What is the Scrap Metal Recycling Market Size?

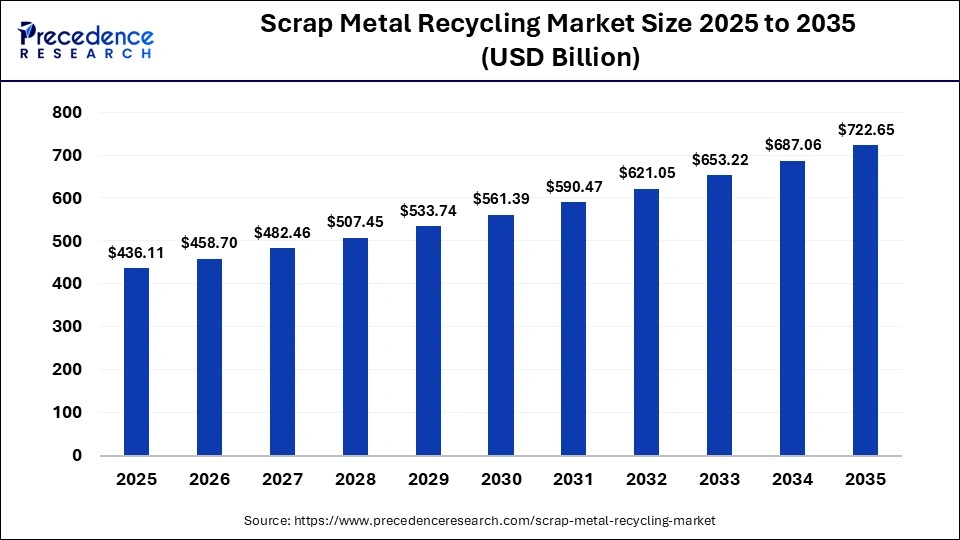

The global scrap metal recycling market size accounted for USD 436.11 billion in 2025 and is predicted to increase from USD 458.70 billion in 2026 to approximately USD 722.65 billion by 2035, expanding at a CAGR of 5.18% from 2026 to 2035. The scrap metal recycling market is growing due to increasing demand for sustainable materials, rising metal prices, and global efforts to reduce environmental impact.

Market Highlights

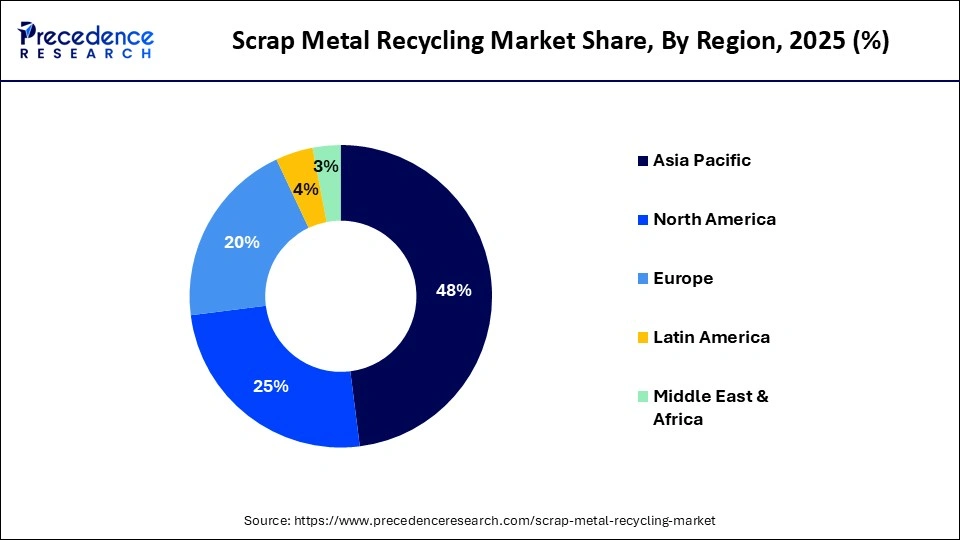

- Asia Pacific dominated the global scrap metal recycling market with a share of approximately 48% in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

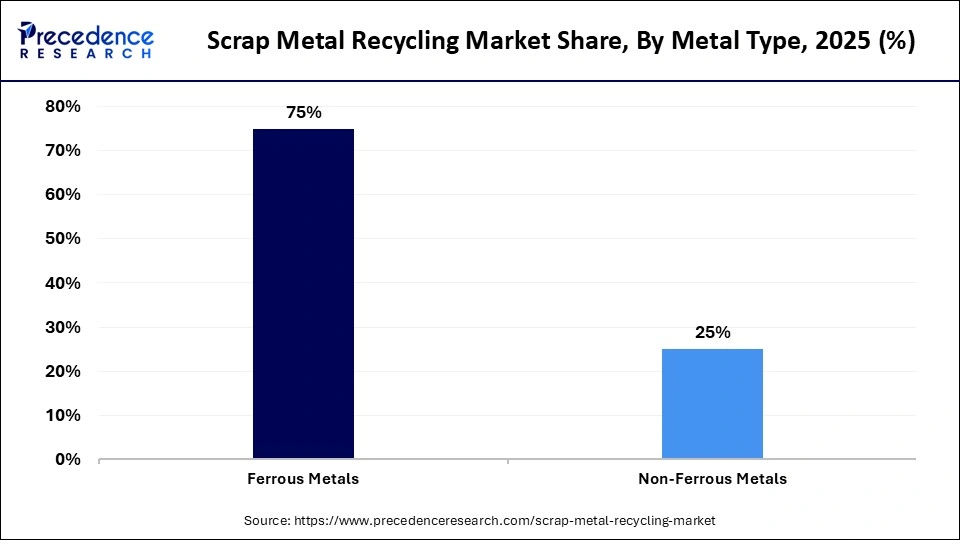

- By metal type, the ferrous metals segment generated the biggest market share of approximately 75% in 2025.

- By metal type, the non-ferrous metals segment is expected to expand at the fastest CAGR of 4.6% between 2026 and 2035.

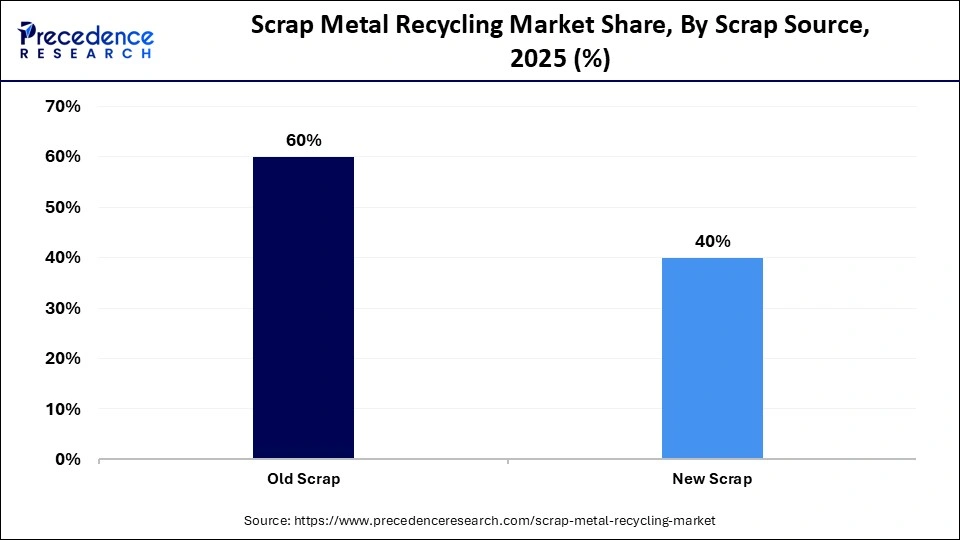

- By scrap source, the old scrap segment contributed the highest market share of approximately 60% in 2025 and is expected to sustain the position during the forecast period.

- By scrap source, the new scrap segment is expected to witness significant growth in the market over the forecast period.

- By end-use industry, the building and construction segment held a major market share of approximately 38% in 2025.

- By end-use industry, the automotive segment is expected to expand at the fastest CAGR of 4.7% from 2026 to 2035.

What is the Scrap Metal Recycling Market?

The market involves the collection, processing, and reuse of discarded metal materials, including ferrous (iron/steel) and non-ferrous (aluminum, copper, etc.) metals, into raw materials for manufacturing industries. Recycling reduces landfill use, conserves resources, and lowers energy consumption compared to primary metal production.

The market is witnessing rapid growth as businesses look for affordable and sustainable sources of metals. This trend is driven by rising metal prices, more stringent environmental laws, and high demand from the manufacturing and construction industries. Furthermore, metal recovery is becoming increasingly profitable and efficient due to advancements in recycling technologies. As a result, both companies and investors can profit from this ecosystem.

How is AI Transforming the Scrap Metal Recycling Market?

Artificial Intelligence (AI) is revolutionizing the scrap metal recycling industry by enhancing efficiency, accuracy, and profitability. AI-powered sorting systems can identify and separate metals faster and with higher precision than traditional methods, reducing waste and operational costs. Predictive analytics help recycling companies optimize supply chains, forecast metal demand, and improve pricing strategies. Leading players are also using AI-driven robotics to automate labor-intensive processes, making recycling safer and more consistent. This technological shift is creating smarter, more sustainable recycling operations worldwide.

Scrap Metal Recycling Market Trends

- Environmental Sustainability: Growing focus on sustainability and the circular economy is increasing the use of recycled metals over virgin materials.

- Technological Advancements: Rapid adoption of AI, automation, and advanced sorting technologies is improving efficiency and metal recovery rates.

- Electric Arc Furnaces: Rising use of electric arc furnaces (EAFs) is boosting demand for scrap-based steel production.

- Growing Adoption in Various Sectors: Non-ferrous metal recycling (aluminum, copper) is expanding due to demand from EVs, electronics, and packaging industries.

- Government Regulations: Stricter environmental regulations and government incentives are encouraging recycling investments.

- Rising Industrial Demand: Increasing infrastructure and construction activities, especially in emerging economies, are driving scrap metal consumption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 436.11 Billion |

| Market Size in 2026 | USD 458.70 Billion |

| Market Size by 2035 | USD 722.65 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.18% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Metal Type, Scrap Source, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Metal Type Insights

Why the Ferrous Metals Segment Dominated the Scrap Metal Recycling Market?

The ferrous metals segment led the market, holding approximately 75% share in 2025, due to their widespread application in the manufacturing, construction, and automotive sectors. Steel and iron are the foundation of the scrap metal recycling industry because they are highly recyclable, reasonably priced, and widely accessible. They are perfect for major infrastructure projects due to their high strength and durability, which guarantees consistent demand in both developed and emerging economies.

The non-ferrous metals segment is expected to be the fastest-growing segment with a CAGR of 4.6%, driven by the need for zinc, copper, and aluminum in high-value applications, such as electronics and transportation industries. They are becoming increasingly popular in contemporary industries due to their lightweight and corrosion-resistant qualities. Furthermore, the use of non-ferrous metals in specialized manufacturing is increasing due to the growing demand for electric cars and renewable energy systems.

Scrap Source Insights

How the Old Scrap Segment Dominated the Scrap Metal Recycling Market?

The old scrap segment dominated the market with a share of approximately 60% in 2025 and is expected to remain dominant in the upcoming years, fueled by environmental regulations, the growing value of recovery metals from end-of-life products, and growing awareness of sustainability. Programs for collection and recycling are being implemented by both the public and private sectors, which is speeding up the availability and utilization of old scrap. By reducing waste and optimizing resource use, this trend also helps circular economy initiatives.

The new scrap segment is projected to expand rapidly in the market in the coming years, because it is of better quality than old scrap and is simpler to process. It guarantees constant metal purity and reduces contamination. Industrial recyclers find it very appealing. Industries favor new scrap to preserve production efficiency and lessen dependency on the extraction of raw ore.

End Use Industry Insights

Which End-Use Segment Dominated the Scrap Metal Recycling Market?

The building and construction segment held the largest revenue share of approximately 38% in 2025, due to the steady need for steel and other ferrous metals in urban development and infrastructure projects. Construction activity is rising due to urbanization and population growth, which in turn fuels the demand for scrap metal. Recycled metals are also used in large-scale residential and commercial projects to achieve cost and environmental sustainability objectives.

The automotive segment is expected to grow rapidly in the market with a CAGR of 4.7%, as producers increasingly use recycled metals to cut expenses, fulfill sustainability goals, and abide by legal requirements. High-quality recycled metals are in high demand due to the growth in electric vehicle production and lightweight vehicle designs. The carbon footprint of car manufacturing is also greatly decreased by automotive recycling.

Regional Insights

What is the Asia Pacific Scrap Metal Recycling Market Size?

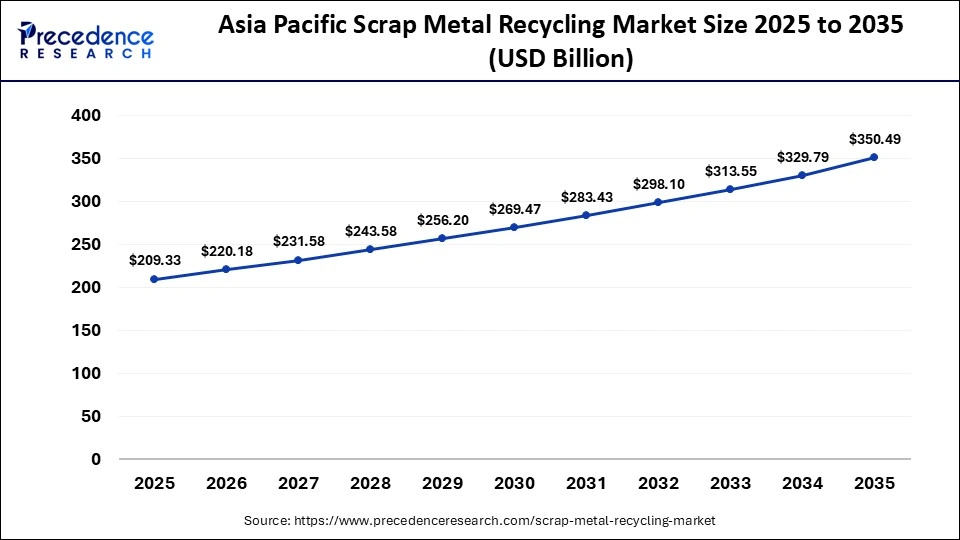

The Asia Pacific scrap metal recycling market size is expected to be worth USD 350.49 billion by 2035, increasing from USD 209.33 billion by 2025, growing at a CAGR of 5.29% from 2026 to 2035.

Why Did Asia-Pacific Dominate the Scrap Metal Recycling Market?

Asia-Pacific held a major revenue share of approximately 48% in the market, due to rapid urbanization, industrialization, and massive infrastructure projects in nations like China and India. The demand for recycled metals is further strengthened by the region's growing manufacturing base and intense construction activity. Furthermore, investments in cutting-edge recycling facilities are being driven by government policies that support environmental sustainability.

India Market Trends

India is a key player in the market, gaining from extensive infrastructure development, rapid urbanization, and industrialization. Ferrous metals are in high demand due to the nation's manufacturing and construction industries, while that for non-ferrous metal recycling is boosted by the expanding automotive and electronics sectors. The Indian government is at the forefront of supporting metal recycling through strategic initiatives. It has earned over Rs 4,088 crore in five years by disposing of scrap from central government offices.

Which is the Fastest-Growing Region in the Scrap Metal Recycling Market?

North America is expected to be the fastest-growing region in the forthcoming years, due to improvements in technology, strict environmental laws, and a growing emphasis on circular economy strategies. Growing consumer and industrial awareness of sustainable metal use also contributes to growth. North America is increasing productivity, cutting expenses, and increasing metal recovery rates thanks to investments in AI and automated recycling technologies.

U.S. Market Trends

The U.S. holds a major market share in North America, driven by stringent environmental laws, advances in technology, and the growing acceptance of circular economy models. The U.S. is home to about 508 businesses involved in scrap metal recycling. Investments in robotics, automated recycling, and AI-driven sorting are increasing productivity and metal recovery rates. Additionally, the growing awareness of sustainability is encouraging end-of-life product collection and recycling.

- For instance,The U.S. Department of Energy (DOE) has established the “Battery Recycling, Reprocessing, and Battery Collection Funding Opportunity” program with a $125 million investment to enhance consumer participation in battery recycling programs and improve the economics of consumer battery recycling.

Will Europe Grow in the Scrap Metal Recycling Market?

Europe is expected to grow at a notable CAGR in the upcoming years, driven by favorable government support and growing awareness of metal recycling. The European nations collectively produce approximately 56% of steel from around 100 million tonnes of scrap steel recycled annually. The burgeoning construction and automotive industries in the region potentiate the demand for metal scrap. The increased import tariffs encourage the EU to strengthen domestic metal recycling, thereby reducing reliance on metal imports.

- For instance,The EU launched the Critical Raw Materials Act to reduce the dependency on critical raw materials and to direct attention towards the value chain. As part of the law, at least 15% of the annual consumption should come from recycling by 2030.

Belgium Market Trends

Belgian Scrap Terminal, Recycling International, and GJR Metal Group are some major metal recyclers in Belgium. The Belgian Scrap Terminal accounts for 1.5 million metric tonnes of metal processing annually across eight facilities in Belgium, France, and Luxembourg. The company exports over 90% of its output to companies outside the EU. In addition, of the 34 critical raw materials identified by the EU, about 15 are produced in Belgium, including by means of recycling.

Who are the Major Players in the Global Scrap Metal Recycling Market?

The major players in the scrap metal recycling market include Nucor Corporation, Sims Metal Management/Sims Limited, Schnitzer Steel Industries, Commercial Metals Company (CMC), Steel Dynamics Inc., European Metal Recycling, Aurubis AG, ArcelorMittal S.A, Tata Steel Limited, Gerdau S.A., Alter Trading Inc., American Iron & Metal, LIBERTY Steel Group, Radius Recycling/Toyota Tsusho (post-acquisition), and SA Recycling LL.

Recent Developments

- In October 2025, JSW Steel announced plans to open a scrap processing facility in Chennai, India, to source and recycle scrap from various sources. The company invested Rs 23 crore for the facility to recycle metals from automobile and white goods manufacturers for its steel-making plants.(Source: https://www.thehindubusinessline.com)

- In September 2025, Aurubis AG launched the multimetal recycler and began the 2026 expansion phase of its Aurubis Richmond facility in Georgia, U.S. The expansion was designed to process up to 180,000 tonnes of complex recycling materials like circuit boards and copper cables annually to recover strategic metals.(Source: https://www.aurubis.com)

Segments Covered in the Report

By Metal Type

- Ferrous Metals

- Non-Ferrous Metals

By Scrap Source

- Old Scrap

- New Scrap

By End-Use Industry

- Building and Construction

- Automotive

- Equipment Manufacturing

- Consumer Appliances/Goods

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting