Quantum Cryptography Market Size and Forecast 2025 to 2034

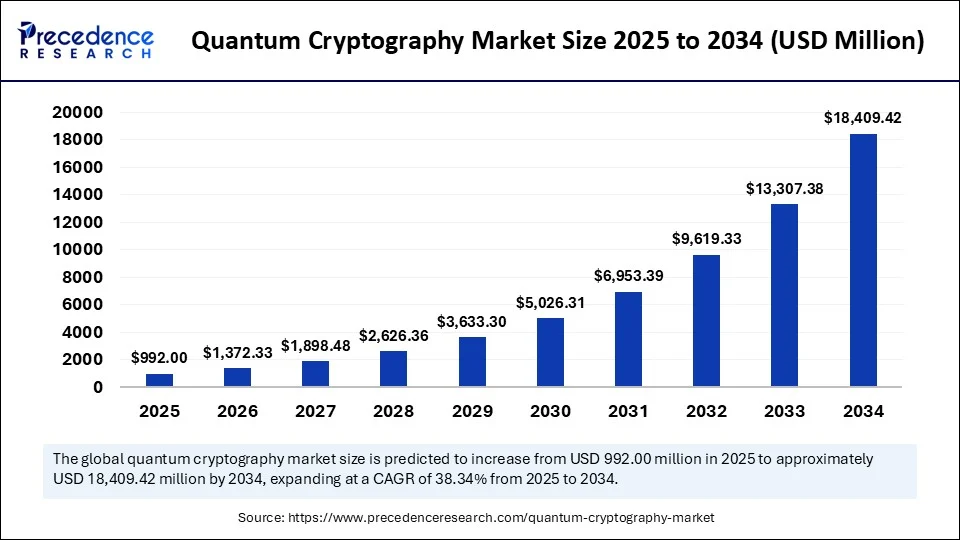

The global quantum cryptography market size was calculated at USD 717.07 million in 2024 and is predicted to increase from USD 992 million in 2025 to approximately USD 18,409.42 million by 2034, expanding at a CAGR of 38.34% from 2025 to 2034. The market is growing due to the rising demand for ultra-secure communication systems that can withstand evolving cyber threats and data breaches.

Quantum Cryptography Market Key Takeaways

- In terms of revenue, the global quantum cryptography market was valued at USD 717.07 million in 2024.

- It is projected to reach USD 18,409.42 million by 2034.

- The market is expected to grow at a CAGR of 38.34% from 2025 to 2034.

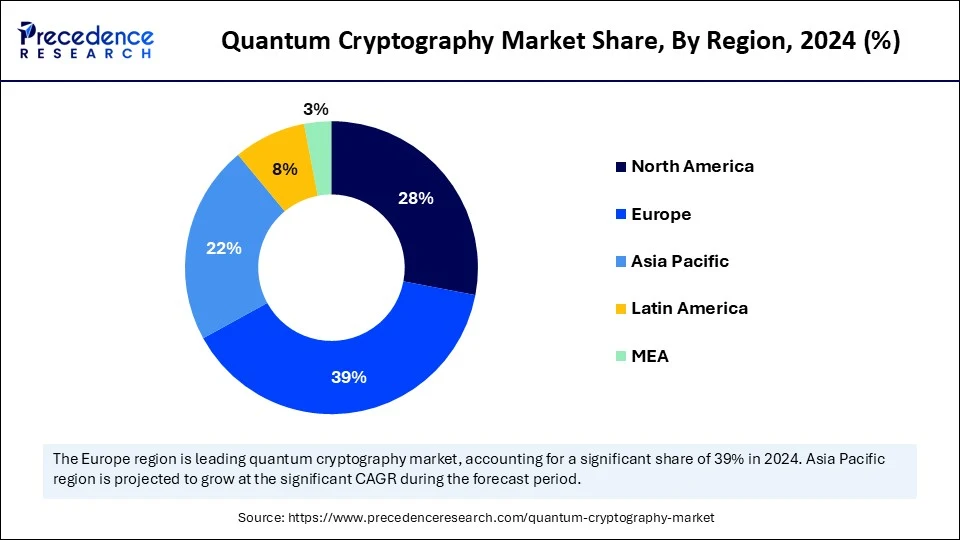

- Europe dominated the quantum cryptography market with the largest market share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By component, the solutions segment held the biggest market share of 67% in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the network security segment captured the highest market share of 45% in 2024.

- By application, the application security segment is projected to grow at the fastest CAGR during the forecast period.

- By industry vertical, the banking, financial services & insurance (BFSI) segment generated the major market share of 34% in 2024.

- By industry vertical, the telecom & IT segment is emerging as the fastest growing during the forecast period.

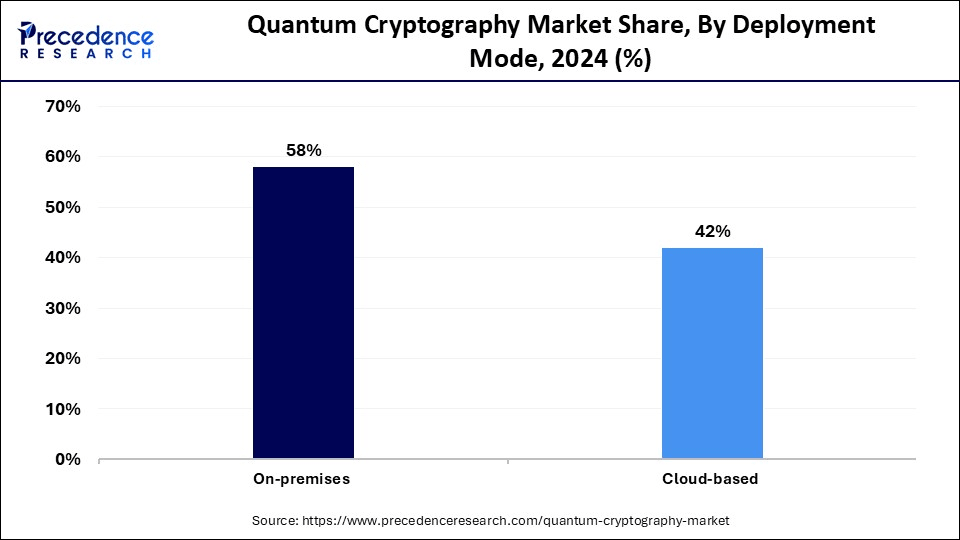

- By deployment mode, the on-premises segment held the largest share at 58% in 2024.

- By deployment mode, the cloud-based segment is expected to grow at the fastest CAGR during the forecast period.

How Is AI Transforming the Growth of the Quantum Cryptography Market?

By making encryption systems more intelligent, resilient, and deployable, artificial intelligence is driving the market for quantum cryptography. Quantum key distribution (QKD) systems can now detect anomalies in real time, generate adaptive keys, and correct errors more quickly thanks to machine learning techniques. These capabilities bolster defenses against constantly changing cyberthreats. Automation powered by AI also lowers operating expenses, which promotes wider adoption by sectors like healthcare, finance, and defense. AI-enhanced quantum encryption, when paired with new networks (5G IoT), guarantees effective, scalable, and future-ready security, hastening the market's transition from specialized experimentation to realistic worldwide deployment.

- In May 2024, Terra Quantum AG released TQ42 Cryptography, an open-source post-quantum cryptography library that simplifies embedding quantum-resistant security into applications across mobile, web, IoT, and cloud platforms.

(Source: https://www.thebusinessresearchcompany.com)

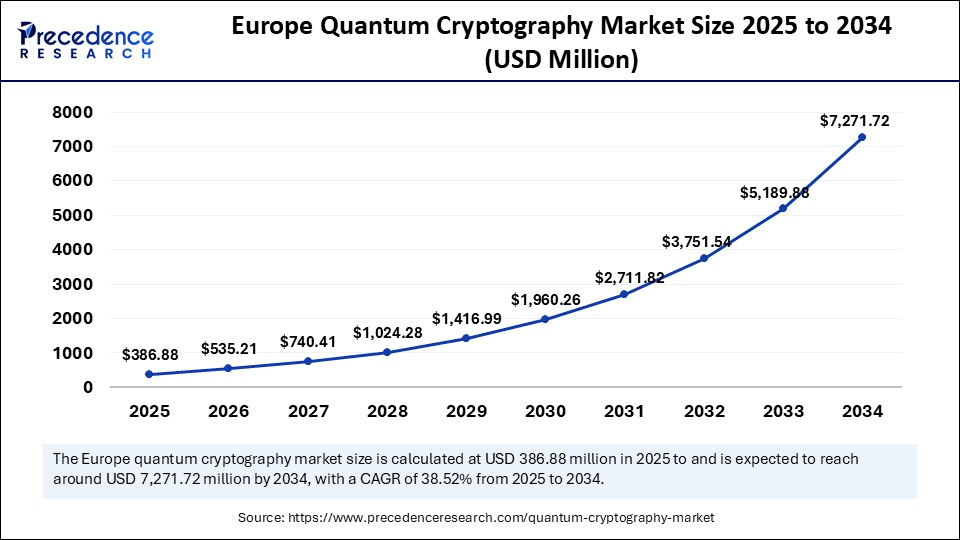

Europe Quantum Cryptography Market Size and Growth 2025 to 2034

The Europe quantum cryptography market size is evaluated at USD 386.88 million in 2025 and is projected to be worth around USD 7,271.72 million by 2034, growing at a CAGR of 38.52% from 2025 to 2034.

What Makes Europe Dominant in the Quantum Cryptography Market in 2024?

Europe dominated the market, driven by significant government funding of cutting-edge R&D projects, and projects like the European Quantum Communication Infrastructure. The deployment of quantum secure communication has centered in Europe because of robust policy support and cooperative efforts between academic institutions, research centers, and private businesses. The European Union's leadership position is further reinforced by its emphasis on long-term digital security and quantum sovereignty.

Asia Pacific is the fastest-growing region, driven by significant government investments in technology in the defense, IT, and telecommunications sectors. The Asia Pacific quantum cryptography market is growing at the fastest rate due to factors like growing communication networks, rapid digitalization, and increased cybersecurity threats. Adoption is accelerating throughout the region thanks to large-scale pilot projects and government-backed commercialization initiatives.

Market Overview

Quantum cryptography leverages the principles of quantum mechanics, especially quantum key distribution (QKD), to secure communications against cyberattacks. Unlike classical cryptography, which depends on mathematical complexity, quantum cryptography provides unconditional security through the laws of physics. Its core use is enabling secure key exchange, but it is expanding into secure networks, satellite-based quantum communications, and defence-grade security systems. Growing concerns over post-quantum threats, rising cyberattacks on critical infrastructure, and government-backed quantum initiatives are fueling rapid adoption across defence, finance, telecom, and healthcare sectors.

How Is the Quantum Cryptography Market Helping Protect Data From Hackers?

Using the concepts of quantum mechanics, the market for quantum cryptography is assisting in the protection of data from hackers by producing encryption keys that are impossible to intercept or duplicate covertly. By using quantum key distribution (QKD), any attempt to intercept a conversation instantly changes the data's quantum state, warning both parties of a possible security breach. This ensures extremely secure communication for sectors like banking, defense, and healthcare by making it nearly impossible for hackers to steal or alter sensitive data.

- On 20 May 2025, China Telecom Quantum Group announced the launch of the world's first distributed cryptography system combining quantum key distribution (QKD) and post-quantum cryptography (PQC), followed by a landmark 1,000 km quantum-encrypted phone call between Beijing and Hefei.

(Source: https://thequantuminsider.com)

Quantum Cryptography MarketGrowth Factors

- Increasing cyberattacks and data breaches are driving demand for highly secure communication networks.

- Rising adoption of quantum key distribution (QKD) in banking, defense, and government sectors to protect sensitive data.

- Growing investments in quantum technologies by both public and private sectors to enhance national security and digital infrastructure.

- Expansion of 5G networks and IoT ecosystems requires advanced encryption solutions for data integrity.

- Technological advancements in quantum computing fuel the need for quantum-safe cryptography solutions.

- Strategic collaborations between technology providers and telecom companies to integrate quantum encryption in global communication networks.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18,409.42 Million |

| Market Size in 2025 | USD 992 Million |

| Market Size in 2024 | USD 717.07 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 38.34% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, Industry Vertical, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Cybersecurity Threats and Data Breaches

The scope and complexity of cyberattacks are increasing, with hackers focusing on private information in the fields of healthcare, defense, and finance. Because of supercomputers and the potential development of quantum computers, traditional encryption techniques are becoming more and more vulnerable. Because it uses the laws of physics to provide unbreakable security, quantum cryptography is a powerful force behind market adoption. Nowadays, businesses are giving quantum-safe techniques top priority in order to protect their digital assets.

- On 13 August 2025, ExpressVPN announced the integration of WireGuard with post-quantum encryption (ML-KEM) to protect users from future quantum hacking risks.(Source: https://www.techradar.com)

Government Support and Strategic Investments

Governments around the world are investing heavily in quantum communication networks to strengthen national security. For example, Europe's EuroQCI initiative and China's quantum satellite programs are building large-scale infrastructures. In the U.S., federal funding supports research to counter future cyber risks. This strong backing accelerates the commercialization of quantum cryptography and builds trust among enterprises

- On 21 January 2025, Thales Alenia Space & Hispasat started development of the world's first geostationary quantum key distribution system (QKD-GEO) under the EuroQCI initiative.(Source: https://www.thalesaleniaspace.com)

Restraints

High Implementation Costs

Quantum cryptography requires specialized hardware such as photon detectors, quantum random number generators, and dedicated fiber networks. These systems are far more expensive than traditional encryption methods, making it difficult for small and mid-sized enterprises to adopt. The high upfront investment remains a key restraint for market expansion, especially in developing economies.

- On 24 April 2025, KETS Quantum Security delivered a quantum cybersecurity prototype to BT, but noted that cost barriers remain for large-scale commercial rollout(Source: https://www.thetimes.co.uk)

Lack of Standardization

There are no widely recognized standards for protocol testing or interoperability in the quantum cryptography industry. Global deployment becomes fragmented across industries and countries in the absence of standardized frameworks. Adoption is slowed, and vendor and telecom provider compatibility issues are brought up.

- In February 2025, Google Cloud rolled out quantum-safe digital signatures, aligning with NIST standards, stressing the importance of global cryptographic frameworks.(Source: https://www.reddit.com)

Opportunities

Integration with 5G, IoT, and Smart Cities

Quantum cryptography has a chance to protect massive real-time data flows as 5G IoT and smart cities grow. Industries are searching for next-generation security to stop breaches in everything from critical infrastructure to driverless cars. It is possible to integrate quantum cryptography into these ecosystems, opening the door for broad use.

- In June 2025, Colt, Honeywell & Nokia launched a space-based QKD trial to secure future transatlantic data transfer, a key enabler for 5G and IoT ecosystems.

(Source: https://aerospace.honeywell.com)

Open-Source and Developer-Friendly Tools

Quantum cryptography companies are increasingly offering open-source tools to attract developers and enterprises. By lowering the entry barrier, these tools expand adoption across industries such as cloud computing, IoT, and enterprise security. This democratization of quantum-safe encryption represents a strong growth opportunity.

- In May 2024, Terra Quantum AG released TQ42 Cryptography, an open-source PQC library for mobile, web, and IoT applications.

(Source: https://www.thebusinessresearchcompany.com)

Component Insights

Why Did the Solutions Segment Dominate the Quantum Cryptography Market in 2024?

Solutions segment dominated the market, driven by the increasing need for advanced encryption platforms, secure communication hardware, and quantum key distribution systems. Businesses and governments are giving strong solution deployments top priority, especially in the BFSI defense and healthcare sectors, because of growing worries about quantum computing's potential to crack traditional encryption. Furthermore, the dominance of solutions is being further cemented by the quick improvements in hardware integration and reliability. Increased government investment in cross-border secure communication initiatives and quantum networks has sped up adoption. They continue to dominate the market thanks to solution-based deployments, dependability, and long-term advantages.

The services segment is the fastest growing, driven by fueled by the growing demand for managed, integrated, and consulting services. Since integrating quantum cryptography with current infrastructure can be challenging, businesses are looking to professional service providers to guarantee scalability, compliance, and smooth adoption. This market is gaining momentum thanks to strategic partnerships between IT consultancies and quantum startups.

Application Insights

Why Did the Network Security Segment Dominate the Quantum Cryptography Market in 2024?

The network security segment dominated the quantum cryptography market, motivated by its vital role in preventing cyber espionage and interception of sensitive communications. Network security is still the foundation of quantum cryptography applications because governments, the military, and financial institutions have adopted QKD networks. Additionally, driving this segment forward is the deployment of terrestrial fiber networks and quantum satellites.

The application security segment is the fastest growing, motivated by the growing requirement to protect cloud-based workloads, mobile platforms, and enterprise apps due to the increase in AI-driven cyberattacks, and cloud migration businesses are implementing application-level quantum cryptography to guarantee end-to-end security. Quantum cryptography is being used by sectors like fintech, e-commerce, and healthcare applications to ensure long-term data integrity.

Industry Vertical Insights

Why Did the Banking, Financial Services & Insurance (BFSI) Segment Dominate the Market?

Banking, financial services & insurance (BFSI) segment dominated the market, motivated by the industry's dependence on safe transactions, adherence to regulations, and safeguarding private client information. Banks and insurers are giving quantum cryptography top priority in order to protect multitrillion-dollar operations due to the growing number of cyberattacks that target financial systems. The demand for unbreakable encryption has increased due to the growth of digital banking and cross-border financial transactions.

The telecom & IT segment is the fastest growing, driven by the pressing need to protect 5G infrastructure and 6G infrastructure as well as next-generation communication networks. Telecom operators and IT providers and quickly implementing quantum secure communication solutions due to the exponential data flows across cloud systems and connected devices. Quantum cryptography is also being investigated by IT behemoths to defend hyperscale data centers against sophisticated cyberattacks.

Deployment Mode Insights

Why Did the On-Premises Segment Dominate the Quantum Cryptography Market in 2024?

The on-premises segment dominated the market, driven by the desire of highly regulated sectors like banking, healthcare, and defense to keep complete control over their cryptographic infrastructure. The most common deployment method is still on premises because of the requirement for specialized, strictly regulated mission-critical environments. Demand is further reinforced by worries about cloud vulnerabilities and compliance requirements.

Cloud cloud-based segment is the fastest growing, driven by the surge in digital services, remote work, and hybrid cloud strategies. Owing to its scalability, cost-effectiveness, and ability to secure distributed networks, cloud-based deployment is seeing rapid adoption across industries worldwide. Cloud providers are partnering with quantum startups to integrate QKD as service models.

Quantum Cryptography Market Companies

- ID Quantique

- Toshiba Corporation

- QuintessenceLabs

- QuantumCTek

- MagiQ Technologies

- Qubitekk

- Crypta Labs

- ISARA Corporation

- QNu Labs

- Post-Quantum

- KETS Quantum Security

- SK Telecom

- Huawei

- NEC Corporation

- Mitsubishi Electric

- Anhui Quantum Communication Technology Co.

- NuCrypt

- QuintessenceLabs – Key Management Solutions

- BT Group

- Orange S.A.

Recent Developments

- On 23 April 2025, Toshiba Europe researchers successfully transmitted quantum-encrypted messages over a 254 km German commercial telecom network using QKD and standard optical fibers no need for ultra-cold equipment, marking a milestone for practical quantum-secure communications.

(Source: https://www.ft.com) - In March 2025, Microsoft integrated ML-KEM and ML-DSA post-quantum algorithms into Windows Insider builds and Linux via SymCrypt-OpenSSL, enabling hybrid TLS key exchange to prepare for future quantum threats.(Source: https://www.its.cz)

Segments Covered in the Report

By Component

- Solutions

- Quantum Key Distribution (QKD) Systems

- Quantum Random Number Generators (QRNG)

- Secure Networking Hardware

- Quantum Cryptographic Software Platforms

- Services

- Deployment & Integration Services

- Consulting & Training

- Managed Security Services

By Application

- Network Security

- Secure Cloud Computing

- Database Encryption

- Application Security

- Others (Blockchain security, IoT security)

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Government & Defense

- Telecom & IT

- Healthcare & Life Sciences

- Energy & Utilities

- Others (Manufacturing, Automotive, R&D)

By Deployment Mode

- On-Premises

- Cloud-Based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting