What is the Serverless Computing Market Size?

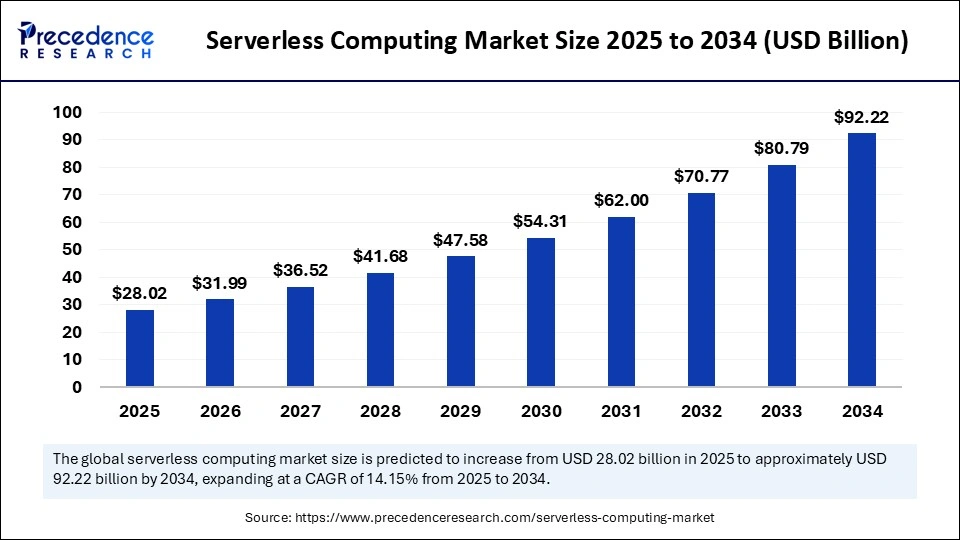

The global serverless computing market size is calculated at USD 28.02 billion in 2025 and is predicted to increase from USD 31.99 billion in 2026 to approximately USD 92.22 billion by 2034, expanding at a CAGR of 14.15% from 2025 to 2034. Growth in the market for serverless computing is attributed to the increasing adoption of cloud-native architectures, real-time data processing requirements, and the rising demand for cost-efficient, scalable, and event-driven computing solutions.

Serverless Computing Market Key Takeaways

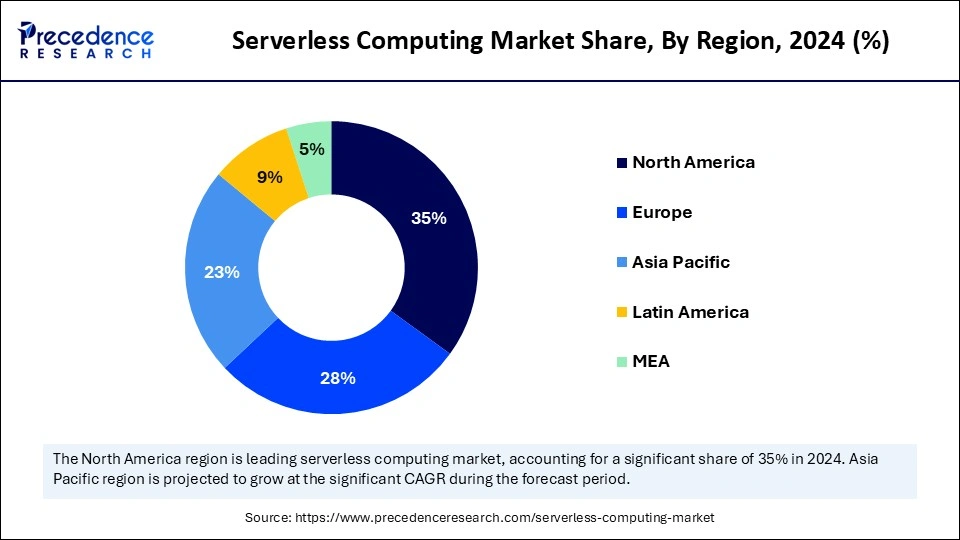

- North America dominated the global serverless computing market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By service model, the function-as-a-service segment held the biggest market share of 65% in 2024.

- By service model, the backend-as-a-service (BaaS) segment is projected to grow at the highest CAGR from 2025 and 2034.

- By deployment model, the public cloud segment contributed the highest market share of 70% in 2024.

- By deployment model, the hybrid cloud segment is expanding at a significant CAGR between 2025 and 2034.

- By enterprise size, the large enterprise segment held the major market share of 60% in 2024.

- By enterprise size, the SMEs segment is expected to grow at a significant CAGR over the projected period.

- By end-use industry, BFSI & IT/telecom segment generated the major market share of 55% in 2024.

- By end-user industry, the healthcare & retail/ecommerce segment is expected to grow at a notable CAGR from 2025 to 2034.

Market Overview

The increasing need to drive cost optimization is likely to drive more adoption of products from the serverless computing market among industries that are moving off traditional infrastructure. This technology employs a functions-as-a-service model, and the applications are executed in ephemeral environments triggered by specific events, eliminating the need for server management. This provides developers with the flexibility to focus solely on the application logic, while providers, including AWS, Microsoft Azure, and Google Cloud, handle the scaling, runtime, and security operations on their behalf. (Source: https://www.cncf.io/announcements)

The Cloud Native Computing Foundation (CNCF) 2024 Annual Survey has found that 89% of enterprises are now operating cloud-native technologies, and 60% are actively deploying CI/CD pipelines, which is the perfect ecosystem to accelerate serverless growth. In the World Economic Forum (WEF) 2024 Future of Digital Economy Report, the authors underlined that serverless technologies lower entry-level costs. This allows small and medium businesses to quickly achieve innovation cycles by reducing entry barriers. Furthermore, the increasing demand for real-time processing of data is expected to reinforce expansion in the serverless computing market, as companies are adopting low-latency, event-driven data processing models to enable logistics, smart city initiatives, and mission-critical services.(Source:https://www.weforum.org)

Impact of Artificial Intelligence on the Serverless Computing Market

Artificial intelligence has a profound impact on the development trend of the serverless computing market since it adds more efficiency, agility, and intelligence to the cloud-native world. Furthermore, the AI-based tools are specially designed to take observations, helping enterprises identify anomalies and increase system reliability in a way that makes the use of serverless more appealing to mission-critical workloads. AI-powered sentiment analysis provides insights into evolving preferences for organic, cold-pressed, or sustainably sourced oils, helping companies adapt quickly. Quality control has been strengthened through AI-enabled sensors and computer vision systems that detect impurities, adulteration, or deviations in oil composition, safeguarding compliance with food safety standards.

Serverless Computing Market Outlook

- Industry Growth Overview: The serverless computing market is poised for rapid expansion from 2025 to 2034, driven by growing demand for simplified cloud management, lower infrastructure costs, and faster application deployment. The rise of functions-as-a-service (FaaS), high demand for serverless databases, and increasing AI/ML workloads, particularly in sectors like e-commerce, media, and IoT, also support market growth.

- AI and Edge Integration:This trend allows for advanced, real-time applications by processing data nearer to the source, decreasing latency and enhancing performance for IoT analytics and immediate decision-making.

- Global Expansion:The market is expanding globally due to the increasing demand for cost-efficient, scalable, and easy-to-manage cloud solutions that accelerate application development and deployment. Emerging regions, particularly in Asia-Pacific and Latin America, present significant opportunities as businesses in these areas embrace digital transformation, cloud technologies, and AI-driven applications, creating a growing need for serverless solutions.

- Major Investors: Major investors in the market include cloud giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, who are leading the development of serverless platforms and providing comprehensive tools for cloud-native applications. Additionally, venture capital firms and strategic partnerships with tech startups are fueling innovation in serverless technologies, enabling faster adoption and expansion across industries such as e-commerce, media, and IoT.

- Startup Ecosystem:The startup ecosystem is thriving, focusing on innovation in observability tools, security solutions, and multi-cloud management platforms. Emerging firms are attracting significant funding by addressing operational challenges in complex serverless environments and by offering solutions that streamline development and deployment processes.

Serverless Computing Market Growth Factors

- Growing Adoption of Multi-Cloud Strategies: Enterprises are increasingly leveraging multiple cloud platforms, driving the need for interoperable serverless frameworks that streamline cross-cloud deployments.

- Rising Demand for Microservices Architectures: The shift toward modular application designs is boosting serverless adoption by simplifying the deployment and scaling of discrete functions.

- Driving Edge Computing Integration: Expanding edge networks are propelling serverless execution closer to end users, reducing latency and supporting real-time analytics.

- Boosting AI-Driven Workflow Automation: Integration of AI into serverless pipelines is fueling intelligent task execution, predictive analytics, and automated decision-making across industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 92.22 Billion |

| Market Size in 2026 | USD 31.99 Billion |

| Market Size in 2025 | USD 28.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Model, Deployment Model, Enterprise Size, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Does the Growing Demand for Cost Optimization Drive the Serverless Computing Market?

Increasing adoption of cloud-native applications is expected to drive growth in the serverless computing market. The growth of uptake of cloud-native applications will catalyze demand in the space. To shorten software development cycles and minimize infrastructure complexity, enterprises adopt agile architectures and use cloud-native methods at scale. In 2024, an industry survey showed that 89% of organizations (to some extent) had adopted cloud-native technologies as part of a more general shift toward microservices and event-driven architectures.

- Google developed Cloud Run and Cloud Functions over the course of 2024, adding new runtimes and control policy options that helped teams integrate serverless with container-based strategies. Moreover, the high scalability and flexibility of serverless frameworks are estimated to fuel their demand in the coming years.(Source: https://www.fortunesoftit.com)

Restraint

Vendor Lock-In Concerns Restrict Expansion of the Serverless Computing Market

Lock-in issues of the hamper vendors are likely to limit the growth of the serverless computing market. Organizations that use serverless computing tend to be heavily dependent on the ecosystem of one cloud provider and are therefore unable to easily port workloads to other platforms. Furthermore, the impediments to compliance and data security risks are likely to limit broader industry adoption in the coming years.

Opportunity

In What Ways Are Spurring Digital Transformation Initiatives Expanding the Serverless Computing Market?

Surging need for real-time data processing is projected to create favorable opportunities for the market growth. Businesses use serverless environments to support event-driven workloads, including streaming analytics, fraud detection, and IoT telemetry, and derive actionable insights within sub-second latencies. In 2024, the Cloud Native Computing Foundation found that 76% of organizations deployed streaming workloads in production with serverless functions. This demonstrates the extent to which real-time data pipelines are implemented with function-based architecture. (Source:https://aws.amazon.com)

- In late 2024, AWS released new Event Source Mapping (ESM) metrics to give better visibility of Lambda-triggered streaming events, and Google Cloud added Cloud Run integrations with Pub/Sub and Dataflow. This allows a low-latency AI model to serve directly in event-driven pipelines. In 2024, IoT uptake also increased, as Ericsson had 3.9 billion cellular IoT connections around the world, many of which can drive high-velocity telemetry that is well-suited to serverless-streaming pipelines. Furthermore, the growing demand for cost optimization is anticipated to accelerate market penetration. (Source:https://iot-analytics.com)

Segmental Insights

Service Model Insights

Why Did Function-as-a-Service (FaaS) Dominate the Serverless Computing Market in the Past Year?

In 2024, the function-as-a-Service (FaaS) segment dominated the serverless computing market, accounting for an estimated 65% market share, due to its ability to enable developers to execute event-driven functions without provisioning or managing servers. E-commerce, fintech, and healthcare organizations emphasize FaaS as a tool that supports unpredictable traffic and implements microservices-based architectures, and provides a shorter time-to-market.

- In 2024, AWS announced that more than 1.5 million customers invoke Lambda each month and invoke tens of trillions of functions each month, highlighting the scale of operation of FaaS can now deliver. Moreover, the FaaS was used to incorporate serverless execution into continuous delivery pipelines by developers to simplify updates and improve agility.(Source: https://aws.amazon.com)

The backend-as-a-service (BaaS) segment is expected to grow at the highest CAGR in the coming years in the serverless computing market, owing to the increase in enterprise need for ready-made backend services. BaaS services make it easy to develop mobile and web applications. Since they offer authentication, database, API integration, and cloud storage without backend knowledge. Furthermore, the surge of mobile-first approaches, real-time application needs, and omnichannel customer experiences is expected to fuel the demand for BaaS technology.

Deployment Model Insights

What Enabled Public Cloud to Lead Serverless Computing Adoption Globally?

Public cloud segment held the largest revenue share in the serverless computing market in 2024, accounting for 70% of market share, as hyperscalers provide mature and globally distributed serverless offerings and compliance-supported services. Moreover, the E-commerce, fintech, and healthcare companies standardized on public-cloud serverless to serve the global market, disaster recovery, and certified compliance stacks. Further, this continues to support public-cloud favoritism in large-scale deployments in the coming years.

The hybrid segment is expected to grow at the fastest CAGR in the coming years, as enterprise demand for data residency control, regulatory alignment, and a consistent experience of developers across environments. Moreover, the platform teams standardized policy-as-code and multicluster deployment patterns, which are predicted to further speed up adoption of hybrid by simplifying governance and ensuring developer velocity across non-homogeneous infrastructures.

Enterprise Size Insights

How Did Large Enterprises Secure the Largest Share in the Serverless Computing Market?

The large enterprises segment dominated the serverless computing market in 2024 that holding a market share of about 60%, due to their ability to invest in modernization and the governance structure of platforms. These organizations standardize on managed function platforms. They adopt serverless ingestion into enterprise CI/CD pipelines, which speeds up large-scale rollouts and implements uniform security and compliance policies. Additionally, the capabilities are estimated to continue to maintain large-enterprise leadership as organizations seek multi-cloud strategies and centralized platform engineering.

The SMEs segment is expected to grow at the fastest rate in the coming years, owing to the increased digitalisation initiatives and availability of turnkey backend services to minimise time-to-market. Cloud-native tool chains and managed serverless services are becoming popular among small and medium-sized businesses to avoid the initial costs of infrastructure provision. That is able to grow resources on demand, enabling rapid product development and expansion into new regions.

- According to policy reports published in 2024, a substantial proportion of SMEs currently use digital tools to make strategic decisions and automate their processes. Regional SME initiatives increase the use of cloud during 2024, which opens up the opportunity to accept serverless adoption. Furthermore, such trends drive the SME adoption rates to even greater levels because companies are seeking lean engineering models and accelerated innovation cycles. (Source:https://www.oecd.org)

End-Use Industry Insights

Why Did BFSI and IT/Telecom Drive the Highest Adoption of Serverless Computing?

BFSI and IT/Telecom segments held the largest revenue share in the serverless computing market in 2024, accounting for an estimated 55% market share, as these sectors require high reliability, regulatory compliance, and real-time transaction processing. In 2024, banking and payment service providers constructed serverless-based fraud screening systems. That detects fraudulent payments and new account attacks, which increases detection accuracy and shortens response times.

- In the 2024 case studies, the accuracy of scam detection and end-to-end response time are above 90% and less than 1 second with AWS serverless and AI-powered services, respectively, in a cybersecurity company. Additionally, these improvements in service offerings by vendors in terms of better policy management, orchestration of functionalities, and secure data management reinforced trust in the highly regulated BFSI and telecom markets.(Source: https://aws.amazon.com)

The healthcare and retail & e-commerce segments are expected to grow at the highest rates in the coming years, as the demand to personalize products on demand, digital healthcare services, and patient monitoring are soaring. Furthermore, the market analysts estimated that operational uptime and system responsiveness from healthcare providers using serverless models improved significantly, forcing the industry into the fastest-growing category.

Regional Insights

U.S. Serverless Computing Market Size and Growth 2025 to 2034

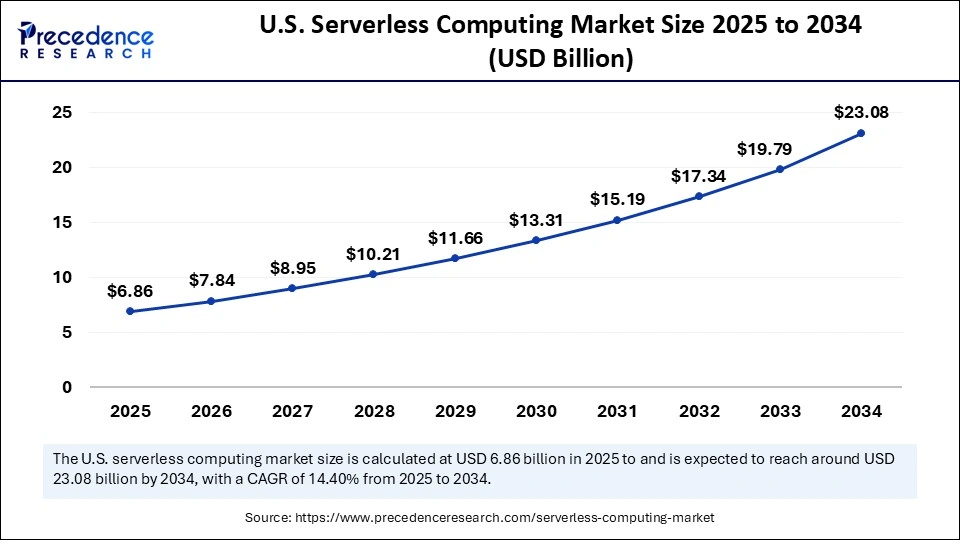

The U.S. serverless computing market size is evaluated at USD 6.86 billion in 2025 and is projected to be worth around USD 14.40 billion by 2034, growing at a CAGR of 14.32% from 2025 to 2034.

What Factors Helped North America Retain Its Leadership in the Global Serverless Computing Market?

North America led the serverless computing market, capturing the largest revenue share in 2024, accounting for 40% of the market share, due to the high density of hyperscale cloud providers, including AWS, Microsoft Azure, and Google Cloud, which together presented a series of new serverless-oriented capabilities in 2024. AWS made Lambda SnapStart available worldwide to enhance cold-start behavior with enterprise workloads, and Microsoft added AI-assisted observability to Azure Functions to simplify production monitoring.

The CNCF 2024 Annual Survey found that close to 70% of enterprises in North America claimed to operate production loads on serverless systems, highlighting the level of adoption maturity in that area. BFSI, healthcare, and e-commerce organizations highly valued the use of serverless deployments to enable real-time fraud detection, telehealth, and transaction-intensive workloads, which strengthened the dominant position of North America. Moreover, the innovations coupled with regulatory encouragement and the depth of the ecosystem is expected to ensure that North America continues to be the leader in the adoption of serverless computing.(Source: https://www.cncf.io)

What Makes Asia Pacific the Fastest-Growing Region in the Serverless Computing Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the high rate of digitalization, large coverage in mobile internet connectivity, and the vigor with which countries in the region pursue their own cloud development strategies. The ITU Digital Connectivity Report reported that in 2024, more than 68% of the new users of the internet were in the Asia-Pacific region, indicating a demand for scalable and affordable architectures like serverless computing.

The governments of India, Singapore, Japan, and Australia developed digital transformation programs that clearly encouraged the use of clouds which was native. The Digital India program in India has scaled country-wide e-governance services, and Singapore's Smart Nation program has made significant investments in event-driven architectures to public platforms, facilitating faster serverless adoption.

Vendors augmented those activities, with Alibaba Cloud, Tencent Cloud, and Huawei Cloud introducing extended serverless suites in 2024, and low-latency BaaS offerings and AI-integrated FaaS platforms customized to local regulations. Furthermore, the hyperscaler growth, startup adoption, and telecom-cloud convergence are likely to drive Asia-Pacific into the fastest-growing serverless computing center in the coming years.

How is the Opportunistic Rise of Latin America in the Serverless Computing Market?

Latin America is experiencing an opportunistic rise in the market, driven by digital transformation efforts and increasing demand for affordable, scalable computing solutions throughout the region. Brazil and Mexico are leading the way in adoption, shifting toward cloud-native application development and deploying serverless models to support the expansion of IoT devices and real-time data processing.

Brazil leads the Latin American market due to high demand for scalable, efficient IT solutions. The market is expected to grow substantially as businesses, including small and medium enterprises, adopt the pay-as-you-go model to cut operational costs and focus on innovation rather than infrastructure management. There is also increasing interest in modern development practices, which are well-suited for serverless platforms provided by major cloud providers.

What Potentiates the Growth of the Middle East and Africa Serverless Computing Market?

The market in the Middle East and Africa (MEA) is fueled by a growing focus on digital transformation and smart city initiatives, especially in the Middle East. The demand for improved efficiency and scalability in the IT, telecommunications, and Banking, Financial Services, and Insurance (BFSI) sectors is prompting investments from leading cloud providers like AWS, Microsoft, and Google, who are building data centers to meet local data residency and compliance needs.

Saudi Arabia is quickly adopting serverless computing to support its national goal of economic diversification and large-scale projects like NEOM. The market benefits from strong government efforts to build digital infrastructure and provide scalable solutions for industries such as oil and gas, public services, and manufacturing. The focus is on using serverless architecture to improve efficiency, boost security, and enable fast application deployment.

What Opportunities Exist in Europe?

Europe has a mature serverless computing market, primarily characterized by a strong emphasis on data privacy, security, and sustainability, which drives the adoption of hybrid and multi-cloud strategies. Key players, including major global cloud providers (AWS, Microsoft, Google) and specialized vendors, are actively tackling concerns like vendor lock-in and debugging challenges to support the region's move toward advanced and compliant cloud solutions.

Germany holds a significant share of the European serverless computing market, driven by its large manufacturing and automotive sectors. These sectors rely on serverless computing to handle fluctuating workloads, especially in IoT-based applications that need real-time data processing and analytics. The country is a leader in innovation, with a focus on private 5G networks and industrial automation, positioning itself at the forefront of industrial edge computing and serverless integration.

Value Chain Analysis

Core Cloud Infrastructure

This involves the physical hardware and data centers forming the cloud service backbone.

- Key Players: AWS, Azure, Google Cloud, Intel, and Nvidia.

Serverless Platform Development

This focuses on developing proprietary software platforms for FaaS and BaaS offerings.

- Key Players: AWS Lambda, Microsoft Azure Functions, Google Cloud Functions, and IBM Cloud Functions.

Developer Tools and Ecosystem Integration

This provides tools and integration services for building, deploying, and managing serverless applications.

- Key Players: Dynatrace, Datadog, Cloudflare, and Twilio.

Application Development and Professional Services

This involves writing code and building applications on serverless platforms, supported by professional and managed services.

- Key Players: NTT DATA, IBM, Accenture, and Deloitte.

Top Five Companies in the Serverless Computing Market and Their Offerings

- Amazon Web Services (AWS): AWS Lambda, the market-leading FaaS platform with vast ecosystem integration.

Microsoft: Azure Functions, Azure Logic Apps, strong integration with Microsoft 365 and hybrid cloud via Azure Arc. - Google Cloud:Google Cloud Functions, Cloud Run, excels in AI/ML and big data analytics integration.

- Alibaba Cloud:Function Compute (FC), Asia's leading provider with strong e-commerce and financial services expertise.

- IBM Corporation: IBM Cloud Functions, Red Hat OpenShift Serverless for hybrid cloud, robust security, and AI capabilities.

Other Key Players

- Cloudflare Workers

- DigitalOcean App Platform

- Iron.io

- MuleSoft

- Netlify Functions

- Nimbella

- OpenFaaS

- Oracle Cloud Functions

- Red Hat OpenShift Serverless

- SAP Serverless Runtime

- Serverless, Inc.

- StackPath Serverless Edge

- Tencent Cloud SCF

- Twilio Runtime

- Vercel

Recent Developments

- In August 2024, Pinecone in August 2024 launched its serverless vector database across Microsoft Azure and Google Cloud. Initially available in preview on AWS earlier in January and made generally available in May, the database's multi-cloud rollout marked a strategic milestone. The expansion enables customers to leverage Pinecone Serverless across all three leading public cloud providers, enhancing deployment flexibility and aligning with enterprise demand for vendor-neutral architectures. (Source: https://www.prnewswire.com)

- In July 2025, AWS expanded the usability of AWS Lambda by introducing seamless console-to-Visual Studio Code (VS Code) integration. This feature streamlines the transition between cloud and local development environments, preserving code and configurations with a single click. The enhancement addresses long-standing challenges developers faced in manually configuring local IDEs, reducing workflow disruptions, and improving productivity. (Source: https://analyticsindiamag.com)

- In May 2025, the momentum continued in May 2025 when Amazon Web Services (AWS) announced the open-source AWS Serverless Model Context Protocol (MCP) Server. This tool integrates AI-driven assistance with serverless expertise to guide developers on architectural, implementation, and deployment decisions, further strengthening modern application development. (Source: https://aws.amazon.com)

Segments Covered in the Report

By Service Model

- Function-as-a-Service (FaaS)

- Backend-as-a-Service (BaaS)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-Use Industry

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Healthcare & Life Sciences

- Retail & eCommerce

- Media & Entertainment

- Manufacturing

- Government & Public Sector

- Others (Education, Travel, Transportation & Logistics)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content