What is the Psychedelic Therapeutics Market Size?

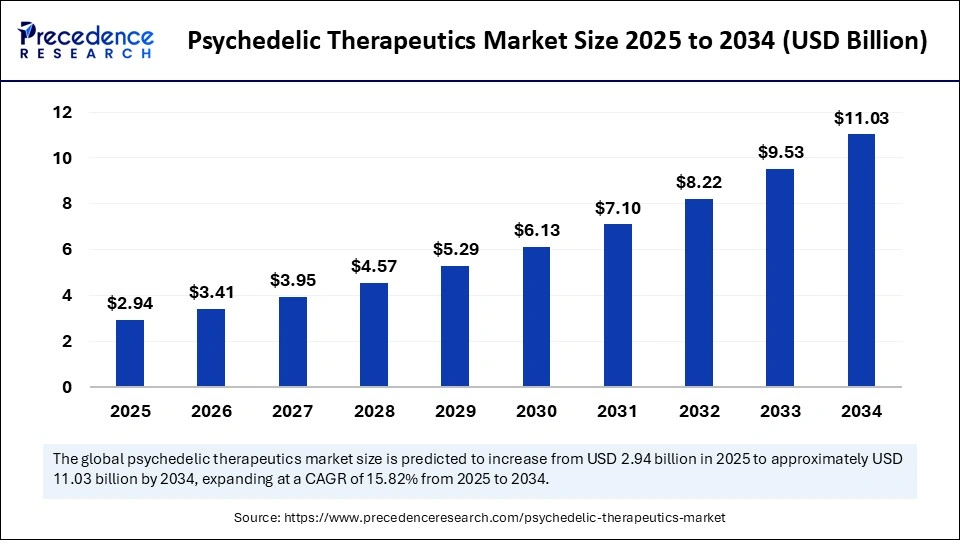

The global psychedelic therapeutics market size was estimated at USD 2.94 billion in 2025 and is predicted to increase from USD 3.41 billion in 2026 to approximately USD 11.03 billion by 2034, expanding at a CAGR of 15.82% from 2025 to 2034. The psychedelic therapeutics market is rapidly emerging as a transformative frontier in mental health treatment, driven by growing clinical validation and regulatory momentum for psychedelic-assisted therapies.

Market Highlights

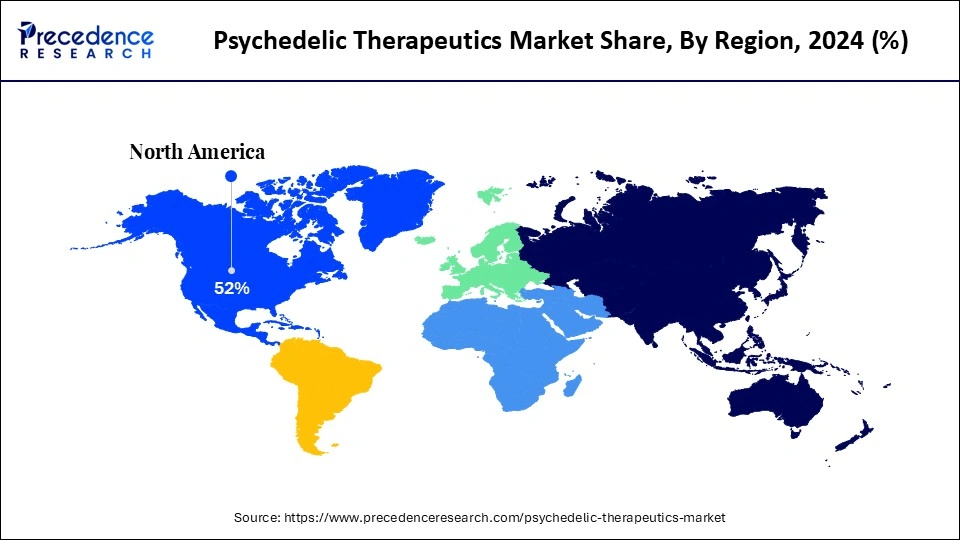

- North America led the psychedelic therapeutics market with around 52% share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 28% between 2025 and 2034.

- By molecule / class, the ketamine / esketamine segment held approximately 55% share of the market in 2024.

- By molecule / class, the psilocybin / psilocin segment is expected to grow at a significant CAGR of 23% between 2025 and 2034.

- By indication / disease area, the depression spectrum segment captured more than 57% of market share in 2024.

- By indication / disease area, the anxiety disorders segment is expected to expand at a notable CAGR 19% from 2025 to 2034.

- By therapy model, the supervised pharmacotherapy in clinic segment captured approximately 64% market share in 2024.

- By therapy model, the psychedelic-assisted psychotherapy segment is growing at a notable CAGR of 22% over the projected period.

- By route / formulation, the intranasal segment held approximately 46% market share in 2024.

- By route / formulation, the oral / ODT segment is poised to grow at a solid CAGR of 28% between 2025 and 2034.

- By dosing paradigm, the repeated / maintenance dosing segment held the major market share of 62% in 2024.

- By dosing paradigm, the single or dual macrodose sessions segment is expanding at a double-digit CAGR of 25% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 2.94 Billion

- Market Size in 2026: USD 3.41 Billion

- Forecasted Market Size by 2034: USD 11.03 Billion

- CAGR (2025-2034): 15.82%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Overview of the Psychedelic Therapeutics Market

The market is driven by rising awareness of mental health issues and the growing prevalence of treatment-resistant depression. The market focuses on the use of hallucinogenic compounds, such as psilocybin, lysergic acid diethylamide (LSD), MDMA (ecstasy), and ketamine, to treat psychiatric and neurological disorders, particularly depression, anxiety, and PTSD. These compounds interact primarily with serotonin receptors (5-HT), promoting neuroplasticity and enhancing emotional processing.

Notably, regulatory progress often coincides with collaborations between research institutions and pharmaceutical companies, driving the expansion of therapeutic pipelines. The psychedelic therapeutics market marks a paradigm shift toward neuroscience-backed, evidence-based mental health treatments, offering the potential for a more personalized and effective approach to psychiatric care.

How is AI Revolutionizing the Psychedelic Therapeutics Market?

Artificial intelligence is rapidly transforming the field of psychedelic research and therapy by accelerating drug discovery, enabling treatment personalization, and enhancing mental health monitoring. Researchers are leveraging AI algorithms to design novel psychedelic compounds that retain therapeutic benefits while minimizing hallucinogenic effects. For instance, in September 2025, Mindstate Design Labs, backed by major Silicon Valley investors, developed a compound described as the least psychedelic psychedelic that's still psychoactive, using AI-powered molecular modeling to target depression and PTSD. (Source: https://www.wired.com)

At the individual level, users are increasingly turning to AI chatbots such as ChatGPT and Altered for emotional grounding, journaling, and integration support during psychedelic experiences. While promising, mental health experts caution against over-reliance on AI during such vulnerable states. A 2024 study published on PubMed further explored AI's potential to analyze brain imaging data, offering insights into the neuroscience of consciousness and optimizing psychedelic interventions.

Overall, the integration of AI into psychedelic therapeutics holds significant promise for safer, more personalized treatments. However, ethical, psychological, and regulatory safeguards must evolve in parallel to ensure responsible deployment. (Source:https://pubmed.ncbi.nlm.nih.gov)

Psychedelic Therapeutics Market Outlook

- Market Growth Overview: The market is expected to grow at a rapid pace between 2025 and 2034, driven by the rising development and broader regulatory acceptance of psychedelic therapies. The U.S. FDA has granted Breakthrough Therapy designations for both psilocybin- and MDMA-assisted treatments. Concurrently, NIH-backed studies continue to build a compelling evidence base for psilocybin as a safe and effective option for mental health disorders.

- Global Expansion: Countries such as Canada, Australia, and the UK are proactively establishing regulatory frameworks for controlled therapeutic use. Canada's Special Access Program and Australia's recent rescheduling of psilocybin for certain psychiatric conditions reflect a global commitment to integrating psychedelics into clinical mental health care.

- Research and Development: Government-funded bodies like the NIH and U.S. Department of Veterans Affairs are accelerating clinical trials focused on psilocybin's effects on neuroplasticity and long-term remission in treatment-resistant conditions. R&D efforts are increasingly addressing standardized dosing protocols and long-term efficacy, helping to overcome regulatory barriers.

- Key Investors: Public institutions and academic research centers are collaborating with biotech firms to advance psychedelic research. Non-profit organizations such as MAPS (Multidisciplinary Association for Psychedelic Studies) are instrumental in working alongside the FDA and academic hospitals to translate research into scalable, regulated treatments.

- Regulatory Landscape: Evolving regulatory frameworks are critical for market maturity. The U.S. DEA and EMA are reconsidering drug scheduling, and the FDA's draft guidance on psychedelic drug development has clarified clinical trial expectations, including psychological integration, safety monitoring, and endpoint measurement.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.94 Billion |

| Market Size in 2026 | USD 3.41 Billion |

| Market Size by 2034 | USD 11.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule / Class, Source / Synthesis Route, Form / Solid-State & Grade, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What is Driving the Growth of the Psychedelic Therapeutics Market?

A primary growth driver is the increasing volume of positive clinical trial data demonstrating efficacy in treatment-resistant mental health disorders. A growing body of research supports that compounds such as LSD and psilocybin offer significant symptom relief where traditional pharmacotherapies have failed. For example, a recent mid-stage LSD trial published in JAMA showed a sustained reduction in generalized anxiety lasting three months. Similarly, in October 2025, Compass Pathways announced that its Phase 3 trial of a single-dose psilocybin treatment achieved a statistically significant reduction in depression scores compared to placebo.

These advancements have fueled strong interest from investors and major pharmaceutical companies. Notably, in August 2025, AbbVie entered a deal worth up to $1.2 billion for a psychedelic asset targeting depression, marking one of the sector's largest transactions to date. This kind of evidence is bringing a credibility to the psychedelic movement that has shifted it into the mainstream beyond the periphery of psychedelics being fringe science.(Source: https://news.abbvie.com)

Restraint

Concerns About Safety and Ethical Risks

A significant restraining factor in the psychedelic therapeutics market is the unresolved safety, ethical, and methodological risks associated with these treatments. For example, the FDA recently raised concerns regarding functional unblinding in MDMA-assisted PTSD trials, where participants could often distinguish between active drug and placebo, potentially skewing efficacy outcomes. Additionally, there have been reports of serious adverse psychological effects, such as prolonged distress following repeated psilocybin use in a training context.

Ethical violations have also surfaced, most notably, allegations of sexual misconduct by a therapist in a Phase II MDMA trial. These issues, ranging from inconsistent consent protocols and poor blinding to inadequate adverse event monitoring and therapist misconduct, pose risks of regulatory backlash, loss of public trust, and longer approval timelines for clinical adoption.

Opportunity

Could the Entry of Big Pharma and Increasing Investments Provide Opportunity in the Psychedelic Therapeutics Market?

One significant opportunity lies in the validation and investment by major pharmaceutical companies, which is expected to rapidly accelerate the acceptance, funding, and scaling of psychedelic therapies. For example, in March 2025, the US Department of Defense (DoD) allocated USD 10 million to research the therapeutic use of MDMA for active-duty military personnel suffering from PTSD and related conditions. As noted by a prominent Republican congressperson, this marks a pivotal policy shift toward legitimizing psychedelics within the medical landscape. (Source: https://www.marijuanamoment.net)

An increase in government funding has the potential to not only normalize psychedelic therapies but also enable clinical collaboration and ensure safety at the federal level. With public institutions supporting and financing mental health innovation, the psychedelic therapeutics market is poised to gain momentum, expanding through clinical trials, collaborative partnerships, and evolving regulatory pathways.

Segment Insights

Molecule / Class Insights

What Made Ketamine / Esketamine the Dominant Segment in the Psychedelic Therapeutics Market?

The ketamine/esketamine segment dominated the market with approximately 55% share in 2024, owing to its reliable and rapid therapeutic effects in treatment-resistant depression and suicidal ideation. It has firmly established itself within the psychedelic therapeutic community and gained broader acceptance, with some hospitals administering these compounds even outside of strict therapeutic protocols. FDA approval for specific indications has further boosted clinician confidence, supporting off-label use in psychiatric care.

The psilocybin/psilocin segment is expected to grow at the fastest CAGR during the forecast period, driven by increasingly compelling clinical evidence for major depressive disorder and PTSD. Government-sponsored research across the U.S., Canada, and the U.K. is accelerating validation of psilocybin's long-acting antidepressant effects. Moreover, a wave of startups is emerging with innovations involving nature-based and semi-synthetic psilocybin formulations, further solidifying market interest and future growth potential.

Indication / Disease Area Insights

Why Did the Depression Spectrum Segment Lead the Psychedelic Therapeutics Market?

The depression spectrum (TRD/MDD) segment led the psychedelic therapeutics market with approximately 57% share in 2024, owing to the high global burden of depression and the compelling potential of psychedelics in treatment-resistant cases. The modern use of ketamine infusions and esketamine nasal sprays represents one of the fastest-growing treatment modalities, providing rapid symptom relief where conventional antidepressants have failed. As a result, depression remains a key indication attracting both patients and providers toward psychedelic-based interventions. This leadership is further reinforced by growing clinical validation and increasing demand for innovative mental health solutions.

Meanwhile, the anxiety disorder segment is projected to grow at the fastest rate, driven by strong emerging data on the efficacy of psychedelics in alleviating generalized anxiety, social distress, and procedure-related anxiety, particularly in terminal illness and PTSD contexts. The expanding body of clinical trials investigating psilocybin's anxiolytic effects is elevating its therapeutic credibility. Additionally, rising public awareness around mental health and growing openness toward non-traditional, non-pharmacological treatments are accelerating demand within this indication.

Therapy Model Insights

What is the Most Common Therapy Model in Psychedelic Treatments?

The supervised pharmacotherapy in clinic segment dominated the market with approximately 64% share in 2024. This model involves medically regulated administration of psychedelics, primarily ketamine, within clinical environments under physician oversight. Its market leadership is driven by regulatory acceptance, reduced risk of misuse, and safety assurance through therapist-monitored sessions. The clinical setting ensures standardized dosing and allows for immediate response to adverse effects, which strengthens its adoption in mainstream psychiatric care.

The psychedelic-assisted psychotherapy segment is projected to expand at the fastest CAGR in the coming years. This growth is fueled by increasing clinical validation of therapeutic protocols combining psychedelic administration with guided therapy sessions. Such integration is showing long-term efficacy in emotional processing and psychological integration, often through a limited number of high-impact sessions. Ongoing clinical trials, especially those involving psilocybin and MDMA, are drawing significant attention from both medical professionals and drug developers, supporting its accelerated adoption as a core treatment paradigm.

Route / Formulation Insights

Why Did the Intranasal Segment Lead the Psychedelic Therapeutics Market?

The intranasal segment led the market with approximately 46% share in 2024, primarily due to the commercial success and clinical adoption of esketamine nasal sprays for treatment-resistant depression. This delivery method offers rapid absorption, ease of dosing, and reduced invasiveness compared to intravenous or oral administration. Its regulatory approval, favorable safety profile, and patient preference have made it a mainstay across leading psychiatric treatment centers.

The oral/ODT (orally disintegrating tablet) segment is expected to register the highest CAGR in the coming years. Oral formulations, including psilocybin capsules and LSD microdose formats, are gaining traction due to their ease of use, non-invasive nature, and growing clinical validation. As standardized dosing protocols evolve and large-scale manufacturing becomes feasible, this subsegment is positioned to acceleratedriven by increased demand for accessible and scalable psychedelic treatment options.

Dosing Paradigm Insights

What is the Leading Dosing Paradigm in the Psychedelic Therapeutics Market?

The repeated/maintenance dosing segment led the market with approximately 62% share in 2024, reflecting its widespread adoption in ketamine-based therapies and chronic depression management protocols. This dosing model involves scheduled, ongoing administration to sustain therapeutic effects, while enabling consistent monitoring of patient response. Its alignment with conventional medical frameworks and established clinical efficacy reinforces its strong position within the psychedelic therapeutics market.

The single/dual macrodose sessions segment is projected to witness the fastest growth, supported by growing clinical evidence demonstrating the sustained benefits of limited high-dose psychedelic sessions. These structured dosing protocols, often involving psilocybin or MDMA, have shown significant reductions in depressive and PTSD symptoms following just one or two administrations. This approach is gaining momentum due to its efficiency, potential for long-term remission, and increasing patient and clinician interest in non-recurring, transformative interventions.

Regional Insights

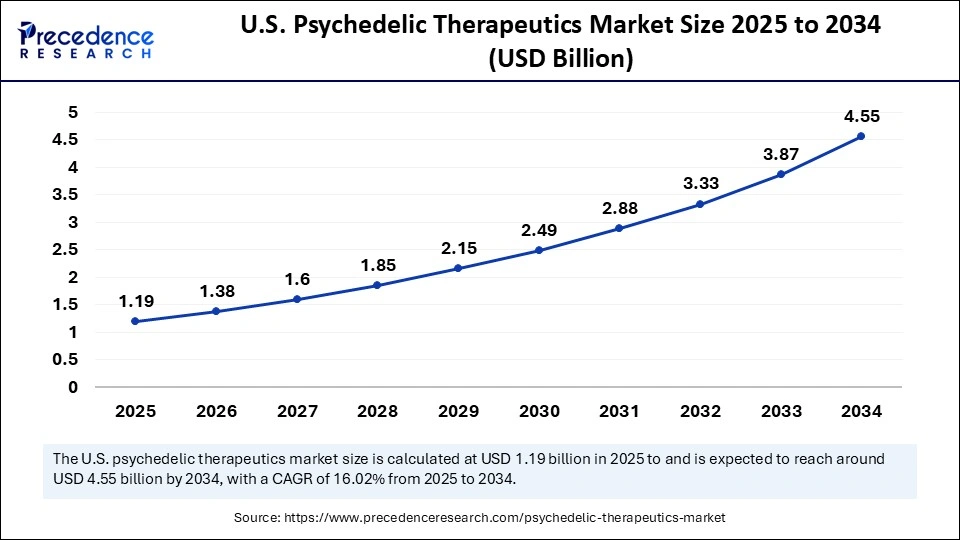

U.S. Psychedelic Therapeutics Market Size and Growth 2025 to 2034

The U.S. psychedelic therapeutics market size was exhibited at USD 1.19 billion in 2025 and is projected to be worth around USD 4.55 billion by 2034, growing at a CAGR of 16.02% from 2025 to 2034.

Why Did North America Lead the Psychedelic Therapeutics Market?

North America remained the dominant region in the psychedelic therapeutics market, accounting for approximately 52% share in 2024. This leadership is primarily driven by a favorable regulatory landscape that supports clinical research and therapeutic use of psychedelics under trained medical supervision. Public perception toward psychedelic-assisted therapy is increasingly positive, and significant capital investment is flowing into companies conducting in-house R&D.

The region has established a strong academic and clinical infrastructure for exploring the use of psilocybin, MDMA, and ketamine for mental health treatment. Notably, several psychedelic compounds have received Breakthrough Therapy Designation from the U.S. FDA, accelerating regulatory pathways. Additionally, a growing number of clinical trials are being conducted at leading universities and biotech firms across the U.S. and Canada, further reinforcing North America's central role in advancing psychedelic therapeutics.

How Is the U.S. Leading North America's Psychedelic Therapeutics Market?

The U.S. is at the forefront of the North American psychedelic therapeutics sector, primarily due to progressive regulatory initiatives and an expanding clinical research ecosystem. The U.S. Food and Drug Administration (FDA) has granted Breakthrough Therapy Designation to several psychedelic compounds, significantly accelerating their clinical development pathways.

- In 2025, Colorado became the first U.S. state to launch a regulated psilocybin therapy program. This initiative enables trained professional facilitators to oversee and support psilocybin administration for patients suffering from mental health conditions such as depression and PTSD. This marks a broader national shift, moving from grassroots advocacy to the formal integration of psilocybin as a viable medical treatment modality within mental health care frameworks.(Source: http://healingadvocacyfund.org)

Why Is Asia Pacific Considered the Fastest-Growing Region in the Psychedelic Therapeutics Market?

Asia Pacific is witnessing rapid growth in the market due to regulatory reforms, expanding R&D efforts, and rising demand for mental health solutions. Several countries in the region are initiating legal pathways for the controlled medical use of psychedelics, particularly for treatment-resistant conditions. This regulatory progress is reinforced by improvements in clinical trial infrastructure, increased psychiatric healthcare investments, and greater public and governmental awareness around mental health issues such as depression and PTSD.

How Is Australia Emerging as the Leading Country in Asia Pacific's Psychedelic Therapeutics Market?

Australia is emerging as the regional leader in the Asia Pacific psychedelic therapeutics market, driven by pioneering regulatory reforms and clinical implementation. The country has developed a robust ecosystem that includes clinical trials, formal training programs for psychiatrists, and local GMP-certified manufacturing of psychedelic compounds.

In February 2024, Australia opened its first dedicated psychedelic therapy clinic, Clarion Clinics, offering a structured nine-month treatment program priced at AUD $24,000. In another key development, Optimi Health Corp. (Source:https://www.theguardian.com)

launched its natural psilocybin capsules in Australia in September 2025 under the Authorised Prescriber Scheme, allowing prescriptions for patients with treatment-resistant depression (TRD). Supported by strong ethical oversight and sustained research funding, Australia is positioning itself as the regional hub for regulated psychedelic therapies, setting a precedent for the rest of Asia Pacific. (Source:https://investingnews.com)

Value Chain Analysis of the Psychedelic Therapeutics Market

- Drug Discovery & Development

This phase involves the identification, design, and validation of psychedelic compounds for therapeutic use. This includes preclinical studies, toxicity assessment, and formulation development to ensure safety, efficacy, and regulatory approval before human testing.

Key Players: Delix Therapeutics, Compass Pathways, MindMed Inc., GH Research, Albert Labs, PSYLO, Clearmind

- Drug Manufacturing and Supply

This stage entails increasing production of psychedelic compounds according to cGMP standards. This provides assurance of chemical consistency, purity, and safe distribution to clinical sites, facilitating research and commercial therapy programs in regulated markets.

Key Players: Psygen, PharmAla Biotech, Filament Health, Optimi Health, CB Therapeutics

Therapy Protocols & Development

This will develop evidence-based therapeutic models that establish how psychedelics are implemented. This includes defined dosage protocols, structure for sessions, integration, and patient safety standards to ensure treatment can be delivered in a standardize fashion and outcomes are replicable.

Key Players: Osmind, Wavepaths, Homecoming, TRIPP, Lumenate

- Provider Training

Training programs support educating therapists, clinicians, and facilitators to prepare them for the delivery of psychedelic-assisted therapies. The programs include ethical considerations, crisis-care protocols, and integration methods to promote effective therapeutic experiences and comply with emerging medical guidelines.

Key Players: Fluence, Clerkenwell Health, BCSP, SunStone

- Clinics & Care Delivery

Psychedelic-assisted therapies are delivered in a clinic that enhances patient safety in a controlled, supporting environment. These clinics are focused on developing the right dose of medicine, monitoring patient response to treatment, and offering integration therapy sessions while providing comfort and safety to patients to promote after-care clinical support.

Key Players: Awakn, Sunstone, Numinus, Field trip

Psychedelic Therapy: Funding Announcements and Research Highlights

| Company / Organization | Date | Funding Details | Description |

| Uppsala University, Sweden | July 2025 | 4 million | Funding granted for research on psychedelic-assisted therapy to study mental health applications and therapeutic mechanisms of psychedelics. |

| Queen's University, Canada | March 2025 | US$ 5 million | Leading a national initiative to advance psychedelic therapy in cancer care, focusing on improving patient quality of life and symptom management. |

| TARA Mind / Red Cell Partners | April 2023 | US$3 million (pre-seed) | Funding to develop novel psychedelic therapies for mental health, supporting early-stage research and company growth in the psychedelic therapeutics space. |

| U.S. Department of Defense (Walter Reed / Emory University) | March 2025 | US$9.8 million (two $4.9M grants) | Study of MDMA-assisted therapy for PTSD in active-duty soldiers, focusing on psychological flexibility and long-term therapeutic outcomes. |

| Texas Veterans Programs | June 2025 | $50 million |

State legislation approved funding for clinical trials of ibogaine, a psychedelic showing promise for treating addiction and PTSD among veterans. |

Top Key Players in the Psychedelic Therapeutics Market

Tier I Major Players

These firms are leading in clinical development, regulatory milestones, and investor valuation. Together they arguably control roughly 45 50% of the market in terms of influence and revenue potential.

| Company | Key Strengths / Why Tier I |

| Compass Pathways plc | Strong Phase 3 psilocybin program for treatment resistant depression; FDA breakthrough therapy status; large investor and public visibility. |

| MindMed | Broad pipeline (LSD, MDMA, others); active in trials; solid funding; known for combining drug + digital/therapy models. |

| ATAI Life Sciences | Platform model covering both psychedelic and non psychedelic compounds; major investments; backing of multiple programs and satellites. |

Tier II Established/Mid Level Contributors

These companies have significant pipelines, but either smaller scale, fewer lateâstage trials, or less regulatory progress than Tier I. Combined, they represent an estimated 25 30% of market value/potential.

| Company | Key Strengths / Why Tier II |

| Cybin Inc | Active in clinical trials; developing differentiated delivery and formulations; growing investor interest. |

| Johnson & Johnson / Janssen | Esketamine already commercialized; strong global reach and distribution; regulatory experience. |

| Pfizer | Broad pharma capacity, interest in next generation mental health and psychedelic investment; strong financial clout. |

Tier III Emerging / Niche Players

These players have important innovations, early stage trials, or regional strength, but less proven commercial or late stage regulatory outcomes. Together they make up approximately 15 20% of the market's current revenue/potential.

| Company | Key Strengths / Niche |

| Delix Therapeutics | Developing non hallucinogenic analogs (psychoplastogens) aimed at some of the same indications; novel science. |

| Beckley Psytech | Focus on 5 MeO DMT and synthetic psilocin; developing intranasal sprays; growing clinical profile and funding. |

| Eleusis / Beckley (via Eleusis) | Preclinical / early clinical programs in serotonergic psychedelics, including anti inflammatory and neuromodulatory work; niche but promising. |

Recent Developments

- In July 2025, Filament Health collaborated with University College London (UCL) in the UK to provide its botanical psilocybin drug candidate, PEX010, for two Phase II research studies. This study aims to investigate the effects of the drug on the function, perception, and psychological well-being of the brain.(Source: https://www.clinicaltrialsarena.com)

- In June 2025, Transformation Counseling, LLC, launched the psychedelic-assisted therapy services, these are legally offered under Schroeder's licensure as a psilocybin facilitator in Oregon and Colorado and supported by advanced clinical training.(Source: https://www.wcia.com)

Segments Covered in the Report

By Molecule / Class

- Psilocybin / PsilocinPsilocybin

- Psilocin

- Deuterated psilocin

- Psilocin prodrugs

- MDMA

- MDMA base

- MDMA salts

- Lysergide / LSD

- Lysergide

- Lysergic acid derivatives

- Tryptamines

- DMT

- 5-MeO-DMT

- Iboga Alkaloids

- Ibogaine

- Noribogaine

- Ketamine Class

- Racemic ketamine

- Esketamine

- Next-gen 5-HT2A modulators / psychoplastogens

- Non-hallucinogenic modulators

- Short-acting serotonergics

By Source / Synthesis Route

- Fully synthetic

- Biosynthetic / fermentation

- Engineered microbial pathways

- Fungal / mycelial fermentation

- Semi-synthetic

- Botanical / fungal extraction (limited)

By Form / Solid-State & Grade

- Salt forms

- Base forms

- Polymorph / crystal forms

- Micronized / particle-size controlled grades

By End Use

- Branded Rx developers/sponsors

- Clinic networks / licensed compounding

- State-regulated service providers

- Academic / investigator-initiated programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content