What is the Standard Pen Needles Market Size?

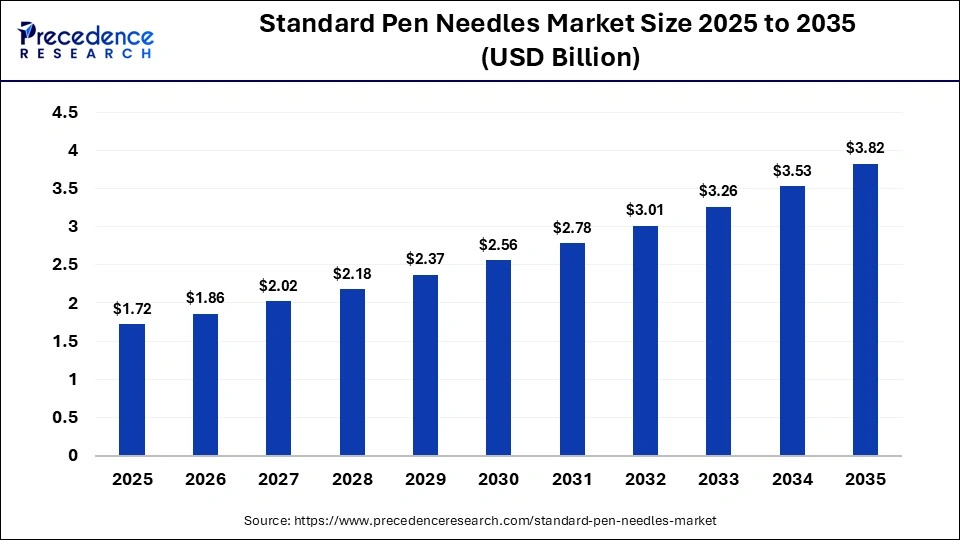

The global standard pen needles market size was estimated at USD 1.72 billion in 2025 and is predicted to increase from USD 1.86 billion in 2026 to approximately USD 3.82 billion by 2035, expanding at a CAGR of 8.30% from 2026 to 2035. The market is experiencing robust growth owing to rising diabetes and obesity cases, increasing home-based self-injection, and wider adoption of injectable therapies for long-term disease management.

Market Highlights

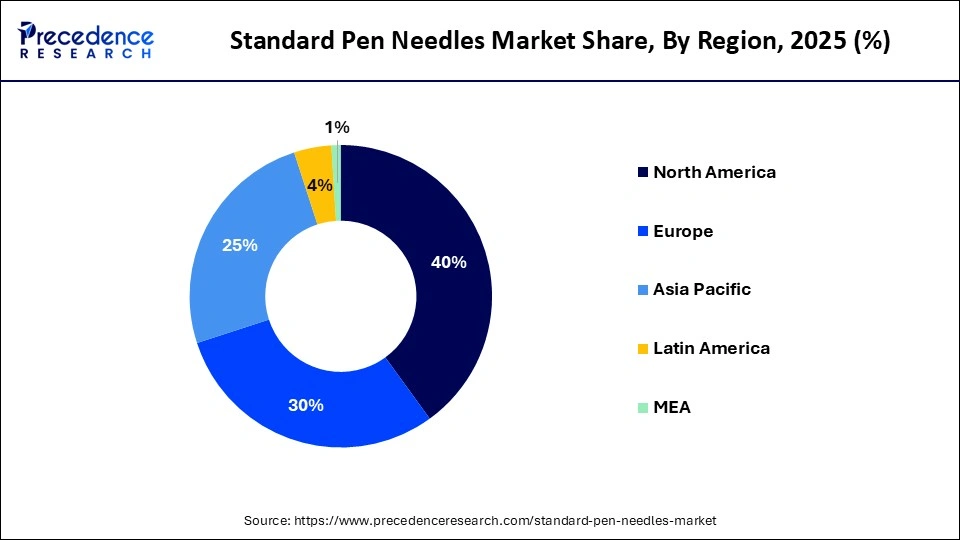

- North America dominated the standard pen needles market in 2025.

- Asia-Pacific is expected to be the fastest-growing region between 2026 and 2035.

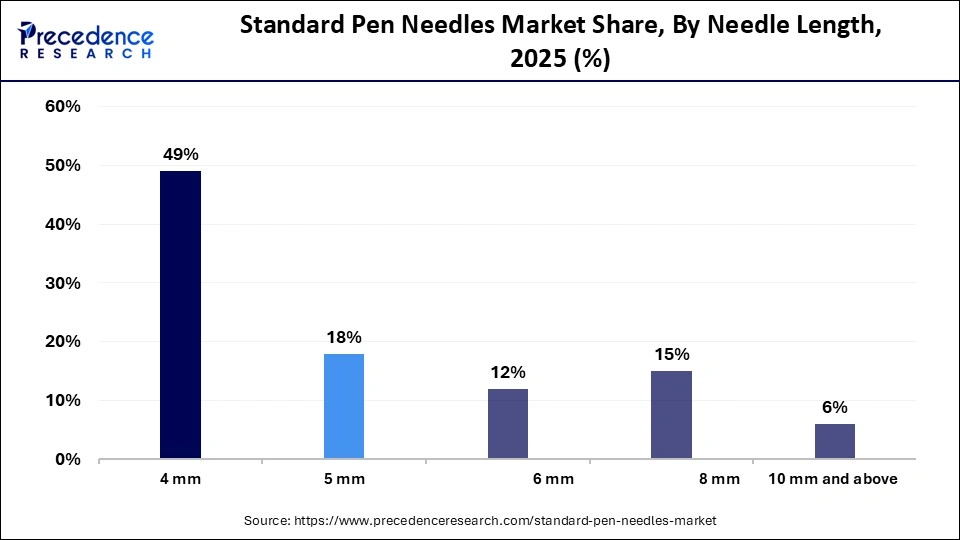

- By needle length, the 4 mm segment held a dominant position in the market with a share of approximately 49% in 2025.

- By needle length, the 5 mm segment is expected to grow at the fastest CAGR of approximately 7.1% during the forecast period.

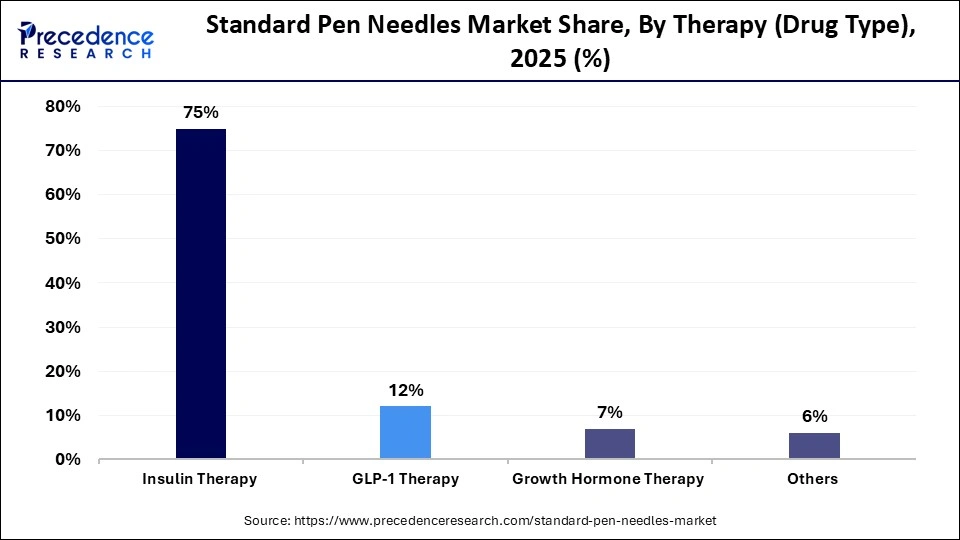

- By therapy (drug type), the insulin therapy segment dominated the market with a share of approximately 75% in 2025.

- By therapy (drug type), the GLP-1 therapy segment is expected to show the fastest growth with a CAGR of approximately 7.3% over the forecast period.

- By distribution channel, the retail pharmacies segment led the global standard pen needles market with a share of approximately 47% in 2025.

- By distribution channel, the online pharmacies segment is expected to witness the fastest growth in the market with a CAGR of approximately 7.4% over the forecast period.

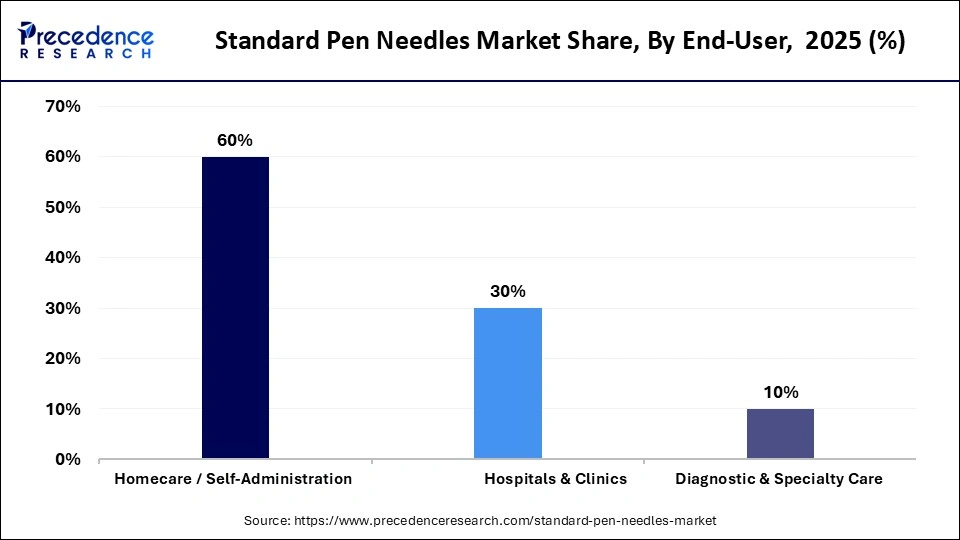

- By end-user, the homecare/self-administration segment registered its dominance over the global market with a share of approximately 60% in 2025.

- By end-user, the hospitals segment is expected to expand rapidly in the market with a CAGR of approximately 7.6% in the coming years.

What are Standard Pen Needles?

Standard pen needles are single-use injection needles compatible with insulin pens and other subcutaneous drug delivery devices. They are widely used for administering insulin, GLP-1, growth hormone, and other therapies in diabetes and chronic disease management due to their cost-effectiveness, broad compatibility, and ease of use. They maintain dominance over safety variants because of widespread adoption, are produced in multiple lengths and gauges, and support both clinical and home administration globally.

AI-based Technological Shifts in the Standard Pen Needles Market

AI is gradually transforming the market by improving accuracy, safety, and patient convenience across diabetes care. Smart insulin pen combined with AI-driven platforms now track injection timing, dose accuracy, and patient behavior to reduce dosing errors. E.g., Medtronic's InPen and Lilly's Tempo system use connected apps and intelligent analytics to guide patients in real time, improving treatment adherence. AI-powered manufacturing systems are also enhancing needle precision, coating consistency, and quality inspection, reducing defects, and improving comfort.

Standard Pen Needles Market Trends

- Rising home-based diabetes care is driving demand for easy-to-use standard pen needles, as patients prefer comfortable, accurate, and safe self-injection options that reduce hospital visits and improve daily treatment convenience.

- Growing adoption of ultra-thin and shorter needles is improving patient comfort, lowering injection pain, and increasing treatment compliance, especially among elderly patients and children requiring frequent insulin administration.

- Rapid growth of GLP-1 therapies for diabetes and weight management is expanding pen needle usage beyond insulin, creating new opportunities, and supporting steady long-term market growth across regions.

- Increasing diabetes awareness programs and government healthcare initiatives are strengthening early diagnosis and treatment adoption, directly boosting the demand for affordable, reliable, and easy-to-use standard pen needles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size in 2026 | USD 1.86 Billion |

| Market Size by 2035 | USD 3.82 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Needle Size, Therapy (Drug Type), Distribution Channel, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Needle Length Insights

Why Did the 4 mm Segment Dominated the Standard Pen Needles Market?

The 4 mm needle size segment held the largest revenue share of approximately 49% in the market in 2025, because it offers comfort, safety, and effective drug delivery. Shorter needles reduce injection pain and anxiety, making daily injections easier, especially for children, elderly patients, and first-time users. They also lower the risk of injecting into the muscle, which helps maintain stable insulin absorption.

Healthcare providers and physicians widely recommend a 4 mm needle for most patients, as they suit different body types and skin thickness levels. Their ease of use, better patient acceptance, and improved treatment adherence have made them the preferred choice in home-based diabetes care.

The 5 mm segment is expected to grow at the fastest CAGR of approximately 7.1% in the market between 2026 and 2035, because it provides a balance between comfort and effective drug delivery. Many patients find 5 mm needles easier to handle than shorter options while still experiencing low injection pain. The size provides better penetration for individuals with moderate skin thickness and slightly higher body weight, ensuring reliable absorption of insulin and GLP-1 therapies. Healthcare professionals increasingly recommend 5 mm needles for patients who struggle with dose consistency using ultra-short needles.

Therapy (Drug Type) Insights

How the Insulin Therapy Segment Dominated the Standard Pen Needles Market?

The insulin therapy segment held a major revenue share of approximately 75% in the market in 2025, because insulin remains the most widely used and essential treatment for diabetes, especially for type 1 patients and advanced type 2 cases. Millions of people worldwide depend on daily insulin injections, creating steady and long-term demand for pen needles. The growing global burden of diabetes, along with increasing life expectancy, has further expanded the patient pool.

Insulin pens are commonly preferred for their ease of use, accuracy, and convenience, especially in home care settings. Regular dosing, multiple daily injections, and long treatment duration together ensure consistent and high-volume use of standard pen needles, strengthening this segment's market leadership.

The GLP-1 therapy segment is expected to expand rapidly in the market with a CAGR of approximately 7.3% in the coming years, due to the rapid adoption of injectable treatments for both diabetes and weight management. These therapies help improve blood sugar control while also supporting weight loss, making them attractive to patients and doctors.

Rising obesity rates, growing awareness of metabolic health, and strong clinical outcomes have boosted prescriptions worldwide; many GLP-1 drugs are delivered through easy-to-use injection pens, directly increasing pen needle demand. In addition, improved affordability, wider availability, and supportive clinical guidelines are encouraging early treatment adoption, driving strong growth for this segment across developed and emerging healthcare markets.

Distribution Insights

What Made Retail Pharmacies the Dominant Segment in the Standard Pen Needles Market?

The retail pharmacies segment accounted for the highest revenue share of approximately 47% in the market in 2025, because it offers easy access, personal guidance, and immediate product availability for patients managing chronic conditions like diabetes. Most patients prefer visiting nearby pharmacies for regular purchases, prescription refills, and quick advice on proper injection techniques. Retail pharmacies also maintain steady stock levels and provide trusted brands, ensuring a consistent supply.

The online pharmacies segment is expected to witness the fastest growth in the market, with a CAGR of approximately 7.4% over the forecast period, due to rising digital adoption, convenience, and improved delivery services. Patients increasingly prefer ordering medical supplies online to save time, avoid travel, and receive doorstep delivery. Competitive pricing, subscription-based refill services, and discreet packaging further attract regular users. This trend is especially strong among working professionals, younger patients, and those living in remote areas with limited pharmacy access.

End-user Insights

Why Homecare/Self-Administration Segment Dominated the Standard Pen Needles Market?

The homecare/self-administration segment contributed the biggest revenue share of 60 % in the market in 2025, because most people with diabetes manage their condition at home through daily self-injection. Insulin and GLP-1 therapies often require long-term or lifelong treatment, making home use more practical, affordable, and comfortable. Pen needles are easy-to-use, portable, and designed for safe self-administration, supporting strong adoption in home settings. Rising awareness of self-care, growing patient education, and better access to injection devices have further increased home-based treatment.

The hospitals segment is expected to grow with the highest CAGR of approximately 7.6% in the market during the forecast period due to rising hospital admissions, expanding diabetes care units, and increased use of injectable therapies in clinical settings. Hospitals are increasingly focusing on advanced diabetes management, obesity treatment, and metabolic care, which requires regular use of pen needles. Growing awareness of early diagnosis, better screening programs, and specialist consultations are also driving higher hospital-based treatment volumes.

Regional Insights

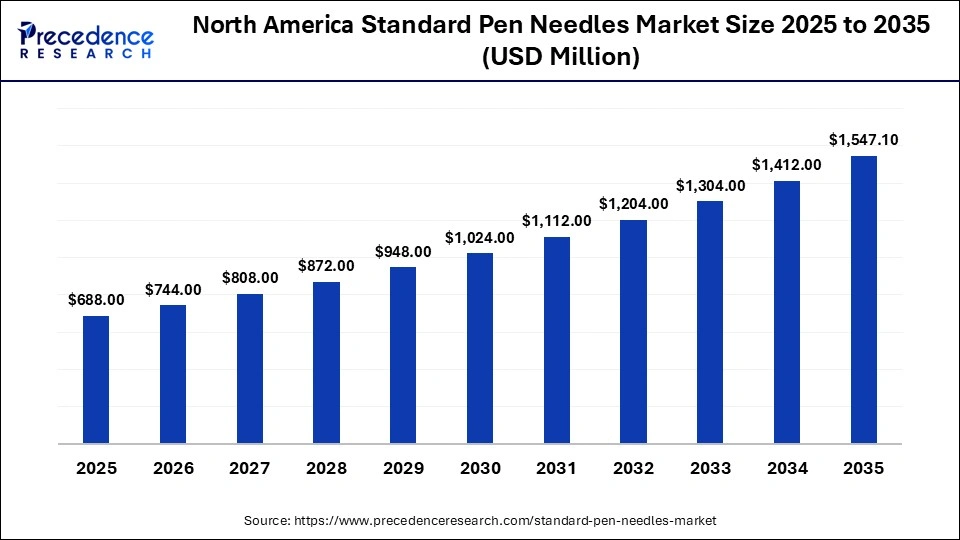

How Big is the North America Standard Pen Needles Market Size?

The North America standard pen needles market size is estimated at USD 688.00 million in 2025 and is projected to reach approximately USD 1,547.10 million by 2035, with a 8.44% CAGR from 2026 to 2035.

North America Standard Pen Needles Market Analysis

North America dominated the global standard pen needles market with a share of approximately 40% in 2025, due to the high prevalence of diabetes, strong healthcare infrastructure, and widespread adoption of insulin pen devices. The region benefits from advanced diagnostic practices, strong reimbursement coverage, and high patient awareness about diabetes management. Growing preference for home-based care and self-injection therapies has increased the demand for safe, short, and pain-reducing pen needles. In addition, continuous product innovation and the strong presence of leading medical device manufacturers further support market dominance.

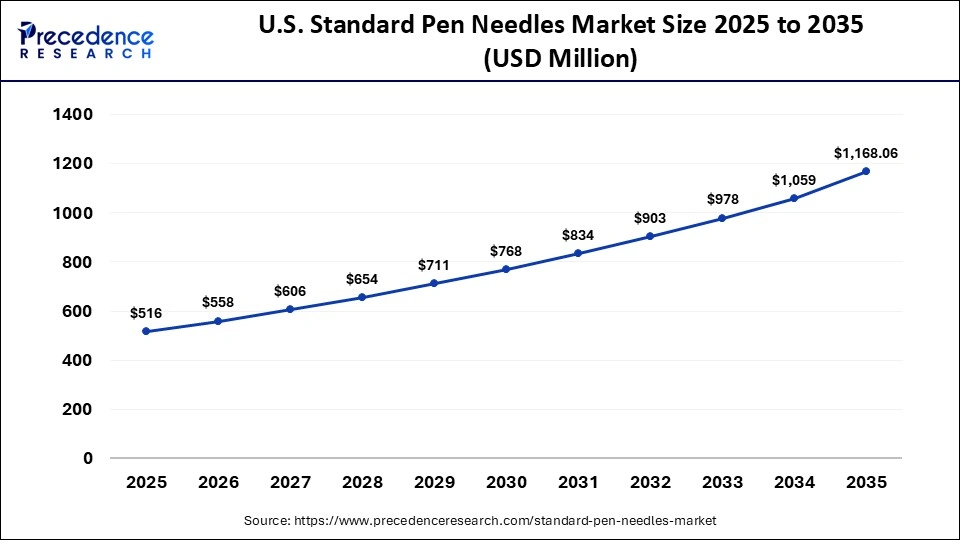

What is the Size of the U.S. Standard Pen Needles Market?

The U.S. standard pen needles market size is calculated at USD 516.00 million in 2025 and is expected to reach nearly USD 1,168.06 million in 2035, accelerating at a strong CAGR of 8.51% between 2026 and 2035.

U.S. Standard Pen Needles Market Trends

The U.S market is shaped by rising diabetes cases, increasing use of injectable therapies, and rapid adoption of user-friendly medical devices. Strong patient education programs and easy availability of pen needles through pharmacies, hospitals, and online platforms support widespread usage. Technological improvements, such as ultra-thin needles, safety designs, and shorter needle lengths, are improving comfort and treatment adherence.

Which Factors Made Europe a Significantly Growing Region in the Market?

Europe is expected to grow at a considerable CAGR in the upcoming period, due to increasing diabetes prevalence, ageing populations, and strong public healthcare spending. Countries such as Germany, the UK, France, and Italy benefit from well-established diabetes care programs and high awareness of insulin therapy. Rising demand for safe injection devices, strict medical safety regulations, and a focus on infection prevention are encouraging the adoption of advanced pen needles. Expansion of homecare services and growing use of disposable injection devices are also supporting market growth.

Which Factors Influence the Fastest Growth of Asia-Pacific?

Asia-Pacific is expected to grow at the fastest CAGR of approximately 9% in the standard pen needles market during the forecast period, because of a rapidly rising diabetic population, improving healthcare infrastructure, and increasing access to affordable insulin therapy. Large patient pools in China and India, combined with growing urbanization and lifestyle changes, are driving demand for regular insulin injections. Government initiatives to expand healthcare coverage and improve distribution networks are enhancing product accessibility.

India Standard Pen Needles Market Trends

India's market is growing steadily due to increasing diabetes prevalence, rising healthcare awareness, and expanding access to affordable insulin therapies. Rapid development of hospitals, diagnostic centres, and retail pharmacies is improving product availability across urban and semi-urban areas. Government health programs and insurance coverage expansion are supporting early diagnosis and regular treatment. Growing adoption of home-based diabetes care and increasing patient education efforts are further driving demand for safe and easy-to-use pen needles.

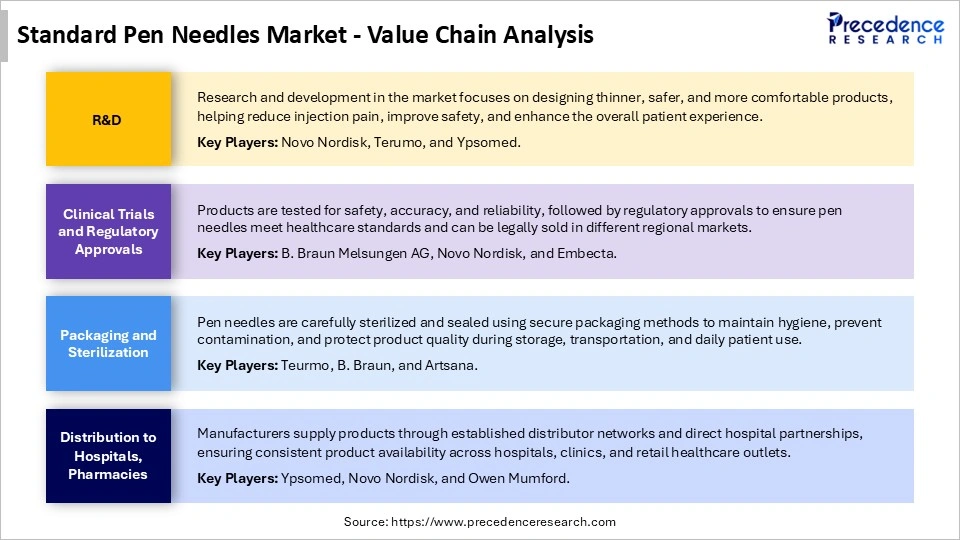

Standard Pen Needles MarketValue Chain Analysis

Recent Developments in the Standard Pen Needles Market

- In August 2025, Eli Lilly launched pre-filled injector pens of Mounjaro Kwikpen in India, expanding access to pre-filled injectable therapy for diabetes and obesity. This launch strengthens the standard pen needle market by boosting demand for compatible, user-friendly injection devices, supporting wider adoption of home-based and self-administered treatments across the country.

- In April 2024, Droplet Micron received expanded FDA approval and over-the-counter availability in the U.S. for its 34G x 3.5mm pen needle, allowing its ultra-thin pen needles to be used beyond insulin, including GLP-1 therapies. This development improves patient access, supports self-care adoption, and strengthens market growth by expanding treatment applications.

Who are the Major Players in the Global Standard Pen Needles Market?

The major players in the standard pen needles market include Becton, Dickinson and Company, Novo Nordisk A/S, Ypsomed AG, Terumo Corporation, Owen Mumford Ltd., Embecta Corp., Cardinal Health, B. Braun SE, UltiMed, Inc., Allison Medical, Inc., HTL-STREFA S.A., Smiths Medical, Artsana Group (Pic), NIPRO Corporation, and GlucoRx.

Segments Covered in the Report

By Needle Size

- 4 mm

- 5 mm

- 6 mm

- 8 mm

- 10 mm and above

By Therapy (Drug Type)

- Insulin Therapy

- GLP-1 Therapy

- Growth Hormone Therapy

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End-User

- Homecare/self–administration

- Hospitals & Clinics

- Diagnostic & Speciality Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting