What is the Smart Parcel Locker Market Size?

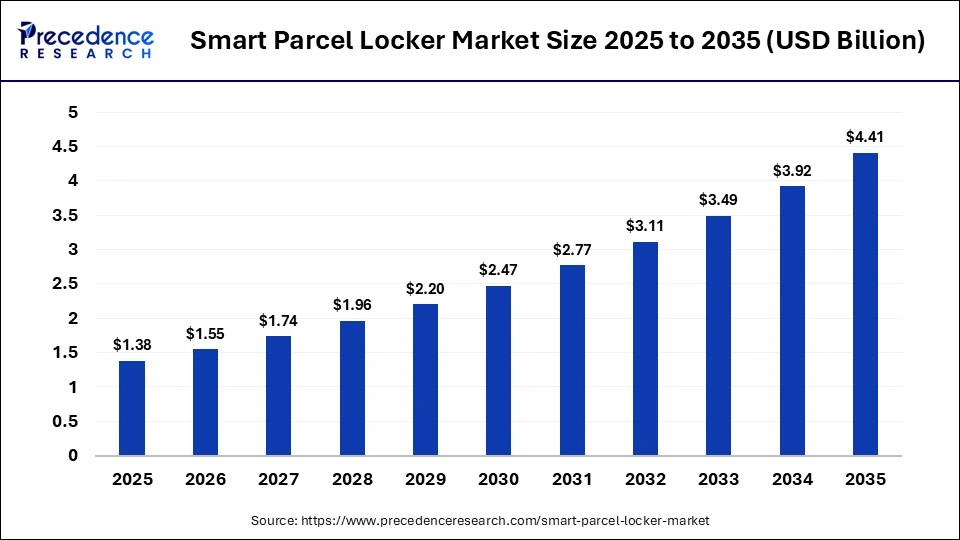

The global smart parcel locker market size was calculated at USD 1.38 billion in 2025 and is predicted to increase from USD 1.55 billion in 2026 to approximately USD 4.41 billion by 2035, expanding at a CAGR of 12.3% from 2026 to 2035. The smart parcel locker market size was estimated to be worth a significant amount in twenty twenty-five, with projections indicating steady growth over the following decade. It is expected to expand substantially from twenty twenty-six through twenty thirty-five, reflecting a strong upward trend in the industry.

Market Highlights

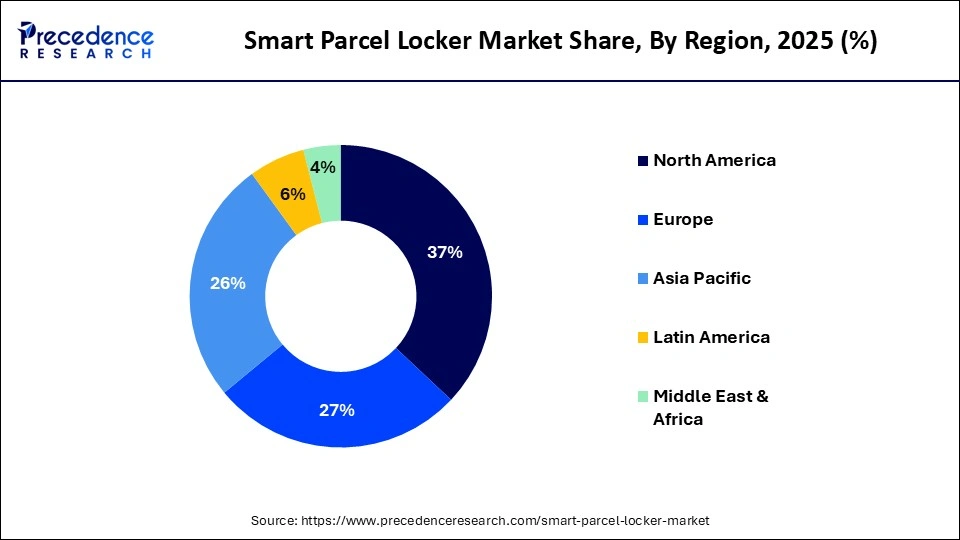

- North America dominated the market, holding a share of 37% during 2025.

- Asia Pacific is projected to grow with a significant CAGR of 12.5% from 2026 to 2035.

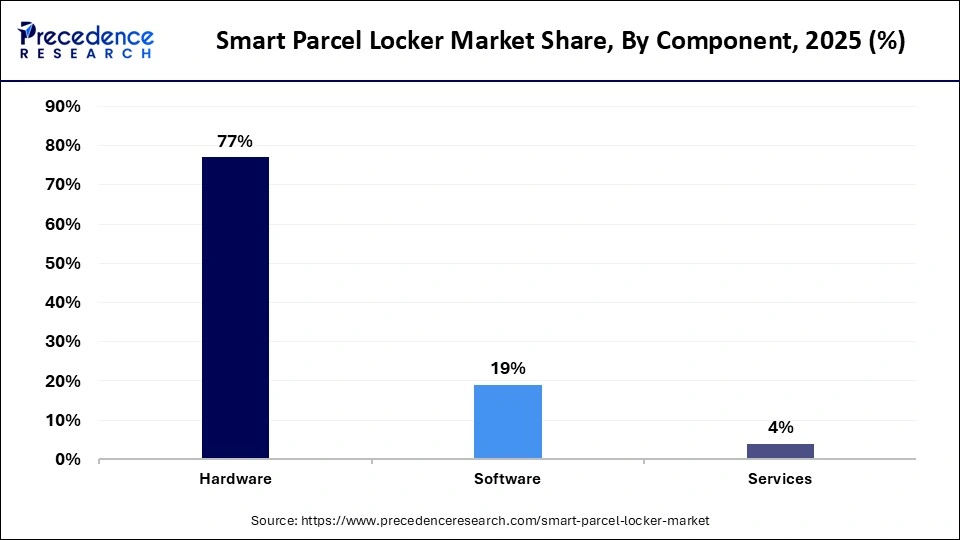

- By component, the hardware segment led the market while holding the largest share of 77% in 2025.

- By component, the software segment is expected to grow at a CAGR of 11.7% between 2026 and 2035.

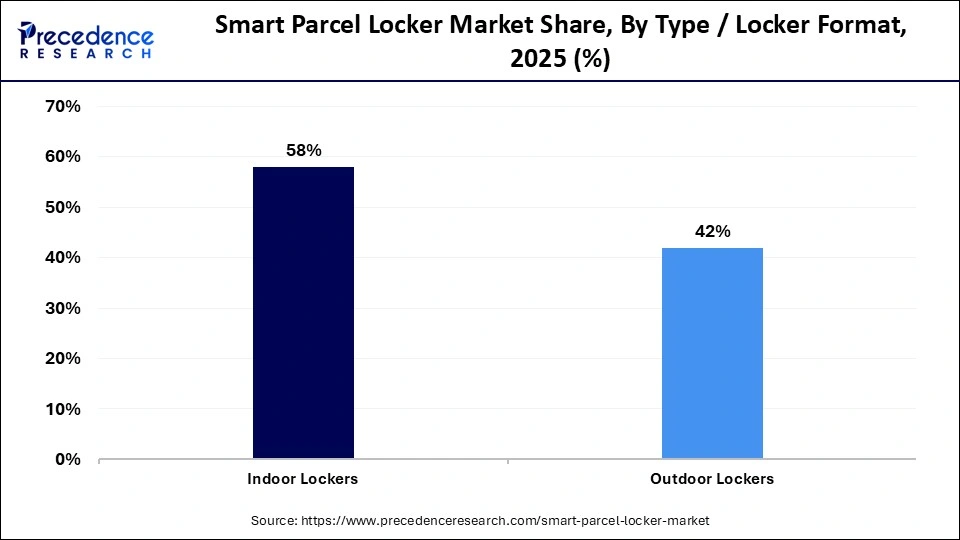

- By type/locker format, the indoor lockers dominated, with an approximate share 58% in 2025.

- By type/locker format, the outdoor lockers segment is set to grow the fastest, with an 11.4% CAGR during the forecasted period.

- By locker design/model, the modular parcel lockers segment contributed the largest market share of 38% in 2025.

- By locker design/model, the temperature-controlled lockers segment is projected to grow at a significant CAGR of 10.6% between 2026 and 2035.

- By application/end user, the logistics & transportation segment contributed the largest market share of 38% in 2025.

- By application/end user, the office/workspace segment is projected to grow at the highest CAGR of 10.9% from 2026 to 2035.

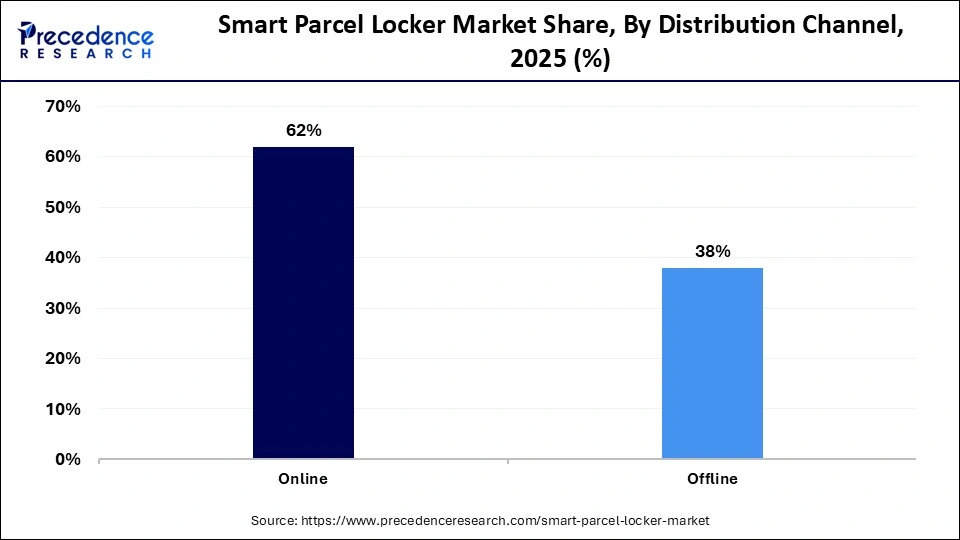

- By distribution channel, the online segment contributed the largest market share of 62% in 2025.

- By distribution channel, the offline segment is projected to grow at a significant CAGR of 11.2% from 2026 to 2035.

What is the Smart Parcel Locker Market?

The smart parcel locker market deals with automated and electronically secured locker systems designed to support parcel delivery, collection, and returns through self-service access available around the clock. These systems leverage connected technologies such as IoT sensors, cloud platforms, and digital authentication to enable real-time parcel tracking, user notifications, and secure access management. Market growth is driven by rapid expansion of e-commerce, increasing urban population density, and rising demand for contactless and flexible delivery options. Smart parcel lockers are increasingly deployed in residential complexes, retail centers, office buildings, logistics hubs, and public infrastructure to reduce failed deliveries, improve last-mile efficiency, and enhance customer convenience.

Growing pressure on courier networks is encouraging adoption of shared locker networks to lower delivery costs and congestion. Integration with mobile applications, digital payments, and carrier management systems is further improving usability and scalability. In parallel, rising participation from logistics providers, real estate developers, and municipalities is accelerating large-scale deployment of smart parcel locker solutions globally.

Smart Parcel Locker Market Key Technologies

The smart parcel locker market is experiencing a huge technological change due to the demand for secure, contactless, and efficient last-mile delivery solutions. Among the most notable changes is the introduction of IoT-enabled lockers that can be tracked in real-time, controlled remotely, and predict maintenance because of the connections with both sensors and sensors. On-premise systems are being replaced by cloud-based locker management systems, which allow logistics operators and property managers to centrally manage thousands of lockers spread across various locations. Capacity optimization, demand forecasting, and route efficiency are being improved with the use of AI and data analytics, which study the usage patterns and the behavior during the peak time. The other important change is a rise in mobile-first access technology, including QR codes, NFC, smartphone apps, and less reliance on physical keys or PINs. Also, locker designs are being created in a modular and scalable form with intelligent power management systems and solar-assisted systems to assist in quick deployment in urban as well as remote locations.

Smart Parcel LockerMarket Trends

- A major trend in the smart parcel locker market is the rising demand for contactless and unattended delivery, driven by e-commerce growth and changing consumer expectations for convenience and safety.

- Multi-carrier and multi-retailer compatible lockers are gaining traction, as they allow multiple logistics providers to share the same infrastructure, improving utilization rates and reducing delivery costs.

- The expansion of lockers beyond residential complexes into retail stores, transportation hubs, office campuses, and smart cities is another strong trend, positioning lockers as part of urban infrastructure. Sustainability is increasingly influencing purchasing decisions, leading to the adoption of energy-efficient lockers and shared delivery models that reduce carbon emissions from repeated delivery attempts.

- There is also a growing focus on value-added services, such as reverse logistics for returns, temperature-controlled compartments for groceries and pharmaceuticals, and integration with building management systems.

Smart Parcel Locker Market Overview

- IndustryOverview: The industry outlook for the smart parcel locker market is highly positive, with increasing adoption across residential complexes, commercial buildings, retail spaces, and public transport hubs. Logistics companies, e-commerce platforms, and real estate developers are increasingly collaborating to integrate locker systems into new and existing infrastructure.

- Global Expansion: Globally, the smart parcel locker market is expanding rapidly across developed and emerging economies. North America and Europe continue to lead adoption due to high e-commerce penetration, advanced logistics networks, and strong consumer acceptance of self-service delivery models. Meanwhile, Asia-Pacific is emerging as a high-growth region, driven by dense urban populations, rising online shopping volumes, and government-led smart city projects.

- Major Investment: The market has attracted significant investment from logistics companies, real estate developers, venture capital firms, and technology providers. Major investments are being directed toward expanding locker networks, developing cloud-based management platforms, and integrating advanced technologies such as AI, IoT, and data analytics. Strategic investments are also focused on mergers and partnerships to strengthen geographic presence and enhance technological capabilities.

- Startup Ecosystem: The startup ecosystem in the smart parcel locker market is dynamic and innovation-driven, with new entrants focusing on software intelligence, modular hardware design, and sustainability. Startups are contributing by developing AI-powered locker management systems, mobile-first user interfaces, and energy-efficient locker units suitable for diverse environments. Many startups are also addressing niche segments such as temperature-controlled lockers, reverse logistics for returns, and community-based shared locker networks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.38Billion |

| Market Size in 2026 | USD 1.55 Billion |

| Market Size by 2035 | USD 4.41 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.3% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component,Type / Locker Format , Locker Design/Model, Application / End User , Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Did Hardware Dominate the Smart Parcel Locker Market in 2025?

The hardware segment dominated the smart parcel locker market in 2025 by holding a share of 77%, as cabinets with lockers, electronic locks, touch screens, sensors, and embedded communication modules form the basis of the whole parcel locker system, requiring the biggest investment upfront. Massive deployments of smart parcel lockers by logistics companies and real estate developers focus on long-term, weather-resistant, and vandal-resistant hardware solutions. The extensive lifespan of locker hardware and the necessity to construct it in a robust state of build also contribute to the overwhelming proportion of its revenue. Locker networks can also be upgraded and expanded in size and capacity with hardware additions. Consequently, hardware is the costliest and biggest of the markets.

The software devices segment is expected to be the fastest growing in the coagulation analyzers market, with a CAGR of 11.7%, progressively demanded by the rising tendency towards smart management and efficient user experience. Cloud applications facilitate real-time visibility, user access control, analytics, and integrated systems within massive locker networks. The increased use of AI and data analytics is improving capacity utilization and predictive maintenance as well as delivery optimization. Multi-carrier interoperability also comes with software solutions and is emerging as a major requirement of shared locker infrastructure. Software models that are based on subscriptions are generating recurring streams and enhancing scalability for operators. Software is now becoming the main source of innovation and differentiation as locker ecosystems continue to get more complex.

Type / Locker Format Insights

Why Did Indoor Locks Dominate the Smart Parcel Locker Market During 2025?

The indoor lockers segment dominated the smart parcel locker market in 2025, holding a share of 58%, because they are commonly used in residential houses, offices, shopping centers, and commercial centers. The advantages of these lockers are that they have controlled environments, which lowers the maintenance requirements and increases the lifespan of the hardware. Popular places like apartment lobbies and shopping centers have a high number of people who can be used and yield high returns. Lockers in the indoor setup are also more secure and can easily be incorporated into the building management systems. The provision of indoor locker infrastructure is becoming a common feature of new developments by property developers. This is a high and stable demand, which still makes indoor lockers the leading segment.

The outdoor lockers segment is set to be the fastest-growing, with an expected CAGR of 11.4% during the forecasted period in the smart parcel locker industry, driven by facilities of delivery points publicly available in suburban and urban regions. These lockers will respond to the necessity of the 24/7 availability and easy collection of the parcels without the entry restrictions in the building. Outdoor locker reliability is being enhanced by the availability in the market of weatherproof, temperature-controlled, and remote-monitored materials. Logistics providers and municipal governments are rolling out open-air lockers at transport hubs and parking places as well as neighborhood centers. Shared, multi-carrier usage models also are supported by outdoor installations, which minimize the congestion of last-mile deliveries. This elasticity and scalability is propelling the outdoor locker segment to grow fast.

Locker Design/Model Insights

Why Did Modular Parcel Lockers Dominate the Smart Parcel Locker Market in 2025?

The modular parcel lockers segment dominated the smart parcel locker market by holding a share of 38% in 2025, because of their flexibility, scalability, and cost-efficiency. These systems enable operators to add or redesign compartments according to patterns of demand and location demands. Modular designs embrace standard parcel sizes, and therefore, they can be used in a vast variety of e-commerce and logistics applications. They can be installed and expanded easily, thereby minimizing the time and operational disturbance. Modular lockers are favored by property managers and logistic companies due to their flexibility in the scale of network investment and scaling. It is this flexibility that has seen modular parcel lockers become the most popular format of design.

The temperature-controlled lockers segment is set to be the fastest growing, holding a CAGR of 10.6% in the smart parcel locker market, by temperature-controlled lockers, which can be attributed to the emergence of grocery delivery, pharmaceutical, and perishable goods logistics. They are used in storing items that need refrigeration or controlled temperatures before retrieval because of these lockers. The increase in online food stores and healthcare logistics is causing a higher demand in the multi-zone lockers, which are cold and ambient. Energy-efficient lockers with temperature monitoring are increasingly becoming a viable business using improvements in technology. The temperature-controlled lockers are being adopted by retailers in a bid to support the click-and-collect and same-day delivery models. This segment is likely to grow fast as new categories of deliveries are offered.

Application/End User Insights

Why Were Logistics & Transportation Dominating the Smart Parcel Locker Market?

The logistics & transportation are dominating the smart parcel locker market by holding a share of 38%, with lockers helping logistics providers to minimize the number of failed delivery orders, to optimize the routes, and to minimize operational expenses of running a business. Large volumes of parcels because of e-commerce websites can guarantee a steady locker utilization. The ability to transport to hubs also increases the efficiency of delivery and convenience to customers. Lockers are especially appealing to large logistics networks since they allow supporting multi-carrier operations. Such high functionality ensures that logistics and transportation will be the dominant application segment.

The temperature-controlled lockers segment is expected to be the fastest growing, holding a CAGR of 10.9% in the smart parcel locker market. Business organizations are also implementing the use of lockers for the distribution of internal mail, administration of assets, and safe equipment swap. The development of common workplaces and manufacturing workshops is causing the surge of the need for adjustable storage and delivery services. Smart lockers enhance business efficiency since they lower manual operations and administrative expenses. Connection to employee access systems improves the security and traceability. These advantages are ushering in high rates of adoption in corporate and industrial settings.

Distribution Channel Insights

Why Is Offline Dominating the Smart Parcel Locker Market in 2025?

The online segment dominated with the largest share of 62% in the smart parcel locker market, with ongoing standardization of locker solutions and digital procurement platforms. The modular lockers are being sold online to smaller businesses and property managers. The digital platforms provide an easier way of comparing features, prices, and services. Software subscriptions and upgrades of a remote system can also be done through online channels. Increasing faith in remote support in the installation process and cloud-based management is lessening the reliance on physical processes of sales.

The offline segment is projected to grow at a significant CAGR of 11.2% because of customized and project-based locker deployments. Big installations usually have site evaluation, hardware design, and system integration where direct contact with the vendors is necessary. Property developers and logistics companies are more favorable to offline channels to get customized solutions and long-term contracts to use the services. Maintenance, installation, and after-sales services are also some important elements in the buying decision. There is also the offline channel that allows strategic partnerships and mass-scale framework agreements. This is a consultative sales model that supports the supremacy of offline distribution.

Regional Insights

Why Did North America Dominate the Smart Parcel Locker Market in 2025?

North America is dominating the utility vegetation management market by holding 37%, driven by the e-commerce environment, well-developed logistic infrastructure, and a high consumer willingness to use convenient and contactless delivery options. Online citizens are concentrated in the area, which promotes the demand for efficient delivery options to home delivery on a consistent basis. The fast process of urbanization and the emergence of multi-family residential complexes are additional reasons to approve locker installations in residential and mixed-use buildings.

Canada also enjoys consistent growth, which has been caused by the concentration of population in urban areas and due to the necessity of security of deliveries in the residential areas. Cold-climate factors are another factor that supports the adoption rate in Canada since lockers minimize multiple delivery attempts. Mexico is slowly turning out to be a growth market in the region because of the rising e-commerce penetration and the rising infrastructure in terms of urban logistics.

U.S. Smart Parcel Locker Industry Trends

The U.S. makes up a large chunk of the North American market, which is favored by the large volume of e-commerce and a well-developed network of last-mile delivery. The cost of labor has been high, and there has been an increase in delivery inefficiencies, and this has increased pressure on logistics firms to consider automated locker solutions to cut operational costs. Digital technologies are being used very early by the logistics operators and retailers in the U.S., which facilitates the smooth integration of the smart lockers in the current supply chain and warehouse management systems. The availability of large e-commerce websites and logistics service companies speeds up the implementation of large networks of lockers.

Why Is Asia Pacific Set to Be the Fastest-Growing Region for the Smart Parcel Locker Industry Between 2026 and 2035?

Asia Pacific is set to be the fastest growing in the smart parcel locker market, with an expected CAGR of 12.5%, due to the high urbanization rates, a flourishing e-commerce, and the rise of smartphones. The large population in the big cities poses a logistical problem, which can be effectively solved by the implementation of smart lockers to minimize the number of failed deliveries and congestion. The governments of the region actively invest in the projects of smart cities, which contain intelligent logistics infrastructure, including parcel lockers. The development of online payment procedures and mobile-exclusive consumer behavior also contributes to locker adoption. The growth of disposable incomes and shifting consumer lifestyles is bringing up the demands of flexible and self-service delivery. Consequently, the residential lockers and commercial lockers in Asia Pacific are undergoing growth at high rates.

China Smart Parcel Locker Market

China is the leader of the Asia Pacific market, as it has a large scale of e-commerce and excellent urban logistics systems. Use of digital platforms and super-apps has caused locker usage to be very intuitive to the consumers. India is a high-potential market due to the high growth in online shopping, rising urban housing complexes, and rising investments in the modernization of its logistics. Japan records a consistent uptake with robust automation culture, space optimization, and acceptance of self-service technology by consumers.

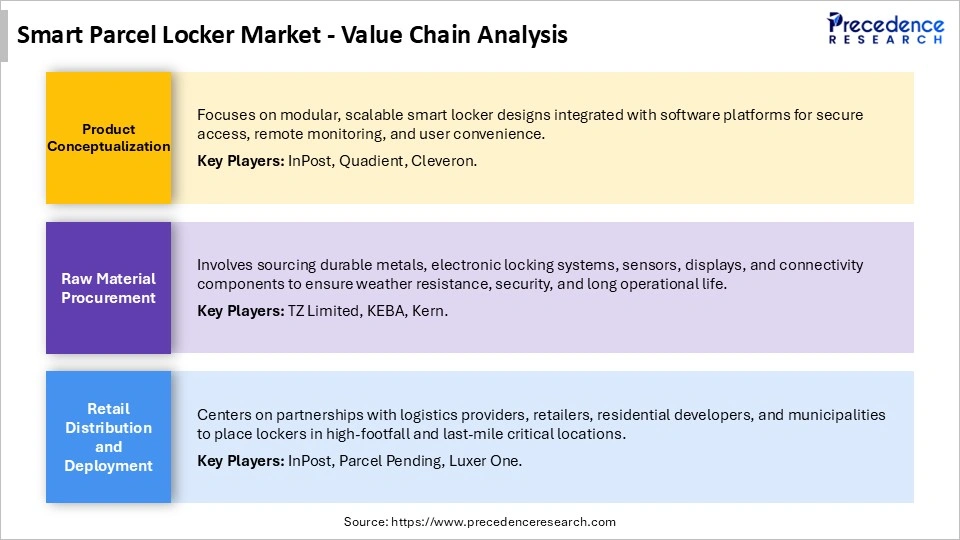

Smart Parcel LockerMarket Value Chain Analysis

Who are the Major Players in the global smart parcel locker Market?

The major players in the smart parcel locker market include InPost (parcel locker operator), Quadient (formerly Neopost), Cleveron, TZ Limited, Pitney Bowes Inc., KEBA AG, Luxer One / Parcel Pending (Quadient), American Locker, Florence Corporation, Hollman, Shenzhen Zhilai Sci & Tech Co., Ltd,. Smartbox Ecommerce Solutions, Snaile Inc,. Vanguard Protex Global, LockTec GmbH

Recent Developments

- In November 2025, Shell Germany announced that it had partnered with myflexbox, the open-network parcel locker provider in Germany and Austria, to install smart parcel lockers at more than 50 service stations across 14 German states, with further locations planned. The cooperation is part of Shell's broader strategy to transform traditional petrol stations into multi-purpose mobility hubs. Customers can now use the myflexbox lockers to pick up, return, or send parcels from multiple carriers, including UPS, DPD, GLS and FedEx. (Source: https://www.mobilityplaza.org)

- In September 2025, SPAR Netherlands announced it had rolled out smart parcel lockers at an increasing number of outlets across the country, in partnership with DHL, DPD, and Vinted Go. The retailer noted that the move ‘enhances its convenience proposition,' enabling customers to send or collect parcels at their local store.(Source: https://www.esmmagazine.com)

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Type / Locker Format

- Indoor Lockers

- Outdoor Lockers

By Locker Design/Model

- Modular Parcel Lockers

- Postal Lockers

- Temperature-Controlled / Fresh Food Lockers

- Laundry/Other Lockers

By Application / End User

- Logistics & Transportation

- Retail

- Residential

- Office / Workspace

- Government / Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting