What is the Recycled Packaging for Apparel Market Size?

The global recycled packaging for apparel market is witnessing significant momentum, supported by green fashion trends and government regulations promoting eco-packaging. This market is growing as consumer demand for sustainable, eco-friendly fashion solutions increases.

Recycled Packaging for Apparel Market Key Takeaways

- Asia Pacific dominated the market, holding the largest market share of 30.90% in 2024.

- Europe is expected to grow at a notable CAGR between 2025 and 2034.

- By material type, the recycled paper & paperboard segment led the market, with 43.60% share in 2024.

- By material type, the recycled plastics segment is expected to grow at a CAGR of 10.7% from 2025 to 2034.

- By packaging type/format, the secondary packaging segment held the largest market share at 49.80% in 2024.

- By packaging type/format, the primary packaging segment is growing at a CAGR of 9.6% from 2025 to 2034.

- By end-use application, the fast fashion brands segment contributed the biggest market share of 32.4% in 2024.

- By end-use application, the luxury & premium apparel segment is poised to grow at the fastest CAGR of 10.90% from 2025 to 2034.

- By printing technology, the flexographic printing segment accounted for the biggest market share of 41.20% in 2024.

- By printing technology, the digital printing segment is expanding at a CAGR of 11.4% from 2025 to 2034.

- By distribution channel, the online retail/e-commerce segment held the largest market share of 45.70% in 2024.

- By distribution channel, the direct-to-brand segment is expected to grow at a CAGR of 12.1% from 2025 to 2034.

Filling the Gap: Boosting Supply of Recycled Materials for Packaging

Advanced recycling technologies that improve the quality and efficiency of converting waste materials into packaging. Paper textiles and post-consumer plastics can all be reused with little degradation thanks to these technologies. They reduce reliance on virgin materials, which helps clothing brands achieve circular-economy objectives.

Innovations in compostable and biodegradable materials lessen their negative effects on the environment. For clothing boxes and wrap materials like plant-based polymers and packaging made from mushrooms are becoming more popular. These innovations naturally reduce the carbon footprint and greatly reduce landfill waste, leading to growth in the recycled packaging for apparel market.

Wrapping Sustainability Goals Into Packaging

The recycled packaging for apparel market is witnessing strong growth as fashion brands increasingly adopt eco-friendly methods to reduce carbon emissions and waste. Advances in material recovery technologies, stricter environmental regulations, and growing consumer awareness are the main forces behind this change. The environmentally friendly packaging supports the growing global appeal of the circular economy and enhances a brand's reputation.

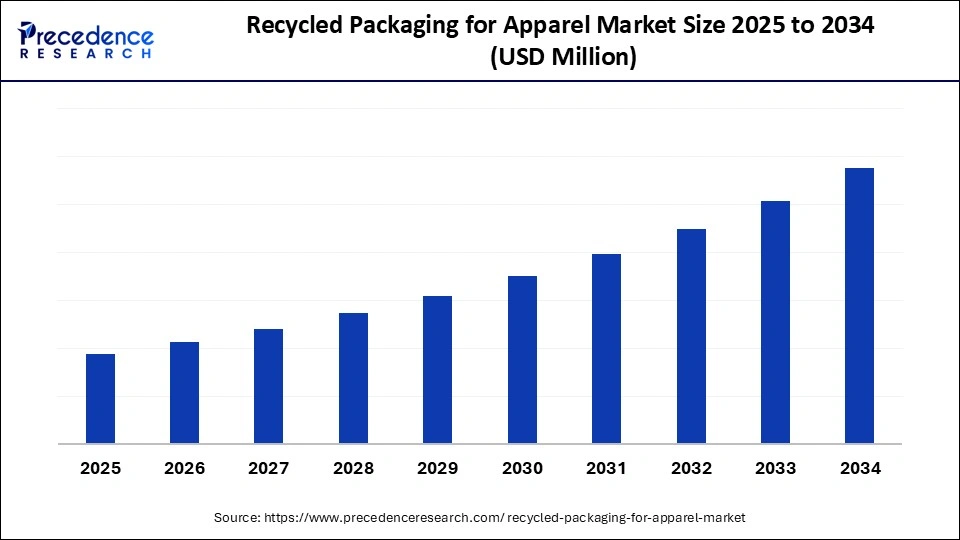

Recycled Packaging for Apparel Market Outlook

Stricter environmental regulations, creative materials, and brand partnerships all contribute to growth since packaging is now seen as a component of sustainability. Apparel companies are forming alliances with startups focused on recycling and eco-materials.

Companies are embracing circular designs that emphasize composability, recyclability, and reuse. Sustainability packaging standards are being shaped by certified eco-labels, the use of waste-based materials, and transparency in sourcing.

Packaging made from plant fibers, mycelium, and textile waste is being pioneered by startups. Their innovative, eco-friendly designs are helping clothing companies improve sustainability and minimize their environmental impact.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

Material Type, Packaging Type/FormatPrinting Technology, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recycled Packaging for Apparel Market Segmental Insights

Material Type Insights

The recycled paper & paperboard segment dominates the recycled packaging for apparel market, accounting for 43.60% of market share in 2024. Propelled by affordability, ease of recycling, and a robust consumer inclination for eco-friendly and sustainable packaging options. The most widely used materials in the clothing industry, recycled paper and paperboard, are preferred by businesses for their adaptability, structural strength, and compatibility with various packaging formats.

The recycled plastics segment is expected to be the fastest-growing in the market during the forecast period, as recycling technology advances and consumer awareness of plastic pollution grows, brands are increasingly moving toward sustainable plastic substitutes. Clothing companies are quickly adopting recycled plastics because of their durability, lightweight nature, and customizable packaging options.

Packaging Type/Format Insights

The secondary packaging segment dominates the recycled packaging for apparel market, with a 49.80% share in 2024, as bulk products require it for storage and transportation, and it serves as protective outer packaging. Retail and logistics regulations that put protecting clothing products and upholding sustainability standards first support its dominance.

The primary packaging segment is expected to be the fastest-growing during the forecast period, as brands focus more on consumer experience and branding, and eco-friendly primary packaging is increasingly used for direct product presentation. This shift is driven by growing demand for customized, visually appealing, and sustainable packaging that enhances brand perception.

End Use Application Insights

The fast fashion segment dominates the recycled packaging for apparel market with a 32.40% share in 2024 because it is sustainable, affordable, and well-suited to their operational scale, given their high production volumes. The use of recycled packaging was further encouraged by their target consumers' environmental consciousness, making it the largest end-use segment.

Luxury brands are increasingly adopting recycled and sustainable packaging to enhance brand image, appeal to eco-conscious consumers, and meet regulatory sustainability standards, which fuels the growth of premium sustainable packaging solutions.

Printing Technology Insights

The flexographic printing segment dominates the market with a 41.20% share in 2024 because it is suitable for large-scale packaging operations, is cost-effective, and can be produced at high speeds. It is perfect for mass production in the apparel packaging industry because it permits printing on a variety of recycled materials without sacrificing quality.

The digital printing segment is expected to be the fastest-growing printing technology during the forecast period. Its advantages include customization, short-run printing, and detailed graphic reproduction, which appeal to brands aiming for personalized, premium packaging while minimizing waste.

Distribution Channel Insights

The online retail/e-commerce segment dominates the market with a 45.70% share in 2024, driven by the need for long-lasting, environmentally friendly packaging solutions that can withstand shipping, as e-commerce apparel sales rise.

The direct-to-brand segment is expected to be the fastest-growing in the market during the forecast period, as brands increasingly focus on direct consumer engagement and brand-owned platforms, and sustainable packaging tailored for direct shipments gains traction, supporting growth in this segment.

Recycled Packaging for Apparel Market Regional Insights

Asia Pacific dominated the recycled packaging for apparel market in 2024. The region leads the way in recycled packaging adoption, driven by powerful government initiatives for sustainable practices, high manufacturing volumes, and rising consumer awareness of environmental issues. Furthermore, nations such as China, India, and Japan are investing significantly in eco-friendly packaging technologies and recycling infrastructure. The need for recycled packaging solutions is further heightened by the presence of significant centers of fast-fashion manufacturing.

India Recycled Packaging for Apparel Market Trends

India's recycled packaging market for apparel is growing rapidly due to increased recycling infrastructure, supportive government initiatives, and growing environmental awareness. The use of recycled paper, plastics, and textiles by brands is growing in response to consumer demand for eco-friendly goods.

Europe is growing rapidly because of increasing sustainability regulations, rising eco-conscious consumer demand, and the proactive adoption of recycled packaging technologies by apparel brands. Moreover, European countries are emphasizing circular economy initiatives and stricter packaging waste laws, encouraging brands to switch to recycled materials. Collaborations between governments and private players to develop innovative, sustainable packaging solutions are further accelerating market expansion.

Germany Recycled Packaging for Apparel Market Trends

Germany leads Europe in recycled packaging for apparel, driven by advanced recycling systems and robust circular-economy regulations. Adoption is accelerating due to consumer demand for environmentally friendly products and government support for sustainable packaging options. The nation is still working to cut waste and encourage the clothing industry to use recycled materials.

Latin America emerged as a notable growth region in the recycled packaging for apparel market in 2024, driven by growing awareness of environmental issues, the shift toward circular-economy models, and the rapid expansion of e-commerce in the fashion sector. Consumers across the region, particularly in Brazil, Mexico, and Chile, are increasingly favoring brands that demonstrate sustainability commitments, leading apparel companies to adopt packaging made from recycled paper, cardboard, and post-consumer plastics. Over the past three years, governments and local authorities have introduced stronger waste management and recycling initiatives, improving the collection and processing of recyclable materials.

At the same time, global apparel brands expanding their presence in Latin America have been implementing uniform sustainability policies that include eco-friendly, recycled packaging for shipping and retail presentation. The combination of consumer-driven sustainability expectations, improved recycling infrastructure, and corporate responsibility initiatives has positioned Latin America as a fast-emerging region for sustainable packaging solutions in the apparel industry.

Brazil Market Analysis

In Brazil, the recycled packaging for apparel market has gained significant momentum in recent years as both domestic and international fashion brands adopt more sustainable materials and packaging practices. The country's strong apparel manufacturing base, combined with rising consumer awareness of environmental issues, has accelerated the shift toward packaging made from recycled and biodegradable materials. Several Brazilian retailers and e-commerce companies have started using recycled cardboard boxes, paper mailers, and packaging made from post-industrial plastic waste to reduce their environmental footprint. The Brazilian government's National Solid Waste Policy, which encourages producers to adopt extended responsibility for packaging waste, has also supported this transition.

Growing collaborations between packaging producers and textile companies are driving innovation in recycled material use, with many firms experimenting with packaging derived from textile offcuts and mixed recyclables. With its expanding retail sector, increasing sustainability investments, and evolving consumer expectations, Brazil is emerging as one of the most dynamic markets in Latin America for recycled packaging in the apparel industry.

Quick Picks by Regional Insights: Recycled Packaging for Apparel Market

| Company | Country | Product/Initiative | Uses/Purpose |

| Patagonia | U.S. | 100% Recycled Polybags & Cardboard | Uses fully recycled and recyclable materials for shipping; its Worn Wear Program promotes repair and reuse of clothing. |

| Zara | Spain | Recycled Paper Bags & Reusable Cardboard Boxes | Implements sustainable packaging and aims for zero waste in logistics centers by 2025. |

| Calvin Klein | U.S. | How2Recycle Packaging Program | Features clear recycling instructions and reduces plastic content across all packaging materials. |

| ASOS | U.K. | Recycled Mailer Bags | Uses mailers made from returned materials and reduced thickness to minimize overall plastic waste. |

| Puma | Germany | Clever Little Bag | Innovative shoebox system that cuts cardboard use and carbon footprint compared to conventional packaging. |

| Allbirds | U.S. | Recycled Shoe Box | Dual-purpose box made from 90% post-consumer recycled fiber, functioning as both product and shipping box. |

| Doodlage | India | Upcycled Fabric Packaging |

Uses recycled and eco-friendly materials for online orders; integrates sustainability in both apparel and packaging. |

Recycled Packaging for Apparel Market Companies

- Headquarters: Ventura, California, United States

- Year Founded: 1973

- Ownership Type: Privately Held (Owned by the Patagonia Purpose Trust and Holdfast Collective)

History and Background

Patagonia was founded in 1973 by Yvon Chouinard as an outdoor apparel and gear company focused on sustainability, innovation, and environmental activism. Initially selling climbing hardware, the company transitioned to high-quality outdoor clothing designed to minimize environmental impact.

Over the decades, Patagonia has become a global leader in sustainable fashion and corporate responsibility. Its core mission—“We’re in business to save our home planet” guides its initiatives in environmental conservation, fair labor, and circular product design. The company has consistently pioneered eco-conscious practices, including recycled materials, renewable energy sourcing, and closed-loop manufacturing systems.

Key Milestones / Timeline

- 1973: Founded by Yvon Chouinard in Ventura, California

- 1993: Introduced the first fleece jacket made from recycled plastic bottles

- 2011: Launched the Common Threads Initiative to promote product reuse and repair

- 2013: Introduced the Worn Wear Program to extend garment life through repair and resale

- 2022: Ownership transferred to the Patagonia Purpose Trust and Holdfast Collective to ensure profits serve environmental causes

- 2024: Expanded global circular economy partnerships for recycling and reuse programs

Business Overview

Patagonia designs, manufactures, and sells outdoor apparel, footwear, and gear for activities including climbing, surfing, skiing, and trail running. The company’s sustainability strategy emphasizes environmental responsibility through material innovation, fair trade practices, and waste reduction. Patagonia also invests heavily in regenerative agriculture and biodiversity conservation initiatives.

Business Segments / Divisions

- Outdoor Apparel

- Footwear and Accessories

- Worn Wear (Repair and Resale Program)

- Patagonia Provisions (Sustainable Food Division)

Geographic Presence

Patagonia operates in over 10 countries with flagship stores across North America, Europe, and Asia-Pacific. The company’s products are distributed globally through retail, online, and wholesale channels.

Key Offerings

- Outdoor and activewear made from recycled or organic materials

- Worn Wear repair and resale service

- Sustainable packaging using 100% recycled and recyclable materials

- Patagonia Provisions food products sourced from regenerative agriculture

Financial Overview

Patagonia generates estimated annual revenues of approximately $1.5–2 billion USD, maintaining consistent profitability through its direct-to-consumer model and brand loyalty. All excess profits are directed toward environmental initiatives through its nonprofit ownership structure.

Key Developments and Strategic Initiatives

- March 2023: Expanded Worn Wear Program to new international markets

- October 2023: Transitioned to 100% renewable electricity across operations

- January 2024: Introduced fully circular packaging using recycled polybags and cardboard

- June 2025: Partnered with environmental organizations to develop large-scale textile recycling programs

Partnerships & Collaborations

- Collaborations with environmental NGOs for conservation and carbon neutrality projects

- Partnerships with sustainable textile producers for closed-loop manufacturing

- Alliances with retailers to promote circular economy and garment take-back initiatives

Product Launches / Innovations

- Recycled Nylon and NetPlus® Fishing Net Fabric line (2023)

- Bio-based wetsuit collection using natural rubber (2024)

- Worn Wear repair toolkit for consumers (2025)

Technological Capabilities / R&D Focus

- Core technologies: Recycled material innovation, regenerative textile development, and circular design systems

- Research Infrastructure: Material innovation centers in California and Japan

- Innovation focus: Waste-free production, bio-based fibers, and scalable recycling technologies

Competitive Positioning

- Strengths: Industry leader in sustainability, strong brand loyalty, and transparent ethical practices

- Differentiators: Full circularity model, nonprofit ownership, and mission-driven brand identity

SWOT Analysis

- Strengths: Global brand recognition, pioneering sustainability leadership, loyal customer base

- Weaknesses: Premium pricing limits accessibility

- Opportunities: Growth in sustainable lifestyle markets and material innovation

- Threats: Greenwashing competition and supply chain climate risks

Recent News and Updates

- April 2024: Patagonia launched new recycled packaging standard across all product lines

- August 2024: Announced partnership with textile recycling startups for global circular economy expansion

- January 2025: Worn Wear Program surpassed 1 million repaired and resold garments globally

- Headquarters: New York City, New York, United States

- Year Founded: 1968

- Ownership Type: Publicly Traded (NYSE: PVH)

History and Background

Calvin Klein was founded in 1968 by designer Calvin Klein and businessman Barry Schwartz as a New York-based fashion label. The brand quickly gained global prominence for its minimalist aesthetic and modern designs, becoming one of the most influential names in contemporary fashion.

Acquired by PVH Corp. (Phillips-Van Heusen) in 2003, Calvin Klein has since evolved into a global lifestyle brand offering apparel, accessories, fragrances, and home products. In recent years, the company has prioritized sustainability through responsible material sourcing, packaging innovation, and transparent manufacturing practices.

Key Milestones / Timeline

- 1968: Founded in New York City by Calvin Klein and Barry Schwartz

- 1982: Launch of Calvin Klein Underwear, redefining fashion marketing

- 2003: Acquired by PVH Corp.

- 2019: Introduced sustainability targets for packaging and materials

- 2023: Implemented How2Recycle labeling on packaging for consumer education

- 2025: Expanded circular design and packaging initiative under PVH+ plan

Business Overview

Calvin Klein operates as a global premium fashion and lifestyle brand, focusing on apparel, underwear, accessories, and home goods. The brand’s sustainability strategy is built around reducing waste, lowering carbon emissions, and promoting responsible packaging practices across its global operations.

Business Segments / Divisions

- Calvin Klein Jeans

- Calvin Klein Underwear

- Calvin Klein Collection

- Calvin Klein Home

Geographic Presence

Calvin Klein products are sold in over 110 countries through standalone stores, department stores, and digital platforms.

Key Offerings

- Sustainable apparel made with organic cotton and recycled materials

- How2Recycle-labeled packaging for easy consumer recycling

- Recycled polybags and low-impact packaging solutions

- Circular design collection promoting reuse and recyclability

Financial Overview

Calvin Klein contributes approximately $3.5–4 billion USD annually to PVH Corp.’s overall revenue. The brand maintains strong profitability through a combination of licensing, wholesale, and direct-to-consumer channels.

Key Developments and Strategic Initiatives

- January 2023: Implemented global packaging standards using recycled materials

- June 2023: Expanded How2Recycle labeling to all e-commerce shipments

- April 2024: Launched circular design collection made with fully recyclable fibers

- September 2025: Announced transition to 100% sustainable packaging across all product lines

Partnerships & Collaborations

- Partnerships with material innovation firms for circular design initiatives

- Collaborations with environmental organizations for supply chain sustainability

- Engagement with PVH’s global sustainability network under the Forward Fashion initiative

Product Launches / Innovations

- Circular denim and apparel collection (2024)

- Biodegradable packaging for Calvin Klein Underwear (2024)

- Recycled fiber product line under PVH+ sustainability platform (2025)

Technological Capabilities / R&D Focus

- Core technologies: Circular textile development, recycled material integration, and digital supply chain tracking

- Research Infrastructure: PVH innovation and sustainability labs in Amsterdam and New York

- Innovation focus: Low-impact materials, digital traceability, and waste reduction technologies

Competitive Positioning

- Strengths: Global brand influence, diversified product portfolio, and commitment to sustainable fashion

- Differentiators: Integration of circular packaging and transparency labeling (How2Recycle)

SWOT Analysis

- Strengths: Strong brand recognition, premium positioning, global reach

- Weaknesses: Dependence on external suppliers for material sourcing

- Opportunities: Growth in circular fashion and sustainable packaging innovations

- Threats: Market volatility, changing consumer expectations, and fast-fashion competition

Recent News and Updates

- February 2024: Calvin Klein launched packaging made entirely from recycled fibers

- July 2024: Expanded partnership with textile recycling startup for closed-loop production

- January 2025: Announced goal to eliminate virgin plastics from all packaging by 2026

Other Companies in the Recycled Packaging for Apparel Market

- Allbirds: Allbirds is a pioneer in sustainable footwear and apparel, known for its use of natural materials such as merino wool, eucalyptus fiber, and sugarcane-basedEVA foam. The brand focuses on low-carbon manufacturing, transparent supply chains, and circular product initiatives such as ReRun (resale) and Flight Plan (carbon-reduction strategy). Allbirds positions itself as a leader in eco-innovation and climate-conscious fashion.

- ASOS: ASOS, a major online fashion retailer, integrates sustainability through its “Fashion with Integrity” program, focusing on ethical sourcing, supply chain transparency, and circular fashion initiatives. The company has launched ASOS Responsible Edit, featuring sustainable materials and eco-certified brands. ASOS is increasingly investing in digital innovation to reduce waste and enable data-driven sustainability in the fast-fashion industry.

- Doodlage: Doodlage is an Indian sustainable fashion label that upcycles textile waste into high-quality, contemporary apparel. The brand combines zero-waste design, ethical production, and eco-friendly fabrics, including organic cotton and post-industrial scraps. Doodlage's focus on upcycling and limited-edition collections makes it a key regional player in circular fashion and responsible production.

- Patagonia: Patagonia is globally recognized for its environmental activism and sustainable outdoor apparel. The company leads with initiatives such as Worn Wear (product repair and reuse), Fair Trade Certified manufacturing, and recycled polyester and organic cotton. Patagonia reinvests profits into climate conservation and advocates for systemic sustainability in the apparel industry.

- Puma: Puma integrates sustainability into its global operations through its Forever Better strategy, focusing on circular design, bio-based materials, and carbon reduction. The brand has introduced RE:Collection and Re:Jersey lines made from recycled fibers, and works towards achieving full supply chain transparency and biodegradable material innovation.

- Zara (Inditex): Zara, under parent company Inditex, is driving large-scale sustainable transformation through its Join Life initiative, which emphasizes eco-efficient fabrics, renewable energy, and sustainable logistics. Zara aims to make 100% of its collections sustainable by 2030, incorporating recycled and organic fibers. Its closed-loop recycling programs and supply chain traceability tools are setting new benchmarks for large-scale sustainable fashion.

Recent Developments

- In October 2024, Sway announced the launch of compostable, seaweed-based packaging in collaboration with fashion brands Alex Crane, Faherty, Florence, and prAna, facilitated through their production partner, EcoEnclose.

- In October 2024, CARBIOS unveiled the world's first 100% "fiber-to-fiber" biorecycled clothing, produced using their pioneering enzymatic polyester recycling technology, in collaboration with brands Patagonia, Puma, PVH Corp, and Salomon.(Source: https://www.carbios.com)

Recycled Packaging for Apparel MarketSegments Covered in the Report

By Material Type

- Recycled Paper & Paperboard

- Recycled Corrugated Boxes

- Recycled Folding Cartons

- Recycled Paper Bags

- Uncoated Recycled Paperboard (URB)

- Recycled Plastics

- Recycled PET (rPET)

- Recycled HDPE (rHDPE)

- Recycled LDPE (rLDPE)

- Recycled PP (rPP)

- Recycled Textiles/Fibers

- Molded Pulp Packaging

- Fabric Pouches/Bags

- Other Recycled Materials

- Recycled Glass

- Recycled Metal

- Bio-based and Compostable Materials

By Packaging Type/Format

- Primary Packaging

- Poly Mailers/Bags (recycled plastic)

- Folding Cartons/Boxes (recycled paperboard)

- Garment Bags (recycled plastic)

- Wraps & Liners (recycled paper/plastic)

- Secondary Packaging:

- Shipping Boxes (recycled corrugated)

- Retail Display Boxes (recycled paperboard)

- Tertiary Packaging:

- Pallet Wraps (recycled stretch film)

- Edge Protectors (recycled paperboard)

By End-Use Application

- Fast Fashion Brands

- Luxury & Premium Apparel

- Sportswear & Activewear

- Casual Wear

- Footwear

- Accessories

By Printing Technology

- Flexographic Printing

- Digital Printing

- Lithographic Printing

By Distribution Channel

- Online Retail/E-commerce

- Brick-and-Mortar Retail

- Direct-to-Brand (DTC)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting