What is the Ultrasonic Aspirator Market Size?

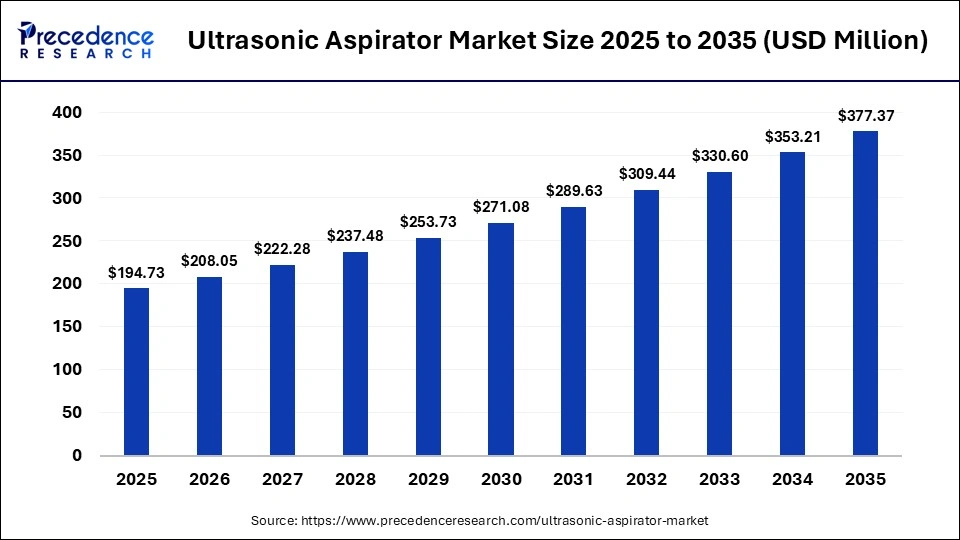

The global ultrasonic aspirator market size was calculated at USD 194.73 million in 2025 and is predicted to increase from USD 208.05 million in 2026 to approximately USD 377.37 million by 2035, expanding at a CAGR of 6.84% from 2026 to 2035.The global ultrasonic aspirator market is experiencing robust growth, driven by the rising prevalence of neurological disorders, the increasing number of surgeries, and advancements in medical technology. Ultrasonic aspirator has become a widely used technique in neurosurgery to treat intracranial and intraspinal tumors, allowing for less invasive surgeries.

Market Highlights

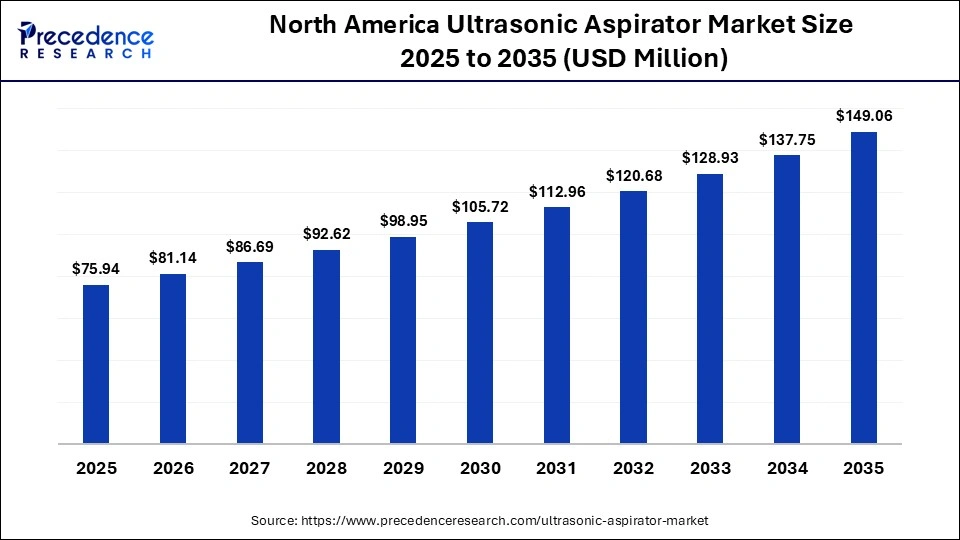

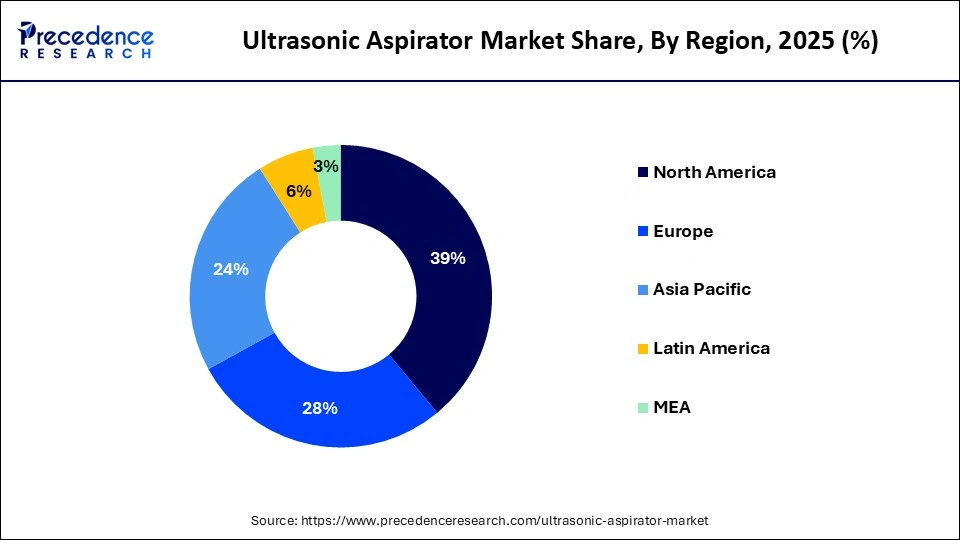

- North America dominated the market in 2025, with a revenue share of approximately 39% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

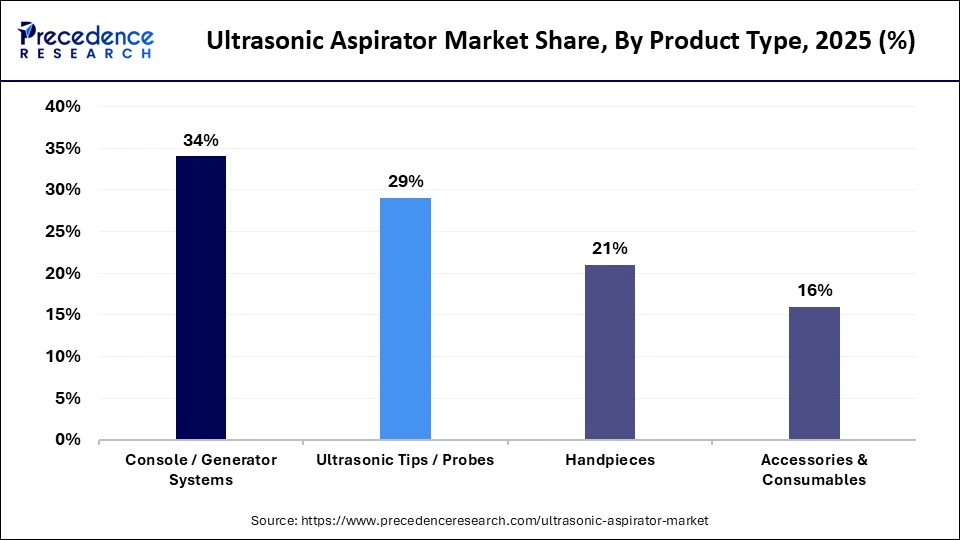

- By product type, the console/generator systems segment dominated the ultrasonic aspirator market in 2025, with a revenue share of approximately 34%.

- By product type, the ultrasonic tips/probes segment in the market is expected to grow at the fastest CAGR in the market during the forecast period.

- By surgery type, the neurosurgery segment dominated the market in 2025, with a revenue share of approximately 46%.

- By surgery type, the spinal surgery segment is expected to grow at the fastest CAGR in the market in 2025.

- By application, the tumor resection segment dominated the market in 2025, with a revenue share of approximately 41%.

- By application, the minimally invasive tissue dissection segment is expected to grow at the fastest CAGR in the ultrasonic aspirator market during the forecast period.

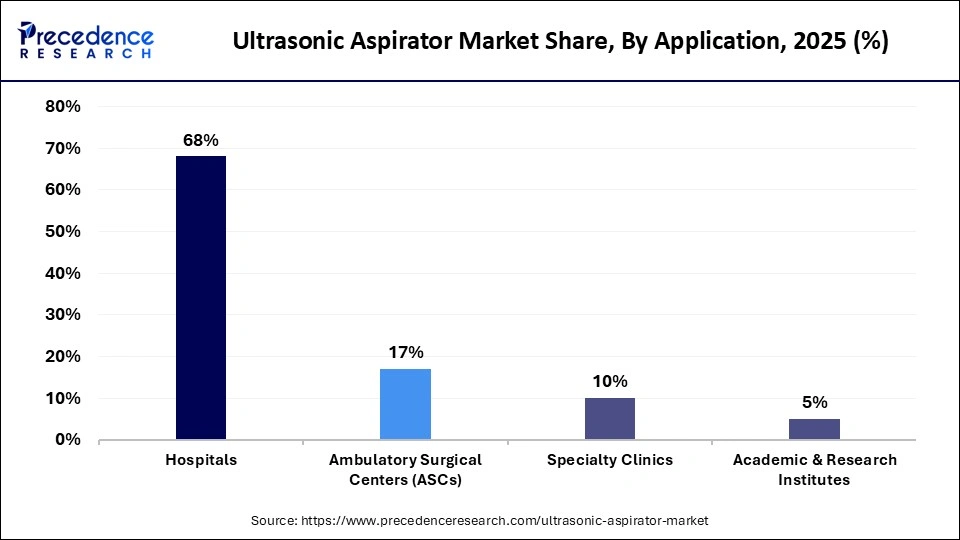

- By end-user, the hospitals segment dominated the market in 2025, with a revenue share of approximately 68%.

- By end-user, the ambulatory surgical centers segment is expected to grow at the fastest CAGR in the market during the forecast period.

Ultrasonic Aspirator: Modernizing Surgical Procedures

The ultrasonic aspirator market includes surgical systems that utilize ultrasonic vibration to fragment soft tissue while simultaneously aspirating debris and irrigating the surgical site. The market is revolutionizing due to the critical importance of the ultrasonic surgical aspirator system in surgical procedures to emulsify, fragment, and aspirate soft and hard tissues. Ultrasonic aspirator is desirable in various surgeries, such as plastic and reconstructive, neurosurgery, orthopedic, laparoscopic, thoracic, liver resection, gynecologic, and transplant.

Ultrasonic aspirator supports high-precision tissue dissection with selective tissue preservation. The market includes console systems, handpieces, tips, and related consumables across hospitals and surgical centers, driven by growing demand for minimally invasive surgeries, improved surgical safety, and increasing neurosurgical and oncology procedure volumes.

- In November 2025, Integra LifeSciences Holdings Corp. announced the U.S. FDA clearance of the ultrasonic surgical aspirator system for the treatment of cardiac surgeries.

What is the Role of AI in the Ultrasonic Aspirator Market?

AI plays a crucial role in the ultrasonic aspirator by introducing automation, thereby enhancing efficiency and precision. It represents various clinical applications in robotic surgery, allowing surgeons to benefit from improved detection, advanced intraoperative metrics, and the complete automation of certain steps in surgical procedures.

AI is expanding the market by contributing to surgical education, where it generates automated skills assessments. It helps physicians make more precise decisions and predict patient outcomes. Recent advances in AI and ML aim to optimize the surgical experience in the operating room and expand the capabilities of surgical robots.

Ultrasonic Aspirator Market Trends

- AI and Real: Time Tissue Sensing: Research focuses on using artificial intelligence (AI) and machine learning (ML) models to analyze obtained datasets and classify them into tissue types. For instance, oncology research evaluates model performance by analyzing the sensitivity, accuracy, and specificity of the model.

- Robotic-Assisted Compatibility: The integration of robotics and AI in surgery has transformed advancements in modern healthcare and expanded the market. It is a promising approach to bring enhanced efficiency, precision, and patient outcomes.

- Demand for Minimally Invasive Surgeries: Minimally invasive surgeries are highly preferred by patients and healthcare providers as they result in faster recovery, less trauma, and shorter hospital stays. They significantly reduce the risk of hospital-acquired infections and minimize healthcare costs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 194.73 Million |

| Market Size in 2026 | USD 208.05 Million |

| Market Size by 2035 | USD 377.37 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type , Surgery Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Ultrasonic Aspirator Market?

The console/generator systems segment held a dominant position in the market with a share of approximately 34% in 2025, owing to their central role in energy conversion and regulation, system protection, and multifunctional control. Emerging trends, such as robotic compatibility, digital integration, connectivity, AI, real-time analytics, and miniaturization for portability, drive the adoption of these systems in healthcare. These systems have evolved into intelligent command hubs that drive operational efficiency and surgical precision.

The ultrasonic tips/probes segment is expected to gain the highest share of the market between 2026 and 2035, due to the key features of ultrasonic probe sonicators, such as power settings, frequency options, precision, and reliability for laboratory applications. They are mainly used in laboratories for sample preparation, nanotechnology, chemical processes, environmental testing, pharmaceutical, and biotechnology. They offer higher efficiency in breaking down materials, versatility in diverse laboratory processes, and reduced processing time.

Surgery Type Insights

What made Neurosurgery the Dominant Segment in the Ultrasonic Aspirator Market?

The neurosurgery segment held the largest revenue share of approximately 46% in the market in 2025, owing to the integration of modern ultrasonic aspirator systems into neuroendoscopic procedures. They enable safer and faster removal of brain abscesses and deep-seated intraventricular tumors through smaller incisions. Research focuses on ML-based tissue differentiation by analyzing the electrical signal feedback from the ultrasonic aspirators.

The spinal surgery segment is expected to grow with the highest CAGR of 6.84% in the market during the studied years, due to the wide use of the Cavitron Ultrasonic Surgical Aspirator (CUSA) in microsurgical treatment of intramedullary spinal cord tumors. It assesses any potential damage through the thermo-mechanical effects on neighbouring tissues. The ultrasonic aspirators are innovative solutions that enable controlled and focused operations.

Application Insights

How did the Tumor Resection Segment Dominate the Ultrasonic Aspirator Market?

The tumor resection segment contributed the biggest revenue share of approximately 41% in the market in 2025, owing to the ideal nature of the ultrasonic aspirator for surgeries on soft tissues, particularly brain and spine tumor resection. These systems allow surgeons to perform fast and safe debulking of tumors with minimal risk to surrounding structures. They also protect neural tissue and blood vessels during dissection, while reducing intra-operative blood loss and surgical time.

The minimally invasive tissue dissection segment is expected to expand rapidly in the market in the coming years, due to specific surgical applications of the ultrasonic aspirator, such as minimally invasive spine surgery, neurological endoscopy, skull base surgery, gynecology, and laparoscopic endometriosis. These systems are highly adopted in healthcare due to AI integration, compatibility with robots, and advanced pulse modes. They are used in precision tissue debulking, maintain safety near important body structures, and ensure homeostasis.

End-User Insights

Which End-User Segment Led the Ultrasonic Aspirator Market?

The hospitals segment led the global market with a share of approximately 68% in 2025, owing to the major clinical applications of the ultrasonic aspirator in neurosurgery, spinal surgery, cardiac surgery, gynecology, and gastrointestinal surgery. The integrated devices are gaining traction in medical centers, while standalone devices are preferred for cost-effectiveness and portability. Hospitals have skilled professionals and favorable reimbursement policies, making them a suitable choice for patients.

The ambulatory surgical centers segment is expected to grow at a rapid rate in the market during the studied period, due to new product launches with compact and portable aspirator systems, which introduce technological miniaturization. These devices are used by ambulatory surgical centers to deliver value-based care and achieve better patient outcomes. These centers prefer standalone ultrasonic aspirators over integrated systems due to their portability, lower capital cost, and plug-and-play ease across multiple operating rooms.

Regional Insights

How Big is the North America Ultrasonic Aspirator Market Size?

The North America ultrasonic aspirators market size is estimated at USD 75.94 million in 2025 and is projected to reach approximately USD 19.06 million by 2035, with a 6.98% CAGR from 2026 to 2035.

How does North America Dominate the Ultrasonic Aspirator Market?

North America held a majority revenue share of approximately 39% the market in 2025, owing to the rising prevalence of neurological and oncological disorders, favorable reimbursement policies to invest in advanced surgical equipment, and sophisticated medical infrastructure. According to the American Hospital Association (AHA), hospitals need to have up-to-date and adequate medical supplies, equipment, and devices to deliver high-quality care to patients.

The region benefits from substantial healthcare spending, rapid integration of innovative surgical technologies, and widespread use of ultrasonic aspirators in neurosurgery, orthopedics, and general surgery. Additionally, favorable reimbursement policies, a high volume of surgical procedures, and continuous investments in R&D and clinical training further strengthen North America's leadership position in the global ultrasonic aspirator market.

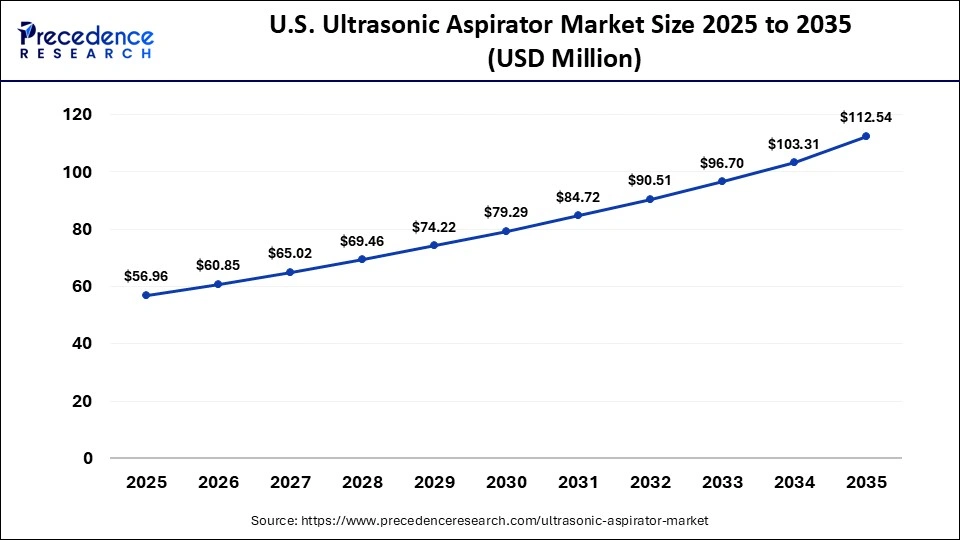

What is the Size of the U.S. Ultrasonic Aspirator Market?

The U.S. ultrasonic aspirators market size is calculated at USD 56.96 billion in 2025 and is expected to reach nearly USD 112.54 billion in 2035, accelerating at a strong CAGR of 7.05% between 2026 and 2035.

U.S. Ultrasonic Aspirator Market Analysis

The U.S. is witnessing an increased demand for compact and portable standalone ultrasonic aspirators as the most cost-effective solutions by Ambulatory Surgical Centers (ASCs). The Trump Administration is dedicated to reviewing the national security implications of medical equipment, personal protective equipment, and device imports. As of May 2024, the U.S. imported $14.9 million of medical equipment, fostering market growth.

What is the Potential of the Ultrasonic Aspirator Market in the Asia Pacific?

Asia Pacific is expected to host the fastest-growing market in the coming years, due to cost-effective local manufacturing, modernization of healthcare infrastructure, and the adoption of real-time imaging, AI-based systems, and robotic-assisted surgery. Some of the major government programs in the Asian Pacific countries driving the market include China's large-scale medical equipment renewal program and Malaysia's medical device regulatory reliance program. The leading players in the market are Stryker, Olympus Corporation, and Integra LifeSciences, which are moving ahead in strategic partnerships and product development to strengthen their global presence.

- In January 2025, the Chinese government published guidelines to boost the reform of medical device and drug regulations in the country by 2027.

India Ultrasonic Aspirator Market Trends

The Indian market is experiencing a massive growth in the medical and surgical equipment industry, driven by the expanding private healthcare facilities and policies to strengthen public health infrastructure. In June 2025, HealthKois launched a $400 million investment fund to advance HealthTech and biopharma innovation in India.

Trade Analysis of Ultrasonic Aspirators

- Germany is the top exporter of ultrasonic aspirators globally. It exported 107 shipments of ultrasonic aspirators from June 2024 to May 2025, mainly to India, Russia, and Kazakhstan.

- The U.S. and Ireland are also among the top three exporters of ultrasonic aspirators after Germany. Their exports mainly went to India, Colombia, Kazakhstan, and Russia.

- India is the leading importer of ultrasonic aspirators in the world, accounting for 197 shipments from June 2024 to May 2025. Aspirators were imported from Germany, the U.S., and Belgium.

- Kazakhstan and Russia are the second- and third-largest importers of ultrasound aspirators, respectively. Kazakhstan imported 60 shipments, while Russia imported 35 shipments.

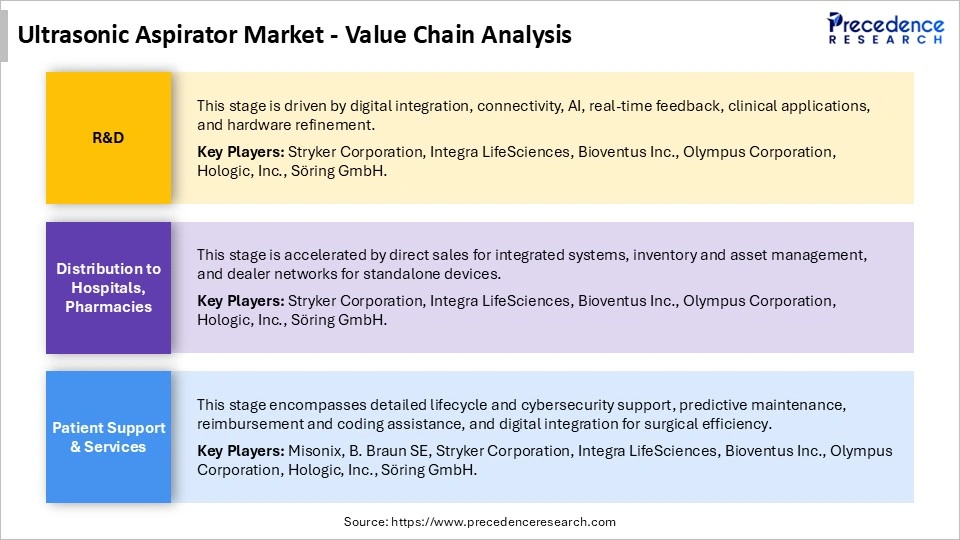

Ultrasonic Aspirator Market Value Chain Analysis

Who are the Major Players in the Global Ultrasonic Aspirator Market?

The major players in the ultrasonic aspirator market include Stryker, Integra LifeSciences, Olympus Corporation, Bioventus, Söring GmbH, Medtronic, Johnson & Johnson MedTech, B. Braun SE, Xcellence Medical Technologies, Ethicon LL, Smith & Nephew

Recent Developments in the Ultrasonic Aspirator Market

- In November 2025, Integra LifeSciences Holdings Corporation announced FDA 510(k) clearance for the use of its CUSA Clarity Ultrasonic Surgical Aspirator System in cardiac surgeries. The clearance covers cardiac tissue debridement procedures, including valve replacement and repair.(Source: https://investor.integralife.com)

- In November 2025, New Jersey–based Integra LifeSciences received U.S. FDA clearance for its CUSA Clarity Ultrasonic Surgical Aspirator System for use in cardiac surgeries, including valve repair and replacement procedures. Previously, the device was approved for removing unwanted tissue in neurosurgery, plastic and reconstructive, orthopedic, gynecological, thoracic, and laparoscopic surgeries.(Source: https://cardiovascularbusiness.com)

- In February 2024, researchers from the University of North Carolina at Chapel Hill and SonoVascular collaborated to develop a novel device that captures and/or suctions out blood clots. The SonoThrombectomy system brings together ultrasound, microbubbles, low-dose thrombolytic drugs, and a less aggressive mechanical retrieval/aspiration device.(Source: https://www.unc.edu)

Segments Covered in the Report

By Product Type

- Console/Generator Systems

- Handpieces

- Ultrasonic Tips/Probes

- Accessories & Consumables (tubing, irrigation kits, filters)

By Surgery Type

- Neurosurgery

- Brain tumor resection

- Skull base surgery

- Spinal Surgery

- ENT Surgery

- General Surgery

- Gynecology/Urology

- Other Surgeries

By Application

- Tumor Resection

- Tissue Debulking/Fragmentation

- Minimally Invasive Tissue Dissection

- Other Applications

By End-User

- Hospital

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content