What is the Pressure Sensitive Tapes Market Size?

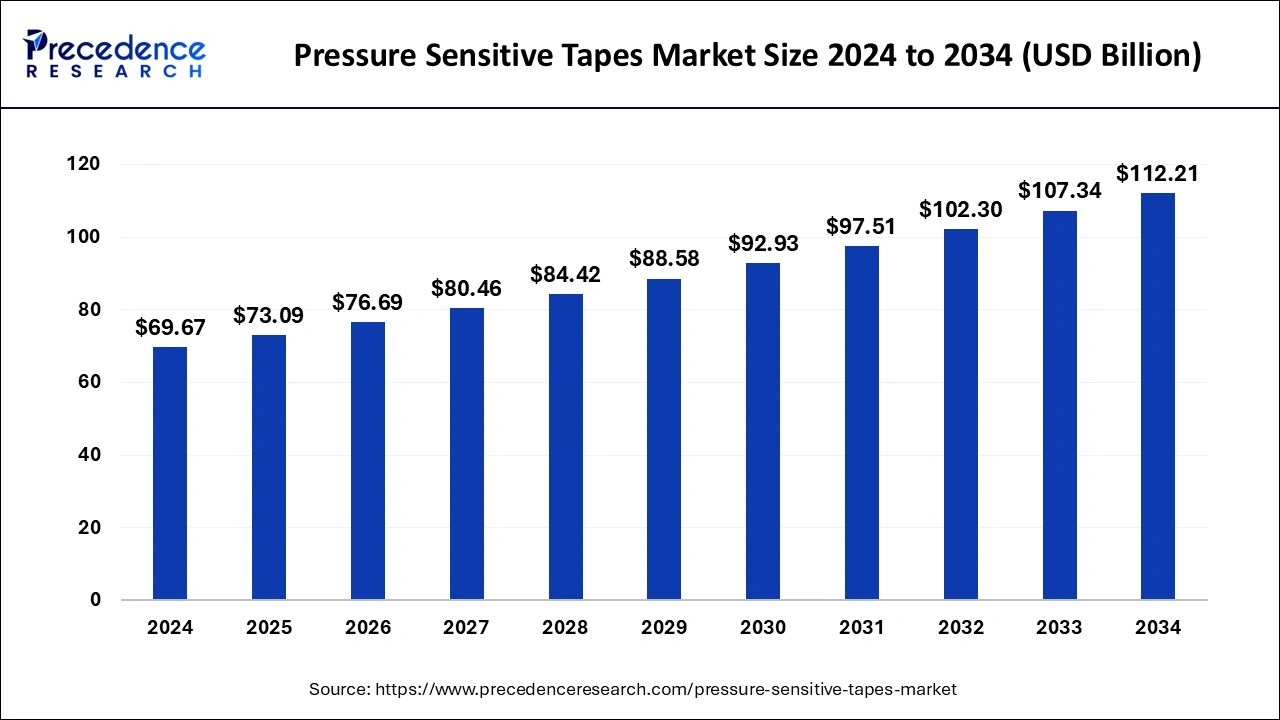

The global pressure sensitive tapes market size is calculated at USD 73.09 billion in 2025 and is predicted to increase from USD 76.69 billion in 2026 to approximately USD 117.19 billion by 2035, expanding at a CAGR of 4.83% from 2026 to 2035.

Pressure Sensitive Tapes Market Key Takeaways

- In terms of revenue, the global pressure sensitive tapes market was valued at USD 73.09 billion in 2025.

- It is projected to reach USD 117.19 billion by 2035.

- The market is expected to grow at a CAGR of 4.88% from 2026 to 2035.

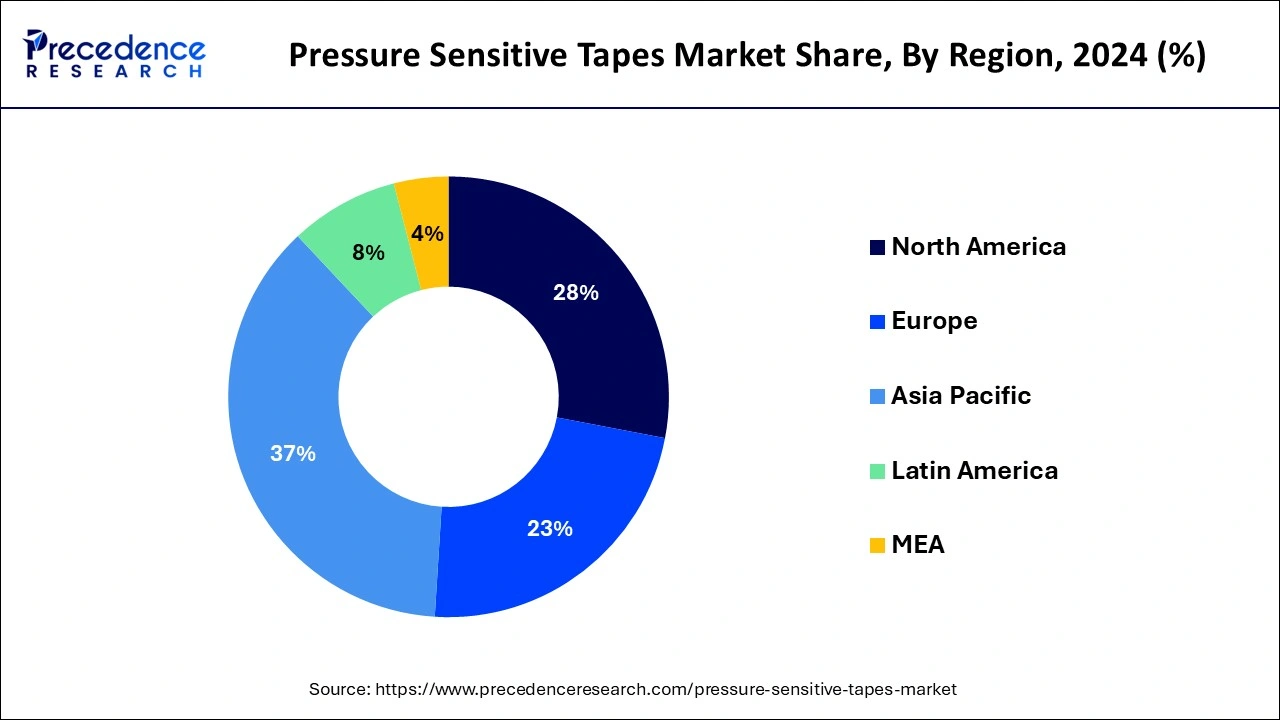

- Asia Pacific has contributed the largest revenue share of 37% in 2025.

- North America is expected to show in the global market during the forecast period.

- By product, the packaging tapes segment has generated the biggest revenue share of hare of 49% in 2025.

- By technology, the hot melt segment has recorded more than 42% of revenue share in 2025.

- By technology, the water-based segment is anticipated to grow at a faster rate during the forecast period.

- By backing material, the woven/non-woven segment has held the major revenue share of 25% in 2025.

- By backing material, the polyvinyl chloride (PVC) segment is expected to show the fastest growth during the projected period.

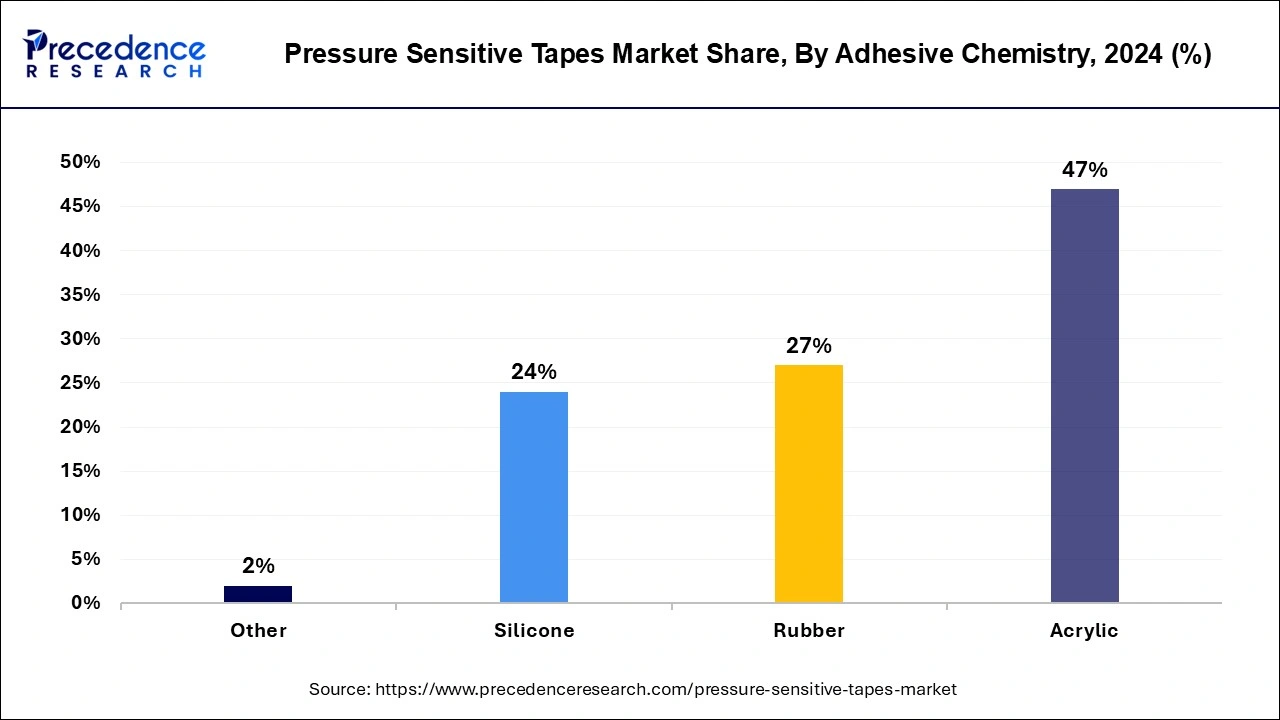

- By adhesive chemistry, the acrylic segment accounted more than 47% of revenue share in 2025.

- By adhesive chemistry, the rubber adhesives segment is expected to witness rapid growth during the studied period.

- By application, the medical segment dominated the market and holds the largest revenue share of 25% in 2024.

Market Overview

Pressure-sensitive tape is a thin, flexible fabric coated on one or both sides with adhesive. It's a premium type of adhesive tape that sticks to many surfaces when applied with pressure to smooth, dry areas. These tapes don't need water, heat, or solvents to activate the adhesive, relying solely on the pressure applied. They are lightweight, inexpensive, and resistant to electricity. Due to these properties, pressure-sensitive tapes are widely used in commercial packaging for sealing, labeling, and various general purposes.

Pressure sensitive tapes help reduce vibrations, noise, and assembly time. Leading manufacturers now offer hot melt and water-based tapes that are stronger and heat-resistant. Globally, pressure-sensitive tapes are categorized into packaging tape, consumer tape, and specialty tape. Packaging tapes often use plastic as a protective coating for easier tearing and greater flexibility. Consumer tapes are versatile, used for bonding, attaching, and temporary mounting, and are made with plastic backing and varying adhesive strengths.

Pressure Sensitive Tapes Market Growth Factors

- The rising population in developing countries, along with rapid urbanization, is expected to drive the growth of the pressure sensitive tapes market.

- Growth in trade relations with a growing adoption of online retailing can boost market growth shortly.

- The increasing utilization of pressure-sensitive adhesive tapes in the construction industry is fueling the pressure sensitive tapes market growth further.

- The advancements in customized tapes designed for specific applications are in huge demand, which can impact market growth positively.

- Growing mergers and acquisitions among key players will likely contribute to the pressure sensitive tapes market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 73.09 Billion |

| Market Size in 2026 | USD 76.69 Billion |

| Market Size by 2035 | USD 117.19 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.83% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Technology, By Backing Material, By Adhesive Chemistry, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Expansion of the labeling industry

The growing use of pressure-sensitive tapes in industries such as automotive and construction is a key factor driving the global pressure sensitive tapes market expansion. Increased global trade and the thriving packaging industry are also contributing to this growth. The rise of e-commerce and the expanding retail sector are expected to further boost the market for pressure-sensitive tapes. These tapes have a wide range of applications, from household to industrial uses, making the growth of various end-user industries a positive influence on the market. The expanding labeling industry is also creating significant demand for pressure-sensitive tapes. Furthermore, ongoing research into developing renewable and eco-friendly tape materials is expected to enhance market growth.

- In May 2023, Duraco Specialty Materials, a leading manufacturer of specialty materials including pressure-sensitive tapes and labels, coated films, and release liners, announced that it had acquired Strata-Tac, Inc., a leading manufacturer of custom engineered pressure sensitive self-adhesive products and coated films, from private sellers.

Restraint

Strict regulatory framework

Volatility in raw material costs is expected to restrain the growth of the pressure sensitive tapes market. The rising prices of these materials, essential for producing pressure-sensitive adhesive tape, are limiting market expansion. Strict regulations on the manufacture of pressure-sensitive adhesives due to health concerns and recycling challenges are also anticipated to hinder market growth. These stringent rules reduce the adoption of pressure-sensitive adhesives in various industries and can further impede the market growth.

Opportunity

Increasing demand for bio-based pressure-sensitive adhesives

The bio-based pressure-sensitive tapes market uses resources produced from plants as raw ingredients. A bio-based material's biomass content in an adhesive product is represented as a percentage of the product's dry weight. Bio-based PSAs are regarded as "carbon neutral" since the raw materials they require are produced from plants, and during production, they absorb the same amount of CO2 as they release when they are burned at the end of their useful life. In comparison to conventional petroleum-based formulations, this leads to a significant reduction in CO2 emissions while maintaining a level of greenhouse gas emissions. Furthermore, the majority of raw materials used in conventional PSAs originate from finite fossil fuels. Because bio-based PSAs use components derived from renewable plants, they lessen the need for petroleum. In the anticipated time, these factors are expected to fuel the rise of pressure-sensitive adhesives by raising the need for bio-based PSAs.

- In January 2024, sustainable materials company Bioaqualife launched a shrink wrap tape that provides the performance of traditional marine-grade shrink wrap tapes while safely biodegrading in natural environments. The solution is designed for taping and sealing seams in all shrink-wrapping applications, including marine, containment, construction, and total winterization applications.

Segment Insights

Product Insights

The packaging tapes segment dominated the pressure sensitive tapes market in 2024 and is expected to grow further over the forecast period. Packaging can be flexible or rigid, and pressure-sensitive adhesives (PSAs) are chosen based on the application's needs. PSAs are used in packaging for electronics and electrical devices, hygiene and medical products, drug delivery systems, construction transit packaging, automotive logistics, and consumer and industrial goods. The rising use of packaging tapes like polypropylene tapes in various applications, including transport, cartons, warehousing, and logistics, is expected to boost market growth. PSAs also improve consumer appeal in packaging with attractive graphics.

Technology Insights

In terms of technology, the pressure-sensitive tapes market in 2024 was dominated by the hot melt segment. The key factor driving demand for hot melt technology in North America is its large consumption volume. Over the course of the forecast period, the bonding and mounting of components in the automotive and aerospace sectors is projected to require this product, which is expected to drive market expansion.

- In May 2023, Dow and Avery Dennison co-developed an innovative and sustainable new hotmelt label adhesive solution that enables polyolefin film labels and polypropylene or polyethylene (PP/PE) packaging to be mechanically recycled together in one stream. The adhesive is the first of its kind on the label market and is approved by Recycles for recycling in the HDPE colored stream - Class B.

In the pressure sensitive tapes market, the water-based segment is anticipated to grow at a faster rate during the forecast period. Water-based adhesive tapes offer the benefit of low VOC content. However, they are unlikely to gain significant market share in Europe and North America due to the high existing use of hot melt and solvent-based adhesive technologies.

Backing Material Insights

The woven/non-woven segment held a substantial share of the pressure sensitive tapes market in 2024. Woven and non-woven backing materials are mainly used in the medical and hygiene industry. The growing aging population and increasing global healthcare expenditure are expected to drive the demand for these tapes.

The polyvinyl chloride (PVC) segment is expected to show the fastest growth in the pressure sensitive tapes market during the projected period. Polyvinyl Chloride (PVC) tapes offer benefits like high elasticity and superior flame retardancy. They also provide excellent adhesion to various materials, including plastic, metal, and aluminum. Furthermore, PVC tapes are widely used in electrical insulation, driving greater demand for the product.

Adhesive Chemistry Insights

The acrylic segment held a significant share of the pressure sensitive tapes market in 2024. Acrylic pressure-sensitive adhesives are widely used across various applications due to their saturated polymer nature, providing excellent resistance to oxidation. They boast favorable physical properties suitable for long-term exterior use. Acrylic PSAs are non-flammable, easy to handle, and have low contamination levels. They also resist migration, sunlight, oxygen, and heat well while offering strong adhesion, cohesion, and tack. The rising demand for acrylic resins is expected to boost the market for pressure-sensitive adhesives, driving overall market growth in the forecast period.

- In September 2023, Henkel presented the PSA range at Labelexpo Europe. Henkel offers mineral-oil-free adhesives, UV acrylic solutions, and wash-off products to increase recycling.

The rubber adhesives segment is expected to witness rapid growth during the studied period. Rubber adhesives used in pressure-sensitive tape production consist of natural or synthetic rubber, often modified with oil, antioxidants, and tacking resins. While these adhesives offer quick initial adhesion, they tend to lose effectiveness in high-temperature environments. Also, their lower resistance to UV light and solvents is expected to reduce demand over time.

Application Insights

The medical segment dominated the pressure sensitive tapes market in 2024. In the medical sector, adhesives are employed to cover wounds and maintain the integrity and positioning of bandages. These tapes play a critical role in various medical procedures, including wound care, IV needles, and post-operative care. Surgical tapes are commonly used to attach bandages, dressings, and gauze to the skin and wounds. The PSA is designed to adhere sufficiently to the skin, underlying layers of tape, or dressing materials while detaching without leaving any damage. As a result, the demand for surgical tapes is expected to increase due to their use in both complex and simple medical procedures.

Regional Insights

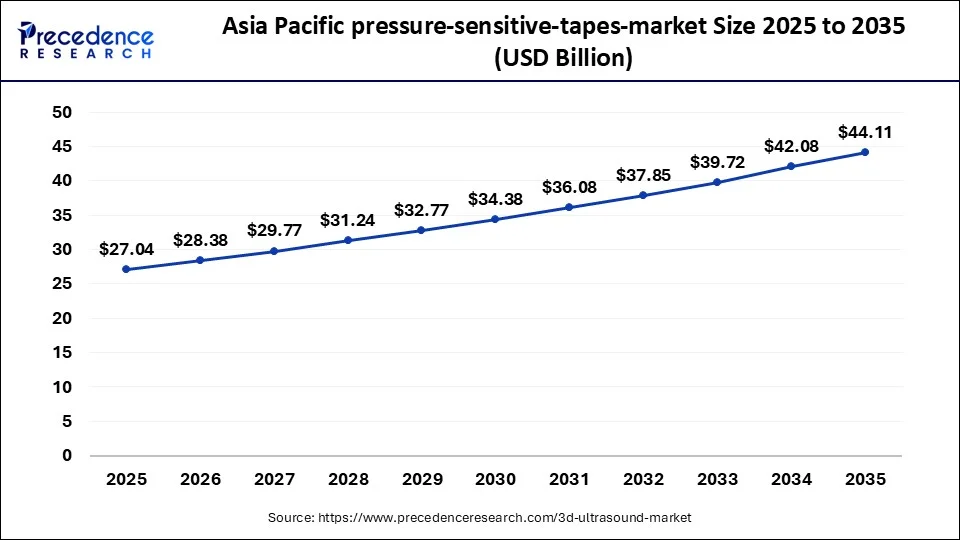

Asia Pacific Pressure Sensitive Tapes Market Size and Growth 2026 to 2035

The Asia Pacific pressure sensitive tapes market size is estimated at USD 27.04 billion in 2025 and is predicted to be worth around USD 44.11 billion by 2035 at a CAGR of 5.02% from 2026 to 2035.

Asia Pacific dominated the pressure sensitive tapes market in 2025. The main reason for this is the robust manufacturing industry in the region, with key manufacturers witnessing increasing investments. Countries like India, Japan, and China, experiencing significant growth in construction, automotive, and aerospace sectors, are driving demand for the product. The rapid growth of major end-user industries such as automobile, e-commerce, and healthcare in this region has been beneficial for market growth. Additionally, rising disposable incomes are expected to further bolster the pressure-sensitive tapes market in this area.

- In June 2023, Henkel invested proactively in the Indian market. India holds a key position for Henkel's global adhesive business as part of its long-term growth strategy both as a domestic market and as a base to serve other international markets.

North America is expected to show in the global pressure sensitive tapes market during the forecast period. The presence of developed economies like the U.S. and Canada in North America supports the growth of the building and construction industry in the region, driving demand for pressure-sensitive adhesive tapes. Moreover, these tapes are well-suited for handling wind loads in Canada's changing climate and outperform mechanical fasteners, making them ideal for bonding architectural panels.

- In April 2024, U.S.-based company Franklin Adhesives & Polymers launched Covinax 625, an emulsion pressure-sensitive adhesive developed especially for performance and versatility in various durable label and tape applications. According to the company, with improved performance, emulsion PSA has gained popularity in multiple durable applications compared to solvent-based PSA due to its environmental benefits from being solvent-free and the reduced total applied cost.

Pressure Sensitive Tapes Market Companies

- Tesa SE

- 3M

- Nitto Denko

- LINTEC Corporation

- L&L Products Inc.

- Henkel

- Lohmann GmbH & Co. KG

- Berry Plastics

- Intertape Polymer

- Avery Dennison

- Scapa

- HB Fuller

- Ashland

- The Dow Chemical Company

- Arkema Group

- Sika AG

Recent Developments

- In September 2024, Henkel introduced a new mineral oil-free hot melt tape called Technomelt PS 3500, which allows the label industry to enhance food safety with mineral-oil hydrocarbons-free formulations and enhance container recycling and waste disposal as these tapes can easily be washed off from plastic bottles.

- In November 2023, Otto Denko Corporation unveiled its new ES Linerless Transfer Tapes, which are designed to improve production efficiency and reduce waste in the electronics industry.

- In October 2023, 3M Company announced the launch of its new ThinlineAcrylic Foam Tapes, which offer high bond strength and conformability for a variety of applications, including mounting, sealing, and gasketing.

Segments Covered in the Report

By Product

- Specialty Tapes

- Packaging Tapes

- Consumer Tapes

By Technology

- Hot Melt

- Water-based

- Solvent-based

- Radiation-cured

By Backing Material

- Woven/Nonwoven

- Polyvinylchloride (PVC)

- Polypropylene (pp)

- Polyethylene Terephthalate (pet)

- Foam

- Metal

- Other Backing Materials

By Adhesive Chemistry

- Acrylic

- Rubber

- Silicone

- Other Adhesive Chemistry

By Application

- Automotive

- Aerospace

- White Goods

- Electronics

- Semiconductors

- Electrical

- Paper & Printing

- Construction

- Medical

- Hygiene

- Retail & Graphics

- Packaging Tapes

- Consumer Tapes

- Other Applications

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting