What is the Soft Gel Encapsulation Machine Market Size?

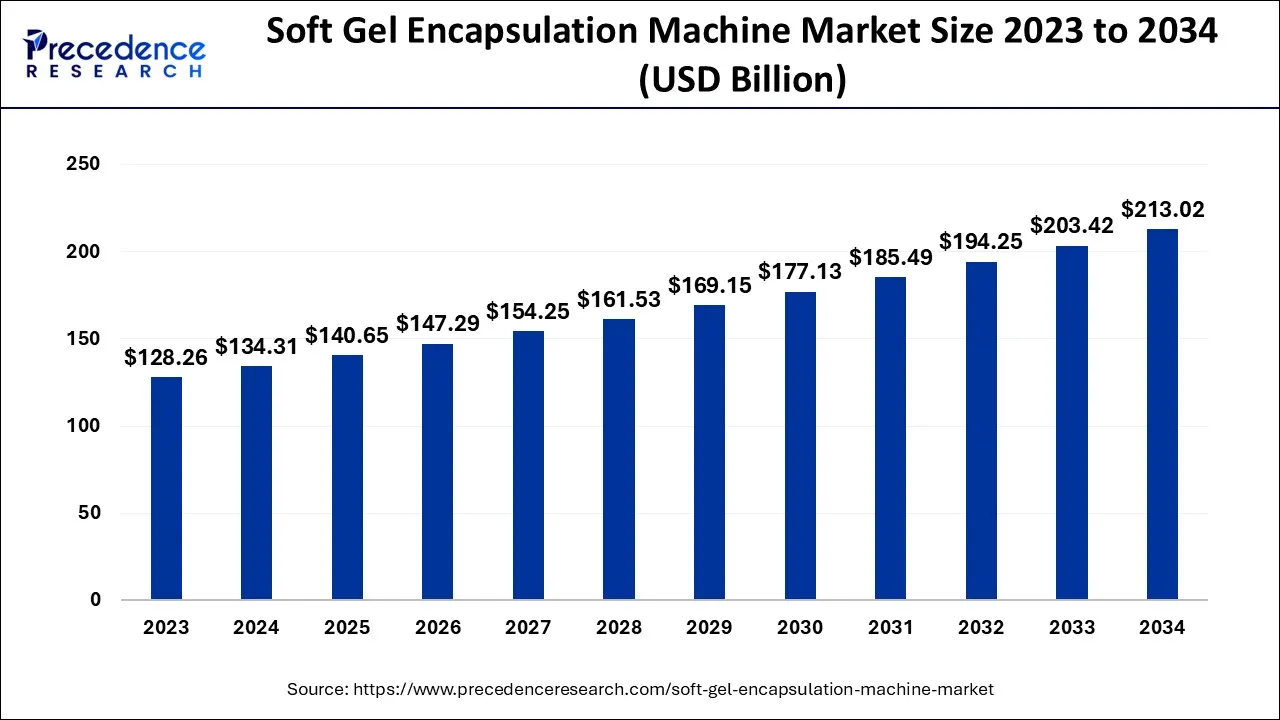

The global soft gel encapsulation machine market size is calculated at USD 140.65 billion in 2025 and is predicted to increase from USD 147.29 billion in 2026 to approximately USD 222.33 billion by 2035, expanding at a CAGR of 4.69% from 2026 to 2035.

How is Soft Gel Encapsulation Machine Transforming Across the Globe?

Soft gel capsules are commonly used in the pharmaceutical, nutraceutical, and cosmetics industries because they are easy to swallow, improve the absorption of nutrients, and can be customized for specific dosages. As a result, there has been a rise in the demand for soft gel encapsulation machines, which are specialized equipment used to manufacture these capsules.

Soft Gel Encapsulation Machine Market Growth Factor

The soft gel encapsulation machine Market is predicted to grow substantially in the future. Firstly, there is a rising demand for soft gel capsules in industries such as pharmaceuticals, nutraceuticals, and cosmetics. Secondly, advancements in machine capabilities are also contributing to the market's expansion. Lastly, the emergence of new markets is further driving the growth of the industry.

Several trends are currently shaping the soft gel Encapsulation Machine Market. One such trend is the increasing customization and flexibility in machine offerings. This allows manufacturers to cater to the specific needs of their customers. Another trend is the focus on sustainability and plant-based options. This reflects the growing consumer preference for eco-friendly products. Lastly, there is a strong emphasis on improving efficiency and productivity in soft gel manufacturing processes.

Trends & Future Outlook of the Soft Gel Encapsulation Machine Market

- Spurring Servo Technology

Day by day, the market is emphasizing servo technology, especially electronic/servo-driven systems for accuracy, speed, and minimal maintenance. - Emphasis on Precise Dosing

In the coming era, researchers will explore adaptive precision dosing mechanisms, probably by employing microfluidic-based encapsulation for highly accurate fill volumes. - Immersive Modular Designs

Players are emerging compact, modular machines for scaling up from R&D and pilot studies to commercial production more effectively.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 140.65Billion |

| Market Size in 2026 | USD 147.29 Billion |

| Market Size by 2035 | USD 222.33 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.69% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rise in chronic diseases

The rise in chronic diseases is a significant factor driving the market for soft gel encapsulation machines. Chronic diseases like cardiovascular diseases, neurological disorders, nutritional deficiencies, and respiratory disorders are becoming more prevalent worldwide. This increase in chronic diseases creates a demand for pharmaceutical products and treatments, many of which are encapsulated in soft gel capsules.

Soft gel capsules offer several advantages for delivering medications used in the treatment of chronic diseases. They provide controlled release, allowing for a consistent and sustained release of active pharmaceutical ingredients (APIs) over time. This controlled release feature is particularly beneficial for medications that require specific dosing schedules or need to maintain therapeutic levels in the body. Furthermore, soft gel capsules are easy to swallow, making them more suitable for patients, especially the elderly and those with difficulty swallowing, who may need to take multiple medications daily. The smooth gelatine-based texture of soft gel capsules improves patient compliance and medication adherence, which is crucial for effectively managing chronic diseases.

As the prevalence of chronic diseases continues to rise, pharmaceutical manufacturers are increasingly focusing on developing and producing medications in the form of soft gel capsules. This drives the demand for soft gel encapsulation machines, which enable efficient and high-quality production of soft gel capsules on a larger scale.

Additionally, the treatment of chronic diseases often involves long-term medication regimens, requiring a continuous supply of encapsulated pharmaceutical products. The need to meet the ongoing and increasing requirements for chronic disease management further fuels the demand for soft gel encapsulation machines.

Restraints

High initial investment

One major obstacle for the soft gel encapsulation machine market is the high initial investment required to enter the market. Soft gel encapsulation machines are complex and sophisticated equipment that require a significant amount of money to purchase. In addition, setting up a suitable manufacturing facility and ensuring compliance with regulatory standards such as Good Manufacturing Practices (GMP) also adds to the cost.

The small and medium-sized enterprises or new companies with limited financial resources, the high initial investment can be a significant barrier. The upfront costs may be too expensive and prevent them from entering the market or expanding their operations. This can limit their growth potential and give an advantage to larger, more established manufacturers who have already made the necessary investments. Furthermore, the cost of maintaining and operating the soft gel encapsulation machines should also be taken into account. This includes ongoing maintenance, repairs, training of personnel, and the procurement of necessary consumables and spare parts. These expenses can further burden the finances of the business and affect its profitability.

To address this obstacle, manufacturers can consider options such as leasing or financing arrangements to reduce the upfront investment burden. Additionally, collaborating with contract manufacturers or outsourcing certain production processes can provide a more cost-effective approach for companies with limited resources. Moreover, government incentives and support programs aimed at promoting innovation and industrial growth can help alleviate the financial strain for new market entrants.

Opportunities

Increasing application in cosmetics and skincare

Soft gel capsules are not only used in pharmaceuticals and nutraceuticals but are also becoming popular in the cosmetics and skincare industry. Soft gel encapsulation machines can be used to create soft gel capsules that contain various skincare ingredients like serums, oils, and anti-aging compounds. The increasing demand for innovative skincare products creates opportunities for manufacturers of soft gel encapsulation machines to meet the needs of this growing market segment.

Soft gel capsules are becoming increasingly popular in the cosmetics and skincare industry as a way to deliver various skincare ingredients. Soft gel encapsulation machines are essential for producing these capsules, which can contain serums, oils, anti-aging compounds, and other beneficial ingredients. The demand for innovative skincare products is growing, as consumers prefer convenient and effective application methods. Soft gel capsules offer advantages such as improved stability, controlled release, and better absorption of active ingredients. This creates a significant opportunity for manufacturers of soft gel encapsulation machines to meet the needs of the expanding cosmetics and skincare market by providing efficient and advanced machines for soft gel capsule production.

SWOT Analysis of the Soft Gel Encapsulation Machine Market

Strength

- These machines can facilitate encapsulation of liquids, suspensions, pastes, and oils, developing diverse shapes, sizes, and colors for different products.

- Alongside, its fully automated, high-speed production further lowers labour and errors, making it suitable for large-scale runs.

Weakness

- They need accurate calibration of dye rolls, injection pumps, and temperatures for continuous ribbon thickness and fill weight, or else it results in defects.

- A greater water content in the shell makes them unfavourable for moisture-sensitive drugs.

Opportunity

- Key players will explore integrated digital twins, AI, and data analytics for predictive maintenance, real-time quality assurance, and adaptive dosing.

- Also, they will focus on the unification of gelatin preparation and encapsulation in smaller footprints.

Segment Insights

Type Insights

A manual encapsulation machine, also known as a Hand Operated Capsule Filling Machine or Manual Operation Capsule Filling Machine, is used for filling capsules with powder, pellets, granules, and tablets. This machine is commonly used in the pharmaceutical, nutritional, biotech, health supplement, food product, and cosmetics industries. It is suitable for filling Hard Gelatine, HPMC, and Veg Capsules in sizes 00, 0, 1, 2, 3, 4, and 5. Different versions of this machine are available in the market, including the Standard Model, GMP Model, and Stainless Steel 316 Model.

Semi-Automatic capsule filling Machine is designed to meet the precise manufacturing requirements of modern pharmaceutical procedures. This machine is capable of filling capsules ranging in size from 00 to 5 with powder, granules, or pellets. We offer three different models that can produce anywhere from 25,000 to 45,000 capsules per hour.

The machine is highly automated and provides a high level of accuracy in filling weights. It is constructed according to GMP standards and features a Stainless-Steel covering. This machine is commonly used in Research and development laboratories, research institutions, for producing the herbal and nutraceutical preparations and Ayurvedic medicines.

It is also suitable for pilot batch productions. The application of this machine is to fill capsules with powder, pellets, and granules. This machine is suitable for use in the pharmaceutical, nutritional, biotech, health supplement, food product, and cosmetics industries. It is compatible with Hard Gelatine, HPMC, and Veg Capsules in sizes 00, 0, 1, 2, 3, 4, and 5. Different versions of this machine are available in the market, including Single Loader, Double Loader, and Mini Model.

Technology Insights

Rotary Die Encapsulation is a widely used technology in soft gel encapsulation machines. These machines use a rotary die system, where two dies rotate to encapsulate the formulation in a gelatine shell. The rotary die system offers high production capacities, precise dosing, and efficient encapsulation of soft gel capsules. It is suitable for large-scale production and is commonly used in the pharmaceutical and nutraceutical industries.

Reciprocating Die Encapsulation machines use a reciprocating die system. In this technology, the dies move back and forth to encapsulate the formulation in a gelatine shell. Reciprocating die machines are typically used for smaller production volumes or specialized applications. They offer flexibility and can handle a range of formulation types, making them suitable for research and development settings or smaller-scale production.

Plate Encapsulation is another technology used in soft gel encapsulation machines. These machines use a plate system, where the formulation is encapsulated between two plates. The plates press together to form the soft gel capsule. Plate encapsulation machines are known for their versatility and ability to handle various formulations, including those with higher viscosities. They are often used for specialized applications or in industries such as cosmetics and skincare.

Application Insights

Soft gel encapsulation machines play a vital role in the pharmaceutical industry by encapsulating active pharmaceutical ingredients (APIs) into soft gel capsules. This process allows for precise dosing, stability, and controlled release of medications. Soft gel capsules are commonly used for oral drug delivery, making them easier to swallow and improving patient compliance.

In the nutraceutical industry, soft gel encapsulation machines are used to encapsulate dietary supplements, vitamins, minerals, herbal extracts, and other nutritional ingredients. Soft gel capsules provide an efficient and convenient delivery system for these supplements, ensuring accurate dosing and enhanced stability. The nutraceutical market relies on soft gel encapsulation machines to produce high-quality and standardized soft gel capsules to meet the growing demand for health and wellness products.

Soft gel encapsulation machines are also utilized in the cosmetics and personal care industry. These machines can encapsulate various skincare ingredients, including serums, oils, anti-aging compounds, and other beneficial components. Soft gel capsules in the cosmetics industry are used for products like facial creams, eye gels, beauty supplements, and other formulations that require precise dosage and controlled release. Manufacturers in the soft gel encapsulation machine market cater to the unique needs of the pharmaceutical, nutraceutical, and cosmetics industries to ensure efficient and reliable soft gel capsule production.

Regional Insights

Soft gel encapsulation machines have significant markets in North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

In North America, the United States and Canada have well-established pharmaceutical and nutraceutical industries, creating a strong demand for these machines.

Europe, with countries like Germany, the United Kingdom, France, Italy, and Spain, is also a prominent market due to leading pharmaceutical companies and stringent quality standards.

The Asia Pacific region, including China, India, Japan, South Korea, and Southeast Asian nations, is experiencing rapid growth driven by a large population, increasing disposable incomes, and rising demand for dietary supplements.

Latin America, particularly Brazil, Mexico, and Argentina, offers growth opportunities fuelled by increasing healthcare expenditure and domestic manufacturing expansion.

The Middle East and Africa region, including the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria, is showing potential due to the growth of the pharmaceutical and nutraceutical sectors.

Soft Gel Encapsulation Machine Market- Value Chain Analysis

- Component Fabrication and Machining

This includes manufacturing precise parts from particular materials, especially high-quality stainless steel for the main body and tanks, and aerospace aluminium alloys for die rolls.

Key Players: Technophar, SaintyCo, Pharmaland, etc. - Installation and Commissioning

This executes site prep, mechanical setup (aligning dies, gears), electrical hookups, system calibration (temperatures, speeds, dosing), robust testing with gelatin/fill, operator training, and final validation.

Key Players: PTEPL, Senieer, Vedic Pac Systems Pvt Ltd., etc. - Product Lifecycle Management

The market covers a comprehensive process of planning, designing, manufacturing, operating, maintaining, and eventually retiring the equipment itself.

Key Players: Bosch Packaging Technology, GEA Group, IMA Group, etc.

Soft Gel Encapsulation Machine Market Companies

- Bosch Packaging Technology:A company that facilitates advanced capsule fillers like the GKF series.

- IMA Group:This mainly specialises in advanced technologies for a variety of dosage forms, such as some specialised liquid and unit-dose filling systems.

- Sejong Pharmatech: It explores high-performance hard capsule filling machines, including the SF-100N and F-Series (VANTIX).

- Romaco Group: This provides highly advanced film coating solutions for soft gelatin capsules (SGCs).

- SaintyCo: It offers diverse Aprila softgel encapsulation machines for numerous scales, from the small-batch SG50 (R&D) and SG100 to the SG200 & SG250.

Other Major Key Players

- Bosch Packaging Technology

- IMA Group

- Sejong Pharmatech

- Romaco Group

- SaintyCo

- Labh Group of Companies

- Schaefer Technologies, Inc.

- Pamasol Willi Mäder AG

- CVC Technologies, Inc.

- S.K. Pharma Machinery Pvt. Ltd.

Recent Developments

- A new model of high-speed rotary die machine with an advanced control system has been introduced in the soft gel encapsulation machine market. This machine can achieve high production speeds while minimizing gel waste. It is equipped with a servo motor drive type, PLC touch screen control, and automatic filling volume control, making it highly efficient and user-friendly.

- There has been a recent shift from using hard gel capsules to soft gel capsules, which is anticipated to increase the demand for soft gel encapsulation machines in the future. This change in preference is expected to have a long-term impact on the market.

Segments Covered in the Report

By Type

- Manual Encapsulation Machine

- Semi-Automatic Encapsulation Machine

- Automatic Encapsulation Machine

By Technology

- Rotary Die Encapsulation

- Reciprocating Die Encapsulation

- Plate Encapsulation

By Application

- Pharmaceutical

- Nutraceutical

- Cosmetics

- Personal Care Products

- Veterinary Medicine

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting