Pumps Market Revenue and Trends 2023 to 2033

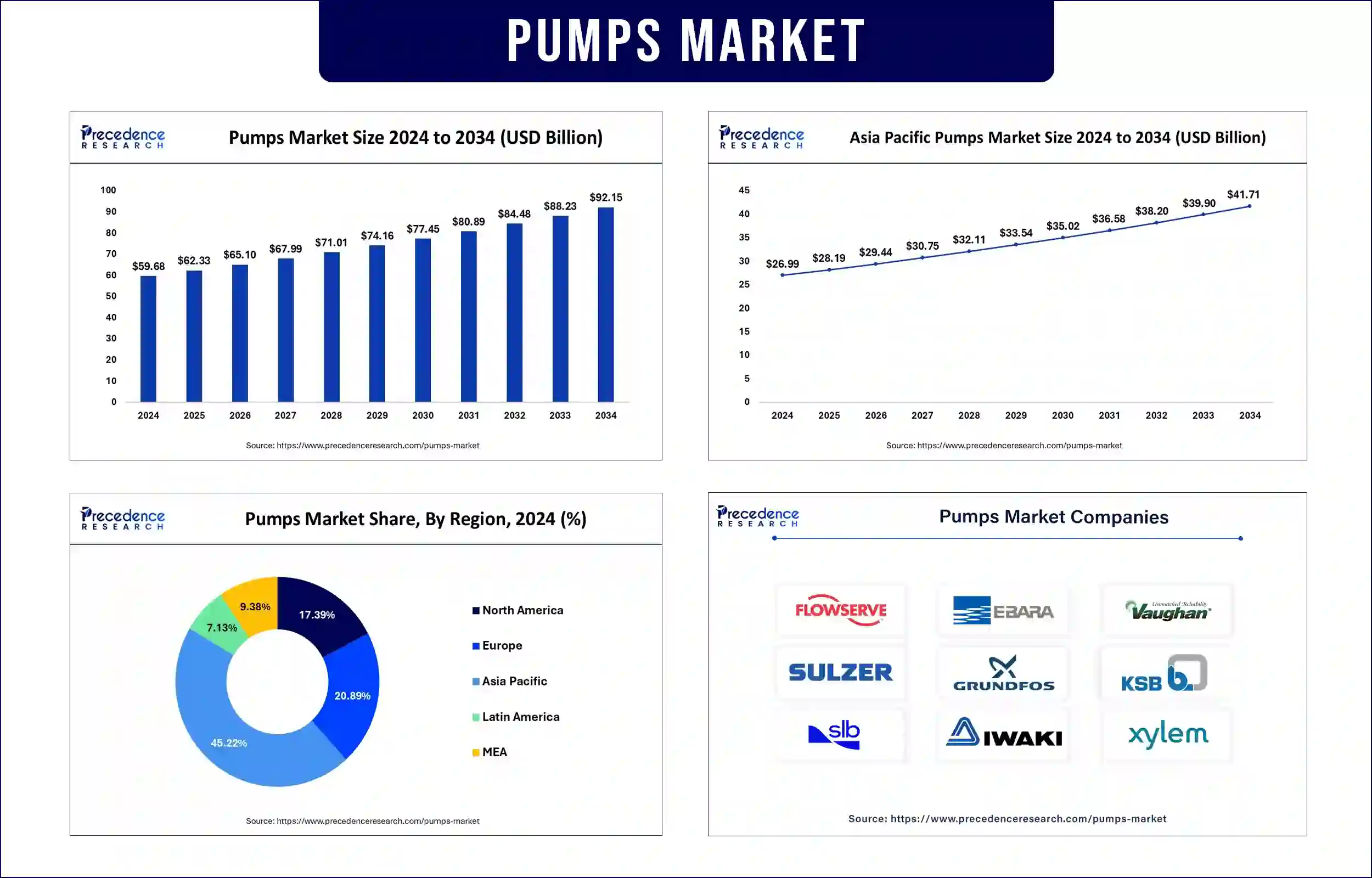

The global pumps market size was estimated at USD 62.33 billion in 2025 and is anticipated to reach around USD 88.23 billion by 2033, expanding at a CAGR of 4.44% from 2025 to 2033. Increasing demand for energy-efficient and technologically advanced pumping solutions is driving market growth.

Market Overview

The global pumps market includes multiple types of pumping systems that serve the needs of water treatment, oil and gas operations, chemical processing applications, and construction operations. The massive energy consumption requires industries to find innovative tools for energy-efficient technology in pumping systems to lower operational costs while decreasing environmental effects.

Through the adoption of Industrial Internet of Things (IIoT) technologies, companies perform predictive maintenance and monitor operations in real time, which enhances both the reliability and performance of their pumps. Additionally, the rising need for wastewater treatment, industrial automation, and smart pumping systems is fuelling market expansion.

Report Highlights

By product types, the centrifugal pumps segment accounted for the largest pumps market share due to their wide-ranging application across industries like oil and gas, water treatment, and chemicals. These pumps are valued for their efficiency and adaptability in handling high-flow applications. The positive displacement pumps segment, known for its precision and ability to handle thick fluids, is expected to see steady growth. The increasing need for more accurate and reliable pumping solutions in industries such as food processing, pharmaceuticals, and chemicals is driving demand for these pumps.

By application, the agriculture segment captured the largest revenue share, driven by the need for efficient irrigation systems. The agricultural sector is evolving towards more advanced and automated solutions that allow farmers to use water more efficiently while maximizing crop yields. The water and wastewater treatment segment is projected to experience continued growth, driven by global efforts to improve water quality and accessibility. As urbanization accelerates and populations grow, there is an increasing demand for infrastructure capable of handling wastewater efficiently.

Market Trends

Technological Advancements in Pumping Systems

The integration of Internet of Things, AI-driven predictive maintenance, and real-time monitoring capabilities is enhancing pump performance, reducing downtime, and optimizing energy consumption. The 2024 U.S. Department of Energy assessment shows that pumps make up 20% of industrial energy usage, which proves how essential effective pump management solutions have become. Smart technology implementations within pumping systems create substantial effects that result in better system performance with environmental sustainability.

- In August 2024, the Bangalore Water Supply and Sewerage Board started using the iPumpnet digital solution, which combines AI and machine learning and IoT technology to optimize their water supply network operations.

Growing Focus on Sustainability and Energy Efficiency

Governments and industries are emphasizing eco-friendly pumping solutions to meet stringent energy efficiency standards, driving the adoption of variable speed drives (VSDs) and smart pump technologies. Advanced pumping technologies receive international support as they help create more efficient energy systems that minimize environmental harm. The Internal Revenue Service (IRS) established the Energy Efficient Home Improvement Credit through their January 1, 2023 rollout, which allows taxpayers to earn up to USD 3,200 in tax credits for qualifying energy-efficient updates like advanced pumping systems.

Expansion of Water and Wastewater Treatment Infrastructure

Rising global concerns about water conservation and wastewater management are boosting the demand for the pumps market in municipal and industrial treatment plants. Aggravating water scarcity issues have pushed governments and organizations to invest in developing expanded water and wastewater treatment projects that enhance universal access to protected water and sanitation services. These initiatives deploy advanced pumping technologies as they help distribute water effectively and manage wastewater properly. High-performance pump demand will likely rise further during the advancement of these initiatives, which simultaneously resolve environmental concerns and protect public health.

The World Health Organization (WHO) documented in 2023 that improper water management combined with unsatisfactory sanitation practices and hygiene results in 1.4 million annual fatalities, influencing the immediate requirement for better water systems. Official data from the WHO/UNICEF Joint Monitoring Programme shows that safely managed drinking water services remained inaccessible to 2.2 billion people worldwide during 2022, which demonstrates the urgent necessity for advanced water treatment installations.

Surge in Demand from the Oil and Gas Industry

The upstream and downstream oil and gas sector continues to require high-performance pumps for crude oil extraction, refining, and transportation, further propelling market growth. The growing market demands require enhanced exploration and production processes, which necessitate improved pumping solutions, as of the pressure on efficiency and reliability needs. The increasing requirements in the oil and gas industry become possible, as of high-performance umps.

- The International Energy Agency (IEA) documented that 1.1 million barrels per day soared as global oil demand in 2024 third-quarter figures surpassed previous second-quarter increases of 435,000 barrels per day.

Regional Insights

Asia Pacific dominated the global pumps market with the largest market share, owing to the rapid urbanization, infrastructure development, and increasing industrialization in countries such as China, India, and Japan. Government initiatives promoting clean energy and smart water management are further boosting demand.

Through the Sagarmala Program, India accomplished 262 projects totaling ₹1.4 trillion before 2023 to advance port connectivity and stimulate economic expansion. Clean energy initiatives and smart water management programs of the government contribute additional momentum to the growing demand.

The World Bank initiated a USD 2.5 billion funding effort in September 2024 to speed up East Asia and Pacific adoption of renewable energy systems, which seeks to decrease greenhouse gas emissions by 60 million tons while expanding clean electrical service to more than 20 million people.

The Malaysian government is promoting renewable energy in data centers through its charging mechanism for resources, where higher rates correlate with environmental benefits and sustainability targets. The area demonstrates a continuous expansion pattern and a firm dedication to developing sustainable infrastructure.

North America is projected to expand at the fastest CAGR in the pumps market during the forecast period due to significant investments in industrial automation, water infrastructure, and stringent environmental regulations promoting the adoption of efficient pumping systems. Developments underscore a region's commitment to sustainable infrastructure and energy-efficient solutions, further driving market growth.

- In August 2023, the U.S. Department of Energy announced USD 28 million for 10 projects aimed at decarbonizing Water Resource Recovery Facilities, which are among the nation's largest industrial electricity users. In September 2024, Canada invested over USD 89 million in clean economy infrastructure projects across British Columbia, including wastewater treatment plants and geothermal electric plants, enhancing energy efficiency and reducing environmental impact.

Pumps Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 62.33 Billion |

| Market Revenue by 2033 | USD 88.23 Billion |

| CAGR | 4.44% from 2025 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In March 2025, Flowserve Corporation, a leading provider of flow control products and services for global infrastructure markets, launched the INNOMAG TB-MAG Dual Drive Pump. This innovative pump is the world’s first sealless model designed to eliminate leaks, setting a new standard for safety and environmental protection.

- In March 2025, Tandem Diabetes Care, Inc., a prominent company in insulin delivery and diabetes technology, announced the commercial launch of Control-IQ+ technology in the United States.

- In January 2025, KNF introduced a new series of OEM liquid diaphragm pumps that offer high precision and reliability for demanding applications. The FM 50 series enhances liquid metering accuracy and customization, utilizing advanced pump drive technology for easy system integration and durability.

Pumps Market Top Companies

- Flowserve Corp.

- EBARA International Corp.

- Vaughan Company Inc.

- Sulzer Ltd.

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Schlumberger Ltd.

- IWAKI Co. Ltd

- Xylem

Market Segmentation

By Product Type

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

- Others

By Application

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa