What is the U.S. AI Materials Product Optimization Market Size?

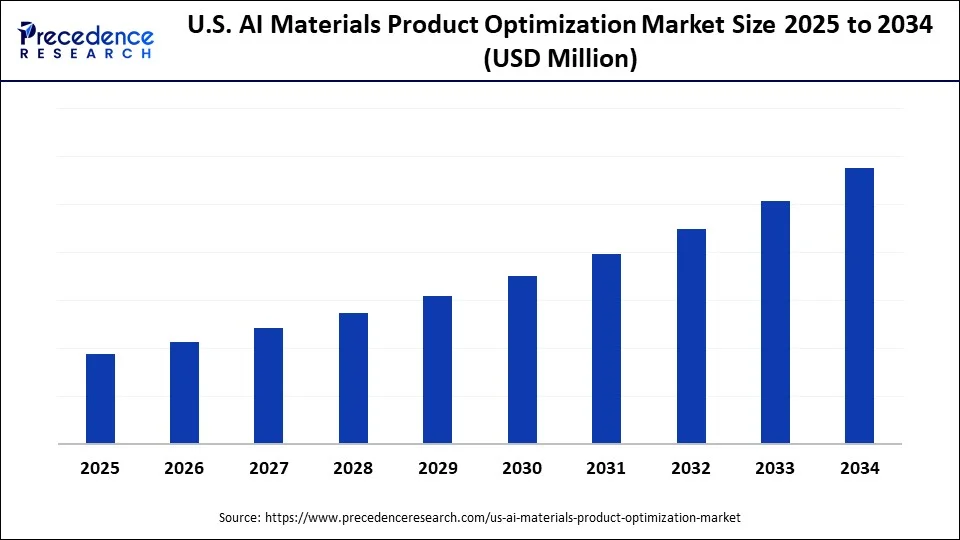

U.S. AI materials product optimization market is witnessing rapid growth as American manufacturers and research institutions leverage AI to accelerate material discovery, testing, and performance optimization.The market is growing due to the increasing adoption of AI-driven tools in the United States, which optimizes development time, leads to more cost-effective production, and improves product performance across various industries in the country.

U.S. AI Materials Product Optimization Market Key Takeaways

- By function/optimization type, the material discovery & design segment held the largest share in 2024.

- By function/optimization type, the predictive modeling & simulation segment is expected to grow at the fastest rate during the forecast period.

- By industry/application, the pharmaceuticals & chemicals segment is expected to grow at the fastest CAGR during the forecast period.

- By industry/application, the electronics & semiconductors segment led the market in 2024.

- By AI technology used, the machine learning segment is expected to grow at the fastest CAGR during the forecast period.

- By AI technology used, the generative AI segment captured the biggest market share in 2024.

- By deployment mode, the cloud-based segment is observed to grow at the fastest CAGR during the forecast period.

- By deployment mode, the hybrid segment generated the major market share in 2024.

- By offering/capability, the software/platforms segment is expected to grow at the fastest CAGR during the forecast period.

- By offering/capability, the services segment held the largest market share in 2024.

Market Overview

What Is Encompassed in the U.S. AI Materials Product Optimization Market?

The U.S. AI materials product optimization market is experiencing rapid growth due to developments in machine learning and artificial intelligence technologies in the United States. These developments enable a range of American industries, including healthcare, energy, automotive, and aerospace, to design, produce, and optimize materials efficiently. Businesses can utilize AI to accelerate research and development, reduce expenses, and enhance material performance, ultimately leading to more high-performing and sustainable products. The incorporation of AI into materials science is revolutionizing conventional methods and opening new opportunities for creativity and competitiveness in the global marketplace.

- In March 2025, Johns Hopkins Applied Physics Laboratory utilized AI to optimize titanium alloy production, uncovering faster and more efficient manufacturing methods with potential applications in aerospace and shipbuilding.(Source: https://www.jhuapl.edu)

- In August 2025, Multiverse Computing introduced Singularity, a quantum and AI-powered software platform designed to solve complex problems in materials science, energy, and manufacturing, accessible via tools like Microsoft Excel(Source: https://en.m.wikipedia.org)

U.S. AI Materials Product Optimization Market Growth Factors

- Rising Adoption of AI in Material Design: American companies are increasingly using AI and machine learning to accelerate material discovery and optimize product performance.

- Demand for Faster Product Development: AI-driven optimization reduces research and development time, enabling faster time-to-market for new materials and products.

- Cost Efficiency in Manufacturing: AI helps identify optimal material combinations and processes, minimizing waste and lowering production costs.

- Increasing Focus on Advanced Materials: Growing demand for high-performance materials in automotive, aerospace, electronics, and healthcare sectors drives market growth.

- Integration with Digital Twin and Simulation Technologies: Combining AI with simulation and digital twin technologies allows accurate prediction of material behavior under real-world conditions.

- Sustainability and Environmental Concerns: AI helps develop eco-friendly and sustainable materials by predicting environmental impacts and optimizing resource usage.

Market Scope

| Report Coverage | Details |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function / Optimization Type, Industry / Application, AI Technology Used, Deployment Mode, and Offering / Capability |

Market Dynamics

Drivers

Enhancing Manufacturing Processes Through AI Optimization

American manufacturers are utilizing AI to optimize material properties, such as electrical conductivity, durability, and heat resistance, before production through predictive modeling. In the United States, the use of AI in material development helps reduce the risk of post-production failures and assists with compliance with stringent performance and safety standards. Advanced AI algorithms are enabling manufacturers to predict material behavior under various conditions, including temperature fluctuations, mechanical stress, and chemical exposure. Collecting and analyzing consumer usage data further enables customization of material properties in various applications, thereby improving reliability and efficiency, driving growth in the U.S. AI materials product optimization market. Additionally, virtual testing supports faster design iterations and more precise product adaptations, streamlining development cycles for U.S. industries.

- In March 2025, researchers from the Johns Hopkins Applied Physics Laboratory (APL) and the Whiting School of Engineering reported using artificial intelligence to optimize the manufacturing of 3D-printed titanium for applications in aerospace and defense manufacturing. By identifying the most efficient processing techniques, researchers are advancing both production speed and material strength, which is expected to drive innovations for various industries, including oceanography and aerospace research. (Source: https://scitechdaily.com)

Sustainability & Waste Reduction

In the U.S. manufacturing sector, AI-driven optimization is also helping reduce material waste by accurately forecasting required quantities, minimizing errors, and enhancing overall production efficiency. These capabilities support national sustainability initiatives by lowering energy consumption and decreasing the environmental impact of operations. The use of AI technologies is also significantly impacting the identification of alternative eco-friendly materials that still meet prescribed performance standards, reinforcing the shift toward circular economy practices. Within supply chain management, AI helps anticipate demand fluctuations, enabling manufacturers to limit surplus production. Furthermore, continuous monitoring and feedback enabled by AI ensure consistent product quality while reducing the incidence of defective outputs.

- In June 2025, Florasis launched a smart factory in Hangzhou, integrating AI-powered defect detection, robotic systems, and real-time monitoring. The system optimizes production efficiency, reduces material waste, and ensures high-quality output, reflecting a commitment to sustainability.(Source: https://www.voguebusiness.com)

Restraints

High Cost of AI Technology Adoption

In the United States, the deployment of AI-driven material optimization solutions involves substantial investment in software, hardware, and skilled personnel. For many small and medium-sized enterprises (SMEs), high upfront costs may limit adoption. Additional expenses often arise from tailoring AI platforms to integrate with existing U.S. manufacturing systems and workflows. The financial burden is further exacerbated by the need for advanced computing infrastructure, including cloud-based platforms and high-performance GPUs. Ongoing model maintenance and system updates also require specialized expertise, contributing to a higher total cost of ownership for American manufacturers and slowing the adoption of technologies in the U.S. AI materials product optimization market.

- In March 2025, Repurpose implemented AI to optimize its operations, including financial processes and marketing campaigns. While AI improved efficiency, the company reported significant investment in software platforms and personnel training, highlighting the high costs associated with adopting AI solutions.(Source: https://www.businessinsider.com)

Data Availability and Quality Issues

In the United States, the accuracy of AI in predicting material behaviors relies heavily on the availability of large, high-quality datasets. Despite this, the effectiveness of these AI-based models can be incomplete, inconsistent, with noisy data leading to inaccurate predictions. This can have significant safety consequences if not detected during quality control. Several American manufacturers report facing challenges in reliably training AI algorithms due to the fragmentation of data sources and the absence of standardized formats for material property information. Additionally, proprietary restrictions often discourage organizations from sharing critical datasets, thereby limiting opportunities for collaborative AI development. Concerns around data privacy and intellectual property further contribute to delays in implementation by restricting access to valuable information.

Opportunities

Expansion in Advanced Industries

In the U.S., heavily technology-reliant industries such as aerospace, automotive electronics (especially for electric vehicles), and healthcare present significant opportunities for AI-driven material optimization. These sectors often require materials with superior strength, thermal resistance, or conductivity. Artificial intelligence accelerates the development of lightweight polymer composites and advanced alloys for applications in wearable devices, electric vehicles, and aerospace components. This enables manufacturers to comply with stringent performance requirements while reducing design cycle costs. By simulating and testing materials in virtual environments, U.S. companies can efficiently scale production and rapidly prototype innovations. Early adoption of AI in this field further provides a competitive advantage by shortening the time to market for U.S. AI materials products in the advanced materials sector.

- In December 2024, Amazon announced a pilot program to test an AI-designed carbon removal material in its data centers. Developed by Orbital Materials, the material functions like a sponge at the atomic level, selectively interacting with CO2. The pilot aims to reduce emissions from AI systems supported by these data centers. The initiatives reflect Amazon's commitment to achieving net-zero carbon emissions by 2040.(Source: https://www.reuters.com)

Customization and Personalization of Materials

In the U.S. AI materials product optimization market, AI enables manufacturers to design materials tailored to specific applications or customer requirements. Through predictive modeling, properties such as elasticity, conductivity, and thermal stability can be adjusted to develop tailored solutions for sectors including electronics, medical devices, and specialty coatings. This level of personalization creates new revenue opportunities by addressing niche applications where conventional materials are insufficient. Moreover, AI supports the optimization of materials to meet environmental conditions, regulatory standards, and even aesthetic preferences, enhancing product differentiation and overall value in highly competitive U.S. industries.

Segmental Insights

Function/Optimization Type Insights

Why Did the Material Discovery & Design Segment Dominate the U.S. AI Materials Product Optimization Market in 2024?

The material discovery & design segment dominated the U.S. AI materials product optimization market, as AI enables the rapid identification of novel material compositions, optimization of microstructures, and the creation of lightweight yet robust substitutes. The foundation of AI-driven additive manufacturing, this function is essential for enhancing strength performance and cost efficiency. Because AI can virtually test material properties before production, it also saves time and money compared to traditional research and development. There is significant demand for advanced materials in sectors such as aerospace, automotive, and healthcare, so AI-driven materials innovation continues to lay the groundwork for widespread adoption.

Predictive modeling & simulation is growing in the United States, fueled by demand for real-time defect detection, process optimization, and virtual testing. AI-powered simulations reduce trial and error, accelerate time to market, and improve reliability, making it increasingly essential for industries scaling up additive manufacturing. Companies utilize predictive modeling to reduce energy consumption and minimize material waste, thereby ensuring more sustainable production. As manufacturing complexity increases, predictive AI becomes indispensable in guaranteeing quality assurance and operational efficiency.

Industry/Application Insights

Why Did the Pharmaceutical/Chemicals Segment Lead the AI Materials Product Optimization Market in 2024?

The pharmaceuticals & chemicals segments led the U.S. AI materials product optimization market in 2024 because of the use of AI-enabled additive manufacturing in advanced material development, bioprinting, and drug formulation. AI improves efficiency and creativity in both laboratories and industrial applications by optimizing molecular structures and printing procedures. This domination is reinforced by the capacity to create chemical compounds and dosage forms tailored to individual patients. Moreover, regulatory clearances and increasing funding for AI-driven research pipelines are expected to maintain this market's leadership in adoption.

The electronics & semiconductors market in the U.S. is growing rapidly for AI-optimized material products, driven by the need for miniaturized, complex, and high-performance components. AI-powered additive manufacturing supports precise circuit printing, thermal management, and advanced packaging, enabling next-generation devices. With rising demand for 5G, IoT, and AI-driven electronics, manufacturers are turning to AI-enhanced 3D printing to achieve micro-level precision. This growth is further supported by increasing research and development funding in semiconductor design and fabrication technologies.

AI Technology Used Insights

Why Did the Machine Learning Segment Dominate the U.S. AI Materials Product Optimization Market in 2024?

The machine learning segment is dominating the U.S. AI materials product optimization market as it powers defect detection, process monitoring, and performance prediction in additive manufacturing. Its ability to learn from large datasets makes it indispensable for optimizing design, reducing errors, and improving product quality at scale. Machine learning also enables predictive maintenance of equipment, extending system lifespans and reducing downtime. As industries continue to digitalize their production processes, ML remains the most established and widely integrated AI technology.

Generative AI is the fastest-growing technology in the U.S. AI materials product optimization market, transforming how designs are created by enabling complex geometries, topology optimization, and innovative product structures. Its ability to automate creative design processes is rapidly accelerating adoption across industries. Generative AI also drives sustainability by reducing material use through the optimization of part designs. The growing integration of generative AI into CAD and simulation platforms makes it a disruptive force in additive manufacturing.

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the AI Materials Product Optimization Market in 2024?

The cloud-based segment dominated the U.S. AI materials product optimization market in 2024, driven by its cost-effectiveness, accessibility, and scalability. Businesses implementing smart manufacturing prefer cloud-based AI-integrated platforms because they facilitate smooth collaboration, real-time monitoring, and remote optimization. For small and medium-sized American enterprises venturing into additive manufacturing, the pay-as-you-go model offered by many cloud-based providers is particularly optimal. Additionally, integration with digital twins and ongoing software updates supports the adoption of cloud computing.

Hybrid mode is growing rapidly, driven by the need for on-premises infrastructure security and control, combined with cloud flexibility. Businesses that need to protect sensitive data while utilizing cloud-enabled AI analytics will find this model especially appealing. With hybrid systems, businesses can utilize the cloud for high-performance simulations while maintaining critical operations under local control. As cybersecurity concerns rise, regulated industries are increasingly opting for hybrid models.

Offering/Capability Insights

Why Did the Software and Platforms Segment Lead the U.S. AI Materials Product Optimization Market in 2024?

Software and platforms led by AI-driven design, simulation, and optimization tools form the foundation of advancing additive manufacturing. These platforms enable generative design, predictive analytics, and workflow automation, making them the most widely adopted capabilities. Companies rely on these solutions for scalability and cross-functional integration in their production ecosystems. With continuous advancements in AI modeling and cloud integration, software platforms continue to be the cornerstone of value creation.

The services segment is growing rapidly in the AI materials product optimization market, driven by the increasing demand for maintenance, integration, training, and consulting services to integrate AI into additive manufacturing. Tailored service offerings ensure operational excellence while facilitating a seamless transition for businesses into AI-driven processes. Managed services and continuous technical support are becoming more in demand as businesses use sophisticated AI platforms. According to this trend, services are positioned as a high-growth factor that facilitates long-term sector adoption.

U.S. AI Materials Product Optimization Market Companies

- Citrine Informatics

- Kebotix

- Exabyte.io

- Polymerize

- Arzeda

- Rescale

- Noble.AI

- Altair Engineering

Recent Developments

- In June 2025, Stratasys and Automation Intelligence, LLC launched the North American Stratasys Tooling Center of Excellence (NASTC) to help manufacturers validate and scale tooling applications via additive manufacturing in production environments.(Source: https://investors.stratasys.com)

- In September 2025, Hiverge, a Cambridge-based AI startup founded by former DeepMind scientists, raised $5 million in seed funding to launch the Hive, an AI platform for backend code optimization. The platform uses program synthesis to automatically design and refine algorithms, enhancing software performance and efficiency. This approach aims to revolutionize backend code optimization, offering significant improvements over traditional methods.(Source: https://www.businessinsider.com)

Segments Covered in the Report

By Function / Optimization Type

- Material Discovery & Design

- Predictive Modeling & Simulation

- Process Optimization

By Industry / Application

- Pharmaceuticals & Chemicals

- Electronics & Semiconductors

- Energy (e.g., Batteries, Solar)

- Automotive & Aerospace

- Construction & Consumer Goods

By AI Technology Used

- Machine Learning

- Generative AI (e.g., diffusion, transformers)

- Predictive Simulation

- Computer Vision

- Natural Language Processing / Sequence Modeling

- Hybrid / Composite AI

By Deployment Mode

- Cloud-based

- Hybrid (Cloud + On-premise)

- On-premise

By Offering / Capability

- Software / Platforms

- Services (Integration, Custom Modeling)

- Hardware / Instrumentation

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting