What is the Steel Rebar Market Size?

The global steel rebar market size is valued at USD 307.08 billion in 2025, and is projected to hit around USD 322.22 billion by 2026, and is anticipated to reach around USD 495.08 billion by 2035, growing at a CAGR of 4.89% over the forecast period 2026 to 2035. The steel rebar market growth is attributed to rising infrastructure investments globally.

Steel Rebar Market Key Takeaways

- In terms of revenue, the market is valued at $307.08 billion in 2025.

- It is projected to reach $473.53 billion by 2035.

- The market is expected to grow at a CAGR of 4.93% from 2026 to 2035.

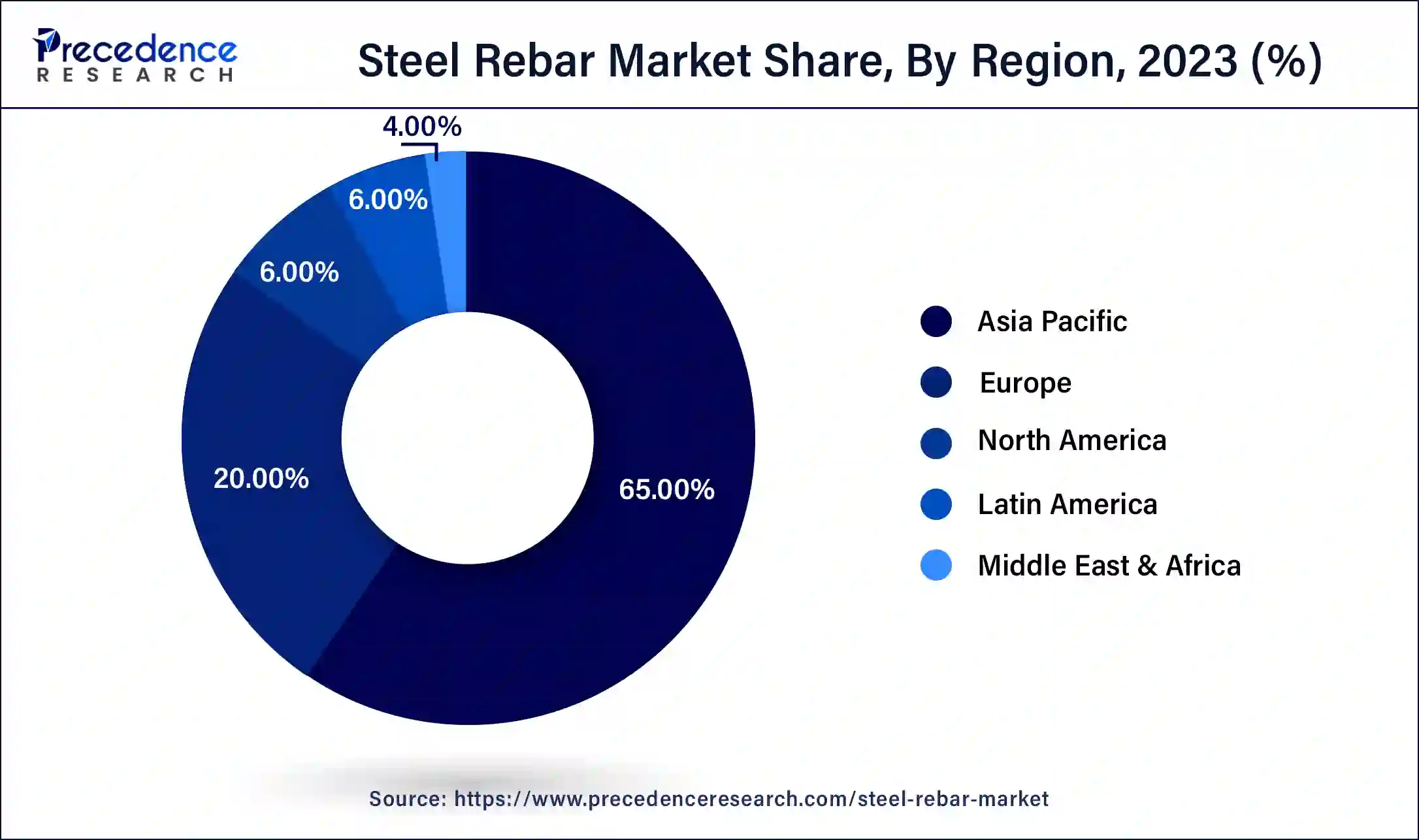

- Asia Pacific dominated the global steel rebar market with the highest market share of 65% in 2025.

- North America is projected to host the fastest-growing market in the coming years.

- By type, the deformed segment held a dominant presence in the market in 2025.

- By type, the mild segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By bar size, the #4 segment accounted for a considerable share of the market in 2025.

- By bar size, the #5 segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By coatings, in 2023, the plain carbon steel rebar segment led the global market.

- By coatings, the epoxy-coated steel rebar segment is projected to expand rapidly in the market in the coming years.

- By process, the oxygen steelmaking segment dominated the global market in 2025.

- By process, the electric arc furnace segment is projected to grow at the fastest rate in the market in the future years.

- By end-use sector, the infrastructure segment dominated the market during the forecasting period

- By end-use sector, the housing segment is projected to grow rapidly in the market in the future years.

Steel Rebar: Building a Sustainable Future

The increasing need for robust and sustainable structures and strong construction activity in various regional markets will boost demand for the steel rebar market in the coming years. Reinforcing steel bars or steel bars used for structural concrete improves tensile stress in structures such as buildings, bridges, and major projects. Recent developments in the material options for construction that include epoxy-coated and corrosion-resistant rebar assure durability and, thus, minimal long-term maintenance costs. These factors are expected to pull the market forward in the coming years, especially given the staking demand for greener and more durable construction material alternatives.

- The Global Infrastructure Hub claims that the demand for global infrastructure investment by the year 2040 will be above USD 94 trillion on account of rapid urbanization and growth in economic activities within emerging countries.

- According to the report by the International Energy Agency IEA, clean energy infrastructure investment globally is set to double by 2030, thereby elevating the demand for steel rebar in renewable power projects, such as wind and solar farms.

- The Asia Pacific region has 45% of the global steel rebar market share and is rapidly growing due to various governmental infrastructure initiatives such as India's National Infrastructure Pipeline amounting to USD 1.4 trillion.

Impact of Artificial Intelligence on the Steel Rebar Market

By implementing the use of artificial intelligence (AI) in manufacturing, manufacturers are able to keep track of the progress of production with fewer to no mistakes and less wastage. AI in demand forecasting enables appropriate changes to be made to output patterns, which eliminates the high costs associated with inventory. Furthermore, it is possible to recognize possible failures in pieces of equipment before they actually fail, thus reducing downtime and maintenance expenses.

Market Outlook

- Industry Growth Overview: The steel rebar market is increasing, driven by rising urbanization, particularly in emerging economies, which leads to growing demand for housing and other industrial and commercial buildings.

- Global Expansion:The steel rebar market is experiencing global expansion, as growing governments are heavily investing in novel and advanced infrastructure, including bridges, roads, and public transit, which are significant for financial growth and urban advancement. Asia Pacific is dominated by rapid industrialization and extensive infrastructure advancement.

- Major investors:Major investors in the steel rebar market include massive international steel companies like ArcelorMittal, Nippon Steel Corporation, and Nucor Corp, as well as prominent regional players such as Tata Steel, JSW Steel, and Gerdau SA.

Steel Rebar Market Growth Factors

- Increasing urbanization: Rapid urbanization in emerging economies, especially in Asia Pacific and Africa, is projected to boost demand for steel rebar in infrastructure projects like housing and transportation networks.

- Rising government infrastructure investments: Government-led infrastructure development initiatives, such as roads, bridges, and airports, in regions like India and the Middle East are driving higher consumption of steel rebar for construction purposes.

- Growing demand for sustainable construction: The global shift towards sustainable construction practices encourages the use of steel rebar, known for its durability and recyclability, making it a preferred material for green building projects.

- Expanding industrial construction: The growth of the industrial sector, particularly in manufacturing and logistics hubs, is expected to drive demand for steel rebar in factories, warehouses, and industrial complex construction.

- Technological advancements in steel production: Technological innovations in steel manufacturing, such as automation and advanced production techniques, are improving the quality and cost-effectiveness of steel rebar, driving market growth.

- Rising affordable housing projects: Government initiatives focused on affordable housing in developing nations, such as India's Pradhan Mantri Awas Yojana, are anticipated to significantly increase the demand for mild steel rebar.

- Increased focus on earthquake-resistant construction: The demand for earthquake-resistant construction materials, including high-strength deformed steel rebar, is expected to rise in regions prone to seismic activity, enhancing market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 495.08 Billion |

| Market Size in 2026 | USD 322.22 Billion |

| Market Size in 2025 | USD 307.08 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.89% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Bar Size, Coatin, Process, End-user Sector, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing urbanization and infrastructure development

Growing urbanization, particularly in emerging economies, is anticipated to drive the demand for steel rebar in construction projects. The growing size of metropolitan areas and demands for housing, transport, and energy compel governments to embark on infrastructure spending. Growing incorporation of environmentally friendly construction materials also boosts this trend, as rebar is a durable material that caters to large structures, particularly in Asia Pacific and Middle Eastern countries. Moreover, the rapid growth of urbanization and infrastructure investments, which in turn are favorable for the development of the steel rebar market, especially in parts of the world that experience increased population densities and urbanization migration.

- About 68% of the global population will reside in urban areas by 2050, up from 55% in 2018, as highlighted by the United Nations, pointing towards the need for development and proper construction more than ever.

- In April 2025, MEIL Group entity Olectra launched a glass fiber reinforced polymer (GFRP) rebar as an alternative to concrete steel reinforcement. The launch marks Olectra's official entry into the construction industry. GFRP Rebar not only ensures cost savings and low maintenance but also significantly improves the lifespan of structures.

| Region | Projected Infrastructure Investment (USD trillion) | Urban Population Growth (%) | Investment Timeline |

| Global | 94 | 68 | 2040 |

| Asia Pacific | 50.76 | 60 | 2040 |

| India | 1.4 | 50 | 2019-2025 |

Restraint

Availability of substitutes

The availability of substitutes is anticipated to impede the steel rebar market's growth as alternative materials, such as fiber-reinforced polymers (FRP), continue gaining traction in the construction industry. FRP exhibits far better resistance to corrosion, excellent durability, and a high strength-to-weight ratio than steel rebar. It is gradually replacing the same in large projects related to building construction and other infrastructural development for durability. Furthermore, increasing awareness and development of sustainable construction materials in the construction industry has further given more preference to FRP.

- A report from the National Institute of Standards and Technology showed that FRP reinforcements, which decrease maintenance costs and extend the living of concrete structures by as much as 25 %, make them more competitive substitutes.

Opportunity

Technological advancements

Ongoing advancement and development in novel steel manufacturing processes are expected to create immense opportunities for the players competing in the steel rebar market. Manufacturing systems through automation, machine learning, and smart manufacturing systems are likely to improve production and decrease costs. Other forms of manufacturing technologies, including integration with IoT, improve material management, cutting more than a fifth fraction of wastage, according to the World Economic Forum. Additionally, the increase in the popularity of steel rebars within industries is due to reduced production costs.

- McKinsey has also predicted that automation is expected to boost manufacturing productivity by as much as 30%, which enables companies to outsource complicated jobs without affecting the quality of their products. These intelligent systems of maintenance forecasts promise a potential of up to 40% reduction in output loss.

- In October 2024, Shyam Metalics and Energy announced the launch of its stainless-steel rebar production, specifically targeting the coastal regions. This initiative comes as a part of Shyam Metalics' commitment to supporting the Government of India's vision of strengthening coastal infrastructure and promoting the ‘Make in India' program by using high-quality.

Segment Insights

Type Insights

The deformed segment held a dominant presence in the steel rebar market in 2024 due to the increased population density and infrastructural developments in various regions, such as Asia Pacific and Latin America. High-strength materials are mostly used due to their being cheap and their longevity, especially in most commercial and industrial buildings where there is a high demand for strength since IT is a determinant of project longevity. Furthermore, reinforced concrete is the most common application of this type of rebar, and it is used in the construction of highways, bridges, extremely tall buildings, and other large structures.

- A report by the World Steel Association shows that in the construction industry, the use of high-strength materials in 2022 rose by over 10%.

The mild segment is expected to grow at the fastest rate in the steel rebar market during the forecast period of 2024 to 2034, owing to its ability to be easily formed. Its uses include small houses, roads, low rises, and stores. The growing trend of building affordable houses using mild reinforced steel throughout developing areas of Africa and certain regions of South Asia is likely to create demand for mild rebar. Furthermore, there has been an increase as infrastructural development projects have changed to green and cheaper materials for necessities, including structure formations.

- India's Prime Minister's Housing Scheme, which seeks to provide affordable shelter to all by 2022 in line with sustainable development goals, promised increased uptake of mild rebar in the construction of SHG residential housing projects.

Bar Size Insights

The #4 segment accounted for a considerable share of the steel rebar market in 2024 due to its use in most of the homes and commercial buildings under construction. The #4 Bar, with a diameter of 1/2 inch, is especially popular because of the right proportion of strength and its lightness, making it ideal for reinforced concrete structures. The continuous rise in population and infrastructure development in construction projects fuels their demand.

- The construction industry in the United States alone is expected to grow approximately 7% annually.

The #5 segment is anticipated to grow with the highest CAGR in the steel rebar market during the studied years, owing to the increased use in larger structures, including bridges, highways, and industrial. The rising interest in durability and safety requirements within construction is likely to foster demand for the #5 Bar, as it has greater tensile strength. Additionally, the increased concern towards the use of sustainable construction materials is expected to spur this segment due to the effective utilization of important materials in large projects.

- Increased investments in power, water, and other infrastructure are expected to reach USD 1.5 trillion in the next decade, further propelling the utilization of the #5 Bar steel rebar.

Coatings Insights

The plain carbon steel rebar segment led the global steel rebar market, due to its versatility and low cost in comparison with traditional construction materials applicable in different forms of construction, including residential, commercial, and infrastructural. Plain carbon steel rebar is the preferred type, as it has high tensile and corrosion strength. Moreover, the rising trend of construction projects, especially in the developing region, is expected to boost the demand for these types of rebar for construction activities.

The epoxy-coated steel rebar segment is projected to expand rapidly in the steel rebar market in the coming years, owing to the increased need for corrosion-resistant materials, especially in the construction sector. These structures are often built in regions that are battered in terms of weather and other conditions, including marine areas and industries. Compared with normal reinforcement steel bars, epoxy-coated rebar is rust or corrode-proof. This durability enhances, and the long-term maintenance costs also lower the structure. Moreover, the growing concern towards building structures and monolithic construction equipment, along with the implementation of stringent construction acts, will foster the growth of the epoxy-coated rebar market over the forecasted period, as it is preferred for expensive projects.

Process Insights

The oxygen steelmaking segment dominated the global steel rebar market in 2024. This process is preferred since lots of oxygen is utilized to decrease the carbon content from the iron ores to steel. The BOS process presents substantial cost synergies because the rates of production of the steel and the quality of steel allow for enormous-scale production of rebar in large quantities. Furthermore, there is an escalating rate by which infrastructural development and construction activities are required worldwide.

The electric arc furnace segment is projected to grow at the fastest rate in the steel rebar market in the future years, owing to the increase of focus on sustainability and recycling within the field of steel. EAF is an innovative technology in which scrap steel is used as the principal input material, thus using much less energy and emitting less CO2 than other conventional techniques. The trend towards environmentally conscious construction and manufacturing means that more EAF steel producers are expected to transition to the usage of rebar, especially for compliance with environmental laws. Additionally, the EAF process makes the production process short and beneficial in catering to the demands of sophisticated global manufacturers.

End-use Sector Insights

The infrastructure segment dominated the steel rebar market during the forecasting period due to the enormous government expenditure on public infrastructural constructs, such as roads, bridges, and transport systems. The continuous urban development and the appearance of new infrastructural development projects, along with the requirement of replacing aged reinforcement bars in multiple countries, foresees a continuous demand for rebar in this sector. Furthermore, enhancements in smart city processes and efficient construction and infrastructure industries are expected to boost the demand for steel bars in this sector.

The housing segment is projected grow rapidly in the steel rebar market in the future years, owing to the increase in demand for residential constructions facilitated by the growing population and increase in urbanization. The population demanding affordable houses, especially in the developing region, is projected to boost the consumption of steel rebar as builders look for tough materials, especially in construction projects. Furthermore, increased investment in the global housing market through government incentives for housing schemes and first-time home buyers.

Regional insights

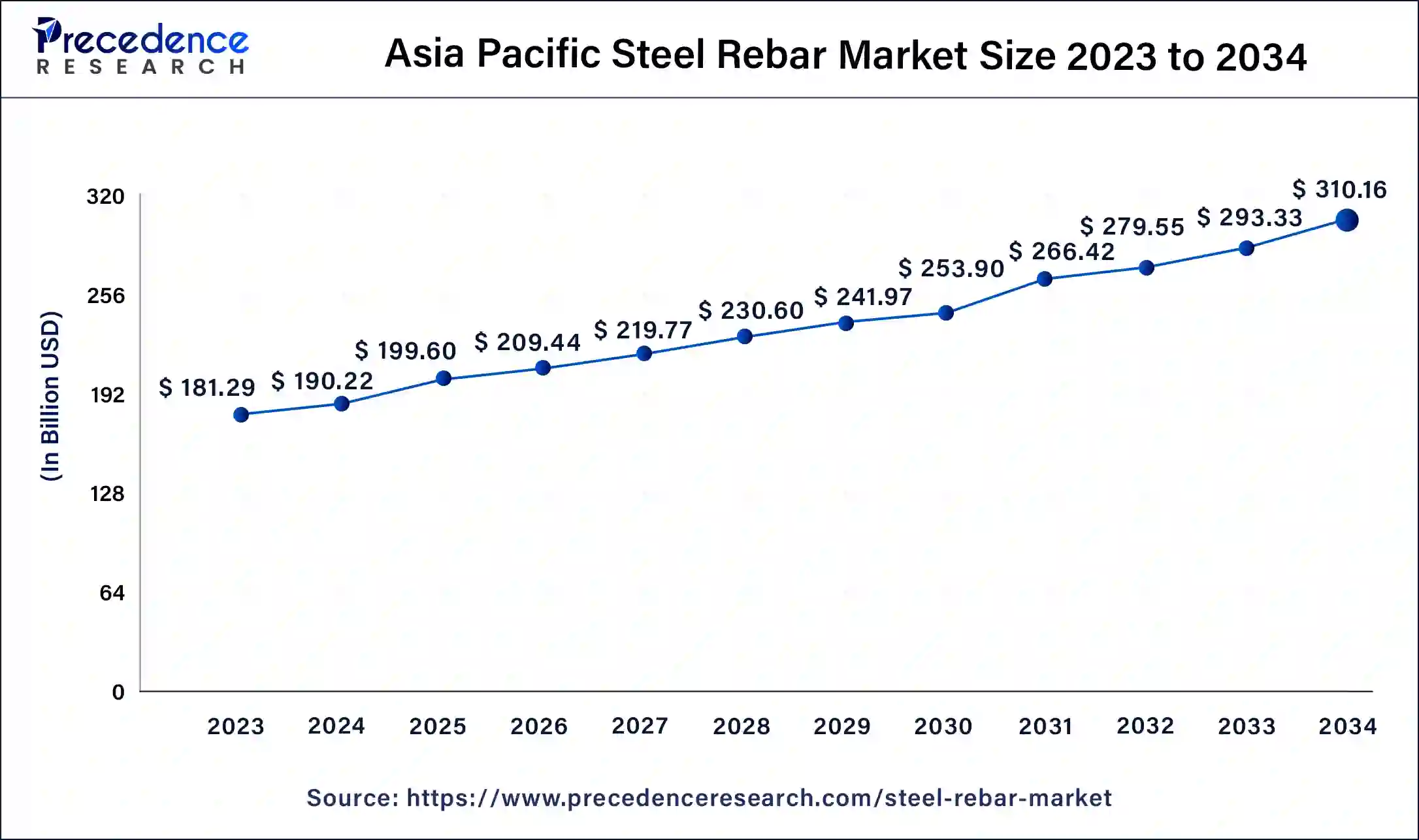

What is the Asia Pacific Steel Rebar Market Size?

The Asia Pacific steel rebar market size is exhibited at USD 199.60 billion in 2025 and is projected to be worth around USD 324.96 billion by 2035, poised to grow at a CAGR of 4.99% from 2026 to 2035.

Increasing government support

Asia Pacific dominated the global steel rebar market in 2024 due to the high rate of development in infrastructure, mainly in developing countries, such as China and India, which were responsible for more than 60% of the region's steel consumption. The two major programs launched by the Indian government, including the Smart Cities Mission and the Housing for All by 2022, are expected to increase the demand for steel rebar in residential and public infrastructure projects in the region in the coming years. Furthermore, the ready availability of raw materials, cheap labor, and high demand within the region are expected to fuel the market in this region.

- In the year 2022, China alone accounted for approximately 933 million metric tons in steel production which were further utilized in local construction and infrastructure industries.

- In November 2024, the DS Jindal Group, a prominent name in the steel and plastic pipe industry, entered the Glass Fiber Reinforced Polymer (GFRP) rebar market under its brand, “Flujo “. This initiative, spearheaded by Managing Director Sahil Jindal, aims to transform the Indian construction landscape by offering an advanced, non-corrosive alternative to TMT rebars.

Massive Infrastructure and Construction Boom

India's quick urbanization and massive regulatory spending in infrastructure projects, like railways, highways (Bharatmala Pariyojana), ports (Sagarmala project), and urban advancement (Smart Cities Mission), are the significant drivers for a massive and sustained demand for steel rebar. The country owns massive domestic reserves of significant raw materials such as iron ore and non-coking coal, which offer competitive benefits by ensuring a stable and affordable supply for steel manufacturing.

Increasing aging infrastructure

North America is projected to host the fastest-growing steel rebar market in the coming years. Due to aging infrastructure, many of the bridges in America are over 50 years old, and therefore, this requires significant levels of repair and reconstruction work. As constructors use steel rebars for constructing bridges, there is a demand for steel rebars. The USD 1.2 trillion passed the U.S Infrastructure Investment and Jobs Act, which is expected to spur a wave of development in roads, bridges, and public transport systems. Moreover, the demand for green construction techniques and energy-efficient structures requires further growth in the market as the governments encourage a shift to sustainable structures.

Technological advancements and sustainability

U.S. manufacturers are leaders in accepting sustainable and progressive production technology, mainly using electric-arc furnaces (EAFs), which utilize plentiful scrap steel. Continuing commercial and housing construction is increasing in major U.S. cities, driven by population growth and demand for housing and commercial spaces such as data centers and production facilities, sustaining high demand for rebar.

Infrastructure development

Europe is experiencing substantial growth in the market due to Governments spending heavily in the transformation and expansion of roads, public transport, and bridges, which requires a large and consistent supply of quality steel rebar. Strict EU building codes and a drive for more durable and long-lasting structures create a greater demand for high-strength and progressive rebar grades, which contributes to the growth of the market.

Increasing demand for high constructions

The UK market has a consistent demand for rebar due to constant construction and large-scale infrastructure schemes. The UK imports considerable amounts of steel from countries such as China, Italy, Germany, and Turkey. Precise rebar quotas for the UK market have often been dominated by imports from countries like Algeria and Egypt.

Why Is the MEA Steel Rebar Market Gaining Momentum?

The Middle East and Africa market has a high momentum because of massive infrastructure development, high pace urbanization, and long-term investments in the construction process. The smart cities, airports, ports, rail corridors, and stadiums are mega projects that are greatly increasing the demand for steel rebar as the essential reinforcement material. Housing shortages in Africa are a result of population growth and urban migration, which are leading to increased construction activity.

UAE Steel Rebar Market Trend

The United Arab Emirates is the market leader in the MEA at the country level, as it is characterized by extensive infrastructural investment due to long-term developmental projects. The NEOM projects, transportation systems, and industrial cities are among the Vision 2030 projects in Saudi Arabia and will be significant in rebar demand. Commercial real estate, tourism infrastructure, and urban redevelopment projects have remained very active in the UAE.

Why Is the Latin American Steel Rebar Market Emerging Rapidly?

The Latin American market is developing at an impressive rate with the increasing infrastructural developments, urban housing, and economic revival in many of its countries. Governments are allocating more to transportation, energy, water management, and public infrastructure to accelerate the growth of the economy in the long term.

Residential construction is growing on a massive scale because of the rising population in cities and the growing housing demand among the middle classes, which is adding fuel to the high consumption of rebar.

Brazil Steel Rebar Market Trend

The Brazilian steel rebar market has been leading in the Latin American region because of its huge construction industry, vast infrastructure requirements, and domestic capacity of steel production. Transportation, housing, and industrial facility demand is still driven by major investments.

Mexico is listed in the second place, which is backed by the growth of industries, urbanization, and the growth of cross-border manufacturing. Chile is one of the key contributors, which is motivated by the upgrades and construction works connected with mining.

Value Chain Analysis – Steel Rebar Market

- Raw Material:

The main raw materials for steel rebar are iron ore and coal, which are used to create steel, along with scrap steel, which is also used to produce billets.

Key Players: Toyota and Honda - Chemical Synthesis and Processing:

The production of steel rebar includes particular chemical synthesis throughout steelmaking to achieve an exact composition, followed by specific processing technology.

Key Players: Ford and Hyundai - Compound Formulation and Blending:

The compound formulation and blending in the steel rebar market focus on attaining precise chemical compositions to meet needed mechanical characteristics and significantly involve the precise blending of iron ore/scrap, coal/coke, and fluxes with micro-alloying rudiments.

Key Players: Kia and BMW

Top Vendors in the Steel Rebar Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Mumbai, India |

innovation and sustainable steelmaking |

Tata Tiscon offers superior strength rebars for all construction drives to more than 6500 dealers and is the best-known rebar brand in India. |

|

|

Indiana |

Entrepreneurial culture and innovation |

In November 2025, Steel Dynamics, Inc. announced that it had consummated the sale of $650 million aggregate principal amount of 4.000% Notes due 2028, as well as reopened and consummated the sale of an additional $150 million aggregate principal amount of 5.250% Notes due 2035 |

|

|

SAIL |

India |

Robust infrastructure and R&D |

Sail is planning to increase its crude steel capacity from 20mn t/yr at present to 35mn t/yr by the fiscal year ending March 2031. |

|

POSCO HOLDINGS INC. |

South Korea |

Technological Innovation |

POSCO operates 65 win-win growth programs in the sectors of business, including technology collaboration, financial assistance. |

|

Nucor |

North Carolina |

Efficient production technology |

Nucor provides a wide array of rebar and related construction products through its Steel Products segment and Nucor Rebar Fabrication business. |

Other Major Key Players

- NLMK

- NIPPON STEEL CORPORATION

- JSW

- Jiangsu Shagang Group

- ArcelorMittal

Recent Development

- In May 2025, Italian steel company Acciaierie di Verona, part of the Pittini Group, completed the construction of a new production unit for the production of Jumbo Stretched rebar. This is a strategic investment aimed at diversifying production, expanding the product portfolio, and increasing the company's competitiveness in the construction steel market.

- In October 2024, ExxonMobil announced a strategic licensing agreement with Neuvokas Corporation, producer of GatorBar, an industry-leading glass fiber reinforced polymer (GFRP) composite rebar. Under this agreement, ExxonMobil has obtained exclusive rights to sub-license Neuvokas' proprietary manufacturing process in markets outside of North America.

- In November 2023, Nippon Steel announced its plans to acquire stakes in iron ore and coking coal. This is to ensure the uninterrupted supply of raw materials such as iron ore and coking coal, and prevent losses from price fluctuations.

- In February 2024, Nucor Corporation announced plans to build a new steel rebar micro mill in the Pacific Northwest, with a projected capacity of 650,000 tons per year. This new facility, expected to take two years to construct, will be the company's largest rebar micro mill, surpassing its existing operations by 50%. Nucor's investment of USD 860 million aims to meet growing infrastructure demands and further strengthen its position in the western U.S. steel market.

Segments Covered in the Report

By Type

- Mild

- Deformed

By Bar Size

- #8 bar Size

- #5 bar Size

- #4 bar Size

- #3 bar Size

- Others

By Coating

- Galvanized Steel Rebar

- Plain Carbon Steel Rebar

- Epoxy-coated Steel Rebar

By Process

- Electric Arc Furnace

- Basic Oxygen Steelmaking

By End-user Sector

- Housing

- Infrastructure

- Industrial

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting