Solar Energy Systems Market Size and Growth 2025 to 2034

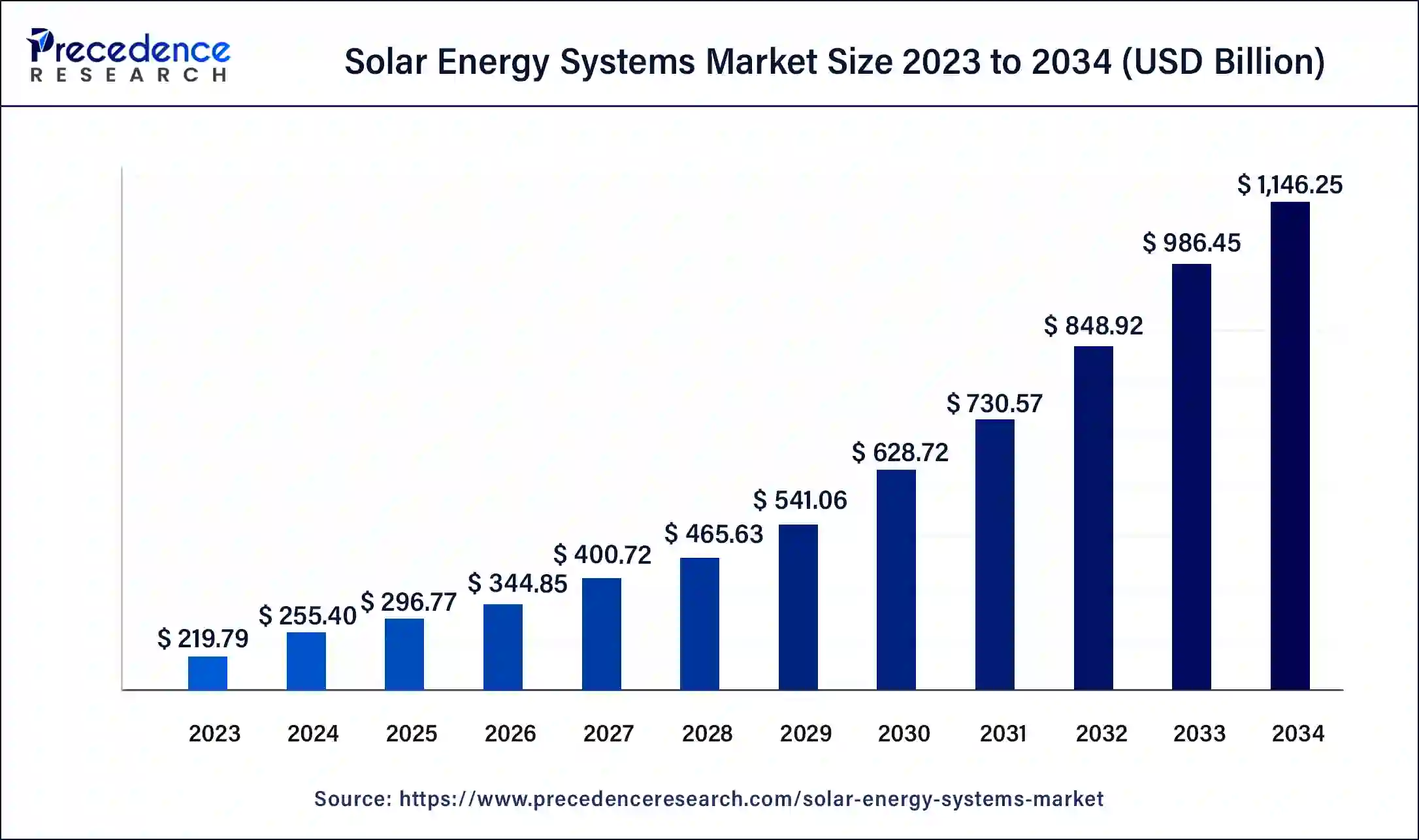

The global solar energy systems market size accounted at USD 255.40 billion in 2024 and is expected to reach around USD 1,146.25 billion by 2034, expanding at a CAGR of 16.20% from 2025 to 2034.

Solar Energy Systems Market Key Takeaways

- In terms of revenue, the solar energy systems market is valued at $296.77 billion in 2025.

- It is projected to reach $1,146.25 billion by 2034.

- The solar energy systems market is expected to grow at a CAGR of 16.20% from 2025 to 2034.

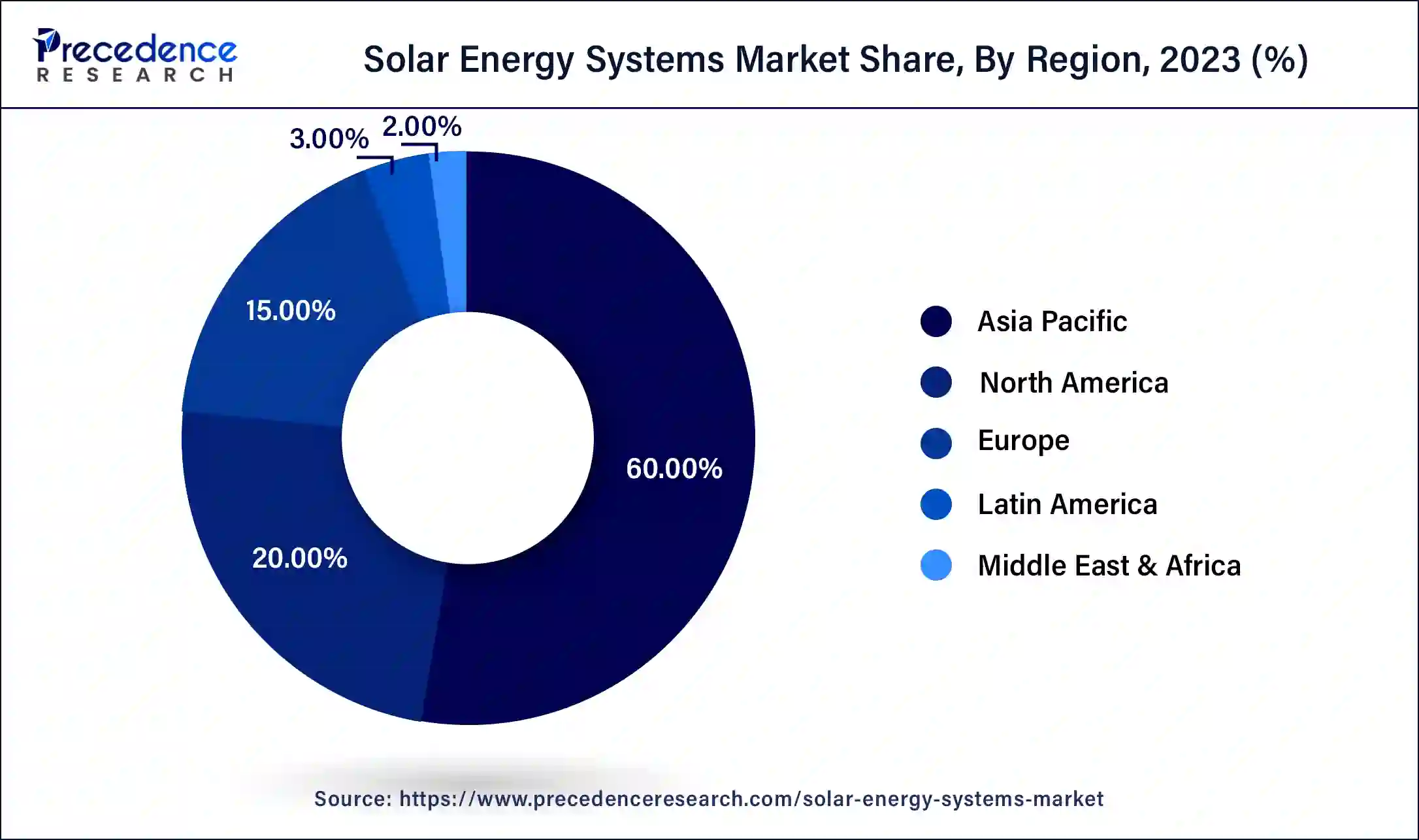

- Asia Pacific generated more than 60% of revenue share in 2024.

- By Product, the solar panels segment contributed more than 43% of revenue share in 2024.

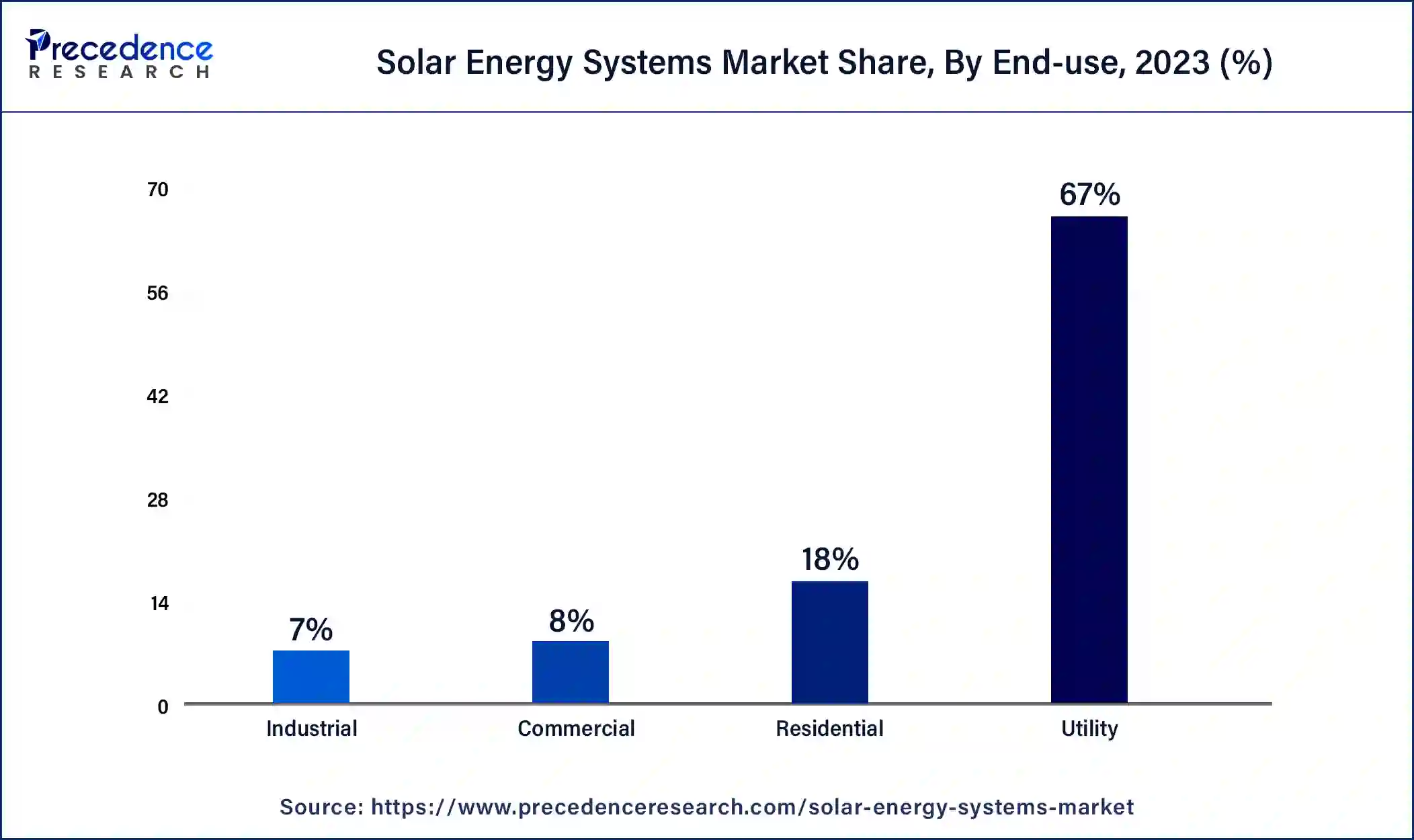

- By End-use, the utility segment captured more than 67% of revenue share in 2024.

- By Source, the new installation segment led the market with the highest market share of 97% in 2024.

Asia Pacific Solar Energy Systems Market Size and Growth 2025 to 2034

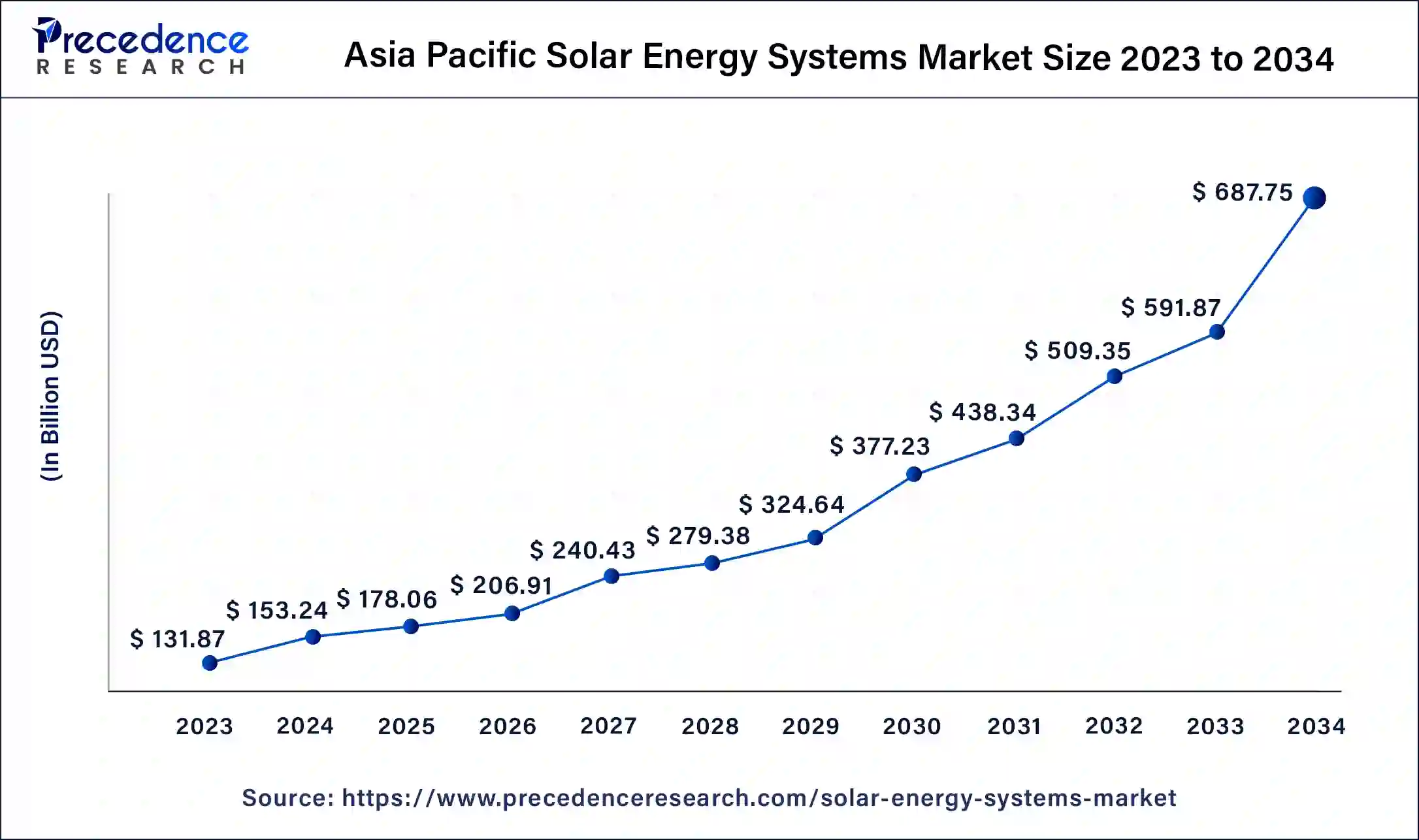

The Asia Pacific solar energy systems market size was estimated at USD 153.24 billion in 2024 and is predicted to be worth around USD 687.75 billion by 2034, at a CAGR of 16.40% from 2025 to 2034.

Asia Pacific is expected to dominate the market over the forecast period.The regional solar energy systems market is poised for continued growth as governments and industries focus on meeting renewable energy targets, addressing energy security concerns, and achieving a more sustainable energy mix. The combination of supportive policies, technological advancements, and increasing awareness of the benefits of solar energy positions Asia Pacific acts as a significant contributor to the global transition towards cleaner energy sources. For instance, as per the data by the International Energy Agency, within 20 years, solar power in India is expected to develop at an exponential rate and surpass coal's proportion in the country's power-generating mix.

India's governmental goals, namely the goal to attain 450 GW of renewable capacity by 2030, are the driving forces behind this sudden reversal. Thus, this is expected to propel the market growth in the region.

North America is expected to hold a significant market share over the forecast period.The regional growth is driven by a combination of technological advancements, environmental concerns, supportive policies, and increasing consumer demand for clean and sustainable energy sources. The United States is a leading player in the North American solar energy market. It has seen substantial growth in both residential and utility-scale solar installations. For instance, in 2022, the United States added 4.8 gigawatt-hours (GWh), or 14.1 GWh, of energy storage to the electrical grid, a 34% year-over-year increase. Thereby, driving the market growth in the region.

Market Overview

Solar energy systems refer to a collection of technologies and components designed to harness sunlight and convert it into usable energy for various purposes, including electricity generation and heat production. These systems utilize the photovoltaic effects or solar thermal processes to capture and convert solar radiation into forms of energy that can be utilized for residential, commercial, industrial, and even utility-scale applications. The solar energy systems market has experienced rapid growth and significant transformation in recent years due to increasing global awareness of the need for sustainable and renewable energy sources.

According to U.S. Census data, in the US, 2.5 GWdc of cells and 28.7 GWdc of modules, an increase of 21% y/y (+5 GW) and 7% y/y (178 megawatts), respectively, were imported in 2022. Additionally, in 2022, 2.5 GWdc of cells were imported. For the second consecutive quarter, quarterly cell imports increased in Q4 2022 (+60 MWdc, +9% quarter-over-quarter).

Solar Energy Systems Market Growth Factors

Considering the rising demand for renewable energy solutions across the globe, the market for solar energy systems is expected to continue to grow in the upcoming period. Multiple governments are actively participating in programs and initiatives to boost the installation of solar energy systems in the industrial sector. Along with this, substantial support by governments in the form of subsidies and tax concessions acts as a growth factor for the market. Moreover, multiple players in the related field have started considering the solar power system business as a risk-free and affordable model of business. This factor also offers a significant growth factor for the market to grow.

Solar Energy Systems Market Growth Factors

- Declining costs of solar technology- Innovations in solar panel efficiencies and manufacturing methods are continuing to lower costs for solar installations. These lower prices will continue to broaden the market of residential, commercial, and utility-scale consumers of solar energy, dramatically accelerating adoption rates around the globe.

- Government incentives and policies- Regulatory support, including subsidies, tax credits, and renewable energy targets, sends a sign of confidence from the government and allows encouragement of investment in solar infrastructure. These incentives and policies are key to disrupting fossil fuels and moving toward clean energy.

- Rising energy demand- The global population continues to grow with significantly increased electrification, and the demand for energy is rapidly growing. Solar energy is a scalable resource, and time will reveal that it is also a sustainable solution to meet our future power demand while limiting environmental impacts.

- Integration of energy storage systems- Technological advances in battery and energy storage systems allow solar systems to provide power when it is not sunny, increasing reliability and grid stability, meaning solar can be a more viable option as a primary energy source.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 255.40 Billion |

| Market Size in 2025 | USD 296.77 Billion |

| Market Size by 2034 | USD 1,146.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.20% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By End-use, and By Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government policies and incentives

Governments around the world have implemented supportive policies and financial incentives to promote the adoption of solar energy. These include tax credits, subsidies, grants, feed-in tariffs, and net metering programs, which make solar investments more attractive for individuals, businesses, and utilities. For instance, the Indian government has initiated multiple subsidies which are consistent with India's Intended Nationally Determined Contributions aim of achieving about 40% cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030. Thereby, driving the market growth over the forecast period.

Restraint

Concerns related to cost and grid integration

While energy storage technologies continue to advance, the costs of establishing large-scale energy storage systems can remain quite expensive, limiting the overall economic sustainability of solar energy systems. Furthermore, integrating solar energy into existing energy networks can be technically challenging, necessitating infrastructure changes to handle two-way energy flows and assure system stability. Thus, this is expected to act as a major restraint for the market growth over the forecast period.

Opportunity

Expansion of product services by key players

The expansion of product services by key players is expected to offer an attractive opportunity for market growth during the forecast period. For instance, in January 2023, an Indian start-up, SOLAR-MAIT announced the offering of a 25-year warranty on its rooftop solar systems. with this offering, the company becomes country's first company to provide such a wide warranty and setting a new benchmark in the rooftop solar market. Simultaneously, SOLAR-MAIT has announced development ambitions and creative business models to build a system in India's rooftop solar sector. These initiatives include the formation of a company franchise in order to promote India's Aatmnirbhar Bharat Abhiyan (Self-reliant India campaign. Thereby, driving the revenue growth.

Product Insights

Based on the product, the solar panels segment is expected to dominate the market during the forecast period. The most important component of a solar energy system is the solar panel, which transforms solar energy into electrical energy. Depending on the installation's needs, multiple solar panel types, including crystalline silicon and thin film are employed. To boost the effectiveness and lifetime of the panel, significant investments have been made in new solar panel technology.

On the other hand, the batteries segment is expected to capture a significant market share over the forecast period. Energy storage batteries play a crucial role in enhancing the functionality and reliability of solar energy systems by storing excess energy generated during sunny periods for use when sunlight is limited. There are various types of batteries used in energy storage systems including lithium-ion batteries, lead-acid batteries, flow batteries and others. For instance, lithium-ion batteries are widely used in solar energy storage due to their highefficiency, energy density and long lifespan. They are suitable for residential, commercial, and utility-scale applications. Thus, this is expected to drive the market growth during the forecast period.

End-use Insights

Based on the end-use, the utility segment is expected to dominate the market over the forecast period. For decades, utility-scale solar has produced reliable, clean energy with a steady fuel price. It is also considered one of the quickest methods to minimize carbon emissions is to develop utility-scale solar electricity. Moreover, utilities invest in research and development to improve the efficiency, reliability, and cost-effectiveness of solar energy technologies. This includes advancements in solar panels, energy storage systems, grid management, and integration solutions.

Besides, the industrial segment is expected to grow at a significant rate over the forecast period. Industrial applications of solar energy systems encompass a wide range of sectors and use cases, where solar power is harnessed to meet energy needs, reduce operational costs, and promote sustainability. The U.S. Department of Energy Solar Energy Technology Agency aims to establish an industrial sector with carbon-free system by 2050. Thus, this is expected to propel the segment expansion over the projection period.

Source Insights

Based on the source, the new installation segment is expected to hold the largest market share over the forecast period. The adoption of solar energy technology is underway, and several nations are encouraging the installation of solar energy systems for the production of electricity. Utility-scale solar systems are being funded by several nations to lower national carbon emissions, which is predicted to boost product demand. Thereby, driving the segment expansion over the forecast period.

Solar Energy Systems Market Companies

- Canadian Solar Inc.

- Kaneka Corp.

- Gintech Energy Corp.

- Bright Source Energy Inc.

- Esolar Inc.

- Wuxi Suntech Power Co. Ltd.

- Acciona Energia S.A.

- Sunpower Corporation

- Abengoa Solar S.A.

- Tata Power Solar

Recent Developments

- In May 2025, Gulf Warehousing Company (GWC) Q.P.S.C. announced the launch of one of the GCC's largest private solar energy projects, supercharging its sustainability efforts and cementing its role as a trailblazer in green logistics. This landmark initiative will see GWC work with Yellow Door Energy, the leading sustainable energy partner for businesses in the Middle East and Africa, to develop solar power plants.

- In April 2025, Hitachi Industrial Equipment Systems launched a next-generation inverter system to support stable, resilient power grids. This cutting-edge system helps stabilize electric power systems during the global transition to renewable energy by simulating the stabilizing effects once provided by large power plants.

- In May 2025, Husk Power Systems launched a dedicated residential rooftop solar service called BEEM, aimed at making the transition to solar energy simple, fast, and affordable for homeowners across India. The service offers a one-stop solution for residential solar photovoltaic (PV) systems.

- In May 2025, SOFAR launches PowerIn and PowerMagic Mini for C&I Energy Systems. The launches, presented over two consecutive days, highlight the company's ongoing push for innovation in Europe's fast-evolving clean energy sector.

- In June 2023,Geneverse, a US-based developer of revolutionary home solar power solutions, made its European premiere at the highly anticipated Smarter E Europe 2023 expo, which was hosted in conjunction with The Smarter E Show. The Smarter E is a prestigious worldwide conference that brings together industry professionals, inventors, and enthusiasts to discuss the most recent trends and achievements in renewable energy. Geneverse's involvement intends to transform the European solar energy environment and make solar power more accessible to a larger range of individuals.

- In June 2023,Automatic Meteorological Station AWS810 Solar Edition was introduced by Vaisala, an international pioneer in meteorological, environmental, and industrial measurements.

Segments Covered in the Report:

By Product

- Solar Panels

- Charge Controllers

- Batteries

- Inverter

- Others

By End-use

- Residential

- Commercial

- Industrial

- Utility

By Source

- New Installation

- MRO

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content