Skin Antiseptic Products Market Size to exceed USD 5.76 Bn By 2032

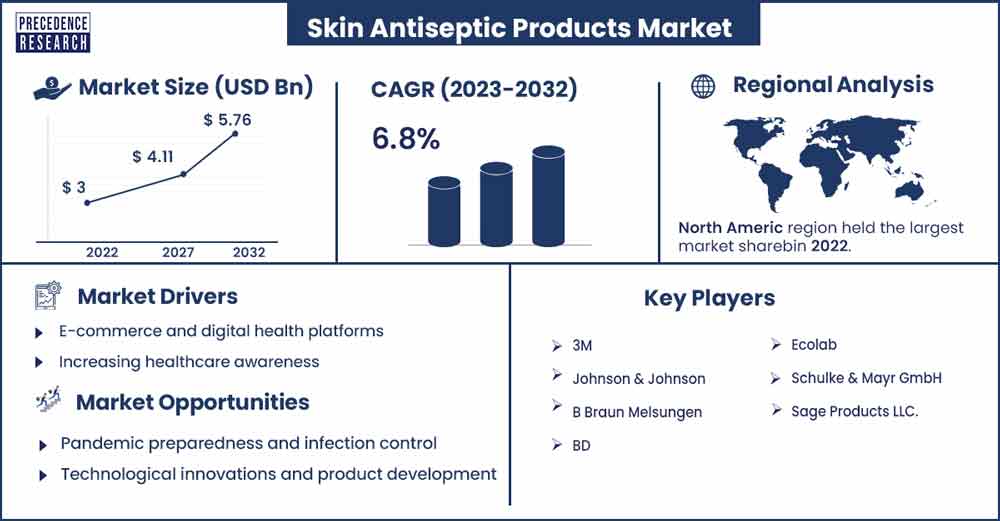

The global skin antiseptic products market size surpassed USD 3.19 billion in 2023 and is expected to exceed around USD 5.76 billion by 2032 poised to grow at a CAGR of 6.8% from 2023 to 2032.

Market Overview

The skin antiseptic products market encompasses a range of products designed to disinfect and cleanse the skin, reducing the risk of infection and promoting hygiene. The market includes various products such as hand sanitizers, surgical scrubs, preoperative skin preparations, and antiseptic wipes.

Skin antiseptic products are subject to regulatory oversight by health authorities, such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other regulatory agencies worldwide. Regulatory requirements govern product safety, efficacy, labeling, and manufacturing practices to ensure quality standards and consumer protection compliance. Regulatory approvals, registrations, and product certifications are required for marketing and distribution of skin antiseptic products market in domestic and international markets.

The skin antiseptic products market is characterized by intense competition among manufacturers, suppliers, and distributors for market share and brand recognition. Key players include multinational corporations, pharmaceutical companies, medical device manufacturers, and consumer goods companies offering a diverse portfolio of skin antiseptic products. The market is driven by the increasing focus on infection prevention, hygiene practices, and patient safety across healthcare and community settings. Product innovation, regulatory compliance, and strategic partnerships are essential for manufacturers to capitalize on market opportunities and meet evolving consumer goods companies offering a diverse portfolio of skin antiseptic products.

Regional Snapshots

In the North American region, the skin antiseptic products market in the United States is characterized by robust demand for hand sanitizers, surgical scrubs, and preoperative skin preparations across healthcare facilities, surgical centers, and consumer markets. Stringent infection prevention guidelines, accreditation standards, and regulatory requirements drive market growth and product adoption in healthcare settings.

Canada’s skin antiseptic products market shares similar trends with the United States, driven by infection control practices, patient safety initiatives, and regulatory compliance in healthcare facilities and community settings. Increasing awareness of hand hygiene and infection prevention protocols, multinational manufacturers compete for market share in Canada’s market.

Asia-Pacific is considered an opportunistic market for the growth of the skin antiseptic products market. Countries like India are focusing on improving hygiene among the people, especially those who belong to rural and slum areas. The country has taken steps in collaboration with the World Health Organization to promote hand hygiene and sanitary practices. The COVID-19 pandemic that started in China is responsible for promoting market growth. Although the pandemic is over, its impact remains, and people are taking precautions to avoid any consequences in the future.

- Dettol launched its new antiseptic cream in India. The purpose of this launch is to create market opportunity in the cuts and wounds segment. It is an over-the-counter product that will be used as a first-level treatment in the case of minor cuts and wounds to prevent infection.

Skin Antiseptic Products Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.19 Billion |

| Projected Forecast Revenue by 2032 | USD 5.76 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.8% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

E-commerce and digital health platforms

The proliferation of e-commerce, online pharmacies, and digital health platforms creates opportunities for manufacturers to reach consumers directly and expand distribution channels for skin antiseptic products. Online sales platforms, subscription services, and direct-to-consumer (DTC) models enable convenient access to hand sanitizers, antiseptic wipes, and disinfectant solutions for household, workplace, and personal use. Digital marketing, social media advertising, and influencer partnerships enhance brand visibility, customer engagement, and online sales growth in the digital marketplace.

Increasing healthcare awareness

The rising awareness of healthcare-associated infections (HAIs) and the importance of infection prevention practices drive the demand for skin antiseptic products market. Healthcare facilities, including hospitals, clinics, and ambulatory surgical centers, prioritize infection control measures to reduce the risk of HAIs, surgical site infections (SSIs), and transmission of pathogens. Skin antiseptic products are critical in hand hygiene protocols, preoperative skin preparative skin preparation, and patient care practices to maintain aseptic conditions and prevent healthcare-associated infections.

Restraints

Regulatory compliance and safety concerns

The skin antiseptic products market is subject to stringent regulatory requirements governing product safety, efficacy, labeling, and manufacturing practices. Compliance with regulatory standards, such as those set forth by the US Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regulatory agencies worldwide, entails rigorous testing, documentation, and quality assurance processes. Manufacturers face challenges navigating complex regulatory frameworks, obtaining regulatory approvals, and ensuring compliance with evolving regulatory requirements, which may delay product launches, increase compliance costs, and impact market access.

Availability of substitutes and alternatives

The availability of substitutes and alternatives, such as soap and water, traditional antiseptics, and disinfectant solutions, may limit the market penetration of skin antiseptic products. While skin antiseptic products offer convenience, rapid disinfection, and broad-spectrum antimicrobial activity, some healthcare professionals, patients, and consumers may prefer traditional or alternative skin cleansing and disinfection products. Education and awareness initiatives highlighting the advantages of skin antiseptic products over conventional methods are essential for overcoming resistance to adoption and promoting product usage.

Opportunities

Pandemic preparedness and infection control

Public health emergencies, infectious disease outbreaks, and pandemic events underscore the importance of infection control measures and hand hygiene practices, driving demand for skin antiseptic products. Opportunities exist for manufacturers to supply healthcare facilities, businesses, and consumers with hand sanitizers, disinfectants, and antiseptic wipes to mitigate the spread of pathogens, reduce transmission risks, and protect public health during pandemics and public health emergencies.

Technological innovations and product development

Technological advancements in formulation technologies, antimicrobial agents, and delivery systems present product innovation and differentiation opportunities in the skin antiseptic products market. Companies can invest in research and development (R&D) to develop novel formulations and long-lasting antimicrobial coatings for skin disinfection and infection control applications. Innovation in hand sanitizer formulations, surgical skin preparations, and antiseptic wipes enhance product efficacy, safety, and user experience, driving adoption and market growth.

Recent Developments

- In August 2023, Dettol Pro Solutions, the business-to-business offering from global cleaning and disinfectant brand Dettol, announced the launch of Dettol 5 Litre (5L) Pro Cleanse Liquid Hand Wash. The new product is specifically designed for professional use and keeps up with how hand hygiene habits have changed since the pandemic.

- In September 2023, Cosmos Health announced the expansion of its C-Sept Brand with the launch of C-Scrub Wash, Capitalizing on the $29 Billion Global Antiseptic and Disinfectant Market.

- ST. PAUL, Minn., on April 2023 - 3M Health Care announced the introduction of its new FDA-approved 3M™ SoluPrep™ S Sterile Antiseptic Solution chlorhexidine gluconate (2% w/v) and isopropyl alcohol (70% v/v) Patient Preoperative Skin Preparation. The product has been shown to provide fast-acting, broad-spectrum antimicrobial activity (in vitro, clinical significance unknown) and persistence in healthy human volunteers for at least 96 hours post-prep.

Key Players in the Market

- 3M

- Johnson & Johnson

- B Braun Melsungen

- BD

- Ecolab

- Schulke & Mayr GmbH

- Sage Products LLC.

Market Segmentation

By Type

- Solutions

- Swab Sticks

- Wipes

By Formulation

- Iodine

- Alcohols

- Chlorhexidine

- Octenidine

- Others

By Application

- Surgeries

- Injection

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1315

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308