What is the Security Analytics Market Size?

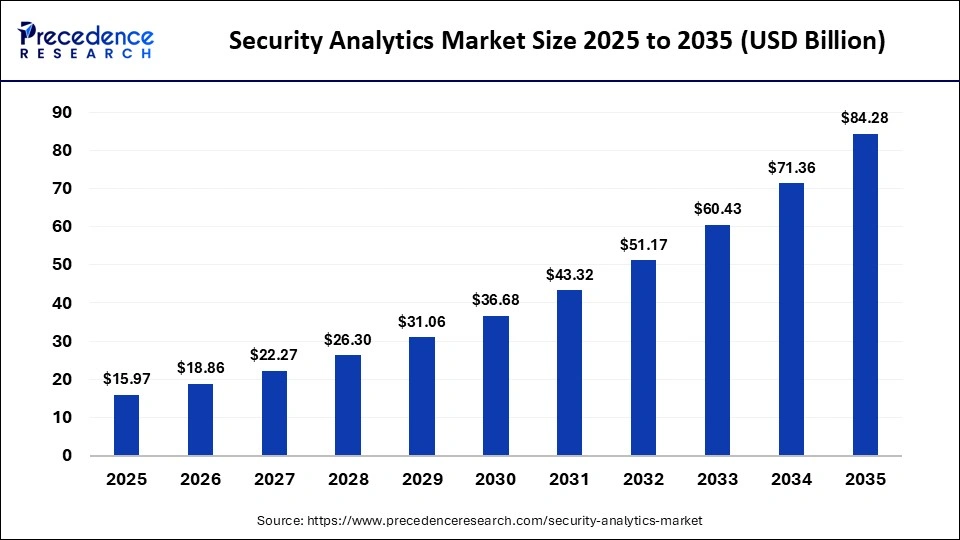

The global security analytics market size was calculated at USD 15.97 billion in 2025 and is predicted to increase from USD 18.86 billion in 2026 to approximately USD 84.28 billion by 2035, expanding at a CAGR of 18.10% from 2026 to 2035.The security analytics market is driven by the growing demand for increasing number of cyber threats, adoption of cloud and digital technologies and the need for real time threat detection and incident response.

Market Highlights

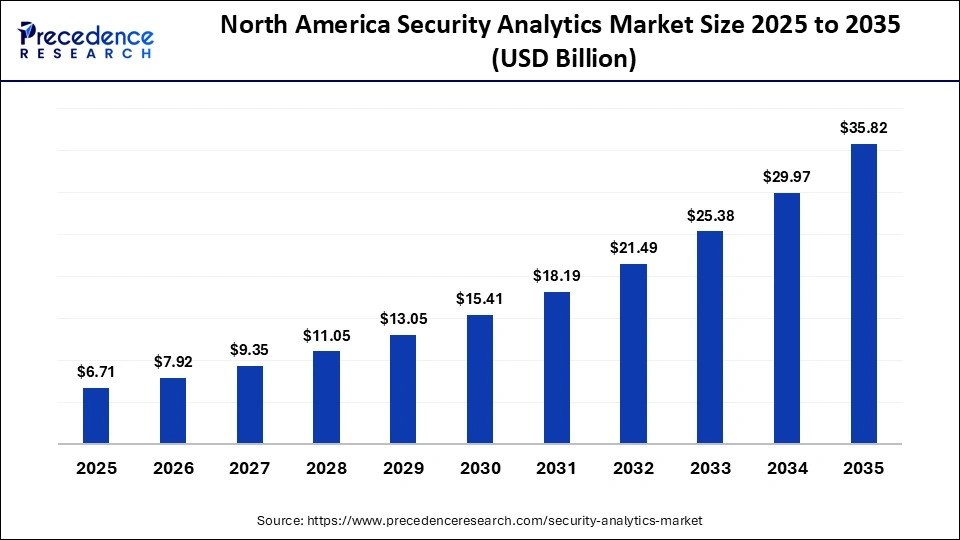

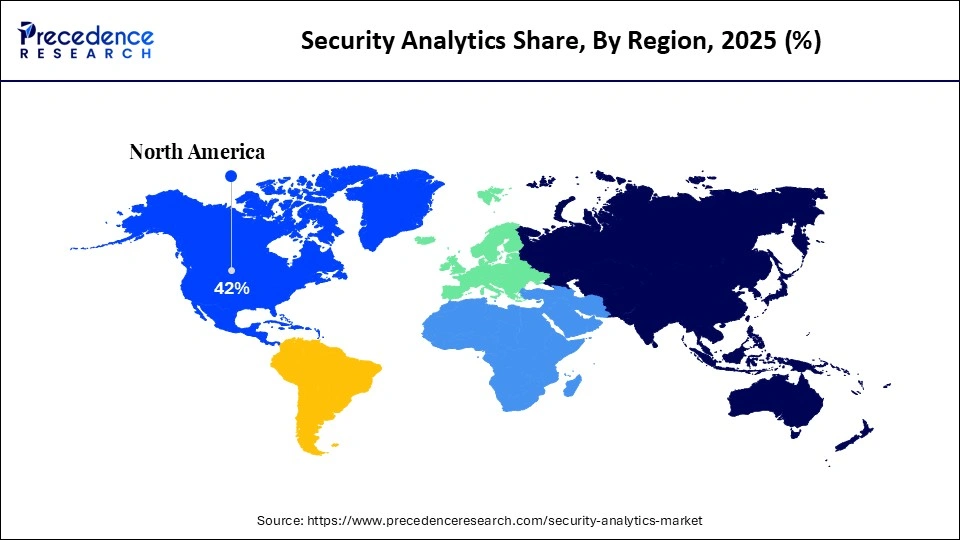

- North America led the security analytics market with the largest share of 42% in the global market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR of 18.5% during the forecast period.

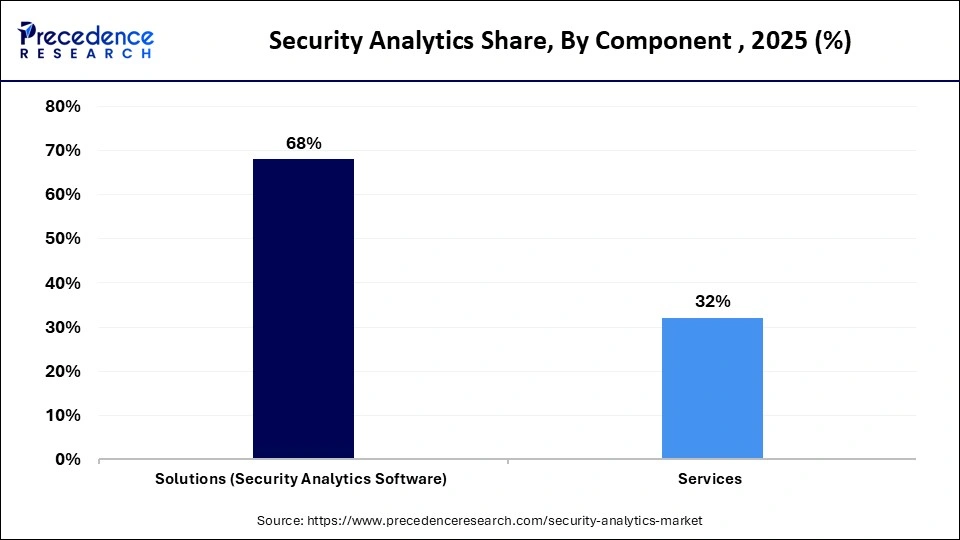

- By component type, the solutions segment led the market and held approximately 68% share in 2025.

- By component type, the services segment is expected to grow at the highest CAGR of 16.6% during the forecast period.

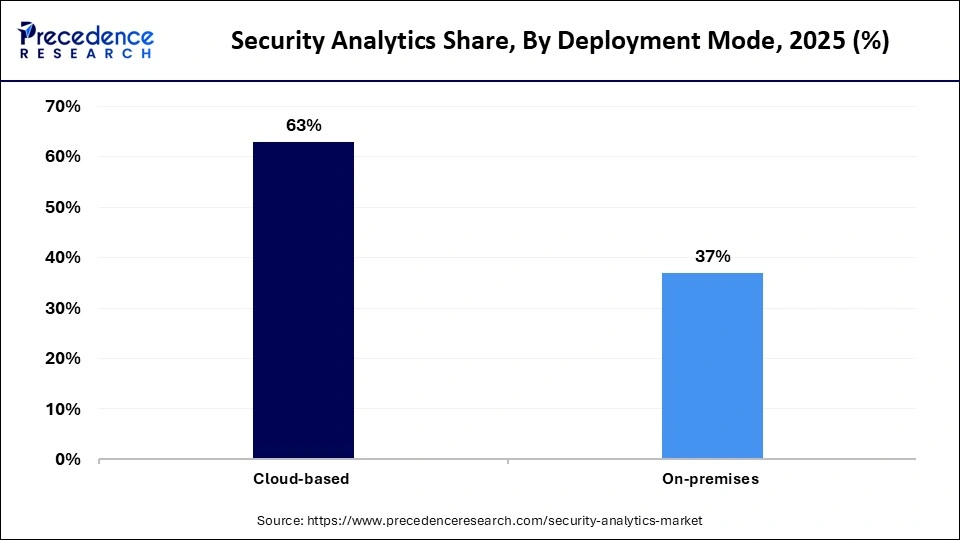

- By deployment type, the cloud-based segment dominated the market with approximately 63% share in 2025.

- By deployment type, the on-premises segment is expected to grow at a notable CAGR between 2026 and 2035.

- By application type, the network security analytics segment led the market and captured 37% share in 2025.

- By application type, the cloud security segment is expected to expand at the highest CAGR of 16.5% from 2026 to 2035.

- By industry type, the BFSI segment led the market with approximately 52% share in 2025.

- By industry type, the healthcare segment is expected to expand at the highest CAGR of 17% from 2026 to 2035.

What is the Security Analytics Market?

The Security Analytics Market involves solutions and services that collect, analyze, and correlate security data from networks, endpoints, applications, and cloud environments to detect threats, anomalies, and breaches in real time. Integrating machine learning, artificial intelligence, and behavioral analytics, security analytics enhances visibility into cyber risks and supports automated incident response. It's critical for risk management, compliance, fraud detection, and proactive cybersecurity across enterprises facing evolving digital threats globally.

How is AI contributing to the Security Analytics Market?

AI is transforming the security analytics industry by providing real time analysis of large security data sets to identify threats, anomalies and malicious activities much faster than traditional methods. Machine learning and predictive analytics help AI detect patterns that indicate possible cyber threats. AI also carries out incident response actions such as segregating compromised systems and blocking malicious traffic. Artificial Intelligence is making security analytics more proactive, accurate and resilient against sophisticated cyber threats.

Security Analytics Market Trends

- Collaborations & Partnerships: Security solutions provider companies are establishing strategic partnerships with cloud service companies and cybersecurity firms to enhance AI powered threat analysis. These collaborations facilitate real time threat prediction by drawing crucial insights from data stored in cloud servers. For instance, Google Cloud collaborated with Mandiant to integrate advanced threat intelligence and analytics capabilities with Google security operations.

- Government Initiatives: Governments are investing in the development of advanced cybersecurity platforms to safeguard critical infrastructure, defense systems and public sector databases. These efforts emphasize the need for centralized monitoring and rapid threat response. For instance, U.S Department of Defense(DoD) enhanced the Joint Cyber Defense Collaborative(JCDC) analytics capabilities to improve threat prevention, network visibility and joint cybersecurity for federal agencies and private sector partners.

- Business Expansions: Companies offering digital security solutions are expanding their offering to integrate AI and cloud data storage facilities to enhance data monitoring and malicious software detection. For instance, CrowdStrike has expanded its Falcon platform by improving AI-based security analytics and cloud-based threat intelligence infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.97Billion |

| Market Size in 2026 | USD 18.86 Billion |

| Market Size by 2035 | USD 84.28Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Application Type, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insight

Component Type Insight

Why Did the Solutions Segment Dominate the Security Analytics Market?

The solutions segment led the market and held approximately 68% share in 2025. The market growth of this segment can be attributed to the growing demand for platforms that can be deployed rapidly and are capable of threat detection, analyzing large amount of data and neutralizing the threat in real time. This segment provides comprehensive functionalities like behavior monitoring, log analysis and incident response in a unified paradigm. The market growth of this segment is further driven by rising number of cyberattacks, cloud adoption and government regulations regarding digital safety.

The services segment is expected to grow at the highest CAGR of 16.6% during the forecast period. The market growth of this segment is due to growing number of organizations that are seeking external expertise to help them deal with their sophisticated IT environments. The increasing adoption of cloud and rising threat levels are boosting demand for consulting, integration, managed services and continuous monitoring. This segment facilitates companies to optimize their technology platforms, stay compliant and have real time threat protection.

Deployment Type Insight

Why Did the Cloud-Based Segment Dominate the Security Analytics Market?

The cloud-based segment dominated the market with approximately 63% share in 2025. The market growth of this segment is because it facilitates scalable analysis of large data streams without the need for heavy infrastructure. Companies prefer cloud platforms due to faster deployment and flexible pricing. This segment provides solutions to effectively manage network traffic and remote users. The accuracy of anomaly detection in this segment is enhanced by the integration of AI algorithms. The adoption of this segment in large organizations is accelerated by its support for hybrid and multi-cloud environments.

The on-premises segment is expected to grow at a notable CAGR between 2026 and 2035. The market growth of this segment is due to rising trend of wielding direct control over data and infrastructure in various companies. Government organizations and certain industries require on-premises deployment to meet the stringent privacy and audit requirements. This segment is compatible with customization and existing infrastructure. The market growth of this segment is driven by growing emphasis by various governments on national cybersecurity and protection of sensitive data.

Application Type Insight

Why Did the Network Security Analytics Segment Dominate the Security Analytics Market?

The network security analytics segment led the market and captured 37% share in 2025. The market growth of this segment can be attributed to the growing emphasis of organizations on data traffic optimization and threat detection at the network level. The rising levels of data flow on cloud platforms, data centers and remote devices generate a need for continuous visibility. These tools facilitate early detection of intrusions, malware and unusual communication patterns. This segment is being widely adopted in various organizations as it helps safeguard hybrid networks and vital infrastructure.

The cloud security segment is expected to expand at the highest CAGR of 16.5% from 2026 to 2035. The market growth of this segment can be attributed to rapid adoption of cloud technologies by businesses and governments for their core functions. There is a need for constant monitoring of workloads, user access and data activity. This segment facilitates early detection of misconfigurations and suspicious activity. The government regulations regarding cybersecurity are becoming more stringent resulting in widespread adoption of cloud-based security solutions in various organizations.

Industry Type Insight

Why Did the BFSI Segment Dominate the Security Analytics Market?

The BFSI segment led the market with approximately 52% share in 2025. The market growth of this segment is because of its essential need to safeguard financial systems and customer trust. Banks, insurance companies and payment service providers constantly handle high value transactions. These operations are prone to disruptions and malicious attacks which can lead to significant financial losses to the organization. The market growth of this segment is further driven by growth of digital banking and mobile payments which require constant monitoring to avoid monetary thefts.

The healthcare segment is expected to expand at the highest CAGR of 17% from 2026 to 2035. The market growth of this segment can be attributed to rapid adoption of digital platforms for patient records and healthcare operations. The use of connected devices and hospital networks requires the integration of security technologies for data safety. The market growth of this segment is further driven by government regulations on data privacy and rising number of cyberattacks on hospital databases.

Regional Insights

How Big is the North America Security Analytics Market Size?

The North America security analytics market size is estimated at USD 6.71 billion in 2025 and is projected to reach approximately USD 35.82 billion by 2035, with a 18.23% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Security Analytics Market?

North America led the security analytics market with the largest share of 42% in the global market in 2025. The market growth in this region is due to widespread adoption of sophisticated cyber defense solutions. This region has a significant presence of prominent information technology companies which invest in security analytics solutions. There have been incidents of cyberattacks on finance, healthcare and government sectors which leads to significant budget allocation for data and network security. The regulatory norms emphasize robust monitoring and reporting capabilities.

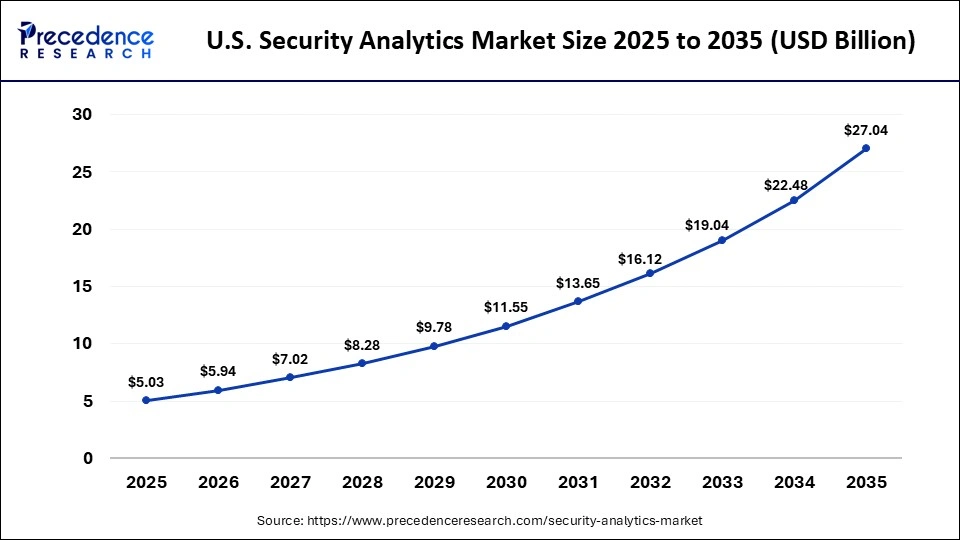

What is the Size of the U.S. Security Analytics Market?

The U.S. security analytics market size is calculated at USD 5.03 billion in 2025 and is expected to reach nearly USD 27.04 billion in 2035, accelerating at a strong CAGR of 18.32% between 2026 and 2035.

U.S Security Analytics Market Analysis

U.S leads the market in North America due to its emphasis on national cybersecurity and large scale digital infrastructure. The government is actively investing in monitoring and threat detection platforms. This country has presence of prominent cybersecurity and technology companies. The high level of exposure to cyber threats in the finance, defense, healthcare and energy industries is accelerating the market adoption. The market growth in this country is further driven by strict regulatory norms and rapid adoption of cloud technology.

Why is Asia Pacific the Fastest Growing Region in the Security Analytics Market?

Asia-Pacific is expected to grow at the highest CAGR of 18.5% during the forecast period. The market growth in this region is due to rapid digital transformation in businesses and government services. Cloud computing and smart infrastructure are expanding in this region which leads to increased amount of sensitive data and network traffic. This leads to a need for improved visibility and faster threat detection. Governments are enforcing stricter cybersecurity policies and country specific frameworks.

China Security Analytics Market Trends

China leads the market in Asia Pacific because of its large scale digital economy and comprehensive cloud and network infrastructure. Government has invested in smart cities, industrial digitalization and data centers. The government regulations regarding data protection and cyber resilience accelerate the market adoption. The market growth in this country is further driven by government investments in enhancing national cybersecurity.

Who are the Major Players in the Global Security Analytics Market?

The major players in the security analytics market include IBM Corporation, Cisco Systems, Inc.,Splunk, Inc., RSA Security LLC, McAfee, LLC, Fortinet, Inc., Palo Alto Networks, Broadcom Inc. (Symantec), Securonix, Inc., Exabeam, Inc,. LogRhythm, Inc., Rapid7, Inc, Trend Micro Incorporated, Check Point Software Technologies Ltd., HP Enterprise Company

Recent Developments

- In March 2025, Red Canary launched enhanced Security Data Lake which assists companies in processing and analyzing massive amounts of logs and telemetry data without the expense and complexity of a traditional SIEM solution. This product has built-in indexing and analytics capabilities to enable rapid detection of anomalies and suspicious patterns.

- In October 2025, NETSCOUT launched KlearSight Sensor which enhances visibility in cloud-native applications running on Kubernetes and microservices. This product aims to address the decoding of encrypted network traffic and performance information. This product integrates telemetry data with advanced analytics to facilitate security analysts better comprehend the data.

- In October 2025, Sophos launched Identity Threat Detection and Response(ITDR) solution which emphasizes identity based risk protection. This product integrates continuous behavior, access and credential misuse monitoring. ITDR facilitates the detection of lateral movement, privilege escalation and other identity based attack methods.

Segments Covered in This Report

By Component

- Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Application Type

- Network Security Analytics

- Endpoint Security Analytics

- Application Security Analytics

- Web Security Analytics

- Cloud Security Analytics

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Healthcare

- IT & Telecom

- Government & Defense

- Retail & E-commerce / Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting