SaaS-based Core Banking Software Market Revenue to Attain USD 83.67 Bn by 2035

SaaS-based Core Banking Software Market Revenue and Trends 2026 to 2035

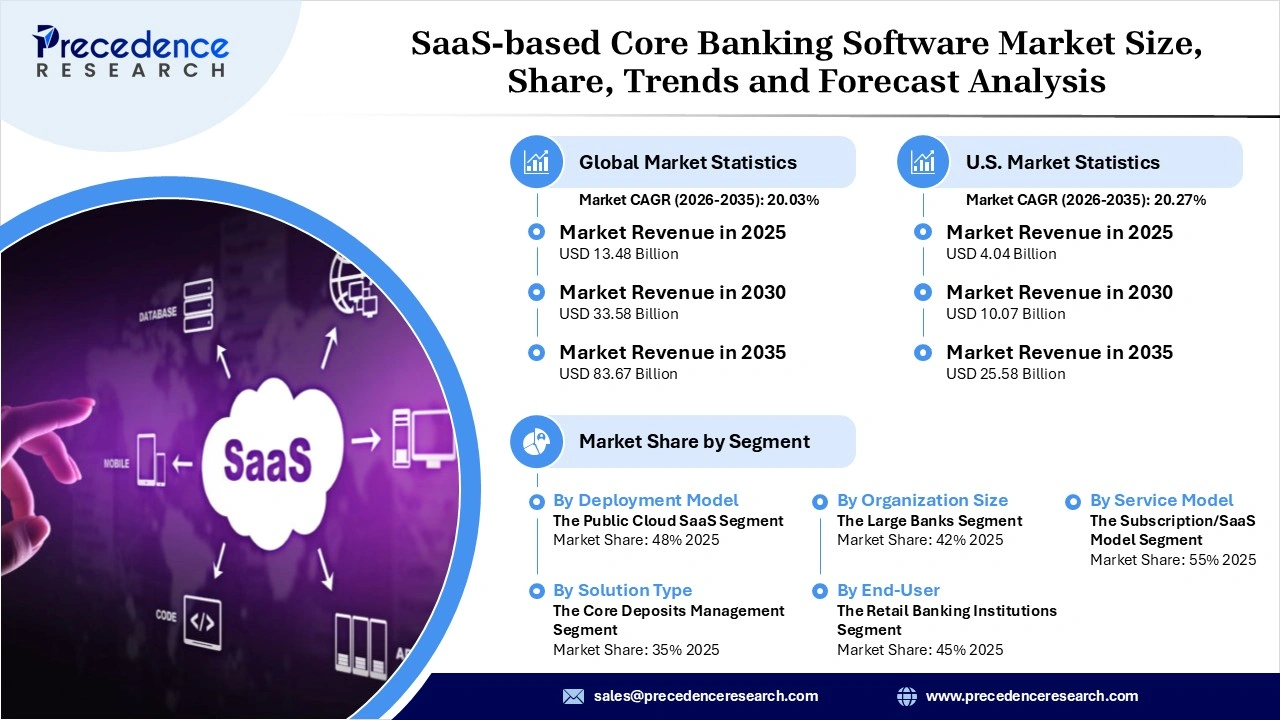

The global SaaS-based core banking software market revenue surpassed USD 13.48 billion in 2025 and is predicted to attain around USD 83.67 billion by 2035, growing at a CAGR of 20.03%. The market is experiencing a significant growth rate due to the growing shift towards predictable subscription-based operational expenses while modernizing their legacy systems.

What are the Key Drivers of the SaaS-based Core Banking Software Market?

A major driving factor for the market is the rise of fintech collaboration combined with growing demand for hyper-personalization to enable safer, more relevant digital financial services. Consumers increasingly favor digital channels because of convenience, faster service delivery, and access to new product offerings, pushing banks to redesign customer engagement models. Hyper-personalization has gained strong traction as institutions use transaction data, behavioral analytics, and AI-driven insights to deliver tailored financial recommendations, real-time alerts, and customized product bundles that improve customer satisfaction and retention.

Many banks are prioritizing open banking as a strategic response to evolving customer expectations and competitive pressure from digital-native players. Open banking frameworks allow secure access to customer-permissioned transaction data for third-party financial service providers through application programming interfaces, enabling innovation in payments, lending, wealth management, and personal finance tools. This shift is expanding ecosystem-based service models, increasing the need for robust core systems, data governance capabilities, and API management platforms that support secure interoperability while maintaining regulatory compliance.

Segments Insights

- By Deployment Model, The Public cloud SaaS segment held the largest market share in 2025, due to its cost efficiency, high scalability, and faster deployment with error recovery like disaster management.

- By Solution Type, The core deposits management segment held the largest market share in 2025, owing to the lower cost of core deposits and stable nature of core deposits that enhances bank interest and margin.

- By Organization Size, The large bank segment dominated the global market in 2025 as these organizations handle high-volume transactions with sensitive data and use hyper-personalization techniques.

- By End-User, The retail banking institutions segment held the largest market share in 2025 due to their increasing focus on improving consumer experience while managing high-volume transactions efficiently.

- By Service Model, The subscription/SaaS Licensing segment held the largest market share in 2025 due to the intention of saving massive costs, increased flexibility and faster AI integration, and better security compliances.

Regional Insights

North America held the largest market share in 2025, supported by a mature financial ecosystem and rapid digital transformation across banking and financial services. Financial institutions in the region are heavily investing in modern core banking systems, cloud-native platforms, and API-driven architectures to improve scalability, security, and customer experience. The strong presence of leading core banking and financial technology providers such as FIS, Fiserv, and Oracle reinforces the region’s leadership by enabling banks and credit unions to modernize legacy systems, adopt real-time payments, and comply with stringent regulatory and data security requirements.

Asia Pacific is projected to grow at the fastest CAGR during the forecast years, driven by a broad-based digital transformation across banking and financial services. Rapid growth in smartphone adoption, expanding internet penetration, and the rise of digital-first consumers are accelerating the deployment of mobile banking, digital wallets, and real-time payment platforms across the region. Government-backed digital finance initiatives and financial inclusion policies in countries such as India and China are further supporting modernization of banking infrastructure, increasing demand for scalable core systems and fintech solutions that can support high transaction volumes and fast-growing user bases.

SaaS-based Core Banking Software Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 13.48 Billion |

| Market Revenue by 2035 | USD 83.67 Billion |

| CAGR from 2026 to 2035 | 20.03% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Development

- In February 2025, a leading provider of the best banking solutions, nCino, Inc., announced the acquisition of sandbox banking aiming to offer digital banking solutions with improved data connections and streamline the operational ability of nCino.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7270

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344