Industrial Batteries Market

Industrial Batteries Market Revenue and Trends

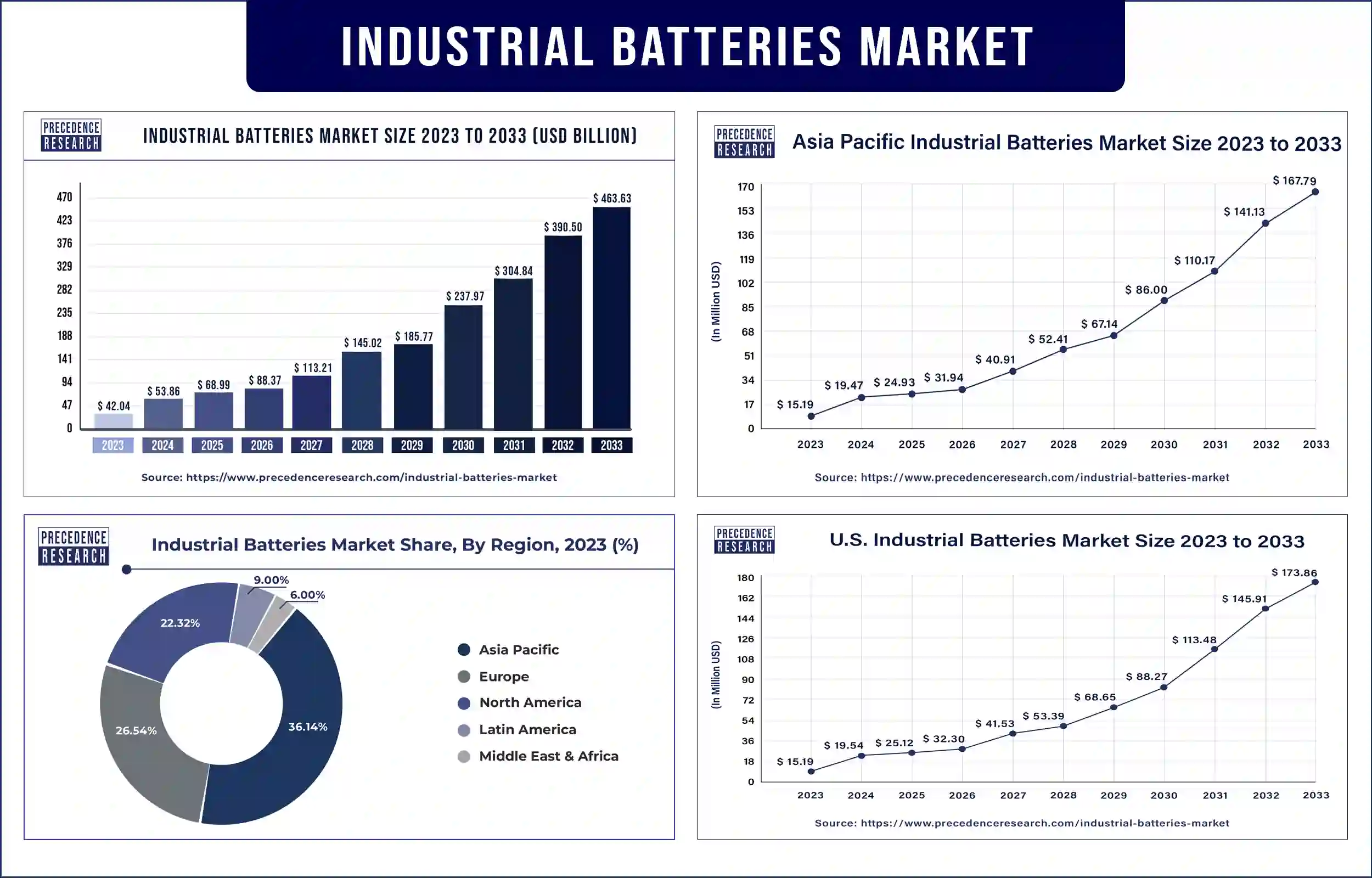

The global industrial batteries market revenue was valued at USD 42.04 billion in 2023 and is poised to grow from USD 53.86 billion in 2024 to USD 463.63 billion by 2033, at a CAGR of 27.02% during the forecast period 2024 - 2033. The rising adoption of lithium-ion batteries in the sustainable energy sector is expected to drive the growth of the industrial batteries market.

Market Overview

The industrial batteries market is expected to supply energy to heavy equipment, lifting materials, and electric vehicles such as trucks and forklifts. Industrial batteries also provide a power source for several data centers and enable continuous internet access. Industrial batteries are used in different types of applications, such as industrial machinery, telecommunications, electric grid storage, and power storage.

The increasing growth in the stationary end-use industry, increasing favorable government policies, and implementation of government regulations regarding carbon emissions are anticipated to drive the growth of the market. In addition, the rapidly increasing demand for clean energy storage solutions, increasing dependency on electrical devices, and growing electrification in most of the sectors such as household, commercial, and industrial are expected to accelerate the growth and demand for the industrial batteries market during the forecast period.

Increasing adoption of renewable energy to fuel market growth

The incorporation of renewable energy sources such as wind power and solar has stimulated the market for industrial batteries. There is an increasing demand to store and capture energy from variable renewable sources as the world focuses more on combating climate change and decreasing carbon emissions. Industrial batteries play an important role in closing the gap between energy consumption and production by acting as energy storage devices.

The demand for industrial batteries is rising as businesses and governments set high aims for enhancing the capacity of sustainable energy sources. In addition, industrial batteries also help to improve commercial organizations, grid operators, and grid resilience, lessen dependency on fossil fuels, and maximize energy efficiency. These are the major driving factors anticipated to drive the growth of the industrial batteries market.

However, the impact of battery manufacturing and disposal may restrain the growth of the market. Industrial batteries are essential for electric transportation and energy storage, but their disposal and production can have negative effects on the environment. The extraction of raw materials such as nickel, cobalt, and lithium during the production of batteries, especially those tailoring chemistries like lithium-iron, can cause resource depletion and destroy ecosystems.

Due to the risk of the buildup of electronic waste and harmful chemical risks, industrial batteries must also be disposed of carefully. Poor disposal methods brought on by a lack of recycling infrastructure can destroy water and soil sources. These are the major restraining factors expected to hinder the growth of the industrial batteries market.

Industrial Batteries Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 53.86 Billion |

| Market Revenue by 2033 | USD 463.63 Billion |

| Market CAGR | 27.02% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Batteries Market Top Companies

- Rolls Battery

- Komatsu

- Orion S.A.

- Sunlight

- Hoppecke

- Saft Group

- Vision Group

- Narada Group

- LG Chem

- Samsung SDI Co., Ltd.

- Leoch International Technology Limited Inc.

- East Penn Manufacturing Company

- Crown Batteries

- Exide Industries Ltd.

- Johnson Controls Inc.

- Exide Technologies Inc.

- Enersys Inc.

- Saft Groupe S.A.

- Northstar Battery Company LLC

- C&D Technologies, Inc.

- Robert Bosch GmbH

- East Penn Manufacturing Company

- Toshiba International Corporation

Recent Innovation in the Industrial Batteries Market by Komatsu

- In October 2023, the leader in manufacturing Lithium-ion power systems, Green Cubes Technology launched commercial availability of its Swappable Mobile Power portfolio. This power portfolio included SWIB-1000 Industrial Battery. This SWIB-1000 provides the highest Watt-Hour ratings for swappable Lithium Iron Phosphate industrial batteries.

Recent Innovation in Industrial Batteries Market by Orion S.A.

- In October 2023, a global specialty chemicals company, Orion S.A., announced the launch of a high-quality conductive additive, PRINTEX kappa 10. This new and innovative high-quality additive provides increasing demand from manufacturers of lithium-ion batteries for consumer applications, energy storage systems, and electric vehicles.

Regional Insights

Asia Pacific dominated the industrial batteries market in 2023. The increasing rapid industrialization, growing development of the IT sector, rising adoption of renewable energy sources, increasing demand for energy storage solutions, and increasing growth of the manufacturing sector in the region are expected to drive the growth of the industrial batteries market in Asia Pacific. China, India, Japan, and South Korea are the major leading companies in the Asia Pacific region. China has one of the largest industrial batteries markets in the Asia Pacific. China is contributing significant growth in the manufacturing sector, which is accelerating the demand for industrial batteries for energy storage and backup power solutions. Chinese government initiatives to enhance the adoption of renewable energy sources are another driving factor of the market.

- For instance; in October 2023, the investments of China in the Lithium battery industry are coming back to materialize the smaller battery manufacturers of the country who have invested billions of subsidies provided by the government and to take advantage of the rising demands. The battery manufacturers of China produced 4,8000 gigawatt-hours of batteries. The manufacturing capacity of battery factories in China is expected to reach approximately 22 million electric vehicles.

North America is expected to grow significantly during the forecast period. The rising need for energy storage solutions in the industrial sector in emerging countries and increasing demand for industrial batteries in the various sectors such as the IT sector, electric grid storage, and automobile industry are anticipated to enhance the growth of the market in North America U.S. and Canada are the major leading countries in North America. The increasing demand for non-residential infrastructure and growing investments in eco-innovations such as forklifts, cranes, and electric bikes are estimated to accelerate the growth of the industrial batteries market in North America.

Market Potential and Growth Opportunity

Increasing battery innovation by key market players

There is significant growth in the research and development activities by battery manufacturers for raising different battery chemistries. Market players are focusing on advancing industrial batteries based on lithium-ion technology. However, lithium-ion batteries have a longer life and are precisely advanced, and many manufacturers are also producing these batteries. Various emerging countries have no domestic manufacturers and import these batteries. However, various industrial battery manufacturers are now investing in launching new products. These are the major opportunities expected to accelerate the growth of the industrial batteries market in the coming years.

Industrial Batteries Market News

- In November 2023, in Europe, a new thematic ETF was launched by BlackRock on the lithium industry battery. These Battery Producers, UCITS ETF and iShares Lithium have been listed with an expense ratio of 0.55% on Euronext Amsterdam. These firms are included in the development of lithium batteries, such as battery producers, compound manufacturers, and miners.

- In May 2023, a new compact Battery Management System, the c-BMS24X, was launched by Sensata Technologies. This new battery management system meets the latest market demands for industrial applications, energy storage systems, and low-voltage electric vehicles. In addition, this new battery management system allows improvements in battery performance and health in industrial applications.

Market Segmentation

By Type

- Lithium-Based

- Nickel-Based

- Lead-Acid Based

- Others

By Application

- Electric Grid Storage

- Industrial Equipment

- Power Storages

- Telecommunication

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2814

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308