What is theRegenerative Aesthetics Market Size?

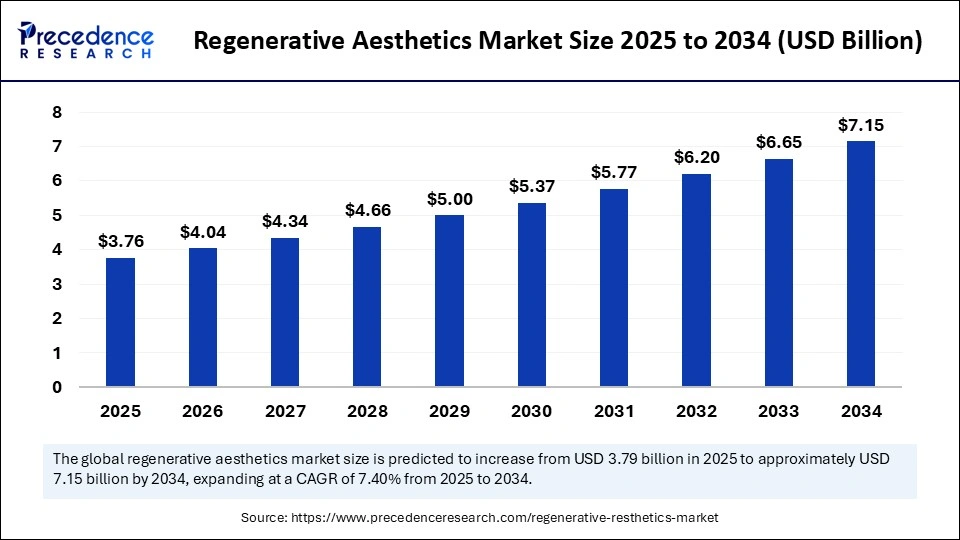

The global regenerative aesthetics market size was calculated at USD 3.76 billion in 2025 and is predicted to increase from USD 4.04 billion in 2026 to approximately USD 7.15 billion by 2034, expanding at a CAGR of 7.40% from 2025 to 2034. The regenerative aesthetics market is a rapidly growing sector focused on advanced cosmetic and medical treatments aimed at tissue repair and rejuvenation. It is shaping the future of aesthetic procedures by emphasizing innovative, minimally invasive solutions that promote natural beauty.

Market Highlights

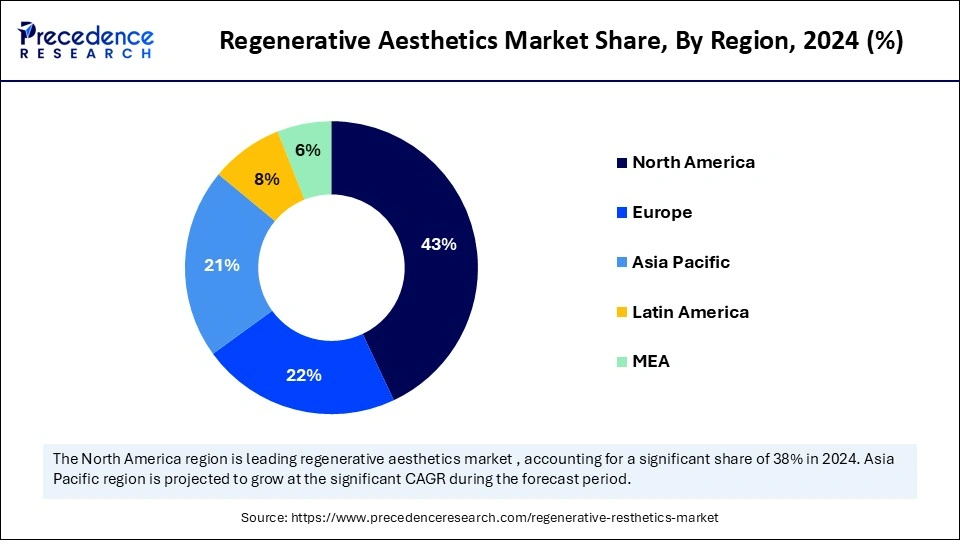

- By region, North America dominated the market, holding the largest market share of 43% in 2024.

- By region, Europe is expected to expand at the fastest CAGR in the regenerative aesthetics market between 2025 and 2034.

- By product & service type, the biologics & cell products segment held the largest market share of 40% in 2024.

- By product & service type, biomaterials & fillers is expected to grow at a remarkable CAGR between 2025 and 2034.

- By technology, the autologous biologics segment held the largest market share of 50% in 2024.

- By technology, the allogeneic cell-based products segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By indication, the facial rejuvenation & volume restoration segment held the largest market share of 40% in 2024.

- By indication, hair restoration is projected to grow at a remarkable CAGR between 2025 and 2034.

- By procedure type, the injectables segment held the largest market share of 55% in 2024.

- By procedure type, surgical grafting is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user type, the dermatology clinics & aesthetic physicians segment held the largest market share of 48% in 2024.

- By end-user type, plastic surgery clinics & ambulatory surgical centers at a remarkable CAGR between 2025 and 2034.

- By distribution channel type, the direct sales to clinics segment held the largest market share of 50% in 2024.

- By distribution channel type, medical distributors & dealer centers at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 3.76 Billion

- Market Size in 2026: USD 4.04 Billion

- Forecasted Market Size by 2034: USD 7.15 Billion

- CAGR (2025-2034): 7.40%

- Largest Market in 2025: North America

- Fastest Growing Market: Europe

What is the Regenerative Aesthetics Market?

The regenerative aesthetics market comprises therapies, products, devices and clinical services that restore, rebuild or biologically stimulate skin, soft tissue and adnexal structures for aesthetic and reconstructive purposes by leveraging regenerative-biology approaches including autologous treatments e.g., platelet-rich plasma, microfat adipose-derived stromal fractions, cell- and exosome-derived biologics, growth-factor conditioned-media formulations, engineered scaffolds and advanced delivery systems often used in combination with energy-based devices lasers, RF, ultrasound to enhance outcomes; the market covers commercialized biologics and biomaterials, medical devices and consumables, procedural revenue at clinics and hospitals, and associated training, licensing and support services across professional aesthetic and surgical care settings.

Market growth in the regenerative aesthetics market is being driven by the convergence of patient demand for durable, natural-looking rejuvenation and the advancement of tissue regenerative technologies that surpass cosmetic camouflage. Clinicians and consumers alike are gravitating toward modalities, cellular therapies, growth-factor-enriched scaffolds, and bioactive injectables that repair or restore tissue architecture rather than merely masking signs of ageing. The market benefits from convergence across dermatology, plastic surgery, and regenerative medicine, with multidisciplinary teams translating translational science into clinically practical protocols. Rising disposable incomes, an ageing but active population, and the destigmatization of aesthetic maintenance further enlarge the addressable base. Regulatory evolution toward pathway clarity for homologous-use biologics and expedited avenues for well-characterized autologous interventions is smoothing commercialization corridors. Consequently, regenerative aesthetics is evolving from a boutique experiment to mainstream therapeutic aesthetic care.

Key Technological Shift in the Regenerative Aesthetics Market

The seminal shift is the move from single-modality aesthetics toward integrated regenerative platforms that combine autologous cell therapies, engineered scaffolds, and smart delivery systems for orchestrated tissue repair. Where once fillers or lasers addressed isolated symptoms, contemporary approaches integrate cellular signaling, such as stromal vascular fraction or mesenchymal cells, with biocompatible matrices and controlled-release growth factors to regenerate volume, texture, and vascularity. Point-of-care processing technologies now make autologous workflows clinically feasible within a single patient visit, reducing logistical friction. Simultaneously, advances in biomaterial science, tunable degradation rates, bioactivity, and immuno-neutrality permit customization by indication and patient phenotype. Digital outcome-tracking and imaging-based quantification further professionalize the field, enabling objective endpoints and comparative effectiveness studies. This integrated paradigm elevates aesthetics from ephemeral correction to sustained tissue restoration.

Regenerative Aesthetics Market Outlook

- Industry Growth Overview: Industry expansion is underwritten by steady investment in scaffold materials, autologous cell processing platforms, and regenerative injectables designed for skin, subcutaneous tissue, and soft-tissue volumization. Translational research that clarifies mechanisms of action, angiogenesis, extracellular-matrix remodelling, and immunomodulation has made protocols more predictable and durable. Companies are converging on turnkey platforms that combine point-of-care processing, validated biomaterials, and digital outcome-tracking to satisfy clinicians' demand for reproducible results. The maturation of training curricula and certification pathways for practitioners is reducing practice variability and improving patient safety. Additionally, global clinic networks and franchised aesthetic chains are beginning to incorporate regenerative modules as premium service lines. Collectively, these forces are converting proof-of-concept enthusiasm into enterprise-scale opportunities.

- Sustainability Trends: Sustainability in regenerative aesthetics emphasizes biodegradable scaffolds, reduced single-use plastics in procedural kits, and energy-efficient point-of-care devices. There is a growing preference for ethically sourced biomaterials and for manufacturing processes that minimize solvent use and waste. Clinics are also adopting circular practices, reprocessable instruments, and consolidated supply chains to reduce carbon footprint. Manufacturers are designing packaging and cold-chain logistics that balance biological integrity with lower environmental impact. Environmental stewardship is becoming a brand differentiator as patients increasingly value responsible care. Sustainability thus permeates both product design and clinical operations.

- Major Investors: Investment flows into the space combine strategic corporate R&D from established medtech and dermocosmetic firms, life-science venture capital backing platform biologics, and private-equity interest in scalable clinic networks. Corporate investors often target late-stage platform technologies that promise rapid clinic adoption, while VCs seed novel biomaterials and cell-processing startups. Family offices and health-focused impact funds are also participating, attracted by the potential for durable outcomes and predictable procedure volumes. Co-investment syndicates that pair commercialization expertise with scientific credibility are common. Overall, the capital mix reflects both financial opportunity and strategic hedging by incumbents.

- Startup Economy: A vibrant cadre of startups is innovating across cell-harvesting systems, exosome-based therapeutics, bioactive peptide matrices, and closed-loop point-of-care manufacturing devices. Many of these ventures spin out of academic tissue-engineering labs and quickly seek clinic partnerships for real-world validation. Startups are differentiated by proprietary scaffolds, simplified processing workflows, or unique biologic payloads that promise superior longevity and safety. Acquisition by larger medtech or dermocosmetic players remains a clear exit pathway for successful teams. The startup ecosystem functions as the creative ferment that continuously replenishes clinical practice with new modalities.

Market Key Trends

- Convergence of autologous biologics with off-the-shelf bioactive scaffolds.

- Proliferation of point-of-care cell-processing systems enabling in-clinic therapies.

- Growth of hybrid protocols combining energy devices (lasers, RF) with regenerative injectables.

- Increased focus on longevity of outcomes and measurable patient-reported metrics.

- Clinic networks and subscription models are broadening access to premium regenerative services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.76 Billion |

| Market Size in 2026 | USD 4.04 Billion |

| Market Size by 2034 | USD 7.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product & Service, Technology / Modality, Indication / Application, Procedure Type, End-User / Buyer, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Durability Sells: The Promise of Lasting Rejuvenation

A dominant driver in the regenerative aesthetics market is the patient and practitioner's appetite for durable, natural-looking outcomes that obviate frequent re-treatment and deliver substantive tissue restoration. Where traditional fillers provide ephemeral volume, regenerative solutions promise remodelling of native tissue with longevity and improved function. This shift in value perception supports higher per-procedure pricing, patient loyalty, and differentiated clinic positioning. As evidence accumulates for longer-lasting benefit, referrals and repeat business increase, reinforcing commercial viability. Providers are thus incentivized to adopt technologies that combine safety with enduring efficacy. In short, the economic logic of durability underpins the market.

Market Restraint

Regulatory and Reimbursement Ambiguities

A key restraint in the regenerative aesthetics market is the heterogeneous and often ambiguous regulatory environment governing biologics, devices, and combination products used in aesthetics, which complicates development timelines and clinic adoption. Differing regional definitions of homologous use, minimally manipulated tissues, and device–drug combinations create compliance uncertainty for manufacturers and practitioners. Reimbursement pathways are largely absent for elective aesthetic procedures, which constrains market access to out-of-pocket consumers and limits uptake in price-sensitive markets. Liability concerns and the need for rigorous long-term safety data also temper rapid expansion. Consequently, regulatory clarity and reimbursement innovation are pivotal to unlocking broader market potential.

Market Opportunity

Democratizing Regeneration: From Boutique to Broad Access

The chief opportunity lies in reducing barriers to clinic adoption by using commoditized, safe, and easy-to-use regenerative kits and scaled training, which enable broader geographic reach beyond elite urban clinics. Standardised point-of-care platforms, bundled with practitioner certification and outcome-tracking, can convert early adopters into mainstream operators. Affordably priced off-the-shelf bioactive matrices combined with simple autologous adjuncts will expand the addressable market into suburban and emerging-economy centers. Ancillary services, long-term outcome registries, maintenance protocols, and patient financing can create recurring revenue streams. The ability to demonstrate clear, durable outcomes at scale will unlock insurance and partial reimbursement for reconstructive-adjacent indications. Thus, democratization of regenerative aesthetics promises both social impact and commercial expansion.

Segment Insights

Product & Service Insights

Why Are Biologics & Cell Products Dominating the Regenerative Aesthetics Market?

The biologics & cell products are dominating the regenerative aesthetics market, holding a 35% share, revered for their ability to restore tissue integrity at a cellular level rather than merely conceal superficial aging. This segment thrives on autologous preparations that ensure immunological harmony and long-term outcomes. Clinics' biologic interventions yield authentic rejuvenation results that mirror natural physiology. Their adoption has been accelerated by scientific validation, clinical reliability, and an ever-increasing consumer preference for sustainable beauty. With rising awareness around cell therapy, practitioners perceive biologics as the epitome of safety, precision, and durability. Thus, biologics and cell products remain the cornerstone of the industry's most transformative pursuits.

Biomaterials and fillers are the fastest-growing segment in the regenerative aesthetics market, holding a 15% share, due to their role as a bridge between science and accessibility in regenerative care. Unlike traditional dermal filters, these next-generation biomaterials now serve as scaffolds for cell recruitment and tissue repair. Their convenience, off-the-shelf availability, and biocompatibility make them particularly appealing for high-volume aesthetic clinics. Recent formulations enriched with peptides or extracellular matrix components elevate their regenerative efficacy. As research advances, these fillers are no longer passive volumizers; they actively participate in dermal remodeling. Consequently, biomaterials and bioactive fillers are reshaping the landscape of accessible regenerative elegance.

Technology Insights

Why Are Autologous Biologics Dominating the Regenerative Aesthetics Market?

The autologous biologics are dominating the regenerative aesthetics market, holding a 45% share. Techniques like platelet-rich plasma, microfat grafting, and stromal vascular fraction leverage the body's innate healing prowess. These methods, refined through years of clinical experience, offer a harmony between natural biology and technological precision. The immediate point-of-care processing allows clinicians to deliver same-day rejuvenation with minimal risk of rejection or infection. Patients value these treatments for their organic appeal and natural integration into existing tissue. Hence, autologous biologics persist as the gold standard for those who seek genuine, personalized restoration.

The allogeneic cell-based products are the fastest growing in the regenerative aesthetics market, holding a share of 11% and rapidly ascending as the vanguard of scalable regenerative innovation. They eliminate the logistical limitations of autologous harvests by providing standardized, ready-to-use cell solutions. Advancements in cryopreservation and immune-matching have significantly enhanced their safety and consistency. Manufacturers now deliver products that marry scientific rigor with operational simplicity, enabling clinics to expand offerings without complex infrastructure. This shift towards standardized cell therapies represents industrialized regeneration, uniform, efficient, and globally distributable. Thus, allogeneic modalities are becoming the accelerant that democratizes cellular aesthetics worldwide.

Indication Insights

How Are Facial Rejuvenation & Volume Restoration Dominating the Regenerative Aesthetics Market?

Facial rejuvenation & volume restoration dominate the regenerative aesthetics market, holding a 40% share due to their visibility and emotional resonance. This segment encapsulates the timeless human desire to preserve youth while maintaining authenticity of expression. Regenerative techniques, whether through PRP, stem-cell-enriched fillers, or adipose-derived injections, deliver long-lasting dermal vitality. Clinics specialize in personalized facial protocols that combine volumetric lift with skin texture refinement. The visual transformation is immediate yet natural, ensuring high patient satisfaction and repeat patronage. Hence, facial rejuvenation remains the cultural and clinical heart of regenerative aesthetics.

Hair restoration is the fastest-growing segment in the regenerative aesthetics market, holding an 18% share, fueled by surging demand from both men and women seeking minimally invasive solutions. Regenerative techniques involving growth factors and cellular injections promise follicular rejuvenation without surgical transplantation. This field's growth is underpinned by emotional gratification, the restoration of self-image, and confidence. Office-based procedures, short recovery times, and visible results have propelled market enthusiasm. With the increasing social acceptance of aesthetic procedures, hair restoration has evolved from vanity to wellness. It stands today as a powerful symbol of regenerative aesthetics' holistic promise.

Procedure Type Insights

How Are Injectables Leading the Regenerative Aesthetics Market?

Injectables dominate the regenerative aesthetics market, holding a 55% share, because they blend immediacy with precision, fitting seamlessly into busy clinical workflows. PRP, microfat, and advanced fillers require minimal downtime, appealing to the modern, efficiency-driven consumer. These treatments also enable layered approaches combining regenerative science with aesthetic artistry. The reproducibility of injectables ensures consistent outcomes and scalable clinic revenue models. Practitioners value their safety, speed, and versatility across indications from facial rejuvenation to scar revision. In essence, injectables are the lingua franca of modern regenerative practice, swift, effective, and enduring.

The surgical grafting is the fastest-growing segment in the regenerative aesthetics market, holding a share of 20%. These techniques offer profound volumetric restoration, leveraging adipose tissue's natural reservoir of regenerative cells. Recent refinements in micrografting and stem-cell enrichment have drastically improved graft survival and texture. While more invasive, their enduring results justify the investment for discerning patients seeking transformative outcomes. Clinics offering these hybrid regenerative surgeries are witnessing a rise in clientele seeking one-time, lasting rejuvenation. Thus, surgical grafting redefines permanence in a field once dominated by temporality.

End-User / Buyer Insights

How are Dermatology Clinics & Aesthetic Physicians Leading the Regenerative Aesthetics Market?

The dermatology clinics & aesthetic physicians are dominating the regenerative aesthetics market, holding the share of 48%, as physicians remain the central custodians of regenerative innovation. Their medical expertise, coupled with aesthetic sensibility, ensures safety and precision in biologic treatments. These practitioners lead the charge in integrating regenerative protocols with conventional skincare regimens. Their clinics function as both therapeutic centers and educational platforms for patient awareness. The procedural diversity and patient volume in these settings sustain market leadership and the flow of innovation. Hence, dermatology and aesthetic practices remain the pulsating nerve of the regenerative revolution.

Plastic surgery clinics and ambulatory centers are experiencing accelerated growth as they merge surgical artistry with regenerative science. These establishments can perform complex grafting and hybrid procedures under controlled settings. Their integration of regenerative materials enhances surgical outcomes, improving healing, minimizing scarring, and optimizing longevity. Surgeons are increasingly embracing cell-enriched grafts and tissue scaffolds for both cosmetic and reconstructive purposes. Patients perceive these centers as hubs of advanced, holistic transformation. Consequently, the confluence of surgery and regeneration is reshaping the high-end aesthetic landscape.

Distribution Channel Insights

Why Direct Sales to Clinics / Hospitals is Dominating the Regenerative Aesthetics Market?

Direct sales to clinics/hospitals dominate the regenerative aesthetics market, holding a 50% share. This remains the lifeblood of regenerative aesthetics commerce, enabling manufacturers to maintain clinical engagement and quality control. Field representatives not only sell but also educate, bridging scientific nuance and practical application. Personalized service, on-site training, and technical support strengthen brand loyalty and procedural consistency. Such partnerships foster trust, critical in an emerging, high-value medical domain. Direct channels also allow agile feedback loops for rapid product iteration and refinement. Thus, direct engagement continues to be the sinew that binds innovation to implementation.

Medical distributors and dealers are rapidly expanding their foothold as they democratize access to regenerative technologies across smaller clinics and new regions. Their logistical acumen ensures swift delivery, regulatory compliance, and local market adaptation. Many now offer training modules and bundled services, transforming from suppliers into strategic partners. Distributors bridge the gap between global innovation and regional practice, making regeneration universally accessible. Their networks help emerging markets leapfrog infrastructure barriers, catalyzing adoption at scale. Therefore, distributors are becoming the arteries through which regenerative aesthetics circulates globally.

Regional Insights

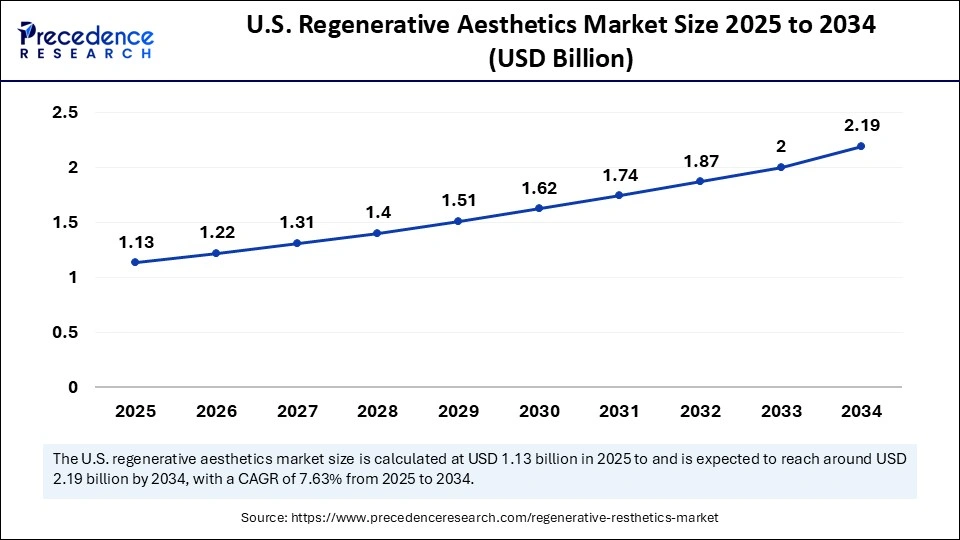

U.S. Regenerative Aesthetics Market Size and Growth 2025 to 2034

The U.S. regenerative aesthetics market size was exhibited at USD 1.13 billion in 2025 and is projected to be worth around USD 2.19 billion by 2034, growing at a CAGR of 7.63% from 2025 to 2034.

Will North America Continue to Define the Clinical and Commercial Playbook for Regenerative Aesthetics?

North America leads the regenerative aesthetics market, anchored by a mature private-pay aesthetic economy, high per-capita spending on elective procedures, and a dense network of academic-industry collaborations. The region's robust clinical trial infrastructure and favourable access to venture capital accelerate translation from bench to clinic. Clinicians here are early adopters of hybrid regenerative protocols, and a proliferating cadre of training academies ensures procedural consistency and safety. Regulatory clarity in certain jurisdictions, paired with advanced malpractice frameworks, makes clinic adoption commercially tenable for high-end practices. Marketing sophistication and consumer readiness further amplify demand for premium regenerative services. Consequently, North America remains the primary growth engine and innovation crucible for the sector.

U.S. regenerative aesthetics market

U.S. dominance also manifests commercially: franchised clinic networks and ambulatory surgery centres rapidly scale regenerative offerings, while insurers selectively reimburse reconstructive procedures that intersect with therapeutic benefit. The United States hosts a dense ecosystem of medtech accelerators, venture funds, and leading plastic surgery societies that shape practice standards and diffusion. This institutional depth, coupled with affluent consumer markets, ensures sustained leadership in both innovation and volume.

Can Europe's Clinical Rigor and Manufacturing Prowess Catalyze Regenerative Aesthetics?

Europe is emerging as the fastest-growing region for the regenerative aesthetics market, combining advancing clinical acceptance with a culturally diverse consumer base that increasingly values minimally invasive, natural-looking rejuvenation. Higher regulatory emphasis on safety and standardization is paradoxically accelerating adoption by raising clinician and patient confidence in validated therapies. Private clinics across Western Europe are adopting hybrid regenerative protocols, while Eastern European centers leverage lower costs to attract medical tourism. Collaborative pan-European research consortia and harmonized training modules are professionalizing the field and shortening the learning curve for practitioners. Sustainability and ethical sourcing narratives resonate strongly with European consumers, guiding procurement and marketing. These dynamics collectively catalyze rapid, principled expansion across the continent.

Country Analysis Germany

Germany stands out as a regional leader, notable for its strong medical device manufacturing base, disciplined regulatory stance, and a patient population that values clinically substantiated outcomes. The country's advanced biomedical research centers and certification frameworks provide a credible pathway for clinic adoption and reimbursement discussions. German clinics and medtech firms often pilot hybrid regenerative protocols that later diffuse across neighboring markets, reinforcing the country's role as a methodological bellwether.

Regenerative Aesthetics Market Value Chain Analysis

- Raw Material Sources: Primary inputs include medical-grade polymers (collagen derivatives, PEG-based scaffolds), hyaluronic acid precursors, recombinant growth factors, and sterilisable disposables for point-of-care kits. Securing ethically sourced, GMP-compliant biomaterials and ensuring traceability is essential to clinical safety and regulatory compliance.

- Technology Used: Core technologies include point-of-care centrifugation and cell-isolation systems (for stromal vascular fraction), enzymatic and mechanical processing cartridges, biodegradable scaffold fabrication, and controlled-release matrices for growth factors. Complementary technologies include imaging systems for volumetric assessment and digital outcome-tracking platforms.

- Investment by Investors: Investors gravitate toward platform plays, companies that marry a point-of-care device with a validated biologic payload and a scalable clinic rollout model. Strategic MedTech corporates often lead late-stage rounds.

Value Chain Analysis of the Regenerative Aesthetics Market

- Raw Material Procurement (Biologics & Biomaterials:This stage sources cellular materials, growth factors, peptides, extracellular matrices, and biomaterials (e.g., hyaluronic acid, collagen, PRP kits) from biotech suppliers or human/animal tissue banks. The value lies in high purity, biocompatibility, and traceability, governed by strict GMP and regulatory frameworks. Sourcing challenges include ethical compliance, donor screening, and maintaining cold chain integrity. Biotech companies and lab suppliers hold strong upstream power due to IP protection and specialized capabilities.

- Processing & Clinical Application Development: Processing converts biologic materials into injectables, skin scaffolds, stem-cell-derived formulations, or exosome therapies for regenerative treatments. This phase requires advanced bioprocessing, formulation R&D, and clinical validation, ensuring safety, sterility, and efficacy. Companies invest heavily in clinical trials, FDA/EMA approvals, and biocompatibility studies, which create significant barriers to entry but also capture high value through patented innovations. Contract manufacturing and regulatory-compliant labs play a critical role here.

- Distribution & Clinical Practice Integration: Products are distributed to dermatology clinics, med-spas, hospitals, and aesthetic practitioners through licensed distributors or direct B2B channels. Education and training forclinicians on proper administration (e.g., PRP, exosome injections) are part of the value delivery. Brand differentiation hinges on scientific credibility, safety data, and practitioner partnerships, not just consumer marketing. The distribution chain must also manage cold chain logistics and adhere to medical device or biologic handling standards.

Top Companies in the Regenerative Aesthetics Market

- AbbVie (Allergan Aesthetics): AbbVie, through its Allergan Aesthetics division, leads the global medical aesthetics market with a broad regenerative portfolio including Juvéderm dermal fillers and Skinvive skin hydrators. The company is investing in next-generation biostimulatory and stem-cell-based technologies that enhance natural collagen production and improve skin texture and elasticity over time.

- Galderma: Galderma is at the forefront of regenerative dermatology, offering injectable solutions like Sculptra (poly-L-lactic acid) and Restylane that promote collagen neogenesis for long-lasting facial rejuvenation. Its clinical focus combines biologics, dermal fillers, and skin health science to deliver personalized, natural-looking aesthetic outcomes.

- Merz Aesthetics: Merz Aesthetics develops biostimulatory injectables such as Radiesse (calcium hydroxylapatite) and Belotero, which trigger natural tissue regeneration and dermal remodeling. The company's research emphasizes combination therapies that pair regenerative injectables with energy-based devices to optimize skin firmness and volume restoration.

- Hologic / Cynosure: Hologic's Cynosure brand provides energy-based aesthetic systems like Potenza RF Microneedling and PicoSure Pro Laser, which stimulate collagen and elastin regeneration. The company focuses on integrating minimally invasive technologies that promote skin renewal, scar reduction, and anti-aging through natural biological processes.

- Lumenis: Lumenis is a global pioneer in laser and light-based regenerative aesthetic devices, offering solutions like Stellar M22 and Legend Pro that rejuvenate skin through controlled tissue remodeling. Its innovations in photothermal and RF energy delivery enable precise collagen induction and long-term skin revitalization with minimal downtime.

Other Companies in the Regenerative Aesthetics Market

- Cutera: Develops non-invasive aesthetic systems using laser and RF technologies that promote tissue regeneration and collagen production for anti-aging applications.

- Venus Concept: Focuses on medical aesthetic devices such as Venus Versa and Venus Viva, which combine RF and pulsed magnetic fields for regenerative skin tightening and resurfacing.

- Anika Therapeutics: Produces hyaluronic acid (HA)-based regenerative products for aesthetic and orthopedic use, supporting skin hydration, elasticity, and tissue repair.

- CollPlant: Innovates in bioengineered regenerative aesthetics with plant-based recombinant human collagen (rhCollagen) for dermal fillers and tissue scaffolding applications.

- RegenLab: Specializes in platelet-rich plasma (PRP) and cell therapy systems used in regenerative aesthetic treatments for skin, hair, and wound repair.

- EmCyte: Provides autologous regenerative technologies, including PRP and stem-cell processing systems that enhance natural tissue healing and skin rejuvenation.

- Lipogems: Develops adipose tissue-based regenerative systems that process and reinject fat-derived microtissues for aesthetic and reconstructive applications.

- Suneva Medical: Offers regenerative aesthetic products such as Bellafill, a long-lasting collagen-stimulating dermal filler, and PRP-based skin revitalization systems.

- Integra LifeSciences: Manufactures collagen-based biomaterials and dermal regeneration templates used in reconstructive and aesthetic skin healing.

- Arthrex: Provides regenerative medical technologies, including autologous PRP and stem-cell systems adapted for aesthetic skin rejuvenation and soft tissue repair.

Recent Developments

- In September 2025, Elixir Wellness, the luxury medical wellness brand founded by public health expert and entrepreneur Tanya Khubchandani, was honored with the prestigious Healthcare Startup of the Year award at the Entrepreneur India 2025 Awards. Regarded as one of the nation's most esteemed recognitions for entrepreneurial excellence, the accolade celebrates Elixir Wellness for its remarkable impact in India's rapidly expanding health and wellness sector. The brand was lauded for its pioneering approach that seamlessly integrates longevity science, regenerative medicine, and luxury wellness into a single, holistic ecosystem.

Segment Covered in the Report

By Product & Service

- Biologics & Cell Products

- Platelet-Rich Plasma (PRP) kits & services

- Autologous cell therapies (adipose-derived microfat / SVF)

- Allogeneic Cell Therapies

- Exosomes & Conditioned-Media Products

- Growth-Factor Formulations

- Biomaterials & Fillers

- Resorbable dermal fillers (HA, bioactive fillers)

- Collagen & Recombinant-Collagen Products

- Acellular Dermal Matrices/Skin Substitutes

- Engineered Scaffolds And Matrices

- Combination Products / Drug-Device Hybrids

- Devices & Equipment

- Energy-Based Devices Used Adjunctively (laser, RF, ultrasound)

- Microfat Harvesting/Processing Systems

- Centrifuges And Cell-Processing Devices

- Consumables & Single-use Kits

- Services

- Clinical Procedures (Injectables, Grafting, Device-Assisted)

- Diagnostic & Consultation Services

- Training, Protocol Development, And Support Services

By Technology / Modality

- Autologous Biologics (PRP, microfat, SVF)

- Allogeneic Cell-Based Products

- Exosomes & Extracellular Vesicles

- Biomaterials & tissue scaffolds (ECM, collagen, synthetic scaffolds)

- Combination Biologic-Device Platforms

- Gene-Modified / Gene-Therapy Related Regenerative Products (Emerging)

- Advanced Delivery Systems (Microneedles, Patches, Carriers)

By Indication / Application

- Facial Rejuvenation & Volume Restoration

- Hair Restoration

- Scar Revision & Acne Scarring

- Wound Healing & Reconstructive Adjuncts

- Body Contouring & Soft-Tissue Defect Repair

- Pigmentation Disorders & Chronic Dermatologic Conditions

- Periorbital/Perioral Specific Indications

By Procedure Type

- Injectables

- Surgical Grafting / Fat Grafting

- Device-Assisted Combination Procedures

- Topical/Patch/Implantable Biomaterial Applications

- Outpatient Office Procedures / Ambulatory Surgical Procedures

By End-User / Buyer

- Dermatology Clinics & Aesthetic Physicians

- Plastic Surgery Clinics & Ambulatory Surgical Centers

- Med-Spas And Cosmetic Chains

- Hospitals & Wound Care Centers

- Hair Restoration Specialty Clinics

- Academic & Research Institutions (For Clinical-Stage Products)

By Distribution Channel

- Direct Sales To Clinics/Hospitals (Field Teams, Direct Rep)

- Medical Distributors & Dealers

- Online professional channels / OEM E-Commerce

- Clinic Franchising & Network Procurement

- Group Purchasing Organizations (GPOs) / Institutional Procurement

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting