Micro-mobility Charging Infrastructure Market Size to Attain USD 83.78 Billion by 2032

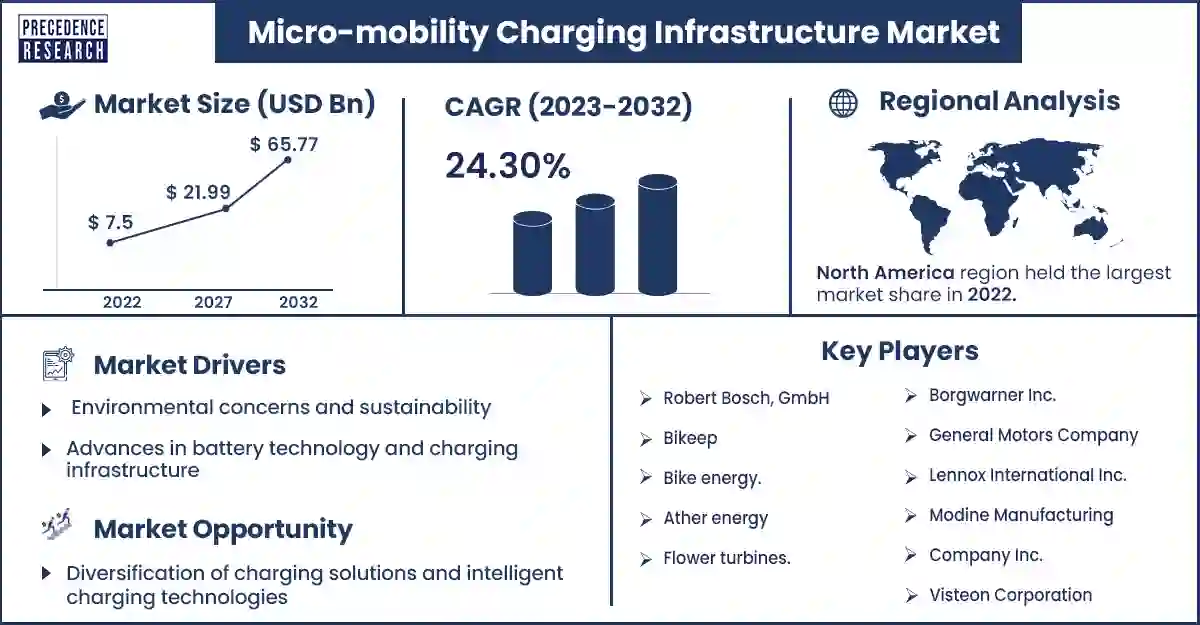

The global micro-mobility charging infrastructure market size surpassed USD 7.50 billion in 2022 and is expected to attain around USD 65.77 billion by 2032, growing at a CAGR of 24.30% from 2023 to 2032.

Market Overview

The micro-mobility charging infrastructure market refers to the segment of the transportation industry that focuses on providing charging solutions for micro-mobility devices such as electric scooters, electric bicycles, and electric skateboards. As these micro-mobility options become increasingly popular in urban areas as a convenient and eco-friendly mode of transportation, the demand for efficient charging infrastructure has risen.

The micro-mobility charging infrastructure market is experiencing significant growth due to the increasing adoption of electric micro-mobility vehicles in urban environments. The market is expected to expand rapidly as more cities and municipalities embrace sustainable transportation solutions to alleviate congestion and reduce carbon emissions. Factors such as government incentives, environmental regulations, and consumer preferences for eco-friendly transportation options drive the demand for micro-mobility charging infrastructure.

The market presents significant opportunities for companies to capitalize on the growing demand for sustainable transportation solutions in urban environments. By providing reliable, accessible, and efficient charging infrastructure, stakeholders can support the widespread adoption of electric micro-mobility vehicles and contribute to building more sustainable and livable cities.

Regional Snapshots

The Asia-Pacific region has emerged as the largest micro-mobility charging infrastructure market due to its massive population, rapid urbanization, and increasing adoption of electric micro-mobility solutions. Cities across China, Japan, South Korea, and Southeast Asia have witnessed a surge in electric scooters and bike-sharing services, leading to growing demand for charging infrastructure. Chinese cities like Beijing and Shanghai have particularly dense charging station networks integrated with bike-sharing programs.

North America has emerged as the fastest-growing market for micro-mobility charging infrastructure, driven by increasing awareness of environmental sustainability, urban congestion, and the need for alternative transportation options. Cities like San Francisco, Los Angeles, and New York have seen a proliferation of electric scooters and bike-sharing services, prompting investments in charging infrastructure by companies such as Lime, Bird, and Spin. Municipalities have also partnered with these companies to integrate charging stations into existing transportation networks, supporting multi-model commuting. The rollout of electric vehicle charging infrastructure has also indirectly benefited micro-mobility by providing additional charging points for electric scooters and bikes.

Micro-mobility Charging Infrastructure Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 9.29 Billion |

| Projected Forecast Revenue by 2032 | USD 65.77 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 24.30% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Environmental concerns and sustainability

Increasing awareness of environmental issues, such as air pollution and climate change, is driving the adoption of electric micro-mobility solutions. As cities strive to reduce greenhouse gas emissions and improve air quality, there is growing interest in replacing traditional fossil fuel-powered transportation with electric alternatives. This demand for eco-friendly mobility options fuels the need for a micro-mobility charging infrastructure market to support electric scooters, bikes, and other micro-mobility vehicles.

Technological advancements

Advances in battery technology and charging infrastructure play a significant role in driving the growth of the micro-mobility charging infrastructure market. Improved battery efficiency, faster charging times, and the development of intelligent charging solutions enhance the feasibility and scalability of electric micro-mobility systems. These technological advancements contribute to expanding charging infrastructure networks and increasing the attractiveness of electric micro-mobility options.

Restraints

Infrastructure costs and regulatory hurdles

Establishing a robust charging infrastructure network requires substantial investment in equipment, installation, maintenance, and operation. The high upfront costs associated with deploying charging stations can be a significant barrier, especially for startups and smaller players in the micro-mobility industry. Regulatory frameworks governing the deployment and operation of charging infrastructure vary across regions and can pose challenges for market participants. Permitting processes, zoning regulations, and compliance requirements may delay the implementation of charging stations and increase administrative burdens.

Limited space and interoperability

Securing suitable locations for charging stations in densely populated urban areas can be challenging due to limited space availability and competing land use priorities. Additionally, ensuring equitable access to charging infrastructure for all users, including those in underserved communities, requires careful planning and coordination. The lack of standardized charging protocols and interoperability between different charging systems can create compatibility issues and fragmentation in the market. Incompatible charging infrastructure may limit the flexibility and convenience of the electric micro-mobility charging infrastructure market, discouraging user adoption.

Opportunities

Expanding market

With the increasing adoption of electric micro-mobility solutions worldwide, there is a growing demand for charging infrastructure to support these vehicles. Companies involved in developing and deploying charging stations can expand their micro-mobility charging infrastructure market reach by targeting regions with high population densities, urbanization rates, and demand for sustainable transportation options.

Diversification of charging solutions and intelligent charging technologies

There is an opportunity to diversify charging solutions to cater to different user needs and preferences. This includes fast-charging stations for on-the-go users, slow-charging stations for overnight charging, and wireless charging technologies for added convenience. Additionally, integrating charging infrastructure into existing urban infrastructure, such as streetlights and benches, can help maximize space utilization and improve accessibility. Integrating innovative charging technologies presents opportunities for optimizing energy use, reducing costs, and enhancing user experience. Intelligent charging solutions can adjust charging rates based on grid conditions, energy demand, and user preferences, improving efficiency and grid stability. Moreover, incorporating connectivity features such as mobile apps and payment systems can enhance the usability and accessibility of charging infrastructure.

Partnership and collaboration

Collaborating with public and private stakeholders, including government agencies, utilities, transportation companies, and real estate developers, can help drive the deployment of charging infrastructure. Partnerships can facilitate access to funding, streamline regulatory approvals, and leverage existing infrastructure assets to accelerate deployment. Additionally, partnerships with electric vehicle manufacturers and micro-mobility operators can create synergies and drive market growth.

Integration with renewable energy sources and data analytics

There is an opportunity to integrate charging infrastructure with renewable energy sources such as solar and wind power to reduce carbon emissions and reliance on fossil fuels. Deploying solar-powered charging stations, for example, can provide clean and sustainable energy for charging electric micro-mobility vehicles while reducing grid dependency and operating costs. Leveraging data analytics and insights can help optimize the deployment and management of charging infrastructure. By analyzing user behavior, traffic patterns, and charging demand, stakeholders can identify opportunities for infrastructure expansion, optimize charging station placement, and enhance user experience. Moreover, data-driven insights can inform strategic decision-making and investment priorities in the micro-mobility charging infrastructure market.

Recent Developments

- In February 2024, NEW YORK — The first of five public outdoor lithium-ion battery charging stations opened.

- In December 2023, The Tech Panda looks at recently launched gadgets and apps. EV: A new WhatsApp feature to offer hassle-free charging for EV users.

- In April 2023, SIDBI launched a new financing solution for electric vehicle space.

- In April 2023, Yulu launched a 2-wheeler Wynn for personal ownership for an electric mobility startup.

Key Players in the Market

- Robert Bosch, GmbH

- Bikeep

- Bike energy.

- Ather energy

- Flower turbines.

- Ground control systems.

- Perch mobility.

- Solum PV.

- Magment GmbH.

- The Mobility House GmbH.

- SWIFTMILE

Market Segmentation

By Vehicle type

- E- scooter

- E- bikes

- E-unicycles

- E-skateboards

By Charger

- Wired Charger

- Wireless Charger

By Power Source

- Battery Powered

- Solar Powered

By End User

- Residential

- Commercial

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1707

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308