Recycled Paper Bags Market Size and Forecast 2025 to 2034

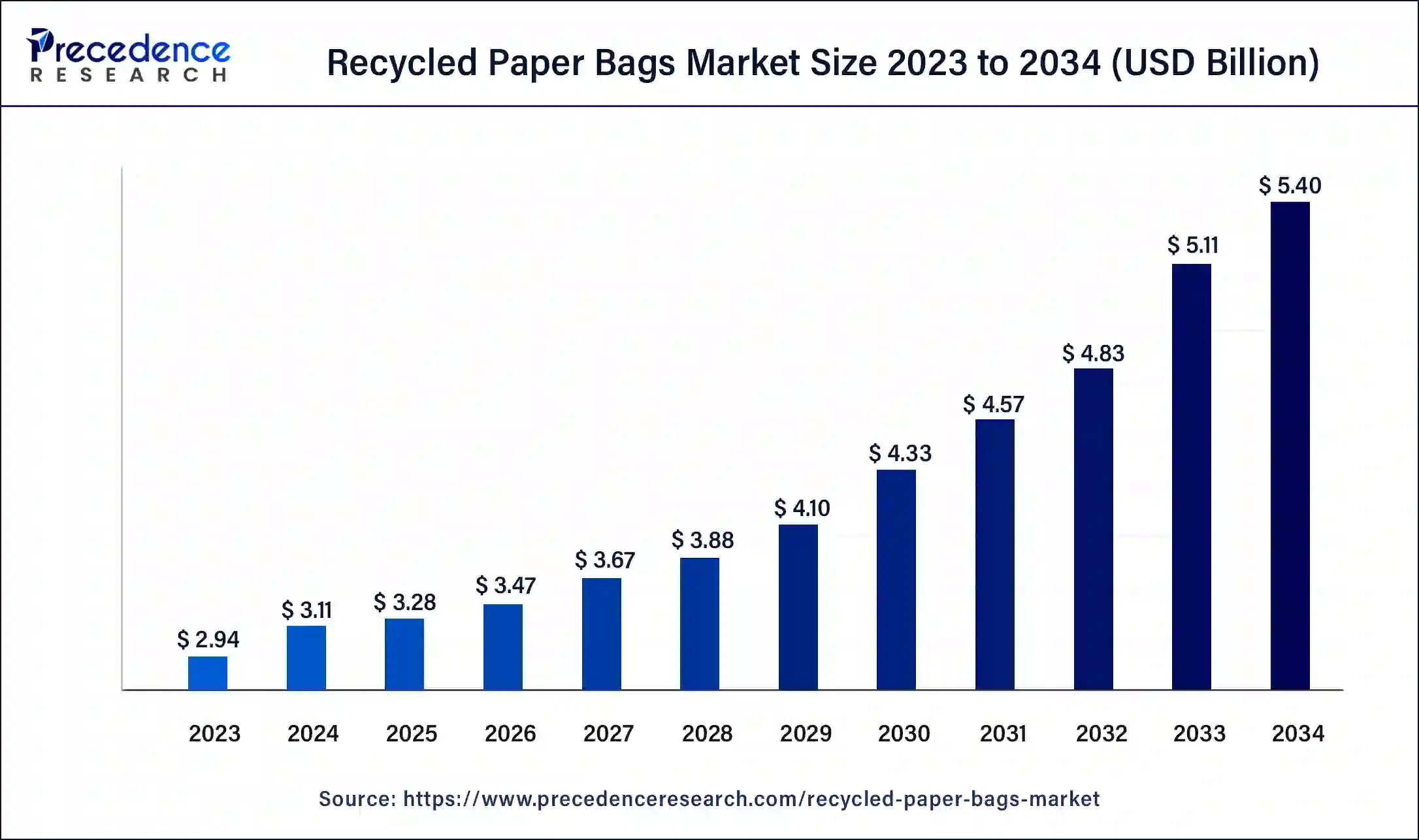

The global recycled paper bags market size was calculated at USD 3.11 billion in 2024 and is expected to reach around USD 5.40 billion by 2034, expanding at a CAGR of 5.67% from 2025 to 2034. The rising demand for cost-efficient andsustainable packaging material drives the growth of the recycled paper bags market.

Recycled Paper Bags Market Key Takeaways

- The global recycled paper bags market was valued at USD 3.11 billion in 2024.

- It is projected to reach USD 5.40 billion by 2034.

- The recycled paper bags market is expected to grow at a CAGR of 5.67% from 2025 to 2034.

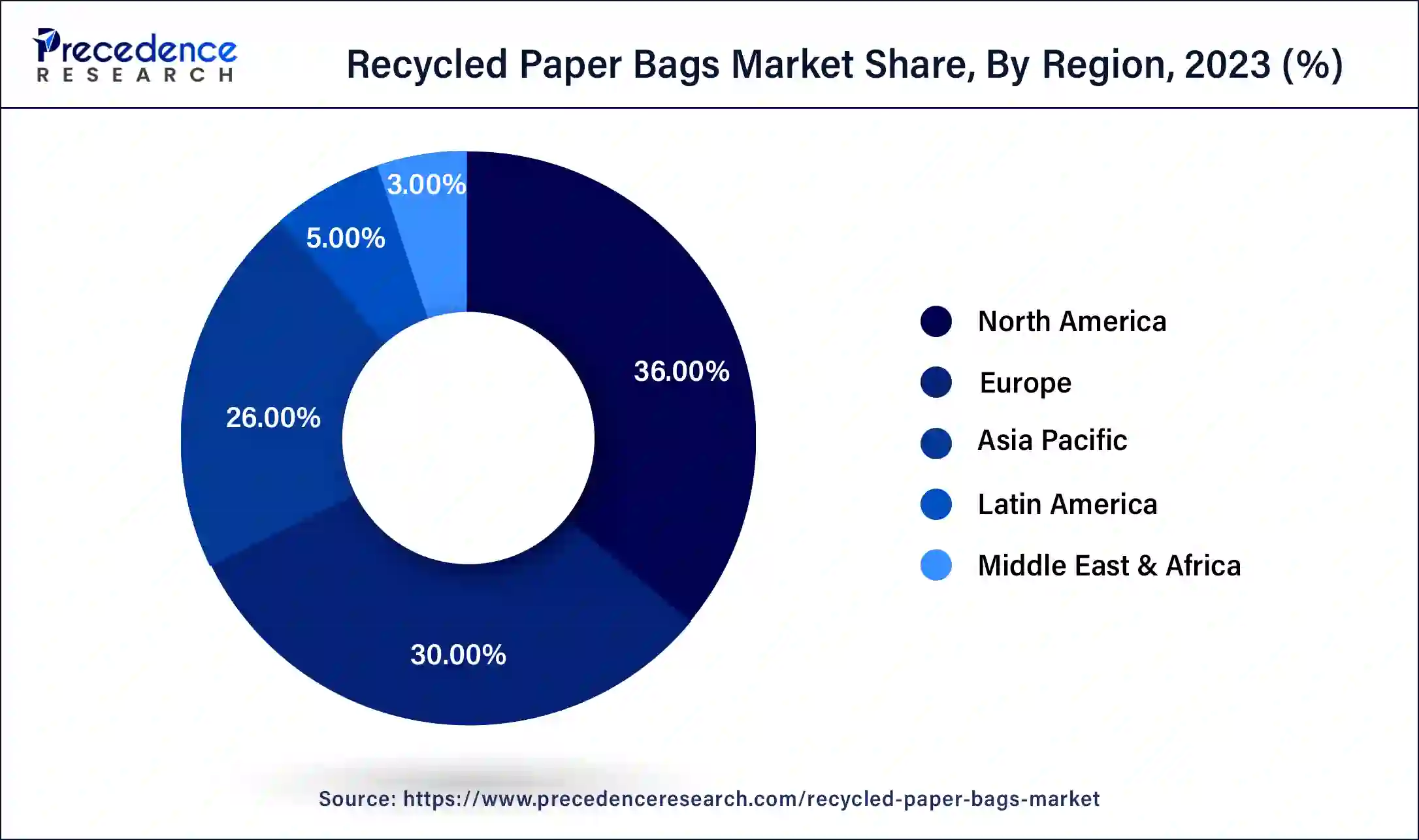

- North America led the global recycled paper bags market and accounted for 36% of revenue share in 2024.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By type, the sewn open-mouth segment dominated the market in 2024.

- By thickness, the 1-ply segment dominated the market in 2024 and accounted for 43% market share.

- By end-user, the commercial segment has held the largest share of around 64% in 2024.

- The commercial segment has held the largest share of around 64% in 2024.

U.S. Recycled Paper Bags Market Size and Growth 2025 to 2034

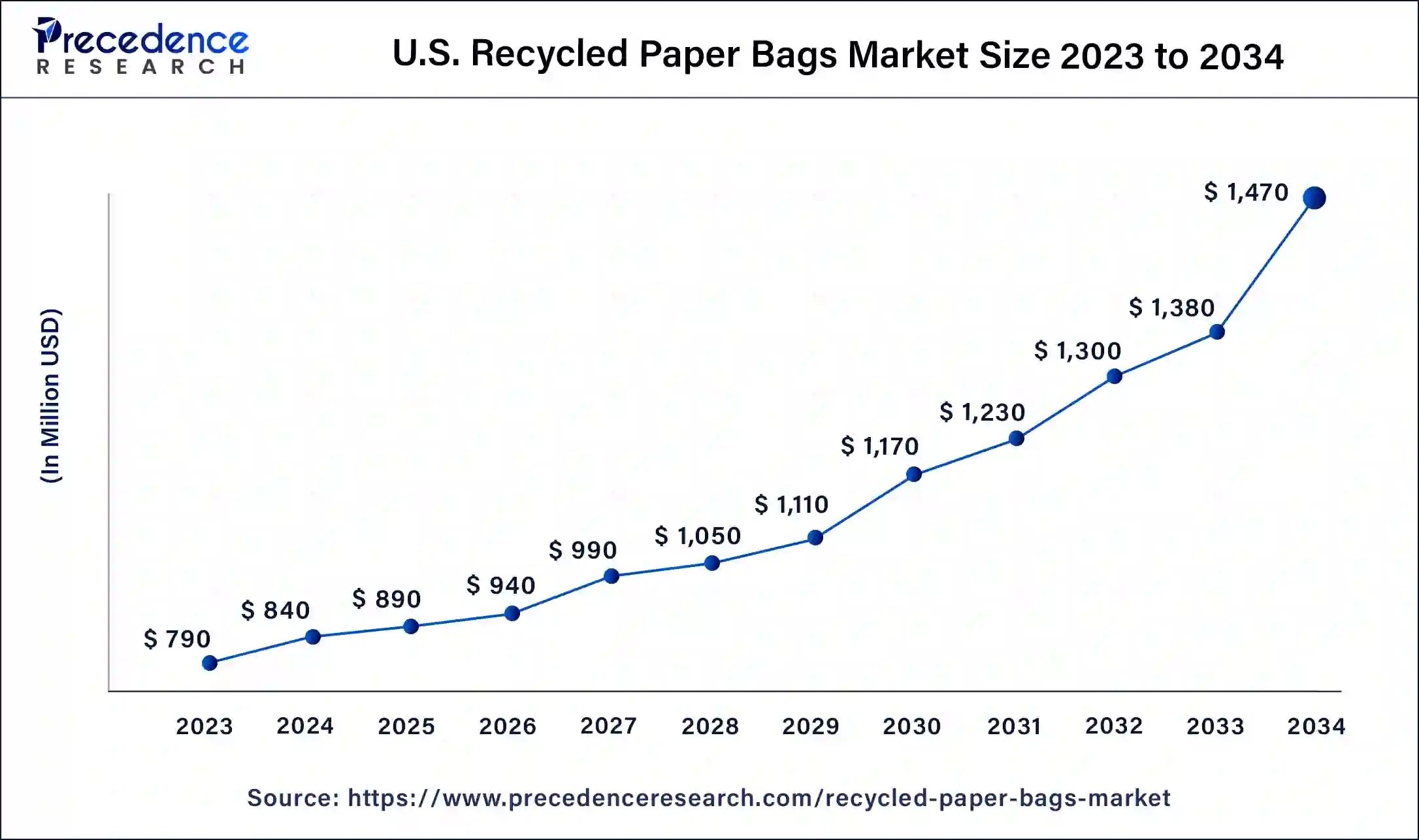

The U.S. recycled paper bags market size was exhibited at USD 840 million in 2024 and is projected to be worth around USD 1,470 million by 2034, poised to grow at a CAGR of 5.76% from 2025 to 2034.

North America led the global recycled paper bags market in 2023. The growth of the market in the region is attributed to the rising industrialization and the rising demand for packaging materials, which are driving the growth of the market. The increasing retail and commercial sectors are creating a major demand for affordable and sustainable packaging material, which accelerates the demand for paper packaging material and drives the growth of the market. Additionally, the rising government initiatives for limiting plastic use and the initiatives for sustainable materials use drive the demand for the market in the region.

Asia Pacific is expected to witness the fastest growth in the recycled paper bags market during the forecast period. The growth of the market in the region is increasing due to the rising population and the increasing consumer base that drives the increasing demand for packaging materials, as well as the rising environmental issues associated with the rising plastic pollution that drives the growth of the market. The increasing government participation in the plastic-free environment and the rising awareness about the usage of sustainable products and materials drive the growth of the market in the region.

Market Overview

Paper bags are considered the best alternative for plastic-based packaging materials. Unlike plastic bags, paper bags are 100% biodegradable and recyclable material, and they can be used several times for recycling. It does not harm the environment and does not cause any kind of pollution in the environment. The paper bags come in various designs and shapes that allow more space for storing goods. Paper bags are goods for the printing of brand names, high-quality images, and designs for the branding process.

Recycling reduces the waste of paper. There is increasing awareness regarding the plastic-based pollution that harms oceans and rivers and creates huge environmental pollution due to the lack of biodegradability in nature. Additionally, the rising government initiatives for minimizing plastic use in every aspect are also further propelling the demand for recycled paper bags in the market.

Recycled Paper Bags Market Growth Factors

- The increasing concern about pollution, global warming, environmental impacts, and climate change is driving the growth and adoption of recycled paper bags by the population, accelerating the growth of the recycled paper bags market.

- The rising demand for efficient packaging of recycled paper from several industries, such as food and beverages, packaging, pharma, and consumer goods industries, is boosting the growth of the recycled paper bags market.

- The increasing demand from the e-commerce industries for packaging goods and the rising e-commerce industries is contributing to the growth of the market.

- The increasing government initiatives and policies for environmental pollution and plastic bans in various regions are driving the demand for alternative packaging products that contribute to the market's growth.

- The increasing adoption of paper bag packaging from the leading brands, supermarkets, and hypermarkets is driving the demand for the recycled paper bags market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.40 Billion |

| Market Size in 2025 | USD 3.28 Billion |

| Market Size in 2024 | USD 3.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.67% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Thickness, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising demand from the food packaging industry

The increasing demand for paper bag packaging from the food packaging industry is due to the rising awareness about the growing plastic wastes that drive the demand for recycled paper bags. Paper and paperboard were the first materials used in the packaging of food products, milk and milk-based products, dry powders, beverages, bakery products, confectionery, etc. The increasing industrialization and the rising e-commerce industry are also propelling the demand for efficient, cost-effective, and sustainable packaging material, which has contributed to the growth of the paper bags and recycled paper bags market.

Restraint

Lack of awareness

Despite its immense potential, the recycled paper bags market growth is impeded due to a lack of awareness about the products and their related technologies. The majority of the population prefers the more robust alternatives to paper bags. Several new innovations in recent years have been able to overcome the drawbacks associated with recycled paper bags. However, a lack of awareness amongst the consumer base negatively impacts the market.

Opportunity

Regularity support

The increasing government support and initiative for a plastic-free environment and the rising concern towards the types of environmental pollution are diverting the focus towards sustainable materials as an alternative to plastic products and materials. The increasing awareness of the environment in the population drives the higher demand for paper-made bags and other product packaging that contributes to the growth of the recycled paper bags market.

The increasing environmental concern drives the recycling of materials like paper, glass, and plastics from waste products that are highly beneficial for the environment and limit global warming. Thus, the increasing focus on recyclable products and packaging materials will drive the growth opportunity for the recycled paper bags market in the upcoming period.

Type Insights

The sewn open-mouth segment dominated the recycled paper bags market in 2024. The growth of the segment is attributed to the rising adoption of sewn open-mouth recycle paper bags by industries such as materials and construction for the packaging of fertilizers, a range of bulk solids, seeds, and pet foods. The open-mouth bags are factory-closed on one side of the tube, and the other side is closely sealed or sewn. The open-mouth bags are made of multi-layered paper or poly-woven material that is closely sewn.

The open-mouth bags are cost-effective and also save equipment costs. They have characteristics like fibrous and non-free-flowing and prevent the use of valve-type bag fillers. These types of bags are leakproof and do not open to the infestation. There are some other terms associated with mouth bags are adhesion, adhesive-hot melt, aluminum foil lamination, back seam woven bags, basic weight, biodegradable, biaxially oriented polypropylene (BOPP), cap sac, bursting strength, coextrusion, cold seal, cure time, delaminating, drop test, density, extrusion, fill end, face width, flexible packaging, flush cut top, guage, gusset, sheat seal, lamination, etc.

Thickness Insights

The 1-ply segment dominated the recycled paper bags market in 2024 and is projected to witness the highest growth during the forecast period. The growth of the segment is attributed to the higher adoption of the 1-ply thickness paper bags as the shopping bags and the increasing demand from the consumer goods industry is driving the growth of the segment. The rising adoption of the 1-ply thickness bags for food and grocery retails, supermarkets, shopping complexes, food materials, etc., is driving the demand for the 1-ply thickness paper bags. It is less expensive and 20% lighter in weight than 2-ply thickness paper bags. 1-ply thickness bags require low materials and give higher-speed filling to several powered goods and other consumer goods. Thus, all these factors are collectively contributing to the growth of the 1-ply thickness paper bags segment.

End-user Insights

The commercial segment held the largest share of the recycled paper bags market in 2024. The growth of the segment is attributed to the increasing demand for paper bags in commercial applications, packaging, and shopping goods, which are driving the expansion of the market. The rise in the commercial sector, such as supermarkets, hypermarkets, and e-commerce industries, and the rising demand for the packaging industries are all contributing to the expansion of the paper bags market. Additionally, the rising awareness about environmental pollution and increasing demand for cost-efficient and sustainable packaging materials in the packaging industries and for various consumer goods are driving the demand for the market.

Recycled Paper Bags Market Companies

- Cascades Inc.

- Saica Group

- Pratt Industries LLC

- WestRock Company

- Sonoco Products Company

- DS Smith PLC

- Steinbeis Papier GmbH

- Smurfit Kappa

- Huhtamaki Oyj

- Heinzel Holding GmbH

- Mondi Plc

- Nippon Paper Industries Co Ltd

- Daio Paper Corporation

- ST PAPER RESOURCES PTE LTD

- Nine Dragons Paper (Holdings) Limited

Segments Covered in the Report

By Type

- Sewn Open-mouth Bags

- Pinched Bottom Open-mouth Bags

- Pasted Valve

- Pasted Open Mouth

- Flat Bottom

By Thickness

- 1-ply

- 2-ply

- 3-ply

- >3-ply

By End-user

- Commercial

- Agriculture & Agriproduce Packaging

- Building & Construction Product Packaging

- Food & Beverage Packaging and Delivery

- Retail Product Packaging

- Chemical Packaging

- Others

- Individual/Household

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting