What is Reprocessed Medical Devices Market Size?

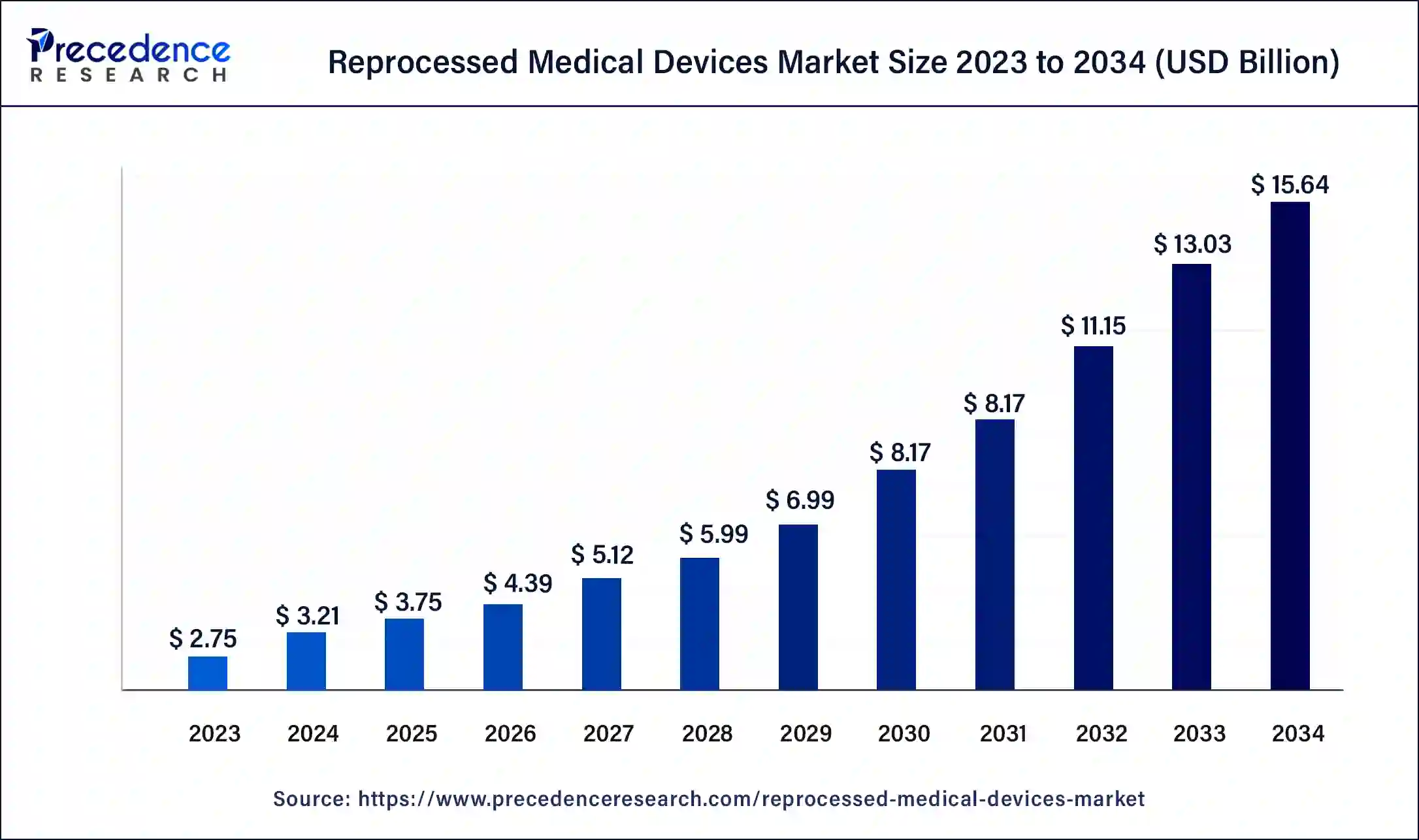

The global reprocessed medical devices market size is valued at USD 3.75 billion in 2025 and is predicted to reach around USD 15.64 billion by 2034, growing at a CAGR of 17.16% from 2025 to 2034. The reprocessed medical devices market is driven by the need to reduce medical waste in healthcare settings, the cost benefits, and increasing awareness about the advantages of reprocessed devices.

Market Highlights

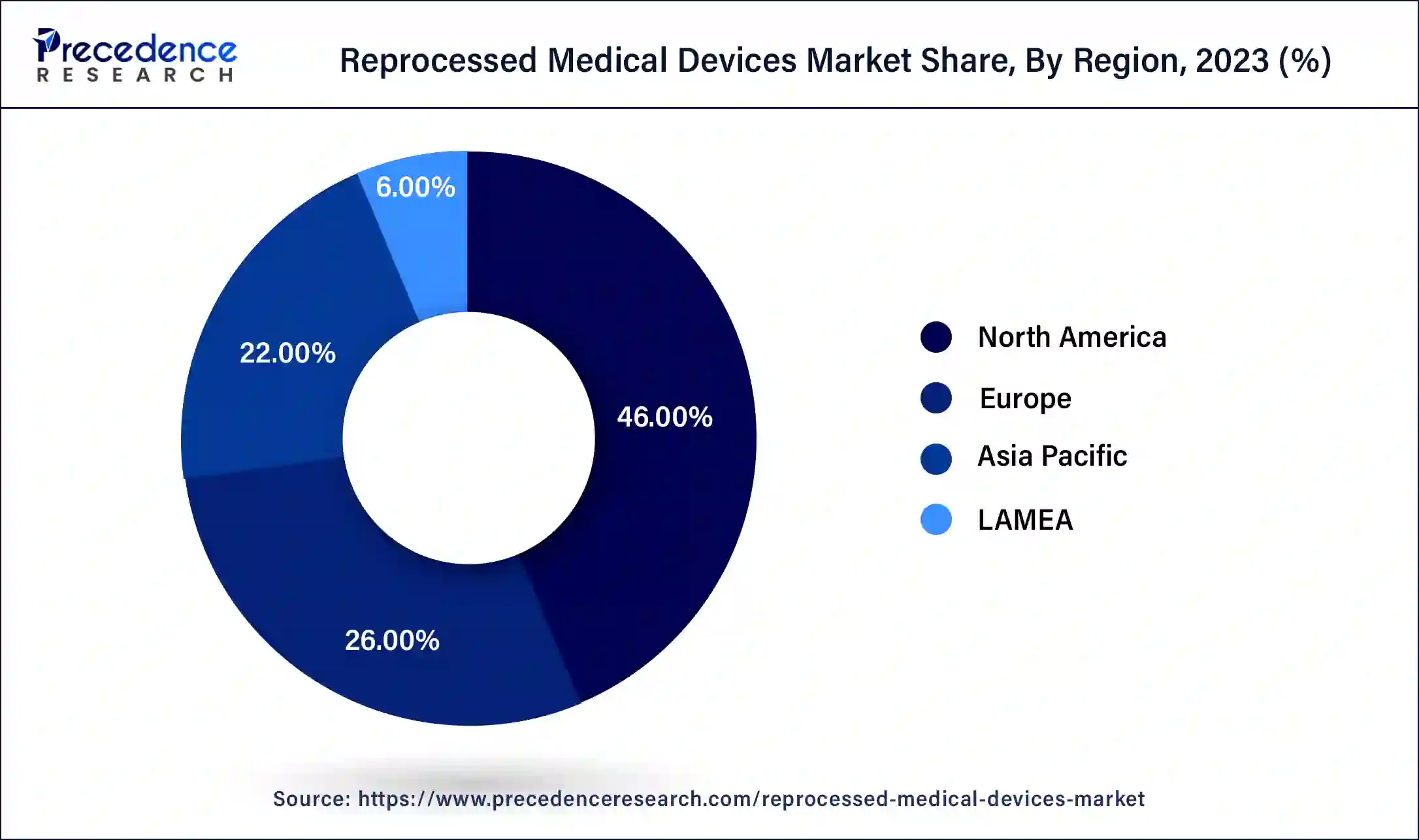

- North America led the market with the largest revenue share of 46% in 2024.

- Asia Pacific is expected to register the fastest rate over the forecast period.

- By product, the cardiovascular segment has held the major revenue share of 56% in 2024.

- By product, the laparoscopy segment is expected to grow at a rapid rate during the forecast period.

- By type, the third-party reprocessing segment led the market with the biggest revenue share of 85% in 2024.

- By type, the in-house reprocessing segment is expected to show significant growth over the forecast period.

- By end-use, the hospital segment has contributed more than 43% of revenue share in 2024.

- By end-use, the home healthcare segment is anticipated to grow at a modest rate over the forecast period.

Market Overview

The reprocessed medical devices market is growing quickly as healthcare providers aim to reduce costs, minimize medical waste, and promote environmental sustainability. Reprocessed medical devices undergo rigorous cleaning, sterilization, and testing to meet quality and safety standards for reuse, providing a sustainable solution without compromising patient safety or the quality of medical care.

However, some industry players have raised concerns about potential risks and performance variations. To mitigate these risks, regulatory agencies worldwide oversee the reprocessing industry, establishing guidelines and standards. Healthcare providers must carefully consider the benefits and risks of using reprocessed medical devices to make informed decisions and ensure patient safety.

Reprocessed Medical Devices Market Growth Factors

- The growing incidence of cardiovascular disorders can contribute to the reprocessed medical devices market expansion over the forecast period.

- Government initiatives to promote equipment reprocessing are anticipated to fuel market growth shortly.

- Increasing healthcare expenditure globally can positively affect the reprocessed medical devices market growth.

- Rising awareness regarding environmental sustainability practices in healthcare can drive the adoption of this device, which will ultimately boost the growth of the reprocessed medical devices market.

Key Factors Influencing Future Market Trends

- Rising Demand for Medical Supplies

The breathing machines, oxygen generators, and machines for monitoring machines are needed everywhere for medical treatment. The growing sale of used medical equipment is driving the international reprocessed medical devices market to grow.

- Building Awareness about Waste Reduction

The awareness of the harm environmental issues and medical waste causes hospitals and organizations to look for ways to reduce the amount of waste they produce. NGOs and health groups encourage people to recycle and reprocess items to reduce waste ending up in landfills and causing pollution.

- Reprocessed Devices Can Save Time and Money

Reprocessed medical devices help save money while still ensuring their safety and quality are not affected. Hospitals and clinics are always finding new ways to cut their costs. Because these medical devices are approved and low-cost, more individuals are now using them, leading to an increase in the market.

Reprocessed Medical Devices Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rapid investment by hospitals for deploying high-quality medical devices coupled with technological advancements in the healthcare sector.

- Major Investors:Several medical device companies and strategic investors are actively entering this market, drawn by collaborations, R&D and business expansion. Numerous market players such as SureTek Medical, Soma Tech Intl, Johnson & Johnson MedTech and some others have started investing rapidly for manufacturing high-quality reprocessed medical devices to cater the needs of the end-users.

- Startup Ecosystem:Various startup brands are engaged in developing reprocessed medical devices for end-user industries. The prominent startup companies dealing in manufacturing reprocessed medical devices comprises of Auricle, Blue Box, Shapecrunch Technology and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.75 Billion |

| Market Size in 2026 | USD 4.39 Billion |

| Market Size by 2034 | USD 15.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.16% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Wide range of applications

Many reprocessed medical devices are in use, including endoscopes, surgical forceps, cardiac stabilization and positioning machines, balloon inflation devices, and more. Reprocessing is mainly used for minimally invasive disposables and surgical instruments, saving on landfill costs and reducing repurchasing expenses for hospitals. Most hospital waste originates from the operating room. The global reprocessed medical devices market is expected to see significant growth due to increased investment by companies in emerging countries in manufacturing facilities and cost reduction efforts. Also, growing awareness in developing countries about the benefits of reprocessed medical devices is encouraging consumer purchasing behavior.

- In October 2023, AA Medical, a provider of sustainable solutions to both the new and resale medical device markets, announced three new partnerships with leading companies in the healthcare asset management, medical device reprocessing, and disposition industries.

Restraint

Concerns about safety and efficacy

The growth of the reprocessed medical devices market is hampered by several restraints. Hesitation among healthcare providers and resistance from patients arise from concerns about the safety and efficacy of reprocessed devices. To address these concerns and establish reliability, clear evidence and studies are essential. Regulatory scrutiny and compliance requirements present additional challenges for reprocessing companies, raising their operational costs. Furthermore, the limited availability of certain high-demand devices for reprocessing can constrain market growth. The preference for new devices by some market players and the potential for liability issues also slow down the widespread adoption of reprocessed medical devices.

Opportunity

Government initiatives

The global demand for medical devices is rising. Key devices in early clinical treatment include respiratory support equipment like life support machines, atomizers, oxygen generators, and monitors. The COVID-19 pandemic has significantly increased the need for medical products, including personal protective equipment such as masks, gloves, and eyeglasses. Healthcare personnel now require more medical supplies than before, driving market expansion. Additionally, growing awareness and initiatives from various non-governmental organizations (NGOs) aimed at reducing medical waste and promoting recycling efforts are expected to boost the reprocessed medical devices market growth further.

- In 2022, Innovative Health, LLC was permitted to reprocess the Philips Eagle Eye Platinum digital IVUS catheter. Innovative Health has successfully entered the Cath lab market. It is a decision that will significantly boost the financial savings hospitals experience through reprocessing.

Segment Insights

Product Insights

The cardiovascular segment dominated the reprocessed medical devices market in 2024. Several factors contribute to the significant market presence of reprocessed cardiovascular medical devices. Cardiovascular diseases remain a major global health concern, with high prevalence and rising cases, leading to substantial demand for devices such as catheters, pacemakers, stents, and electrophysiological devices. Reprocessing these devices offers a cost-effective solution for healthcare providers to meet growing demand without compromising patient care. Cardiovascular procedures often require expensive and complex devices, and reprocessing them provides a viable alternative to reduce costs for hospitals and healthcare facilities while ensuring safety and efficacy.

- In February 2023, Abbott announced two approvals as part of its growing suite of electrophysiology products in the global market. The company's TactiFlex Ablation Catheter, Sensor Enabled, the world's only ablation catheter with a flexible tip and contact force sensing, received CE Mark1 for treating people with abnormal heart rhythms like atrial fibrillation (AFib).

The laparoscopy segment is expected to grow at a rapid rate in the reprocessed medical devices market during the forecast period. The significant waste generated by disposable devices is driving the demand for reprocessed laparoscopic devices. The growing preference for minimally invasive techniques is expected to create opportunities for increased reprocessing approvals in laparoscopy by contributing to the growth of this segment.

Type Insights

The third-party reprocessing segment was the dominant force in the reprocessed medical devices market in 2024. Healthcare facilities, such as hospitals, engage in in-house reprocessing by sterilizing and refurbishing medical devices for reuse within their own premises. Conversely, third-party players collect used medical devices that would otherwise become medical waste and utilize various cleaning, sterilization, and refurbishment techniques to make them suitable for reuse. AMDR member companies are estimated to reprocess a wide range of clinical devices used in respiratory therapy, orthopedics, and cardiology, catering to outpatient surgery centers and hospitals.

The in-house reprocessing segment is expected to show significant growth in the reprocessed medical devices market over the forecast period. The practice of in-house reprocessing involves healthcare facilities, such as hospitals, sterilizing and refurbishing medical devices for reuse on their premises. This industry is highly regulated, which requires reprocessors to meet stringent regulatory demands and guidelines to ensure the safety and efficacy of reprocessed devices. To achieve this, the program must include appropriate equipment, ongoing quality control measures, trained personnel, and documented procedures.

End-use Insights

The hospital segment dominated the reprocessed medical devices market in 2024. Hospitals play a significant role in the market, holding a substantial share. As major healthcare providers with high patient volumes, they have a greater demand for the practice of in-house reprocessing involving healthcare facilities, such as hospitals, sterilizing and refurbishing medical devices for reuse on their premises. This industry is highly regulated, which requires reprocessors to meet stringent regulatory demands and guidelines to ensure the safety and efficacy of reprocessed devices.

To achieve this, the program must include appropriate equipment, ongoing quality control measures, trained personnel, and documented procedures and medical devices. Reprocessed devices offer hospitals a cost-effective solution to meet equipment needs without compromising patient care. The cost savings from reprocessed devices help hospitals manage tight budgets and allocate resources more efficiently. Hospitals prioritize patient safety and adhere to rigorous quality control standards, further supporting their prominent presence in this market segment.

The home healthcare segment is anticipated to grow at a modest rate over the forecast period. The rising demand for low-cost home equipment drives the market for reprocessed home medical devices. These devices, including patient monitoring systems, orthopedic equipment, and external support devices, significantly enhance patient mobility at home. Furthermore, growth prospects are anticipated to improve due to the increasing potential for incorporating reprocessed products in home healthcare, largely driven by the limited number of home medical device suppliers.

Regional Insights

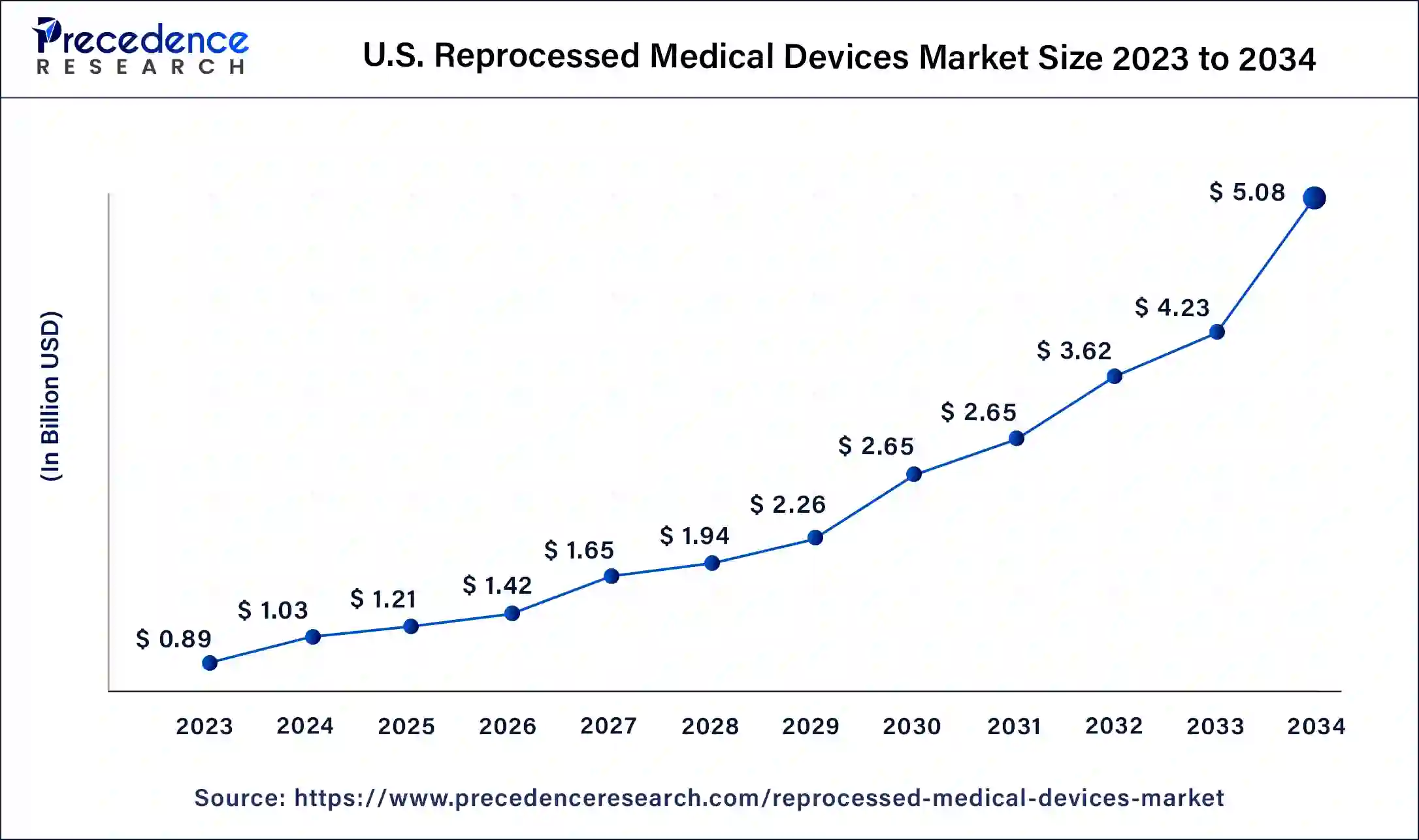

U.S. Reprocessed Medical Devices Market Size and Growth 2025 to 2034

The U.S. reprocessed medical devices market size is estimated at USD 1.21 billion in 2025 and is predicted to be worth around USD 5.08 billion by 2034 with a CAGR of 17.30% from 2025 to 2034.

North America dominated the reprocessed medical devices market in 2024. North America's well-established healthcare infrastructure and advanced medical facilities lead to high medical device usage, providing a larger pool of devices for reprocessing and driving market growth. Stringent regulations ensure reprocessed devices meet quality and safety standards. Cost containment initiatives by healthcare providers promote the adoption of reprocessed devices to achieve savings without compromising patient care. Furthermore, increasing environmental awareness and sustainability efforts further boost the demand for reprocessed medical devices, contributing to North America's significant revenue share in the market.

- In December 2022, PENTAX Medical America launched a new fast endoscope drying solution - the PlasmaTYPHOONdry. Designed to improve productivity and traceability, this system further advances endoscope drying to enhance patient safety.

- In February 2023, Northeast Scientific Inc. received FDA 510(k) clearance for reprocessing the Philips IVUS Eagle Eye Platinum RX Digital catheter. With the launch of this product, considerable savings for Office-Based Labs and Hospital Cath Labs across the United States are likely to be achieved.

Asia Pacific is expected to register the fastest rate over the forecast period. The expanding market for reprocessed medical devices in the region is driven by a growing economy, rising prevalence of chronic conditions, and an increasing need to reduce hospital costs. Developing countries like China and India have experienced a surge in chronic diseases, prompting a greater emphasis on healthcare. While governments are actively investing in healthcare infrastructure, their spending is constrained, which results in high demand for cost-effective, reprocessed medical devices.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The rising cases of cardiovascular diseases in numerous countries such as Germany, France, Italy, UK and some others has boosted the market expansion. Additionally, rapid investment by market players for opening up new production centers to increase the production of reprocessed medical devices is expected to drive the growth of the reprocessed medical devices market in this region.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The increasing emphasis of hospitals to adopt high-quality medical devices across Brazil and Argentina has driven the market expansion. Also, partnerships among nursing homes and medical device companies for developing high-quality orthopedic devices is expected to boost the growth of the reprocessed medical devices market in this region.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The growing number of government hospitals in numerous countries such as Saudi Arabia, UAE, South Africa, Qatar and some others has boosted the market expansion. Also, numerous government initiatives aimed at strengthening the healthcare infrastructure is expected to foster the growth of the reprocessed medical devices market in this region.

Value-Chain Analysis

- Raw Material Procurement

The raw materials used for the production of reprocessed medical devices includes stainless steel, titanium alloys, polyethylene, polypropylene and some others.

Key Companies: Allegheny Technologies Incorporated, Alloy Metals Company, Plymouth Tube and others. - Testing and Quality Control

Testing and Quality Control (QC) of reprocessed medical devices are critical processes within a comprehensive quality management system (QMS) to ensure that the devices remain safe, effective, and perform to their original specifications after each use and subsequent reprocessing cycle.

Key Companies: Eurofins Scientific, Cigniti, Nelson Labs and others. - Distribution Channel

The distribution channels for reprocessed medical devices are primarily Business-to-Business (B2B) models, where devices are supplied directly to healthcare facilities, and through B2B and online distributors, which can include both large manufacturers and smaller online retailers.

Key Companies: Medline Industries, LP., Arjo, Vanguard AG and others.

Key Players in Reprocessed Medical Devices Market and their Offerings

- Stryker: Stryker is a global medical technology company that creates a diverse range of innovative products and services across the orthopedics, medical and surgical, and neurotechnology and spine sectors. This company aims at providing advanced healthcare solutions by improving patient and healthcare outcomes through its technologies like the Mako robotic-arm for joint replacement surgery.

- NEScientific, Inc.: NEScientific, Inc. (or NE Scientific) has two distinct entities: one is a medical device reprocessing company founded in 2005, based in Waterbury, CT, focused on providing reprocessed medical devices to reduce costs and waste. The other is a software company, also called NE Scientific, founded in 2010 in Boston, that develops real-time ablation simulation software for cancer treatment to help physicians improve outcomes.

- Medline Industries, LP.: Medline Industries, LP is a privately held American manufacturer and distributor of medical-surgical products, serving healthcare providers globally from its headquarters in Northfield, Illinois. This company provides a wide range of products ranging from gloves and gowns to durable medical equipment and advanced wound care

- Arjo: Arjo is a global medical technology company specializing in solutions that promote patient mobility and safety in healthcare settings. This company provides numerous products and services include medical beds, patient handling equipment, hygiene systems, and diagnostic tools.

- Vanguard AG: Vanguard AG can refer to two distinct companies: a German company specializing in medical remanufacturing services. The Vanguard Ag provides numerous services in water quality, irrigation technology, and crop nutrition.

- Cardinal Health: Cardinal Health is an American multinational health care services company that distributes pharmaceuticals and medical products, manufactures and distributes a wide range of medical and laboratory products, and provides data and performance solutions. The company serves hospitals, pharmacies, and other healthcare providers in over 100,000 locations globally and operates one of the largest nuclear pharmacy networks in the United States

Recent Developments

- In July 2025, Nanosonics launched an ultrasound disinfection product. This product is designed for numerous countries such as United Kingdom, Australia and New Zealand.

- In June 2025, Cardinal Health launched Kendall DL multi system. Kendall DL multi system is designed for enhancing patient monitoring system across the world.(Source: https://www.prnewswire.com)

- In May 2025, Croom Medical collaborated with Global Advanced Metals (GAM). This collaboration is aimed at launching TALOS platform.

(Source: https://www.voxelmatters.com) - In December 2024, GE Healthcare focused on making sustainability part of its operations and products. GE Healthcare knows that it has a dual responsibility to deliver high-quality patient healthcare solutions while reducing its environmental footprint. This commitment will come from innovative ways in which the company will improve patient care while protecting our planet.

- In August 2024, the FDA developed some online resources to provide information about reprocessing single-use medical devices for healthcare facilities and FAQs. This webpage boasts knowledge to help healthcare facilities understand the reprocessed medical devices that were originally labeled for single-use, and the level of FDA's regulatory oversight of these reprocessed single-use medical devices to remain as safe and effective as the original manufactured devices.

- In July 2024, Innovative Health Inc. entered into a partnership agreement with MC Healthcare. This partnership is a collaborative effort to promote the reprocessing of medical devices as a sustainable practice in the health care setting. The purpose of the partnership and agreement is to increase awareness and implementation of device reprocessing in hospitals and health care facilities.

- In March 2023, Vanguard AG signed the Dutch Green Deal's third edition. This agreement is the result of a partnership between industrial groups, government ministries, and other organizations dedicated to improving sustainable development in the Netherlands. Vanguard is also collaborating with the scientific and professional network Landelijk Netwerk de Groene OK to help them accomplish their aim of CO2-neutral care.

- In May 2022, Innovative Health, LLC was granted authorization to reprocess the Philips Eagle Eye Platinum digital IVUS (intravascular ultrasonography) catheter. This approval essentially marks the company's debut in the Cath lab area, increasing the company's medical device reprocessing market reach in cardiac applications.

- In June 2022, the Association of Medical Device Reprocessors launched 'Global Regulatory Standards for 'Single-Use' Medical Device Reprocessing and Remanufacturing,' the first roadmap to help Notified Bodies, Ministries of Health, and regulatory authorities of medical devices to unlock these benefits for hospitals and health systems worldwide.

Segments Covered in the Report

By Product

- Cardiovascular

- Blood Pressure Cuffs

- Positioning Devices

- Cardiac Stabilization Devices

- Diagnostic Electrophysiology Catheters

- Electrophysiology Cables

- Deep Vein Thrombosis Compression Sleeves

- Laparoscopic

- Harmonic Scalpels

- Endoscopic Trocars

- Gastroenterology

- Biopsy Forceps

- Others

- General Surgery Devices

- Balloon Inflation Devices

- Pressure Bags

- Orthopedic Devices

By Type

- Third-party Reprocessing

- In-house Reprocessing

By End-use

- Hospitals

- Home Healthcare

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting