Smart Shelves Market Size and Forecast 2025 to 2034

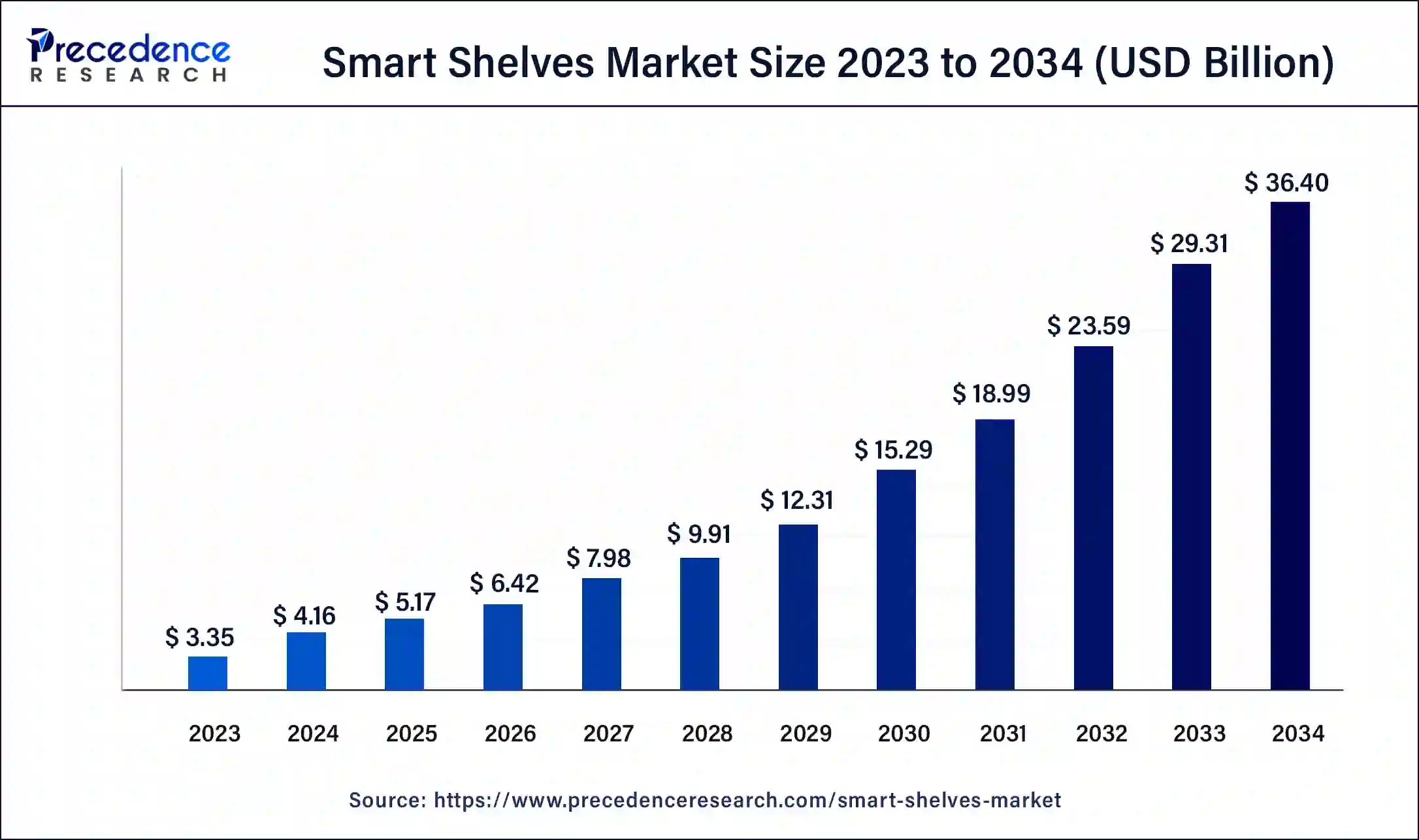

The global smart shelves market size was estimated at USD 4.16 billion in 2024 and is predicted to increase from USD 5.17 billion in 2025 to approximately USD 36.4 billion by 2034, expanding at a CAGR of 24.22% from 2025 to 2034. The growing retail sector, targeted marketing, changing customer needs, and technological advancements drive the smart shelves market

Smart Shelves Market Key Takeaways

- In terms of revenue, the global smart shelves market was valued at USD 4.16 billion in 2024.

- It is projected to reach USD 36.4 billion by 2034.

- The market is expected to grow at a CAGR of 24.22% from 2025 to 2034.

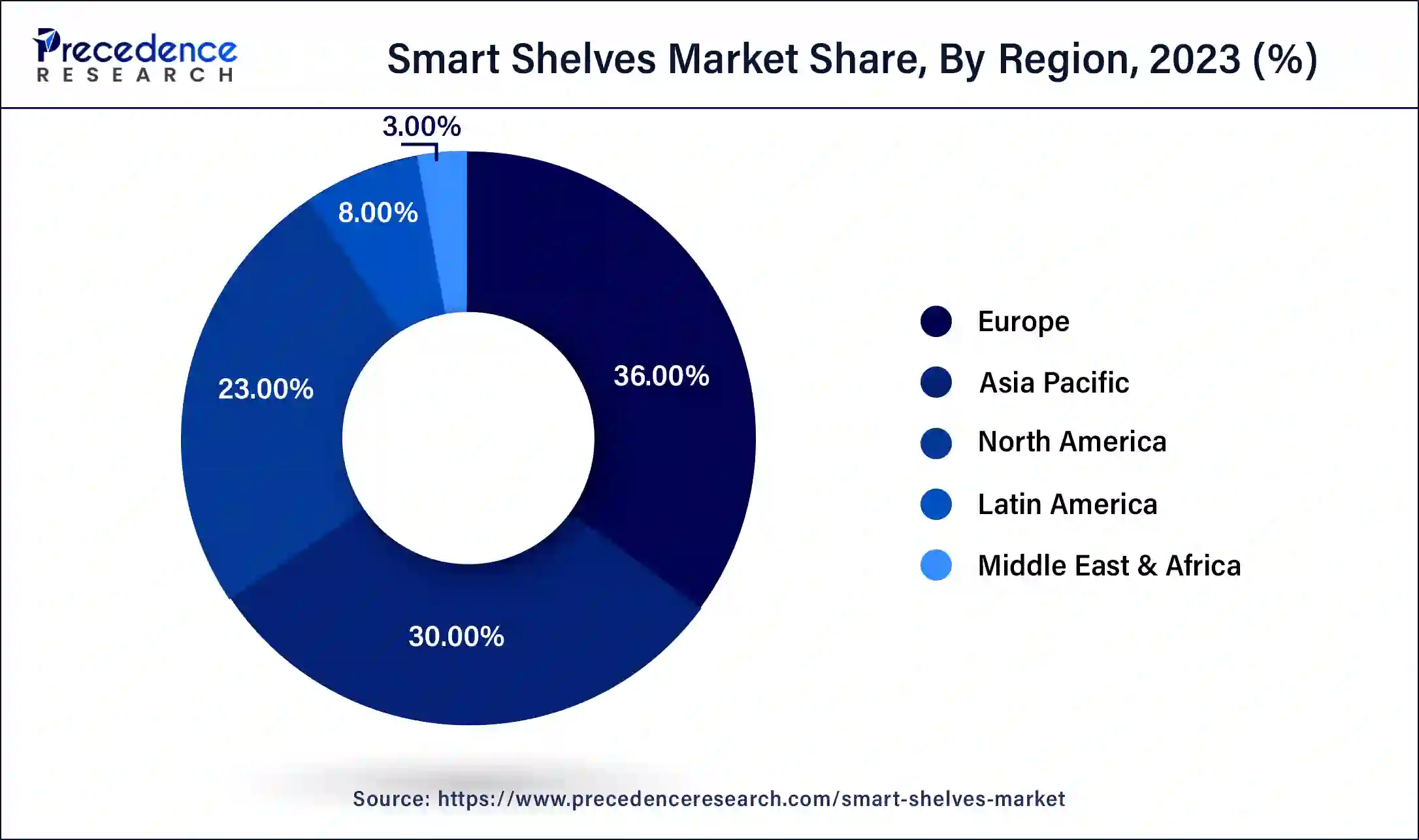

- Europe dominated the smart shelves market with the largest market share of 36% in 2024.

- Asia Pacific is anticipated to grow at a rate in the fastest CAGR during the forecast period.

- By component, the hardware segment captured more than 48% of the market share in 2024.

- By component, the software segment is expected to grow at a double-digit CAGR of 24.82% during the forecast period.

- By application, the inventory management segment led the market with the major market share in 2024.

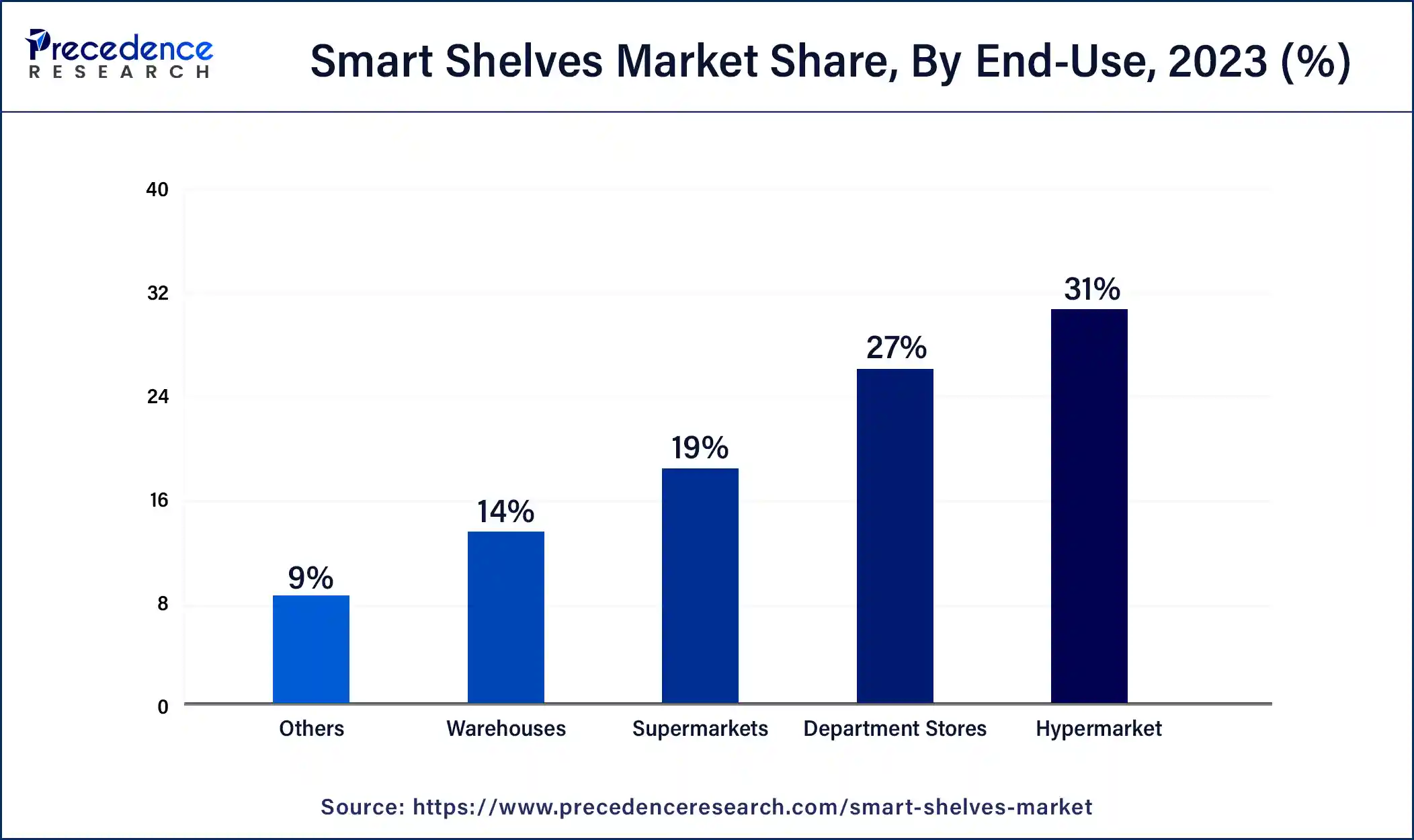

- By end-use, the hypermarket segment contributed the biggest market share of 31% in 2024.

- By end-use, the department stores segment will grow at a significant rate in the market over the studied period.

What is the role of AI in the smart shelves market?

Advanced technologies like artificial intelligence (AI) and IoT revolutionize the shopping experience for customers and enhance inventory management for shopkeepers. Smart shelves use weight sensors, proximity sensors, electronic shelf labels, IoT sensors, 5G technology, radio frequency identification reader (RFID) tags, and pressure sensor foils. AI provides real-time data and insights to improve operational efficiency. It also predicts the changing demands of customers and aids retailers to evolve according to consumer behavior. AI-powered computer vision facilitates advanced monitoring and benchmarking of out-of-stock instances and product merchandising. Hence, it provides access to automated infrastructure and real-time stock management through barcode scanning, ID scanning, and optical character recognition (OCR). It also enables the optimization of product placements by putting the most popular products on the shelf. Collectively, AI plays an essential role in streamlining operations, reducing costs, and delivering exceptional customer experiences.

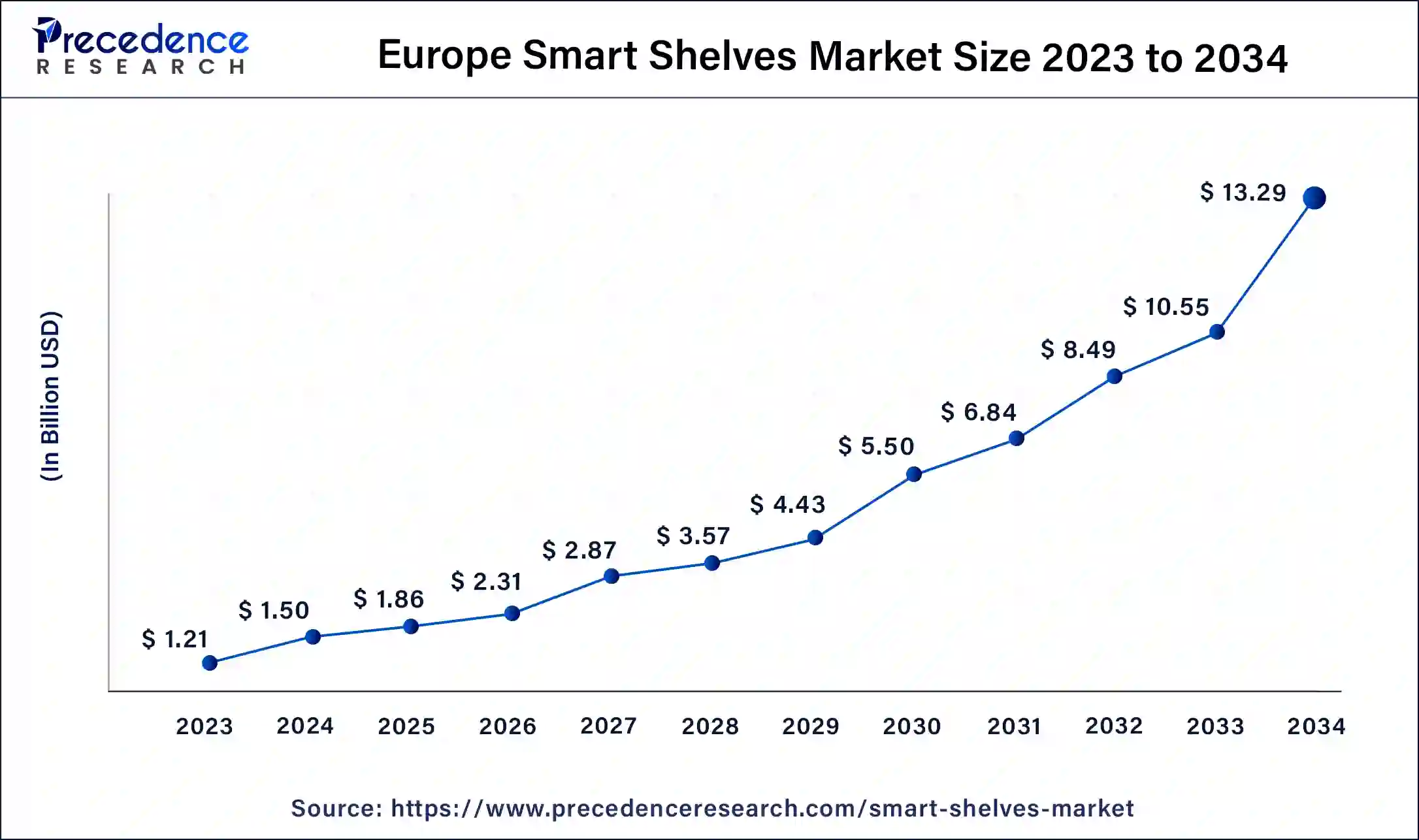

Europe Smart Shelves Market Size and Growth 2025 to 2034

The Europe smart shelves market size was valued at USD 1.5 billion in 2024 and is expected to be worth around USD 13.29 billion by 2034, at a CAGR of 24.38% from 2025 to 2034.

Europe held the dominant share of the smart shelves market in 2024. The presence of key players like Smart Storing, Pricer, and SOLUM ESL drives the market growth. The market is also driven by the increasing demand for sustainability. There is a high demand for electronic shelf labels (ESL) in Europe as it saves tonnes of carbon annually used in paper price tags. Additionally, increased investments & collaborations, and technological advancements boost the market growth. The European government actively supportsinternet of things (IoT) technologies by collaborating with industry, organizations, and academia to unleash its potential within Europe and beyond. According to the European Commission, the number of installed IoT-connected devices was found to be 40 billion in 2023 and is projected to increase to 49 billion by 2026.

- In June 2024, Netto, a Danish supermarket chain, announced a partnership with VusionGroup to roll out smart digital shelf labels. Netto will install a cloud technology by VusionGroup across its 550 stores to remotely manage and update shelf labels.

Asia-Pacific is also projected to host the fastest-growing smart shelves market in the coming years. The rising population, changing customer needs, increasing retail stores, and technological advancements drive the market. China and India are among the most populous countries in the world. As the population increases, consumer needs and demands change, accounting for the use of smart shelf technology to cater to their needs. There are approximately 66,197 supermarkets in India as of August 2024. At the same time, there are 32,513 retail stores in China as of 2023. This influences the huge demand for smart shelves. In addition, the government's policies on IoT and wireless technology augment the market growth.

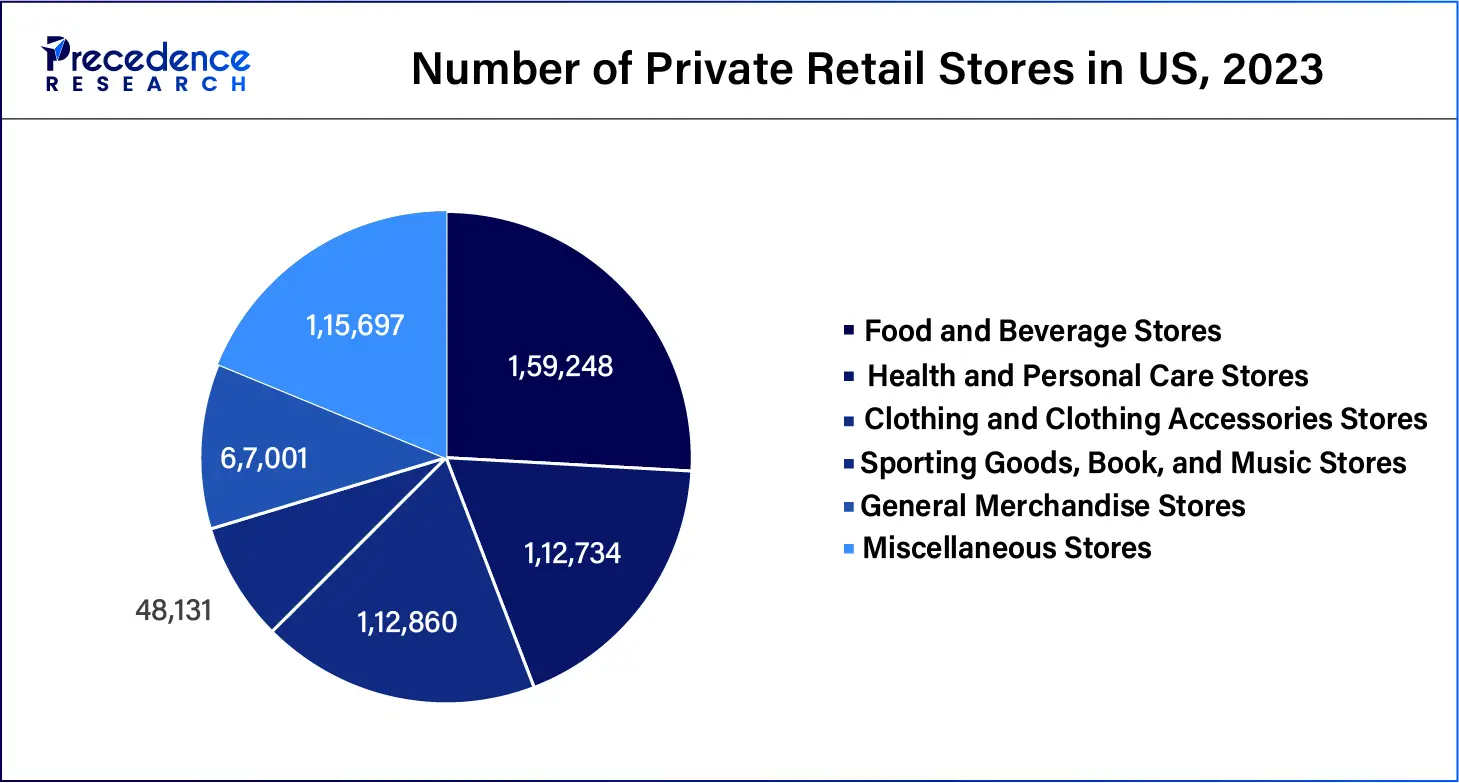

North America is anticipated to grow at a significant rate during the forecast period. The technological advancements, presence of key players, increased investments, favorable infrastructure, and the huge amount of retail stores in the region drive the smart shelves market. According to the US Bureau of Labor Statistics, there are approximately more than 1 million private retail establishments in the U.S. as of 2023. Major retail giants like Amazon and Walmart are adapting smart shelf technology to improve their store operations, enhance customer service, provide cost-effective service, and reduce the time of employees. Additionally, the demand for sustainability aids in the complete transformation from paper price tags to digital tags. Furthermore, the U.S. government invests millions of dollars to enhance wireless technology not only in the U.S. but also in partner nations.

Market Overview

Smart shelves are digital technology that retail shops use to automate the shopping experience. Smart shelves use advanced technology to get real-time data about inventory and stocking. They use a combination of sensors, digital displays, and RFID tags to provide detailed product information, marketing, and cross-selling suggestions. They give the retailers an idea about stock availability or misplaced products. Hence, smart shelves help retailers make informed decisions about stocking and inventory. Smart shelves benefit customers by enabling them to get personalized advertisements, product details and reviews, and promotional offers. Additionally, it helps manufacturers in targeted marketing by increasing brand visibility and influencing purchase decisions. They can also use inventory data from smart shelves to optimize their supply chain. Therefore, smart shelves are a smart option for manufacturers, retailers, and customers.

Smart Shelves Market Growth Factors

- Growing Retail Sector: The growing retail sector increases the demand for the use of advanced technology to attract more customers, thereby increasing market growth.

- Rising Population: The rise in population leads to changing consumer needs and behaviors, which can be easily managed by smart shelves.

- Increasing Competition: Increasing market competitiveness also drives market growth, enabling retailers to use smart shelves to adapt to consumer preferences.

- Technological Advancements: The advancements in technology facilitate the demand for smart shelves.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.40 Billion |

| Market Size in 2024 | USD 5.17 Billion |

| Market Size in 2024 | USD 4.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.22% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for customer satisfaction

The primary motive of retailers and shopkeepers is customer satisfaction. It is difficult for retailers to identify the changing needs of the consumers. Smart shelves provide numerous advantages to enhance customer experience and increase customer satisfaction by adapting to the changing customer needs and requirements. Smart shelves enable the availability of goods, individualized service, and convenient shopping. Also, the rising competition among retailers in the global market necessitates the use of advanced technology to attract more customers and fulfill their requirements. Smart shelves also enable a highly personalized experience by offering relevant information and product suggestions as customers browse the aisles. The absence of stock items is the major reason for customer dissatisfaction; hence, smart shelf technology should be implemented to notify retailers to refill their stock on time.

Restraints

Customer privacy and high cost

Although smart shelves offer numerous benefits, several limitations hinder their use by retailers and customers. The major limitation is customer privacy. Since smart shelves use technologies like AI and IoT to monitor customer preferences, hackers can easily track such information and breach the privacy of the customer. This restricts consumers for the use of smart shelves. Approximately 71% of web users have expressed that they do not want companies to use AI to improve customer experience if it threatens to infringe on their privacy. Additionally, the high upfront cost of installing infrastructure for smart shelves restricts small vendors and retailers from using them. Retailers also face technical challenges like reader collision, interference, and limitations in tag read ranges.

Opportunity

Targeted Marketing

Smart shelves embedded with cutting-edge technologies like cameras, digital price tags, and sensors enable businesses to gain access to a wealth of information about consumer behavior and inventory levels. This allows customers to enjoy a more convenient and interesting shopping experience. Retailers can leverage customer demographics through the use of smart shelves to modify and optimize their selling strategies. It attracts customers' attention to the latest and most relevant product promotions and creates opportunities for potential sales to increase profits and improve customer satisfaction. Hence, it benefits the customers by finding personalized products faster and easier while also benefitting retailers by increasing sales and reducing waste products. Smart shelves also help manufacturers understand consumer preferences and accordingly promote the branding/advertisement of their products.

Component Insights

The hardware segment held a dominant presence in the smart shelves market in 2024. The hardware components used in smart shelves include sensors, digital shelf labels, digital signages, RFID, and cameras. These components are used to gather data on the movement and location of items on the shelves. RFID tags contain a microchip, reader, and antenna to transmit and receive data. It enables product placement in desired locations and enables data collection and delivery along the supply chain without human intervention. Pressure sensor foils are also integrated within smart shelves that recognize the change of items on a shelf. These foils contain a multiplexer chip and a capacitive-to-digital converter, along with resistors and capacitors.

The software segment is expected to grow at the fastest rate in the smart shelves market during the forecast period of 2024 to 2034. Software solutions like AI and IoT accelerate the development of smart shelves technology and enable implementation at supermarkets and retail stores. The data obtained from the hardware components are analyzed by software to improve inventory management and optimize stocking levels. The software enables effective communication between employees and customers. Software is widely preferred as it eliminates the need for installation complexity, cost, and time. It optimizes the system performance and cost by employing powerful IoT attributes. Additionally, it can be accessed anytime and anywhere using wireless technologies.

Application Insights

The inventory management segment led the global smart shelves market in 2024. Inventory management is a complex process, especially for larger organizations. Advanced technologies like IoT simplify the process of inventory management by utilizing various data and keeping track of the products. Smart shelves give accurate information about stock availability. Retailers can consistently track the existing items and their movements within the shelf. Small-sized goods can be measured through weight sensors, and large-sized goods can be measured through RFID tags. Hence, retailers analyze and translate the information into customer preferences, like marketing trends and hot spots. Additionally, it alerts retailers about misplaced items and products with expiry dates.

The pricing management segment is predicted to witness significant growth in the smart shelves market over the forecast period. Supermarkets and department stores have ample products, from food stock to household items. These stores generally use paper price tags, which makes it difficult for the employees to change the prices of all goods. Smart shelves provide real-time data about products and their sales, enabling retailers to optimize prices according to the demand. It can also display discounts and promotions above the listed prices to attract more customers, thus increasing sales. Additionally, smart shelves enable syncing with online shopping platforms to ensure that the same price is available online and in-store.

- In June 2024, Walmart started using digital shelf labels (DSLs) in place of paper price tags and will expand to 2,300 stores by 2026. This allows employees to change prices on the product with a few clicks on a mobile app.

End-use Insights

The hypermarket segment registered its dominance over the global smart shelves market in 2024. A hypermarket is an amalgamation of a supermarket and a department store. It is a large retail space that houses a variety of goods, including complete grocery and general merchandise lines like appliances and clothing. The demand for smart shelves is high in hypermarkets due to huge amounts of diverse products and a high inflow of customers. Store management becomes easy with price label digitization, inventory management, and even customer service. Smart shelves can also enable retailers to manage supply chain management. Additionally, hypermarkets consist of favorable infrastructure and capital investment for the installation of smart shelves.

The department stores segment will grow at a significant rate in the smart shelves market over the studied period of 2023 to 2034. A department store is a retail establishment selling a wide range of products organized into distinct departments to satisfy the customer's needs under one roof. Smart shelves are preferred in department stores to stay competitive in the market. They aid in inventory and planogram management, focusing on customer-centric shopping experience.

Smart Shelves Market Companies

- Avery Dennison Corporation

- AWM Smart Shelf

- E Ink Holdings, Inc.

- Hanshow Technology Co. Ltd.

- Honeywell International, Inc.

- Huawei Technologies Co. Ltd.

- LPS Technology

- Mirnah Technology Systems

- Panasonic Connect

- Partron ESL

- ShelfWise

- SOLUM ESL Global

- Trax Retail

- WiiHey Technologies

Recent Developments

- In February 2024, Lidl, a German supermarket chain, announced the implementation of electronic shelf labels (ESL) in all its 960 stores in the UK. The technology can enhance operational efficiency, save time of staff, and make it easy to restock goods.

- In August 2024, SPAR Austria announced the integration of smart electronic shelf labels (ESL) in its 200 stores by year-end to enable a modern and convenient shopping experience for customers and digital price labeling for store employees. The chain's transition to digital labels was more customer-friendly and easy for personnel.

- In August 2024, Scandit announced the asset acquisition of shelf audit automation technology from MarketLab. The acquisition was made to broaden Scandit's smart data capture capabilities for the wider retail industry.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Application

- Inventory Management

- Pricing Management

- Planogram Management

- Content Management

- Others

By End-use

- Hypermarket

- Department Stores

- Supermarkets

- Warehouses

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting