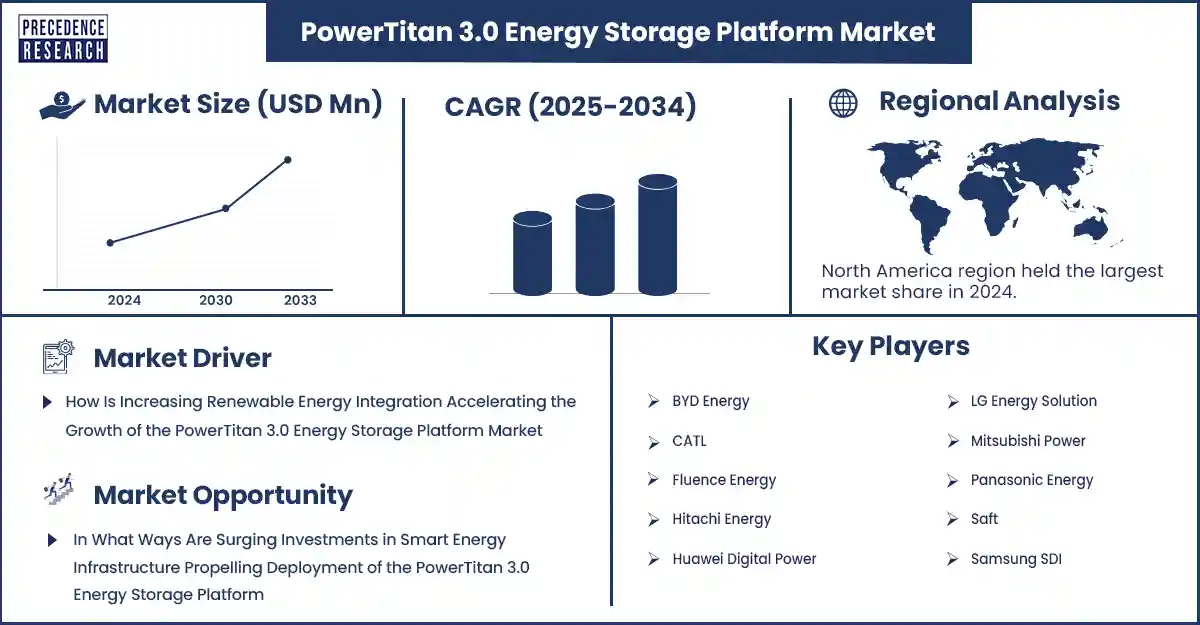

PowerTitan 3.0 Energy Storage Platform Market Revenue and Forecast by 2033

PowerTitan 3.0 Energy Storage Platform Market Revenue and Trends 2025 to 2033

The global powertitan 3.0 energy storage platform market expanding with advanced battery systems, boosting efficiency in solar, wind, and power grid projects.

What is PowerTItan 3.0 Energy Storage Platform?

The PowerTitan 3.0 energy storage platform market refers to the commercial ecosystem surrounding the development, deployment, and adoption of PowerTitan 3.0, a next-generation modular energy storage system designed for utility-scale, commercial, and industrial applications. PowerTitan 3.0, developed by Contemporary Amperex Technology Co. Limited (CATL), is engineered to deliver high-efficiency grid integration, peak shaving, frequency regulation, and renewable energy stabilization through advanced battery chemistry, intelligent thermal management, and scalable architecture.

Segmentation Analysis:

System Type / Technology Insightsx

In 2024, integrated liquid-cooled systems led the PowerTitan 3.0 market, favored for their superior thermal performance, scalability, and energy density. Regulatory pushes in North America and Europe further boosted adoption. Meanwhile, hybrid storage platforms (BESS + renewables) are projected to grow fastest, driven by grid decentralization and smart EMS integration.

Battery Chemistry Insights

In 2024, lithium iron phosphate (LFP) led the PowerTitan 3.0 energy storage platform market due to its strong safety profile, cost-efficiency, and long cycle life. With pack prices falling to around USD 100/kWh, LFP became the preferred choice for utility-scale and commercial deployments. Its thermal stability, cobalt- and nickel-free composition, and 3,000–10,000 cycle lifespan made it ideal for reducing total ownership costs while enhancing system reliability.

Power Capacity Insights

The 2 MWh to 5 MWh segment dominated the PowerTitan 3.0 energy storage platform market in 2024, offering an ideal balance of scalability, cost-efficiency, and operational flexibility for commercial and utility-scale use. These systems enabled peak shifting, backup power, and renewable integration without the complexity of larger setups.

Looking ahead, the above 5 MWh segment is set to grow fastest, driven by rising demand for multihour dispatch, grid resilience, and long-duration storage at renewable energy hubs and substations.

Application / Use Case Insights

The renewable energy integration (solar/wind hybrid projects) segment led the PowerTitan 3.0 market in 2024, driven by global decarbonization and energy resilience goals. These hybrid storage solutions enable smoother management of intermittency and enhance grid stability through intelligent energy management systems, reducing reliance on peaker plants during peak demand.

With solar PV and wind capacity growing nearly 20% in 2024, hybrid energy storage's critical role was further solidified. Policymakers have moved beyond incentives to mandate a sixfold increase in battery storage capacity by 2030, ensuring grid flexibility aligns with aggressive renewable energy targets worldwide.

End-User Insights

In 2024, the independent power producers (IPPs) segment dominated the PowerTitan 3.0 energy storage market, leveraging the platform to enhance grid flexibility, balance intermittent renewable generation, and defer costly infrastructure upgrades. Supportive regulatory incentives for co-located storage and generation further cemented IPPs and utilities as key adopters.

Regional Analysis:

Asia-Pacific dominated the PowerTitan 3.0 energy storage platform market in 2024, securing the largest share of global revenue. This regional leadership is primarily attributed to strong policy support across emerging economies, including government subsidies, regulatory reforms, and national energy storage targets. China played a pivotal role, intensifying its efforts to integrate large-scale battery systems with renewable energy sources, an essential move to stay on course for its carbon neutrality target by 2060.

Other fast-growing economies in the region—such as India, Japan, and South Korea accelerated their deployment of energy storage systems to enhance grid reliability amid rising levels of renewable energy integration. According to data from the International Energy Agency (IEA), over 50% of all new global battery storage installations in 2024 were concentrated in the Asia-Pacific region, underscoring its dominance in the market. Additionally, region-wide initiatives such as government-backed Green New Deal programs funneled capital into grid-scale storage, smart grid infrastructure, and technology upgrades solidifying Asia-Pacific's position as a global innovation hub in energy storage.

Meanwhile, North America is projected to register the fastest growth during the forecast period, largely driven by the Inflation Reduction Act (IRA) of 2022. This landmark policy introduced long-term tax credits and grants, which continue to incentivize utilities, independent power producers (IPPs), and commercial users to adopt advanced energy storage solutions like PowerTitan 3.0.

PowerTitan 3.0 Energy Storage Platform Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Top PowerTitan 3.0 Energy Storage Platform Market Key Players

- BYD Energy

- CATL (Contemporary Amperex Technology Co. Ltd.)

- Fluence Energy

- Hitachi Energy

- Huawei Digital Power

- LG Energy Solution

- Mitsubishi Power

- Panasonic Energy

- Saft (TotalEnergies)

- Samsung SDI

- Schneider Electric

- Siemens Energy

- Sungrow Power Supply Co., Ltd. (Developer of PowerTitan 3.0)

- Tesla Energy

- Wärtsilä Energy

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6843

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344