Logistics Market Revenue to Attain USD 21.92 Tn by 2033

Logistics Market Revenue and Trends 2025 to 2033

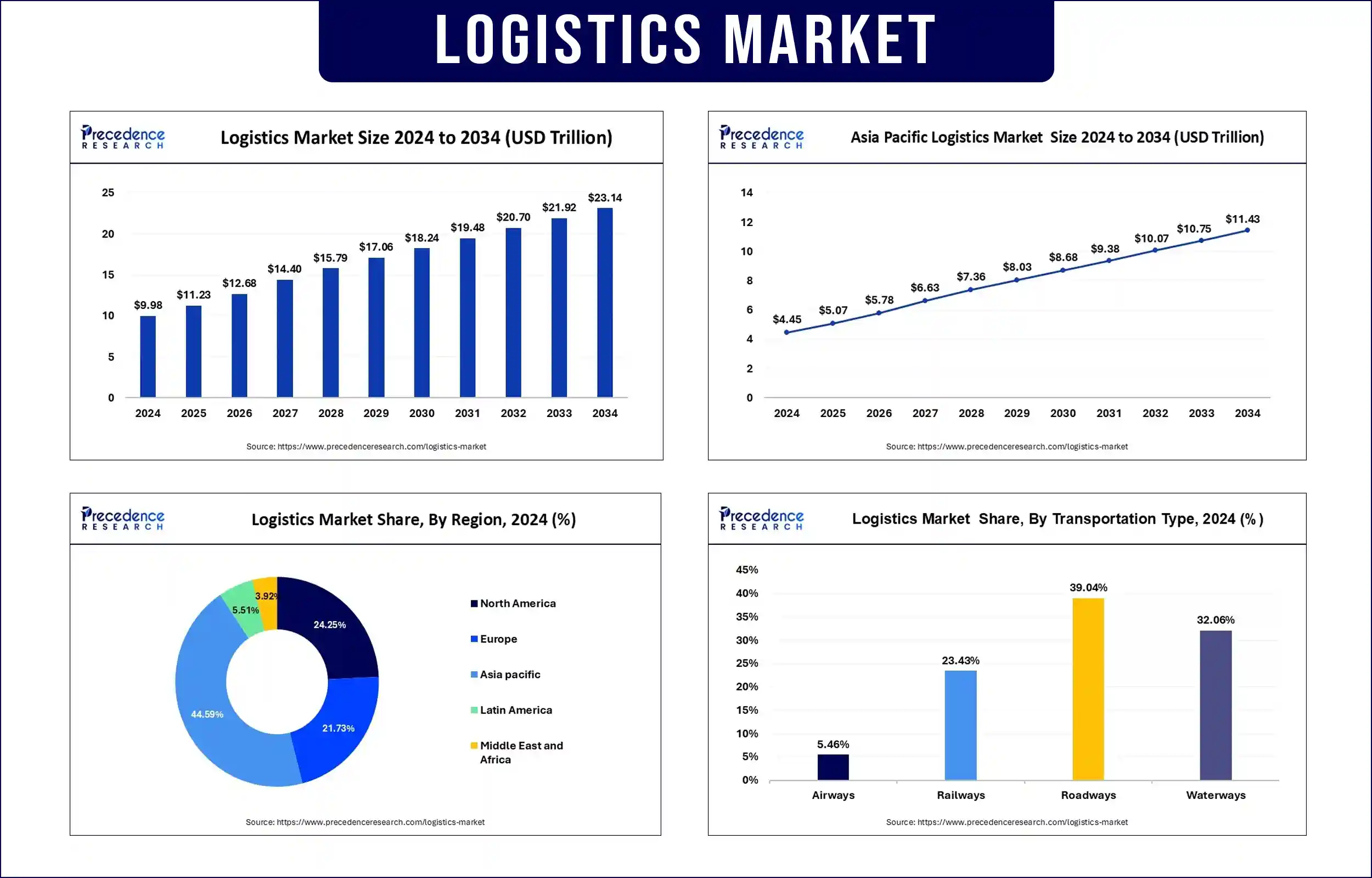

The global logistics market revenue is estimated USD 11.23 trillion in 2025 and is predicted to attain around USD 21.92 trillion by 2033 with a CAGR of 8.36%. The market is expected to expand at a significant growth rate during the forecast period due to rising e-commerce activities, advancements in supply chain technologies, and increasing trade.

Market Overview

The logistics market includes services such as transportation, warehousing, inventory, and packaging for the transfer of goods from producers to consumers. The market is greatly influenced by the ever-growing e-commerce sector and the necessity to make supply chain operations smoother. The International Transport Forum forecasted that the global freight demand will triple by 2050, exerting pressure on the logistics network. This, in turn, boosts investments in smart logistics infrastructure. Furthermore, the implementation of real-time tracking systems and warehousing automation, and the rising demand for immediate deliveries are transforming the logistics environment to provide more agile and resilient services.

Logistics Market Trends

Surge in E-commerce Activities and the Need for Last-Mile Delivery

The ever-increasing e-commerce activities across the globe have transformed logistics operations, particularly in urban areas. The rising consumer preference for online purchasing is exerting pressure on logistics providers to provide timely and affordable last-mile deliveries. “As per the UNCTAD 2024 eCommerce Update, online Retail transactions represented 15.3% of global retail transactions in 2023, highlighting the importance of logistics to keep up with them

Technological Integration in Logistics Operations

Logistics operations are transforming through automation, robotics, and AI technologies. Automated storage and retrieval systems (ASRS) in smart warehouses increase the accuracy of operations and lower the costs associated with labor. In 2024, the International Federation of Robotics released statistics that indicated a 10% increase in the deployment of warehouse robots across the world, which showed strong momentum for automation. Such technological integrations enhance efficiency and also support sustainability goals by enabling the efficient utilization of resources and lower emissions.

Sustainability and Green Logistics Initiatives

Environmental predispositions and regulations are urging logistics companies to invest in green traffic and carbon neutrality measures. Logistic providers have embraced electric fleets and energy-efficient warehousing solutions to reduce their carbon footprints. Logistic providers are facing pressure from regulators and customers alike to introduce responsible environmental logistics solutions. In 2024, the World Health Organization (WHO) emphasized that clean logistics infrastructure mitigates the urban air pollution that directly correlates with the incidence of lower-respiratory-disease cases. This encourages the shift toward greener logistics networks in the interest of national climate and public health strategies.

Globalization and Supply Chain Resilience

The increased global trade necessitates that logistics providers address complex cross-border regulatory frameworks and risks of a geopolitical nature. The COVID-19 pandemic and geopolitical tensions caused supply chain disruptions, encouraging logistics providers to diversify their offerings and strengthen supply chains. The WTO’s 2024 Trade Outlook Report demonstrated that resilient supply chains are now a pillar of international trade policy.

Report Highlights of the Logistics Market

Transportation Type Insights

In 2024, the roadways segment held a major share of the market. This is mainly due to strong infrastructure, flexible route networks, and high demand for intra-city deliveries. Road transport continues to play a crucial role in connecting rural and urban regions efficiently, especially for short-haul logistics. On the other hand, the waterways segment is expected to grow at the fastest rate in the coming years, driven by increasing global maritime trade and a push for low-emission shipping alternatives. Governments across Asia Pacific and Europe are investing in port modernization and inland waterway development, bolstering the segmental growth.

Logistics Type Insights

The second party segment led the market in 2024, as companies expanded strategic partnerships with carriers for enhanced control over transportation assets and routes. Meanwhile, the third party segment is projected to grow at the fastest rate during the projection period due to the rising demand for outsourced logistics solutions. Businesses are increasingly relying on 3PL providers for warehousing, distribution, and value-added services, allowing them to focus on core operations.

End User Insights

The industrial and manufacturing sector led the market with the largest share in 2024 and is anticipated to continue its growth trajectory in the upcoming period. The rising need for real-time inventory management in the manufacturing sector is likely to support segmental growth. The growing need to improve supply chain efficiency continues to boost logistics demand in the manufacturing sector. On the other hand, the healthcare sector is expected to grow at a significant rate during the forecast period, driven by the rising need for reliable, temperature-controlled logistics solutions for pharmaceutical products, such as vaccines and drugs. The growing focus on emergency preparedness has made logistics a vital enabler for healthcare delivery.

Regional Insights

Asia Pacific dominated the logistics market with the largest share in 2024. This is mainly due to the increased manufacturing activities, volumes of export-import, and government initiatives aimed at enhancing trade corridors. The Asian Development Bank (ADB) 2024 report identifies projects such as the China-Europe Railway Express and India’s Dedicated Freight Corridors as major logistics drivers. The rapid shift toward digitization and multimodal transport networks further bolstered the regional market growth. The rise of e-commerce also influenced the market in the region.

North America is expected to witness the fastest growth in the coming years. This is mainly due to its well-developed logistics infrastructure, a high adoption of advanced technologies, and rising e-commerce activities. The US Department of Transportation’s 2024 Freight Analysis Framework report demonstrated growth in domestic freight tonnage to support the expansion of warehousing and distribution services. Logistic providers in the region are adopting advanced technologies, such as real-time tracking, predictive analytics, and route optimization solutions to streamline supply chain operations and reduce delivery delays.

Logistics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 11.23 Trillion |

| Market Revenue by 2033 | USD 21.92 Trillion |

| CAGR | 8.36% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments in the Logistics Market

- In March 2025, DP World and India’s Reliance Industries have partnered to introduce a novel logistics solution for the petrochemicals sector, shifting cargo movement from roadways to rail, greatly reducing carbon emissions while boosting operational efficiency. This new route links Reliance’s Jamnagar facility in Gujarat with DP World’s inland container depot (ICD) in Ahmedabad, extending to the port of Mundra. The earlier Mundra-Jamnagar-Mundra journey involved roughly 700km of road transport per container. Now, the Ahmedabad-Jamnagar-Mundra path, also about 700km, is rail-based, resolving the environmental and operational drawbacks of long road hauls without compromising on distance.

- In March 2025, Onward Robotics, a leader in mobile robotics and intelligent software, has signed an agreement to supply its Meet Me automation solution to FST Logistics, a full-service 3PL provider. FST Logistics will adopt Onward Robotics’ innovative Pyxis software and Lumabot autonomous mobile robots (AMRs) to streamline order fulfillment operations. This collaboration aims to help FST meet rising demands in e-commerce, warehousing, and logistics by enhancing efficiency and adapting to evolving supply chain challenges.

- In January 2025, CEVA Logistics unveiled its new sub-brand, CEVA FORPLANET, focused on offering low-carbon and sustainable logistics options to assist companies in reducing environmental impact. This launch highlights CEVA’s dedication to supporting greener global supply chains. As firms set decarbonization targets, CEVA FORPLANET is positioned to help with green transport modes and circular economy models. The suite includes accurate CO2e tracking tools, enabling customers to transparently measure and report their sustainability performance across the supply chain.

- In November 2024, Welspun One, India’s fastest-growing logistics and industrial real estate developer, invested USD 325M in the nation’s largest single-location ‘Grade A’ warehouse and industrial park at the Jawaharlal Nehru Port Authority (JNPA) SEZ in Navi Mumbai. Initially planned as a 1.2 million sq. ft. project requiring ~USD 84M, the venture has now expanded to ~4.45 million sq. ft. of built-up area to meet rising export-import demand linked to the JNPA Port. The scale-up reflects booming logistics infrastructure demand at India’s largest container port.

- In November 2024, C.H. Robinson, a global leader in 3PL and 4PL services, introduced C.H. Robinson Managed Solutions, a next-gen logistics management platform. This development addresses growing market needs by giving shippers seamless access to cutting-edge TMS technology, combined with 3PL managed and 4PL integrated services. This offering delivers unmatched flexibility and scale, ideal for navigating today’s increasingly complex and dynamic supply chain landscape.

Logistics Market Key Players

- United Parcel Service Inc. (UPS)

- MOLLER – MAERSK

- DSV (DSV Panalpina)

- Robinson Worldwide Inc.

- FEDEX

- Kuehne+Nagel

- GEODIS

- Nippon Express

Market Segmentaion

By Transportation Type

- Airways

- Waterways

- Railways

- Roadways

By Logistics Type

- First Party

- Second Party

- Third Party

- Contract Logistics

- Freight Forwarders

- Asset-based logistics provider

- Contract Warehousing

- Providers

- Others

By End User

- Industrial and Manufacturing

- Retail

- Healthcare

- Oil & Gas

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2630

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344