What is the RFID Smart Cabinets Market Size?

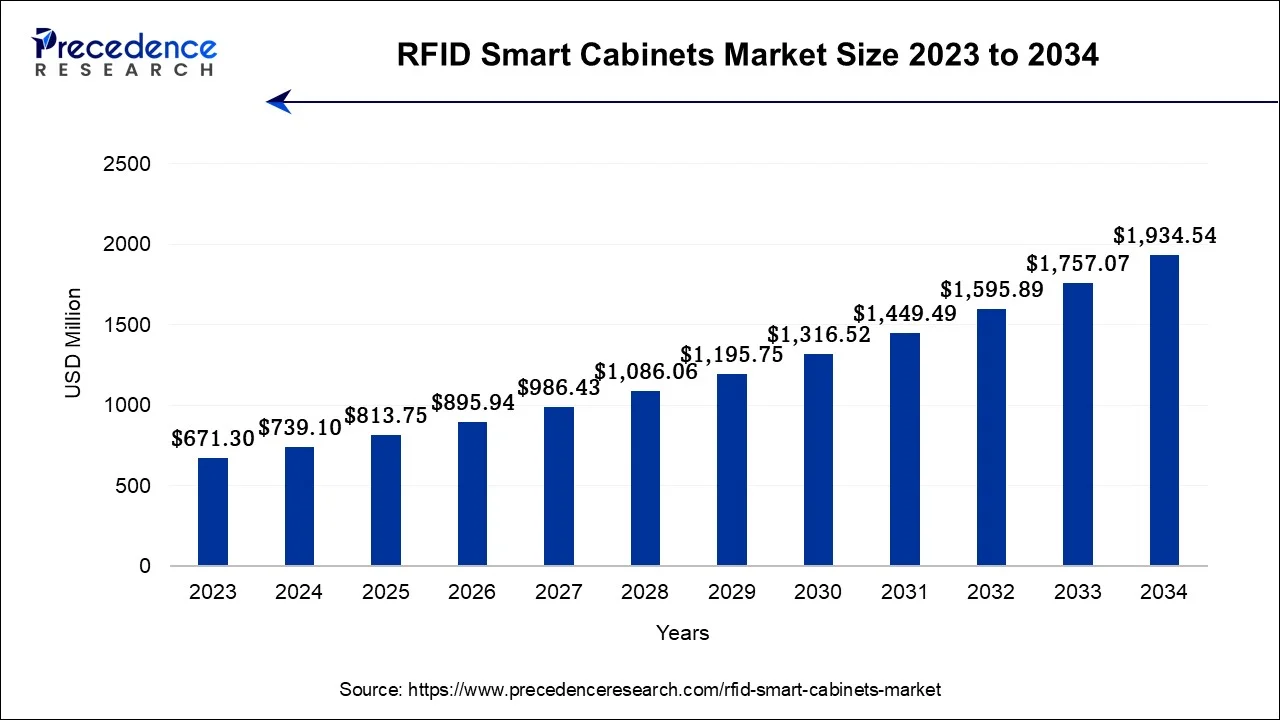

The global RFID smart cabinets market size accounted for USD 813.75 million in 2025and is predicted to increase from USD 895.94 million in 2026 to approximately USD 2,101.15 million by 2035, expanding at a CAGR of 9.95% between 2026 to 2035.

RFID Smart Cabinets Market Key Takeaways

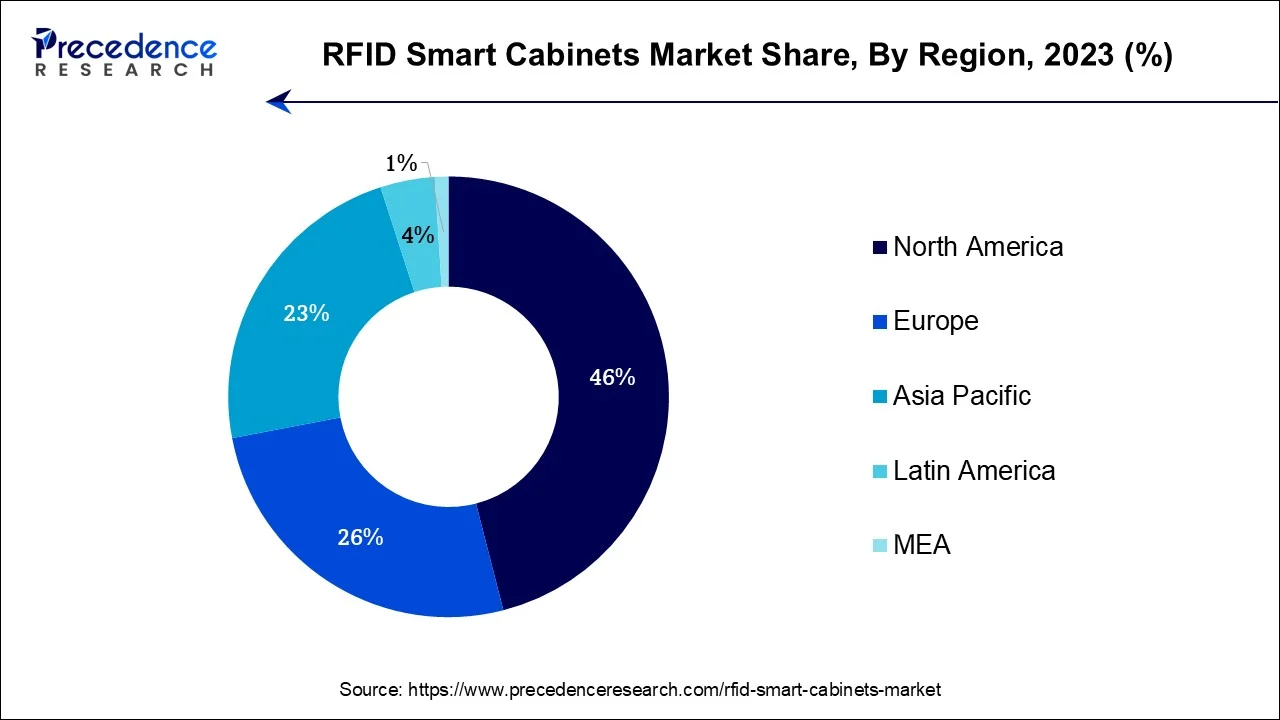

- North America generated more than 46% of revenue share in 2025.

- Asia-Pacific region is projected to grow at the fastest CAGR from 2026 to 2035.

- By Component, the RFID Tags segment held the largest market share of 42% in 2025.

- By Component, the RFID Readers segment is projected to grow at the fastest rate over the projected period.

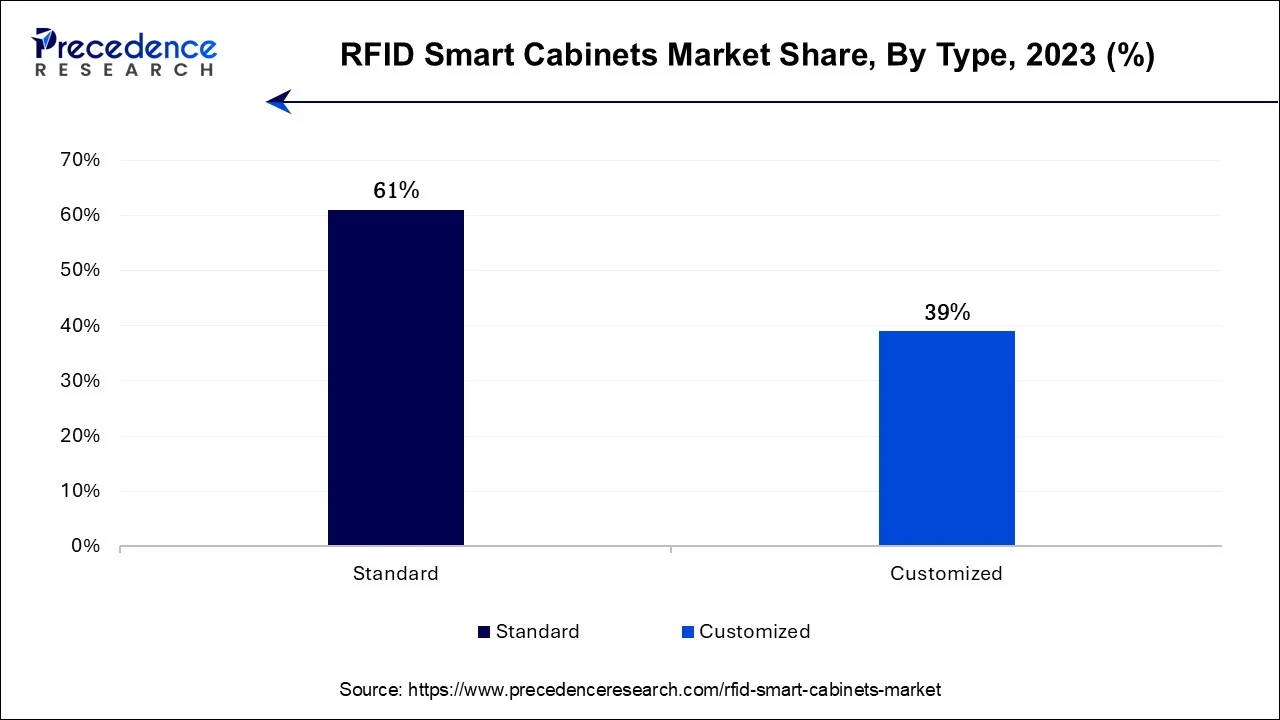

- By Type, the standard segment has held the largest market share of 61% in 2025.

- By Type, the customized segment is predicted to expand at a notable CAGR of 7.8% during the projected period.

- By End User, the hospital and clinic segment contributed the highest market share of 58.6% in 2025.

- By End User, the biopharmaceutical companies segment is anticipated to expand at the fastest CAGR over the projected period.

Market Overview

- The RFID smart cabinets market is defined as a segment within the healthcare technology industry that provides intelligent storage solutions equipped with radio-frequency identification (RFID) technology.

- These cabinets enable real-time tracking and management of medical supplies, equipment, and pharmaceuticals, improving inventory control, reducing manual errors, and enhancing overall operational efficiency in healthcare settings.

- The market's nature is characterized by the integration of RFID technology, increased demand for inventory optimization, and the growing emphasis on healthcare digitization, which collectively drive innovation and adoption in this sector.

RFID Smart Cabinets Market Growth Factors

- The market is witnessing several compelling trends and growth drivers, including the growing emphasis on healthcare digitization, has led to increased adoption of RFID smart cabinets, which play a crucial role in automating inventory control and ensuring accurate supply chain management. Moreover, the ongoing need for error reduction and patient safety improvement in healthcare settings has driven demand for these cabinets, as they minimize manual errors and enhance the overall quality of care.

- Additionally, the COVID-19 pandemic accelerated the adoption of these solutions as healthcare facilities sought to streamline supply chain operations and maintain adequate stock levels of critical medical supplies.

- Several factors are propelling the growth of the RFID smart cabinets market. One major driver is the pursuit of cost-efficiency and resource optimization within healthcare institutions. RFID smart cabinets help reduce waste, lower operational costs and enable healthcare providers to allocate resources more effectively. Moreover, the need for compliance with stringent regulatory requirements for accurate inventory tracking and traceability has made RFID technology indispensable.

- The growth of the aging population, coupled with the rising demand for quality healthcare services, also fuels the adoption of RFID smart cabinets in healthcare facilities globally. Despite the promising growth, the industry faces certain challenges. One key hurdle is the initial implementation cost, as integrating RFID smart cabinets require a significant investment in hardware and software infrastructure.

- Data security and privacy concerns also come into play when handling sensitive patient and inventory data, necessitating robust cybersecurity measures. Additionally, resistance to change and the need for staff training can pose challenges during the adoption phase. Standardization and interoperability issues across different RFID systems and vendors need to be addressed to ensure seamless integration into diverse healthcare environments.

- The RFID smart cabinets market offers abundant business opportunities. Innovations in RFID technology, such as the development of smaller, more affordable RFID tags and improved software solutions, create opportunities for market growth. Partnerships with healthcare providers, suppliers, and technology companies can drive innovation and expand market reach.

- Furthermore, expanding the application of RFID smart cabinets beyond hospitals, such as in pharmacies and laboratories, presents untapped potential. As healthcare facilities continue to prioritize inventory accuracy and efficiency, the RFID smart cabinets market is projected to capitalize on these evolving needs by providing intelligent and indispensable solutions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9.95% |

| Market Size in 2025 | USD 813.75Million |

| Market Size in 2026 | USD 895.94 Million |

| Market Size by 2035 | USD 2,101.15 Million |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Efficient inventory management and patient safety

Efficient inventory management is a paramount driver in the RFID smart cabinets market. These cabinets revolutionize the healthcare supply chain by offering real-time tracking and precise inventory data. They reduce stockouts, minimize overstocking, and enhance resource allocation. This not only ensures that critical medical supplies are readily available when needed but also optimizes operational costs. Healthcare facilities increasingly recognize the significant cost savings and improved patient care quality that RFID smart cabinets offer, thereby surging the market demand for these transformative solutions. Moreover, Patient safety is a paramount concern in healthcare, and it significantly surges the market demand for RFID smart cabinets.

These cabinets enable healthcare facilities to accurately track and manage medical supplies, medications, and equipment in real-time. By minimizing manual errors, ensuring the availability of the right items when needed, and enhancing overall inventory control, RFID smart cabinets play a pivotal role in enhancing patient safety. The demand for these cabinets is propelled by the imperative to reduce adverse events, medication errors, and ensure the highest standard of care for patients.

Restraints

High initial costs, maintenance and upkeep

High initial costs present a significant restraint on the market demand for RFID smart cabinets. Healthcare facilities, especially smaller ones with limited budgets, may find the upfront investment in hardware, software, and staff training prohibitive. This financial barrier can impede adoption, preventing many institutions from benefiting from the improved inventory management and patient safety advantages offered by RFID smart cabinets. Overcoming this challenge requires cost-effective solutions and financial incentives to make these cabinets more accessible to a broader range of healthcare providers. Moreover, maintenance and upkeep represent significant restraints on the market demand for RFID smart cabinets.

These systems require ongoing attention, including software updates, hardware maintenance, and periodic calibrations to ensure optimal performance. The associated costs and resource allocation for maintenance can strain healthcare budgets. Failure to adequately maintain RFID smart cabinets can lead to system malfunctions, data inaccuracies, and operational disruptions, potentially undermining the trust and efficiency these cabinets are meant to provide, thus impeding their adoption and market demand.

Opportunities

Healthcare expansion and integration with EHRs

Healthcare expansion, especially in emerging markets, significantly surges the market demand for RFID smart cabinets. As healthcare infrastructure grows, the need for efficient inventory management and patient care escalates. RFID cabinets offer precise tracking of medical supplies, medications, and equipment, ensuring optimal resource allocation. In expanding healthcare ecosystems, these cabinets become indispensable for enhancing operational efficiency, minimizing waste, and maintaining high standards of patient care.

The demand for RFID smart cabinets rises in tandem with the global expansion of healthcare services, making them vital components of modern healthcare facilities. Moreover, Integration with electronic health records (EHRs) significantly propels the market demand for RFID smart cabinets. This synergy ensures seamless data exchange between RFID cabinets and patient records, enhancing patient care and safety. RFID cabinets integrated with EHRs enable accurate and real-time tracking of supplies, medications, and equipment, streamlining inventory management and reducing manual errors. The demand surges as healthcare facilities prioritize efficient supply chain management and compliance with regulatory requirements, making the integration of RFID cabinets with EHRs a vital component of modern healthcare infrastructure.

Segment Insights

Component Insights

By component, RFID Tags held the largest market share of 42% in 2023. RFID Tags are essential components in the RFID smart cabinets market, serving as data carriers that store unique identification information. These tags are affixed to medical supplies and equipment, allowing for accurate tracking and management within smart cabinets. A notable trend in RFID Tags is miniaturization, leading to smaller, more cost-effective, and versatile tags.

Additionally, there's an increasing focus on RFID Tags with enhanced durability and read ranges, ensuring reliable performance in various healthcare settings. These trends are contributing to the improved efficiency and accuracy of inventory management, bolstering the adoption of RFID smart cabinets in healthcare facilities.

The RFID Readers segment is projected to grow at the fastest rate over the projected period. RFID Readers, a crucial component in the RFID smart cabinets market, are devices that interact with RFID tags to capture data. They transmit radio signals to activate tags and receive information from them, facilitating real-time tracking of items within smart cabinets. Trends in RFID Readers include increased integration with IoT technologies for enhanced data collection and analytics. Moreover, advancements in reader capabilities, such as extended read ranges and improved data processing, are enhancing the efficiency of RFID cabinets, making them even more valuable for healthcare inventory management.

Type Insights

According to the type, the Standard RFID smart cabinets segment has held 61% revenue share in 2023. Standard RFID smart cabinets are pre-designed, off-the-shelf solutions that offer a set of predefined features and functionalities. These cabinets are readily available for purchase and deployment, providing users with essential RFID tracking capabilities. In the RFID smart cabinets market, a trend observed is the increasing adoption of standard-form cabinets by smaller healthcare facilities and clinics due to their affordability and quick implementation. These cabinets often come with basic inventory management features and are popular for their cost-effectiveness.

The Customized RFID smart cabinets segment is anticipated to expand at a significantly CAGR of 7.8% during the projected period. Customized RFID smart cabinets are tailored solutions designed to meet specific needs and requirements of healthcare facilities. They are built to integrate seamlessly with existing systems and workflows, offering advanced features and personalized configurations. A trend in the RFID smart cabinets market is the growing demand for customized solutions among larger hospitals and healthcare institutions. Customization allows these organizations to optimize inventory control, enhance security, and improve overall efficiency in a way that aligns precisely with their unique operational needs.

End User Insights

In 2023, the hospital and clinic segment had the highest market share of 58.6% on the basis of the installation. Hospitals, as end users in the RFID smart cabinets market, refer to healthcare facilities where these intelligent storage solutions are extensively employed. Hospitals deploy RFID smart cabinets to efficiently manage and track medical supplies, pharmaceuticals, and equipment. A key trend in this segment is the integration of RFID cabinets with hospital information systems and electronic health records (EHRs), facilitating seamless data exchange and further enhancing inventory control. Hospitals are increasingly recognizing the value of RFID smart cabinets in reducing costs, minimizing errors, and ensuring the availability of critical supplies, driving their continued adoption in healthcare settings.

The Bio-pharmaceutical companies is anticipated to expand at the fastest rate over the projected period. Bio-pharmaceutical companies in the RFID smart cabinets market refer to businesses involved in the research, development, and production of biopharmaceuticals, including vaccines, drugs, and biological products. These companies utilize RFID smart cabinets to manage and secure sensitive laboratory materials, medications, and research equipment. The trend in this sector is moving towards the integration of RFID technology to enhance asset tracking, improve compliance with regulatory standards, and ensure the efficient management of valuable biological assets. This not only streamlines operations but also contributes to maintaining the integrity and quality of bio-pharmaceutical products throughout their lifecycle.

Regional Insights

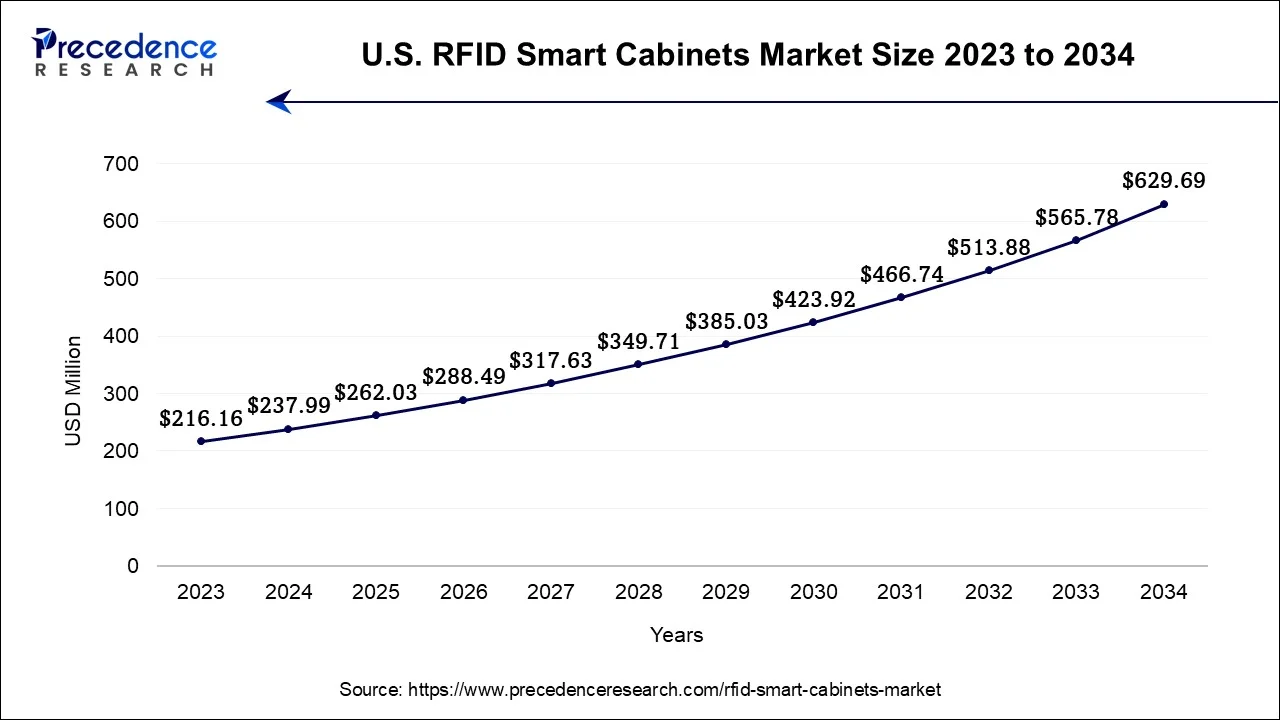

What is the U.S. RFID Smart Cabinets Market Size?

The U.S. RFID smart cabinets market size is estimated at for USD 262.03 million in 2025 and is expected to be worth around USD 685.59 million by 2035, growing at a CAGR of 10.22% from 2026 to 2035.

North America has held largest revenue share 46% in 2023. In North America, the RFID smart cabinets market is characterized by several notable trends. The region demonstrates a high adoption rate of advanced healthcare technologies, driving the integration of RFID cabinets into healthcare facilities for streamlined inventory management. Moreover, the emphasis on patient safety and regulatory compliance propels the demand for RFID solutions. The COVID-19 pandemic further accelerated their adoption as healthcare providers prioritized efficient supply chain management. Additionally, ongoing efforts to digitize healthcare and optimize resource allocation continue to create a favorable environment for RFID smart cabinets in North America.

U.S. Market Analysis

The U.S. dominates the North American RFID smart cabinets market thanks to advanced hospital automation, stringent drug traceability regulations, and widespread adoption of smart supply chain technologies. Healthcare facilities in the U.S. are extensively utilizing RFID cabinets for medication management, implant tracking, and controlled substance monitoring. Furthermore, high adoption across defense logistics, aerospace manufacturing, and other high-value industrial sectors reinforces market growth and expansion in the country.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the RFID smart cabinets market is experiencing notable trends. The growing healthcare infrastructure and increased awareness of the benefits of RFID technology are driving adoption. Healthcare digitization initiatives in countries like China and India are boosting the integration of RFID smart cabinets. Moreover, the need for efficient inventory management and asset tracking in the wake of the COVID-19 pandemic has accelerated their adoption. Collaborations between local technology providers and healthcare institutions are fostering innovation, making the Asia-Pacific region a dynamic landscape for the RFID smart cabinets market.

China Market Analysis

China is a major contributor to the Asia Pacific RFID smart cabinets market due to large-scale hospital modernization, expanding pharmaceutical manufacturing, and increasing adoption of automation technologies. Hospitals are deploying RFID smart cabinets to manage high-value drugs and medical consumables, while other industries are using them to enhance efficiency in large-scale manufacturing operations. Strong government support for digital healthcare initiatives and smart factory development further accelerates market penetration across the country.

Europe: A Significant Market

Europe is a significant market for RFID smart cabinets, driven by regulatory compliance requirements, increasing hospital digitalization, and a strong focus on supply chain transparency. The region prioritizes patient safety, inventory accuracy, and cost control, especially within public healthcare systems. Adoption is also rising in manufacturing, aerospace, and research laboratories, supported by government initiatives promoting digital health and Industry 4.0 technologies.

Germany Market Analysis

The RFID smart cabinets market in Germany is driven by widespread hospital automation, strict regulatory requirements for drug traceability, and a strong emphasis on patient safety and inventory accuracy. Additionally, high adoption of Industry 4.0 technologies, digital healthcare initiatives, and the need for secure management of high-value drugs and medical supplies further propel market growth

How is the Opportunistic Rise of Latin America in the Market?

Latin America is witnessing opportunistic growth in the RFID smart cabinets market due to increasing healthcare infrastructure development, rising adoption of digital inventory management, and growing awareness of drug safety and traceability. Hospitals and clinics are gradually deploying smart cabinets to improve medication management and reduce inventory losses. Additionally, expanding industrial sectors such as pharmaceuticals and manufacturing are adopting RFID solutions to enhance operational efficiency, creating further market opportunities.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) offers significant opportunities in the market driven by rapid healthcare infrastructure expansion, modernization of hospitals, and increasing adoption of digital supply chain solutions. Rising demand for secure medication management, controlled substance tracking, and inventory optimization in hospitals and pharmaceutical facilities is creating new growth avenues. Additionally, government initiatives promoting smart healthcare systems and Industry 4.0 technologies are further supporting market penetration across the region.

RFID Smart Cabinets Market Companies

- Logi-Tag Systems Inc.

- Terso Solutions, Inc.

- WaveMark, Inc. (a Cardinal Health Company)

- SATO Holdings Corporation

- Impinj, Inc.

- LogiQuip LLC

- Nexess

- QuVa Pharma, Inc.

- Censis Technologies, Inc.

- Stanley Healthcare

- Avery Dennison Corporation

- Alien Technology, LLC

- Smartrac N.V.

- RF Surgical Systems, Inc.

- iDROLOC

Recent Developments

- In September 2024, Oracle announced a new RFID for Replenishment solution within its Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) suite.

(Source: www.oracle.com/ ) - In 2020, The SATO+Impinj RAIN RFID solution simplified medical inventory dispatch and returns by validating kit contents simultaneously, saving time, enhancing accuracy, and reallocating human labor for more productive tasks, eliminating the need for manual scanning.

- Stanley Healthcare and Cisco have joined forces to assist healthcare providers in digitizing inventory tracking, streamlining operations, and improving inventory management efficiency. This partnership aims to enhance healthcare facilities' overall asset visibility and utilization.

- In 2020, Avery Dennison acquired Smartrac, a RFID and NFC solutions provider, to expand its RFID capabilities, including smart cabinets, in healthcare and other sectors.

- Medtronic acquired RF Surgical Systems, a company focused on healthcare asset management solutions, including RFID-enabled cabinets, to enhance its portfolio of healthcare technologies.

Segments Covered in the Report

By Component

- RFID Tags

- RFID Readers

- RFID Antenna

- Others

By Type

- Standard

- Customized

By End User

- Hospitals & Clinics

- Bio-Pharmaceutical Companies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting