What is the Subscriber Identity Module (SIM) Market Size?

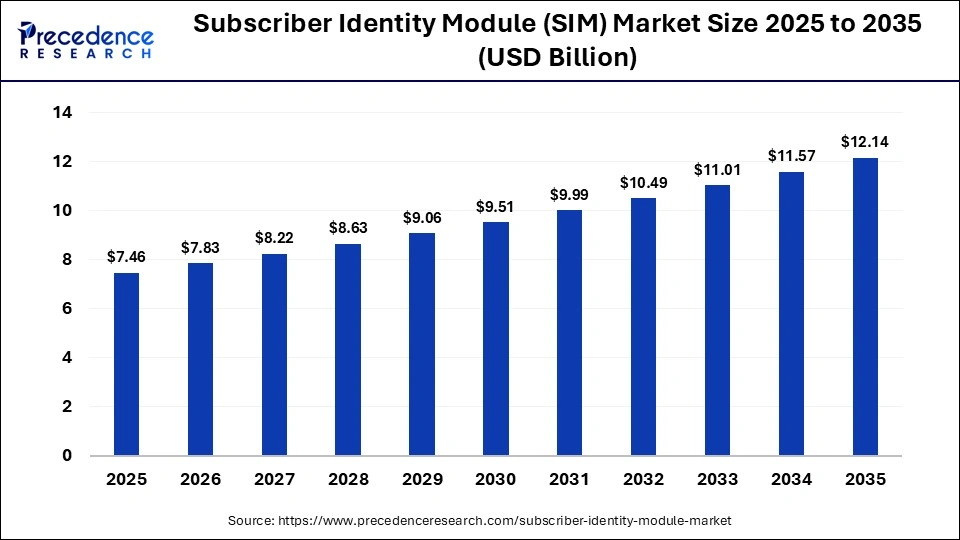

The global subscriber identity modules (SIMs) market size was calculated at USD 7.46 billion in 2025 and is predicted to increase from USD 7.83 billion in 2026 to approximately USD 12.14 billion by 2035, expanding at a CAGR of 5.00% from 2026 to 2035.The market growth is attributed to rising smartphone adoption, expanding 4G/5G networks, and increasing IoT connectivity.

Market Highlights

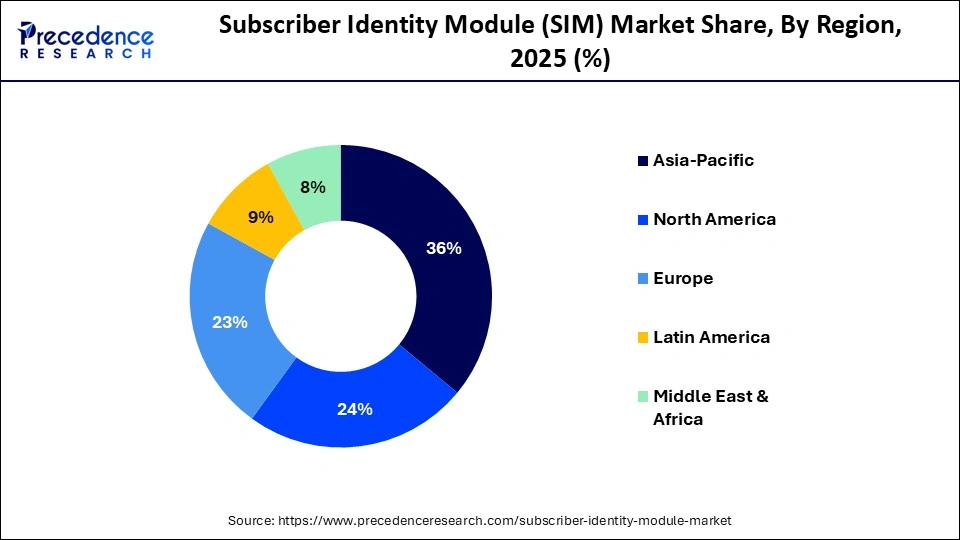

- Asia Pacific dominated the market with 36% of the market share in 2025.

- The Middle East & Africa is expected to grow at the fastest CAGR between 2026 and 2035.

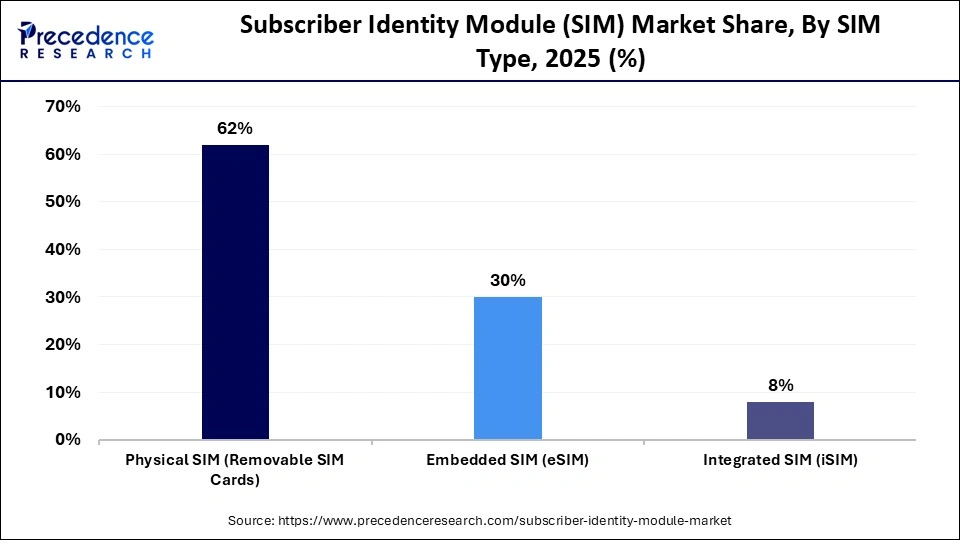

- By SIM type, the physical SIM segment contributed the highest market share of 62% in 2025.

- By SIM type, the integrated SIM (iSIM) segment is growing at a strong CAGR between 2026 and 2035.

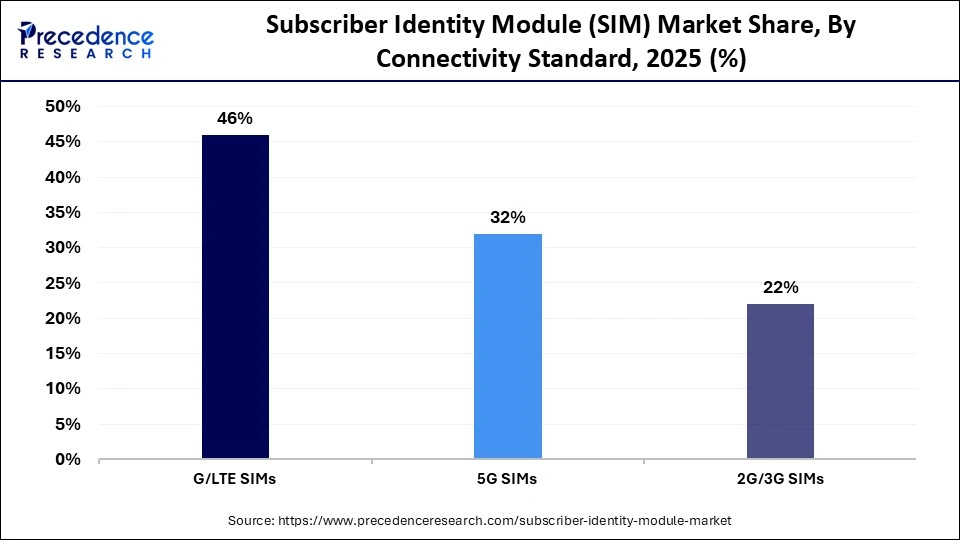

- By connectivity standard, the 4G/LTE SIMs segment held a major market share of 46% in 2025.

- By connectivity standard, the 5G SIMs segment is expected to expand at a notable CAGR from 2026 to 2035.

- By application, the smartphones segment captured the highest market share of 52% in 2025.

- By application, the IoT & M2M connectivity segment is poised to grow at a robust CAGR between 2026 and 2035.

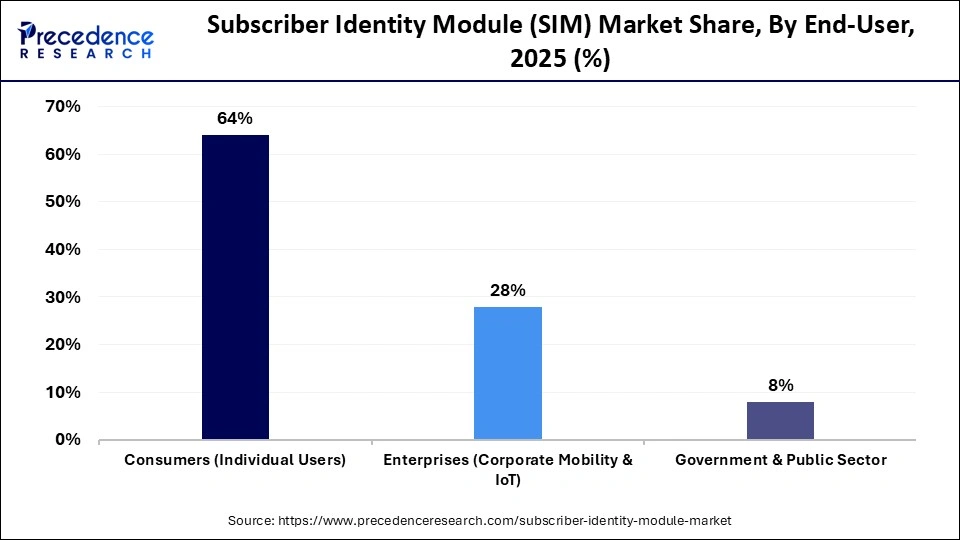

- By end-user, the consumers (individual users) segment generated the biggest market share of 64% in 2025.

- By end-user, the enterprises (corporation mobility & IoT) segment is expanding at the fastest CAGR in the forecasted period.

What are Subscriber Identity Modules?

Subscriber Identity Modules (SIMs) are secure components that authenticate devices on mobile networks and enable access to voice, data, and messaging services. The SIM market is undergoing a structural transition from removable physical SIM cards toward embedded SIM (eSIM) and integrated SIM (iSIM) technologies, which allow remote provisioning, support multiple operator profiles, and eliminate the need for manual SIM replacement. These capabilities are increasingly deployed across smartphones, tablets, wearables, and connected vehicles, where manufacturers and operators require flexible lifecycle management of connectivity.

According to the Trusted Connectivity Alliance, global eSIM shipments exceeded 503 million units in 2024, reflecting 35% year-over-year growth, while consumer eSIM profile downloads increased by 56%, indicating accelerating adoption at the device level. Beyond consumer electronics, eSIM and iSIM technologies are being adopted across enterprise IoT deployments, including smart city infrastructure, logistics fleets, utilities metering, and industrial manufacturing systems, where centralized provisioning and persistent connectivity are critical for large-scale device management and operational efficiency.

Impact of Artificial Intelligence on the Subscriber Identity Module (SIM) Market

The use of AI is profoundly changing the functioning of digital SIM technologies by introducing smarter, data-directed connectivity management and predictive optimization. Mobile network operators are now using AI algorithms to analyze network usage and automatically anticipate network congestion. This enables dynamic SIM profile provisioning to enhance service quality and minimize manual interventions. Furthermore, in network operations and customer service, telecom bodies such as GSMA report that AI usage has become widespread, and most operators have launched AI strategies that have optimized operations and services to customers.

AI is also being applied to real-time SIM lifecycle management, where operators use predictive analytics to trigger remote profile switching for roaming users and IoT devices based on latency, cost, and regulatory constraints. In enterprise IoT deployments across logistics, utilities, and connected vehicles, AI-enabled SIM platforms support anomaly detection, fraud prevention, and automated connectivity recovery without manual reconfiguration. Regulators and standard-setting organizations are increasingly evaluating AI-governed SIM orchestration frameworks to ensure security, lawful interception compliance, and reliability as digital SIM adoption scales globally.

Subscriber Identity Module (SIM) MarketGrowth Factors

- Rising Adoption of eSIM-Enabled Devices: Increasing production of smartphones, wearables, and laptops is driving global eSIM integration.

- Growing IoT and M2M Deployments: Expanding industrial automation, smart cities, and connected vehicles are propelling SIM demand for seamless connectivity.

- Boosting 5G Network Rollouts: Accelerated 5G coverage across urban and suburban regions is fueling demand for next-generation SIM solutions.

- Driving Enterprise Digital Transformation: Corporate mobility and IoT initiatives are growing the need for scalable SIM management and secure connectivity.

Subscriber Identity Module (SIM) Market Value Chain Analysis

- Secure Element & Chip Manufacturing: Design and fabrication of secure SIM/eSIM/iSIM chips for identity and encryption.

Key Players: Qualcomm, STMicroelectronics, NXP Semiconductors, Sequans, Infineon Technologies. - SIM Operating System & Security Software Development: Development of secure operating systems and cryptographic firmware for authentication and management.

Key Players: ARM/Kigen, Thales Group, Giesecke+Devrient (G+D), IDEMIA. - Mobile Network Operator Integration & Certification: Integration and certification with operators for network access and compliance.

Key Players: Vodafone, Deutsche Telekom, Telefónica, China Mobile, and AT&T. - Device OEM & IoT Module Integration: Embedding SIM/eSIM/iSIM into smartphones, wearables, vehicles, and IoT devices.

Key Players: Apple, Samsung Electronics, Huawei, Cavli Wireless, and IoT module makers. - Distribution & Retail/Service Channels: Delivery via retail, OEM pre-installation, apps, and enterprise IoT platforms.

Key Players: Mobile carriers' retail networks, Yesim, platform service providers, MVNOs.

Shaping the Future of Connectivity: Strategic Innovations and Market Momentum in the Subscriber Identity Module (SIM) Market

- eSIM penetration grew rapidly, with approximately 27% of smartphone connections using eSIM by the end of 2023, and is forecast to reach around 50% of smartphone connections by the end of 2025 as eSIM-only devices expand across carriers in the United States and Canada.

- The Asia Pacific region is witnessing early but accelerating eSIM penetration; GSMA Intelligence data shows adoption rising from around 2% in 2023 to approximately 5% in 2024 and near 9% in 2025, with continued momentum into 2026 as networks and OEM support expand across China, India, and Southeast Asia.

- In 2024, there were approximately 112 mobile-cellular subscriptions per 100 inhabitants globally, up from around 111 in 2023, illustrating continued penetration growth worldwide.

- The global number of cellular IoT (M2M) subscriptions increased approximately 14% in 2024 to reach 3.8 billion connections, representing about 30% of total mobile subscriptions worldwide.

- According to IoT Analytics tracking, total cellular IoT connections surpassed 4 billion by the end of 2024, driven by LTE and 5G technologies such as LTE Cat-1 bis and 5G.

- Cisco's IoT Control Center managed ~262 million SIM connections for enterprise and industrial customers by the end of 2024, while Aeris supported ~84 million connected devices, indicating strong adoption of centralized SIM and connectivity management platforms.

- The number of 5G mobile connections worldwide surpassed 2 billion by the end of 2024, indicating strong global uptake of 5G-capable devices that typically use SIM/eSIM for connectivity.

Subscriber Identity Module (SIM)Market Trends

- Cross-Border Multi-Network Orchestration Growth: Increasing implementation of the GSMA SGP.32 is fueling multi-network profile management that dynamically switches connections according to the coverage and cost. This trend is propelling scalable, autonomous connectivity management that reduces vendor lock-in and operational friction in 2026.

- Mainstream Non-Terrestrial Network (NTN) Integration: Satellite and non-terrestrial networks are growing into mainstream cellular packages under 3GPP NTN specs, extending coverage where terrestrial signals fail. This device-satellite blend is also driving the reliability of devices all around the globe and creating an increased application of SIM to areas previously accessible through the network.

- Hybrid Satellite Cellular SIM Solutions Emerging: Hybrid connectivity models are rising where eSIM and satellite links provide seamless fallback when terrestrial networks fail. The trend is driving emerging SIM use cases that expand connectivity to important assets and problematic areas.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.46Billion |

| Market Size in 2026 | USD 7.83 Billion |

| Market Size by 2035 | USD 12.14Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.00% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | SIM Type, Connectivity Standard, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

SIM Type Insights

Why Did Physical SIMs Dominate the Subscriber Identity Module (SIM) Market in 2025?

The physical SIM (removable SIM card) segment dominated the subscriber identity module (SIM) market in 2025, accounting for an estimated 62% market share, due to its widespread compatibility, simple installation, and legacy device support. Physical SIMs were known to be highly reliable and possess low complexity of integration.

These sims became the default option among mobile operators in those areas that experienced a lag in digital identity infrastructure or where device OEMs had not yet adopted embedded versions. Furthermore, the physical SIM domination was further ensured by organized logistical ecosystems and retail distribution chains around the world.

The integrated SIM (iSIM) segment is expected to grow at the fastest rate in the coming years, accounting for the highest CAGR, as it offers built-in connectivity, thus avoiding the separate SIM hardware and costing the device less and less. According to Juniper Research, the number of iSIM installations is expected to grow by 2026 to more than 10 million, up in 2024 by approximately 800,000 devices.

iSIMs are easy to manufacture and offer remote provisioning options that enable them to cut system complexity from the supply chain. Moreover, the low-power usage with the sleek and streamlined design of the device and the improved security functions further facilitate the iSIM market demand.

Connectivity Standard Insights

Why Did 4G/LTE SIMs Dominate Connectivity Standards in the Market for Subscriber Identity Modules (SIM)?

The 4G/LTE SIMs segment held the largest revenue share in the subscriber identity module (SIM) market in 2025, holding a market share of about 46%, as they attracted the largest sheer number of network connections worldwide. They provide a comprehensive and reliable, wide-ranging infrastructure. According to the ITU report, global 4G coverage encompassed around 93% of the global populace by the mid-2020s, far surpassing initial 5G rollouts. Additionally, the network operators were encouraged to keep and develop 4G services, ensuring that LTE SIMs remained of high relevance in the mid-2020s.

The 5G SIMs segment is expected to grow at the fastest CAGR in the coming years, accounting for 32% CAGR. Owing to next-generation networks being very fast in terms of speed, latency, and new enterprise-grade applications, they create demand for high SIM abilities. By the end of 2024, global 5G connections topped over 2.25 billion, showing a fast adoption and growth. Furthermore, the consumer demand for high-speed, low-latency services puts 5G SIMs in the leading position of the fastest-growing sub-segment in the coming years.

Application Insights

Why Did Smartphones Lead the Subscriber Identity Module (SIM) Market During 2025?

The smartphones segment led the subscriber identity module (SIM) market in 2025, accounting for an estimated 52% market share, due to the fact that the majority of mobile users use them as their main source of communication and access to the internet. According to GSMA Intelligence, the number of eSIM-enabled smartphone connections is expected to increase twofold to approximately 598 million in 2024. This shows high demand for modern mobile phones by consumers. Regions such as Asia Pacific, North America, and Europe reported the highest smartphone penetration, thus further propelling the growing demand for subscriber identity modules globally.

Source:

The IoT & M2M Connectivity segment is expected to grow at the fastest rate in the coming years, owing to the rapid expansion of connected devices across industries, enterprises, and infrastructure ecosystems. In 2024, licensed cellular IoT connections had exceeded 4 billion and experienced robust growth in machine-to-machine connections facilitated by LTE Cat 1 bis and 5G. Furthermore, to support massive device fleets, remote provisioning, and lifecycle control, operators are providing more specialized IoT plans and eSIM profile management, thus facilitating the market growth.

End-User Insights

Why Did Consumers (Individual Users) Make Up the Largest Share in the Market for Subscriber Identity Modules?

The consumer segment held the largest share in the subscriber identity module (SIM) market in 2025, accounting for an estimated 64% market share, due to personal mobile usage being the main force behind SIM deployments in the world. Individual smartphone usage remained growing exponentially, encouraged by cheap devices, wide 4G and 5G networks, and daily reliance on cellular broadband to communicate, socialize, and entertain. Moreover, the strong smartphone penetration in Asia Pacific, Europe, and North America ensured that individual mobile users dominated SIM usage in the coming years.

The enterprises (corporate mobility & IoT) segment is expected to grow at the fastest rate/fastest CAGR in the coming years, owing to the high levels of digitalization being undertaken in businesses and machine-to-machine communications, the requirement is increasing at a rapid pace compared to personal. Enterprise applications are becoming an increasingly large percentage of this number, with smart buildings and smart manufacturing taking up large shares of this increase. Furthermore, the demand for private corporate networks and IoT services encourages investment in embedded SIMs and profile management platforms that maintain high uptime and data integrity.

Regional Insights

How Big is the North America Subscriber Identity Modules Market Size?

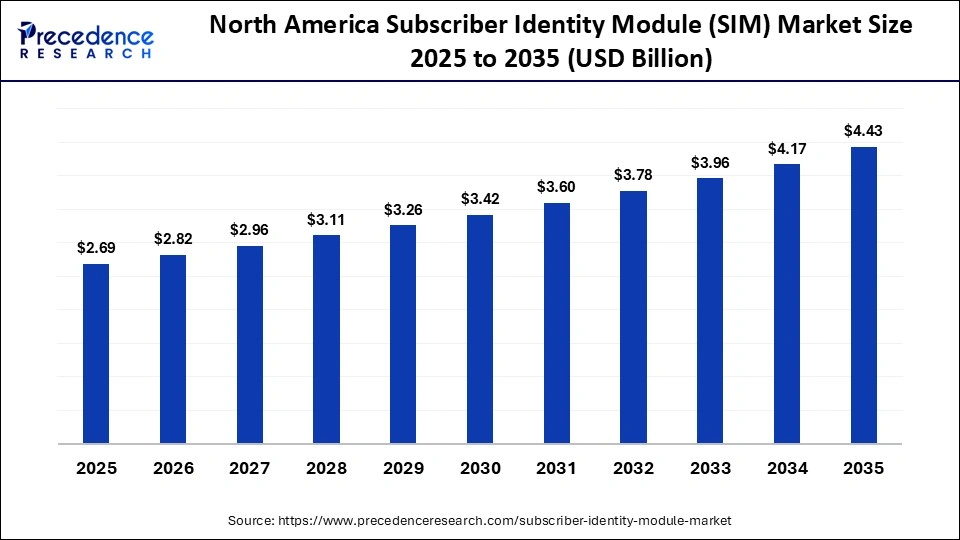

The North America subscriber identity module (SIM) market size is estimated at USD 2.69 billion in 2025 and is projected to reach approximately USD 4.43 billion by 2035, with a 5.12% CAGR from 2026 to 2035.\

Why Did North America Dominate the Subscriber Identity Modules Market in 2025?

North America dominated the subscriber identity module (SIM) with a share of around 45% in 2025. The growing cases of cardiovascular diseases in several nations, such as Canada, the U.S., and Mexico, have boosted the market growth. Also, the rapid investment by governments for opening new healthcare research centers, along with the surging prevalence of neuropsychiatric disorders, is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous radioactive tracer manufacturers, including Eli Lilly and Company (Lilly), GE HealthCare, Cardinal Health, and PerkinElmer, is expected to propel the growth of the PET scanners market in this region.

What is the Size of the U.S. Subscriber Identity Modules Market?

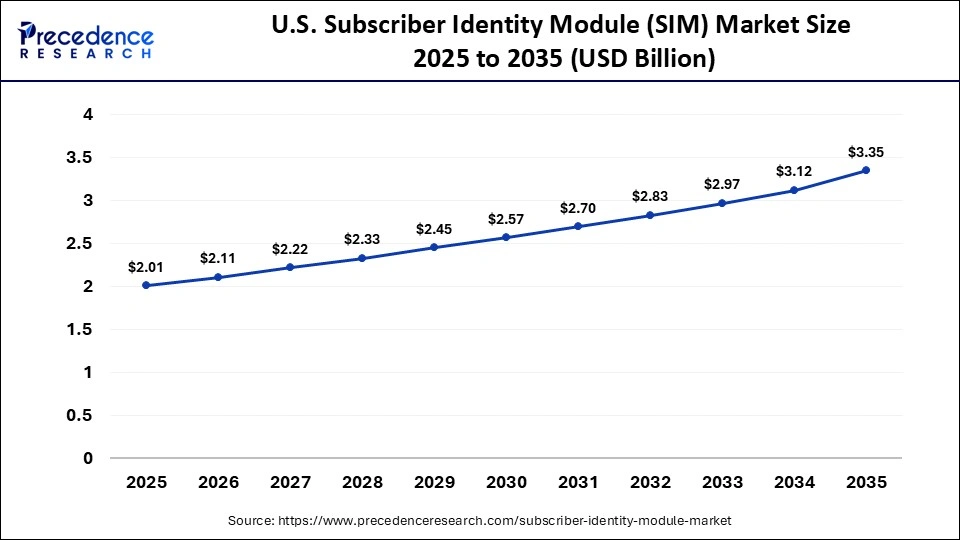

The U.S. subscriber identity module (SIM) market size is calculated at USD 2.01 billion in 2025 and is expected to reach nearly USD 3.35 billion in 2035, accelerating at a strong CAGR of 5.24% between 2026 and 2035.

U.S. Subscriber Identity Modules Industry Analysis

The U.S. subscriber identity module (SIM) is expanding due to increased investment by pharmaceutical manufacturers in domestic radiopharmaceutical production facilities, combined with the rising clinical burden of blood cancer and colorectal cancer. Federal oversight by the U.S. Food and Drug Administration has encouraged standardized manufacturing and quality control practices, which has supported the commissioning of new cyclotron and radiochemistry sites. In parallel, hospital networks are allocating capital to modernize nuclear medicine and surgical centers to support integrated PET imaging workflows.

Why Did Asia Pacific Lead the Market for Subscriber Identity Modules (SIM) in 2025?

Asia Pacific led the subscriber identity module (SIM) market, capturing the largest revenue share in 2025, accounting for an estimated 36% market share. Due to the region's largest population and the highest number of SIM connections compared with all other regions in the world. It was the newcomers of a massive subscriber base and growing broadband coverage as a result of China, India, Japan, South Korea, and Indonesia.

This dominance is further supported by aggressive 4G and 5G rollout programs led by national telecom regulators across the region. High prepaid SIM penetration and multi-SIM usage patterns continue to inflate total SIM volumes relative to other regions. Large-scale smartphone manufacturing ecosystems in China, South Korea, and Vietnam reinforce sustained SIM demand through device bundling. Rapid expansion of IoT connectivity in smart cities, logistics, and consumer electronics also contributes to continued SIM volume growth.

In the Asia Pacific, there are 1.4 billion active internet subscribers in 2024, which is an indication of high mobile penetration. The high population densities facilitate high volumes of SIM activation to cater to the rapidly urbanizing centers and heavy users of data services. Additionally, the rapid technology progression and competitive pricing models sustained high activation rates, keeping Asia Pacific at the forefront of global SIM deployment and subscriber growth.

China: Driving Asia Pacific Connectivity Expansion

China leads the market due to the massive mobile subscription volumes and rapid technology adoption. The country had a large market, which is well above any other market in the APAC. This indicates that consumers and businesses in the country continue to demand SIM connections. The country supported roughly 1.76 billion to 1.82 billion mobile subscriptions at the end of 2023. Furthermore, China's massive subscriber base and rapid technology adoption sustained its leadership in the Asia Pacific and globally, shaping SIM trends in both legacy and next-generation networks.

Why Is MEA Growing Fast in the Region in SIM Adoption?

MEA is anticipated to grow at the fastest rate in the subscriber identity module (SIM) market during the forecast period, accounting for the highest CAGR, owing to a faster increase in mobile adoption. The operators in MEA have been investing in 4G and 5G technologies, which have been supporting the growing demand for mobile broadband and enterprise connectivity solutions in both urban and rural markets. Furthermore, the MEA's mobile ecosystem growth remains strong despite economic headwinds, strengthening penetration of both consumer and enterprise SIM use cases.

This growth is reinforced by national broadband and digital inclusion programs led by telecom regulators in countries such as Saudi Arabia, the United Arab Emirates, Nigeria, and South Africa. High reliance on prepaid SIM models and multi-SIM usage continues to expand active connections across price-sensitive consumer segments. Expansion of mobile money, e-government services, and cloud-based enterprise applications is increasing SIM demand beyond basic voice services. In parallel, rising deployment of SIM-enabled devices in logistics, utilities, and energy infrastructure is accelerating enterprise SIM adoption across the region.

Nigeria: Fast Growth within Middle East & Africa

Nigeria is emerging as one of the fastest-growing SIM adoption markets within the Middle East & Africa region due to its large population base and rapidly expanding mobile penetration. According to national telecommunications reporting, the country has surpassed 150 million active cellular connections, with population penetration at approximately 64%, reflecting strong demand for mobile connectivity services. This growth is reinforced by Nigeria's youthful demographics and rising smartphone availability, which have pushed mobile network operators to accelerate 4G rollout and initiate early-stage 5G deployments. As a result, increasing data traffic consumption and aggressive network expansion strategies are directly translating into higher SIM activations across both consumer and enterprise segments.

Who are the Major Players in the Global Subscriber Identity Module (SIM) Market?

The major players in the subscriber identity modules (SIMs) market include ARM Holdings (for iSIM architecture), Giesecke+Devrient (G+D), IDEMIA, Infineon Technologies AG, STMicroelectronics, Thales Group.

Recent Developments

- In September 2025, Pelion introduced its Consumer eSIM for IoT, providing connectivity solutions for businesses by leveraging the rising adoption of consumer eSIM chipset technology across various devices. Dave Weidner, CEO at Pelion, said, "This launch comes at a critical inflection point for the industry. As chipset technology becomes commoditized, innovations from yesterday's cutting-edge chipsets, such as Bluetooth, Wi-Fi, or cellular, are built in at the silicon level. This includes Consumer eSIM, which today has been adopted by mobile network operators and travel SIM companies as the global standard for flexible, digitally delivered connectivity.(Source: https://telconews.in)

- In September 2025, Mobile Telecommunications Limited (MTC) launched its electronic Subscriber Identity Module (eSIM) service for local users, expanding beyond its previous offering limited to customers travelling abroad. The launch took place in Windhoek on Friday and was officiated by Minister of Information and Communication Technology Emma Theofelus. Theofelus stated that adopting eSIM technology positions Namibia on the path to universal, secure, and seamless connectivity.(Source: https://www.computerweekly.com)

- In April 2025, Telenor IoT unveiled its ‘future-proof' eSIM solution, claiming a major leap forward in the IoT sector by being one of the first to adopt GSMA SGP.32, the latest embedded subscriber identity module (eSIM) standard designed specifically for IoT challenges. SGP.32 is a next-generation global eSIM standard from the GSMA, aimed at remote SIM provisioning for IoT devices, particularly those without a user interface. It fundamentally enables large-scale, hands-off management of eSIM profiles, simplifying deployment and operation of IoT devices without physical access.(Source: https://www.namibian.com)

Segments Covered in the Report

By SIM Type

- Physical SIM (Removable SIM Cards)

- Mini SIM

- Micro SIM

- Nano SIM

- Embedded SIM (eSIM)

- Integrated SIM (iSIM)

By Connectivity Standard

- 4G/LTE SIMs

- 5G SIMs

- 2G/3G SIMs

By Application

- Smartphones

- IoT & M2M Connectivity

- Tablets & Laptops

- Wearables

- Other Applications

By End-User

- Consumers (Individual Users)

- Enterprises (Corporate Mobility & IoT)

- Government & Public Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content