What is Sheet Metal Fabrication Services Market Size?

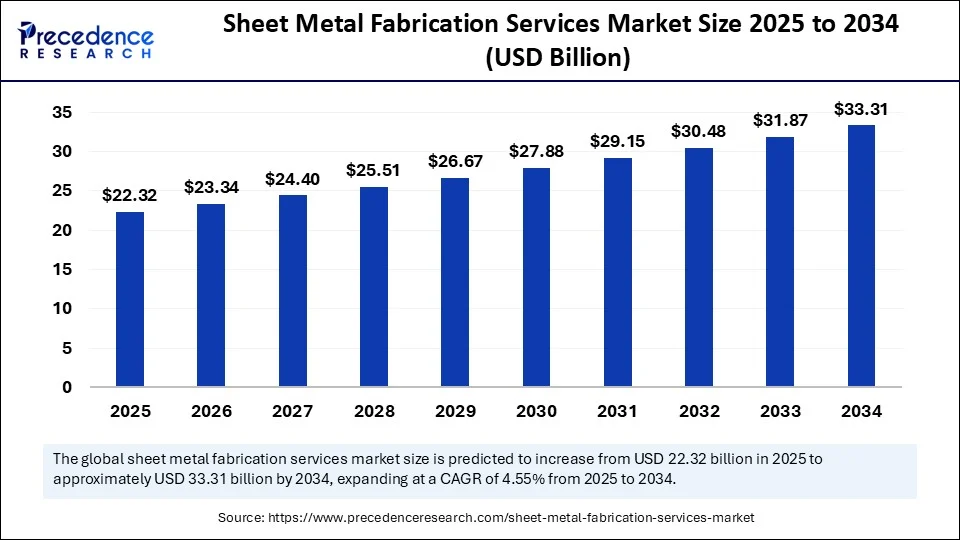

The global sheet metal fabrication services market size accounted for USD 22.32 billion in 2025 and is predicted to increase from USD 23.34 billion in 2026 to approximately USD 33.31 billion by 2034, expanding at a CAGR of 4.55% from 2025 to 2034. The growth of the market is driven by increasing demand for cutting, welding, bending, and various other services from the automotive, aerospace, and construction industries. The greater adoption of precision engineering and advanced manufacturing technologies further support market expansion.

Market Highlights

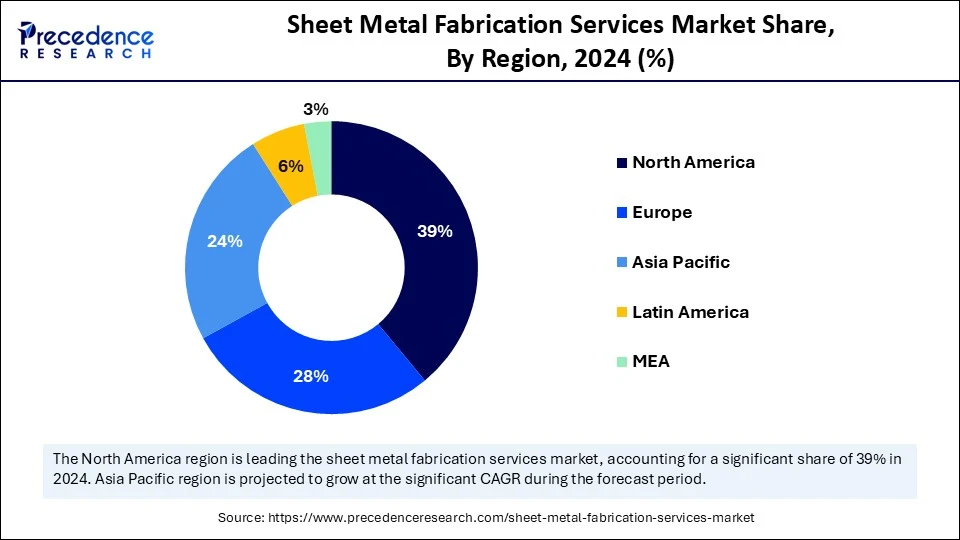

- Asia Pacific led the global sheet metal fabrication services market with the largest share of 39% in 2024.

- The Middle East & Africa is expected to grow at the highest CAGR from 2025 to 2034.

- By service type, the cutting services segment held a major market share in 2024.

- By service type, the welding services segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By material type, the steel segment captured the largest market share in 2024.

- By material type, the aluminum segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end-use industry, the aerospace & defense segment led the market in 2024.

- By end-use industry, the electronics segment is expected to experience the fastest growth during the forecast period.

Market Overview: Strategic Overview of the Global Sheet Metal Fabrication Services Industry

The sheet metal fabrication services market consists of third-party providers offering precision processing, including cutting, bending, welding, stamping, punching, roll forming, finishing, assembly, and related operations across various industries such as automotive, aerospace, electronics, construction, energy, and industrial machinery. This market is experiencing significant growth, driven by ongoing technological advancements and rising demand for customized components. Automation and robotics are improving the efficiency and precision of various processes, including cutting and welding. The rising need for tailored metal parts across various industries further boosts the growth of the market.

Artificial Intelligence: The Next Growth Catalyst in Sheet Metal Fabrication Services

Artificial intelligence (AI) is transforming the market by improving efficiency, precision, and predictive capabilities. AI systems optimize production, forecast potential issues, and enhance quality control, leading to lower costs and higher throughput. By analyzing historical data and real-time information, AI helps optimize schedules, minimize waste, and better allocate resources, resulting in faster, more accurate quotes and enhanced customer service. AI-powered vision systems and sensors can detect defects during fabrication, ensuring consistent quality and reducing rework. In manufacturing, AI-powered systems are used to automate and optimize several processes.

What are the Key Trends in the Sheet Metal Fabrication Services Market?

- Growing Focus on Sustainability and Lightweight Materials: The rising emphasis on sustainable practices is promoting the use of eco-friendly fabrication methods and materials. Additionally, demand for lightweight materials like aluminum and titanium in the automotive and aerospace sectors is growing as manufacturers seek improved fuel efficiency and reduced emissions.

- Infrastructure Development and Urbanization:Global infrastructure projects and increasing urbanization, especially in emerging economies, are creating strong demand for fabricated metal products, fueling market expansion.

- Outsourcing and Specialization:Companies are increasingly outsourcing their metal fabrication needs to specialized providers to focus on core competencies, cut costs, and boost efficiency, which further drives market growth.

- Technological Advancements:The adoption of advanced manufacturing technologies plays a crucial role in market expansion. The integration of robotics and automated systems, such as IoT devices and CNC machines, enhances efficiency, precision, and consistency in fabrication processes, contributing significantly to this growth.

Market Outlook

- Market Growth Overview: The sheet metal fabrication services market is expected to grow significantly between 2025 and 2034, driven by rising industrial automation, investment in infrastructure, and growing demand from key sectors.

- Sustainability Trends: Sustainability trends involve material efficiency and waste reduction, energy efficiency and decentralization, and green manufacturing technologies.

- Major Investors: Major investors in the market include State Street Corp, KKR & Co., Blackstone Group, Warburg Pincus, and Shastra VC and BEENEXT

- Startup Economy: The startup economy is focused on AI-powered on-demand manufacturing platforms, integration of automation and robotics, and advanced manufacturing technology.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.32 Billion |

| Market Size in 2026 | USD 23.34 Billion |

| Market Size by 2034 | USD 33.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Material Type, End-Use Industry, Volume Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand from End-Use Industries

The primary factor driving the growth of the sheet metal fabrication services market is the increasing demand from industries like automotive, aerospace, construction, and electronics. This demand is further driven by the need for lightweight, durable, and precision-engineered components, especially with the rise of electric vehicles and expanding infrastructure projects. The construction sector relies heavily on sheet metal for applications such as roofing, siding, and structural components, where sheet metal fabrication is vital for constructing buildings, transportation systems, and other critical infrastructure. With the rapid urbanization in urban areas, the development of smart infrastructure is rising, which further boosts the demand for sheet metal for various applications.

Restraint

Expensive Raw Materials

The primary restraint for the sheet metal fabrication services market is the high cost of raw materials, particularly steel and aluminum, resulting from global supply chain volatility. Fluctuations in the prices of these commonly used materials are influenced by factors such as supply disruptions, geopolitical tensions, and international trade issues. This volatility results in unpredictable costs for fabricators, which in turn impact their profitability and pricing strategies. Significant price swings directly influence operational costs for companies in this sector, making it difficult to maintain consistent pricing and profitability.

Opportunity

Growing Adoption of Automation and Robotics

A major future opportunity in the sheet metal fabrication services market lies in the growing adoption of automation and robotics to boost efficiency, precision, and safety. Integrating robots into fabrication processes, such as welding, cutting, and material handling, is a key trend. These robots perform repetitive tasks with high accuracy and speed, freeing workers to focus on more complex activities and streamlining workflows. Automation helps reduce downtime, accelerates production cycles, and meets tight deadlines, all driven by the demand for faster, more accurate, and customizable production.

Segment Insights

Service Type Insights

What Made Cutting Services the Dominant Segment in the Sheet Metal Fabrication Services Market in 2024?

The cutting services segment dominated the market with the largest share in 2024. The segment's dominance stems from its essential role in shaping metal into desired forms. Advances in cutting technologies like laser and plasma cutting have made these processes faster, more precise, and more versatile, supporting various industry applications. Cutting techniques, including shearing, blanking, punching, laser, and plasma cutting, can produce a wide range of shapes and sizes. Improvements in laser and plasma cutting have significantly enhanced the accuracy and efficiency of metal fabrication.

The welding services segment is expected to grow at the fastest rate in the coming years, driven by the increasing demand from sectors like automotive, construction, and electronics, along with technological advancements. Robotic welding systems now deliver greater consistency, speed, and accuracy, resulting in higher-quality welds and shorter production times. These advancements include robotic welding, laser welding, and AI-enhanced automation, all of which improve precision and efficiency to meet demands in infrastructure development and manufacturing.

Material Type Insights

How Does the Steel Segment Lead the Sheet Metal Fabrication Services Market in 2024?

The steel segment remains the leading material in the market in 2024 due to its strength, versatility, and cost-effectiveness. Its popularity spans industries such as automotive, construction, and heavy equipment. Steel's robustness, ease of handling, and recyclability make it highly desirable. It can be easily fabricated into various shapes and sizes, accommodating complex designs and intricate components. Additionally, steel's recyclability aligns with the growing focus on sustainability.

The aluminum segment is expected to expand at the fastest CAGR over the projection period. This is mainly because of its light weight, corrosion resistance, and recyclability, all of which support sustainability goals and reduce long-term costs. Aluminum naturally forms a protective oxide layer, making it suitable for outdoor and marine environments without additional coating. Its lower density compared to steel makes it ideal for applications where weight reduction is critical, such as in the automotive and aerospace industries. Advanced aluminum alloys offer exceptional strength, enabling use in demanding applications.

End Use Industry Insights

Why Did the Aerospace & Defense Segment Dominate the Sheet Metal Fabrication Services Market in 2024?

The aerospace & defense segment dominated the market while holding a major revenue share in 2024, as these industries heavily rely on metal fabrication for developing aircraft and defense equipment's components. Stringent requirements for high strength-to-weight ratios, precision, and durability in aircraft and defense components further bolstered the segment. Aircraft parts must withstand extreme temperatures, pressures, and vibrations throughout their service life. The industry increasingly adopts lightweight, high-strength materials like carbon fiber composites, titanium alloys, and advanced polymers to meet performance standards.

The automotive industry is the second largest segment, holding a significant share in 2024. This is primarily because of its focus on lightweighting, fuel efficiency, and innovative manufacturing techniques. Automakers are increasingly using sheet metal with high strength-to-weight ratios to reduce vehicle weight and improve fuel economy. Advancements in 3D modeling and laser cutting allow for the creation of intricate shapes and designs, enabling more complex vehicle architecture. The automotive industry is shifting toward sustainable practices, and sheet metal fabrication plays a role in using recyclable materials and optimizing production processes.

The electronics segment is expected to grow at the fastest rate in the upcoming period. This is primarily due to the increasing proliferation of smartphones, laptops, wearables, and other consumer electronics, along with the growing adoption of smart devices in industries such as healthcare and automotive. Manufacturing electronic components often require sheet metal fabrication. Innovations in areas such as 5G, electric vehicles, and the Internet of Things (IoT) are major drivers of this growth, necessitating more complex and customized electronic enclosures and components.

Regional Insights

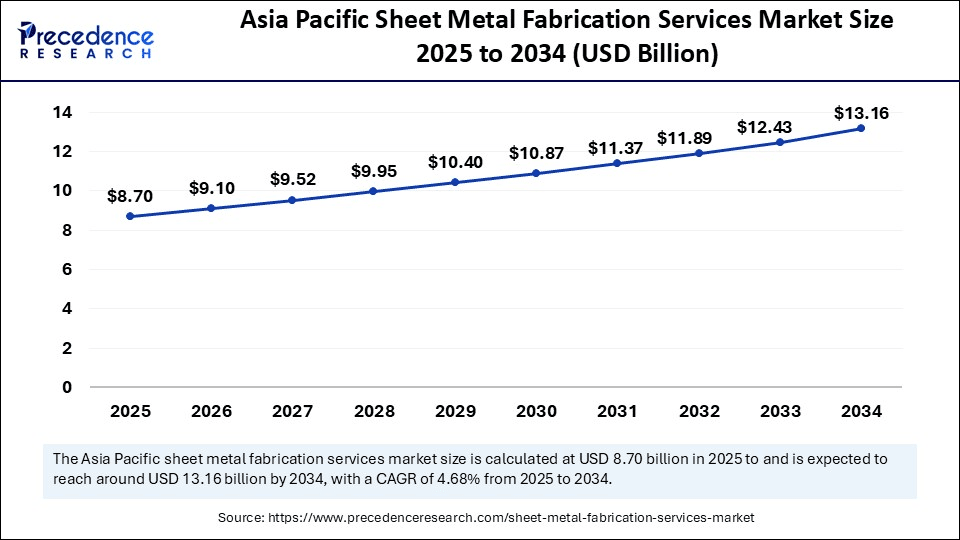

Asia Pacific Sheet Metal Fabrication Services Market Size and Growth 2025 to 2034

Asia Pacific sheet metal fabrication services market size is exhibited at USD 8.70 billion in 2025 and is projected to be worth around USD 13.16 billion by 2034, growing at a CAGR of 4.68% from 2025 to 2034.

What Made Asia Pacific the Dominant Market for Sheet Metal Fabrication Services in 2024?

Asia Pacific dominated the sheet metal fabrication services market while capturing the largest share in 2024. This is mainly due to rapid industrialization, a large manufacturing base, and strong government support for manufacturing and infrastructure development. Countries like China, India, and Japan are experiencing significant industrial growth, driving the demand for sheet metal fabrication services across various industries. The region hosts numerous manufacturing hubs, especially in China and Southeast Asian countries, further increasing the demand for fabricated metal products. Additionally, many governments actively promote manufacturing and infrastructure development through policies and investments, facilitating the long-term growth of the market.

Asia Pacific: China Sheet Metal Fabrication Services Market Trends

China's market growth is driven by strong demand from key sectors like automotive and construction, and the widespread adoption of automation and advanced technologies like CNC machining and robotics. The market is increasingly focused on high-precision manufacturing to meet stringent quality standards for global competitiveness.

What Opportunities Exist in the North American Power the Sheet Metal Fabrication Services Market?

North America significantly contributes to the global market. This is primarily due to its strong industrial base, a growing construction sector, and increasing adoption of advanced technologies like CNC machining and automation. With a well-established manufacturing sector, providing a solid foundation for sheet metal fabrication, there is a high demand for metal components. Government investments in infrastructure projects and incentives for advanced technology adoption further support market growth. There is a growing emphasis on sustainable materials and practices, driving innovation and market expansion.

What Makes the Middle East & Africa the Fastest-Growing Market for Sheet Metal Fabrication Services?

The market in the Middle East & Africa is expected to grow at the fastest rate in the upcoming period. This is mainly due to the rapid industrialization, infrastructure development, and increasing investments in the manufacturing sectors. The regional market growth is also fueled by the rising demand for sheet metal components in industries such as automotive, aerospace, and construction. Moreover, the presence of prominent companies like Middle East Manufacturing Steel LLC, Spar Steel Industries LLC, and Al Khaleej Steel Industries LLC contributes to market expansion. Governments and private sector investments in manufacturing activities further boost the demand for sheet metal fabrication.

Why is Europe Considered a Notable Region in the Sheet Metal Fabrication Services Market?

The European sheet metal fabrication market is experiencing notable growth, driven by the increasing demand from key industries, such as automotive and aerospace, the adoption of advanced technologies, and supportive government initiatives. There is a strong focus on high-quality, precise, and sustainable fabrication solutions. Additionally, the EU's robust automotive industry relies heavily on sheet metal fabrication for developing automotive components, contributing to regional market growth.

In October 2025, Amada opened its new Welding Technical Center at the premises of AMADA ITALIA. This center serves as a shared hub for Amada Group companies across Europe, supporting sales activities by promoting and validating advanced welding technologies. It aims to address labor shortages, skill gaps, and stricter environmental regulations in the European market.

What Factors Contribute to the Sheet Metal Fabrication Services Market in Latin America?

The market in Latin America is expected to grow at a steady rate due to the expanding industrial base and government support aimed at promoting industrial diversification and technological innovation. Companies in the region, such as Bruning Tecnometal and Metalparts in Brazil and Acinox SA in Colombia, are increasingly adopting automation and digitalization to enhance efficiency, accuracy, and production capacity, further influencing market growth. The region also anticipates a rise in automation, digitalization, and the adoption of advanced technologies in key sectors like energy, automotive, and construction, which will drive demand for sheet metal fabrication services.

Middle East & Africa: Saudi Arabia Sheet Metal Fabrication Services Market Trends

Saudi Arabia has the government's ambitious Vision 2030 economic diversification plan, which is driving massive investment in non-oil sectors like construction, automotive, and renewable energy infrastructure. These mega-projects, such as the development of smart cities like NEOM, require vast quantities of fabricated steel components, fueling immense demand.

Europe: Germany Sheet Metal Fabrication Services Market Trends

Germany its leadership in technology, with deep integration of Industry 4.0 principles, automation, AI, and IoT to achieve high precision and efficiency. The automotive sector, particularly the shift to electric vehicles and lightweight materials, is a key driver of demand for advanced, precision components. Sustainability is a major focus, with stringent EU regulations pushing investments in green manufacturing practices, energy efficiency, and waste minimization.

Value Chain Analysis of the Sheet Metal Fabrication Services Market

- Raw Material Supply

This initial stage of the value chain involves the production and supply of metal sheets in various materials, including carbon steel, stainless steel, and aluminum, to fabricators.

Key Players: Tata Steel Limited and JFE Steel Corporation - Equipment Manufacturing

This stage involves the development and manufacturing of advanced machinery and software used in the fabrication process, such as laser cutters, CNC punching and bending machines, and welding equipment.

Key Players: TRUMPF (Germany) and KUKA AG, Mitsubishi Electric and Amada. - Fabrication Service Providers

This is the core stage where raw metal sheets are transformed into finished or semi-finished products through various processes, including cutting, forming, welding, and finishing.

Key Players: Mayville Engineering Company, Inc., O'Neal Manufacturing Services, Proto Labs, Inc., Xometry, Inc., and KMF Group - Distribution and Logistics

This stage involves the efficient movement of finished fabricated parts from the service provider to the end-user.

Key Players: DHL and FedEx - End-User Industries

The final stage comprises the diverse range of industries that purchase and integrate fabricated metal components into their own products or operations.

Key Players: Ford Motor Company and Toyota Motor Corporation, Lockheed Martin and Airbus.

Sheet Metal Fabrication Services Market Companies

- Trumpf GmbH & Co. KG

- SafanDarley B.V.

- Durma Machine Tools

- Mate Precision Technologies

- Mitsubishi Electric Corporation

- Bystronic Laser AG

- Amada Co. Ltd.

- BLM Group S.p.A.

- LVD Company NV

- Mazak Corporation

- Murata Machinery, Ltd.

- Haco Group

- Wilamowski S.A.

- Komatsu Ltd.

- Prima Industrie S.p.A.

- O'Neal Industries (O'Neal Manufacturing Services)

- Amada America, Inc.

- BTD Manufacturing

- Dalsin Industries

- Jaco Products

Industry Leader's Announcement

- In April 2025, BICO Steel announced the acquisition of Pioneer Steel Corporation. This move strategically expands BICO's die set manufacturing capabilities and reinforces its commitment to providing customers with industry-leading lead times, quality, and service. John Frazier, CEO at BICO, stated, “This acquisition represents a strategic expansion of our die set manufacturing capabilities and reinforces our commitment to providing customers with industry-leading lead times, quality and service.”(Source: https://www.businesswire.com)

Recent Developments

- In February 2025, Meviy introduced an aluminum composite plate for sheet metal processing. These lightweight yet rigid materials are ideal for those looking to reduce part weight while maintaining structural integrity. They also serve as excellent options for device covers, enclosures, and other applications where strength and lightweight properties are essential, addressing challenges related to cost reduction, weight savings, and quick availability. (Source: https://insights.globalspec.com)

- In September 2024, Geomiq introduced Instant Quoting for sheet metal fabrication service, designed to offer immediate and accurate pricing that allows you to get your parts into production with ease. This new instant quoting feature enables industries to move swiftly from design to production, providing instant feedback through quick quotes upon uploading CAD files, with accurate pricing and streamlined processes. (Source:https://geomiq.com)

Segments Covered in the Report

By Service Type

- Cutting Services

- Bending Services

- Welding Services

- Stamping Services

- Punching Services

- Roll Forming Services

- Assembly Services

- Finishing & Others

By Material Type

- Steel

- Aluminum

- Stainless Steel

- Titanium

- Copper / Brass

- Other Alloys

By End-Use Industry

- Automotive

- Aerospace & Defense

- Construction

- Industrial Machinery

- Electronics

- Energy & Power

- HVAC Systems

- Telecommunications

By Volume Segment

- Low Volume (1–100 units)

- Medium Volume (101–1,000 units)

- High Volume (>1,000 units)

By Region

- North America

- Europe

- AsiaPacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content