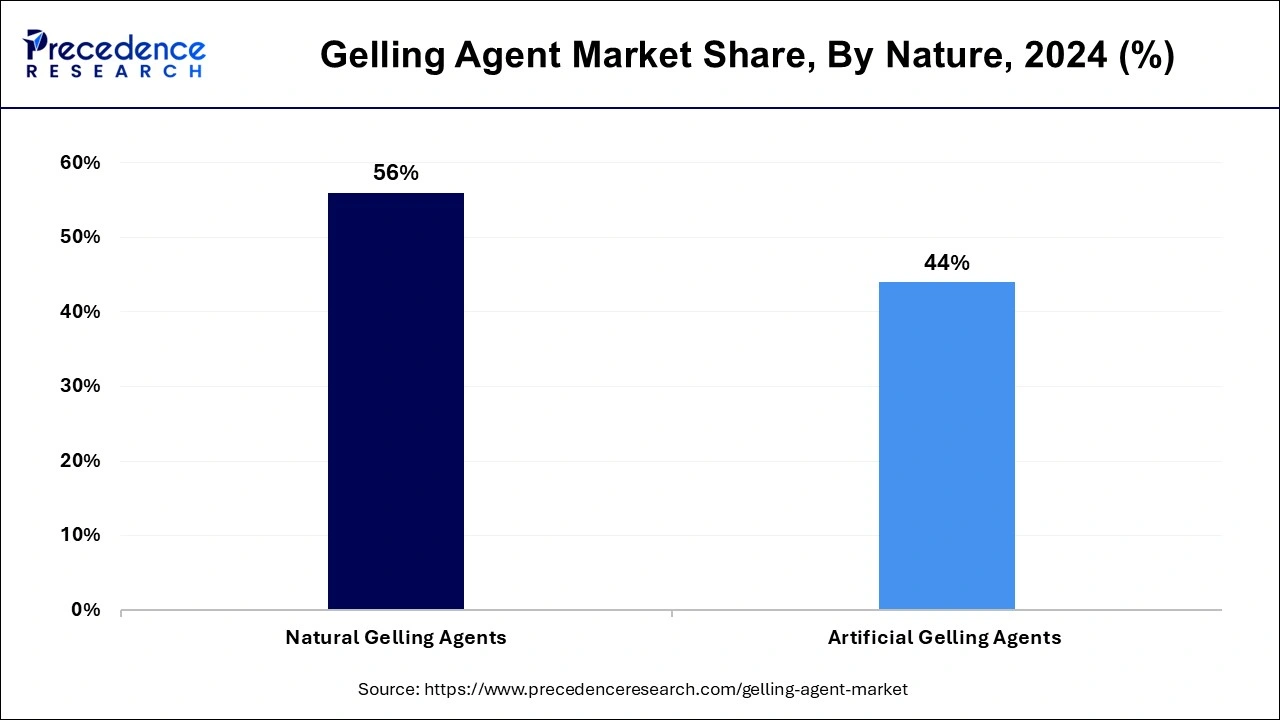

- By nature, the natural gelling agents segment contributed the highest market share of 56% in 2024.

- By nature, the artificial gelling agents segment expects significant growth during the forecast period.

- By product type, the gelling gum segment dominated the market in 2024.

- By product type, the agar-agar segment will witness substantial growth in the market during the predicted period.

- By function, the stabilizers segment dominated the market in 2024.

- By function, the thickener segment expects notable growth during the forecast period.

How does AI impact the Gelling Agent Market?

Artificial intelligence (AI) can have a positive impact on the market. AI has the ability to accelerate the formulation of new gelling agents. Using AI and Machine Learning technologies enhances the quality control process in manufacturing, leading to the production of high-quality gelling agents that meet stringent regulatory standards of food agencies. In addition, AI technologies automate manufacturing processes and reduce waste generation, which helps save resources, thereby reducing manufacturing and product costs.

Market Overview

The gelling agents are also known as additives or solidifiers. It has a gel-like texture and reacts with oil to form rubber-like solids. The gelling agent can be made naturally or artificially with simple sugar like glucose. It is an FDA-approved food additive that can be used in different types of food materials, such as thicker emulsifiers, stabilizers, and sometimes as a preservative. The gelling agent helps stabilize or improve the viscosity, structure, and color preservation in food products.

Gelling Agent Market Growth Factors

- Rising demand from industries: The increasing demand for gelling agents from a wide range of industries including food, cosmetics, pharmaceutical, chemicals, and others as a stabilizer, thickeners, and other different properties in their respective products are contributing in the growth of the gelling agent market.

- Increasing demand for natural ingredients: The increasing awareness regarding the adoption of natural ingredients or materials into different food, cosmetics, or medicinal products due to their lower side effects and enhanced effectivity, which boosts the demand for the gelling agent by the industries.

- Widespread adoption by dairy products: Dairy products are one of the largest consumers of gelling agents; they are used as stabilizers, thickeners, and emulsifiers in milk-based products, which helps in giving them a smooth texture and creamy taste. The increasing demand for dairy-based products is accelerating the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 5.64 Billion |

| Market Size in 2025 | USD 5.37 Billion |

| Market Size in 2034 | USD 8.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Nature, Product, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Benefits associated with gelling agents

There is increasing awareness about the health benefits of the gelling agent market, such as improved gut health and enhanced digestion. There are several gelling agents that are used as an additive in food and cosmetics products. Gelling agents are used as a nutritional supplement in different plant-based products. Additionally, there are significant benefits of different gelling agents in skincare products, such as maintaining the pH level of the skin and others.

Restraint

Insufficient antimicrobial properties

In the gelling agent, there is a lack of antimicrobial properties, which makes it necessary to use preservatives at the time of formulation in any type of product, and the availability of the alternatives collectively limits the growth of the gelling agent market.

Opportunity

Increasing demand from the cosmetics industry

The rapid evaluation of the cosmetic industry is owing to the continuous demand for new and innovative skincare and cosmetics products. The increasing adoption of the gelling agent into the wide range of cosmetic products as a thickener, natural polymer, and gums is driving the growth in the demand for the gelling agent. Xanthan gum, hydroxyethylcellulose, acacia gum, konjac, sclerotium gum, and hyaluronic acid are some types of gelling agents that are used in cosmetic products. The rise in the cosmetic industry is driving the potential opportunity for gelling agent market expansion.

Nature Insights

The natural gelling agents segment led the global gelling agent market in 2024. The rising demand for clean and sustainable sources of gelling agents is causing a higher demand for natural gelling agents. The increasing adoption of natural gelling agents from a wide range of industries, such as pharmaceuticals, food, chemicals, and others in different industrial applications, is accelerating the expansion of natural gelling agents.

The artificial gelling agents segment expects significant growth in the gelling agent market during the forecast period. The increasing demand for artificial gelling agents from the wide range of industries due to its long-lasting properties and superior quality. Many industries prefer artificial gelling agents due to their cost-effectiveness and quality.

Product Type Insights

The gellan gum segment dominated the gelling agent market in 2024. The Magellan gums are a type of food additive. It added different types of food material, typically for binding, texturizes, and processed food. It can be produced both naturally and artificially. It is naturally produced in the water lilies and can be artificially produced by sugar fermentation with some specific type of bacteria. Gellan gums are typically used in food and beverage products like juices and plant-based milk to dissolve the supplement nutrients evenly into the beverage rather than just lie down at the bottom of the container. It is used in desserts to give them a smooth and creamy texture.

The agar-agar segment will witness substantial growth in the gelling agent market during the predicted period. The agar-agar is also one of the types of gelling agents that is derived naturally from the red algae. It is a totally vegan type of food additive that can be consumed by people with a vegan diet. The agar-agar has no taste or smell, which makes it an ideal choice as the gelling additive in different types of food products. It is firmer than the gelatin and can also be set at room temperature. It is highly digestive and improves gut health. The rising acceptance of agar-agar from different brands of food and beverages is accelerating the demand for the gelling agent.

Function Insights

The stabilizers segment dominated the gelling agent market in 2024. The gelling agent can be used in the different industries including food, pharmaceuticals, cosmetics, chemicals, and others offering variety of functions to the different industrial applications. Gelling agents are used as stabilizers in the product. The gelling agent works as a stabilizer in the food product to dissolve or mix into the product evenly. Carrageenan, agar, and pectin are some types of stabilizers that are used in dairy products, syrups, and others.

The thickener segment expects notable growth in the gelling agent market during the forecast period. Thickener is the type of additive that is used in food products to improve their viscosity without causing any taste change. It is mostly used in soups, gravies, sauces, puddings, and gravies. Proteins like gelatin or polysaccharides like starches are some types of thickeners that are mostly used by different food brands.

Regional Insights

North America dominated the gelling agent market in 2024. The growth of the market is attributed to the rising demand for the food and beverages industry and acceptance of the fast food and ready-to-eat food segment due to the changing lifestyle of people and low availability of the time, which causes the higher demand for the different types of gelling agent for making of a number of food items in which it can be used as a preservative, emulsifiers, thickeners, and stabilizers which creates the boosts in the market expansion. Additionally, there is a rising demand for gelling agents from industries such as cosmetics, chemicals, pharmaceuticals, and others.

- The all-food Consumer Pricing Index (CPI) increased by 25.0% from 2019-2023. It is the highest among all-item CPI, which increased by 19.2% in the same period. The total spending by the U.S. consumer on domestically produced food is 26.1% of the wholesale (11.4 cents) and retail (14.7 cents) trade.

Asia Pacific is expecting substantial growth in the market during the predicted period. The growth of the market is owing to the rising population and the increasing demand for the food industry, as well as the rising consumption of packaged food products by regional countries such as India, China, Japan, and South Korea is driving the expansion of the gelling agent for the manufacturing of the food products. The increasing awareness regarding gelling agents and additives in pharmaceuticals.

Food consumption is expected to reach USD 1.2 trillion by 2025-26 due to the changing consumption pattern and growing urbanization. India's food processing industry is expected to reach USD 1,100 billion by FY35, USD 1,500 billion by FY40, USD 1,900 billion by FY45, and USD 2,150 billion by FY47 according to the Viksit Bharat@2047 report.

Gelling Agent Market Companies

- Cargill Incorporated

- Tate & Lyle

- Archer Daniels Midland Company

- Ingredion Incorporated

- Naturex

- Kerry Group

- Agro Gums

- Riken Vitamin

- CP Kelon

- E. I. DuPont De Nemours

Latest Announcement by Industry Leaders

- In November 2024, Cargill Incorporated was awarded two of the nine awards at the Fi Europe's Innovation Awards, held at the Fi Europe in Frankfurt. Anne Mertens-Hoyng, Cargill Category Leader for chocolate confectionery and ice cream, said, “The world around us is changing, with a rapidly growing population and a growing demand for more sustainable foods. We need to develop a future-proof food model capable of efficiently replicating consumers' favorite food products in a more sustainable way,”

Recent Developments

- In July 2024, KMC, a Danish ingredient supplier, introduced the potato-starch-based new gelling agent following the plant-based confectionery production having a soft, chewy texture.

- In August 2024, Traumagel, the latest bleeding control tool, gets approval from the Food and Drug Administration's medical device clearance, which can address severe bleeding in seconds. It is the 30-ml syringe of an algae- and fungi-based hemostatic gel with the texture and color of hummus.

Segments Covered in the Report

By Nature

- Natural Gelling Agents

- Artificial Gelling Agents

By Product

- Agar-Agar

- Gellan Gum

- Xanthan Gum

- Karaya Gum

- Gelatin

- Pectin

- Guar Gum

- Gum Arabic

By Function

- Stabilizers

- Thickener

- Texturizer

- Emulsifier

ByGeography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content