RFID Blood Refrigerators and Freezers Market Size and Forecast 2025 to 2034

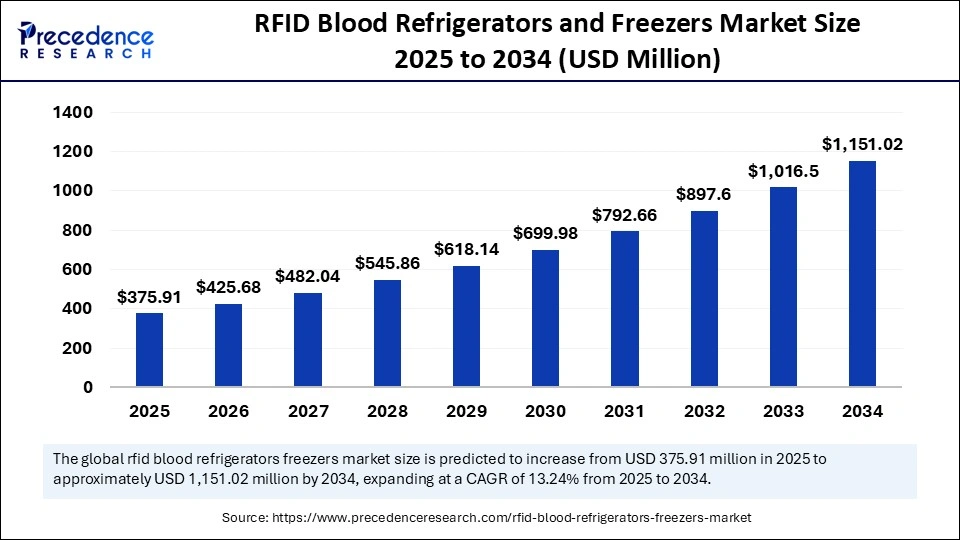

The global RFID blood refrigerators and freezers market size accounted for USD 331.96 million in 2024 and is predicted to increase from USD 375.91 million in 2025 to approximately USD 1,151.02 million by 2034, expanding at a CAGR of 13.24% from 2025 to 2034. The market is experiencing significant growth due to the increasing demand for safe and effective blood storage and tracking solutions. Rising adoption of automation and real-time inventory management systems in blood banks and hospitals also support market growth.

RFID Blood Refrigerators and Freezers MarketKey Takeaways

- In terms of revenue, the global RFID blood refrigerators and freezers market was valued at USD 331.96 million in 2024.

- It is projected to reach USD 1,151.02 million by 2034.

- The market is expected to grow at a CAGR of 13.24% from 2025 to 2034.

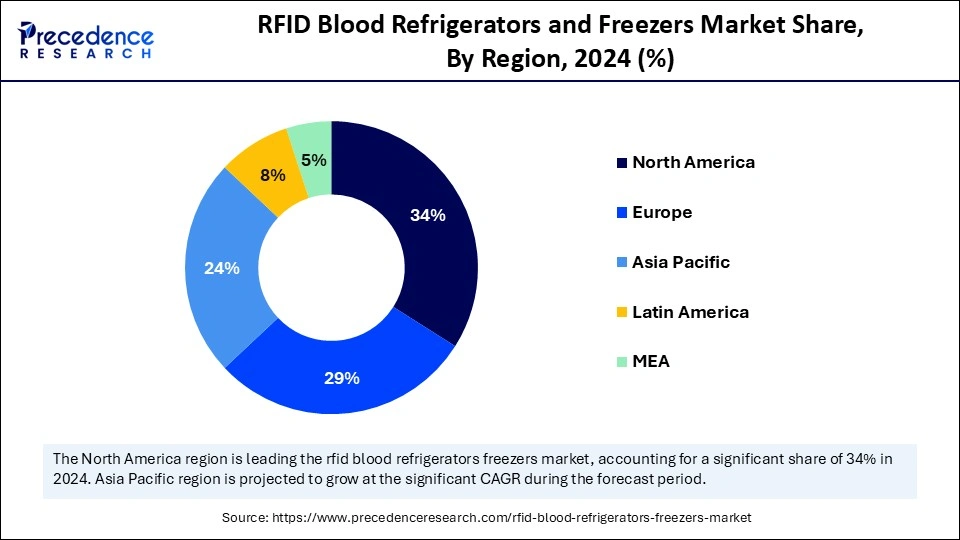

- North America dominated the RFID blood refrigerators and freezers market with the largest share of 34% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

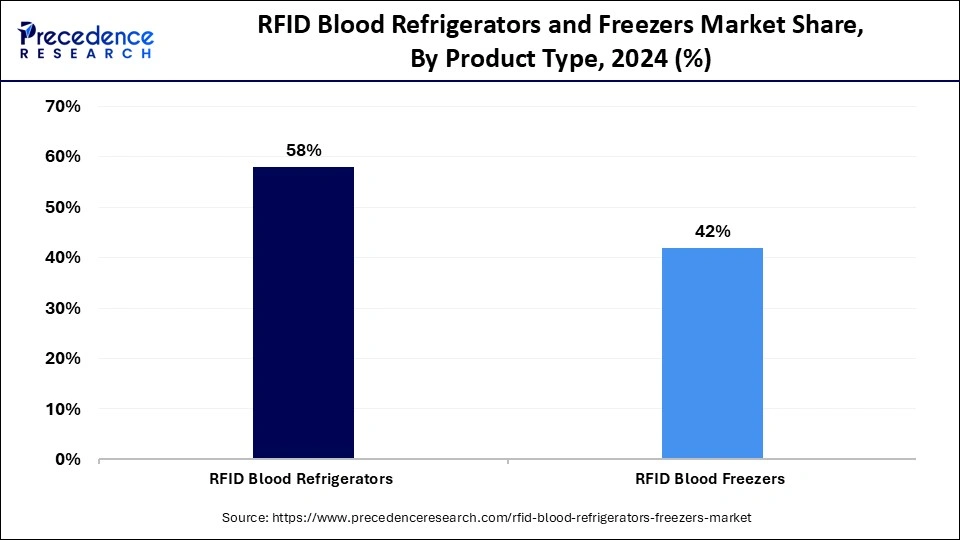

- By product type, the RFID blood refrigerators segment captured the biggest market share of 58% in 2024.

- By product type, the RFID blood freezers segment is expected to grow at a significant CAGR over the projected period.

- By capacity, the 301-600 liters segment contributed the highest market share of 35% in 2024.

- By capacity, the above 600 liters segment is expected to grow at the highest CAGR from 2025 to 2034.

- By end user, the hospitals segment held the biggest market share of 42% in 2024.

- By end user, the diagnostic laboratories segment is expanding at a significant CAGR from 2025 to 2034.

- By RFID frequency type, the high frequency (HF) segment generated the major market share of 44% in 2024.

- By RFID frequency type, the ultra-high frequency (UHF) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By distribution channel, the direct sales segment held the largest market share of 60% in 2024.

- By distribution channel, the e-commerce platforms segment is projected to grow at a notable CAGR between 2025 and 2034.

- By application, the blood storage segment accounted for the significant market share of a 53% in 2024.

- By application, the compliance & audit support segment is expected to grow at the fastest CAGR over the projected timeframe.

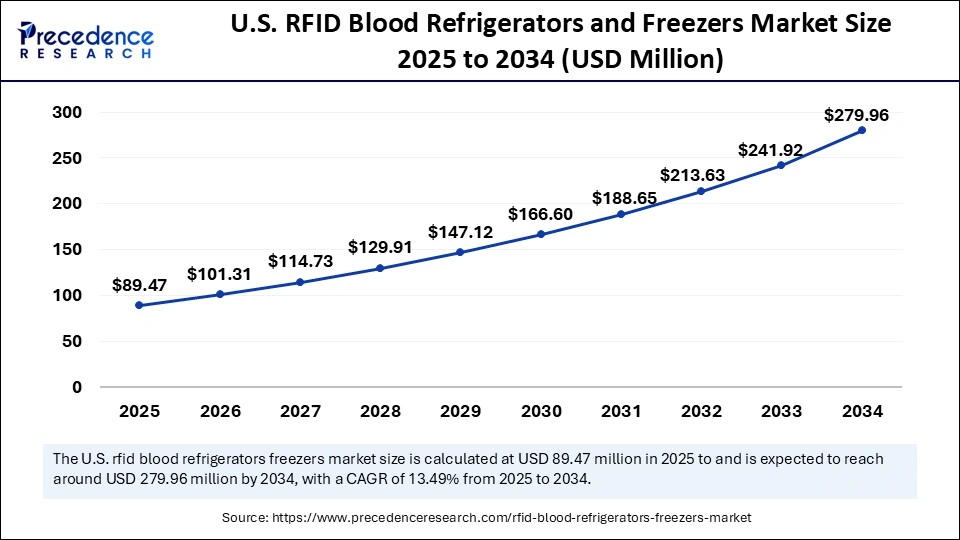

U.S. RFID Blood Refrigerators and Freezers Market Size and Growth 2025 to 2034

The U.S. RFID blood refrigerators and freezers market size was exhibited at USD 79.01 million in 2024 and is projected to be worth around USD 279.96 million by 2034, growing at a CAGR of 13.49% from 2025 to 2034.

What Made North America the Dominant Region in the RFID Blood Refrigerators and Freezers Market in 2024?

North America registered dominance in the market by holding the largest share in 2024. This is mainly due to its well-established and technologically advanced healthcare system, including hospitals and blood banks equipped with specialized refrigerators and freezers. As the region leads in technological innovation, with continuous advancements in RFID technology and temperature control systems for blood storage, regulations governing the storage and transportation of blood and blood products are strict. This ensures high standards of safety and quality, which in turn increases the demand for reliable RFID-enabled storage solutions. Initiatives like voluntary blood donation programs and campaigns raise awareness and encourage regular blood donations, further boosting the market for blood storage solutions. RFID technology is increasingly adopted for inventory management and tracking of blood products, improving efficiency and safety in blood banks and hospitals.

U.S. RFID Blood Refrigerators and Freezers Market Trends

The U.S. is a major contributor to the market in North America, driven by high demand for blood and blood components, stringent safety and traceability regulations, and ongoing technological advancements in RFID and healthcare automation. The country benefits from the presence of major market players and innovators developing advanced blood management and storage solutions. Despite challenges like high initial costs and integration complexities, the market is set for continued growth, especially with the rising integration of IoT and cloud computing capabilities

What Makes Asia Pacific the Fastest-Growing Region in the RFID Blood Refrigerators and Freezers Market?

Asia Pacific is expected to experience the fastest growth in the upcoming period, driven by increasing healthcare expenditure, especially in countries like China and India. Many governments in the region are investing in advancing healthcare infrastructure and promoting advanced technologies like RFID in blood banks, accelerating market growth. Ongoing improvements in refrigeration technology and increased demand for blood and plasma treatments are propelling RFID adoption for efficient blood management. Investments in research and development are leading to more energy-efficient, cost-effective, and technologically advanced RFID blood refrigerators and freezers.

- In September 2023, Haier Biomedical, a China-based company, announced the launch of its new line of energy-efficient TwinCool Frequency Conversion ULT Freezers designed for pharmaceutical, clinical research, and public health laboratories. This innovative range features technologies such as frequency conversion compressors for low power consumption and dual refrigeration systems to keep samples safe and secure with minimal environmental impact.(Source: https://www.haierbiomedical.co.uk)

India RFID Blood Refrigerators and Freezers Market Trends

India is emerging as a significant market for RFID blood refrigerators and freezers, mainly due to increasing awareness of blood safety, rising demand for transfusions and blood products, and government initiatives like the Digital India program, which promotes digital healthcare transformation. Strengthening cold chain infrastructure and supporting domestic manufacturing through programs like Make in India will be vital for sustained growth.

Why is Europe Considered a Notable Region in the RFID Blood Refrigerators and Freezers Market?

Europe is a notable region for RFID blood refrigerators and freezers, driven by strict regulations, high healthcare awareness, and government initiatives to develop advanced healthcare infrastructure. Europe's well-established healthcare systems and focus on patient safety are fueling demand for reliable, RFID-enabled storage solutions for blood and blood components. Many European governments actively support building and enhancing healthcare infrastructure, including blood banks and hospitals, which further spurs the demand for RFID-enabled storage solutions.

How Will Latin America Surge in the RFID Blood Refrigerators and Freezers Market?

The market in Latin America is expected to grow due to factors such as rising healthcare infrastructure, government initiatives promoting healthcare advancements, and increasing technology adoption. The region is witnessing a trend of integrating RFID technology into blood storage systems to improve traceability, security, and safety compliance. Growing awareness of blood safety and cold chain logistics is also promoting the use of RFID-enabled blood storage solutions. Specifically, Brazil is expected to have a stronghold on the market in Latin America, fueled by the rising need for enhanced traceability and safety of blood products.

What Opportunities Exist in the Middle East & Africa RFID Blood Refrigerators and Freezers Market?

The Middle East & Africa is seeing a steady growth, mainly due to increased healthcare spending, a higher prevalence of chronic diseases, and investments in infrastructure modernization. Government initiatives aimed at improving healthcare access and infrastructure, along with technological advancements and strategic partnerships, are further driving growth. Several governments in the region are actively promoting digital health initiatives and collaborating with private companies to enhance healthcare infrastructure and services, including the adoption of RFID technology in blood banks and hospitals.

How is AI Impacting the RFID Blood Refrigerators and Freezers Market?

Artificial intelligence (AI) is transforming the RFID blood refrigerators and freezers market by enhancing inventory management, optimizing storage conditions, and streamlining logistics. AI algorithms analyze data from RFID systems to forecast demand, optimize blood supply, and minimize waste. These algorithms can track inventory levels in real-time, identify expiring blood units, and automate restocking processes by monitoring temperature, humidity, and other environmental factors within refrigerators, ensuring optimal storage conditions for blood and other sensitive materials. Additionally, AI reduces the risk of human errors in inventory management and storage, helping to ensure the safety and integrity of blood products.

Market Overview

The RFID blood refrigerators and freezers market refers to the global industry involved in the production, deployment, and maintenance of cold storage units embedded with Radio Frequency Identification (RFID) technology. These units are specifically designed for secure storage, tracking, and inventory management of blood and blood components such as plasma, platelets, and red blood cells. These smart systems are widely used in blood banks, hospitals, diagnostics labs, and transfusion centers, enabling real-time visibility, automated inventory control, and improved compliance with regulatory standards. RFID integration helps reduce human error, maintain cold chain integrity, prevent stock-outs or overstocking, and enhance blood traceability. This market is growing due to rising demand for blood and blood products, advances in medical research, and the need for efficient and reliable storage solutions.

What Are the Key Trends in the RFID Blood Refrigerators and Freezers Market?

- Increasing Demand for Blood and Blood Components: The rising number of surgical procedures, trauma cases, and chronic diseases such as leukemia, thalassemia, and hemophilia is leading to a higher demand for blood transfusions and blood-derived products. This surge is driving the need for efficient blood storage solutions.

- Advancements in Medical Research: Research in fields like transfusion medicine, hematology, and bloodborne diseases relies heavily on the availability of properly stored blood samples and components, further increasing the demand for advanced storage systems.

- Stringent Regulations: Regulatory requirements surrounding blood storage and transportation, particularly in hospitals and blood banks, necessitate the use of advanced technologies like RFID to ensure compliance.

- Increasing Organ Transplants: The growing number of organ transplant procedures is also contributing to the demand for specialized storage solutions for organs and tissues, which often require temperature-controlled environments.

- Real-time Tracking and Inventory Management: RFID technology offers accurate and efficient tracking of blood units, reducing manual errors and enhancing overall operational efficiency and cost-effectiveness, alongside improvements in cold chain management.

Market scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,151.02 Million |

| Market Size in 2025 | USD 375.91 Million |

| Market Size in 2024 | USD 331.96 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Capacity, End User, RFID Frequency Type, Distribution Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Need for Safe, Secure, and Traceable Storage of Blood, Plasma, and Organs

A major factor driving the growth of the RFID blood refrigerators and freezers market is the increasing need for safe, secure, and traceable storage of blood, plasma, and organs. This is further supported by the rising prevalence of chronic diseases and the demand for effective blood management in hospitals and blood banks, along with an aging population and higher rates of chronic illnesses, which boost the need for robust blood storage and management systems. RFID technology offers real-time tracking of blood products, minimizing human error and improving inventory management. This is critical for maintaining the quality and safety of blood and blood components, ensuring they are available when and where needed. Moreover, stringent regulations regarding the safety of blood products are expected to propel market growth.

Restraint

High Initial Cost Associated with Adopting RFID Technology

A major restraining factor in the RFID blood refrigerators and freezers market is the high initial cost associated with implementing RFID technology, including the specialized hardware, software, and integration with existing systems. This can be a barrier, especially for smaller healthcare facilities and blood banks operating on limited budgets. Implementing RFID systems involves significant upfront expenses for RFID tags, readers, and software. Healthcare institutions must also ensure their RFID systems comply with regulations like HIPAA, which adds complexity and cost to the adoption process, along with the challenges posed by existing infrastructure and the need for specialized maintenance.

Opportunity

Integration of Advanced Technologies

The key future opportunity in this market lies in integrating advanced technologies to develop more efficient and intelligent blood storage solutions. RFID systems integrated with IoT and AI can provide continuous monitoring of storage conditions such as temperature and humidity, alerting staff to any deviations from set parameters, which prevents spoilage and ensures regulatory compliance. This includes real-time environmental monitoring, automated inventory management, and predictive maintenance, all of which contribute to improved blood safety and reduced operational costs. In addition, the rising development of sophisticated RFID technologies opens up new growth avenues for the market.

Product Type Insights

What Made RFID Blood Refrigerators the Dominant Segment in the RFID Blood Refrigerators and Freezers Market?

The RFID blood refrigerators segment dominated the market while holding the largest share in 2024. This is mainly due to the increased need for safe, secure, and traceable storage for blood and blood products. RFID systems enable healthcare facilities to comply with regulations governing blood product storage and handling, improve tracking of blood inventory, reduce wastage, and optimize stock levels. This segment's growth is also fueled by rising chronic disease cases, the demand for effective blood management in hospitals, and technological advancements.

The RFID blood freezers segment is expected to grow at the fastest CAGR in the upcoming period, with plasma freezers leading the charge, driven by their critical role in blood safety and management. The increasing demand for efficient blood storage, the rising prevalence of chronic diseases requiring plasma transfusions, and advancements in RFID technology are all contributing to segmental growth. Hospitals and blood banks are adopting RFID-enabled freezers to facilitate real-time tracking and monitoring of plasma, ensuring optimal storage conditions and reducing the risks of spoilage or errors.

Capacity Insights

How Does the 301-600 Liters Segment Dominate the Market in 2024?

The 301-600 liters segment dominated the RFID blood refrigerators and freezers market in 2024. The dominance of the segment stems from its suitability for a broad range of healthcare facilities and the volume of blood it can store. This capacity strikes a good balance between the needs of smaller clinics and larger hospitals, offering sufficient storage without being too bulky or costly. Smaller facilities might find larger units too expensive or space-consuming, while larger hospitals may require multiple units within this capacity range. In many healthcare settings, space is limited, making this capacity ideal for maximizing available space. This range has become a standard preferred by many healthcare facilities, due to its ease of use and familiarity, which facilitates efficient blood inventory tracking and management.

The above 600 liters segment is likely to experience rapid growth during the forecast period. This is mainly due to the increasing need for effective storage solutions in hospitals and blood banks. The capability of more than 600 liters of refrigerators and freezers to handle a large volume of blood products makes them suitable for hospitals and laboratories. The imperative for enhanced blood safety measures and the adoption of advanced tracking and inventory management technologies such as RFID also supports the growth of the segment. Stricter regulations and greater awareness about blood safety among medical professionals and the public are also fueling demand. Increased government and NGO initiatives promoting blood donation further drive the need for larger blood storage units, supporting this segment's expansion.

End User Insights

Why Did the Hospitals Segment Dominate the RFID Blood Refrigerators and Freezers Market in 2024?

The hospitals segment led the market in 2024, driven by high blood transfusion and storage needs in hospitals. Hospitals are primary sites for blood transfusions, organ transplants, and treating various diseases that require blood products, which are tightly regulated in terms of storage and handling. RFID also improves inventory management and the safety of blood products in hospitals, encouraging adoption. With the growing number of surgeries performed in hospitals, there is a high demand for blood products, creating the need for blood refrigerators and freezers.

The diagnostic laboratories segment is expected to grow at the fastest rate over the projection period due to the increasing demand for precise and efficient blood sample management for various tests, including those for chronic diseases and cancer treatments. These laboratories require effective storage and retrieval of blood samples, which RFID technology provides. Moreover, innovations such as automated inventory and real-time tracking help improve operational efficiency and reduce manual errors. Government and NGO efforts promoting blood donation and safety awareness also raise demand for advanced storage solutions.

RFID Frequency Type Insights

How Does the High Frequency (HF) Segment Lead the RFID Blood Refrigerators and Freezers Market in 2024?

The high frequency (HF) segment led the market in 2024 because of its ideal balance of read range, speed, and cost. Operating around 13.56 MHz, HF RFID offers a read range of a few feet, enough for tracking blood units in refrigerators. It also provides faster data transfer than LF RFID, allowing quick inventory updates. HF tags are cheaper to produce than UHF tags, making them suitable for large-scale use in blood banks. They are designed to endure the harsh environments of blood storage areas, making them reliable for tracking blood within refrigerators and freezers.

The ultra-high frequency (UHF) segment is expected to expand at the fastest CAGR in the coming years, owing to its longer read range, quicker data transfer, and ability to track many items at once, making it ideal for inventory management. UHF readers can scan multiple tags simultaneously, enabling fast inventory checks of racks or sections of blood products, saving time and effort compared to manual checks. This helps in efficiently tracking blood bags and components, ensuring proper storage, and reducing waste.

Distribution Channel Insights

What Made Direct Sales the Dominant Segment in the RFID Blood Refrigerators and Freezers Market in 2024?

The direct sales segment dominated the market in 2024 due to the increased need for specialized knowledge and support during the sales and installation of these vital medical devices. Direct sales enable manufacturers to have direct communication with end-users, providing guidance and support services according to their needs. This distribution channel allows manufacturers to build strong relationships with healthcare providers and customize solutions to meet specific needs. Direct sales foster personal service and trust, critical in healthcare where reliability matters. It also gives manufacturers control over how their products are presented, ensuring consistent branding.

The e-commerce platforms segment is expected to grow at the fastest rate during the forecast period due to their ability to reach a broader consumer base. Online platforms provide convenience, competitive pricing, and product comparisons. These platforms simplify buying blood refrigerators and freezers by removing the need for physical visits and offering 24/7 access. They provide detailed product info, specs, features, and customer reviews, helping customers make informed decisions. Enhancements in e-commerce automation and quick shipping improve efficiency and delivery, further fueling growth.

Application Insights

Why Did the Blood Storage Segment Lead the RFID Blood Refrigerators and Freezers Market in 2024?

The blood storage segment led the market in 2024, driven by the rising need for secure, traceable storage of blood, plasma, and organs, fueled by the rise in chronic illnesses and surgeries. RFID improves inventory accuracy, reduces human errors, and ensures regulatory compliance, making it vital for blood storage. Increased surgeries, trauma cases, and chronic conditions like leukemia and thalassemia boost demand for blood components, heightening the need for efficient storage solutions. Government and NGO campaigns promoting blood donation and storage awareness also support market growth.

The compliance & audit support segment is likely to grow at a rapid pace over the projection period because of the focus on meeting regulatory standards. It ensures accurate tracking, proper monitoring of storage conditions, and detailed records. Real-time data reduces manual checks and waste from expired or mishandled units, improving inventory management. RFID integrated with IoT and cloud tech offers predictive analytics, remote monitoring, and stronger datasecurity, providing comprehensive support for compliance and audits.

RFID Blood Refrigerators and Freezers Market Companies

- B Medical Systems

- Thermo Fisher Scientific

- Follett Products, LLC

- Panasonic Healthcare Co., Ltd.

- Vestfrost Solutions

- Angelantoni Life Science

- Haier Biomedical

- PHC Holdings Corporation

- Arctiko A/S

- BioLife Solutions

- Labcold Ltd.

- Evermed S.R.L.

- Migali Scientific

- So-Low Environmental Equipment Co.

- Dometic Group

- Kirsch Medical GmbH

- Tritec GmbH

- Coldway Technologies

- Blue Star Limited

Recent Developments

- In February 2024, PHC Corporation of North America (PHCNA) announced the launch of a new model of PHCbi brand VIP ECO SMART ultra-low temperature (ULT) freezer series for use in facilities including medical institutions, universities, and pharmaceutical companies. The MDF-DU703VHA-PA is the first PHCbi brand ULT freezer to feature dual voltage capability, allowing laboratories to switch between 115V and 220V power sources while benefiting from the award-winning energy-saving performance and enhanced security of the VIP ECO SMART series. (Source: https://www.phchd.com)

- In May 2025, SATO Healthcare Co., Ltd announced its participation in the 2025 International Society of Blood Transfusion (ISBT) Congress, held in Milan from May 31 to June 4, 2025. At Stand G48, the SATO Group will present its comprehensive PJM RFID Vein-to-Vein solutions, fully compliant with ISBT guidelines and ISO18000-3 Mode 2 standards. PJM RFID technology ensures complete traceability, significantly enhances operational efficiency, and reinforces patient safety across the entire blood management process. (Source:https://www.satoeurope.com)

Segments Covered in the Report

By Product Type

- RFID Blood Refrigerators

- Upright Refrigerators

- Under-Counter Refrigerators

- Walk-in Refrigerators

- Others

- RFID Blood Freezers

- Plasma Freezers

- Platelet Freezers

- Cryogenic Freezers

- Others

By Capacity

- Less than 100 Liters

- 100–300 Liters

- 301–600 Liters

- Above 600 Liters

By End User

- Hospitals

- Public Hospitals

- Private Hospitals

- Blood Banks

- Standalone Blood Banks

- Hospital-Associated Blood Banks

- Diagnostic Laboratories

- Research & Academic Institutes

- Others (e.g., military healthcare facilities, biopharma logistics providers)

By RFID Frequency Type

- Low Frequency (LF)

- High Frequency (HF)

- Ultra-High Frequency (UHF)

- Dual Frequency Systems

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- E-Commerce Platforms

By Application

- Blood Storage

- Blood Transportation (RFID-enabled transport cold boxes)

- Blood Inventory Management

- Compliance & Audit Support

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting