What is the Sleep Aid Supplements Market Size?

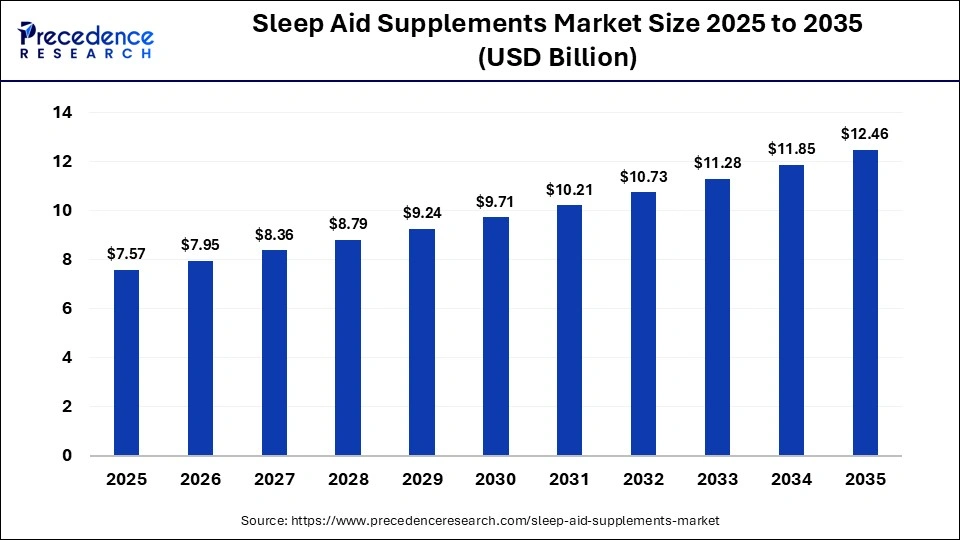

The global sleep aid supplements market size was calculated at USD 7.57 billion in 2025 and is predicted to increase from USD 7.95 billion in 2026 to approximately USD 12.46 billion by 2035, expanding at a CAGR of 5.11% from 2026 to 2035. The market is growing due to the rising prevalence of sleep disorders, increasing awareness of sleep health, and a significant shift towards natural and herbal sleep aid supplements.

Market Highlights

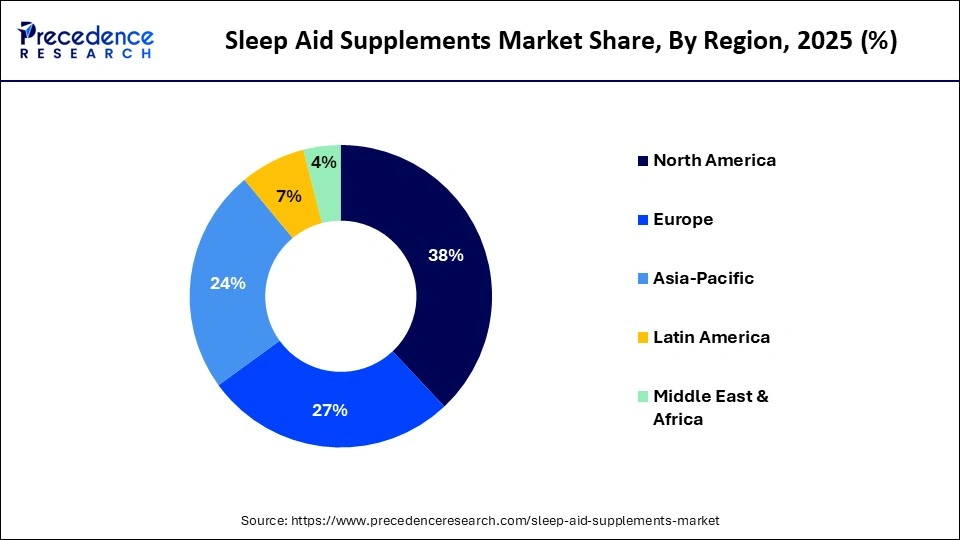

- North America dominated the sleep aid supplements market in 2025, with approximately 38% share.

- Asia-Pacific is expected to be the fastest-growing region between 2026 and 2035.

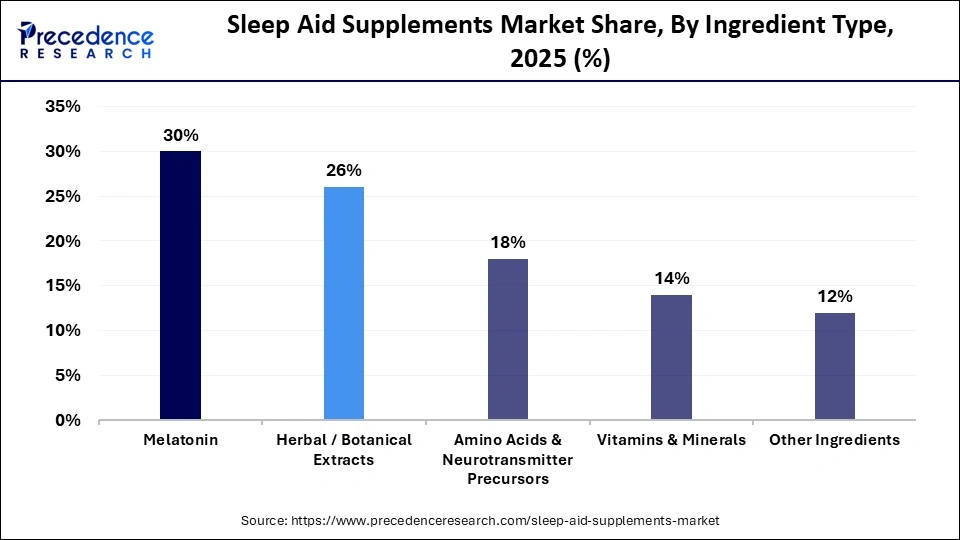

- By ingredient type, the melatonin segment held a major revenue share of approximately 30% in the market in 2025.

- By ingredient type, the amino acids & neurotransmitter precursors segment is expected to witness the fastest growth in the market over the forecast period.

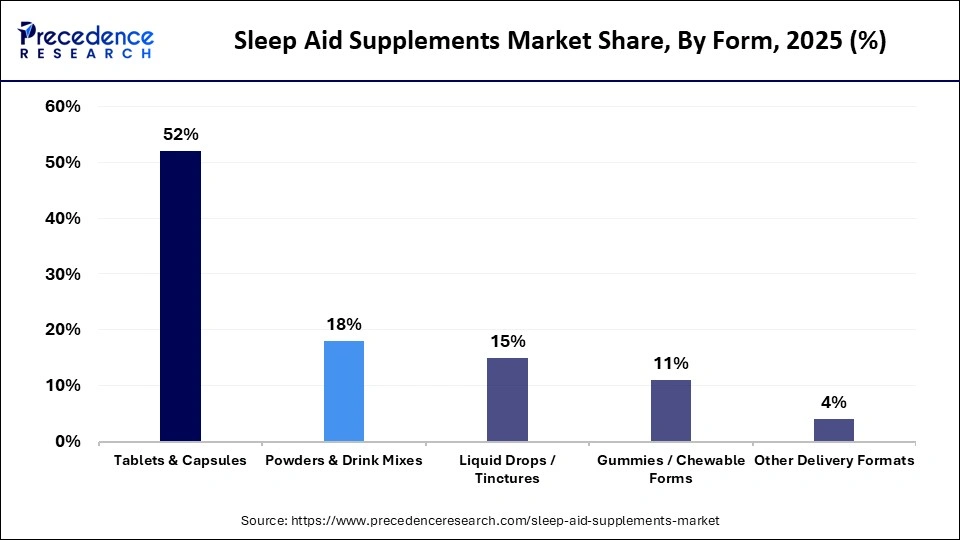

- By form type, the tablets & capsules segment led the global market with a share of approximately 52% in 2025.

- By form type, the gummies/chewable forms segment is expected to witness the fastest growth in the market over the forecast period.

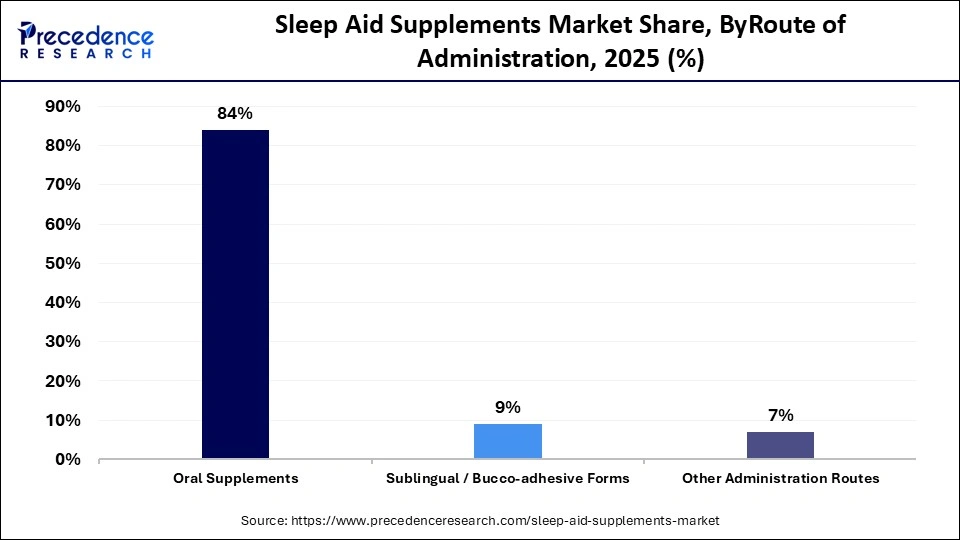

- By route of administration type, the oral supplements segment dominated the sleep aid supplements market with a share of approximately 84% in 2025.

- By route of administration type, the sublingual/bucco-adhesive forms segment is expected to show the fastest growth over the forecast period.

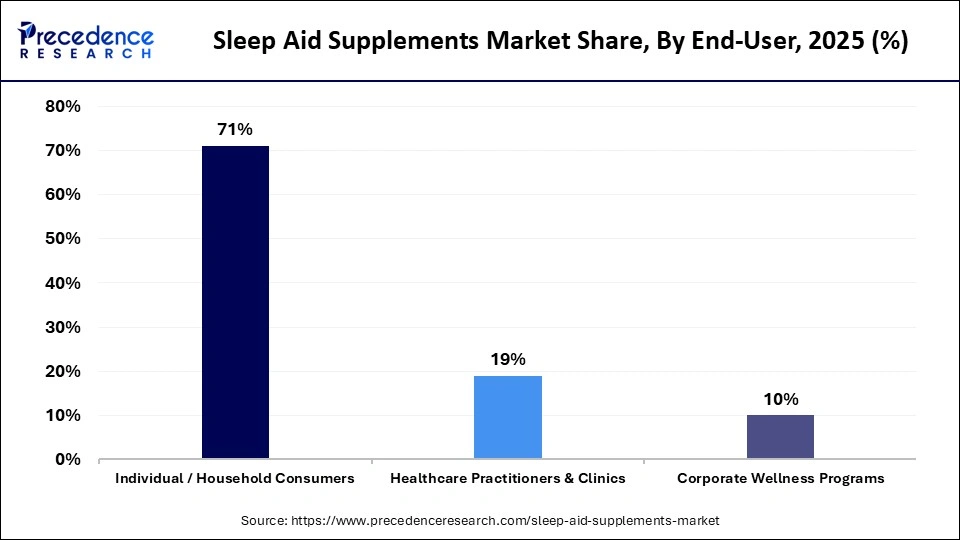

- By end-user, the individual/household consumers segment registered its dominance over the global market in 2025, with a revenue of approximately 71%.

- By end-user, the healthcare practitioners & clinics segment is expected to expand rapidly in the market in the coming years.

Market Overview

The global sleep aid supplements market includes nutraceuticals, functional ingredients, and dietary formulations aimed at improving sleep quality, onset, duration, and restoration. These supplements comprise natural botanical extracts, amino acids, vitamins, minerals, and other sleep-modulating compounds used by consumers to address insomnia, disturbed circadian rhythms, jet lag, and stress-related sleep issues. Market growth is driven by the rising prevalence of sleep disorders, consumer preference for natural health solutions, wellness-oriented lifestyles, and ease of over-the-counter access.

What is the Role of AI in the Market?

Artificial intelligence is slowly changing the sleep aid supplements market by helping brands to understand real consumer sleep problems. AI can be integrated into smart technologies and wearable devices for sleep monitoring. The large data sets from wearable devices, surveys, and reviews are analysed by AI to identify common sleep patterns and triggers that affect rest. This data helps companies to design supplements that fulfil consumer needs. AI also plays a role in product formulation by predicting ingredient interaction, dosage responses, and potential side effects, which will help companies to create effective products and combinations. This leads to safe and more targeted sleep support products.

What are the Market Trends?

- Increasing cases of people struggling with poor sleep due to stress, screen exposure, and busy routines are making sleep supplements a regular part of their daily routine.

- Rising preference for natural sleep supplements made with valerian roots, chamomile, magnesium, other plant extracts, and herbs over synthetic and chemical options.

- Melatonin is widely used as a sleep aid supplement, but consumers are slowly exploring non-melatonin formulas, which include blends of calming herbs and plant extracts to support sleep without next-day tiredness.

- Innovative product forms like gummies, powders, and liquid drops are gaining attention because they are easy to consume and can be integrated into a nighttime routine.

- Online platforms are growing rapidly because consumers prefer buying sleep supplements online that offer easy access, detailed information, and home deliveries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.57 Billion |

| Market Size in 2026 | USD 7.95 Billion |

| Market Size by 2035 | USD 12.46 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Ingredient Type, Form, Route of Administration, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Ingredient Insights

Why Melatonin Segment Dominated the Sleep Aid Supplements Market?

The melatonin segment registered its dominance over the global market with a share of approximately 30% in 2025 because it directly supports the body's natural sleep-wake cycle. It is an effective solution for issues like delayed sleep, jet lag, and sleep disorders, and is easily available without a prescription in many countries. Melatonin-based products are available in tablets, gummies, liquids, and sprays, making them accessible to different age groups.

The amino acids & neurotransmitter precursors segment is expected to gain the highest CAGR in the sleep aid supplements market during the forecast period because consumers look for alternatives to melatonin-based products. Ingredients such as L-theanine, glycine, GABA, and tryptophan are gaining attention for their ability to promote relaxation and improve sleep quality without causing dependency. These supplements are used for long-term sleep support, especially for stress-related or anxiety-driven sleep issues. Demand is increasing as consumers who experience side effects from melatonin or prefer a non-hormonal solution. Growing awareness of brain health and stress management further supports the growth of the segment in the market.

Form Insights

How Tablets & Capsules Segment Dominated the Sleep Aid Supplements Market?

The tablets & capsules segment held a dominant position in the market with a share of approximately 52% in 2025 because they are convenient to use in everyday routine. Tablets and capsules offer better stability, longer shelf life, and an accurate dose, which are suitable for consumers. They are also cost-effective to produce, making them widely available in pharmacies, hospitals, and online platforms. Healthcare professionals often recommend these forms of medication.

The gummies/chewable forms segment is expected to expand rapidly in the market in the coming years. This form of appealing to younger users and people who have difficulty swallowing tablets. Gummies are flavoured and easier to include in night-time routines. Social media influence and high awareness of lifestyle-focused wellness products have boosted the visibility of gummies.

Route of Administration Insights

Why Did the Oral Supplements Segment Hold the Largest Share of the Market?

The oral supplements segment led the global sleep aid supplements market with a share of approximately 84% in 2025 because they are simple and easy to include in a daily routine. Most consumers are already comfortable taking tablets, capsules, powders, or gummies, making oral products the most widely accepted form. Oral supplements allow flexible dosing and support a wide range of ingredients, from melatonin to magnesium, herbal blends, and amino acids. Manufacturers prefer this route because it is cost-effective and scalable, and easier to distribute across retail stores, pharmacies, and online platforms.

The sublingual/bucco-adhesive forms segment is expected to witness the fastest growth in the market over the forecast period because they offer faster absorption and quick onset of action. These forms bypass the digestive system, making them suitable for consumers who want immediate sleep support. They are especially useful for low-dose ingredients like melatonin, where rapid delivery can improve effectiveness.

End-User Insights

What Made the Individual/Household Consumers Segment Lead the Market in 2025?

The individual/household consumers segment registered its dominance over the global sleep aid supplements market with a share of approximately 71% in 2025 because most sleep issues are self-managed rather than clinically treated. People often try supplements first to address mild or occasional sleep problems before consulting health professionals. Easy availability through online platforms, pharmacies, and supermarkets has made these products part of routine. Affordable pricing and a wide variety of products allow repeated purchasing supports dominance in the market.

The healthcare practitioners & clinics segment is expected to gain the highest share of the market during the forecast period. Doctors, therapists, and sleep specialists increasingly recommend supplements as a supportive option alongside behavioural therapy and lifestyle changes. Rising awareness of sleep-related health risks, such as anxiety, metabolic issues, and cardiovascular problems, is leading more patients towards professional consultation.

Regional Insights

How Big is the North America Sleep Aid Supplements Market Size?

The North America sleep aid supplements market size is estimated at USD 2.88 billion in 2025 and is projected to reach approximately USD 4.80 billion by 2035, with a 5.24% CAGR from 2026 to 2035.

Why Did North America Dominate the Market in 2025?

North America dominated the global sleep aid supplements market with a share of approximately 38% in 2025 because sleep problems are openly discussed and widely treated as a health concern. More screen exposure, high stress levels, long work hours, and irregular sleep routines have made sleep support products a regular part of daily routine. Consumers from this region are aware of sleep health and actively looking for over-the-counter solutions. Consumers prefer naturals and clean-label products, especially with melatonin, magnesium, and herbal blends. Strong retail networks, online platforms, and easy access to new supplements further strengthens region's dominance in the market.

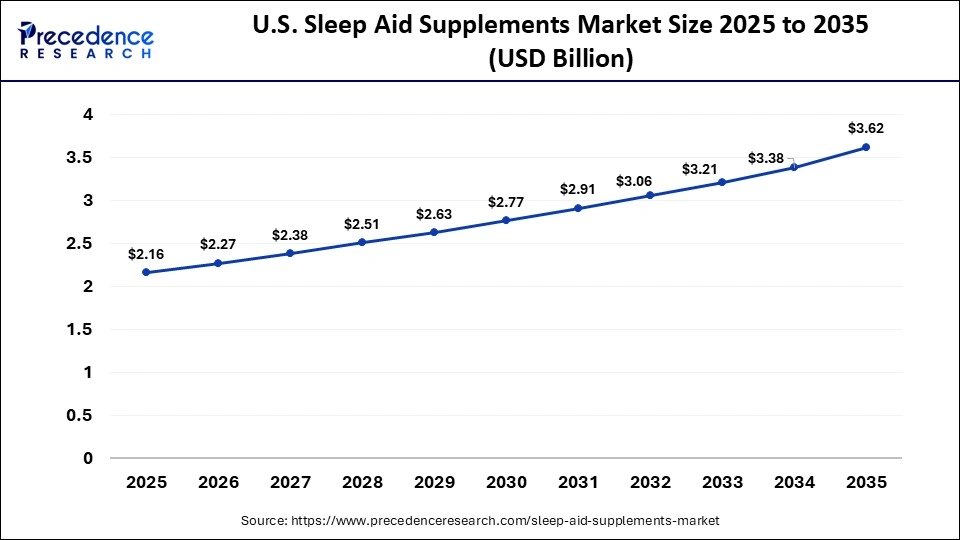

What is the Size of the U.S. Sleep Aid Supplements Market?

The U.S. sleep aid supplements market size is calculated at USD 2.16 billion in 2025 and is expected to reach nearly USD 3.62 billion in 2035, accelerating at a strong CAGR of 5.30% between 2026 and 2035.

U.S. Sleep Aid Supplements Market Analysis

The U.S. plays a major role in the market due to lifestyle-driven sleep disorders. Busy work, high-stress jobs, long screen exposure, and rising mental health concerns have significantly increased demand for sleep support products. Consumers prefer supplements because they are easily available and safer than prescription sleep medication. The market shows strong demand for melatonin-based products, magnesium supplements, and calming herbal blends. Gummies and flavoured forms are popular, especially in younger consumers. Online platforms, subscription models, and home deliveries make purchasing a sleep support product convenient. Strong presence of supplement brands and continuous product innovation help market growth in the region.

Why Is the Asia Pacific Growing with the Highest CAGR in the Market?

Asia Pacific is expected to grow at the fastest rate in the sleep aid supplements market during the forecast period due to rapid urbanization, long working hours, academic pressure, and increased smartphone use, which are affecting sleep quality and duration across the region. In countries like India, Japan, China, and South Korea, sleep health awareness is rising, and consumers are preferring natural and herbal ingredients in sleep support products. Health awareness campaigns and expanding e-commerce platforms are helping sleep aid supplements reach a wider population, supporting strong future growth.

China Sleep Aid Supplements Market Analysis

China's market is expanding as sleep disorders are becoming more common in urban areas. Changing lifestyle, high stress level and long screen time have reduced sleep quality and duration in many people. A significant volume of the ageing population in the region faces higher rates of insomnia, fueling demand for sleep aid supplements in the region. Consumers are increasingly adopting supplements for better sleep, especially those with natural ingredients and a traditional herbal touch. Domestic brands are participating in this market and offering affordable products with modern formats and herbal ingredients. E-commerce platforms are also helping to increase product reach and fulfill the demands of younger consumers.

Sleep Aid Supplements Market Value Chain Analysis

- R&D

Research and development in the market focuses on discovering and developing safe and effective products that help to promote sleep.

Key Players: Nature's Bounty (Nestle Health Science), Natrol LLC, Church & Dwight Co., Inc., NOW Foods

- Clinical Trials and Regulatory Approvals

Products are tested for safety, efficacy, accuracy, and reliability, followed by regulatory approvals to ensure products meet healthcare standards and can be legally sold in different regional markets.

Key Players: Procter & Gamble (Vicks ZzzQuil/PUREZzzs), OLLY (Unilever), Nature's Bounty (Nestle Health Science), Natrol LLC

- Distribution to Hospitals, Pharmacies

Manufacturers supply products to ensure consistent product availability across hospitals, clinics, and retail healthcare outlets

Key Players: GNC Holdings, Herbalife Nutrition, Zarbee's Naturals, Amway (Nutrilite), Nature's Bounty (Nestle Health Science).

- Patient Support and Services

Patient support and services focus on improving treatment experience through follow-up care, lifestyle guidance, and easy access to healthcare support.

Who are the Major Players in the Global Sleep Aid Supplements Market?

The major players in the sleep aid supplements market include The Nature's Bounty Co., Natrol LLC, Church & Dwight Co., Inc., NOW Foods, Herbalife Nutrition Ltd., OLLY Public Benefit Corporation, Gaia Herbs, Inc., GNC Holdings LLC, Life Extension, Pure Encapsulations, Sundown Naturals, Solgar, Inc., Thorne HealthTech Inc., Mountain Rose Herbs, Douglas Laboratories, Amway, Buyers' Health products, Optimum Nutrition, Inc., By-Health, Blackmores, Nutrafol, and PharmaNord.

Recent Developments

- In February 2026, a South Korea-based pharmaceutical company, Dong-A, launched a liquid sleep aid product called EasyQuil Night Act. The main active ingredient, diphenhydramine hydrochloride, is a first-generation antihistamine that helps with allergies and short-term insomnia.(Source: https://www.nutraingredients.com)

- In August 2025, the premier healthy lifestyle brand launched a melatonin-free sleep support powder called LTH Dream. It has a blend of three readily absorbable forms of magnesium with other calming nutrients that helps to fall asleep.(Source: https://www.prnewswire.com)

- In May 2025, a Delhi-based wellness startup, Fytika Health Products, launched melatonin-based gummies as non-addictive sleep aid supplements. Melatonin is a natural hormone that helps to calm the body and promote sleep by rising melatonin level in the body at night. (Source: https://www.moneycontrol.com)

Segments Covered in the Report

By Ingredient Type

- Melatonin

- Herbal/Botanical Extracts

- Valerian root

- Chamomile

- Passionflower

- Lavender

- Amino Acids & Neurotransmitter Precursors

- L-tryptophan

- L-theanine

- Vitamins & Minerals

- Magnesium

- Vitamin B6

- Other Ingredients

- 5-HTP

- CBD & adaptogens

By Form

- Tablets & Capsules

- Powders & Drink Mixes

- Liquid Drops/Tinctures

- Gummies/Chewable Forms

- Other Delivery Formats

By Route of Administration

- Oral Supplements

- Sublingual/Bucco-adhesive Forms

- Other Administration Routes

By End-User

- Individual/Household Consumers

- Healthcare Practitioners & Clinics

- Corporate Wellness Programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting