Tubeless Insulin Pump Market Size and Forecast 2025 to 2034

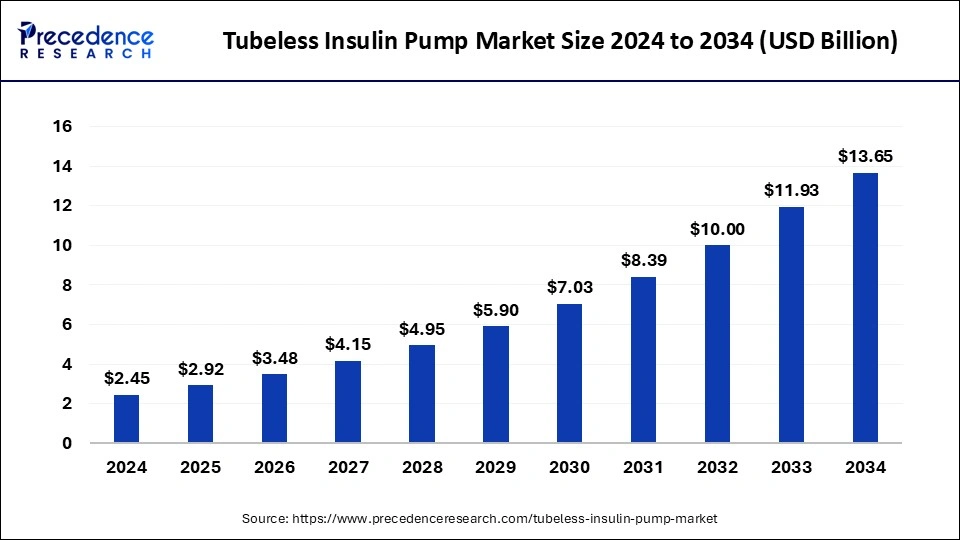

The global tubeless insulin pump market size accounted for USD 2.45 billion in 2024 and is predicted to increase from USD 2.92 billion in 2025 to approximately USD 13.65 billion by 2034, expanding at a CAGR of 18.74%.

Tubeless Insulin Pump MarketKey Takeaways

- The global tubeless insulin pump market was valued at USD 2.45 billion in 2024.

- It is projected to reach USD 13.65 billion by 2034.

- The tubeless insulin pump market is expected to grow at a CAGR of 18.74% from 2025 to 2034.

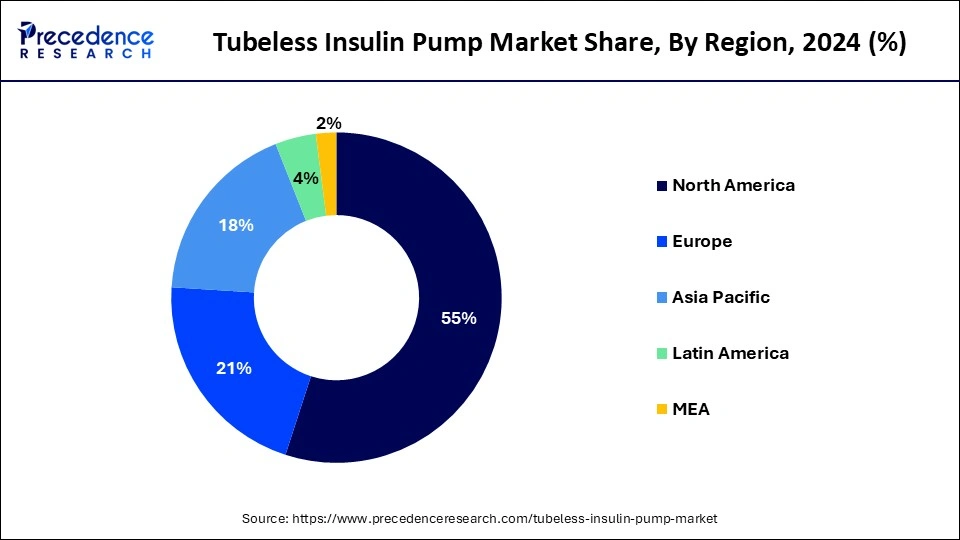

- North America held the largest market share of 55% in 2024.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By type, the insulin patch pump segment accounted for the dominating share in 2024. The segment is observed to continue growth at a significant rate in the upcoming period.

- By component, the pod or patch segment held the largest share of the market in 2024.

- By end users, the hospitals segment held the largest share of the market in 2024.

U.S.Tubeless Insulin Pump Market Size and Growth 2025 to 2034

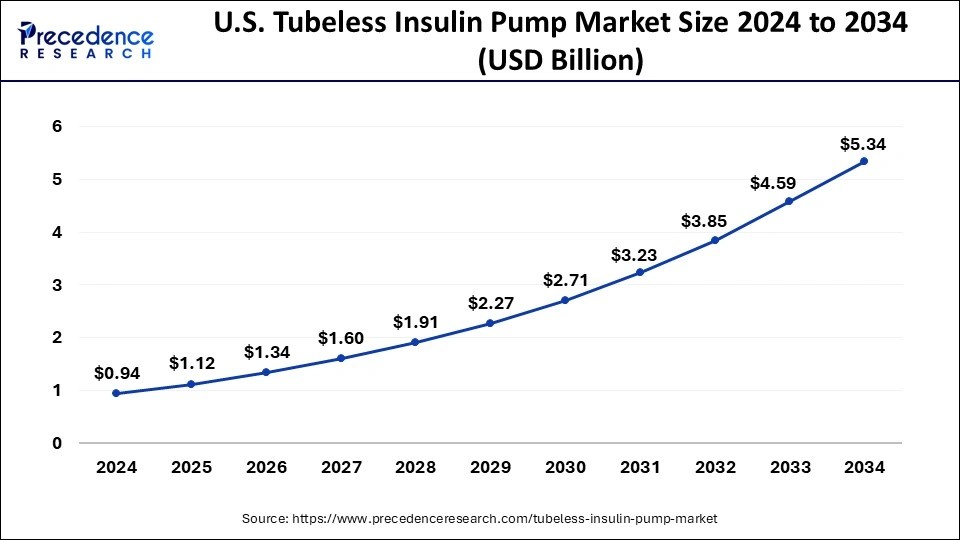

The U.S. tubeless insulin pump market size was exhibited at USD 0.94 billion in 2024 and is projected to be worth around USD 5.34 billion by 2034, growing at a CAGR of 18.97%.

North America led the global market with the highest market share of 55% in 2024. The region is observed to sustain the position throughout the forecast period. The presence of prominent market players drives the region's growth focused on developing tubeless insulin pumps, rising healthcare expenditure, rising burden of diabetes, increasing government awareness of diabetes campaigns, growing need for portable devices, presence of sophisticated healthcare facilities, rising research and development activities, rapid improvements in technology, and rising adoption of tubeless insulin pumps.

The United States is the major contributor to the tubeless insulin pump market due to various reasons, including the increasing introduction of innovative and compact diabetes devices, the increasing number of patients who prefer tubeless insulin pumps, rising product approvals by various regulatory organizations, technological advancement in diabetic management products, rising geriatric population, rising disposable income, and increasing prevalence of diabetes.

- In January 2022, the FDA announced the approval of 1st automated, tubeless insulin pump for people with Type 1 diabetes. The Omnipod 5 is available for people ages 6 to 70. A new technology for people with Type 1 diabetes, one that has been nearly a decade in the making, has been approved by the U.S. FDA. The Omnipod 5 is now the first tubeless system of its kind on the tubeless insulin pump market and the first to be fully controlled via a smartphone app.

Asia Pacific's tubeless insulin pump market is expected to grow at the fastest pace during the forecast period. The region's growth is expected to expand with increasing cases of diabetes, rising government initiatives to spread awareness regarding diabetes and increasing investment in the healthcare infrastructure. Furthermore, the market is observed to grow with the rising acceptance of advanced technology, significant economic growth, and rising strategic initiatives and product innovations. Such factors are expected to fuel the demand for the tubeless insulin pump in the region. China and India are the leading marketplaces for tubeless insulin pumps.

- Type 1 diabetes happens when the body has little or no insulin. It is usually diagnosed in children and young adults, although it can occur at any age. According to the Indian Council of Medical Research (ICMR), in 2022, around 95,600 children below the age of 14 years in India suffer from type 1 diabetes.

Market Overview

The tubeless insulin pump market offers handheld device that is designed to control the blood glucose level. Tubeless insulin pumps are lightweight, tiny, and unobtrusive. These devices are cost-effective and are easy to use on the human body. These are widely used to decrease the need for regular injections. It includes components, namely pod/patch and remote, and accessories such as reservoirs, batteries, and others. The pump tubeless insulin inserts through a device and enters the skin at the push of a button. An individual can also wear it on their body. Patients with diabetes prefer tubeless insulin pumps to manage their disease by delivering a consistent supply of insulin to the body without the need for traditional insulin injections.

- According to the Centers for Disease Control and Prevention report for 2022, 38.4 million people, or 11.6 percent of the United States population, have diabetes. In addition, The Centers for Disease Control and Prevention (CDC) National Diabetes Statistics Report 2023 estimated that 97.6 million U.S. adults have prediabetes and 27.2 million adults 65 or older have prediabetes. Moreover, the estimated cost of diagnosed diabetes in 2022 was USD 413 billion, including USD 307 billion in direct medical costs and USD 106 billion in indirect costs attributable to diabetes. Excess medical costs associated with diabetes were nearly USD 12,000 per person in 2022.

Tubeless Insulin Pump Market Growth Factors

- The aging population, particularly in developed regions, is driving demand for innovative healthcare solutions, including tubeless insulin pumps, to address the unique needs and challenges of older adults with diabetes.

- Favorable reimbursement policies for insulin pump therapy, coupled with increasing awareness among healthcare providers and payers about the benefits of tubeless insulin pumps, are driving market growth.

- Rising healthcare expenditure and government initiatives to improve diabetes management and outcomes are contributing to the growth of the tubeless insulin pump market by expanding access to advanced diabetes care technologies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.74% |

| Market Size in 2025 | USD 2.92 Billion |

| Market Size by 2034 | USD 13.65 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, and End-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of diabetes

The rising prevalence of diabetes across the globe is expected to accelerate the adoption of tubeless insulin pump systems for the management of disease, driving the growth of the tubeless insulin pump market. Diabetes is a common and lifelong disease. Type 1 diabetes is becoming more common globally. At the regional level, the highest rate is 9.3 percent in North Africa and the Middle East, and that number is anticipated to increase to 16.8 percent by 2050. The rate in Latin America and the Caribbean is anticipated to increase to 11.3 percent. Major market players emphasize developing innovative technologies incorporated into tubeless insulin pump devices, which can be easily used at home with accurate results and are anticipated to fuel the market's revenue during the forecast period.

- According to the report of the Institute for Health Metrics and Evaluation in June 2023, more than half a billion people are living with diabetes globally, affecting men, women, and children of all ages in every country, and it is estimated diabetes cases to rise from 529 million to 1.3 billion in the next 30 years. The latest estimates indicate that the current global prevalence rate is 6.1 percent, which makes diabetes one of the leading causes of death and disability.

Restraint

High cost

The high cost associated with tubeless insulin pumps is anticipated to hamper the market's growth. The high cost of tubeless insulin pumps discourages individuals from purchasing and less product accessibility in middle and lower-income countries. In addition, the lack of healthcare services in low-income countries may restrict the expansion of the global tubeless insulin pump market.

Opportunity

Rising concerns over obesity

The rising obesity and geriatric population are anticipated to offer lucrative opportunities for the expansion of the tubeless insulin pump market during the forecast period as the obese and aging populations are more susceptible to Diabetes. Tubeless insulin pumps are small, lightweight, portable, and effective to use in aging diabetic patients, and type 1 diabetes patients highly use them. The increasing number of diabetes cases in the aging population increases the demand for diabetes management devices. The burden of obesity is critical because it is associated with various chronic diseases, including type 2 diabetes, stroke, heart disease, arthritis, some cancers, and others. Therefore, the rise in the obesity and geriatric population led to an increasing acceptance of tubeless insulin pumps.

- According to the data published by the IHME in June 2023, Diabetes is more prone among people 65 and above in every country and recorded a prevalence rate of more than 20 percent globally. The highest rate was 24.4 percent for those between ages 75-79.

- According to Harvard University, nearly 2 out of 3 U.S. adults are overweight or obese (69 percent), and one out of three are obese (36 percent). If the trend continues to grow, then by 2030, it is estimated that nearly half of all men and women will be obese.

Type Insights

The insulin patch pump segment held the largest share of the tubeless insulin pump market in 2024. The segment is also projected to continue its dominance over the forecast period. Patch pumps are small, directly attached to the skin, require less supervision, and have built-in innovative technology. Patch pumps are connected to the body for blood glucose management. Insulin patch pumps are more effective devices than traditional pumps as they are easy to use, cost-effective, and relatively smaller. Traditional via-syringe combinations are gradually being replaced by advanced technology developments, such as insulin patch pumps. Such supportive factors are expected to drive the tubeless insulin pump market's revenue during the forecast period.

Component Insights

The pod or patch segment held the largest share of the tubeless insulin pump market in 2024, which is expected to sustain the position throughout the forecast period. Rapid technological advancement and continuous improvement in function and pod size have occurred. The innovative design to control pump functions is tubeless and has a remote control. In addition, pumps are integrated with calculators that assist in determining the exact insulin dosage patients require, which reduces the overdosage of insulin. On the other hand, the accessories segment is expected to grow significantly during the forecast period.

End-users Insights

The hospital segment stood as a dominating share in 2024 for the tubeless insulin pump market due to the accessibility of well-skilled medical staff and healthcare professionals, which assists in establishing better interaction with the patient and the easy availability of tubeless insulin pumps. The availability of huge patient-base at hospitals that require continuous treatment for diabetes opens up a sustained opportunity for the segment to continue its growth.

The e-commerce segment is expected to grow at a notable rate during the forecast period. The robust growth of the e-commerce sector is facilitated by highly attractive economic benefits offered to customers by these channels rather than purchases through the offline channels. The market has witnessed a rising customer preference to make purchases from e-commerce channels due to the wide range of product availability and offers of attractive discounts and various other associated benefits.

Recent Developments

- In August 2023, the Tubeless insulin pump received FDA clearance for diabetes people. The Accu-Chek Solo micropump (Roche Diabetes) was granted 510(k) clearance from the FDA. Accu-Chek Solo micropump is tubeless, small, and lightweight. Users can place the device on four different infusion sites on the body. The device is detachable, allowing people with diabetes to change the infusion site when necessary.

- In July 2023, the FDA announced the clearance of Tandem Diabetes Care's Mobi durable automated insulin pump. The approval covers people with diabetes aged six and above, expanding Tandem's portfolio of products. Mobi features a 200-unit insulin cartridge and an on-pump button to provide an alternative to phone control for insulin boluses.

- In February 2024, Omnipod 5 received approval to integrate with the new freestyle libre two plus sensor. The Omnipod 5 hybrid closed loop system has received approval to integrate with the Abbott FreeStyle Libre 2 Plus Sensor in the UK, which will give people living with diabetes additional choice and flexibility for managing their blood sugar levels.

- In April 2023, Insulet announced FDA clearance of Omnipod GO, a first-of-its-kind basal-only insulin pod for people with type 2 diabetes aged 18 and above. Omnipod GO is a wearable, standalone insulin delivery system that provides a fixed rate of continuous rapid-acting insulin for 72 hours.

Tubeless Insulin Pump Market Companies

- Medtronic plc

- Hoffmann-La Roche Ltd

- Tandem Diabetic Care, Inc.

- Insulet Corporation

- Ypsomed

- Cellenovo

- Abbott

- Tandem Diabetes Care

- Insulet Corporation

- Sooil Development

- Valeritas, Inc

- JingasuDelfu Co., Ltd.

- Cellnova

- Roche Holdings

- Spring Health Solutions

- Johnson & Johnson

- Medtrum Technologies

- Debiotech

- CeQur

- Valeritas Holding

- Animas Corporation

Segments Covered in the Report

By Type

- Insulin Patch Pump

- Traditional Pump

By Component

- Pod or Patch

- Remote

- Accessories

By End-users

- Hospitals

- Pharmacies

- E-commerce

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting