What is the Transparent Electronics Market Size?

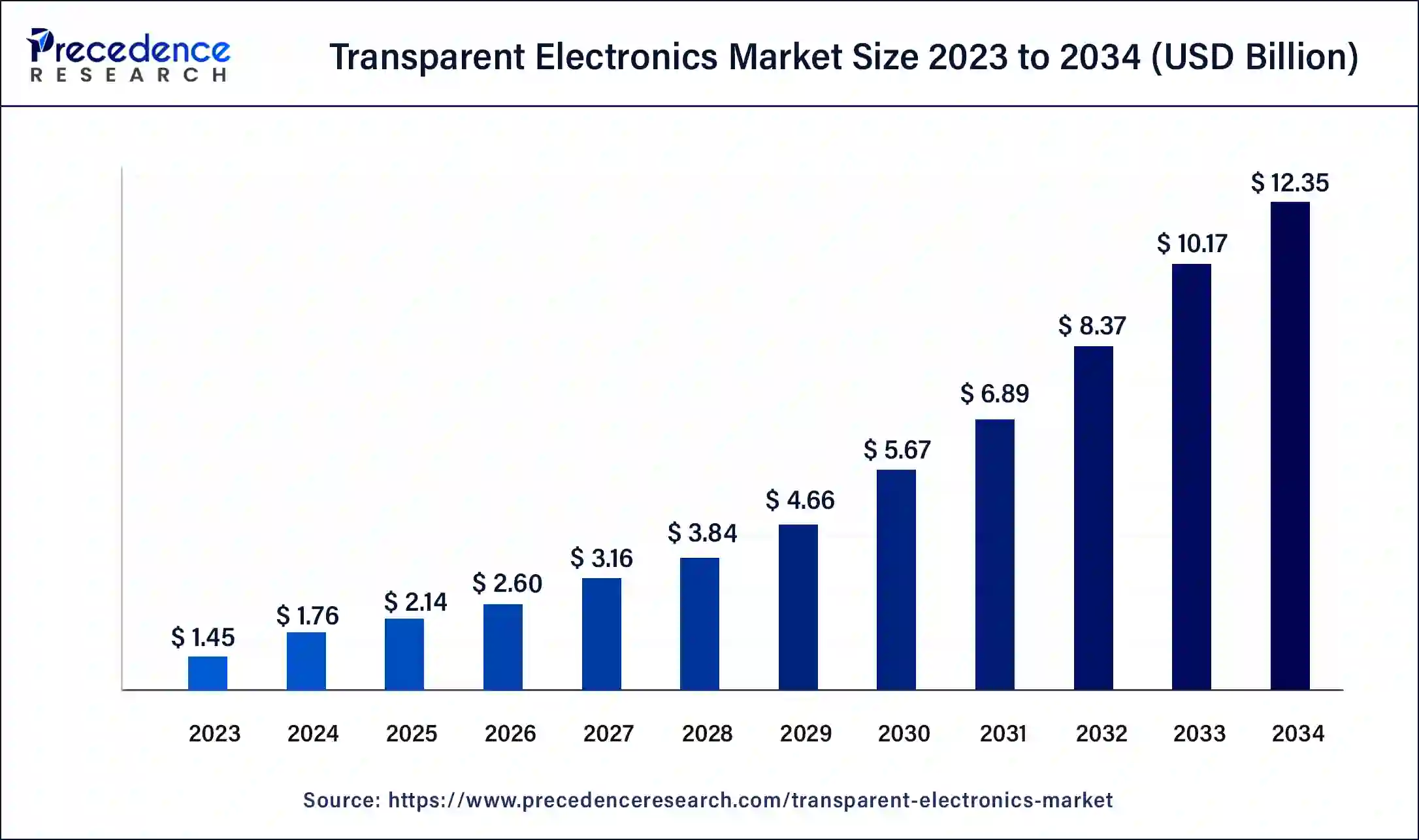

The global transparent electronics market size is accounted at USD 2.14 billion in 2025 and predicted to increase from USD 2.60 billion in 2026 to approximately USD 12.35 billion by 2034, at a CAGR of 21.5% from 2025 to 2034.

Transparent Electronics Market Key Takeaways

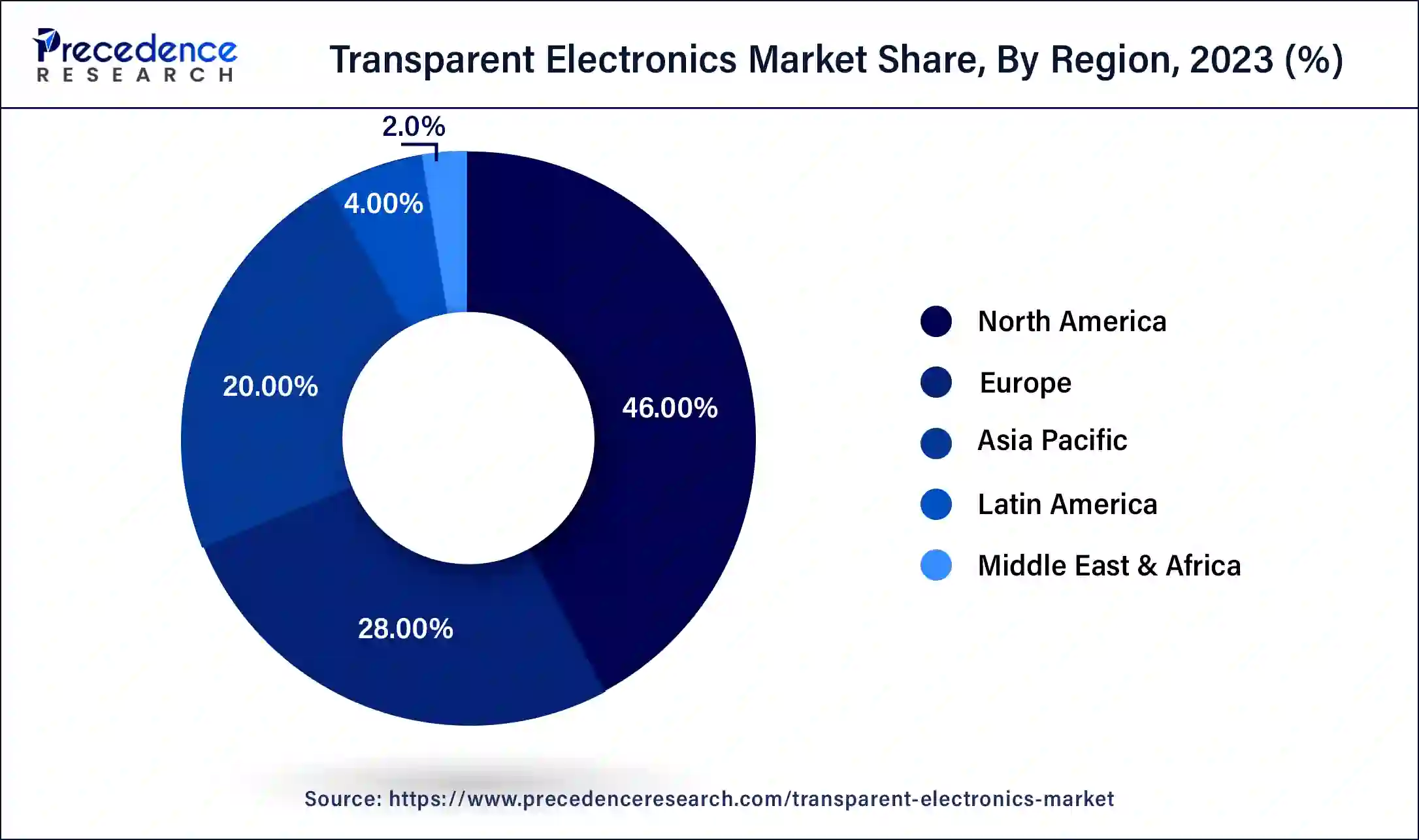

- North America contributed more than 46% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the transparent displays segment has held the largest market share of 43% in 2024.

- By product type, the transparent solar panels segment is anticipated to grow at a remarkable CAGR of 31.8% between 2025 and 2034.

- By application, the consumer electronics segment generated over 34% of revenue share in 2024.

- By application, the automotive segment is expected to expand at the fastest CAGR over the projected period.

Transparent Electronics Market Overview: The Clear Revolution

The transparent electronics market refers to the emerging field of electronics that utilizes materials with transparency properties, enabling the creation of see-through electronic components. Key applications include transparent displays, solar cells, batteries, and sensors. These innovations find use in consumer electronics, automotive, energy, healthcare, and various other sectors. Transparent electronics offer aesthetic appeal and functionality, driving their integration into diverse products. Growing demand for transparent displays and solar technologies fuels market expansion, fostering advancements in consumer electronics, sustainable energy solutions, and transparent electronic devices across industries.

Transparent electronics is an evolving sector focusing on transparent materials for electronic components, allowing the creation of see-through devices. The market is driven by the demand for aesthetically appealing and functional transparent displays, solar cells, and sensors. This technology finds applications in consumer electronics, automotive, energy, healthcare, and other industries, fostering innovations in sustainable energy solutions and transparent electronic devices.

Transparent Electronics Market Growth Factors

- Consumer electronics demand: The escalating demand for sleek and aesthetically pleasing consumer electronics, such as smartphones and smartwatches, is a significant driver for transparent electronics adoption. Consumers seek devices with transparent displays, touchscreens, and innovative electronic features, contributing to the market's robust growth.

- Automotive innovation: Transparent electronics play a pivotal role in the automotive sector, fostering innovation in heads-up displays, smart windows, and other advanced automotive electronics. As vehicles become more connected and autonomous, the integration of transparent electronic components enhances the driving experience and safety features.

- Emerging display technologies: The rapid adoption of transparent OLED (Organic Light Emitting Diode) and LED (Light Emitting Diode) technologies represents a transformative shift in display capabilities. Transparent displays offer improved image quality, vibrant colors, and unique design possibilities, propelling market expansion and capturing the attention of industries seeking cutting-edge visual solutions.

- Solar energy applications: Transparent solar cells and panels are emerging as key components in the pursuit of sustainable energy solutions. By integrating transparent electronics into building surfaces, windows, and other structures, solar energy harvesting becomes an integral part of architectural design, contributing to the growth of the renewable energy sector.

- Healthcare integration: Transparent electronics find promising applications in the healthcare sector, particularly in medical devices and wearable sensors. The transparency of these electronic components allows for non-intrusive monitoring and diagnostics, driving advancements in healthcare technology and enhancing patient care.

- Smart windows: The demand for energy-efficient and smart building solutions has fueled interest in transparent electronics for smart windows. These windows can dynamically control light and heat, contributing to building automation systems and providing eco-friendly solutions for modern architecture.

- Research collaborations: Collaborations between research institutions and industry players are crucial for driving innovation in transparent electronics. Joint efforts contribute to breakthroughs in materials, manufacturing processes, and applications, creating a collaborative ecosystem that accelerates the development and commercialization of transparent electronic technologies.

- Flexible electronics: Transparent electronics that offer flexibility and bendability pave the way for new possibilities in display technologies. The advent of flexible and bendable transparent electronics enables the creation of curved displays and wearable devices with enhanced durability and user comfort.

- Increased investments: Growing investments in research and development for transparent electronics technologies signify a commitment to driving market expansion. These investments support initiatives aimed at improving performance, reducing costs, and broadening the range of applications for transparent electronic components.

- Rising environmental awareness: The emphasis on sustainable and eco-friendly technologies has a profound impact on the adoption of transparent electronics. Transparent solar cells, energy-efficient displays, and environmentally conscious electronic solutions align with the growing awareness of environmental issues, driving the integration of transparent electronics across various applications.

- Government initiatives: Supportive government initiatives and policies focused on promoting sustainable technologies provide a favorable environment for transparent electronics adoption. Incentives, grants, and regulatory frameworks encourage businesses to invest in and adopt transparent electronic solutions, fostering market growth.

- Innovation in touchscreen technology: Ongoing innovations in transparent touchscreen technology drive improvements in user interfaces and interactive displays. Transparent touchscreens offer a unique user experience, enabling intuitive interactions and expanding the possibilities for touch-sensitive applications across different sectors.

- Integration in wearables: Transparent electronics contribute significantly to the development of stylish and visually appealing wearables. Transparent displays, sensors, and electronic components enhance the aesthetics of wearable devices, meeting consumer preferences for sleek and modern designs in the rapidly evolving wearables market.

- Customizable electronics: The ability to customize transparent electronic components for specific applications is a key driver for market growth and diversification. Tailoring transparent electronics to meet the specific requirements of different industries and applications ensures that the technology aligns with the evolving needs of businesses and consumers.

Transparent Electronics Market Outlook: Transparency Tech Trends

- Industry Growth Overview: The growth in the automotive head-up displays, building integrated photovoltaics, adoption of consumer electronics, and advances in material science are driving the industrial growth in the market.

- Major Investors: Large corporations and specialized venture capital firms are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is focusing on developing specialized reality devices, smart windows, and solving technical challenges to enhance their applications.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.5% |

| Market Size in 2025 | USD 2.14 Billion |

| Market Size in 2026 | USD 2.60 Billion |

| Market Size by 2034 | USD 12.35 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Consumer electronics evolution and rapid advancements in display technologies

The transparent electronics market is experiencing a surge in demand driven by the evolution of consumer electronics and rapid advancements in display technologies. As consumers increasingly demand sleek and innovative designs in their electronic devices, manufacturers are incorporating transparent electronic components to meet these expectations.

The dynamic evolution of smartphones, smartwatches, and wearables has become a pivotal driver for transparent electronics. Consumers are drawn to devices with transparent displays, offering a futuristic and aesthetically pleasing design while maintaining functionality. This trend has prompted manufacturers to invest in transparent OLED and LED display technologies, contributing to the market's robust growth.

Furthermore, the rapid advancements in transparent display technologies play a crucial role in fueling market demand. Transparent OLED and LED displays offer superior image quality, vibrant colors, and unique design possibilities. This has attracted various industries, including automotive and healthcare, seeking cutting-edge visual solutions.

In the automotive sector, transparent displays find applications in heads-up displays and smart windows, enhancing driving experiences and safety features. Simultaneously, the healthcare industry is leveraging transparent electronics for wearable technologies, enabling non-intrusive monitoring and diagnostics. These factors collectively underscore the market's growth, driven by the convergence of consumer electronics evolution and the relentless progress in display technologies.

Restraint

Limited material options and complex manufacturing processes

Limited material options and complex manufacturing processes present significant challenges and restraints for the transparent electronics market. The availability of suitable materials that exhibit both transparency and electronic functionality is limited, hindering the development of transparent electronic components. Transparent conductive materials, crucial for displays and sensors, often face trade-offs between transparency, conductivity, and flexibility. The scarcity of materials meeting these criteria impedes the production of cost-effective and high-performance transparent electronic devices.

Moreover, the complex manufacturing processes required for transparent electronics contribute to the market's constraints. Fabricating transparent electronic components involves intricate procedures such as thin-film deposition, patterning, and encapsulation, which can be challenging and resource-intensive. These complexities result in higher production costs, limiting scalability and mass adoption. Manufacturers grapple with optimizing processes to achieve the delicate balance between transparency, conductivity, and cost-effectiveness, posing a restraint on the seamless integration of transparent electronics into various applications. Addressing these challenges is crucial for unlocking the full potential of transparent electronics across industries.

Opportunity

Emerging applications and flexible electronics

The surge in demand for transparent electronics market is significantly driven by the exploration of emerging applications and the evolution of flexible electronics. As industries seek innovative solutions, transparent electronics find applications in novel areas, ranging from augmented reality (AR) devices to smart textiles. The integration of transparent OLED and LED displays in AR glasses, headsets, and visors enhances user experiences by overlaying digital information onto the real world seamlessly.

Moreover, the advent of flexible electronics, such as transparent flexible displays and sensors, propels the market further. Flexible transparent electronics enable the creation of bendable and conformable electronic devices, offering design flexibility and durability.

Applications in flexible and transparent electronic skins for wearables, foldable smartphones, and curved displays in automotive interiors exemplify the diverse applications contributing to the market's growth. The convergence of emerging applications and flexible electronics not only expands the market footprint but also drives continuous innovation in transparent electronic technologies, opening avenues for transformative solutions in various industries.

Product Type Insights

According to the product type, the transparent displays segment has held a 43% revenue share in 2024. Transparent displays are innovative screens that allow users to view digital content while maintaining transparency. They find applications in retail, automotive, and consumer electronics. The trend in transparent displays includes the development of OLED and LED technologies, improving transparency levels and image quality. Applications extend to smart windows, heads-up displays in vehicles, and interactive retail displays, showcasing the potential for immersive and engaging user experiences.

The transparent solar panels segment is anticipated to expand at a significant CAGR of 31.8% during the projected period. Transparent solar panels are designed to generate electricity while allowing light to pass through. These panels are integrated into windows and building facades, turning them into energy-producing surfaces. The trend in transparent solar panels involves advancements in materials and efficiency, making them more viable for commercial and residential use. With a focus on sustainability, these panels contribute to the growing adoption of clean energy solutions, aligning with green building practices and energy-efficient designs.

Application Insights

Based on the application, the consumer electronics segment held the largest market share of 34% in2024. Transparent electronics revolutionize consumer electronics by enabling the creation of futuristic devices with see-through displays and touch-sensitive surfaces. The trend in this application involves the development of transparent OLED and LED displays for smartphones, tablets, and TVs, providing immersive and visually stunning experiences. Moreover, transparent touch sensors and interactive surfaces enhance user interfaces, contributing to sleek and innovative designs in the consumer electronics landscape.

On the other hand, the automotive segment is projected to grow at the fastest rate over the projected period. In the automotive sector, transparent electronics redefine vehicle interiors with transparent displays, augmented reality windshields, and smart windows. Transparent OLEDs integrated into car windows offer heads-up displays and information overlays, enhancing driver safety and convenience.

Additionally, transparent touch panels on infotainment systems and interactive dashboards contribute to a seamless and connected driving experience. The trend in automotive transparent electronics involves advancements in heads-up display technology, augmented reality applications, and the integration of transparent displays in various vehicle components.

Regional Insights

U.S. Transparent Electronics Market Size and Growth 2025 to 2034

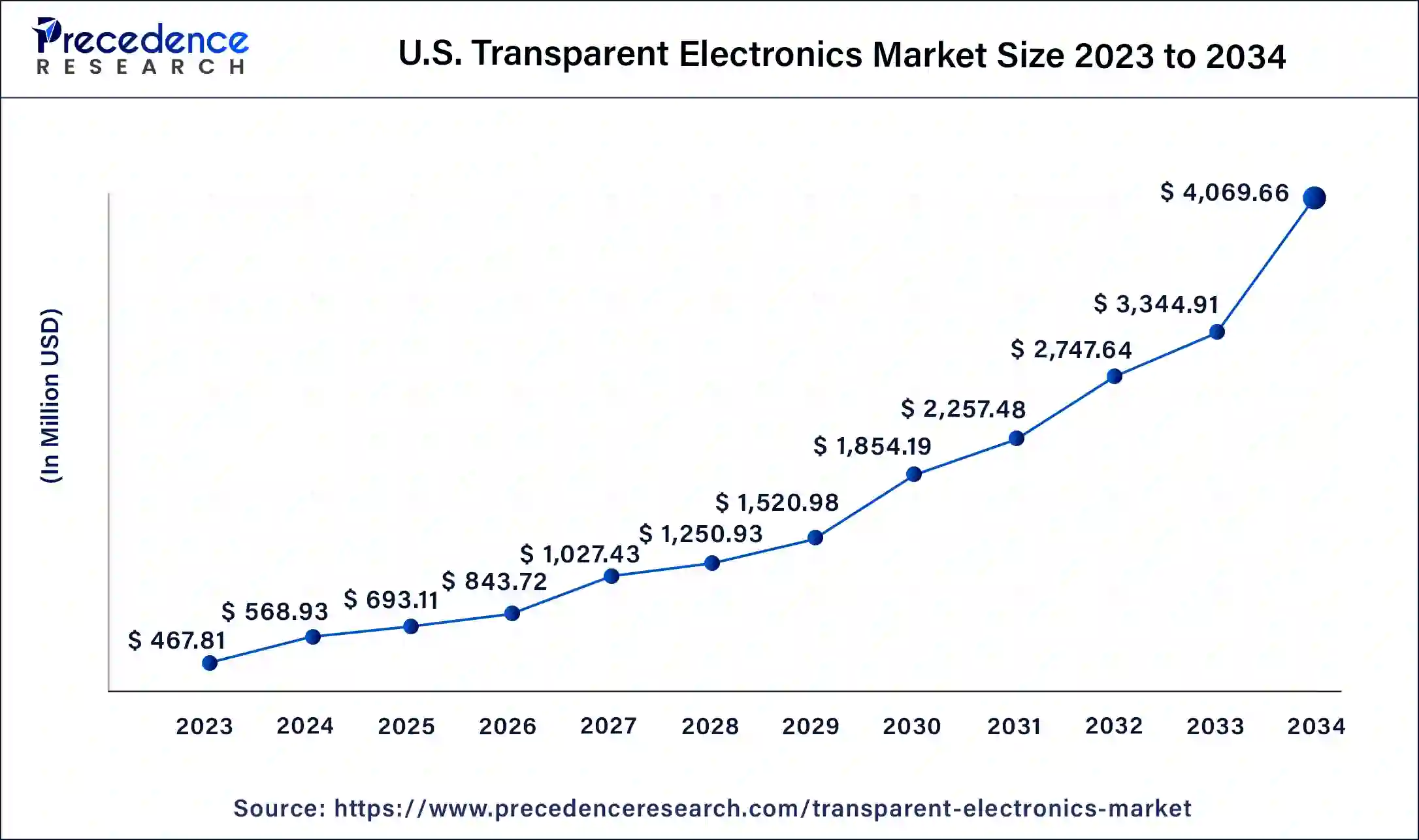

The U.S. transparent electronics market size is estimated at USD 693.11 million in 2025 and is predicted to be worth around USD 4,069.66 million by 2034, at a CAGR of 21.7% from 2025 to 2034.

North America has held the largest revenue share 46% in 2024. In North America, the transparent electronics market is witnessing robust growth driven by the region's technological prowess and innovation hubs. Significant investments in research and development, particularly in the United States, are instrumental in driving advancements in transparent electronics. The market is thriving due to its applications in consumer electronics, healthcare, and the automotive sector. There is a concerted effort to innovate and create state-of-the-art devices and solutions within these industries, contributing to the sustained growth and development of the transparent electronics market.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region dominates the transparent electronics market, with countries like China, Japan, and South Korea at the forefront. The region is a global manufacturing hub, fostering the production of transparent electronic components. The demand for transparent displays, smart gadgets, and electronic wearables propels the market's expansion. Moreover, government initiatives, technological collaborations, and a burgeoning consumer electronics market fuel the growth of transparent electronics in Asia-Pacific, making it a key driver for the global market.

Europe is a key player in the transparent electronics market, fostering innovation through robust research initiatives and collaborations. The region sees notable developments in transparent electronic applications across various sectors, including consumer electronics and automotive. With a focus on advancing technology and sustainable solutions, Europe contributes significantly to the global landscape of transparent electronics.

Innovations Lead the U.S.

The growing technological innovation in the U.S is increasing the advancement in transparent electronics. The companies are developing various transparent conductors, displays, which are driving their adoption rates. At the same time, the expanding automotive industry is also increasing its use of smart windows or heads-up displays.

India Driven by Transparency Initiatives

The growing government initiatives are driving the adoption of transparent electronics in India. At the same time, the growing urbanization and digitalization are increasing their use in various cities, where transparent constructors are being used for developing renewable electricity. Additionally, the growing use of smartphones is also increasing their use in displays.

UK Buildings Fuels Transparent Electronics

The rapid expansion in the building and infrastructure of the UK is driving the demand for transparent digital solutions for smarter buildings. They are also being used in the development of advanced display systems, where the companies are developing organic film transistor technology. Additionally, these electronics are also being used in airports, rail stations, and other dense transportation hubs.

Consumer Tech Craze Drives South America

South America is expected to grow significantly in the transparent electronics market during the forecast period, due to growth in consumer electronics. Additionally, the growing urbanization is increasing their utilization in commercial venues and retail malls. Moreover, the growing investments are also driving their innovations, promoting the market growth.4

Transparent Electronics: Brazil's Clear Vision of Growth

Brazil's market for transparent electronics is emerging with strong potential, driven by innovative applications in smart displays and energy solutions. As technology advances and manufacturing costs decrease, the sector is experiencing increased interest, particularly within the automotive and consumer gadget industries, paving the way for substantial, continuous expansion.

Value Chain Analysis

- Raw Material Procurement

The raw material procurement of transparent electronics involves the sourcing of key materials for integrating them into product form for major companies.

Key players: Samsung Electronics Co., Ltd., 3M Company, LG Electronics Inc. - Testing and Quality Control

Ensuring consistent performance along with the mechanical properties is the main focus in testing and quality control of transparent electronics.

Key players: Samsung Electronics Co., Ltd., LG Electronics Inc., Sumitomo. - Lifecycle Support and Recycling

The lifecycle support and recycling of transparent electronics ensure effective end-of-life management and adherence to environmental regulations.

Key players: TES-AMM, Samsung Electronics Co., Ltd., LG Electronics Inc.

The Transparent Electronics Market Leads and their Offering

- Cambrios Technologies Corp.: The company provides silver nanowire-based transparent conductive films.

- Sharp Corporation: See-through display panels are developed by the company using IGZO technology.

- LG Electronics Inc.: The company offers transparent OLED displays.

- Samsung Electronics Co., Ltd.: Transparent OLED and transparent MicroLED are developed by the company.

- Panasonic Corporation: The company offers transparent OLED TVs.

Transparent Electronics Market Companies

- Evonik Industries AG

- 3M Company

- LG Electronics Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Pioneer Corporation

- Panasonic Corporation

- Sony Corporation

- AU Optronics Corp.

- ClearLED Ltd.

- PolyIC GmbH & Co. KG

- Grafoid Inc.

Recent Developments

- In 2020, Huawei introduced a smartphone featuring a partially transparent display section below the selfie camera. The display becomes semi-transparent, allowing status bar icons to be visible. Users can adjust the screen's transparency with a touch. This innovation enhances the user experience, providing a unique and customizable interface on the smartphone.

Segments Covered in the Report

By Product Type

- Transparent Displays

- Transparent Solar Panels

- Transparent Windows

- Others

By Application

- Consumer Electronics

- Automotive

- Construction

- Healthcare

- Military and Defense

- Security Systems

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting