What is the Soy Lecithin Market Size?

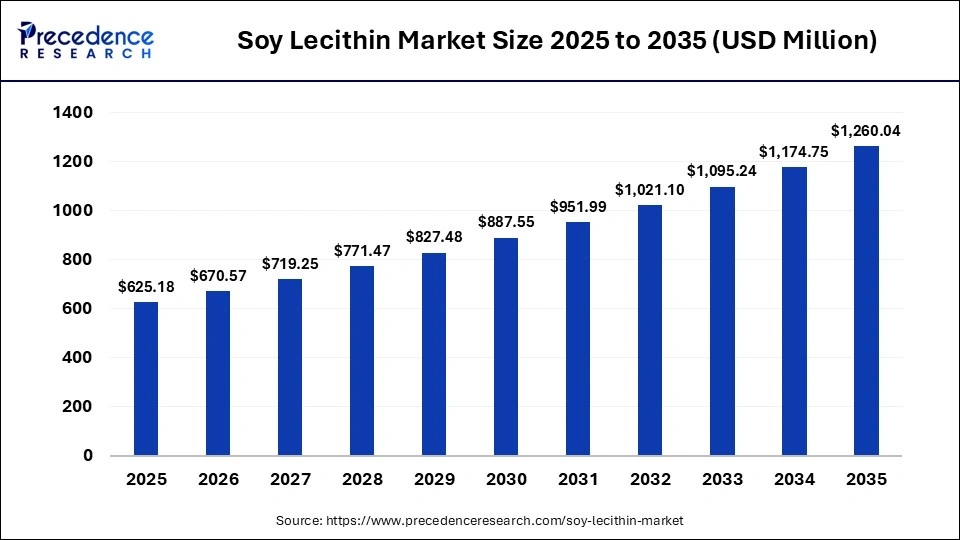

The global soy lecithin market size was calculated at USD 625.18 Million in 2025 and is predicted to increase from USD 670.57 Million in 2026 to approximately USD 1260.04 Million by 2035, expanding at a CAGR of 7.26% from 2026 to 2035.The soy lecithin market is generally boosted by the surging demand for organic food products, along with the growing application of soy lecithin from the pharma industry. Additionally, the rapid expansion of the personal care industry, as well as the growing popularity of lecithin powder in developed nations, is playing a vital role in shaping the industrial landscape.

Market Highlights

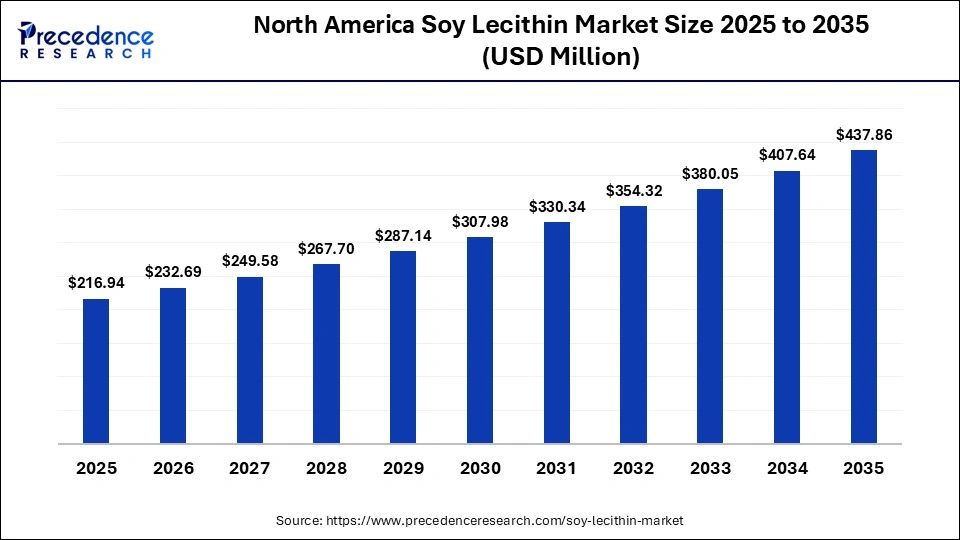

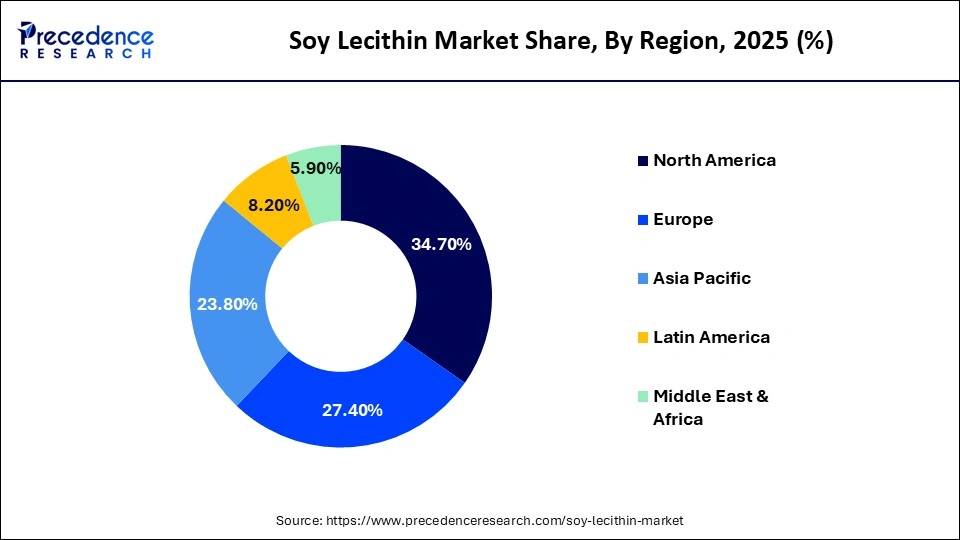

- North America dominated the soy lecithin market, holding a share of 34.70% in 2025.

- Asia Pacific is expected to expand with the highest CAGR of 7.60% during the forecast period.

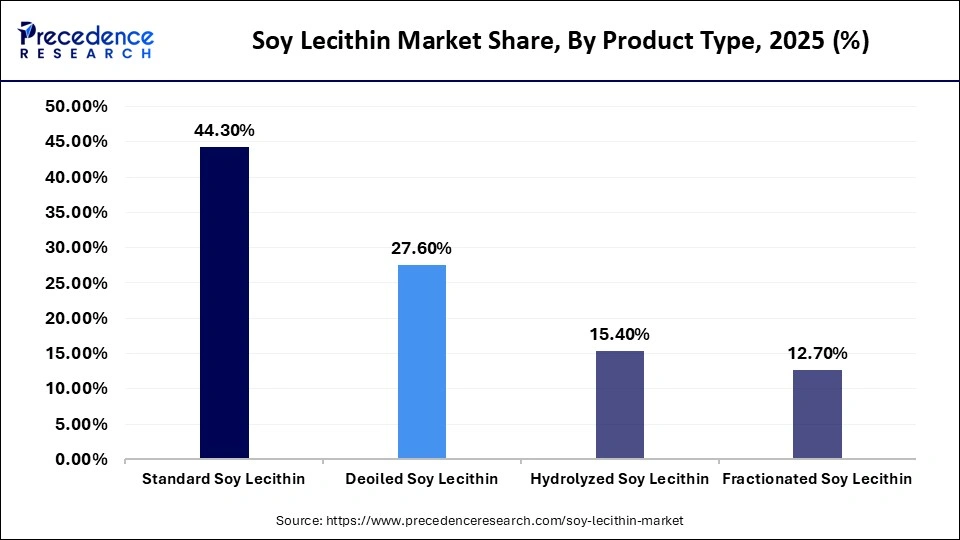

- By product type, the standard soy lecithin segment held the largest market share, accounting for 44.30% in 2025.

- By product type, the fractionated soy lecithin segment is expected to grow at a remarkable CAGR of 7.60% between 2026 and 2035.

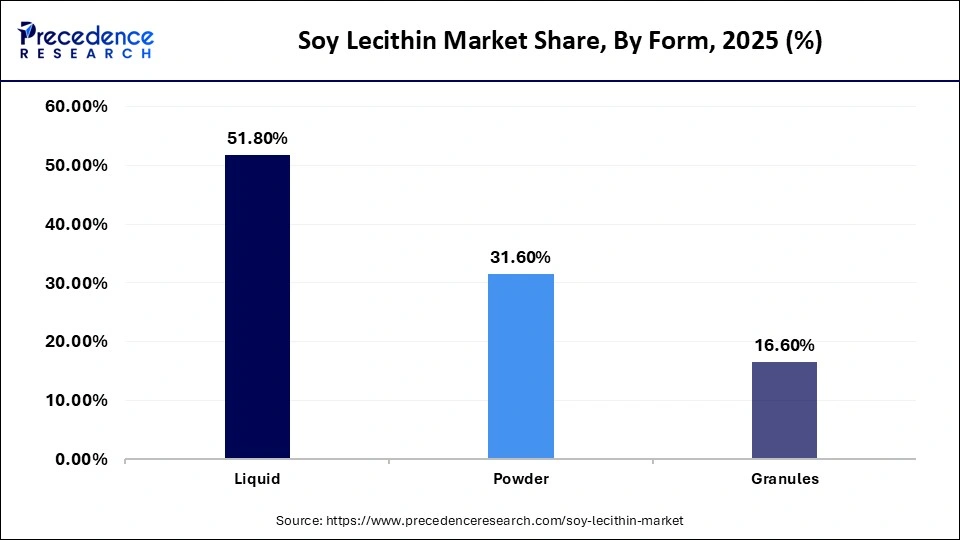

- By form, the liquid segment dominated the market with a share of 51.80% in 2025.

- By form, the powder segment is expected to rise with a considerable CAGR of 7.2% during the forecast period.

- By application, the food & beverages segment held the largest share with 58.90% of the market in 2025.

- By application, the cosmetics & personal care segment is expected to grow with the highest CAGR of 7.4% between 2026 and 2035.

- By function, the emulsifier segment held the largest share of 49.40% in the industry.

- By function, the dispersing agent segment is expected to grow with the highest CAGR of 7.20% between 2026 and 2035.

- By end user, the food processing companies segment dominated the soy lecithin sector.

- By end user, the feed producers segment is expected to expand with the fastest CAGR from 2026 to 2035

What is the Landscape of the Soy Lecithin Market?

The soy lecithin market is a specialized segment of the food ingredients and oleochemicals industry, focused on the extraction, processing, and commercialization of phospholipids derived from soybean oil during degumming. Soy lecithin is primarily used as an emulsifier, dispersing agent, and release agent in bakery products, confectionery, chocolate, margarine, and instant foods, where it improves dough handling, viscosity control, and shelf-life stability.

Growth is strongly driven by rising consumption of packaged bakery and confectionery products and expanding use of lecithin as a functional excipient in cosmetics, where it enhances skin penetration, moisture retention, and formulation stability. Additional demand is coming from pharmaceutical and nutraceutical manufacturers using soy lecithin in capsules, soft gels, and lipid-based drug delivery systems. At the same time, increasing preference for non-GMO, allergen-controlled, and identity-preserved soy lecithin is reshaping sourcing, processing standards, and pricing dynamics across the global market.

What is the Role of AI in the Soy Lecithin Market?

The integration of AI in the soy lecithin sector has changed the overall landscape of this sector. The deployment of AI in the lecithin industry helps in optimizing production and enhancing research and development activities. Also, the AI developers are increasing their emphasis on developing AI platforms for the discovery of plant-based foods and speeding up the animal food manufacturing process. Moreover, AI-based platforms are deployed in the lecithin production centers for demand forecasting, improving inventory management, and enhancing traceability. Thus, AI has played a prominent role in positively contributing to the industry.

Soy Lecithin Market Trends

- Collaborations: Numerous market players are collaborating with food companies to develop a wide range of lecithin additives for the food and beverage sector.

- Business Expansions: The lecithin manufacturers are investing rapidly in opening new production centers to increase the production of lecithin.

- Government Initiatives: The governments of several nations are launching various initiatives to develop the food and beverage industry.

- In January 2026, Umami launched Alkemyst. Alkemyst is an AI-based platform that helps in manufacturing a wide variety of animal feeds.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 625.18 Million |

| Market Size in 2026 | USD 670.57 Million |

| Market Size by 2035 | USD 1260.04 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Form, Function, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Why did the Standard Soy Lecithin Segment Dominate the Soy Lecithin Market in 2025?

The standard soy lecithin segment dominated the soy lecithin market, accounting for 44.30% in 2025, as the increasing demand for standard soy lecithin from the food and beverage industry for improving texture in food items has boosted the market expansion. Additionally, the surging use of these lecithin products in the pharma sector for manufacturing brain health supplements is expected to accelerate the growth of the soy lecithin industry.

The fractionated soy lecithin segment is expected to rise at a remarkable CAGR of 7.60% between 2026 and 2035. The growing use of fractionated soy lecithin in the pharma sector for manufacturing nutritional supplements has driven the market growth. Also, the surging demand for these products from the cosmetics sector for the production of skin care and hair care products is expected to propel the growth of the soy lecithin industry.

Form Insights

What Made the Liquid Segment Lead the Soy Lecithin Market in 2025?

The liquid segment led the soy lecithin market with a share of 51.80% in 2025, due to increasing use of liquid lecithin substances from the veterinary sector for manufacturing animal food, which has boosted the market expansion. Additionally, the rapid adoption of these liquids for producing moisturizers and shampoos is expected to propel the growth of the soy lecithin industry.

The powder segment is expected to expand with a considerable CAGR of 7.2% during the forecast period. The growing demand for lecithin powder from the pharma sector for manufacturing neurological drugs has boosted the market growth. Moreover, the rising use of these powdery substances from the industrial sector for producing rust inhibitors is expected to accelerate the growth of the soy lecithin sector.

Application Insights

Why Did the Food & Beverages Segment Hold the Largest Share of the Soy Lecithin Market?

The food & beverages segment held the largest share of the soy lecithin market with 58.90%. The growing demand for hydrolyzed soy lecithin from the food and beverage industry to manufacture texture improvers and nutritional food items has driven the market expansion. Additionally, the rapid investment by the government in several countries for developing the food and beverage industry is expected to propel the growth of the soy lecithin market.

The pharmaceuticals segment is expected to rise with the fastest CAGR of 12.90% between 2026 and 2035. The rising use of deoiled soy lecithin from the pharmaceutical industry for manufacturing liposomal drugs and softgel capsules has boosted the market growth. Also, the rapid investment by the pharma companies for opening new production centers is expected to accelerate the growth of the soy lecithin market.

Function Insights

What made the Emulsifier Segment lead the soy lecithin industry?

The emulsifier segment leads the soy lecithin industry with a share of 49.40%, due to the growing demand for emulsifiers from the food and beverage sector for improving texture in food products has boosted the market expansion. Also, the surging use of emulsifiers from the cosmetics industry for manufacturing lotions and creams is expected to propel the growth of the soy lecithin sector.

The dispersing agent segment is expected to expand with the highest CAGR of 7.20% between 2026 and 2035. The rising usage of dispersing agents for manufacturing detergents and coatings has boosted the market growth. Also, the surging application of these substances for manufacturing superplasticizers to cater to the needs of the construction sector is expected to drive the growth of the soy lecithin market.

End-User Insights

Why Did the Food Processing Companies Segment Hold the Largest Share of the Soy Lecithin Market?

The food processing companies segment held the largest share of the soy lecithin market. The increasing demand for standard soy lecithin products from the food processing companies to manufacture infant formulas and mayonnaise has boosted the market expansion. Additionally, the rapid investment by food processing companies for opening new production centers is expected to foster the growth of the soy lecithin industry.

The feed producers segment is expected to expand with the highest CAGR during the forecast period. The growing demand for high-quality soy lecithin products from feed producers to manufacture a wide range of animal foods has boosted the market growth. Also, the surging emphasis of animal food companies to manufacture nutritional supplements for animals is expected to accelerate the growth of the soy lecithin market.

Regional Insights

How Big is the North America Soy Lecithin Market Size?

The North America soy lecithin market size is estimated at USD 216.24 million in 2025 and is projected to reach approximately USD 437.86 million by 2035, with a 7.28% CAGR from 2026 to 2035.

Why Did North America Dominate the Soy Lecithin Market in 2025?

North America dominated the soy lecithin market with a share of 34.70 % in 2025. The increasing sales of standard soy lecithin from the cosmetics industry across several nations, including the U.S., Canada, and Mexico, have boosted the market expansion.

Numerous government initiatives aimed at developing the food and beverage sector, along with surging investment by pharma companies for opening new production centers, are playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players, such as American Lecithin Company, Bunge, Cargill Incorporated, and Archer Daniels Midland Company, is expected to drive the growth of the soy lecithin sector in this region.

- In August 2024, Bunge launched a new range of lecithin portfolios in North America. These lecithin products are used in several industries, such as beverages, snacks, and food supplements.

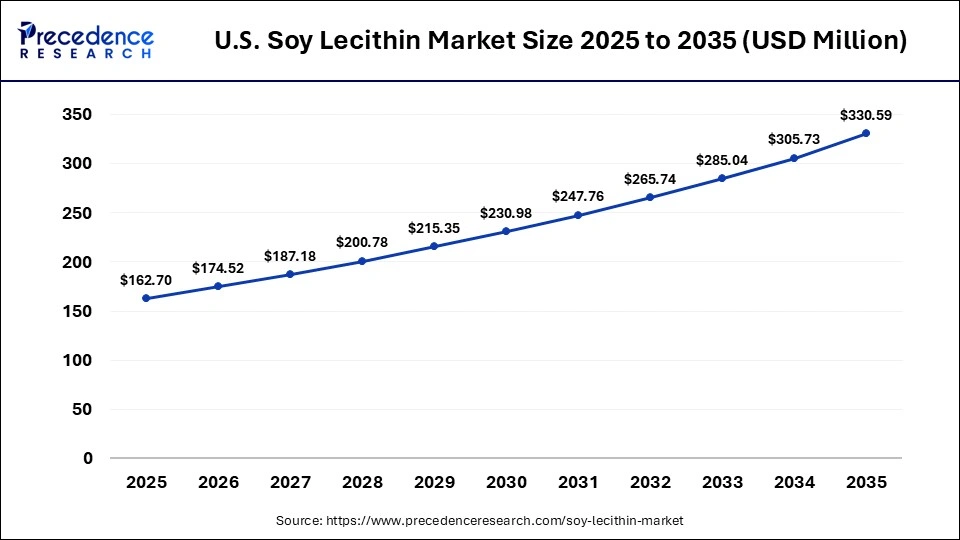

What is the Size of the U.S. Soy Lecithin Market?

The U.S. soy lecithin market size is calculated at USD 162.70 million in 2025 and is expected to reach nearly USD 330.59 billion in 2035, accelerating at a strong CAGR of 7.35% between 2026 and 2035.

U.S. Soy Lecithin Market Analysis

The growing demand for lecithin-based food products, along with the rapid expansion of the dairy sector, has driven the market expansion. Additionally, the surging investment by cosmetics brands for opening new production centers, coupled with the increasing sales of fractionated soy lecithin, is positively impacting the industry.

Why Is the Asia Pacific Growing With the Highest CAGR in the Soy Lecithin Industry?

Asia Pacific is expected to grow with the highest CAGR of 7.60% during the forecast period. The surging demand for organic supplements across several nations, including China, India, Japan, and South Korea, has boosted the market expansion. Additionally, the rapid investment by the nutraceutical companies for opening new production centers, along with rising sales of infant foods, is positively impacting the industry. Moreover, the presence of various market players, including Ceresking Ecology & Technology Co. Ltd, Ruchi Soya Industries, ZC Lecithin, Foodchem, Louis Dreyfus Company (LDC), Shandong Youmi, and Sonic Biochem, is expected to propel the growth of the soy lecithin industry in this region.

- In September 2025, Louis Dreyfus Company (LDC) opened a nutrition lab in Luohe, Henan Province, China. This lab is inaugurated to enhance research and development of lecithin-based products in this nation.

China Soy Lecithin Market Trends

The China soy lecithin market is expanding due to rapid growth of the food and beverage sector and rising demand for emulsifiers from the pharmaceutical industry, where lecithin is used in tablet coatings, softgel formulations, and lipid-based delivery systems. Increasing consumption of processed and convenience foods is driving higher usage of soy lecithin in bakery, confectionery, instant foods, and edible oils to improve texture, stability, and shelf life. Strong growth in sales of lecithin powder reflects its suitability for dry mixes, infant nutrition, and functional food applications.

Rising domestic food processing capacity is strengthening bulk demand from industrial manufacturers. Expansion of pharmaceutical manufacturing is increasing requirements for high-purity and standardized lecithin grades. In parallel, growing export-oriented production is encouraging compliance with international quality and food safety standards.

Recent Developments

- In January 2026, Lekithos launched a new range of Sunflower Lecithin Granules. These granules are used for optimizing digestive health, enhancing cognitive functions, and improving cholesterol management in human beings.(Source: https://www.prnewswire.com)

- In August 2025, Bunge Global SA announced the acquisition of Solae. This acquisition is aimed at expanding the range of soy lecithin products across the world.(Source: https://www.tridge.com)

- In May 2025, Louis Dreyfus Company (LDC) inaugurated a new factory in Tianjin, China. This new production unit was opened to increase the production of specialty feed lecithin for the consumers of this nation.(Source: https://www.ldc.com)

Who are the Major Players in the Global Soy Lecithin Market?

The major players in the soy lecithin market include Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, American Lecithin Company, DuPont de Nemours, Inc., Ruchi Soya Industries, Denofa Ceresking Ecology & Technology Co. Ltd, Lipoid GmbH, Lasenor

Segments Covered in the Report

By Product Type

- Standard Soy Lecithin

- Deoiled Soy Lecithin

- Hydrolyzed Soy Lecithin

- Fractionated Soy Lecithin

By Form

- Liquid

- Powder

- Granules

By Function

- Emulsifier

- Stabilizer

- Dispersing Agent

- Release Agent

By Application

- Food & Beverages

- Pharmaceuticals

- Animal Feed

- Cosmetics & Personal Care

- Industrial Applications (Paints, Inks, Lubricants)

By End User

- Food Processing Companies

- Pharmaceutical Manufacturers

- Feed Producers

- Cosmetic & Personal Care Manufacturers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting