What is the Product Engineering Services Market Size?

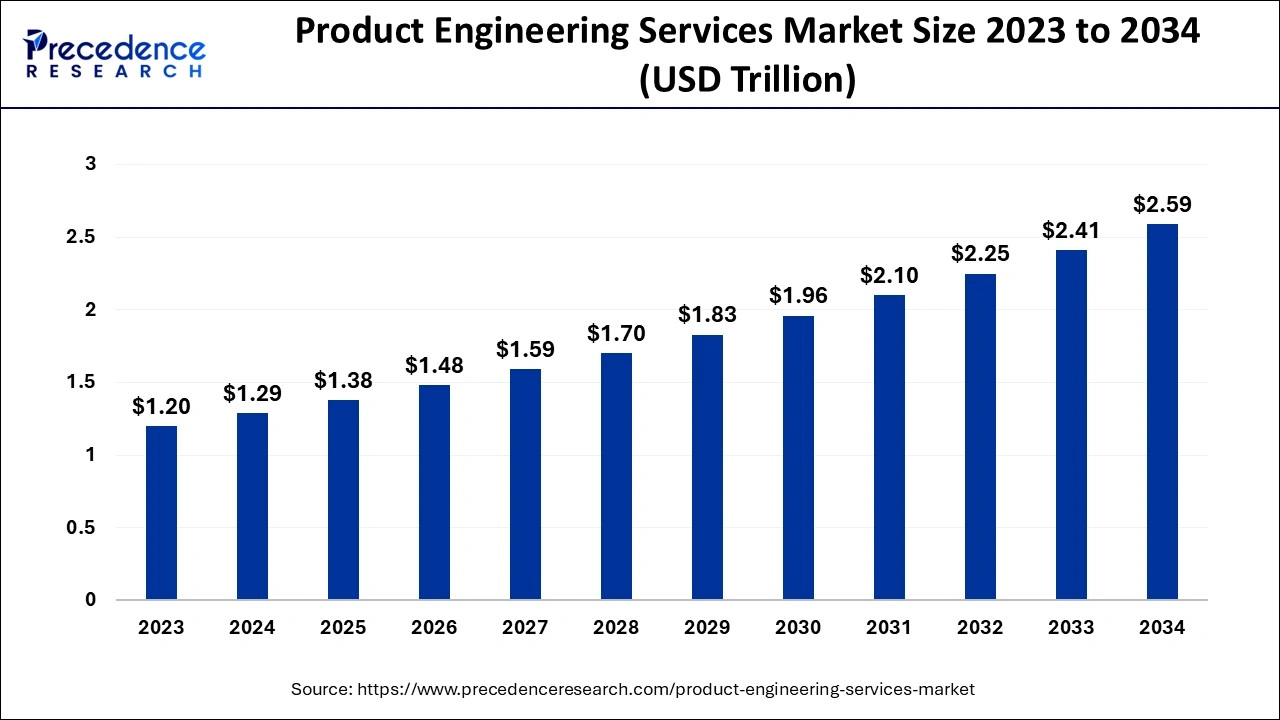

The global product engineering services market size is accounted at USD 1.38 trillion in 2025 and predicted to increase from USD 1.48 trillion in 2026 to approximately USD 2.76 trillion by 2035, representing a CAGR of 7.18% from 2026 to 2035. The rising digitization and adaptation of automation in industries are driving the growth of the product engineering services market.

Product Engineering Services Market Key Takeaways

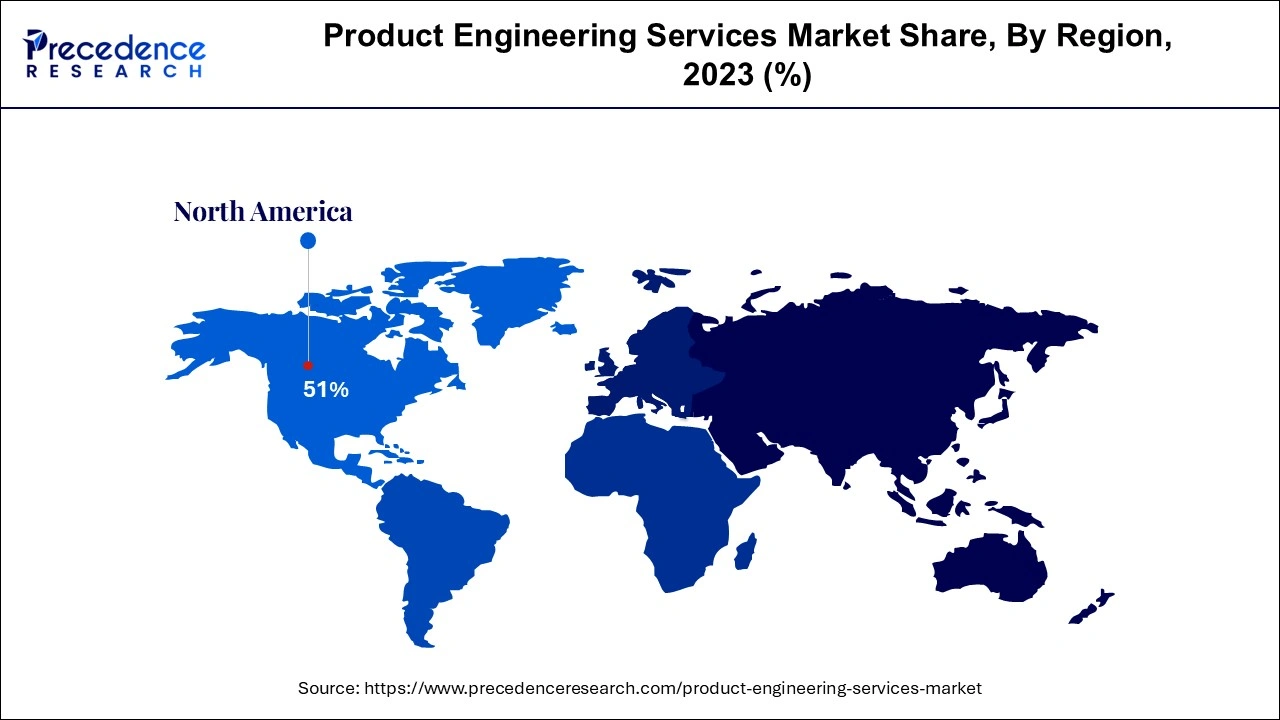

- North America dominated the global market with the largest market share of 51% in 2025.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By service, the development segment contributed the highest market share in 2025.

- By service, the deployment segment will show significant growth during the forecast period.

- By enterprise, the large enterprise segment led the market in 2025.

- By enterprise, the small and medium enterprise segment will witness significant growth during the forecast period.

- By industry, the manufacturing segment accounted for the highest market share in 2025.

- By industry, the healthcare and life science segment is anticipated to show significant growth from 2026 to 2035.

How Can AI Impact the Product Engineering Services Market?

The integration of artificial intelligence in the product engineering services market helps revolutionize the industrial process by streamlining the product development cycle. AI-powered automation maintains and streamlines repetitive tasks, minimizes the time to market, and increases overall efficiency. AI accelerates product development cycles, product quality and performance, and personalizes user experience.

- In October 2024, Capgemini launched engineering and R&D-specific Generative AI (Gen AI) infused solutions for consumers to streamline engineering, innovation, and R&D processes with high-level automation and new innovations.

How will summary redefine exceptional insights of the Product Engineering Services Market?

The product engineering services involve the development of the service or the platform using the hardware design, industrial design, and embedded software techniques. The product engineering services offer different programming tools and devices, microprocessors, interfaces, memory devices, operating systems, and UI tools to develop and engineer a product. There are a number of product engineering services that serve in medical devices, wearable goods, aerospace and military, automotive electronics, industrial products, and several other industries.

Product Engineering Services Market Growth Factors

- Increasing industrialization: The rising industrialization across the world and the association of technologies in the industries for improving the efficiency in product and service development is driving the growth of the market.

- Modernization in technology: Product engineering plays a significant role in the modernization of industrial technology; there are several leading technology firms offering advanced technological solutions that provide benefits in operations in a wide range of industries.

- The Investment in technologies: The rising investment in technological advancement in companies and the rising digital transformation across countries are driving the demand for the product engineering services market.

Market key trend

The product engineering services market is evolving rapidly, guided by a shift in consumer expectations, rising digital transformation, and the need for accelerated innovation. Businesses are no longer focused solely on functionality; they now demand intelligent, interconnected, and user-friendly product ecosystems. This evolution is being propelled by advancements in technologies such as artificial intelligence, the Internet of Things, and augmented reality, which are seamlessly integrated into the product development cycle. Furthermore, sustainability and energy efficiency are taking centre stage, pushing engineering firms to rethink materials, processes, and lifecycles with an eco-conscious lens.

Product Engineering Services Market Outlook

The start-up ecosystem in the product engineering services is a comprehensive revolutionising environment characterised by advanced technologies such as cloud and AI, innovation and smart collaboration. The start-ups in this market have accelerated PES firms to push them to excel in optimising cost, promise access to skilled expertise and scalability by eliminating the need for huge in-house teams.

The growth of the product engineering services market is aligned to the rapid technological advancement, fastest Time-to-Market (TTM), high demand for customisation and innovation and the push of automation and Industry 4.0. The major push for industrial automation, connected devices, and smart manufacturing is stimulating demand for equipped systems, data analytics and software integration potential in the product development.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 2.76 Trillion |

| Market Size in 2026 | USD 1.48 Trillion |

| Market Size in 2025 | USD 1.38 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Enterprise, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Product engineering services advantages

The increasing spending on technologies and digitization across industries and personal businesses are driving the growth of the product engineering services market. Product engineering offers several benefits to the wider application in industries such as software testing, prototyping, ideation, product modernization, product design, product engineering, business process reengineering, new product development, architecture design, hardware integration, quality engineering, maintenance, turnkey product development, software development, migration, improving performance, and others.

Restraint

Data issues

The data privacy issue, such as concerns related to the protection of data, is the major restraining the growth of the product engineering services market.

Opportunity

Rising IT and telecom industry

The rising investment in the evaluation of the IT (information technology) and telecom (telecommunication) industries is emerging as a potential opportunity for the product engineering services market expansion. Product engineering enhanced product development, software testing, product support, product modernization, prototype development, product engineering, product lifecycle management, quality engineering, software engineering, technology assessment, embedded engineering, and other applications in the field.

Product Engineering Services Market Segment Insights

Service Insights

The development segment dominated the product engineering services market in 2024. The increasing demand for product engineering in the industries for the overall development of all the stages of product development collide with the user requirements and organization goals. The rising demand for product development in different industries and services and the rising digitization across industries are driving the demand for product development in the product development segment.

The deployment segment will show significant growth in the product engineering services market during the forecast period. Product deployment is also known as the release or launch of the software to the users. The deployment of the software is done via different distribution channels, including app stores, cloud platforms, and internal distribution channels. Continuous Deployment and Continuous Integration pipelines allow efficient deployment of software with minimum disruption and downtime.

Enterprise Insights

The large enterprise segment led the product engineering services market in 2024. The increasing demand for the product engineering in the large enterprises or organizations for increasing the efficiency of the product development cycles and services. Product engineering helps large enterprises across a wide range of applications from start to end product development.

The small & medium enterprise segment will witness significant growth in the product engineering services market during the forecast period. The increasing industrialization across the world, the ongoing investment in the development of small and medium enterprises, and the increasing digital transformation are driving the demand for product engineering services for the development of different software products and services.

Industry Insights

The manufacturing segment accounted for the highest share of the product engineering services market in 2024. The rising population causes higher demand for the manufacturing sector, and the demand for product and service development and management in the manufacturing sector is driving the demand for product engineering services. Product engineering helps improve product quality, enhance productivity and cost savings, enhance customer satisfaction, increase innovations with new product development, and more.

The healthcare & life science segment is anticipated to show significant growth in the product engineering services market during the forecast period. The integration of product engineering is revolutionizing the overall healthcare and life science industry. Product engineering in the healthcare sector helps in the designing, testing, development, and deployment of software. Product engineering helps improve patient monitoring, increase the safety and security of patients, provide remote healthcare assistance, improve health management, and enhance accuracy.

Product Engineering Services Market Regional Insights

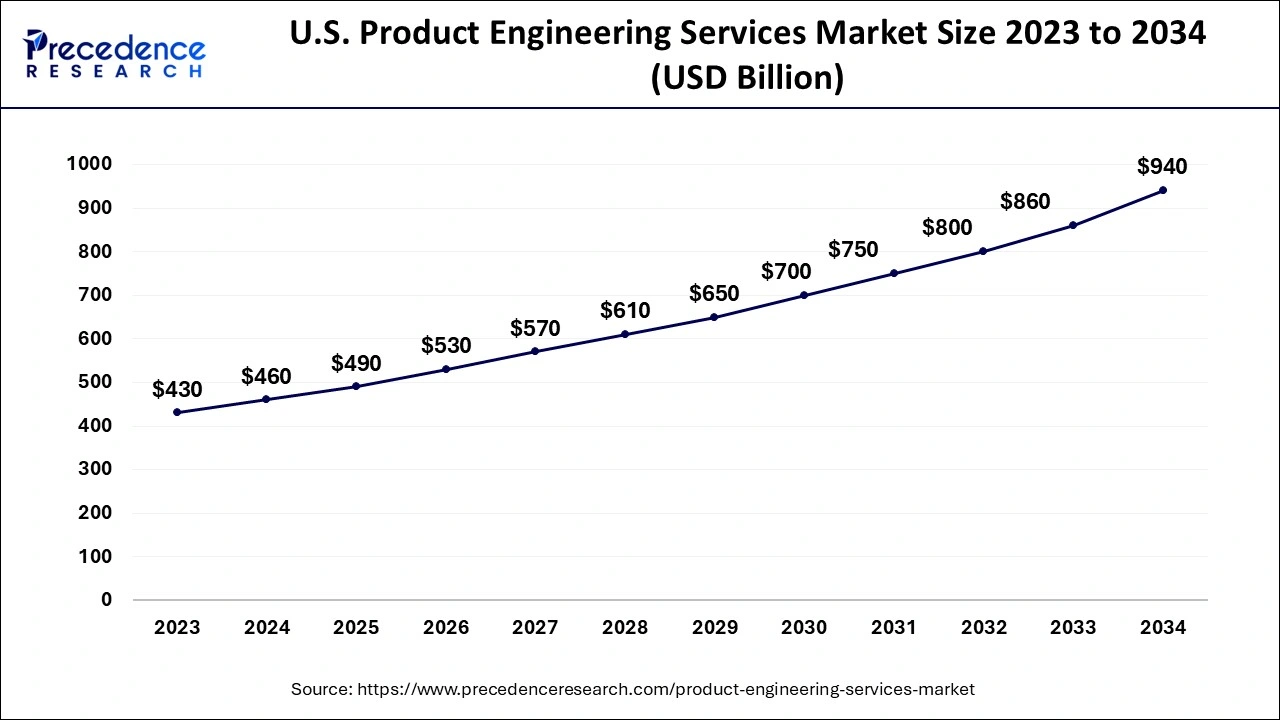

The U.S. product engineering services market size is evaluated at USD 490 million in 2025 and is projected to be worth around USD 1,006.67 million by 2035, growing at a CAGR of 7.47% from 2026 to 2035.

North America dominated the product engineering services market in 2025. The growth of the market is attributed to the rising industrialization, such as the growth in the industries including healthcare, automotive, BFSI, telecommunication, IT, aerospace and defense, retail, and others are driving the demand for the product engineering services for the development of the different types of products and services in the organization from start to the finished product deployment to the consumers or users. Furthermore, there is an ongoing investment in research and further technological development.

North America holds a prominent position in the global product engineering services landscape. Countries like the United States and Canada are driving this momentum through a well-established technological infrastructure, robust industrial base, and highly skilled engineering talent. The governments in this region have implemented supportive frameworks to foster innovation and digital adoption across industries. Incentives are provided for companies that focus on smart manufacturing, digital product design, and engineering R&D, which further boosts the growth of service providers. This proactive policy environment, coupled with high demand for customized engineering solutions, makes North America a key player in this space.

- In the United States, there are 84.7% of the surveyed companies specializing in developing Enterprise Applications for clients. 53% of the participant's organizations take on software projects on business process automation. 15.4% of organizations provide customer relationship management software solutions.

- Marketing software is the top priority factor in terms of investment, with 28% second to IT security (32%) for all the consumers of software worldwide in 2024.

Asia Pacific is expected to witness significant growth in the product engineering services market during the forecast period. The growth of the market is attributed to the continuously growing population, which causes the increased demand for industrial development, and the rising spending on technological advancements in the industrial process is driving the growth of product engineering services across the region.

Asia Pacific is emerging as the fastest-transforming region in the product engineering services domain, owing to its dynamic market conditions and increasing appetite for innovation. Countries such as India, China, South Korea, and Vietnam are witnessing substantial investments in design-led manufacturing and end-to-end engineering solutions. The rise in technology-driven start-ups and government-backed initiatives to promote local innovation is encouraging global service providers to expand their footprints here. Additionally, improvements in education and the growing availability of engineering talent are empowering firms to meet international standards at competitive costs. As enterprises in the region embrace digital product development and smart industrial processes, the demand for specialized engineering services continues to soar.?

- The IT and BPM industry is one of the emerging sectors in the Indian economy, significantly contributing to the country's GDP and public welfare. The IT industry accounted for about 7.5% of India's GDP in FY23 and is anticipated to contribute 10% to India's GDP by 2025.

- India's IT industry revenue touched USD 227 billion in FY22, and the 15.5% YoY growth is estimated to touch USD 245 billion in FY23. The software industry in India is expected to record a notable growth of 11.1% in 2024.

Europe's advancement into this market is characterised by comprehensive initiatives in popular sectors like industrial and automotive manufacturing. Alongside the region's impactful consideration of sustainability and acceptance of digital technologies like IoT, AI, and automation, it has brilliantly supported the evolution of the product engineering services. The tech integration is a smooth extension of the modern tech driver, like ML, AI, IoT and automation. This advances design accuracy and upgrades production efficiency.

By far, Europe's key advancements have marked the fruition of profit in the vast product engineering services market.

The region has witnessed a major shift in the market to become a significant hub for product engineering services. Firstly, Latin America has now moved from just playing a historical role as a typical IT outsourcing station and has moved ahead to transform and stimulate the market with its elevated skilled smart pool and technological advancement. This has invited new human resources to drive the start-up ecosystem and thrive in smart government initiatives.

Product Engineering Services Market Value Chain Analysis

The inbound logistics covers collecting data, balancing primary project inputs and sourcing client needs. Overall, the focus is on serving full-fledged, appropriate requirements to prevent expensive reworks. The outbound includes packaging, distribution and release of the final confirmed software or product and handling deployment logistics.

The operational analysis of the core engineering work involves software development, quality control, testing, prototyping and product design. The key analyses under the operations are the usage meter of automation, effect reduction rates and efficiency process (eg, agile methodologies).

The smart strategies are designed to spotlight engineering potential and induce clients to choose appropriate services. This involves establishing value propositions like high quality and unique product features that resonate with focused customers.

Product Engineering Services Market Segment Covered in Report

By Service

- Design

- Development

- Deployment

- Testing

- Support and Maintenance

- Redesigning and Re-Engineering

- Others (Strategy, Research, and Consulting)

By Enterprise

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry

- Automotive

- Aerospace and Defense

- Healthcare

- BFSI

- IT

- Industrial Manufacturing

- Energy and Utilities

- Telecom

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Product Engineering Services Market Companies

- Oracle. (U.S.)

- Accenture (Ireland)

- Infosys Limited (India)

- GEP (U.S.)

- Genpact (U.S.)

- Proxima (U.K.)

- IBM (U.S.)

- Broadcom (U.S.)

- WNS (Holdings) Ltd. (India)

- Capgemini (France)

- Wipro Limited (India)

- HCL Technologies Limited (India)

- Tata Consultancy Services Limited. (India)

- DXC Technology Company (U.K.)

- AEGIS Company. (India)

- Corbus, LLC. (India)

- Aquanima S.A. (Spain)

Latest Announcement by Industry Leaders

- In October 2024, Oracle launched the latest AI-powered capabilities within Oracle Fusion Cloud Field Service and Oracle Fusion Cloud Service, which are designed to help the service teams enhance productivity, serving customers with a better understanding of customer issues. The update will automatically detect customer issues and recommendations for actions, streamline resolution, and improve first-time fix rates.

- In December 2024, Accenture announced its intentions to acquire AOX, a leading company that specializes in embedded software for carmakers and their suppliers based in Germany. The equation helps in elevating the consumer experience by helping automotive clients solve challenges in their transition to software-defined vehicles.

Recent updates on product engineering services- 2025

Digital transformation fuels market expansion

- In March 2025, the growing need for digital transformation across industries is driving the market for product engineering services. To boost innovation and shorten time-to-market, businesses are increasingly outsourcing product development. Tech auto and healthcare companies are increasingly using services that cover the entire product lifecycle from conception to deployment. Engineering processes are being altered by the use of Agile DevOps and AI-driven development tools. These services are being used by both startups and large corporations to maintain their competitiveness in rapidly evolving markets.

Focus on embedded systems and AI integration

- In April 2025, the market witnessed an increase in embedded product engineering investment fueled by industrial automation, automotive electronics, and smart devices. To enable intelligent features and predictive maintenance, AI and machine learning are being incorporated into product design. Companies are looking for more and more experience with real-time system optimization, IoT platforms, and sensor integration. Demand for next-generation engineering services is being further accelerated by edge computing and 5G connectivity, particularly in wearables and autonomous systems.

Recent Developments

- On 12 February 2025, Alten, AVL, and HCL technologies were recognized as market leaders. These three firms were highlighted in an industry report for their strong presence across key sectors such as automotive, aerospace, and medical devices. Their ability to deliver full-cycle engineering solutions from concept to manufacturing support has helped them maintain leadership as enterprises shift toward digital product innovation.

- On 25 March 2025, Capgemini announced a new suite of engineering services infused with generative AI to support rapid prototyping and virtual testing. This offering is tailored to industries seeking accelerated product rollouts and cost optimization through automation in the design and validation stages.

- On 5 September 2024, Tata Consultancy Services focused on AI-enhanced productivity. TCS shared that its product engineering teams have seen major productivity gains through AI tools used in requirements analysis, code generation, and design optimization. The company plans to integrate AI further into its engineering services to meet the evolving expectations of clients in highly competitive markets.

- In July 2024, L&T Technology Services Limited, a leading firm in the global digital engineering and R&D company, launched the third annual Digital Engineering Awards in association with global technology research and advisory firm Information Services Group (ISG) and business news channel CNBC TV18 in India.

- In November 2024, Suzuki Motor Corporation, a Japanese multinational mobility manufacturer and the global leader in the design and technology services �Of Tata Elxsi' launched the �SUZUKI-TATA ELXSI Offshore Development Center' in Pune, India. The center is especially dedicated to Suzuki's innovations in advanced engineering and revolutionizing the future.

- In June 2024, Cognizant comes into the agreement for providing engineering services to Gentherm, a leading player in innovative thermal management and pneumatic comfort technologies in the automotive industry and a leading player in medical patient temperature management systems. The Cognizant provided system engineering, model-based development services, and validation from Hyderabad, India, and established the test facility to conduct research and development for Gentherm products.

Segments Covered in the Report

By Service

- Design

- Development

- Deployment

- Testing

- Support and Maintenance

- Redesigning and Re-Engineering

- Others (Strategy, Research, and Consulting)

By Enterprise

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry

- Automotive

- Aerospace and Defense

- Healthcare

- BFSI

- IT

- Industrial Manufacturing

- Energy and Utilities

- Telecom

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content