Protein Bar Market Size and Forecast 2025 to 2034

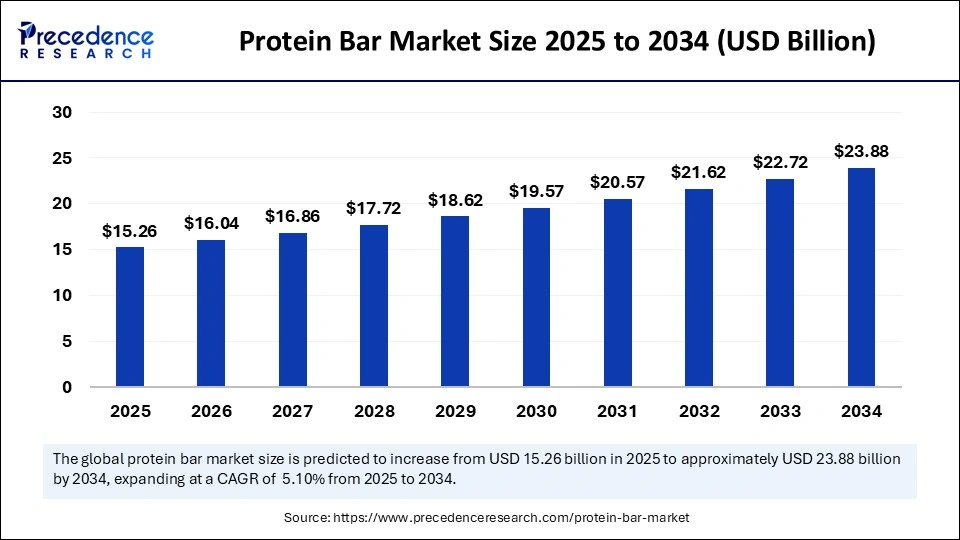

The global protein bar market size is calculated at USD 15.26 billion in 2025 and is predicted to increase from USD 16.04 billion in 2026 to approximately USD 23.88 billion by 2034, expanding at a CAGR of 5.10% from 2025 to 2034. The global protein bar market is expanding steadily, led by rising health consciousness, need for convenient nutrition, and innovation in flavors.

Protein Bar Market Key Takeaways

- In terms of revenue, the protein bar market is valued at $15.26 billion in 2025.

- It is projected to reach $23.88 billion by 2034.

- The market is expected to grow at a CAGR of 5.10% from 2025 to 2034.

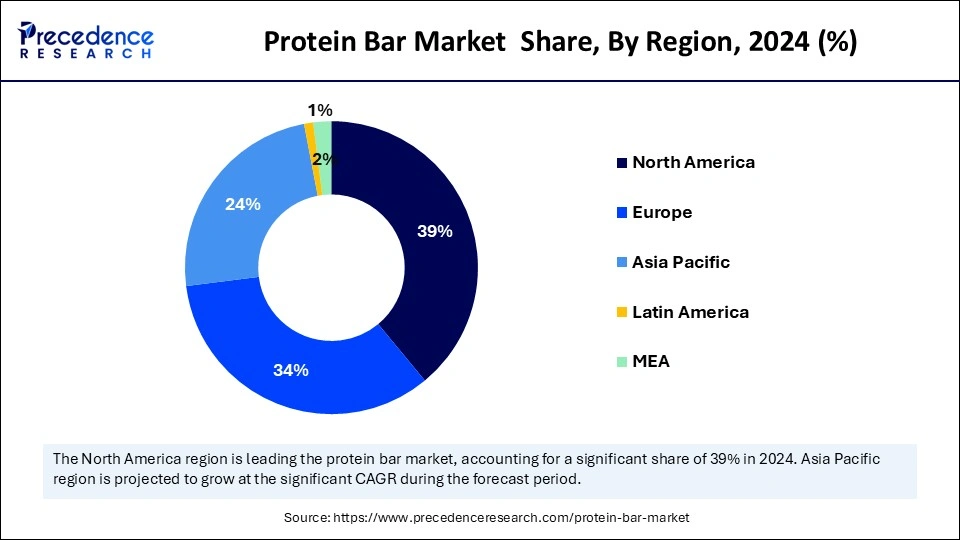

- North America accounted for the largest revenue share of 39% in 2024.

- Asia Pacific is expected to grow at a notable CAGR of 6.52% during the forecast period from 2025 to 2034.

- By type, the sports nutritional bars segment contributed the highest revenue share of 51% in 2024.

- By type, the meal replacement bars segment is growing at a CAGR of 6.3% over the forecast period from 2025 to 2034.

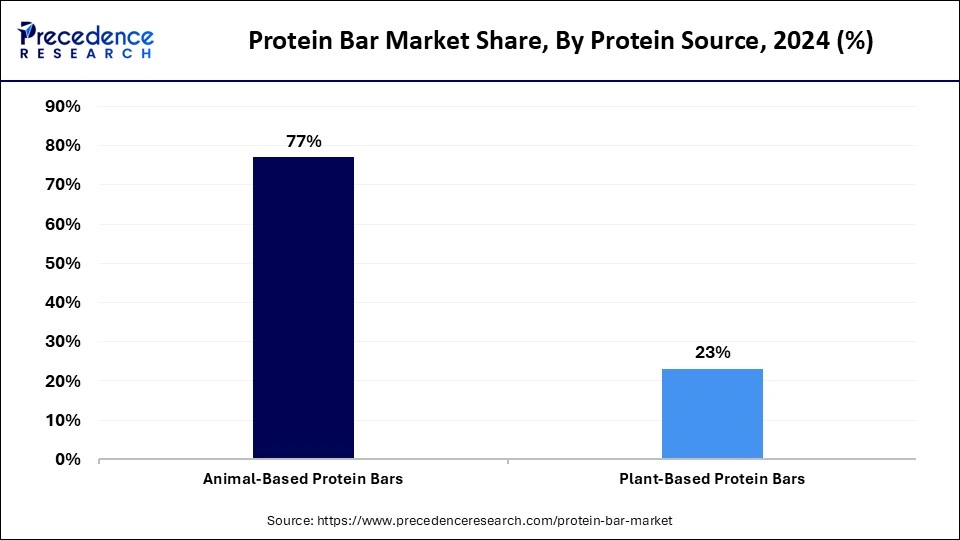

- By protein source, the animal-based protein bars segment captured the biggest revenue share of 77% in 2024.

- By protein source, the plant-based protein bars segment is projected to grow at a CAGR of 6.2% between 2025 and 2034.

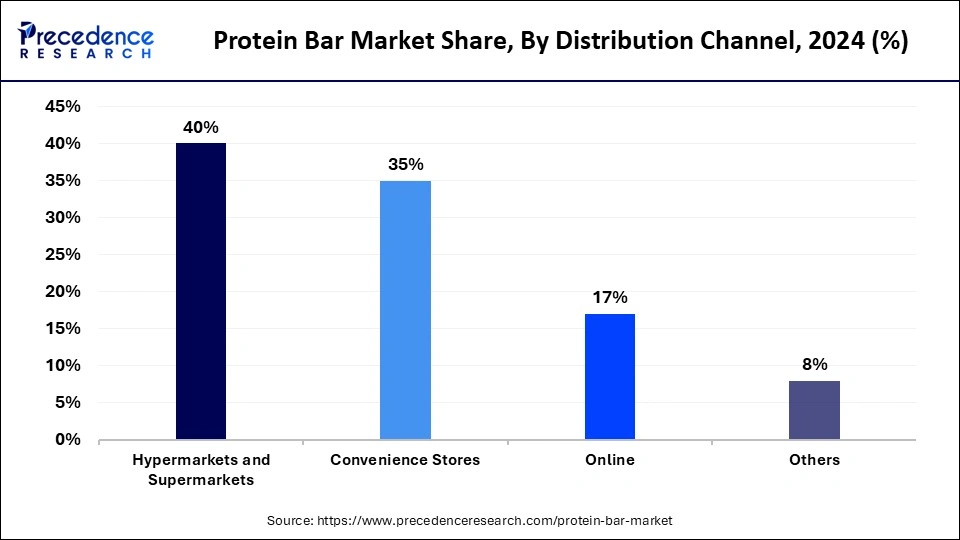

- By distribution channel, the hypermarkets and supermarkets segment held a significant revenue share of 40% in 2024.

- By distribution channel, the online segment is expanding rapidly at a CAGR of 6.5% in the coming years from 2025 to 2034.

How is Artificial Intelligence Revolutionizing the Protein Bar Market?

Artificial Intelligence is increasingly revolutionizing the protein bar market, enabling better product development and customization, as well as improved supply chain effectiveness. AI-driven platforms help predict demand, plan an inventory, and make distribution channels smooth. AI lends real-time analysis of online reviews and social media feedback that direct firms on refining flavors, ingredients, and packaging. With AI, brands can easily follow market changes and client dynamic demands and deliver novel products based on data. In addition to making the operation more efficient, this technological advancement is highly improving customer' satisfaction and interaction with the protein bar industry.

U.S. Protein Bar Market Size and Growth 2025 to 2034

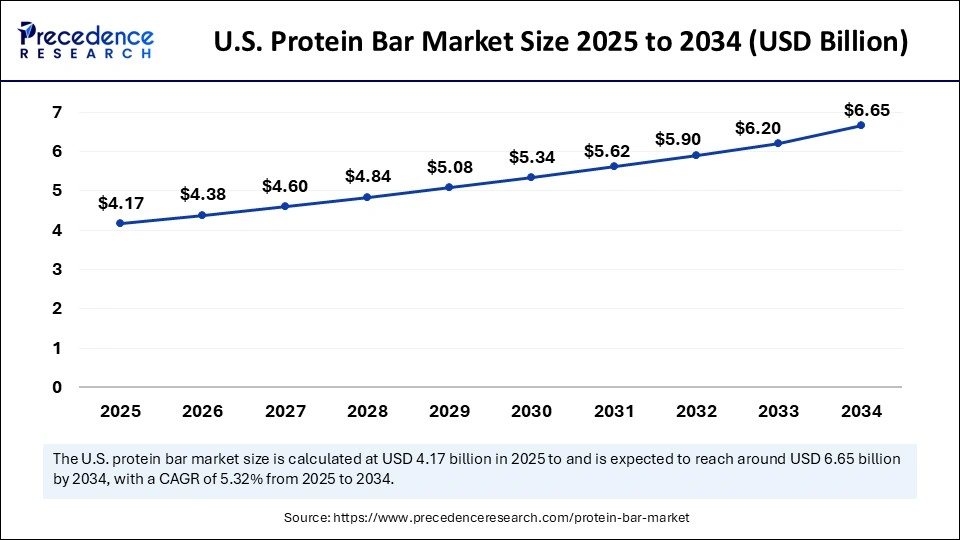

The U.S. protein bar market size is exhibited at USD 4.17 billion in 2025 and is projected to be worth around USD 6.65 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034.

North America dominated the protein bar market with the major revenue share of 39% in 2024. This is mainly due to increased fitness, health, and wellness concerns. The increased number of fitness enthusiasts, gyms, fitness training centers, and health clubs within the region has greatly added protein bars to daily routines. The U.S. has experienced a rise among health-conscious consumers who want convenient and nutritious snacks. In the U.S., there is a high demand for healthier and more convenient food products among consumers. The increasing rates of chronic diseases, including high cholesterol, obesity, and diabetes, are encouraging consumers to embrace products that are nutritious and free from artificial components.

Asia Pacific is projected to grow at a CAGR of 6.52% during the forecast period from 2025 to 2034. The increasing number of hypermarkets & supermarkets in emerging economies is supporting market development. Countries such as China and India are experiencing high demand for protein-rich food due to increasing health and wellness awareness. Western food culture also plays a huge role, with a rise in the number of people following Western diets and looking for a high-protein snack option. The rising health-conscious consumers in China, Japan, and Australia are driving the growth of the market.

Europe is considered to be a significantly growing area. The growth of the protein bar market in the region is attributed to the rising interest in plant-based proteins, since many consumers consider such products healthier than traditional animal proteins. Europe's greater interest in health and wellness is fueling the market, as consumers look for healthier and even more convenient food products to satisfy their exercise and well-being objectives. Protein bars are a convenient method of adding more protein to a person's busy lifestyle, which makes them preferable.

Market Overview

Protein bars are high-concentration protein snacks accompanied by other important nutrients. They are highly preferred by fitness freaks, athletes, and health-conscious people needing a fast, yet nutritious shot. Created from ingredients such as whey, plant-based proteins, nuts, seeds, and natural and artificial sweeteners, such bars provide a balanced blend of proteins, carbohydrates, and healthy fats. Their popularity is connected with growing consumer awareness of the issues of health and wellness as well as the nutritional value of protein-rich diets. Protein bars have emerged as a modern diet replacement for a meal, a pre-workout or post-workout supplement, or a quick snack.

The protein bars market has experienced tremendous advances due to increased consumer demand for easy, nutritious snacking alternatives. The increased awareness about health and fitness has seen the consumer looking for foods that will support the recovery of muscles, weight management, and general well-being. The rise in the culture of sports and gym, as well as the wellness marketing via influencers, has brought about the visibility and growth of the market.

Growth Factor for the Protein Bar Market

- Rising health and fitness awareness: A greater global perception of priority for health, fitness, and balanced nutrition has catalyzed demand for protein bars. The consumers of fitness-related goods, gym devotees, are seeking to improve their lifestyles by consuming functional and convenient nutrition.

- Demand for convenient and on-the-go foods: These bars form meal replacements or energy boosting snacks that need no preparation. Their portability nature, as well as the long shelf life, makes them the best option in a market dominated by active professionals and travelers, enhancing their rapid growth in the fast-moving global foods and drinks market.

- Demand for plant-based ingredients: Plant-based and clean-label products are in demand, and brands are moving to produce protein bars with such vegan proteins as pea or soy, rice. Such diversification appeals to a more diverse segment audience, vegetarians, vegans, and persons with dietary restrictions, increasing market share and segment innovation in the protein bars segment.

- E-commerce and retail channels: The improved retail distribution networks have helped market expansion. Protein bars are easily available through the internet, supermarkets and gyms, and special health stores across the world. Online reviews, subscription model, and targeted marketing have further enhanced visibility as well as sales, promoting new product trials and brand loyalty in a competitive environment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23.88 Billion |

| Market Size in 2025 | USD 15.26 Billion |

| Market Size in 2026 | USD 16.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Protein source, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Number of Health and Fitness Centers

The increasing health and fitness centers around the world has become an important driver of the protein bar market. Fitness freak people heavily embrace a fitness-oriented way of life and increasingly demand sports and nutritional products, such as energy bars. Protein bars are convenient and help fuel athletic performance and recovery. This has been compounded by an increasing tendency among the middle-aged and old people towards fitness and sports activities, leading to an increased demand for exercise equipment. Work, stress, and other critical behaviors are being changed, and an increased awareness of keeping physical well-being is leading more people to gyms, which is maintaining the demand for energy-supportive nutrition.

Restraint

High Cost of Protein Bars

The high cost of protein bars is a significant barrier to market growth. Protein bars are much more expensive, considering that they contain premium ingredients, such as whey, pea, or soy protein, as well as due to the high level of technical processes needed to preserve nutritional value. Many bars also specialize in specific gluten-free, vegan, or clean-label diets, increasing production costs. Such costs are normally passed on to the final consumer, which makes it more expensive for price-sensitive demographics to purchase protein bars. The prohibitive cost point limits mass adoption, which may hamper the entry into markets, particularly where consumers look for cost-effective, nutritious alternatives.

Opportunity

Clean Label and Natural Ingredients Shift

The increasing consumer preference for clean-label products creates immense opportunities in the protein bar market. Health-conscious consumers are looking for products that contain natural, familiar ingredients, without artificial additives and preservatives. This change also hints at a wider trend to clean eating, in which openness and simplicity in food formulation are prized highly. Manufacturers are responding through innovation, re-formulating protein bars with natural sweeteners like Honey, agave syrup, and dates, plant-based protein, and organic ingredients.

Type Insights

The sports nutritional bars segment led the protein bar market with the largest revenue share of 51% in 2024. The increased need for a high-protein diet bolstered the growth of the segment. These bars are specially designed according to the nutritional requirements of athletes and those who like leading a fit life, as they have a great percentage of protein, necessary vitamins, and minerals. Bodybuilders and professional athletes heavily use sports nutritional bars for muscle recovery and performance. Sports nutritional bars are highly preferred under different categories of sports such as football, basketball, cricket, and hockey, because they are energy-yielding, packed with calories, and highly nutritious. Additionally, the rising popularity of endurance events such as marathons and triathlons fuels demand for these bars.

The meal replacement bars segment is expected to grow at a CAGR of 6.3% in the market over the forecast period. Meal replacement bars are balanced in macronutrients- proteins, fats, carbohydrates, essential vitamins, and minerals, and can substitute meals. These bars are attractive to consumers who might not have time to prepare full meals but would like to keep a healthy diet. They are also the preferred choice of health-conscious consumers who want to control portions and the calories consumed. With the increasing preference for remote working, the desire for easy-to-prepare healthy meals is rising, contributing to the segment's growth.

Protein Source Insights

The animal-based protein bars held the major revenue share of 77% in 2024. These bars are usually produced from proteins obtained from animal milk (whey, casein) or eggs, which contain high biological value. Animal-based proteins are classified as complete proteins because they contain all of the amino acids required to repair and build muscle mass. These bars are also good for use by those looking to add lean muscle; Animal proteins are very bioavailable and used efficiently by the body. As more health-conscious people join fitness clubs and endeavor to build their bodies, the need for animal-based protein bars remains high. These protein bars' high quality and easy-digestible nature make them the first choice in sports nutrition.

The plant-based protein bars segment is projected to grow at a 6.2% in the coming years from 2025 to 2034. These protein bars are prepared with organic ingredients of plant origin, including fruits, seeds, nut butters, and plant protein. The increased awareness regarding environmental sustainability, animal welfare, and personal health is boosting the demand for vegetarian, vegan, and plant-based diets. The demand for plant-based protein bars has been increasing due to the rise of specialty diets, such as gluten-free bars, keto bars, or low-carb bars.

Distribution Channel Insights

The hypermarkets and supermarkets segment led the protein bar market by holding more than 40% of revenue share in 2024. These retail outlets play a crucial role in the distribution of protein bars, whereby consumers have easy access to a large number of products from various brands. A majority of consumers shop in such stores for their daily shopping, and protein bars are an impulse purchase item that are displayed close to health food sections or checkout counters. The easy accessibility to these outlets bolstered the growth of the segment.

The online segment is expected to expand at a CAGR of 6.5% between 2025 and 2034. Online shopping is a convenient way through which consumers can browse and buy protein bars from the convenience of their homes. There are emerging direct-to-consumer (DTC) sales models that have become popular, which is a sales model that a lot of businesses, particularly smaller or newer ones, can use to reach a larger audience without having to go through accustomed retail partnerships. Digital advertising, including targeted promotion on social media networks, is increasing the online sales of protein bars.

Recent Developments

- In April 2025, TREK, the UK's number one protein bar and one of the fastest-growing brands in Cereal and Sports Nutrition Bars, has reinvented the category with the launch of its all-new High Protein Low Sugar range, the first of its kind, and a milestone in high protein snacking.

- In May 2024, Gelita launched Optibar, intended to be used as an ingredient to make the softest sugar-free protein bar. The hard-to-beat content is formulated in a way that increases protein levels but maintains an indulgent texture. It can replace the need for sugar; it's used as a binder and can be made with claims "no sugar" and "low sugar."'

- In April 2024, Ready, a leading active nutrition company, launched its new Kids Whole Grain Protein Bars to further its commitment to developing healthy and delicious snack options for families. The Kid's Whole Grain Protein Bar is also formulated for the needs of active kids with 6 grams of protein, 8 grams of whole grains, and 20% less total sugar than existing favorite kids' Whole Grain Snacking Bars.

Protein Bar Market Companies

- Clif Bar & Company

- Quest Nutrition

- Kellogg Company (RXBAR)

- General Mills (Nature Valley)

- MusclePharm

- GNC (General Nutrition Corporation)

- ThinkThin (Think Products)

- Larabar (General Mills)

- Orgain

- PowerBar

Segments covered in the report

By Type

- Sports nutritional bars

- Meal replacement bars

- Others

By Protein source

- Animal-Based Protein Bars

- Plant-Based Protein Bars

By Distribution Channel

- Hypermarkets & supermarkets

- Convenience stores

- Online

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting