What is the Rare Earth Metals Market Size?

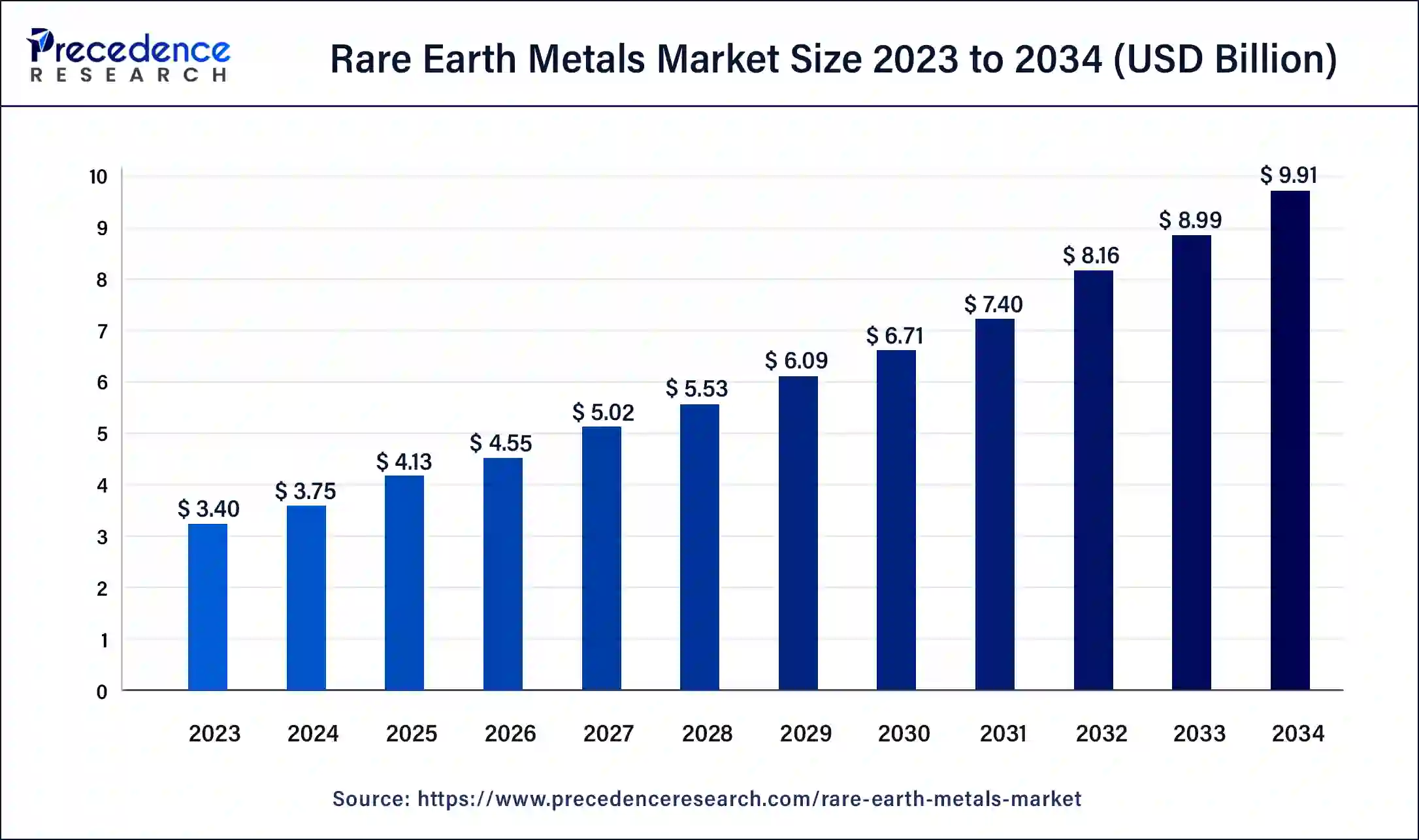

The global rare earth metals market size is accounted at USD 4.13 billion in 2025 and predicted to increase from USD 4.55 billion in 2026 to approximately USD 10.83 billion by 2035, representing a CAGR of 10.12% from 2026 to 2035. The adoption of electronic vehicles globally and the rising demand for smart technologies, which require permanent magnets that can be obtained from rare earth metals, are the major driving factors of the rare earth metals market.

Rare Earth Metals Market Key Takeaways

- In terms of revenue, the global rare earth metals market is valued at USD 4.13 billion in 2025.

- It is projected to reach USD 10.83 billion by 2035.

- The market is expected to grow at a CAGR of 10.12% from 2026 to 2035.

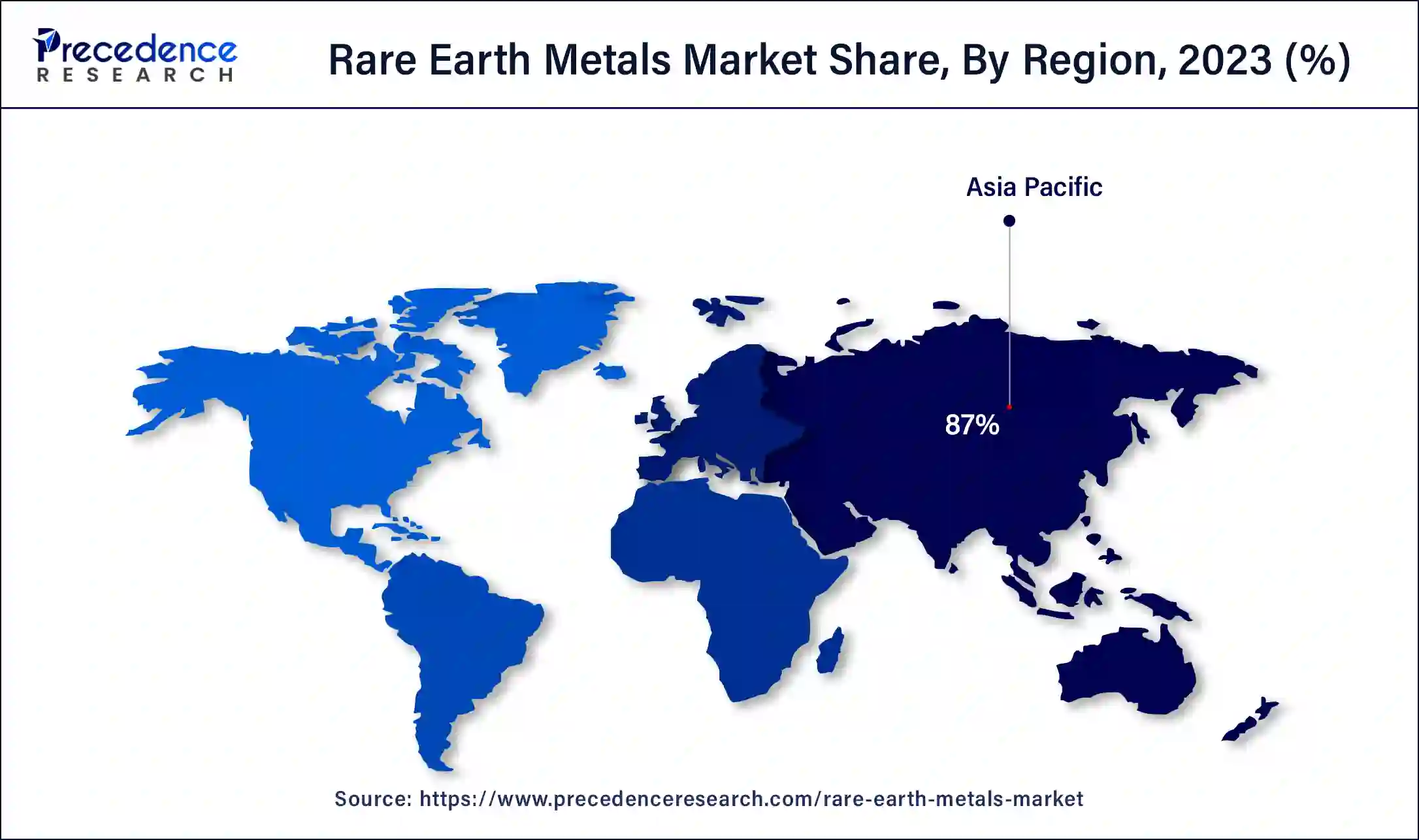

- Asia Pacific dominated the rare earth metals market with the largest market share of 87% in 2025.

- North America is anticipated to host the fastest-growing market in the studied period.

- By region, Europe is a major contributor to the market's growth on a global scale.

- By type, the neodymium segment held the largest share of the market in 2025.

- By type, the lanthanum segment is expected to grow at the fastest rate in the global market during the forecast period.

- By application, the magnets segment dominated the global market in 2025.

- By application, the battery segment is expected to showcase substantial growth in the market over the forecasted years.

The AI Impact on the Rare Earth Metals Market

In the rising era of AI, the rare earth metals market could not be the exception, and it isn't affected by the waves created by AI in the global market. AI is revolutionizing the rare earth metals market in an unprecedented manner by enhancing the efficiency of earth exploration and mining processes and searching for new metals or rare earth elements using predictive analytics. AI-driven technologies are enabling a more precise and cost-effective identification process for rare earth deposits. AI is also helpful in improving the refinement process by predicting equipment failures and their causes, which optimizes resource allocation, enhances overall productivity, and reduces adverse environmental impact.

- In January 2023, Rio Tinto announced an AI integration system that optimizes their exploration for earth elements while reducing the overall cost and time to do this tedious task.

What is the Rare Earth Metal?

The rare earth metals market is witnessing significant growth, driven by rising demand across high-tech industries such as electronics, renewable energy, and electric vehicles. These metals, which include neodymium, dysprosium, and terbium, are crucial for manufacturing permanent magnets, batteries, and advanced alloys. The market is dominated by China, which controls over 80% of global production and refining capacity, creating supply chain vulnerabilities. Efforts to diversify sources and increase recycling are gaining momentum. Technological advancements and governmental policies promoting green energy are key growth drivers. However, environmental concerns associated with mining and processing rare earth metals pose challenges.

Rare Earth Metals Market Growth Factors

- Increased use in electronics, renewable energy, and adoption of EVs across the globe.

- Rare earth elements are a vital part of manufacturing the strong permanent magnets required in the production of motors and generators.

- It's crucial in battery production with advanced technologies.

- Initiatives like green energy, low carbon emission, promoting the use of renewable energy sources, and policies supporting such initiatives are fuelling market growth.

- Growing adoption of E vs. market globally increases the need for rare earth metals as they are required in the production of batteries and motors.

- Efforts made by major industries to reduce the reliance on China while exploring new locations for mining and recycling.

- Supportive regulations and government policies for metal mining and its processing.

- Rising applications of metals in the military sector and defense sector.

- increasing focus on climate-friendly energy resources and their wide applications with sustainable practices fuels the rare earth metals market.

Market Outlook

- Industry Growth Overview: The increasing demand from the sectors of clean energy, electronics, and defense has been one of the main drivers of the rare earth metals market growth.

- Sustainability Trends: The practices of recycling, advanced extraction, and responsible supply chains are now gaining priority in the global markets.

- Global Expansion: The companies engaged in mining and processing are no longer concentrating only on the Chinese market, but new locations for these activities are being established.

- Major Investors: MP Materials, Lynas Rare Earths, Iluka Resources, and China Northern Rare Earth Group High-Tech Co., Ltd., among others, are the companies that have invested most heavily in the sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 10.83 Billion |

| Market Size in 2025 | USD 4.13 Billion |

| Market Size in 2026 | USD 4.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.12% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand from different industries

The significant driving factor for the growth of the rare earth metals market is the increasing demand for metals and earth elements from various industries to manufacture the products efficiently. These earth metals are mandatory and crucial, too, in the production of various electronic devices such as smartphones, gadgets, laptops, desktops, and highly advanced medical machinery/equipment. They are essential for manufacturing the permanent magnets used in wind turbines and electric vehicle motors.

The global shift towards smart technologies and digitalization continues to accelerate the demand for metals, thus driving the global market. With the increasing adoption of renewable energy sources and electric vehicles on a large scale, the need for metals is further amplified and boosts the rare earth metals market growth globally.

- In April 2025, Solvay launches a rare earth processing expansion amid China restrictions. Solvay, which also makes chemicals like soda ash and specialty polymers utilized in cars and airplanes, will initially focus its rare earth expansion on two elements required to make super-strong magnets that power electric vehicles and wind turbines - neodymium and praseodymium.

Environmental initiatives supported by governments worldwide

Another driving factor of the rare earth metals market is increasing support from authorities worldwide to reduce their carbon footprint and embrace renewable energy sources instead of traditional ones, which cause harm to the climate. Governments worldwide are implementing policies to promote green energy, which helps reduce carbon emissions and further fuels the growth of the market. These rare earth metals are crucial for the development of cleaner energy technologies such as wind and solar power systems and electric vehicles.

Moreover, the strategic initiatives, subsidies provided by the government, and notable investments to develop sustainable energy infrastructure are encouraging increased production and proper utilization of rare earth metals. Again, the efforts made to develop and refine recycling processes for these metals are gaining traction, further contributing to a more stable and environmentally friendly supply. Such regulatory support from authorities, keeping the clean climate as a primary focus, is fuelling the rare earth metals market globally.

Restraint

Adverse impact on the ecosystem due to the mining process

A major restraint that hinders the rare earth metals market is the harmful impact on the overall ecosystem associated with mining and processing for the purification of these raw metals obtained from the earth's crust/core. Extracting rare earth metals often involves environmentally damaging practices such as extensive landfalls, disruptions in lands, water contamination, air pollution, and noise pollution with tons of hazardous waste. These climatic impacts have led to stringent regulations and created a backlash from local communities as they disrupt their way of living. Such opposition further complicates the establishment and expansion of mining operations.

Moreover, the complex processes that are energy intensive, which are required to separate and refine the raw metals from the earth, further lead to high operational costs and create delays, which eventually affect the profitability and supply chain stability in the global market, which hinders the rare earth metals market expansion significantly.

Opportunities

Recycling and sustainable practices

As environmental concerns around mining intensify, the rare earth metals market has significant opportunities in recycling and sustainable practices. Developing efficient recycling technologies can recover valuable metals from electronic waste, reducing dependency on primary mining. This not only helps in addressing environmental issues but also stabilizes supply chains. Companies investing in sustainable extraction methods and eco-friendly processing technologies can gain a competitive edge, meeting regulatory requirements and consumer demand for greener products. This focus on sustainability opens up new avenues for growth and innovation in the market.

Geographical diversification of supply

Diversifying the geographical sources of rare earth metals presents a major opportunity for the rare earth metals market. Currently, China dominates production, leading to supply chain vulnerabilities. Investing in the exploration and development of rare earth deposits in other regions, such as the United States, Australia, and Africa, can mitigate risks associated with over-reliance on a single source. This diversification not only enhances global supply security but also fosters competitive pricing. Companies and governments collaborating on these initiatives can unlock new reserves, ensuring a more resilient and stable supply for high-tech and green energy industries.

Type Insights

The rare earth metals market is further segmented into lanthanum, cerium, neodymium, praseodymium, samarium, europium, and others. In 2025, the neodymium segment held the largest share of the market. The growth of this segment is attributed to increasing demand for electric and hybrid vehicle manufacturing on a wider scale. Batteries used in electric vehicles are made of neodymium-based magnets. Since batteries are the primary part of the functioning of EVs, the rising production and adoption of EVs in various regions is directly proportional to the growth of the neodymium segment, which, in turn, increases the market and its growth globally. Similarly, the cerium element is a vital part of automotive manufacturing. Thus, its growth is associated with the proliferation of the automotive industry. To minimize carbon emissions, cerium is generally used in the exhaust system and catalytic converters in the automobile.

The lanthanum segment is expected to grow at the fastest rate in the global rare earth metals market during the forecast period. The proliferation of this segment on a global scale is due to the increasing expansion of battery manufacturers. Nickel metal batteries are primarily used in consumer electronics devices, where lanthanum is used as an intermetallic component of nickel metal hybrid batteries. Hence, the rising adoption of electronic devices by the masses on a routine basis is the major contributor to this segment's growth in the market.

Application Insights

The magnets segment dominated the global rare earth metals market in 2025. The market is further segmented into metallurgy, batteries, polishing, glass and ceramics, catalysts, phosphorous, and others. There are continuous demands from various manufacturers, such as handheld consumer electronics, hard drives, servo motors, sensors, speakers, and headphones.

The battery segment is expected to showcase substantial growth in the rare earth metals market over the forecasted years. Technological development at a rapid pace, combined with the rising adoption of EVs, where batteries are an essential part of EV components, is the prominent factor driving battery segment growth in this market. Also, the substantial growth rate for energy storage applications with increasing reliance on electronic gadgets further fuels the battery segment and its expansion on a wider scale. Region-wise, China, the U.S., and European countries are the largest producers of EVs and will eventually become major contributors to this segment's growth globally.

Regional Insights

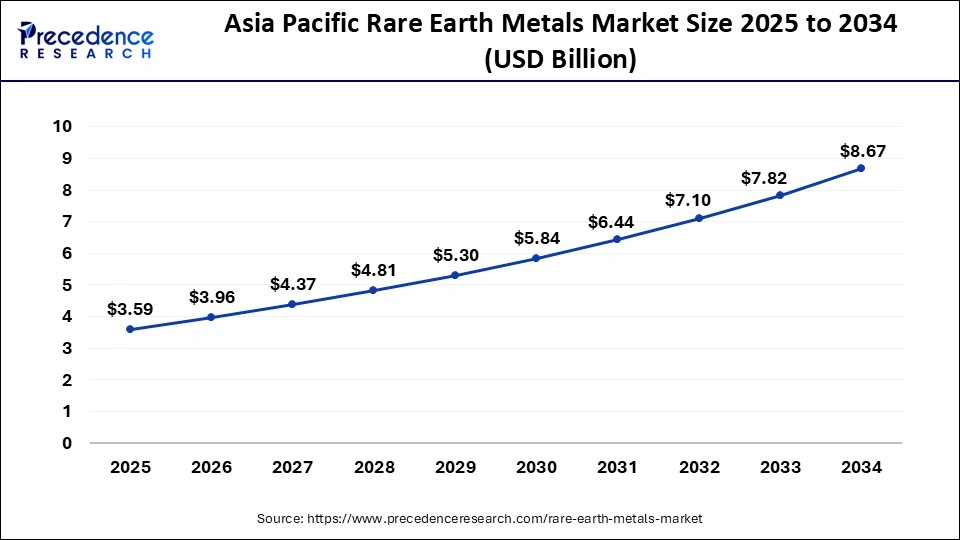

Asia Pacific Rare Earth Metals Market Size and Growth 2026 to 2035

The Asia Pacific rare earth metals market size was exhibited at USD 3.59 billion in 2025 and is projected to be worth around USD 9.52 billion by 2035, poised to grow at a CAGR of 10.24% from 2026 to 2035.

Asia Pacific accounted for the largest share of the rare earth metals market in 2025. Asia, particularly China, dominates the rare earth metals market due to its vast reserves and established mining infrastructure. China's government has heavily invested in the industry, ensuring a robust supply chain from extraction to processing. The region's advanced technological capabilities and cost-effective production also contribute to its dominance.

- In June 2023, China Northern Rare Earth Group announced a major expansion of its mining operations, further solidifying its market leadership.

Additionally, China's strategic stockpiling and export controls influence global prices and availability, reinforcing its pivotal role in the rare earth metals market. Asia, particularly China, dominates the market due to its vast reserves and established mining infrastructure. China's government has heavily invested in the industry, ensuring a robust supply chain from extraction to processing. The region's advanced technological capabilities and cost-effective production also contribute to its dominance. India and Japan are also making significant strides.

- In April 2023, India Rare Earths Limited announced new exploration projects aimed at boosting domestic production. Japan, lacking natural reserves, has focused on recycling and alternative sources.

- In May 2023, Toyota Tsusho Corporation unveiled an innovative recycling program to reclaim rare earths from electronic waste, enhancing Japan's supply chain resilience.

North America is expected to grow at the fastest rate in the rare earth metals market over the forecast period. The growth of the region can be credited to the substantial surge in the adoption of plug-in EVs, provided by major players in the region, like Nissan, Ford, Audi, Tesla, Chevy, and BMW. Furthermore, the region is also seeking several other mining options to minimize its reliance on Chinese supply. Hence, the increasing demand for EVs is anticipated to impact regional growth positively.

- In May 2024, FedEx, Pyxera Global, and several other companies launched the Circular Supply Chain Coalition to propel the U.S. supply of critical minerals for new tech hardware by “mining” discarded consumer electronics. Electronic goods all need rare earth elements. Batteries need lithium, nickel, cobalt, manganese, and graphite to function.

What Are the Driving Factors of The Rare Earth Metal Market in Europe?

The rare earth metal market is growing at a remarkable rate owing to its decarbonization goals and electric mobility policies in Europe. The region highlights the importance of recycling and the implementation of the methods of the circular economy. The policies involve the high-tech recycling investments, and the development of the primary domestic resources bases to get rid of the importation dependence in the long term.

Germany Rare Earth Metal Market Trends:

The key aspects that have been increasing the demand of Germany in regard to the rare earths are the highly developed industries of automotive, chemical, and automation, which always need their sustenance. The e-motors cannot be created without rare earth metals, which are also commonly utilized in the industrial system. Though in the gradual shift to eliminate the use of external sources by use of recycling efforts, Germany has focused on investments in supply diversification and circular economy activities.

Value Chain Analysis of the Rare Earth Metals Market

- Feedstock Procurement: Involves the purchase of the rare earth ores and minerals that are required by the downstream processes.

Key players: China Northern Rare Earth, MP Materials, Lynas Rare Earths - Chemical Synthesis and Processing: Conversion of the raw materials into rare earth compounds and usable and purified intermediates.

Key Players: Lynas Rare Earths, MP Materials, Shenghe Resources - Compound Formulation and Blending: Blending the refined compounds to acquire the required properties of the functional material.

Key Players: China Northern Rare Earth, China Minmetals Rare Earth, Shenghe Resources - Quality Testing and Certification: The examination of purity, functionality, and conformity to the standards before the launch of the product into the market.

Key Players: Bureau Veritas, Intertek, Cotecna, Shiva Analyticals

Top Rare Earth Metals Market Companies and their Offerings

- Baotou Rare Earth: Apart from producing rare earth concentrates, the company also manufactures catalysts, polishing materials, and hydrogen storage products from large-scale mining operations.

- China Minmetals Rare Earth: The company is active in refining all rare earth materials and supplying them for industrial and strategic applications in the southern region of China.

- Avalon Advanced Materials: The company is engaged in developing critical mineral projects with a focus on rare earth elements and talking about advanced material supply security.

Rare Earth Metals Market Companies

- Baotou Rare Earth (China)

- China Minmetal Rare Earth (China)

- Avalon Advanced Materials (Canada)

- IREL (India)

- Metall Rare Earth Limited (China)

- Arafura Resources (Australia)

- Canada Rare Earth Corporation (Canada)

- Lynas Corporation (Australia)

- Northern Minerals (Australia)

- Greenland Minerals Limited (Australia)

Recent Developments

- In April 2024, U.S. President Donald Trump ordered a probe into potential new tariffs on all U.S. critical minerals imports, a major growth in his dispute with global trade partners, and an attempt to pressure industry leader China.

- In February 2025, Russian aluminum producer Rusal announced that it is setting up a 1.5 tonne-a-year production facility for the rare-earth metal scandium, with the capacity to increase to 19 metric tonnes a year. Investment in the project will amount to 500 million roubles (USD 5.73 million), Rusal said in a statement. Production will start this year at its Bogoslovsky aluminum plant, located near the Ural Mountains.

- In January 2026, Japan is undertaking a rare initiative to secure its rare earth minerals due to concerns over China's control of exports. A mining vessel has set off to explore seabed mud rich in these resources near Minamitori Island, highlighting Tokyo's aim to reduce dependency on China. (https://moderndiplomacy.eu)

- In December 2025, India approved a ₹7,000 crore scheme to enhance domestic manufacturing of sintered rare earth permanent magnets, aiming to reduce import reliance and bolster industrial self-sufficiency. With significant rare earth mineral reserves across various states, this initiative supports key economic and strategic objectives through a robust domestic ecosystem. (https://www.gktoday.in)

Segments Covered in the Report

By Type

- Lanthanum

- Cerium

- Neodymium

- Praseodymium

- Samarium

- Europium

- Others

By Applications

- Magnets

- Metallurgy

- Batteries

- Polishing Agent

- Glass & Ceramics

- Catalysts

- Phosphors

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting