Prostaglandin Analogs Market Size and Forecast 2025 to 2034

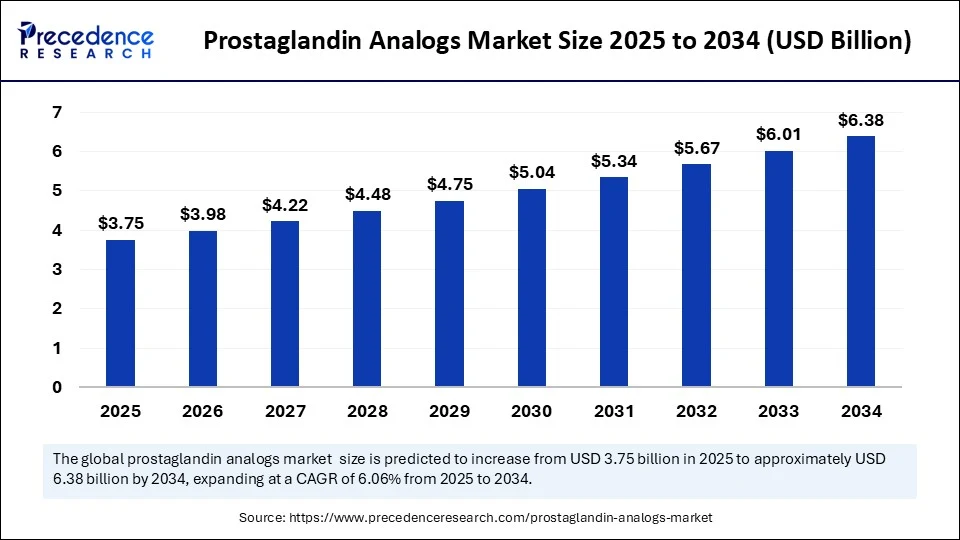

The global prostaglandin analogs market size accounted for USD 3.54 billion in 2024 and is predicted to increase from USD 3.75 billion in 2025 to approximately USD 6.38 billion by 2034, expanding at a CAGR of 6.06% from 2025 to 2034. The market growth is attributed to the rising glaucoma prevalence and increasing adoption of early treatment protocols supported by global health initiatives.

Prostaglandin Analogs Market Key Takeaways

- In terms of revenue, the global prostaglandin analogs market was valued at USD 3.54 billion in 2024.

- It is projected to reach USD 6.38 billion by 2034.

- The market is expected to grow at a CAGR of 6.06% from 2025 to 2034.

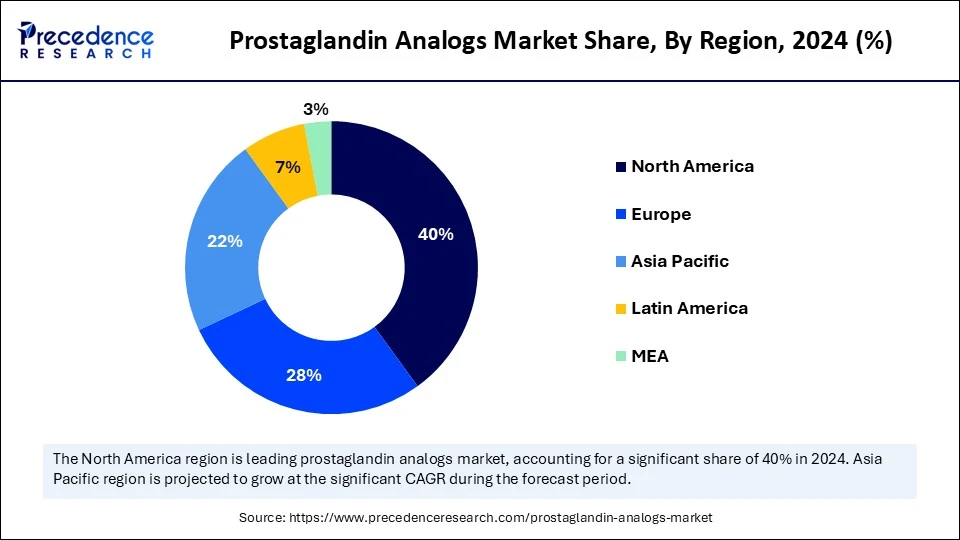

- North America dominated the global prostaglandin analogs market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the latanoprost segment held the major share of 38% in 2024.

- By product type, the tafluprost segment is projected to grow at a CAGR between 2025 and 2034.

- By formulation, the eye drops segment contributed the biggest market share of 90% in 2024.

- By formulation, the injectables & others segment is expanding at a significant CAGR between 2025 and 2034.

- By indication, the glaucoma and ocular hypertension segment led the prostaglandin analogs market in 2024.

- By indication, the pulmonary arterial hypertension segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, hospital pharmacies held the biggest market share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a notable CAGR from 2025 to 2034.

What Is the Impact of Artificial Intelligence on the Prostaglandin Analogs Market?

Artificial intelligence is transforming the prostaglandin analogs market since it optimizes all phases of the product development, medical and operational applications, and their commercialization. The AI-based systems that the drug companies can use will help scientists discover new variations of molecules. AI-based assistive technology assists in diagnosing glaucoma earlier, facilitates the timely appointment of prostaglandin analogs, and aids in patient staging. Additionally, the AI streamlines the production processes, reduces the interruption of the supply chain, and enables the implementation of specific marketing strategies.

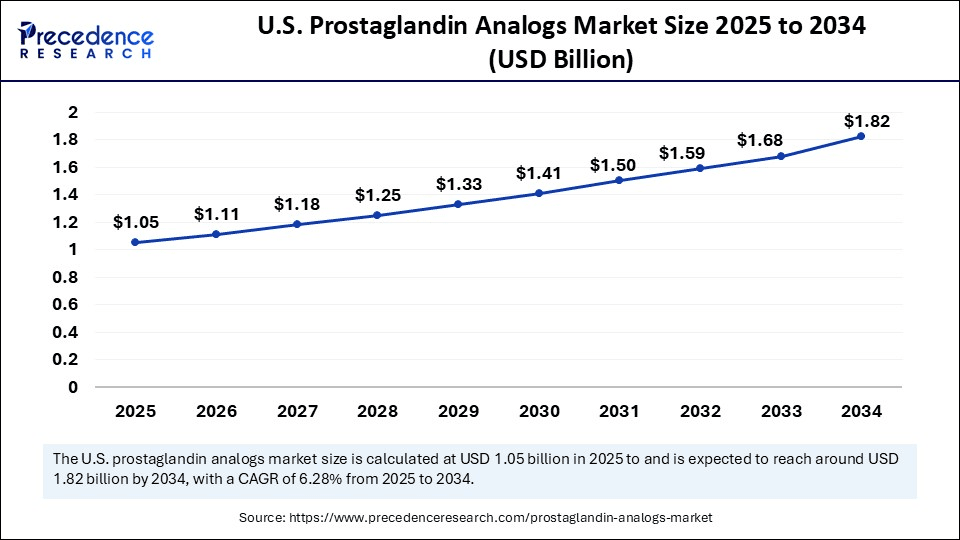

U.S. Prostaglandin Analogs Market Size and Growth 2025 to 2034

The U.S. prostaglandin analogs market size was exhibited at USD 0.99 billion in 2024 and is projected to be worth around USD 1.82 billion by 2034, growing at a CAGR of 6.28% from 2025 to 2034.

Why Did North America Lead the Prostaglandin Analogs Market in 2024?

North America led the prostaglandin analogs market, capturing the largest revenue share in 2024, accounting for an estimated 40% market share, due to the high burden of glaucoma and significant pathways of treatment by the inbuilt implementation of prostaglandin analogs as the first-line of treatment. According to the CDC's 2024 report, over 3 million Americans are living with glaucoma, and this figure is projected to reach 6.3 million by 2050 as the nation's population continues to age. Powerful insurance, Medicare/Medicaid reimbursements, and large formulary accommodations support a high volume of prescriptions.

Major players in the pharmaceutical industry, including Allergan (AbbVie), Bausch + Lomb, and Pfizer, ensure that their products are always available via well-developed distribution channels. The successive increase in the use of preservative-free formulations due to concerns about the ocular surface is expected to reinforce compliance in the long term. Furthermore, the future volatility of fixed-dose combinations, microdosing applicators, and unit-dose packages is also likely to strengthen the North America region as one of the major markets.(Source: https://www.cdc.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the growing screening and diagnostic network, enhanced diagnostic facilities, and increased prioritization of vision care by governments. In 2024, the Asian Pacific Academy of Ophthalmology (APAO) emphasized that glaucoma is a disease that has challenged close to 30 million citizens in the area, with underdiagnosis being highly felt in the rural demographics.

It is expected that the initiation rates of prostaglandin analog therapy accelerate due to rapid urbanization and the rising government-induced eye-care systems in countries, including China, India, and Japan. The affordability and reach should be benefited through government-led insurance expansion and the listing of glaucoma drugs in the essential medicines list. Additionally, the increase in patient education campaigns, especially that on aging patients, is estimated to increase adherence and persistence of treatment, further boosting the market in this region.(Source: https://apaophth.org)

Market Overview

The prostaglandin analogs market comprises pharmaceutical products that mimic prostaglandins, naturally occurring lipid compounds involved in various physiological functions, to treat medical conditions, primarily glaucoma and ocular hypertension. These analogs work by increasing the outflow of aqueous humor from the eye, reducing intraocular pressure (IOP). Beyond ophthalmology, prostaglandin analogs have emerging applications in other therapeutic areas, such as labor induction and pulmonary hypertension. Market growth is driven by the high prevalence of glaucoma worldwide, patent expiries, introduction of new formulations, and expanding patient awareness.

Rising cases of glaucoma are likely to stimulate stable demand for prostaglandin analog-based treatment. To give a scale of the scale of the problem, global health organizations estimate that tens of millions of the world population endure glaucoma. EyeWikiPMC Clinicians note that clinical follow-up is simplified and dose errors are minimized in the senior population by a sustained-release treatment device. Thereby validating superior performance in real-world use as compared to conventional topical prescriptions. Furthermore, the aging population is expected to fuel the market in the coming years.

- According to a UNFPA report, India's elderly population is experiencing a decadal growth rate of 41%, and the proportion of citizens aged 60 years and above is projected to double to over 20% of the total population by 2050.

Prostaglandin Analogs Market Growth Factors

- Driving Demand for Combination Therapies: Rising preference for fixed-dose combinations with complementary agents is enhancing treatment convenience and clinical outcomes in glaucoma and ocular hypertension management.

- Growing Adoption of Sustained-Release Formulations: Advances in ocular drug delivery systems are improving dosing frequency and patient compliance, supporting long-term disease control.

- Boosting Awareness Through Global Eye Health Campaigns: Initiatives from organizations such as the World Glaucoma Association and International Agency for the Prevention of Blindness are encouraging early screening and proactive treatment adoption.

- Propelling Innovation in Novel Prostaglandin Analog Molecules: Research into next-generation analogs with improved tolerability profiles is expanding therapeutic options and driving market competitiveness.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.38 Billion |

| Market Size in 2025 | USD 3.75 Billion |

| Market Size in 2024 | USD 3.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Formulation, Indication, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Prevalence of Glaucoma Accelerating Demand for Prostaglandin Analogs?

The increasing prevalence of glaucoma is expected to drive consistent growth of the prostaglandin analogs market. The rising incidence of glaucoma is likely to lead to a stable market demand for prostaglandin analog-based solutions. In its calculations, the World Glaucoma Association determined that more than 80 million people in the world live with glaucoma in 2024. In 2040, the figure is expected to increase to over 111 million. (Source: https://wga.one)

A 2024 study published in JAMA Ophthalmology, of 2022 data, stated that around 4.22 million adults have glaucoma in the United States. There are 1.49 million people with vision-threatening types, and it has a prevalence of 5.2 % among adults aged 65 years or older. The National Eye Institute is focusing on early detection and timely treatment as the best combination in preventing and treating permanent vision loss. Further encouraging the increased volumes of prescriptions of hand-cropped prostaglandin analog as a first-line treatment. Moreover, the spurring healthcare infrastructure development in emerging economies is likely to expand access to prostaglandin analog therapies in the coming years.(Source:https://jamanetwork.com)

Restraint

What is the Impact of Ocular Side Effects on Patient Adherence?

Patient adherence is expected to be hampered by ocular side effects such as conjunctival hyperemia, eyelash changes, and periocular skin darkening, which are likely to affect market growth. The situation imposes a bigger burden on the caregivers and clinicians whenever the elderly patients experience difficulties in the instillation, since side effects would escalate adherence to the treatment. Furthermore, the restraint broadens patient eligibility through systemic safety concerns and contraindications, projected to limit prescriber preference in complex comorbidity cases.

Opportunity

Why Are High Research and Development Investments Transforming the Future of Prostaglandin Analog Treatments?

High research and development investments are estimated to foster innovation and expand therapeutic applications for prostaglandin analogs, further creating immense opportunities for the players competing in the prostaglandin analogs market. In 2024, the National Eye Institute sponsored several pilot studies of sustained-release implants that improve the control of intraocular pressure but require fewer doses. In 2024, an observational study using ClinicalTrials.gov assesses the neuroprotective effect of prostaglandin analog eye drops on retinal ganglion cells.

A step that integrates therapeutic effects and long-term preservation of vision, Big pharma, including Allergan (AbbVie) and Novartis. There are efforts to develop combination products that combine prostaglandin analogs with nitric oxide-donor compounds to achieve dual action (dual-action) intraocular pressure lowering. Furthermore, the surging advancements in ophthalmic drug delivery technologies are projected to enhance treatment adherence and therapeutic outcomes, thus further fuelling the market in the coming years.(Source: https://www.clinicaltrials.gov)

Product Type Insights

Why Did Latanoprost Dominate the Prostaglandin Analogs Market in the Past Year?

The latanoprost segment dominated the prostaglandin analogs market in 2024, accounting for an estimated 38% market share, as it lowers intraocular pressure (IOP) and maintains the same reduction in long-term use. This, from a clinical standpoint, spells reliability and confidence, and compliance.

Latanoprost appears in the Model List of Essential Medicines 23rd List, 2023, of the World Health Organization, which is a verification of global recognition. A real-world observational study showed that the transfer of patients to a preservative-free formulation of latanoprost significantly enhanced tolerability. Additionally, the latanoprost/timolol and latanoprost/netarsudil further increased access and convenience, boosting the segment in the coming years.(Source: https://www.who.int)

The tafluprost segment is expected to grow at the fastest CAGR in the coming years, owing to the preservative-free nature of Tafluprost and its positive ocular surface association. Preclinical observations support that preservative-free tafluprost has much less cytotoxic and inflammatory effects on corneal epithelial cells compared to preservative-free latanoprost. Furthermore, the Expanded regulatory approvals in new geographies during 2024 and listings on public formulary lists are expected to propel the market growth.

Formulation Insights

Why Do Eye Drops Remain the Preferred Formulation in the Prostaglandin Analogs Market?

The eye drops segment held the largest revenue share in the prostaglandin analogs market in 2024, accounting for 90% of the market share, due to their once-daily dosing advantage of multiple agents, which makes them very widespread. Fixed-dose combinations that ease the burden caused by bottles and simplify regimens. Clinical practitioners and well-established brands preferred them. Additionally, the manufacturers developed unit-dose and microdose applicators that reduce waste and irritation, further facilitating the segment demand.

The injectables & others segment is expected to grow at the fastest rate in the coming years, as it addresses adherence weaknesses and shortcomings of the technique in older patients and patients on multiple medications. Depots, such as intracameral and periocular solutions, which offer months of IOP lowering, are likely to increase market share in regions where the delivery mechanisms focus more on visit delivery rather than daily self-delivery. Furthermore, these formats are expected to beat conventional normal add-on declines among treated cohorts as health systems test-run adherence-risk screening and bundled reimbursements of procedure-based therapy.

Indication Insights

Why Do Glaucoma and Ocular Hypertension Drive the Largest Share in the Prostaglandin Analogs Market?

The glaucoma & ocular hypertension segment dominated the prostaglandin analogs market in 2024, due to the established clinical guidelines that emphasize the use of prostaglandin analogs as the initial treatment in managing long-term lowering of intraocular pressure (IOP). Very high prevalence rates in the world market are maintaining a steady demand in both developed and emerging markets.

Wide formulary coverage, access to multiple generics, and advanced preservative-free and fixed-dose combination therapy are likely to enhance compliance and reduce failure to maintain treatment. The National Eye Institute (NEI) also emphasized in 2024 that prostaglandin analogs lower IOP, which further explains why it is one of the effective classes used in treating primary open-angle glaucoma. Furthermore, the use of preservative-free- free formulations in patients further justifies the overall trend toward persistent use of prostaglandin analog therapy.(Source: https://pmc.ncbi.nlm.nih.gov)

The pulmonary arterial hypertension (PAH) segment is expected to grow at the fastest CAGR in the coming years, owing to the enhanced awareness of the disease and diagnosis, and the entry of newer, more selective prostaglandin-based drugs. In 2024, the European Society of Cardiology felt that earlier application of the prostacyclin analogs resulted in greater survival and long-term functional capacity, thus leading to increased utilization in specialized centers. Moreover, the use of improved inhalation delivery systems and continuous intravenous or subcutaneous infusion pumps should widen accessibility of treatment, thus facilitating the market in the coming years.(Source: https://bmcpulmmed.biomedcentral.com)

Distribution Channel Insights

Why Do Hospital Pharmacies Hold the Dominant Position in Prostaglandin Analogs Distribution?

The hospital pharmacies segment held the largest revenue share in the prostaglandin analogs market in 2024, due to the specialist-initiated use of prostaglandin analogs after verified diagnoses of glaucoma or ocular hypertension. The collective care pathways enhance standard baseline IOP prescription, testing, and early follow-up, which is likely to maintain the first-dispense volumes in both tertiary and secondary centers.

Perioperative glaucoma procedures and fixed-dose combinations would strengthen in-hospital initiation, which is forecast to remain the focus of hospital pathways during medication initiation. Furthermore, the availability of a steady supply of stock due to consolidated purchase and cold-chain or sterility procedures that are correct, most certainly keeps hospital pharmacies ahead of the distribution channels.

The online pharmacies segment is expected to grow at the fastest rate in the coming years, owing to the growth in e-prescription. The home delivery and automated reminders on refill overcome the limitations in mobility and caregiver support, which is expected to increase the level of month-to-month continuity in the elderly groups of users. Additionally, improved authentication, pharmacovigilance reporting, and temperature-controlled logistics reaffirm trust that is expected to drive sharper gains in the channel in the coming years.

Prostaglandin Analogs Market Companies

- Alcon (Novartis division)

- Allergan (AbbVie) (Lumigan - Bimatoprost)

- Bausch + Lomb (part of Bausch Health)

- Bausch Health Companies Inc.

- Chengdu Kanghong Pharmaceutical Group Co., Ltd.

- Dr. Reddy's Laboratories Ltd.

- Eagle Pharmaceuticals, Inc.

- Fresenius Kabi AG

- Glenmark Pharmaceuticals Ltd.

- Hugel, Inc.

- Ipsen

- Macleods Pharmaceuticals Ltd.

- Mylan N.V. (Viatris)

- Novartis AG

- Pfizer Inc. (Xalatan - Latanoprost)

- Santen Pharmaceutical Co., Ltd.

- STADA Arzneimittel AG

- Sun Pharmaceutical Industries Ltd.

- Sunovion Pharmaceuticals Inc.

- Zhejiang Xianju Pharmaceutical Co., Ltd.

Recent Developments

- In January 2025, Glaukos Corporation (NYSE: GKOS), an ophthalmic pharmaceutical and medical technology company specializing in therapies for glaucoma, corneal disorders, and retinal diseases, announced several positive clinical updates for its iDose sustained-release procedural pharmaceutical platform.

(Source: https://investors.glaukos.com) - In December 2024, the U.S. Food and Drug Administration (FDA) approved a generic version of latanoprost, a prostaglandin analog, for treating open-angle glaucoma and ocular hypertension. According to Gland Pharma Limited, the FDA determined that the generic product is both bioequivalent and therapeutically equivalent to Xalatan (latanoprost 0.005%, Pfizer).(Source: https://www.ophthalmologyadvisor.com)

- In December 2023, the FDA approved the iDose TR sustained-release implant, a prostaglandin analog delivery device that continuously administers 75 mcg of travoprost for up to 36 months. This single-administration implant helps lower intraocular pressure (IOP) and could reduce or eliminate the need for daily topical drops. Given the challenges of patient compliance with topical therapies, this development provides ophthalmologists with a long-acting alternative to manage ocular hypertension and open-angle glaucoma.(Source: https://www.reviewofoptometry.com)

- In June 2025, Qlaris Bio, a clinical-stage biotechnical company, announced the development of a novel preservative-free, fixed-dose combination therapy (QLS-111-FDC) combining QLS-111 and latanoprost. The therapy targets primary open-angle glaucoma (POAG), ocular hypertension (OHT), and normal-tension glaucoma (NTG), particularly for patients needing additional IOP reduction via episcleral venous pressure (EVP) modulation. QLS-111 addresses EVP, a component of IOP not targeted by current approved treatments, representing a potential advancement in glaucoma management.(Source: https://www.ophthalmologytimes.com)

Segments Covered in the Report

By Product Type

- Latanoprost

- Bimatoprost

- Travoprost

- Tafluprost

- Unoprostone

- Others (including new analogs and fixed-dose combinations)

By Formulation

- Eye Drops

- Ophthalmic Solutions & Suspensions

- Injectables & Others

By Indication

- Glaucoma and Ocular Hypertension

- Pulmonary Arterial Hypertension (PAH)

- Labor Induction

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting