What is the Satellite IoT Market Size?

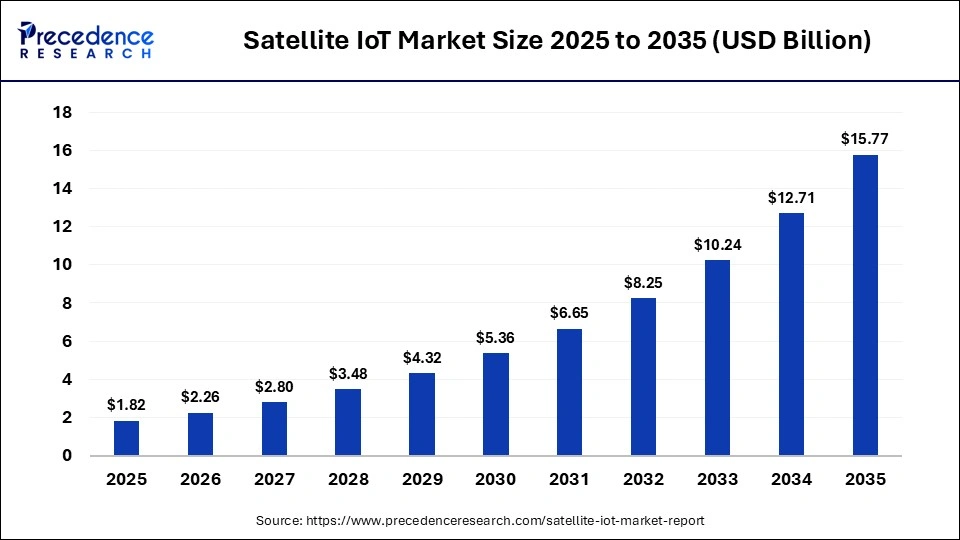

The global satellite IoT market size was calculated at USD 1.82 billion in 2025 and is predicted to increase from USD 2.26 billion in 2026 to approximately USD 15.77 billion by 2035, expanding at a CAGR of 24.1% from 2026 to 2035.The market is experiencing a rapid growth rate due to the technological shift to leverage satellite connectivity for uninterrupted connectivity needs, integration with cellular networks, and the growing demand for such connectivity in various crucial sectors.

Market Highlights

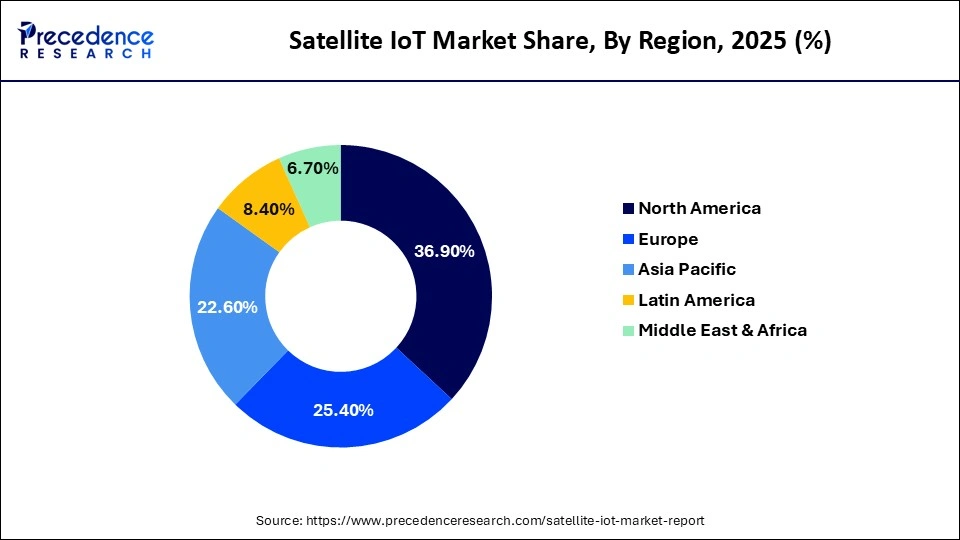

- By region, North America held the largest market share of 36.90% in 2025.

- By region, Asia Pacific is projected to grow at the fastest CAGR of 24.50% from 2026 to 2035.

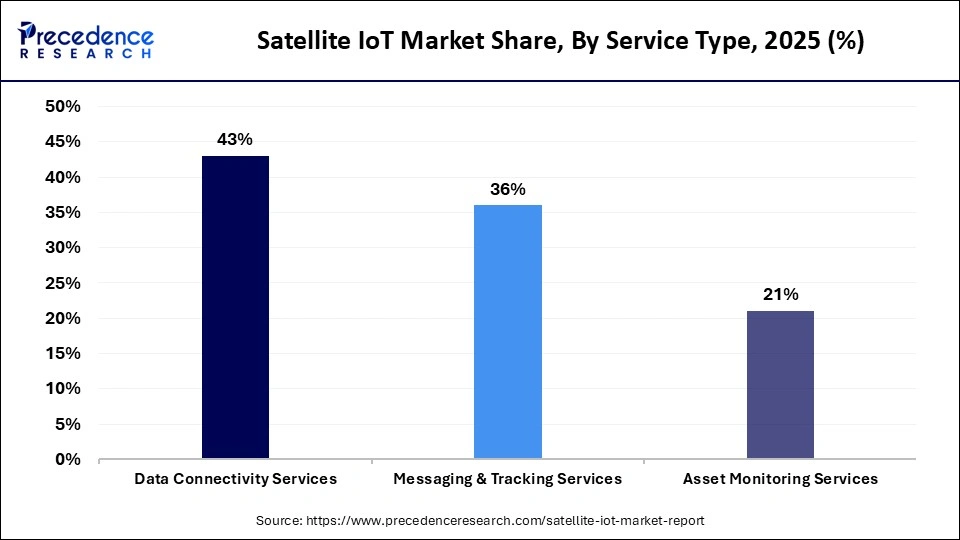

- By service type, the data connectivity services segment held the largest market share of 42.80% in 2025.

- By service type, the asset monitoring services segment is projected to grow at the fastest CAGR of 23.60% from 2026 to 2035.

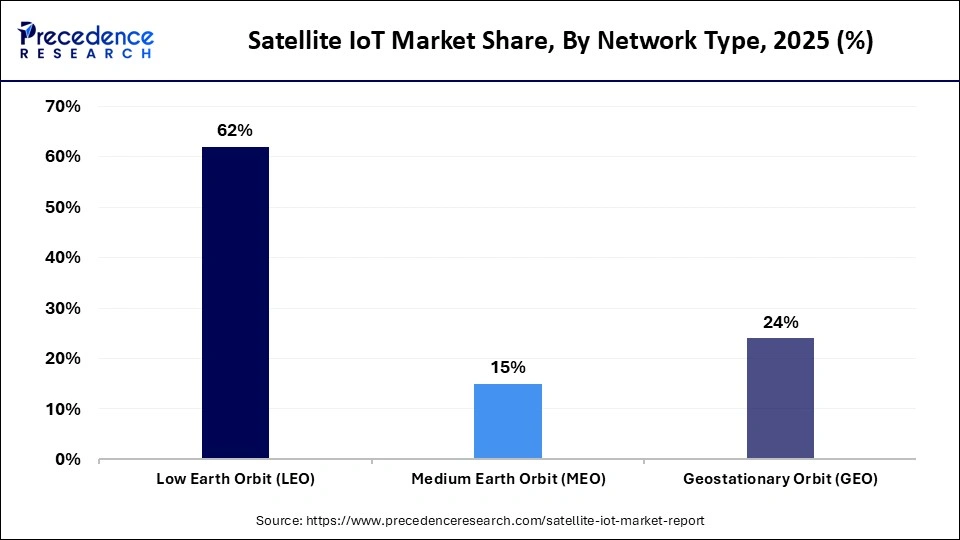

- By network type, the low earth orbit segment held the largest market share of 61.70% in 2025 and is set to grow at a 24.90% CAGR during the forecasted period.

- By network type, the medium earth orbit segment is projected to grow at the fastest CAGR of 14.80% from 2026 to 2035.

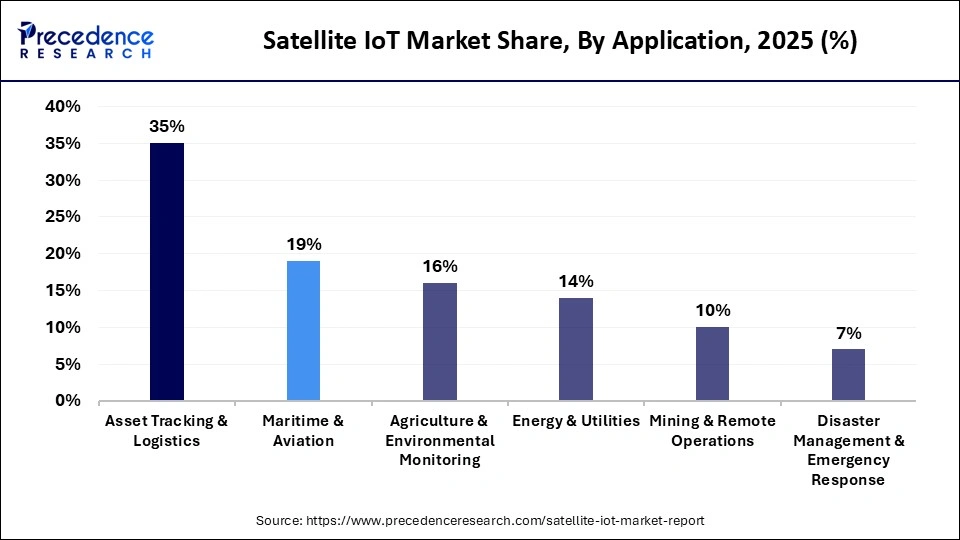

- By application, the asset tracking & logistics segment held the largest market share of 34.60% in 2025.

- By application, the disaster management & emergency recovery segment is projected to grow at the fastest CAGR of 24.10% from 2026 to 2035.

- By end user, the commercial enterprises segment held the largest market share of 39.40% in 2025.

- By end user, the agriculture & environmental agencies segment is projected to grow at the fastest CAGR of 23.80% from 2026 to 2035.

What is Satellite IoT?

Satellite IoT refers to the integration of satellite communication networks with Internet of Things devices to enable connectivity, tracking, and monitoring in locations where terrestrial networks are unavailable or unreliable. It relies on satellite architectures such as low Earth orbit and geostationary orbit to transmit small data packets from distributed sensors and devices across vast geographic areas.

Market growth is being accelerated by the shift from high-cost geostationary systems toward large-scale LEO constellations, which significantly reduce latency, lower operational costs, and improve coverage density. Satellite IoT is gaining strong traction across logistics, agriculture, environmental monitoring, maritime operations, defense, and remote asset management due to its ability to deliver continuous connectivity in remote and hard-to-reach regions.

Rising deployment of connected sensors in precision agriculture and supply chain monitoring is expanding commercial adoption. Growth in maritime and aviation tracking requirements is increasing demand for global, always-on connectivity. Integration of satellite IoT with cloud platforms and analytics tools is improving real-time decision-making. In parallel, declining launch costs and advances in small satellite manufacturing are supporting rapid scaling of satellite IoT networks worldwide.

AI Shifts in Satellite IoT Market

AI algorithms can seamlessly deploy on-satellite to process data in a more filtered way and prioritize and transmit only actionable and significant insights to the earth's ground station. AI-based systems can now analyze sensor data from satellites to predict potential challenges or device disconnection before they occur, which enhances the uptime and longevity of satellite assets. Also, AI is changing manual intervention to handle complex processes and enable machines to perform them more precisely than humans.

Machine learning models can be further utilized for enabling networks to automatically reroute traffic during network congestion or failure, which improves their reliability. AI algorithms also analyze user demand in real time to adjust network beams accordingly to leverage its highest potential.

Satellite IoT Market Trends

- The satellite IoT market is witnessing a rapid growth rate due to the emerging trend of 3GPP standards that allows terrestrial IoT devices to connect directly to satellites, which minimizes deployment barriers.

- The increasing deployment of low-cost, high-throughput satellites backed by launch vehicles like starship is offering low-latency coverage and reducing costs globally.

- The market is largely shifting towards combining cellular and satellite networks that enable seamless switching between networks for uninterrupted and huge coverage in underserved areas.

- Direct-to-device expansion is another trend where low-cost satellite IoT modules are enabling direct connectivity, which is highly feasible for SMEs in sectors like fisheries and agriculture to embrace satellite technology.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.82Billion |

| Market Size in 2026 | USD 2.26 Billion |

| Market Size by 2035 | USD 15.77Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 24.1% |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Network Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

Why Do Data Connectivity Services Dominate in the Satellite IoT Market in 2025?

The data connectivity services segment held the largest market share of 42.80% in the satellite IoT market during 2025 due to satellite services offering uninterrupted global coverage even in rural and underserved areas where terrestrial networks are difficult to achieve by filling the gaps to ensure any device can connect virtually anywhere across the globe. Also, satellite communications cannot be disturbed even by natural disasters, power outages, or infrastructure failures, making it a highly reliable option for data connectivity services. Satellite IoT solutions can be deployed easily without building new infrastructure or depends on fiber optics cable. Fueling the segment's growth on a large scale.

The asset monitoring services segment is projected to grow at the fastest CAGR of 23.60% during the foreseeable period due to the key benefits like enhanced security, compliance, robust support for remote operations, and cost-effectiveness at a scale that are highly crucial factors for asset monitoring services. The ‘always on' connectivity by satellite IoT system is facilitating the asset monitoring services even for crucial applications like environmental monitoring, remote monitoring of agricultural lands and offshore oil and gas platforms, and maritime monitoring.

Network Type Insights

What Are the Benefits Offered by the Low Earth Orbit Network in the Satellite IoT Market?

The low earth orbit segment held the largest market share of 61.70% in the satellite IoT market during 2025 and is expected to grow at the fastest CAGR of 24.9%, due to the key benefits like significantly minimized latency, wide area coverage, faster deployment at lower cost, and increased scalability for high data output. LEO satellites offer comprehensive coverage, enabling seamless IoT connectivity even for remote areas where cellular networks are unidentified. Due to the low altitude, IoT devices need less power to transmit signals that eventually extend the operational lifespan of remote sensors. It further facilitates the application of advanced IoT systems that need higher data throughput than conventional narrowband satellites.

The medium earth orbit segment is projected to grow at a notable rate during the foreseeable period, as they offer high-speed data transmission and stable connectivity for defense, maritime, and logistics sectors and cover a vast area at the same time. Medium Earth Orbit network type provides resilient and secure connectivity for crucial and mission-centric operations led by businesses and government sectors. Thus, MEO satellites are further used alongside GEO and LEO for hybrid networks to balance cost, performance, and overall coverage.

Application Insights

Why Do Asset Tracking & Logistics Dominate in the Satellite IoT Market During 2025?

The asset tracking & logistics segment held the largest market share of 34.60% in the satellite IoT market during 2025 as asset tracking and logistics sectors are heavily dependent on continuous visibility of high-value and mobile assets in remote areas, which is offered by satellite networks seamlessly. Various industries like shipping, mining, and heavy equipment transport deal with substantial amounts of assets require robust monitoring. Cellular networks are largely susceptible to power outages either by infrastructure failure or by natural disaster. But Satellite IoT provides highly resilient tracking across their entire supply chain, reducing the risk of loss or damage, leading to significant cost savings and enhanced efficiency.

The disaster management & emergency recovery segment is projected to grow at the fastest CAGR of 24.10% during the foreseeable period as satellite IoT systems are invaluable tools used in an emergency case by rescue teams by providing precise data in real-time for logistics, personal movements, and current environmental conditions. IoT sensors can monitor flood levels, structural integrity of infrastructure, and potential spread of wildfire, making it an integral part of the disaster management and emergency recovery sector as it further extends the functionality of existing broadcast and emergency communication systems with constant link transmission.

End User Insights

Why Is the Satellite IoT Market Seeing Dominant Growth in Commercial Enterprises?

The commercial enterprises segment held the largest share of 39.40% in the satellite IoT market during 2025 as these enterprises require seamless global connectivity to manage assets and operations in remote locations where cellular networks fall short of reaching. Commercial enterprises leverage satellite IoT for real-time data collection to streamline processes and reduce overall costs. Industries having hazardous distributed operations, satellite IoT offers reliable communication for safety protocols and emergency alerts. The development of mass production of LEO satellites has made this technology accessible and commercially viable for various enterprises and SMEs.

The agriculture & environmental agencies segment is projected to grow at the fastest CAGR of 23.80% during the foreseeable period as connectivity in remote areas, resource preservation, and enhanced operational efficiency are crucial for these sectors. Many farms and forests reside in underserved remote areas that require continuous monitoring with real-time data analysis to collect data about GHG emissions, air/water quality, and potential natural disasters. All these factors are essential for agriculture and environmental agencies that fuel the demand for satellite IoT in these sectors.

Regional Analysis

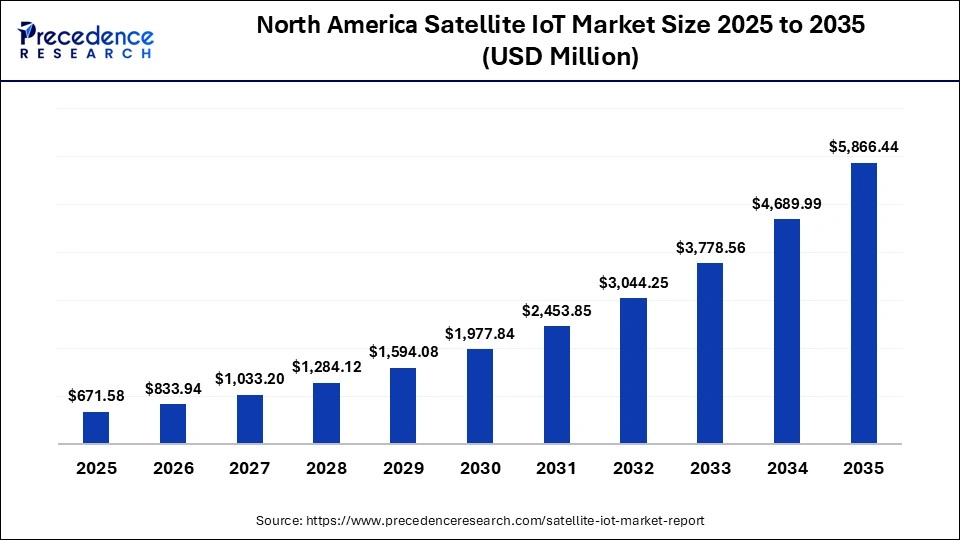

How Big is the North America Satellite IoT Market Size?

The North America satellite IoT market size is estimated at USD 671.58 million in 2025 and is projected to reach approximately USD 5.866.44 million by 2035, with a 24.2% CAGR from 2026 to 2035.

How Did North America Dominate in the Satellite IoT Market During 2025?

North America held the largest market share of 36.90% in 2025 due to a robust technology ecosystem, strong innovation capacity, strategic adoption of satellite IoT across key industries, and a supportive regulatory and funding environment.

Companies in North America are at the forefront of launching, developing, and operating large-scale LEO constellations, with players such as SpaceX and Amazon Kuiper enabling global satellite IoT connectivity. Integration of satellite connectivity directly into consumer electronics and industrial IoT devices is further accelerating adoption. Expansion of satellite hardware manufacturing, including user terminals, antennas, and AI-enabled edge processing tools, is strengthening end-to-end system performance and scalability.

Rising demand from logistics, defense, and remote infrastructure monitoring is sustaining high utilization of satellite IoT services. Strong collaboration between satellite operators, chipset vendors, and cloud service providers is improving interoperability and deployment speed. In parallel, continued public and private investment in space infrastructure is reinforcing North America's leadership in the satellite IoT market.

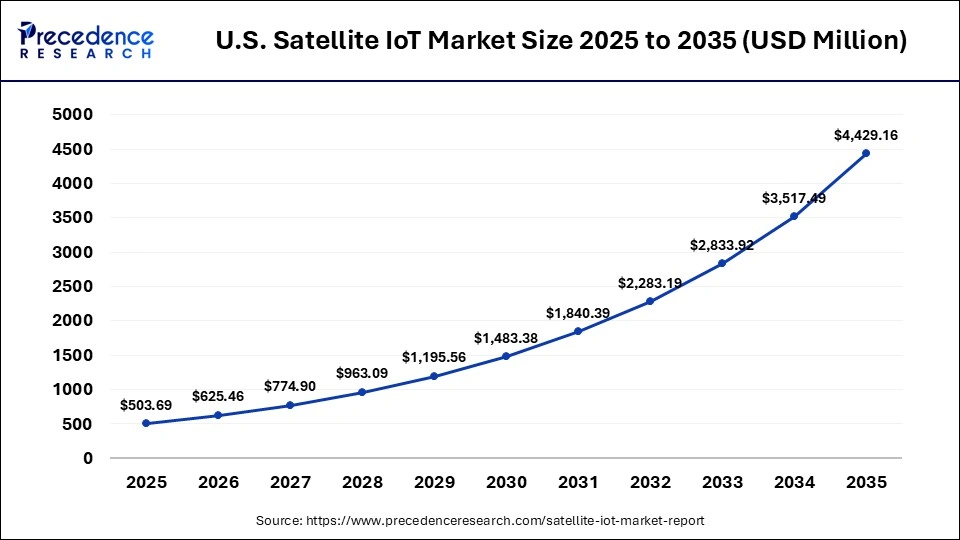

What is the Size of the U.S. Satellite IoT Market?

The U.S. satellite IoT market size is calculated at USD 503.69 million in 2025 and is expected to reach nearly USD 4,429.16 million in 2035, accelerating at a strong CAGR of 24.28% between 2026 and 2035.

U.S. Satellite IoT Market Trends

The U.S. satellite IoT market is shaping majorly due to the key trends like the integration of cellular networks like LE/M and NB-IoT to offer ‘always on; coverage to enable the ‘best of both worlds' approach. The growing standardization of adoption of 3GPP NTN standards to allow IoT devices to connect to satellites by reducing the need for expensive hardware is another crucial factor for the region's growth. A major push for the connection of smartphones directly to satellite networks is witnessing a rapid surge in the U.S. for emergency services, fueling the market's growth on a large scale.

What Factors Will Drive the Asia Pacific Satellite IoT Market In Coming Years?

Asia Pacific is projected to grow at the fastest CAGR of 24.50% during the foreseeable period due to the major factors like the increasing demand for connectivity in hard-to-reach areas and underserved and naturally challenged areas that can be utilized for industrialization, along with the rising adoption of smart agriculture, transportation, supply chain, and remote monitoring, which boosts the demand for satellite IoT connections on a large scale.

The increasing number of satellite launches and regional partnerships between key players and satellite service providers to enhance their service quality and transparency are creating avenues in the satellite IoT sector. Government is also supporting the adoption of seamless connectivity to promote digital inclusion and infrastructure development, further boosting the market growth in Asia pacific.

China Satellite IoT Market Analysis

The region is witnessing a rapid growth rate due to the government support for technological advancements and its adoption to stay highly competitive in the market, along with rapid LEO expansion and emerging demand for environmental monitoring and development of smart cities. maritime and logistics are the largest sectors in China leveraging satellite IoT connectivity.

For instance, in January 2026, China further showed their national interest and strategies to expand in space technology by filing an ITU aiming to put nearly 200,000 satellites into orbit. It majorly comes from a new joint government-industry body known as the ‘Radio Spectrum Development and Technology Innovation Institute.'

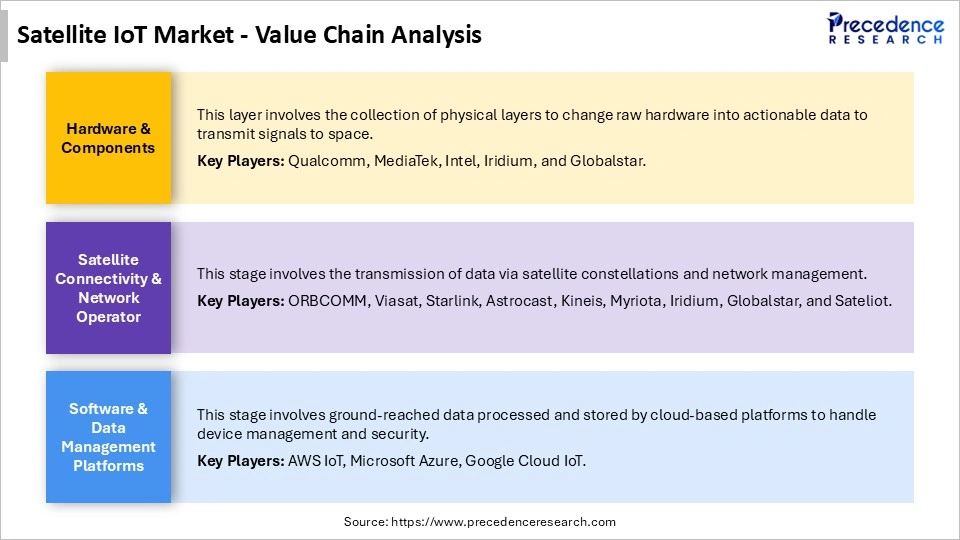

Satellite IoTMarket Value Chain Analysis

Who are the Major Players in the Global Satellite IoT Market?

The major players in the satellite iot market include SpaceX (Starlink), Iridium Communications, ORBCOMM, Astrocast, Myriota, Skylo Technologies, Kepler Communications, Hiber / Astrocast (merged service), Sateliot, Kinéis

Recent Developments

- In November 2024, China launched a commercial trial of satellite IoT services that will stay up to two years, aiming to offer a healthy and supportive environment for the aerospace sector's expansion and support other industries with a low-altitude economy.(Source: https://www.yicaiglobal.com)

- In October 2025, Tele2 IoT, a Swedish operator, launched a new global satellite IoT connectivity service in a collaboration with Skylo. Tele2 is popular for providing the first 3GPP-based direct-to-device satellite IoT solution.(Source: https://www.skylo.tech)

Segments Covered in the Report

By Service Type

- Data Connectivity Services

- Messaging & Tracking Services

- Asset Monitoring Services

By Network Type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

By Application

- Asset Tracking & Logistics

- Maritime & Aviation

- Agriculture & Environmental Monitoring

- Energy & Utilities

- Mining & Remote Operations

- Disaster Management & Emergency Response

By End User

- Commercial Enterprises

- Government & Defense

- Transportation & Logistics Operators

- Energy & Utility Companies

- Agriculture & Environmental Agencies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content