Nanomaterials Market Size To Rake USD 61.96 Bn By 2032

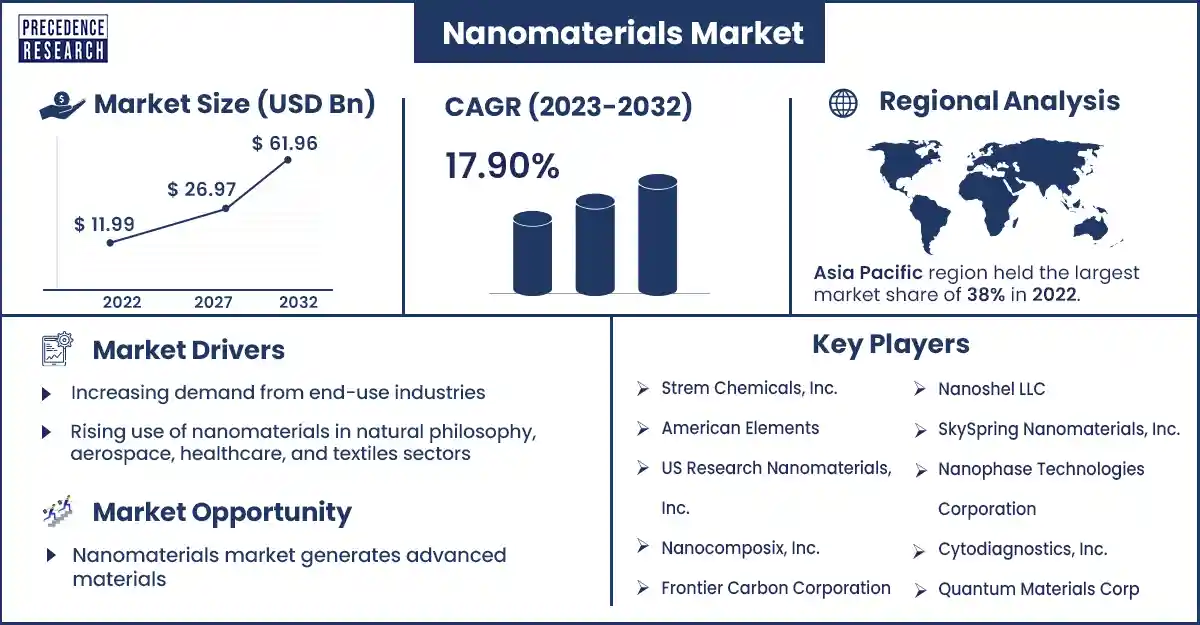

The global nanomaterials market size surpassed USD 11.99 billion in 2022 and is expected to rake around USD 61.96 billion by 2032, poised to grow at a CAGR of 17.90% from 2023 to 2032.

Market Overview

Nanomaterials are substances ranging in size from 1 nm to ~100 nm. Their qualities impact solubility, reactivity, spectroscopy, electrical and magnetic properties, and membrane transport. The study of nanomaterials and their uses, known as nanotechnology, has applications in consumer goods, energy, water, performance materials, health, and information technology. The advancement of nanotechnology depends on the finding of graphene and fullerenes. Applications for fullerenes and related materials in medicine include biological materials and medication delivery. Numerous publications, magazines, and books on nanoscience and nanotechnology have appeared due to the progress in these fields.

Regional Snapshot

Asia Pacific dominated the nanomaterials market. In the Asia-Pacific area, China, Japan, South Korea, and India are at the forefront of both the production and consumption of nanomaterials. With a concentration on the electronics, healthcare, and energy industries, China is a significant producer and user of nanomaterials. Japan is renowned for its cutting-edge research in nanotechnology and its use in the electronics and automotive sectors. Another major player in the industry, South Korea, focuses on the automotive, healthcare, and electronics industries. The market for nanomaterials in India is expanding quickly due to government efforts, increased R&D, and a growing need for sophisticated materials. On the other hand, obstacles include rising R&D spending, infrastructural growth, and regulatory concerns.

Nanomaterials Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 14.08 Billion |

| Projected Forecast Revenue by 2032 | USD 61.96 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 17.90% |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand from end-use industries

Growing demand from end-use sectors, especially electronics, healthcare, energy, automotive, aerospace, construction, and textiles, propels the nanomaterials market. Because of nanomaterials' unique mechanical, electrical, and thermal characteristics, these sectors can improve performance and efficiency across various applications. Nanomaterials are utilized in healthcare for scaffolds for tissue engineering, enhanced contrast in imaging, and targeted medication delivery. Nanomaterials improve energy conversion, storage, and efficiency in batteries, supercapacitors, fuel cells, and solar cells.

Miniaturization trend

The nanomaterials market is being pushed by the advancement of smaller, more efficient electronics. Energy harvesting devices, memory devices, sensors, displays, and transistors are all made smaller and more energy-efficient using nanomaterials such as carbon nanotubes, graphene, and nanowires. Compared to conventional technology, these nanomaterials provide better storage densities, quicker read/write rates, and reduced power consumption.

Additionally, they make new electronic features possible, such as using quantum dots in displays to provide vivid colors and increase energy efficiency. Furthermore, integrating several functionalities into a single device is made possible by the nanomaterials market, such as sensors that can concurrently detect various gasses. Finally, nanomaterials can reduce the cost of electronic gadgets by producing flexible electronics that are less expensive to manufacture.

Restraint

High cost

The requirement for functionalization and purification, pricey raw ingredients, and intricate production procedures are the reasons for the high cost of nanomaterials. Filtration and chemical treatments are purification procedures that guarantee purity by eliminating contaminants. Functionalization, the process of adding molecules or functional groups to nanomaterials, increases their stability but raises costs since more materials and processing processes are needed. The infrastructure and equipment required to produce nanomaterials can be costly, and adhering to regulations may raise expenses even more. Documentation and testing beyond regulatory requirements are also necessary for compliance.

Health and safety concerns

Since nanomaterials markets have unique characteristics at the nanoscale, they provide severe health and environmental risks. Different toxicity profiles might arise from their large surface area-to-volume ratio, which can cause higher reactivity and biological activity. Nanomaterials can cross biological barriers and induce genotoxicity, oxidative stress, and inflammation. Workers involved in manufacturing and managing nanomaterials are concerned about occupational exposure. Risk assessment is complex because of their unique characteristics and the absence of standardized testing procedures. Safer designs, engineering controls, and protective gear are examples of mitigation measures. Significant obstacles to regulation and public skepticism of nanotechnology also exist.

Opportunity

Advanced materials

The nanomaterials market generates advanced materials such as composite, innovative, and functional coatings because of their unique nanoscale features. Intelligent materials, including sensors and actuators, react to external stimuli, whereas composite materials, like carbon nanotubes, graphene, and nanocellulose, are stronger, lighter, and more durable.

Additional features, including hydrophobic or hydrophilic repellence, scratch resistance, anti-corrosion, anti-microbial, thermal barrier, UV protection, and suitability for biomedical, energy, and membrane materials, are provided by functional coatings, such as hydrophobic or hydrophilic coatings. Nanomaterials are also utilized in energy, biomedical, and membrane materials for increased durability, permeability, and selectivity. Numerous industries employ these materials, including the sports goods, automotive, and aerospace sectors.

Recent Developments

- In March 2024, Berlin Nanotechnology Institute launched a program named Artist-in-Residency Program in which artists will be able to collaborate with technicians and researchers to access nanomaterials.

- In October 2023, Leading nanotechnology manufacturer Nanoco Group Plc announced a substantial change in its trajectory for the year ending July 31, 2023, with high revenue growth.

Key Market Players

- Strem Chemicals, Inc.

- American Elements

- US Research Nanomaterials, Inc.

- Nanocomposix, Inc.

- Frontier Carbon Corporation

- Nanoshel LLC

- SkySpring Nanomaterials, Inc.

- Nanophase Technologies Corporation

- Cytodiagnostics, Inc.

- Quantum Materials Corp

Market Segmentation

By Product

- Carbon Nanotubes

- Titanium Nanoparticles

- Silver Nanoparticles

- Aluminum Oxide Nanomaterials

- Gold (Au)

- Iron (Fe)

- Copper (Cu)

- Platinum (Pt)

- Nickel (Ni)

- Antimony Tin Oxide

- Bismuth Oxide

- Others

By Application

- Aerospace

- Automotive

- Medical

- Energy & power

- Electronics

- Paints & Coatings

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1752

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308