Thermal Interface Materials Market Revenue to Attain USD 11.14 Bn by 2033

Thermal Interface Materials Market Revenue and Trends 2025 to 2033

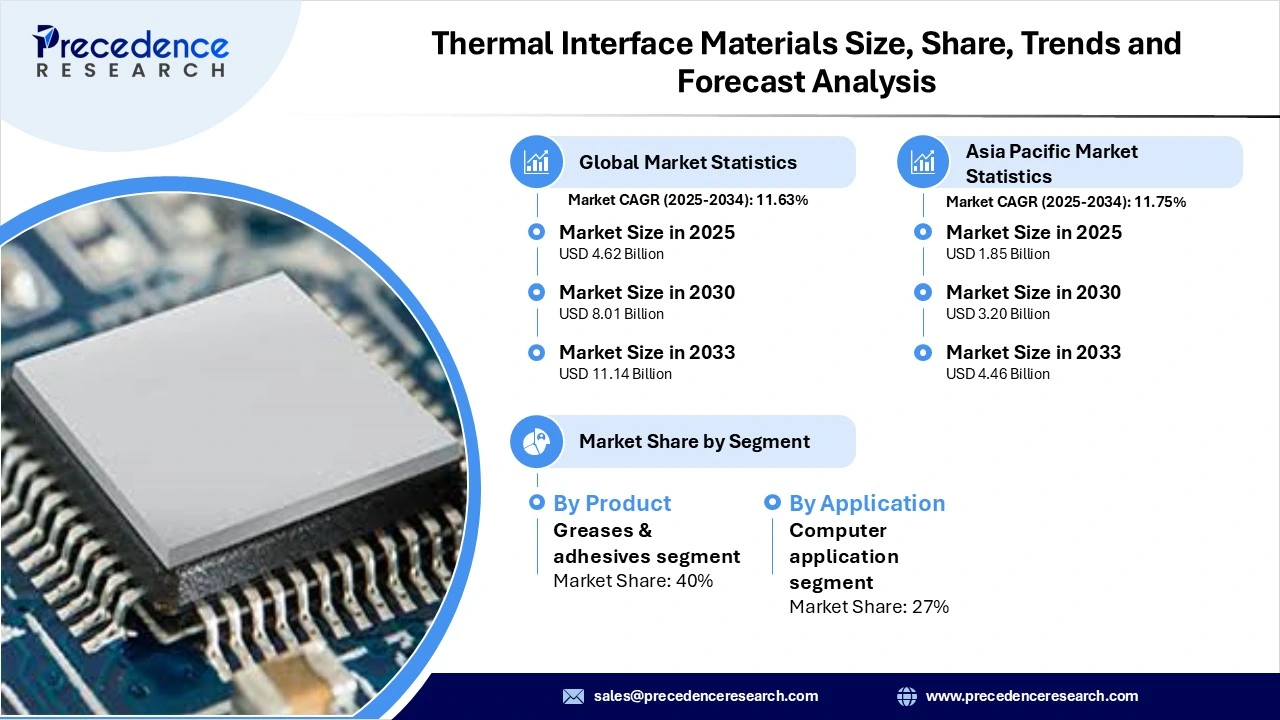

The global thermal interface materials market size was exhibited at USD 4.62 billion in 2025 and is anticipated to touch around USD 11.14 billion by 2033, expanding at a CAGR of 11.63% from 2025 to 2033.

Market Overview

The thermal interface materials market comprises the production, distribution, and sale of specialized materials designed to enhance thermal conductivity between two or more surfaces. These materials are utilized in various electronic devices, industrial machinery, automotive components, and other applications that require efficient thermal management. The market offers a broad spectrum of materials, such as thermal greases, thermal pads, phase change materials, thermal tapes, and adhesives, catering to the diverse needs of different industries.

The thermal interface materials market is witnessing a substantial surge, primarily due to the growing demand for electronic devices across diverse industries. The rising usage of smartphones, laptops, tablets, and other electronic gadgets has led to an increasing requirement for thermal interface materials to improve heat dissipation and ensure optimal performance of these devices.

Moreover, the mounting adoption of electric vehicles (EVs) is driving the demand for thermal interface materials in battery management systems and power electronics to enhance thermal conductivity and efficiency, thereby supporting the shift toward sustainable transportation.

Additionally, continuous advancements in materials science and manufacturing processes facilitate the development of innovative thermal interface materials with advanced properties, such as enhanced thermal conductivity and flexibility, further propelling the market growth of thermal interface materials. These factors are collectively contributing to the expansion of the market, offering profitable opportunities for stakeholders across various industries.

Regional Snapshot

Asia-Pacific dominated the thermal interface materials market in 2023, a major consumer and producer of these materials. The region's electronics industry, particularly in China, Japan, South Korea, and Taiwan, is driving significant demand for thermal interface materials. Given that Asia is a hub for electronics manufacturing, there is a constant need for these materials to improve the thermal performance and reliability of electronic devices. Asia's rapid industrialization and urbanization have led to significant investments in infrastructure, including telecommunications, data centers, and automotive sectors. This has increased the demand for thermal interface materials, particularly for applications such as base stations, servers, and electric vehicles.

Asia Pacific dominated the global thermal interface materials market by accounting for the highest revenue share in 2024. The dominance of the region is attributed to the well-established electronics manufacturing capability in countries like Japan, China and South Korea. The majority of the companies have managed to emerge on the global stage due to the lower manufacturing costs in the region. The rapid innovation in smartphone usage has led to the adoption of thermal management solutions that improve the overall functionality of these electronic devices.

China stands as a dominant country in the thermal interface materials market due to the leading electronic production base that produces products like laptops, servers, smartphones and many others. The country is stated to be the world-leading electronic manufacturer with around 60-70% of the world’s manufacturing capability of smartphones and laptops. The Chinese Government also backs the local manufacturers with initiatives like ‘Make in China 2025’ to attract a majority of the growth.

North America is a rapidly expanding thermal interface materials market for thermal interface materials, with its strong electronics industry, particularly in the United States. This industry significantly contributes to the global demand for thermal interface materials, driving the region's prominent position in this market. North America is home to many leading technology companies and fosters a culture of innovation, continuously seeking advanced thermal management solutions to enhance the performance and reliability of electronic devices.

The growing adoption of EVs in North America fuels the demand for thermal interface materials, especially in battery management systems and power electronics. As the automotive industry shifts towards electrification, there is a growing focus on thermal management solutions to optimize the efficiency and longevity of EV components.

North America is expected to grow at a significant CAGR during the forecast period of 2025 to 2034. The growth of the region is attributed to the rising requirement for high-performance computing and 5G infrastructure that creates demand for heat dissipation solutions. The governments in countries like the U.S. and Canada are also investing heavily in R&D activities for semiconductor manufacturing that is expected to support the market growth in the coming years.

The United States is a leading country in the North American market due to their technological leadership in electronics, cloud infrastructure and AI. The country also stands with the support of industry leaders that help in boosting the EV, telecom and consumer electronics capabilities in the country.

Thermal Interface Materials Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2025 | USD 4.62 Billion |

| Projected Forecast Revenue by 2033 | USD 11.14 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.63% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Largest Market | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for electronic devices

The usage of electronic devices has become more widespread than ever before, leading to a significant increase in their popularity. Consequently, to optimize these devices' performance and heat dissipation, the utilization of thermal interface materials has become necessary. These materials are designed to enable effective heat transfer between electronic components and their surrounding environment. As the consumer electronics industry continues to grow, the need for efficient thermal interface materials is expected to surge even higher in the years to come.

A new range of Thermal Conductive Adhesives (TCA) in June 2023 was launched by Bostik and Polytec PT. This new TCA range is expected to play a vital role in accelerating innovation in battery design. The TCA range offers excellent thermal conductivity, which is essential for optimal heat dissipation in battery applications.

Rising adoption of EVs

With the growing popularity of electric vehicles, the demand for advanced battery management systems and power electronics has been increasing rapidly. The role of thermal interface materials has become crucial to ensure optimal performance and reliability of these systems. These materials are designed to improve thermal conductivity and efficiency, which ultimately helps in achieving better heat transfer and dissipation. Through such materials, electric vehicles are becoming more reliable, safer, and energy-efficient, all while reducing their environmental impact by minimizing their carbon footprint.

- In May 2023, WAE Technologies will be introducing a novel structural battery pack optimized for low-volume electric vehicle manufacturing. This innovative battery pack is designed to serve as a structural component of the EV, which enables it to reduce weight and improve space utilization, leading to better energy efficiency and performance. This new technology is expected to revolutionize the EV industry by providing a more sustainable transportation solution with increased range, safety, and reliability.

Restraints

Environmental regulations

Environmental regulations regarding the use of chemicals and materials in the manufacturing of thermal interface materials in the thermal interface materials market pose a significant challenge for manufacturers. Adhering to these strict guidelines is essential for ensuring the sustainability of the manufacturing process. Finding alternative materials that meet the performance requirements and are less harmful to the environment is a challenging task. Developing eco-friendly alternatives to traditional materials without compromising the quality and performance of the final product requires a considerable investment in research and development.

Supply chain disruptions

The global supply chain is currently facing significant disruptions, which could create a ripple effect across several industries. One of the areas that could be impacted the most is the production and availability of thermal interface materials. These materials are crucial for managing heat transfer in various applications, including electronics and aerospace. However, due to shortages of raw materials and logistical challenges, the supply of these materials may be limited, which could lead to higher prices and slower market growth. Therefore, it is essential for businesses and consumers to stay up to date with these developments to make informed decisions and plan accordingly.

Opportunities

Emerging applications in 5G technology

The advent of 5G technology has brought about a surge in the requirement for thermal interface materials (TIMs) in the telecommunications sector, which will give a boost to the thermal interface materials market. These materials are utilized in different infrastructure components, such as base stations and network equipment, to ensure that the heat generated by high-speed data transfer is dissipated efficiently. This creates new opportunities for market players seeking to benefit from increasing demand for thermal interface materials. With the expansion of 5G networks, the demand for these materials is set to soar, making it a profitable market for businesses operating in this space.

Growing focus on energy efficiency

Energy efficiency has become a crucial factor across multiple industries, such as data centers, automotive, and consumer electronics. This has resulted in an increase in awareness and regulatory measures aimed at promoting sustainable practices. One of the significant developments in this regard is the growing adoption of thermal interface materials. These materials are specifically designed to optimize thermal management and reduce energy consumption by facilitating the transfer of heat among different components within a system. Using thermal interface materials can significantly improve overall performance and efficiency while also enhancing the lifespan of electronic devices, which will ultimately increase the demand for the thermal interface materials market.

Recent Developments

- In January 2025, TDK Ventures invested in Pennsylvania-based NovoLINC to advance its ultra-low thermal resistance interface technology for next-gen AI data centre cooling and high-density semiconductor applications (Source: https://www.businesswire.com)

- The Chomerics Division of Parker Hannifin Corporation has recently launched its latest product, the THERM-A-GAP™ PAD 80 high-performance gap filler pads. This innovative solution offers a thermal conductivity of 8.3 W/m-K, offering the designers of electronics and telecoms devices superior heat transfer capabilities.

- In November 2023, GELID introduces their latest innovation, HeatPhase Ultra Phase Change Thermal Interface. This advanced technology boasts exceptional thermal conductivity, surpassing traditional thermal pastes and greases.

Thermal Interface Materials Market Key Players

- Dow Corning Company

- The 3M Company

- Honeywell International, Inc.

- Parker Chomerics

- Indium Corporation

- Henkel AG & Co, KGaA

- Momentive Performance Materials, Inc.

- GrafTech International Ltd.

- Laird Technologies, Inc.

- Fuji Polymer Industries Co., Ltd.

- AIM Specialty Materials

- Shin-Etsu Chemical Co. Ltd.

- Wakefield-Vette, Inc.

- DK Thermal

- AOS Thermal Compounds LLC

- SEMIKRON

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1139

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344