What is thePsychedelic API Market Size?

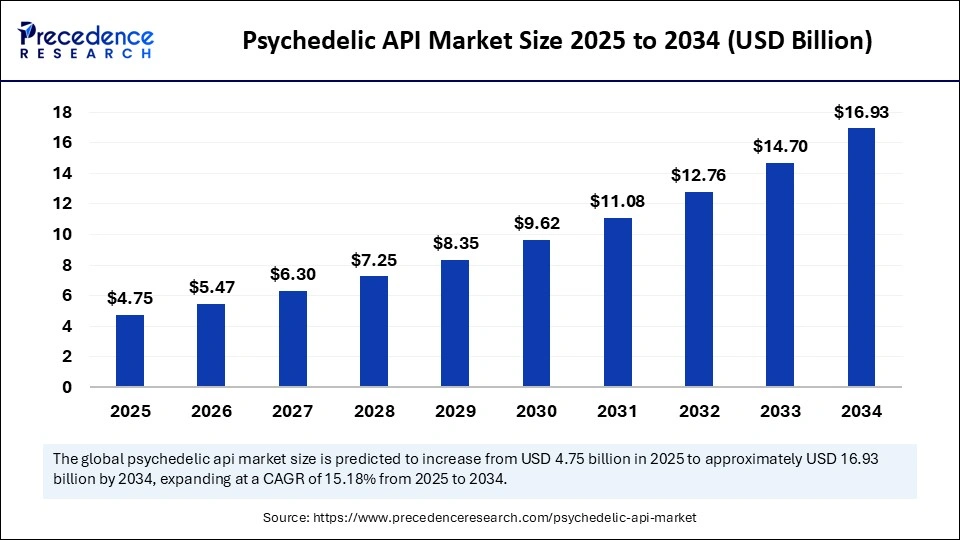

The global psychedelic API market size was calculated at USD 4.75 billion in 2025 and is predicted to increase from USD 5.47 billion in 2026 to approximately USD 16.93 billion by 2034, expanding at a CAGR of 15.18% from 2025 to 2034. The global psychedelic API market experiencing significant growth, driven by increasing clinical research, expanding therapeutic applications, and rising interest in mental health treatments using psychedelics.

Market Highlights

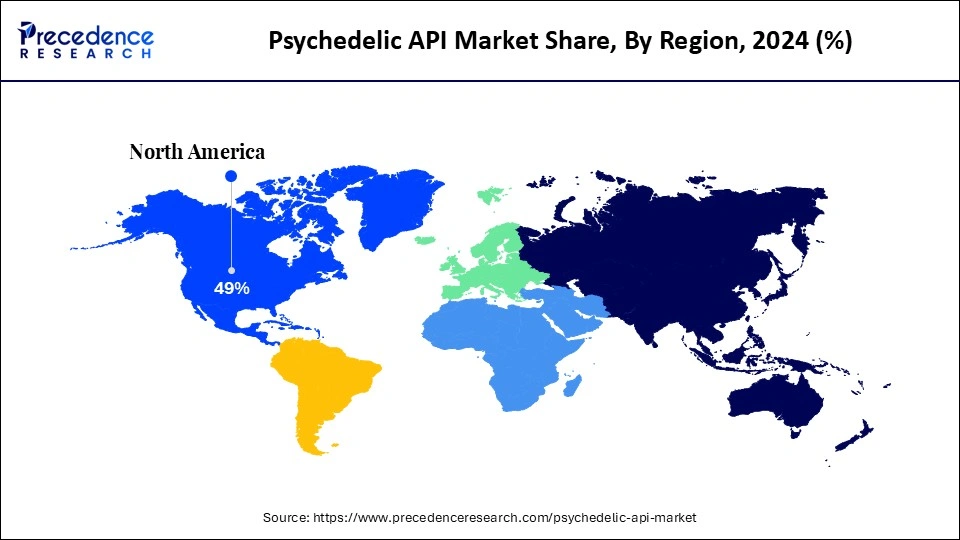

- North America dominated the global psychedelic API market with the largest share of 49% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By molecule/class, the ketamine class segment contributed the largest market share of 57% in 2024.

- By molecule/class, the psilocybin / psilocin segment is expected to grow at a significant CAGR of 22% between 2025 and 2034.

- By source/synthesis route, the fully synthetic segment led the market while holding the largest share of 86% in 2024.

- By source/synthesis route, the biosynthetic / fermentation segment is growing at a solid CAGR of 9% between 2025 and 2034.

- By form / solid-state & grade, the salt forms segment held the major market share of 61% in 2024.

- By form / solid-state & grand, the polymorph / crystal forms segment is expanding at a notable CAGR of 14% between 2025 and 2034.

- By contracting model, the CDMO outsourcing (development to scale) segment led the market while holding the largest share of 69% in 2024.

- By contracting model, the dual-sourcing / tech transfer segment is expected to expand at a double-digit CAGR of 15% between 2025 and 2034.

- By end use, the branded Rx developers / sponsors segment led the market while holding the largest share of 63% in 2024.

- By end use, the state-regulated service providers segment is expected to grow at the fastest CAGR 17% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 4.75 Billion

- Market Size in 2026: USD 5.47 Billion

- Forecasted Market Size by 2034: USD 16.93 Billion

- CAGR (2025-2034): 15.18%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Psychedelic API?

The psychedelic API market is experiencing significant growth driven by an increase in clinical research, rising mental health awareness, and changing regulatory landscapes. The market covers cGMP active pharmaceutical ingredients for serotonergic psychedelics and adjacent compounds used in regulated clinical development, special-access programs, and approved therapies. Scope includes synthesis/biosynthesis, quality/regulatory pathways, controlled-substance logistics, and CDMO supply models for finished-dose developers. Regulatory advancements like the development of a favorable regulatory framework, like the FDA's breakthrough therapy designation for psilocybin and MDMA, are enabling significant support for innovation and developments of psychedelic APIs.

Governments worldwide are investing heavily in psychedelic research to support local pharmaceutical and biopharmaceutical industries with a focus on API development and clinical trials. This growth is accelerating the increase in prevalence of treatment-resistant mental health disorders and growing awareness about mental health among patients and healthcare professionals. Pharmaceutical companies are focusing on collaborating with biotechnology firms that specialize in psychedelic research to leverage expertise and accelerate the development of novel drugs and treatments.

The Future of Psychedelic APIs: Key Technological Developments

The psychedelic API market is undergoing a rapid technological transformation, driven by advancements in production techniques and evolving regulatory frameworks. Pharmaceutical companies are prioritizing the development of synthetic and biosynthetic materials for the production of scheduled APIs, enhancing scalability, purity, and consistency. This is further supported by the growing demand for GMP-certified APIs, which ensure high manufacturing standards crucial for clinical trials and therapeutic applications. Additionally, the integration of digital health technologies, such as AI-driven diagnostic tools, enabling the optimization of treatment protocols and improving patient outcomes.

Key players like Delix Therapeutics and Gilgamesh Pharmaceuticals are investing heavily in the development of next-generation psychedelics or psychoplastogens, focusing on new compounds that promote neuroplasticity without hallucinogenic effects, thus increasing treatment accessibility.

Psychedelic API Market Outlook

- Market Growth Overview: The psychedelic API market is expected to experience spectacular growth between 2025 and 2034 due to increased awareness of importance of psychedelic compounds and their therapeutic potential in treating mental health conditions, including anxiety, depression, and PTSD. The rising acceptance of psychedelic therapies and growing research funding are also expected to boost the market.

- Global Expansion: Expansion into emerging countries unlocks growth potential by increasing access to diverse patient populations and broadening the scope of clinical trials, thereby accelerating the acceptance and regulation of psychedelic therapies worldwide. International partnerships and investments help scale production, standardize quality, and expand the market for psychedelic-based treatments across emerging and developed economies. Additionally, regulatory approvals for new therapies and API investments in regional areas like North America, Asia Pacific, and Europe are supporting market expansion.

- Major Investors: Pharmaceutical companies, research institutions, and venture capital firms are the major investors in the psychedelic API research and development. Major companies like Cayman Chemical Company, Atai Life Sciences, Beckley Psytech, and Core One Labs Inc. are investing heavily in providing efficient psychedelic therapies. These investors are emphasizing clinical trials and studies on psychedelic compounds.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.75 Billion |

| Market Size in 2026 | USD 5.47 Billion |

| Market Size by 2034 | USD 16.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule / Class, Source / Synthesis Route, Contracting Model, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Molecule/Class Insights

What Made Ketamine Class the Leading Segment in the Psychedelic API Market?

The ketamine class segment dominated the market, accounting for approximately 57% share in 2024, due to high therapeutic acceptance and regulatory support. The FDA has accelerated the development of commercial infrastructure to support the approval of the esketamine class. The existing FDA approvals of ketamine for treatment-resistant depression are fulfilling the segment expansion. Ketamine is widely used in treating PTSD, depression, and anxiety disorders, driving demand. This class has widespread clinical acceptance, established manufacturing infrastructure, and rapid-acting antidepressant properties.

The psilocybin / psilocin segment is expected to grow at the fastest CAGR over the projection period, driven by the promising clinical trial data and the active psilocin metabolite's therapeutic potential. Psilocybin/psilocin is increasingly being used in studies aimed at treating mental health conditions, with regulatory agencies granting breakthrough therapy designations to accelerate its clinical development. Additionally, rising pharmaceutical investments are driving innovation within the psilocybin/psilocin class, further fueling its market expansion.

Source/Synthesis Route Insights

How Does the Fully Synthetic Segment Dominate the Psychedelic API Market in 2024?

The fully synthetic segment dominated the market with a 86% in 2024 due to its consistent quality, scalability, and purity, crucial for pharmaceutical applications. The growth in supply, commercial viability, and standardization is fueling the innovations and developments of fully synthetic APIs. Fully synthetic production ensures high-quality APIs, which are essential for pharmaceutical applications. Full synthetic production allows for precise control and reduction of variability.

The biosynthetic / fermentation segment is likely to grow at the fastest CAGR between 2025 and 2034 due to its potential for scalable and affordable production. The biosynthetic/fermentation process offers superior scalability, cost-effectiveness, and consistency compared to conventional botanical extraction and chemical synthesis. The demand for pharmaceutical-grade psychedelics has increased for clinical trials and mental health therapies, driving the adoption of biosynthetic / fermentation. The heavy investments by companies like ATAI Life Science and MindMed in biosynthetic psychedelics for enhancing scalability and consistency contribute to the segment's growth.

Form/Solid-State & Grand Insights

Why Did the Salt Forms Segment Dominate the Psychedelic API Market?

The salt forms segment dominated the market with a 61% share in 2024, due to increased clinical trial activity and groundbreaking therapy designations. The salt forms enable high stability, enhance bioavailability, and optimization of the manufacturing process. These forms allow the creation of a drug product more suitable for clinical and commercial use. The salt forms enable consistent purity, quality, and scalability of synthetic APIs for pharmaceutical applications.

The polymorph / crystal forms segment is expected to expand at the highest CAGR in the upcoming period, driven by its solubility, bioavailability, and stability. The polymorph/crystal forms enable drug developers to patent and create unique formulations with distinct and advantageous properties. The polymorph/crystal forms have a highly significant impact on bioavailability and solubility, enhancing their efficacy. Polymorph screening is crucial in API development to ensure the chosen form meets high safety and efficacy standards.

Contracting Model Insights

Which Contracting Model Dominates the Psychedelic API Market in 2024?

The CDMO outsourcing (development to scale) segment dominated the market with a 69% share in 2024, thanks to its specialized infrastructure, expertise, and regulatory navigation that enable psychedelic drug developers. Psychedelic components face complex and strict regulations and need comprehensive CDMO outsourcing (development to scale) for more efficiency. CDMO has specialized expertise in handling intricate synthesis routes, quality control, and containment requirements for psychedelic compounds. CDMOs are crucial in navigating stringent regulatory bodies, ensuring APIs meet GMP standards and safety requirements.

The dual-sourcing / tech transfer segment is expected to grow at the fastest CAGR in the coming years due to its ability to mitigate supply chain risk. Dual-sourcing strategies are reducing supply chain risk, ensuring consistent availability for critical psychedelic APIs. The increased demand for mental health treatments, successful clinical trials, and favorable regulatory shifts are driving a significant need for dual-sourcing / tech transfer. The tech transfer contracting model enables efficient production methods, reduces cost, and navigates complex regulatory frameworks.

End Use Insights

Which End Use Segment Holds the Largest Share of the Psychedelic API Market?

The branded Rx developers / sponsors segment dominated the market while holding the largest share of 63% in 2024 due to an increased number of clinical trials with high safety and efficacy. The branded Rx developers / sponsors control the development and commercialization process in the psychedelic APIs. The branded Rx developers / sponsors secure their market position with research and development, strategic alliances, and regulatory approvals. The increased innovations for product development and growing regulatory support are fueling the segment's growth.

The state-regulated service providers segment is likely to grow at the fastest rate over the forecast period due to increased acceptance of psychedelics for therapeutic uses. The state-regulated service providers support clinical trials and research initiatives. The ability of state-regulated service providers to expand therapeutic applications, leading to an increased demand for high-quality psychedelic APIs. These providers are facilitating the development and commercialization of psychedelic substances.

Regional Insights

U.S. Psychedelic API Market Size and Growth 2025 to 2034

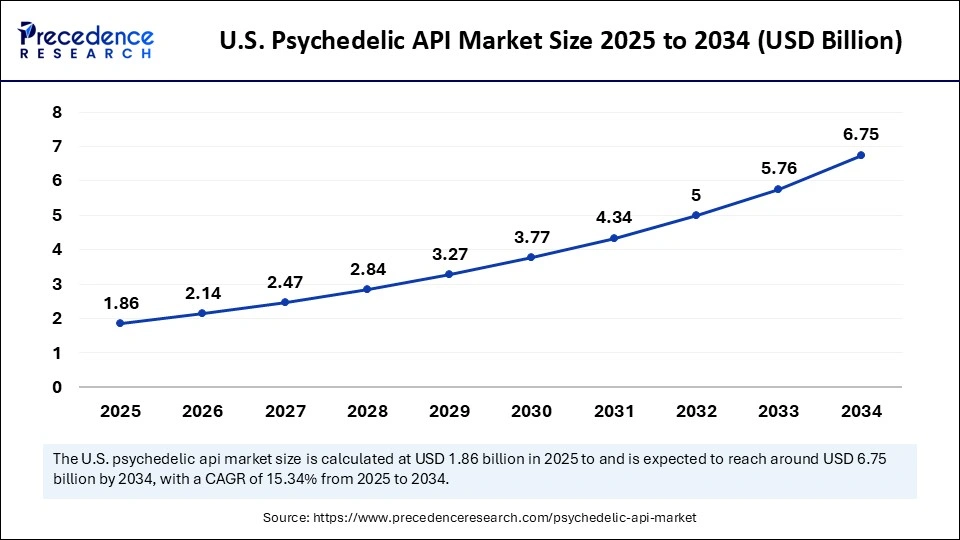

The U.S. psychedelic API market size was anticipated at USD 1.86 billion in 2025 and is predicted to reach at USD 6.75 billion in 2034, expanding at a CAGR of 15.34% from 2025 to 2034.

What Made North America the Dominant Region in the Psychedelic API Market?

North America dominated the global psychedelic API market with the largest share of 49% in 2024. This is mainly due to the region's advanced clinical trials sector and regulatory recalibration. Significant investments in research and development, along with collaborations between pharmaceutical companies and research institutions, also fueled market growth. North America boasts an advanced research infrastructure and a favorable regulatory environment. Rising awareness of psychedelic therapies and their potential benefits for treating mental health conditions is driving significant innovations in psychedelic API therapies. The region is also at the forefront of research and development for synthetic APIs.

Strong Research Infrastructure to Boost the U.S. Market

The U.S. is a major contributor to the North American market due to its advanced research infrastructure and the high prevalence of mental health conditions like depression, anxiety, and PTSD. The country serves as a hub for established clinical trial networks and renowned research institutions, such as the Johns Hopkins Center for Psychedelic and Consciousness Research. Strong regulatory support for novel therapies and the development of synthetic APIs further solidifies the U.S.'s position in the market. Additionally, the FDA's drafted guidance from June 2025 on psychedelic clinical investigations is expected to serve as a foundational breakthrough for research sponsors in 2025.

- In July 2025, at the 2025 Psychedelic Science Conference in Denver, the FDA's advisory committee voted against MDMA-assisted therapy for PTSD, despite promising phase 3 trial results, citing concerns over data reliability and ethical violations at a trial site. Joel Stanley, CEO of Ajna Biosciences, discussed the regulatory and ethical lessons learned from the setback, emphasizing the need for improved trial protocols, standardized care models, and a stronger role for pharmacists in ensuring safety, compliance, and regulatory readiness in future psychedelic research. (Source: https://www.pharmacytimes.com)

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth throughout the forecast period, driven by increased awareness of mental health, strong regulatory support, and access to cost-effective production. Countries like China and India are well known for their cost-effective manufacturing capabilities in the psychedelic industry. Growing awareness of the therapeutic potential of psychedelic compounds for treating mental health conditions is driving this growth. Additionally, regulatory support, such as Australia's progressive frameworks, along with a rise in clinical research activities, is further fueling innovations and the development of significant psychedelic APIs.

China's Market Trends

China is a major player in the regional market, driven by its high API production capabilities and significant investments in pharmaceutical manufacturing. The Chinese government is heavily investing in local pharmaceutical manufacturing infrastructure. Additionally, the need for affordable production of psychedelic APIs is further contributing to this expansion. China is a key source of affordable generic and synthetic APIs and is increasingly focusing on higher-value products. The ongoing innovations and expansion in biotech APIs are also shifting the Chinese pharmaceutical sector toward psychedelic APIs.

Psychedelic API Market Value Chain Analysis

- R&D

R&D process for psychedelic APIs includes creation, testing, and manufacturing of high-purity psychedelic compounds for utilization in clinical trials and medical treatments.

Key Players: Atai Life Sciences, COMPASS Pathways, Cybin, and MindMed.

- Clinical Trials and Regulatory Approvals

Numerous psychedelic APIs are currently in clinical trials, especially psilocybin and MDMA. THE U.S. FDA hasn't given a full approval for any classic psychedelic for therapeutic use.

Key Players: Atai Life Sciences, MindMed, Cybin, and the Multidisciplinary Association for Psychedelic Studies (MAPS)

- Formulation and Final Dosage Preparation

Careful formulation to ensure stability, control, and bioavailability is crucial in the development of the final dosage for psychedelic APIs. The number of psychedelic compounds is potent and has compact pharmacologies, where overcoming significant technical and regulatory challenges is involved.

Key Players: MindMed, Compass Pathways, Delix Therapeutics, and Cybin.

Top Companies in the Psychedelic API Market

These companies are dominant in the psychedelic API market, with significant revenues, broad product portfolios, and extensive clinical trials infrastructure. They lead in terms of market influence, R&D, and regulatory approval.

- Compass Pathways: A leader in psilocybin-based therapies for mental health conditions, including depression and PTSD.

- MindMed (Mind Medicine Inc.): Known for its comprehensive approach to psychedelic therapies, including LSD and psilocybin for various mental health treatments.

- Atai Life Sciences: A prominent company in the psychedelic therapeutic space, focusing on a range of compounds like DMT, psilocybin, and others.

- Cybin Inc.: Leading with a broad portfolio in psychedelic therapeutics, particularly psilocybin and other compounds in mental health treatments.

- Usona Institute: Focused on psilocybin-based therapies for depression, with significant R&D backing.

Tier II – Mid-Level Contributors

These companies are well-established and contribute a strong presence in the market but have a more focused or niche portfolio, often specializing in specific psychedelic compounds or regional markets.

- Delic Holdings Inc.: Focuses on the commercialization of psychedelic therapies and related products, especially in the wellness and mental health sectors.

- Havn Life Sciences: A key player in the development of natural plant-based psychedelics, particularly psilocybin, and focused on microdosing solutions.

- Beckley Psytech: Specializes in psychedelic medicines and has strong collaborations with academic institutions for psilocybin-based clinical trials.

- Psilera Inc.: A biotech company that focuses on psychedelic-based treatments for mental health disorders, including research on psilocybin.

- NeonMind Biosciences: Specializes in psilocybin research and treatment for mental health conditions like depression and anxiety.

Tier III – Emerging and Niche Players

These companies are emerging or regionally focused players that contribute to the expansion of the psychedelic API market but are generally at earlier stages of product development or focused on specific niche areas within the market.

- Seelos Therapeutics: A small player working on psychedelic treatments, particularly focused on psilocybin, ketamine, and other novel compounds for depression and PTSD.

- MINDCURE Health Inc.: Focuses on the research and development of psychedelic treatments for mental health, including anxiety, depression, and addiction.

- Ehave Inc.: Focused on the integration of psychedelic therapies in mental health care and wellness applications, including psilocybin research.

- Silo Wellness Inc.: A company focusing on psilocybin wellness products, including microdosing options, and expanding its research into psychedelic treatments.

- Eleusis: Works on the clinical research of psychedelic compounds like LSD and psilocybin for a range of mental health applications, particularly in depression.

Recent Developments

- In July 2025, Psyence Biomedical Ltd collaborated with PsyLabs, a leader in the purified psychedelic compounds, for the production of a GMP-aligned lbogaine Total Alkaloid extract. This collaboration demonstrates Psyence BioMed's investments to support PsyLabs' development of scalable, compliant, and globally relevant psychedelic APIs.(Source: https://www.globenewswire.com)

- In February 2025, Researchers at UC Davis' Institute for Psychedelics and Neurotherapeutics successfully synthesized ibogaine and its analogs from pyridine, a cost-effective and widely available chemical. This breakthrough, reported in Nature Chemistry, paves the way for easier exploration of ibogaine's therapeutic potential.(Source: https://www.sciencedaily.com)

Exclusive Analysis on the Psychedelic API Market

The psychedelic API market is poised for exponential growth, driven by an amalgamation of evolving regulatory landscapes, heightened research investments, and burgeoning clinical evidence supporting the efficacy of psychedelics in addressing pervasive mental health disorders. From a market analyst's perspective, the psychedelic API sector stands at a confluence of scientific innovation, market demand, and regulatory recalibration, presenting a unique and lucrative opportunity for stakeholders positioned across pharmaceutical, biotechnology, and healthcare domains.

The therapeutic potential of psychedelics, primarily psilocybin, MDMA, and DMT, has gained significant traction in recent years, underpinned by an increasing body of clinical research demonstrating efficacy in conditions such as treatment-resistant depression, PTSD, anxiety, and addiction. The regulatory recalibration, spearheaded by entities like the FDA, is progressively aligning with these advances, fostering an environment conducive to rapid innovation and approval. The FDA's expedited pathways for psychedelics, such as breakthrough therapy designations, have catalyzed a surge in investment and collaborative partnerships, further solidifying the trajectory toward market penetration.

A core opportunity in the psychedelic API market lies in the ongoing development of synthetic APIs, which address the scalability challenges posed by natural plant-based derivatives. The emergence of scalable, sustainable, and cost-efficient synthesis methodologies, such as the total chemical synthesis of ibogaine and its analogs, marks a pivotal turning point, mitigating supply chain constraints and enhancing market accessibility. This not only opens doors for more cost-effective production but also lays the foundation for diversified psychedelic APIs, expanding the therapeutic applications of psychedelics beyond current boundaries.

Asia Pacific, with its robust manufacturing infrastructure and emerging regulatory frameworks, represents a critical market segment for cost-effective psychedelic API production. The convergence of increasing mental health awareness and expanding clinical research initiatives, particularly in nations like Australia, China, and India, offers substantial market penetration opportunities for stakeholders looking to capitalize on favorable production costs and regulatory incentives. Furthermore, strategic collaborations between research institutions and pharmaceutical giants are expected to drive R&D investments in both synthetic and plant-derived psychedelic APIs, opening new avenues for therapeutic innovations.

From an investment perspective, the market presents a high-risk, high-reward proposition. Early-stage entrants that can navigate the complex regulatory and clinical landscapes stand to capture significant market share. However, success will hinge on their ability to demonstrate not only the safety and efficacy of their products but also the scalability and sustainability of production methods. As the market matures, integration of data-driven decision-making, precision medicine approaches, and digital therapeutics will further augment growth potential, ensuring that the psychedelic API market remains at the forefront of next-generation mental health treatments.

In summary, the psychedelic API market represents a dynamic, high-growth sector with immense potential for long-term value creation. Strategic investments in research and development, coupled with a robust regulatory framework and growing societal demand for alternative mental health treatments, present significant opportunities for market leaders and emerging players alike. The convergence of innovation, regulation, and manufacturing capability will define the trajectory of the market, positioning it as one of the most promising frontiers in the pharmaceutical and biotechnology industries.

Segment Covered in the Report

By Molecule / Class

- Psilocybin / Psilocin

- Psilocybin

- Psilocin

- Deuterated psilocin

- Psilocin prodrugs

- MDMA

- MDMA base

- MDMA salts

- Lysergide / LSD

- Lysergide

- Lysergic acid derivatives

- Tryptamines

- DMT

- 5-MeO-DMT

- Iboga Alkaloids

- Ibogaine

- Noribogaine

- Ketamine Class

- Racemic ketamine

- Esketamine

- Next-gen 5-HT2A modulators / psychoplastogens

- Non-hallucinogenic modulators

- Short-acting serotonergics

By Source / Synthesis Route

- Fully synthetic

- Biosynthetic / fermentation

- Engineered microbial pathways

- Fungal / mycelial fermentation

- Semi-synthetic

- Botanical / fungal extraction

By Form / Solid-State & Grade

- Salt forms

- Base forms

- Polymorph / crystal form

- Micronized / particle-size controlled grades

By Contracting Model

- CDMO outsourcing (development to scale)

- Captive / in-house API

- Dual-sourcing / tech transfer

- Pathway / IP licensing (biosynthesis)

By End Use

- Branded Rx developers / sponsors

- Clinic networks / licensed compounding

- State-regulated service providers

- Academic / investigator-initiated programs

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting