Pharmaceutical CDMO Market Revenue to Attain USD 345.60 Bn by 2033

Pharmaceutical CDMO Market Revenue and Trends 2023 to 2033

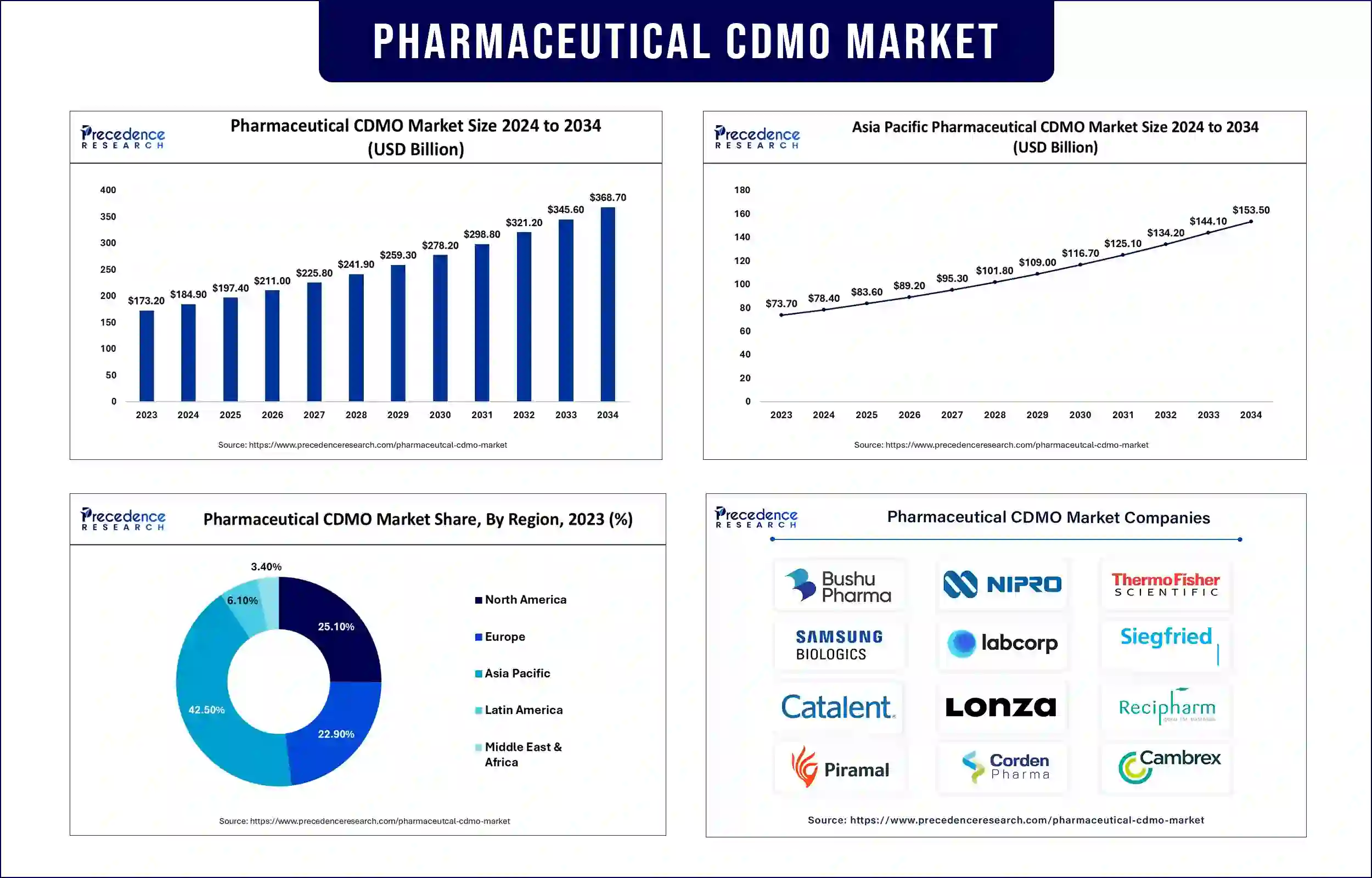

The global pharmaceutical CDMO market revenue was valued at USD 173.20 billion in 2023 and is expected to attain around USD 345.60 billion by 2033, growing at a CAGR of 7.2% during the forecast period. The increasing investments in drug development, rising demand for novel therapies, and genetic drugs, and the rising prevalence of cancer and age-related diseases boost the growth of the market.

Market Overview

Contract development and manufacturing organizations (CDMOs) offer a range of services, such as commercial manufacturing, packaging and labeling, research, and drug development, assisting pharmaceutical companies in developing drugs. Drug development is a complex procedure that requires substantial investments in additional infrastructure. However, partnering with CDMOs allows pharmaceutical companies to outsource the manufacturing process. CDMOs also help pharmaceutical and biotechnology companies create innovative formulas, ensuring products reach the market quickly.

The rising demand for biosimilars, biologics, orphan drugs, and personalized medicine significantly drives the pharmaceutical CDMO market. Outsourced services from CDMOs further allow pharmaceutical and biotechnology companies to save resources and focus on core areas, reducing costs associated with drug development. The increasing research and development activities and clinical trials by the pharmaceutical industry drive market growth. Moreover, various leading pharmaceutical companies are establishing CDMO facilities to meet the increased demand for outsourcing.

- In October 2024, NorthStar Medical Radioisotopes unveiled its Contract Development and Manufacturing facility dedicated to the production and development of radiopharmaceuticals. These drugs are crucial in the treatment of cancer because they can destroy tumors with deadly targeted radiation.

Report Highlights of the Pharmaceutical CDMO Market

- Based on service type, the active pharmaceutical ingredient (API) manufacturing segment accounted for the largest market share in 2023, owing to the increasing demand for APIs in drug development. APIs enhance the efficacy of drugs, making them crucial in drug development. They play a key role in disease diagnosis, cure, prevention, and treatment. Outsourced API manufacturing services from CDMOs allow pharmaceutical companies to reduce costs incurred in the drug development process.

- On the basis of the research phase, the phase III segment held the largest share of the market in 2023. Phase III clinical trial is a lengthy procedure. However, outsourcing phase III clinical trials to CDMOs allows pharmaceutical companies to focus on other key areas and save on resources.

Pharmaceutical CDMO Market Trends

- Increasing Prevalence of Chronic Diseases: With the rising prevalence of chronic diseases, including cancer, the demand for targeted and personalized therapies is increasing. However, outsourcing services from CDMOs accelerate the drug development process. Moreover, the rising demand for generic medicines propels the growth of the market.

- Technological Advancements: Advances in technology help CDMOs automate various operations, thereby enhancing efficiency and reducing errors. Implementing AI technologies in manufacturing processes detects potential drug candidates, which further improves drug discovery. The increasing investments by CDMOs in advanced technologies like artificial intelligence, blockchain, cloud computing, and machine learning create immense opportunities in the market.

- Rising Demand for Novel Therapies: The increasing demand for novel therapies boosts the need for effective formulations. However, CDMOs help pharmaceutical companies develop new formulations quickly and accelerate the drug development process.

Regional Analysis

Asia Pacific dominated the pharmaceutical CDMO market with the largest share in 2023. This is primarily due to the increase in the number of clinical trials registered and the rise in demand for cell and gene therapies. China and Japan are major contributors to market expansion. With the increase in the prevalence of chronic diseases, the demand for personalized medicines has increased. In addition, a strong emphasis on drug discovery and development contributed to the region’s dominance.

On the other hand, Europe is projected to experience the fastest growth in the market during the forecast period. This is mainly due to the increasing demand for outsourcing services among pharmaceutical companies to reduce costs associated with drug development. There has been significant growth in R&D activities to discover novel drugs. Moreover, technological advancements, strict regulatory requirements, and high demand for injectable drugs contribute to regional market expansion.

Pharmaceutical CDMO Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 184.90 Billion |

| Market Revenue by 2033 | USD 345.60 Billion |

| CAGR | 7.2% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In August 2024, OneSource Specialty Pharma incorporated CDMO to address the increasing demand for drug-device combinations and biologics drug substances and products.

- In May 2024, Enzene Biosciences announced the launch of a new drug discovery division that further expands its CDMO services to biotech industries.

Market Segmentation

By Service Type

- Active Pharmaceutical Ingredient (API) Manufacturing

- Small Molecule

- Large Molecule

- High Potency (HPAPI)

- Finished Dosage Formulation (FDF) Development and Manufacturing

- Solid Dose Formulation

- Tablets

- Others (Capsules, Powders, etc.)

- Solid Dose Formulation

- Liquid Dose Formulation

- Injectable Dose Formulation

- Secondary Packaging

By Research Phase

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2936

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344