What is the Proton Exchange Membrane Fuel Cells Market Size?

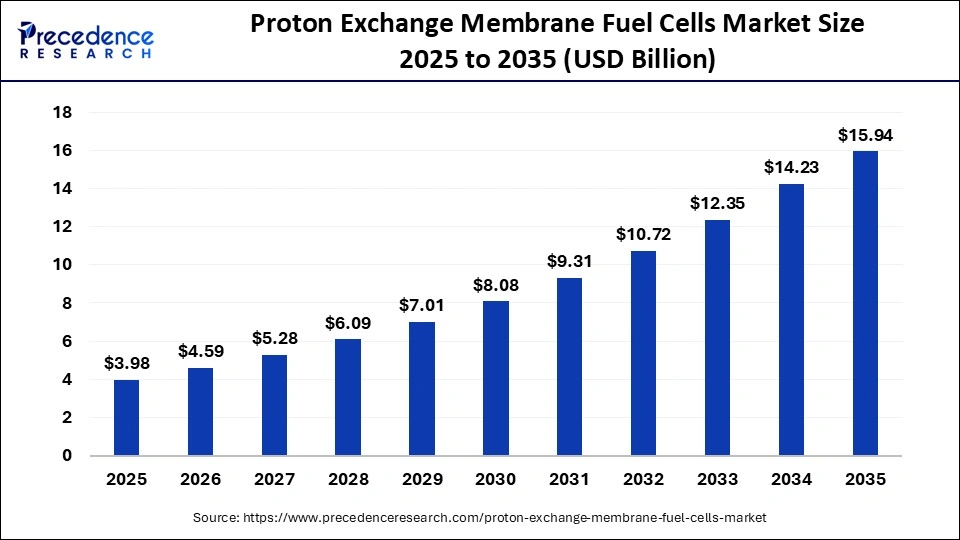

The global proton exchange membrane fuel cells market size is expected to be valued at USD 3.98 billion in 2025 and is anticipated to reach around USD 15.94 billion by 2035, expanding at a CAGR of 14.88% over the forecast period 2026 to 2035.

Proton Exchange Membrane Fuel Cells Market Key Takeaways

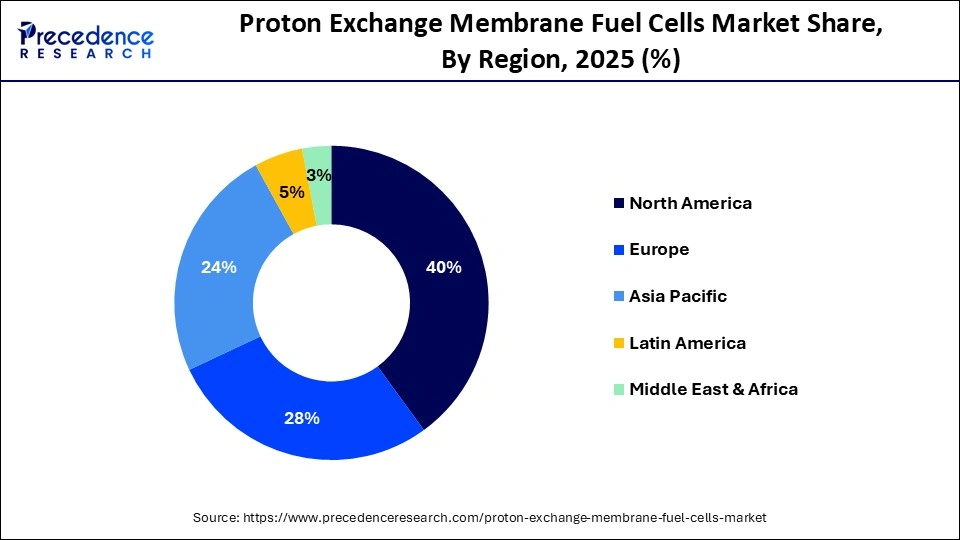

- North America held the highest market share of 40% in 2025.

- By Type, the high temperature segment held the maximum market share in 2025.

- By Application, the automotive segment has generated more than 30% of revenue share in 2025.

What are Proton Exchange Membrane Fuel Cells?

Proton exchange membrane (PEM) fuel cells are utilized in automobiles. These fuel cells use oxygen from air and hydrogen fuel to produce electricity. Proton exchange membrane fuel cell is a kind of electrochemical energy conversion technology which can be used for converting the chemical energy of fuels directly to electricity.

Rising concerns regarding greenhouse gas emissions combined with supporting government policies are expected to boost the requirement for PEMFCs. PEMFCs are majorly developed for stationary fuel-cell applications, transport applications, and portable fuel-cell applications.

Companies such as Ballard Power and W. L. Gore & Associates, Inc. hold a notable share in the global PEM fuel cells market owing to high investments in the proton exchange membrane capabilities.

The increasing adoption of medium, commercial, light, and heavy-duty automobiles is anticipated to further foster the demand for proton exchange membrane fuel cells. PEMFCs feature high-power density and can function even at low temperatures. This makes proton exchange membrane fuel cells useful for numerous stationary applications.

The US Department of Energy has provided $3 million to Cummins. This $3 million will be used for proton exchange membrane fuel cell systems for heavy-duty applications. The funding from the United States government is driving the development and deployment of proton exchange membrane fuel cells across the North American region. The stringent regulations with respect to carbon emissions and Carbon Pollution Standards introduced by the U.S. EPA are supporting the adoption of proton exchange membrane fuel cells considerably. The global proton exchange membrane (PEM) fuel cells industry is expected to gain traction due to the growing inclination of automotive manufacturers towards fuel cell electric vehicles.

Government authorities in Canada, the U.S., the United Kingdom (UK), Mexico, South Korea, and Germany have implemented numerous policies for developing H2-based fuels. Also, the development of various hydrogen refueling stations is expected to support the growth of the proton exchange membrane fuel cells market size. In 2019, the South Korean government reported that it has decided to construct hydrogen refueling stations as per its policy which encourages the use of clean energy in the automobile sector.

How is AI contributing to the Proton Exchange Membrane Fuel Cells Industry?

Artificial intelligence is the key driver to improve proton exchange membrane fuel cells in several areas, namely design optimization, operational control, diagnostics, and material discovery. AI models are conducting design explorations, rapidly simulating performance, and controlling processes in real time. Smart systems have made it possible to detect faults, forecast deterioration, conduct maintenance beforehand, and perform energy management in a hybrid manner.

Machine learning facilitates faster development of membranes with longer life, catalysts with higher efficiency, and more resilient components, thus improving efficiency, durability, and reliability, and consequently reducing the cost of the entire fuel cell systems all over the world sustainably.

Market Outlook

- Industry Growth Overview: Environmental issues, new technologies, and the government's firm support of the clean energy sector have been the main reasons for the market's growth.

- Sustainable Trends: The new practices in the industry point to the use of non-precious catalysts, more durable membranes, lower costs, and better environmental performance for the entire system around the world.

- Global Expansion: Global growth is speeding up as the oil and gas and power industries are looking for ways to reduce their carbon footprints through the use of fuel cells. This is part of a worldwide movement.

- Major Investors: Ballard Power Systems, Plug Power, Cummins, Toyota, and Hyundai, as well as Intelligent Energy, are the main investors fueling the development of the market.

- Startup Ecosystem: Startups all over the world are working on new catalysts, new materials, and new manufacturing techniques that improve the performance and lower the costs of fuel cell commercialization.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.29 Billion |

| Market Size by 2035 | USD 31.35 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 15.93% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Proton exchange membrane fuel cell is emerging as promising alternative to fossil fuels. The potential to decrease overall energy consumption makes proton exchange membrane fuel cell fuel cells suitable for a variety of applications. In the past few years, research interest in proton exchange membrane fuel cells is increasing owing to growth in green energy requirements.

A demonstration indicated that the economic and technical viability of deploying 1 kW - 10 kW proton exchange membrane (PEM) fuel cells with 72 hours of on-site fuel storage can offer efficient power backup for utility networks and cell phone tower sites. The expansion of the telecommunication network is creating significant scope for proton exchange membrane fuel cells respectively.

The proton exchange membrane (PEM) fuel cells industry players can consider expansions, collaborations, joint ventures, acquisitions, and partnerships in order to advance the scope for proton exchange membrane fuel cells. However, the high cost associated with particular proton exchange membrane fuel cells can hinder the proton exchange membrane (PEM) fuel cells market growth to some extent during the forecast period.

Moreover, in order to gain further access to the regional markets, companies can undertake various strategic initiatives including the expansion of existing product portfolio. These initiatives may result in more intensive rivalry over the forecast period. Additionally, rapidly evolving fuel cell technology can make the existing fuel cell technology obsolete very soon. This further intensifies the market competition among the prominent players.

Since the count of proton exchange membrane fuel cell providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is relatively higher as compared to the bargaining power of buyers. Owing to considerable profit margins, the threat of new entrants in the proton exchange membrane (PEM) fuel cells market is moderate as of now.

Our proton exchange membrane (PEM) fuel cells report includes an in-depth analysis of the recent market situation. The report covers numerous factors such as key players, competitive landscape, ongoing trends, and regional analysis. The analytical research on the impact of the COVID-19 situation helps in determining the effects on the supply and demand side. The segmental analysis provides a clear view of proton exchange membrane (PEM) fuel cell variants and particular applications.

Type Insights

Based on type, the high temperature segment held the largest market share in 2025. The high-temperature segment is expected to hold a significant market share during the forecast period. The high-temperature proton exchange membrane fuel cell (HT-PEMFC) utility with respect to systems requirements keeps evolving from time to time.

Usually, the HT-PEMFC system is utilized in hybrid operation with a battery. The HT-PEMFC systems fueled with natural gas can also be useful for combined heat and power applications in buildings.

For operating HT-PEMFC in a preferable situation, a suitable controller and system are highly essential. The low-temperature proton exchange membrane fuel cell (LT-PEMFC) can be operated around 60 to 80 °C while the HT-PEMFC can be operated above 120 °C up to 200 °C.

The LT-PEMFC generally utilizes perfluorosulfonic acid (Nafion) as the membrane. Since Nafion is sensitive to fluctuations in its internal moisture level, the LT-PEMFC functions at temperatures less than 100 °C.

Application Insights

Based on applications, the automotive segment had the highest revenue share in 2025. The automotive segment is expected to dominate the market during the study period.

Among the most common forms of fuel cells for automobile applications is the polymer electrolyte membrane (PEM) fuel cell. In the polymer electrolyte membrane fuel cell, the electrolyte membrane is fixed in between an anode (a negative electrode) and a cathode (a positive electrode). In the simulation of automotive PEMFC during the cold start, a major modification is advised to be done on the water transport submodel.

The proton exchange membrane fuel cells can be broadly used in various forklifts, automobiles, backup power systems, and telecommunication applications. Product versatility and high efficiency are anticipated to allow the stationary segment to maintain a steady position in the market share. Being environmentally friendly, proton exchange membrane fuel cell is preferred in transportation in order to reduce greenhouse gases (GHG). Since the fuel cell is of small size, the proton exchange membrane fuel cells can become a preferred alternative for various portables.

Regional Insights

U.S. Proton Exchange Membrane Fuel Cells Market Size and Growth 2026 to 2035

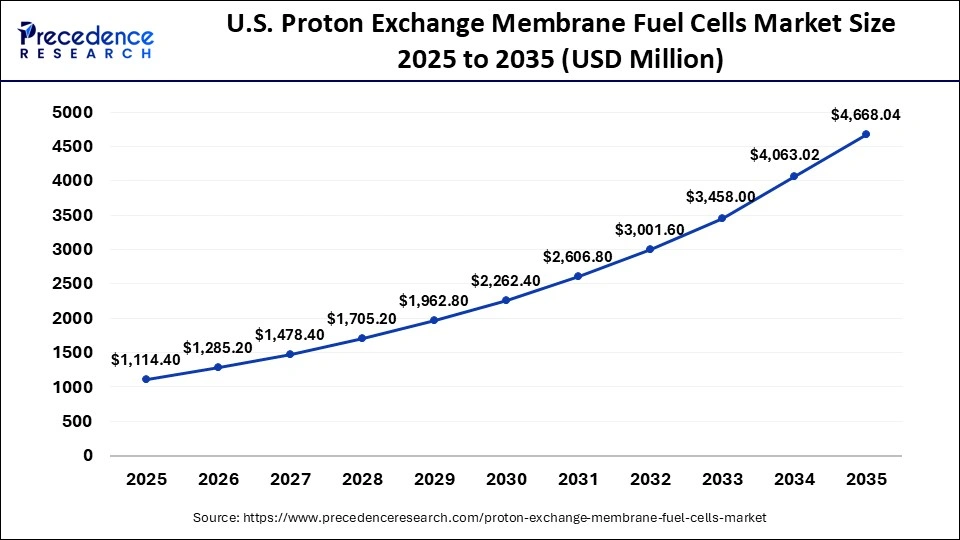

The U.S. proton exchange membrane fuel cells market size is exhibited at USD 1,114.40 million in 2025 and is projected to be worth around USD 4,668.04 million by 2034, growing at a CAGR of 15.40% from 2026 to 2035.

The market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America held the largest share of the global proton exchange membrane (PEM) fuel cells market in 2023. The U.S. held the largest share followed by Canada and Mexico in 2025. North America is the most technically advanced continent with the presence of countries with beneficial economic policies, high (GDP) gross domestic product, an ecosystem of well-established electronics infrastructure, and early adoption of the latest technologies.

The European proton exchange membrane (PEM) fuel cells market is segmented into Germany, France, the United Kingdom, Italy, and the Rest of Europe. Germany is expected to hold the largest share in the Europen proton exchange membrane (PEM) fuel cells market during the study period.

Rising funding in the automotive domain is anticipated to support the proton exchange membrane (PEM) fuel cells market growth remarkably. Fuel cell electric vehicles can produce electricity using a fuel cell powered with hydrogen, instead of deriving electricity from just a battery. Europe is anticipated to experience remarkable growth on account of the rising production of fuel cellelectric vehicles(FCEVs).

The Asia Pacific (APAC) region is segmented into India, China, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. China dominated the Asia Pacific region followed by Japan and India in 2023. As per the International Trade Administration, the Japanese government subsidy for buying new electric vehicles accounted for $18,500 for Fuel Cell Electric Vehicles (FCEV).

Latin America, Middle East, and African (LAMEA) proton exchange membrane (PEM) fuel cells sector is segmented into North Africa, South Africa, Saudi Arabia, Brazil, Argentina, and the Rest of LAMEA. The Middle East and the Latin America region are anticipated to have notable growth in the proton exchange membrane (PEM) fuel cells market during the forecast period. Brazil held the largest share in the LAMEA region in 2023. Due to low literacy, uncertainty, and civil war in African countries, the proton exchange membrane (PEM) fuel cells market in Africa is expected to grow at a comparatively slow rate.

Proton Exchange Membrane Fuel Cells Market-Value Chain Analysis

- Resource Extraction: Searching and acquiring hydrogen and feedstock materials necessary for the production and operation of proton exchange membrane systems.

Key players: Air Products & Chemicals, Linde, and Anglo American - Power Generation: Transformation of chemical energy into electrical output through the use of applications involving proton exchange membrane fuel cell systems.

Key players: Ballard Power Systems, Plug Power, Bloom Energy - Distribution Network Management: The planning and operation of the infrastructure that is responsible for the transportation of hydrogen or electricity from production sites to storage and end-users.

Key Players: Siemens, ABB - Energy Storage Systems: The process of capturing and storing generated energy for later use, thus helping to balance the supply variability and demand fluctuations efficiently.

Key Players: LG Energy Solution, CATL, Cummins, Bosch - Grid Maintenance and Monitoring of Proton Exchange Membrane Fuel Cells: All the service, monitoring, repair, and quality assurance activities that are performed to ensure the safety, reliability, and efficiency of the operations of the fuel cell networks.

Key Players: General Electric, Siemens

Top Companies in the Proton Exchange Membrane Fuel Cells Market & Their Offerings:

- Altergy: Altergy creates and fabricates proton exchange membrane fuel cell systems that render reliable, non-polluting backup power for very important infrastructure applications.

- AVL: AVL provides engineering know-how, software for simulation, and testing services for the global development, optimization, and validation of fuel cell systems.

- Ballard Power Systems: Ballard Power Systems is involved in the research, development, and manufacturing of PEMFC stacks and engines for mobile and stationary power applications.

Proton Exchange Membrane Fuel Cells Market Companies

- Altergy

- AVL

- Ballard Power Systems

- Cummins Inc.

- ElringKlinger AG

- Horizon Fuel Cell Technologies

- Infinity Fuel Cell and Hydrogen, Inc.

- Intelligent Energy Limited

- ITM Power PLC

- Loop Energy Inc.

- Nedstack Fuel Cell Technology BV

- NUVERA FUEL CELLS, LLC

- Plug Power Inc.

- PowerCell Sweden AB

- W. L. Gore & Associates, Inc.

Recent Developments

- In March 2021,Ballard Power System reported that Fuel Cell Electric Vehicles (FCEVs) powered by Ballard systems are driven more than 75 million kilometers. Around 80% of this 75-million-kilometer milestone is from the fuel cell electric vehicles deployed in China. Ballard Power System offers proton exchange membrane (PEM) fuel cell products and technology for medium-duty and commercial heavy applications.

- In March 2023,the Hydrogen and Fuel Cell Technologies Office announced a funding opportunity announcement (FOA) for supporting the development of electrolyzer technology and high-throughput manufacturing of fuel cells. The funding of up to $750 million will emphasize on innovations in recycling and recovery for proton exchange membrane (PEM) fuel cells. The FOA identifies proton exchange membrane (PEM) as one of the electrolyzer technologies that possess the greatest commercial and technological maturity.

- In December 2025, Sarbananda Sonowal inaugurated India's first fully indigenous hydrogen fuel cell vessel at Namo Ghat. This marked a significant step towards promoting sustainable and eco-friendly inland water transport. (https://www.indianewsnetwork.com)

- In September 2025, Horizon Fuel Cell introduced a 3MW backup module for data centers, named Horizon Packs. This 40-foot containerized system delivers 100% more power than PEM fuel cells and 300% more than SOFCs, which are popular in the data center sector.(https://www.datacenterdynamics.com)

Segments Covered in the Report

By Type

- High Temperature

- Low Temperature

By Application

- Automotive

- Portable

- Stationary

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting