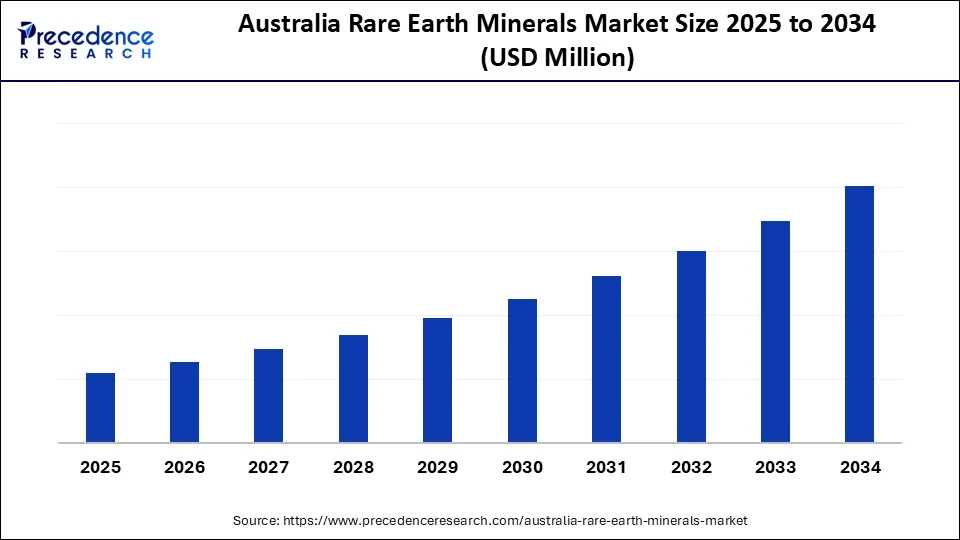

Australia Rare Earth Minerals Market Size and Forecast 2025 to 2034

The Australia rare earth minerals market is growing rapidly due to rising demand for clean energy technologies, EVs, and electronics. Abundant reserves and government support are positioning Australia as a key supplier in the critical minerals supply chain. The rising demand for clean energy technologies is expected to boost the growth of the market. Restrictions on Chinese supply chains are contributing to the expansion of the Australia rare earth minerals market.

Australia Rare Earth Minerals Market Key Takeaways

- Western Australia held the largest market share in 2024.

- By type, the light rare earth elements (LREE) segment led the market while holding the largest share in 2024.

- By type, the heavy rare earth elements (HREE) segment will grow at the highest CAGR between 2025 and 2034.

- By application, the magnets segment dominated the market with the largest share in 2024.

- By application, the batteries segment will grow at a significant CAGR between 2025 and 2034.

- By end-use industry, the electronics segment contributed the biggest market share in 2024.

- By end-use industry, the automotive segment will expand at a significant CAGR between 2025 and 2034.

Impact of AI on the Australia Rare Earth Minerals Industry

Australia is facing challenges of losing its critical mineral edge. However, AI is emerging as a major force, transforming the rare earth minerals industry with its crucial role in exploration & discovery for rare earth deposits. AI is helping to reduce exploration costs and enhance the discovery rate of rare earth minerals. Australia's growing competition with China has led to a significant emphasis on the adoption of AI in the rare earth minerals industry. AI-powered predictive modeling is bringing excrete targeted exploration and mining facilities. AI is playing a significant role in process optimization, enhancing the overall process efficiency and reducing waste.

With a growing focus on environmental impact, AI is gaining significant traction in the rare earth minerals market. Additionally, Australia is leveraging the essential use of AI to enhance its supply chain management and logistics optimization. With AI's ability to reduce environmental footprints, reduce cost, cut downtimes, and uncover rare minerals. The country is looking forward to a grand welcome for AI.

Australia Rare Earth Minerals Market Snapshot

The Australia rare earth minerals market is experiencing significant growth, driven by increased production of rare earth minerals in the country. In 2024, Australia was the world's largest rare ore-producing country. The federal government's ‘Australia's Critical Minerals Strategy' is the key force in boosting the country's mining powerhouse. The large supply of rare earth minerals globally is a factor that contributes to Australia's recognition in the world. Australia is a major country that rapidly produces rare earth minerals, including both light rare earths and heavy rare earths.

The strong presence of key market players and their initiatives in rare earth projects is supporting the market. Additionally, the growing demand for rare earth minerals in various applications, such as industrial processes, electronics, and renewable energy, is contributing to a boost in Australian production. Moreover, government support for the development of the rare earth industry, through initiatives such as the Modern Manufacturing initiatives and funding for critical minerals projects, is shaping market growth.

What are the Key Factors Boosting the Growth of the Australia Rare Earth Minerals Market?

- Rising Demands: The demand for rare earth minerals has been increasing due to the growing need for clean energy technologies and the production of electric vehicles, thereby boosting market growth.

- Growing Diversification: The growing shift towards supply chain diversification in the Australian supply chain for rare earth miners is supporting market growth.

- Government Initiatives: The Australian government, along with other governments, supports and invests in the development of rare earth minerals. Governments are providing significant funding, implementing policies, and initiating collaborations to improve supply chain security and boost the market.

- Technological Advancements: The technological advancements, such as battery technologies and magnet manufacturing, are driving the design of novel and innovative applications, thereby increasing the demand for rare earth minerals.

- Growing Adoption of Consumer Electronics: The increasing use of devices such as smartphones, tablets, laptops, and others is driving up the demand for rare earth minerals.

Market Scope

| Report Coverage | Details |

| Dominating Region | Western Australia |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use Industry, and Country |

Market Dynamics

Drivers

Investments in the Exploration and Processing of Rare Earth Minerals

The Australian rare earth minerals industry is experiencing significant growth, driven by government investments in the production and exploration of these minerals. Several new projects, such as Nolan's rare earth projects developed by Arafura Resources, Dubbo projects developed by Australian Strategic Materials, and the Yangibana Rare Earth project in Western Australia, developed by Hastings Technology Metals, are bringing extreme processing and exploration opportunities to the market. With government support and funding for critical mineral projects and the construction of novel plants, production volumes of rare earth minerals have been increasing. Additionally, the existence of a robust mining industry in Australia is driving the exploration, extraction, and processing of rare earth minerals in the country.

Abundant Resources

Australia possesses substantial reserves of rare earth elements, providing a strong foundation for its rare earth minerals market. This abundant resource supports the development of mining operations, processing facilities, and related infrastructure. Moreover, Australia has a well-established mining industry and robust regulatory framework, enhancing its capability to capitalize on its rare earth elements resources.

Australian Collaboration in the Rare Earth Minerals Sector

| Month | Agreements | Initiatives |

| June 2025 | Korean Metals Plants |

Australian Strategic Materials reported an update of rising commercial interest and sales of neodymium and praseodymium metal, and 15 tons of neodymium-iron-boron alloy at their Korean Metal Plant.(Source:https://investingnews.com) |

| June 2025 | JV Agreement |

The Government of Victoria, Australia, has approved the Donald Project, the Work Plan for construction and operations. The agreements highlight investments of AU$183 million, plus US$17.5 million, in energy fuels and common shares of 49% interest in the project.(Source:https://investors.energyfuels.com) |

| July 2025 | India and Australia's Restrictions on Chinese Export |

India and Australia discussed the shortage of rare earth minerals stemming from Chinese export restrictions. Australia invited India to secure early-stage blocks and collaborations with Australian companies. (Source: https://economictimes.indiatimes.com) |

| July 2025 | Quad Critical Minerals Initiative |

For the 10th Quad Foreign Ministers' meeting, the Secretary of State of the United States and the Foreign Ministers of Australia, India, and Japan met in Washington. The Quad Foreign Minister launched the Quad Critical Minerals Initiative to strengthen economic security, maritime & transnational security, support humanitarian assistance & emergency response, and critical & emerging technology. (Source:https://www.mea.gov.in) |

Limitations of Processing and Refining

Australia currently lacks extensive local refining and processing facilities, resulting in a major reliance on China's imports for raw minerals. The limitations of energy-intensive refining processes, transportation logistics, and workforce shortages further add to the production of complex deposits. This limitation contributes to the high production cost, thereby increasing the overall cost and complications. Supply chain vulnerabilities are hindering Australia from realizing the full economic value of its resources.

What is the Future Growth Opportunity for the Australia Rare Earth Minerals Market?

Increased Adoption of REM for Clean Energy and High-Tech Applications

The demand for rare earth minerals (REMs) is increasing in clean energy applications, such as wind turbines and electric vehicles, as well as in high-tech applications like magnets, electronics, and consumer electronics, including smartphones, computers, and other devices. The rare earth minerals are essential for the permanent magnets used in wind turbines and electric vehicles. The growing focus on advancements of ceramics and phosphors is further driving demand for critical earth minerals. Additionally, the crucial role of rare earth minerals in military & defense applications, including advanced defense systems and weapons, is contributing to increasing global demand. The rising adoption of clean energy technologies is bringing significant opportunities for the Australian rare earth mineral industry.

Type Insights

Why Did the Light Rare Earth Elements (LREE) Segment Dominate the Australia Rare Earth Minerals Market in 2024?

The light rare earth elements (LREE) segment dominated the market in 2024 due to the widespread use of these elements in various applications like permanent magnets and other technologies. Australia has emphasized its focus on the light rare earth elements (LREE) due to their higher concentration in deposits and critical use in renewable energy technologies. The light rare earth elements (LREE), including cerium, lanthanum, praseodymium, and neodymium, are more abundant and require less mining cost compared to the heavy rare earth elements (HREE), making them suitable for extraction and processing. The widespread use of these elements in applications such as electronics, automotive, and clean energy sources is contributing to the segment's growth.

The heavy rare earth elements (HREE) segment is expected to grow at the fastest rate in the coming years due to the high abundance of heavy rare earth elements (HREE) deposits in Australia. The demand for heavy rare earth elements (HREE) has increased in high-tech applications. The heavy rare earth elements (HREE) are found in higher deposits in Western Australia and the Northern Territory. The heavy rare earth elements (HREE), including yttrium, dysprosium, and terbium, are widely adopted in specific applications such as magnets, phosphors, and nuclear applications due to their unique properties. Additionally, government initiatives and funding for the development of the heavy rare earth elements (HREE) sector are accelerating domestic resource development and improving the supply chain, thereby leveraging segment growth.

Application Insights

What Made Magnets the Dominant Segment in the Australia Rare Earth Minerals Market in 2024?

The magnets segment dominated the market with a significant share in 2024, driven by increased demand for rare earth magnets across various industries. The use of rare earth magnets has increased in clean energy technologies, electric vehicle production, wind energy, and consumer electronics. Rare earth magnets contain exceptional magnetic strength and energy efficiency, making them ideal for various applications. The rare earth elements create powerful, compact, and efficient magnets due to their unique properties, driving demand for these technologies. The need for rare earth elements in high-performance manufacturing drives segment growth.

The batteries segment is expected to expand at the fastest CAGR during the projection period. The growth of the segment is attributed to the rising demand for novel, long-lasting batteries in consumer electronics and electric vehicles. Rare earth minerals, such as lanthanum, are widely used in battery components. Rare earth elements enhance battery performance, weight, and capacity. Australia has an abundance of lithium resources, an expanding automotive sector, and a strong focus on renewable energy sources, which contribute to the development of specialized rare earth minerals for advanced battery technologies.

End-use Industry Insights

Why Did the Electronics Segment Dominated the Australia Rare Earth Minerals Market in 2024?

The electronics segment dominated the market in 2024 due to the increased use of rare earth minerals in various electronic devices and components. Rare earth elements play a crucial role in the manufacturing of various electronic devices, including laptops, TVs, and smartphones. The significant role of rare earth elements in the creation of lightweight, compact, and efficient electronic components contributes to the segment's growth. Additionally, the rare earth elements are essential in the manufacturing of high-strength and high-performance magnets, which are used in hard devices, electric motors, and speakers. The rare earth minerals are crucial for both consumer and industrial electronics applications.

The automotive segment is expected to grow at the highest CAGR over the forecast period, driven by increased demand for rare earth minerals in electric vehicles and hybrid vehicle production. Rare earth elements, such as dysprosium, neodymium, and praseodymium, are essential in the manufacturing of permanent magnets, which are used in electric vehicle motors. Additionally, cerium, dysprosium, and lanthanum play a crucial role in the production of advanced batteries, high-strength alloys, and catalytic converters, used in electric vehicles. Neodymium is the major rare earth element that dominates the market due to its widespread utilization for permanent magnet production, which is essential for electric motors, as well as its use in both electric vehicles and hybrid vehicles.

Country Iisights

Western Australia Rare Earth Minerals Market Trends

Western Australia continues to maintain its stronghold in the market, with a strong presence of key processing facilities, including Lynas Rare Earths' processing facility in Kalgoorlie and Iluka's refinery. Western Australia is the hub for various rare earth deposits, like the Yangibana Rare Earths project, one of the largest developing rare earth projects in Australia. The strategic position of Western states for rare earths processing is contributing to the market growth. Additionally, strong government support and an expanding mining industry are helping the state reach its highest position.

The Government of Western Australia is investing heavily in the development of advanced extraction and processing facilities. The robust mining industry, with its expertise in extracting and processing various minerals, is fostering the state's value. Additionally, government funding for rare earth extraction is contributing to the establishment of a novel rare earth province and attracting international investments in Western Australia's advanced processing facilities.

Australia Rare Earth Minerals Market Companies

- Iluka Resources

- Lynas Rare Earths

- Hastings Technology Metals

- Northern Minerals

- Arafura Rare Earths

- Australian Strategic Minerals Ltd.

- Alkane Resources Ltd.

- Ucore Rare Metals Inc.

- Lindian Resources Ltd.

- Lanthanien Resources.

Recent Developments

- In April 2025, Australian Prime Minister Anthony Albanese announced investments of A$1.2 billion in a strategic reserve for critical minerals. The announcement came after China imposed export restrictions on seven rare earth elements, essential to the production of advanced technologies like EVs, fighter jets, and robots.

(Source: https://www.bbc.com) - In January 2025, the Federal Government announced an investment of $200 million in the Gina Rinehart-backed Arafura Rare Earths, with a total volume of support for the critical minerals venture exceeding $1 billion.

(Source: https://www.theguardian.com)

Segments Covered in the Report

By Type

- Light Rare Earth Elements (LREE)

- Heavy Rare Earth Elements

By Application

- Magnets

- Catalysts

- Metallurgy

- Polishing

- Lass

- Batteries

- Ceramics

By End-use Industry

- Automotive

- Electronics

- Energy

- Aerospace & Defense

- Healthcare

- Others

By Country

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Get a Sample

Get a Sample

Table Of Content

Table Of Content