Underwater LiDAR Market Size and Forecast 2025 to 2034

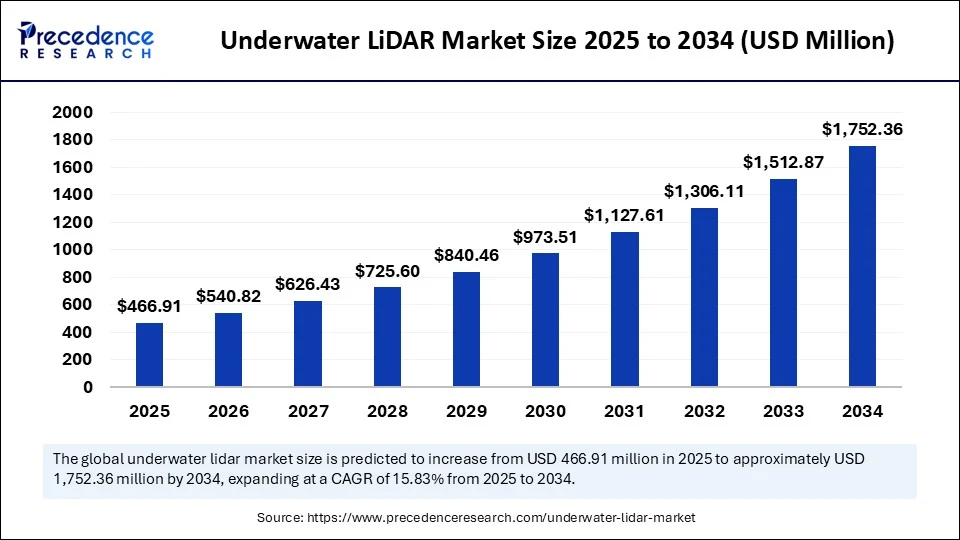

The global underwater LiDAR market size was calculated at USD 403.10 million in 2024 and is predicted to increase from USD 466.91 million in 2025 to approximately USD 1,752.36 billion by 2034, expanding at a CAGR of 15.83% from 2025 to 2034. The market for underwater LiDAR represents an emerging technological frontier at the intersection of marine exploration, defense, and environmental conservation, by utilizing laser-based detection and ranging systems.

Underwater LiDAR Market Key Takeaways

- In terms of revenue, the global underwater LiDAR market was valued at USD 403.1 million in 2024.

- It is projected to reach USD 1,752.36 million by 2034.

- The market is expected to grow at a CAGR of 15.83% from 2025 to 2034.

- North America dominated the underwater LiDAR market in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By system type, the bathymetric LiDAR systems segment held a largest market share in 2024.

- By system type, the Hybrid/topo-bathy integrated systems segment is expected to grow at the fastest CAGR during the forecast period.

- By platform/deployment type, the airborne segment captured the highest market share in 2024.

- By platform/deployment type, the UAV / drone-mounted (VTOL / multirotor / fixed-wing drones) segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By range/depth capability, the shallow services segment contributed the biggest market share in 2024.

- By range/depth capability, the moderate segment is set to experience the fastest CAGR from 2025 to 2034.

- By components/subsystems type, the laser transmitter modules segment generated the major market share in 2024.

- By components/subsystems type, the Integrated receiver + waveform digitizer end-user type, the hydrographic surveying & nautical charting segment maintained a leading position in 2024.

- By end-user/buyer type, the offshore wind farm survey & cable routing segment is projected to expand rapidly in the coming years.

- By end-user/buyer type, the national hydrographic offices/government agencies are projected to expand rapidly in the coming years.

- By service model/offering type, the full system sales segment generated the major market share in 2024.

- By service model/offering type, the survey services segment is projected to expand rapidly in the coming years.

- By water type/environmental sustainability, the clear coastal waters segment accounted for the significant market share in 2024.

- By water type/environmental sustainability, the turbid coastal waters segment is projected to expand rapidly in the coming years.

How AI Is Reshaping the Underwater LiDAR Market?

Artificial Intelligence (AI) is revolutionizing the efficiency and accuracy of underwater LiDAR applications. AI-powered algorithms enable the rapid processing of vast datasets captured during underwater surveys, thereby reducing the need for manual intervention and minimizing human error. Machine learning models are increasingly applied to classify seabed features, detect anomalies, and identify marine species, accelerating research outcomes. Predictive analytics supported by AI enhances decision-making in offshore energy projects by assessing potential risks in real time. AI also optimizes LiDAR signal processing by filtering out noise caused by water turbidity, thereby improving clarity and accuracy. Moreover, autonomous underwater vehicles (AUVs) integrated with AI and LiDAR systems enable real-time mapping without requiring constant human supervision. This synergy between AI and LiDAR is setting a new standard for underwater exploration and monitoring.

- In March 2024, Fujitsu revealed details of a new technology that employs LiDAR and AI to capture detailed 3D data of natural features such as coral reefs and other organisms, as well as man-made structures like offshore wind turbines, using autonomous underwater vehicles (AUVs). This effort is part of their R&D initiative to develop an ocean digital twin. These digital replicas will enable researchers to study underwater ecosystems more accurately, forecast environmental changes, and assess the potential impacts of conservation strategies. (Source: https://www.fujitsu.com)

Market Overview

Underwater LiDAR (bathymetric LiDAR) is an active remote-sensing technology that uses short-pulse green/blue-green laser light to penetrate the water column and measure seabed and submerged-feature elevations by recording the time delay and intensity of surface and bottom return pulses, integrated with precise positioning (GNSS/INS) and post-processing software to generate high-resolution bathymetric point clouds, topographic shore data, and derived products for coastal, hydrographic, offshore and scientific applications.

The underwater LiDAR market is steadily gaining traction due to rising demand for accurate seafloor mapping and hydrographic surveys. Governments, research institutes, and private enterprises are increasingly investing in advanced LiDAR technologies to address challenges in marine resource management and security. The offshore oil and gas industry is also leveraging this technology for pipeline monitoring and structural inspections, driving adoption. Defense organizations utilize underwater LiDARs for coastal surveillance, submarine detection, and mine identification, further broadening their relevance. Environmental scientists employ it for coral reef monitoring and underwater habitat assessment, underlining its ecological importance. Overall, the market is poised for significant expansion as technological innovations improve depth range resolution and affordability.

Market Key Trends

- Growing adoption of autonomous underwater vehicles integrated with LiDAR.

- Expansion of underwater LiDAR in offshore renewable energy projects.

- Rising demand for ecological conservation and coral reef mapping.

- Miniaturization of LiDAR systems for easier deployment in remote regions.

- Increasing collaboration between defense agencies and technology providers.

- Integration of LiDAR with multisensory platforms, combining sonar and photogrammetry.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,752.36 Million |

| Market Size in 2025 | USD 466.91 Million |

| Market Size in 2024 | USD 403.10 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sysrem Type, Platform / Deployment Platform, Components / Subsystems, Data Product / Output, Application / End-use Application, Service Model / Offering, Water Type / Environmental Suitability, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Illuminating the Depths with Precision

Underwater LiDAR market drivers are increasing demand for high-resolution mapping of seafloor terrains and main structures. Traditional sonar systems, with effective, often lack the precision required for modern applications. LiDAR provides unparalleled detail, enabling industries to monitor offshore pipelines, subsea installations, and coastal ecosystems with accuracy. The rise of offshore renewable energy projects, particularly wind farms, has further accelerated the need for reliable underwater mapping. Governments worldwide are also investing in advanced hydrographic surveys to support maritime navigation and security. This convergence of industrial, environmental, and defense needs is propelling the adoption of underwater LiDAR technologies.

- In August 2025, after more than six months of delay, the center granted approval to the defence ministry and Mazagon Dock Shipbuilders Limited to initiate negotiations for the acquisition of six submarines under Project 75 India. As a part of the deal, the submarines will be built in India with technological support from Germany. Earlier in January, the defence ministry had chosen state-owned MDL to construct six air-independent propulsion-enabled submarines in collaboration with German firm ThyssenKrupp Marine Systems. (Source: https://www.financialexpress.com)

Restraints

The Challenges Beneath the Surface

Despite its promise, the Underwater LiDAR market faces several constraints that could hinder rapid adoption. The technology remains relatively costly, making it inaccessible for smaller research institutes and enterprises. Water turbidity, depth limitations, and environmental conditions often impact LiDAR accuracy, restricting its application in certain regions. Maintenance and calibration of LiDAR systems in corrosive underwater environments present further operational challenges. Additionally, the lack of skilled professionals trained in underwater LiDAR technologies hampers its broader utilization. Regulatory complexities related to oceanic research and maritime security also create hurdles for deployment. Overcoming these barriers will be critical for unlocking the full market potential.

Opportunity

Deep Seas, Deeper Possibilities

The market presents immense opportunities in fields that extend far beyond conventional maritime activities. With climate change threatening marine ecosystems, Underwater LiDAR offers powerful tools for conservation and monitoring. Marine archaeologists are using the technology to uncover shipwrecks and submerged cities, unlocking new historical insights. Defense and naval forces are increasingly exploring LiDAR for strategic underwater surveillance. Furthermore, emerging opportunities lie in combining LiDAR with unmanned surface vessels (USVs) and AUVs for autonomous, large-scale surveys. The growing push for sustainable resource management and the expansion of blue economy initiatives globally are likely to open lucrative pathways for market players.

System Type Insights

Why Are Bathymetric LiDAR Systems Dominating the Underwater LiDAR Market?

The bathymetric LiDAR systems have become a dominant force in the underwater LiDAR market industry, due to their proven accuracy and reliability in mapping seabeds, coastlines, and shallow waters. Their ability to penetrate water surfaces and capture detailed depth measurements makes them indispensable for hydrographic surveys and environmental monitoring. Widely adopted by government agencies, defense authorities, and marine research organizations, these systems provide unmatched precision. Their dominance is further reinforced by their application in navigation safety, port management, and coastal zone mapping. The demand is supported by growing maritime trade and marine infrastructure projects worldwide. As regulatory compliance for maritime operations strengths, bathymetric systems remain the gold standard.

The hybrid/topo-bathy integrated systems are the fastest-growing in the underwater LiDAR sector, offering the versatility of capturing both land and underwater topography in a seamless dataset. This dual functionality significantly reduces survey time and costs, making them highly attractive for coastal infrastructure planning, disaster management, and environmental conservation. These systems address the increasing need for holistic geospatial data, particularly in climate resilience projects. Their adaptability to UAV and airborne platforms further enhances their appeal. With technology advancements improving resolution and depth penetration, these systems are expected to witness exponential adoption. They represent the natural evolution of underwater LiDAR solutions.

Platform / Deployment Platform Insights

Why Are Airborne Systems Leading the Underwater LiDAR Sector?

The airborne systems segment is leading the underwater LiDAR market, driven by its extensive coverage, efficiency, and capability to survey vast coastal and offshore regions. Widely utilized for large-scale hydrographic mapping, disaster management, and coastal defense, airborne LiDAR offers high accuracy with relatively low operational complexity. National hydrographic offices and defense organizations continue to rely heavily on airborne surveys for strategic operations. Their ability to integrate advanced sensors with manned aircraft makes them the preferred choice for long-range missions. Despite higher costs compared to UAV platforms, their comprehensive data collection capabilities secure their leading position.

The UAV / drone-mounted (VTOL / multirotor / fixed-wing drones) are the fastest-growing in the underwater LiDAR market sector, followed by their extensive use in coastal mapping, harbor management, and environmental studies. Their precision in capturing detailed bathymetric profiles of nearshore waters makes them invaluable for coastal resilience and navigation safety. These systems are especially critical in managing sediment transport, erosion, and habitat monitoring. Their widespread adoption is further supported by cost-effectiveness and operational efficiency. As coastal population density and maritime activities rise, shallow range systems remain indispensable to both commercial and government users. Their market leadership is rooted in versatility and immediate utility.

Range / Depth Capability Insights

Why Are Shallow Systems Making Up the Largest Share of the Underwater LiDAR Market?

The shallow segment maintained a leading position in the underwater LiDAR market industry, owing to its extensive use in coastal mapping, harbor management, and environmental studies. Their precision in capturing detailed bathymetric profiles of nearshore waters makes them invaluable for coastal resilience and navigation safety. These systems are especially critical in managing sediment transport, erosion, and habitat monitoring. Their widespread adoption is further supported by cost-effectiveness and operational efficiency. As coastal population density and maritime activities rise, shallow range systems remain indispensable to both commercial and government users. Their market leadership is rooted in versatility and immediate utility.

The UAV / drone-mounted (VTOL / multirotor / fixed-wing drones) are the fastest-growing in the underwater LiDAR market sector, driven by the need for deeper water surveys without resorting to costly ship-based sonar operations. These systems fill the critical gap between shallow-water mapping and deep-sea exploration. With offshore energy projects, including wind farms and subsea infrastructure, expanding rapidly, moderate-range solutions are increasingly vital. They provide high-resolution data while covering extended depths, supporting both defense and industrial use cases. Advancements in laser penetration and water column correction technologies are accelerating adoption. Their growth reflects a shift toward mid-depth maritime operations.

Components / Subsystems Insights

Why Are Components / Subsystems in a Prominent Position in the Underwater LiDAR Market?

The laser transmitter modules segment enjoyed a prominent position in the market for underwater LiDARs during 2024, enabling depth penetration and accuracy in bathymetric mapping. High-performance lasers capable of handling varying water clarity conditions are critical to system efficiency. Demand for compact, energy-efficient, and longer-wavelength transmitters continues to rise. These modules are integral in ensuring precise measurement across shallow and moderate depths. Their importance is underscored by the need for reliability in both defense missions and environmental monitoring. As technology advances, transmitter innovations remain central to LiDAR's effectiveness.

The integrated receiver and waveform digitizer modules are the fastest-growing in the underwater LiDAR market sector, driven by advancements in sensor fusion and signal processing capabilities. Modern receivers combine high sensitivity with enhanced filtering techniques, allowing accurate detection in turbid and variable water conditions. Their integration with AI-driven algorithms improves real-time data interpretation and noise reduction. As the demand for compact and cost-efficient LiDAR systems grows, integrated receivers offer a critical balance of performance and affordability. Their rising adoption reflects the industry's pivot toward smarter, more efficient data capture technologies.

Application / End-use Application Insights

Why Did Hydrographic Surveying Systems Register Their Dominance in the Underwater LiDAR Market?

The hydrographic surveying segment registered its dominance over the underwater LiDAR market industry, underpinned by global demand for accurate nautical charts, coastal mapping, and port management. Governments and defense authorities heavily invest in hydrography to ensure maritime safety and national security. Commercial shipping, offshore exploration, and environmental monitoring further drive demand. LiDAR's ability to provide fast, accurate, and high-resolution seabed mapping cements its role in this sector. With international trade and shipping routes expanding, hydrographic applications remain at the forefront. Their dominance represents the foundation upon which underwater LiDAR is built.

The offshore wind farm survey & cable routing are the fastest-growing in the underwater LiDAR market sector, fuelled by the rapid expansion of renewable energy infrastructure worldwide. LiDAR systems play a pivotal role in seabed mapping, site selection, and environmental impact assessments for offshore wind projects. The transition to clean energy is driving massive investments in offshore wind farms, particularly in Europe, Asia, and North America. Underwater LiDAR ensures efficient planning and operational safety in these multi-billion-dollar projects. As governments accelerate decarbonization goals, this application segment is expected to witness exponential demand. It embodies the synergy between green energy and advanced marine technology.

Service Model / Offering Insights

Why Are Full System Sales Dominating the Market?

The full system sales have become a dominant force in the underwater LiDAR market, driven by defense agencies, research institutions, and large commercial entities that prefer owning LiDAR systems for long-term use. This model allows users complete control over operations, customization, and security of collected data. System ownership is particularly critical for military applications and national hydrographic offices where confidentiality is paramount. Despite high upfront costs, the ability to deploy systems independently supports steady demand. Full sales remain the market's backbone, providing predictable revenue streams for manufacturers.

The survey services are the fastest-growing in the underwater LiDAR market sector, addressing the needs of organizations that lack the resources or expertise to own and operate LiDAR systems. Specialized service providers offer end-to-end solutions, from deployment to data analysis, making high-end surveys accessible to smaller clients. This model is especially attractive for environmental consultancies, offshore energy developers, and regional governments. The pay-per-service approach reduces capital expenditure and offers operational flexibility. As demand for on-demand, project-specific surveys grows, survey services are set to expand rapidly. This shift underscores the market's move toward accessibility and outsourcing.

Water Type/Environmental Suitability Insights

Which Water Type Led the Underwater LiDAR Sector?

The clear coastal waters led in the underwater LiDAR market industry, due to their high transparency and low turbidity. Systems deployed in these waters deliver superior depth penetration and data accuracy, supporting coastal mapping, tourism management, and ecological studies. Many government-funded surveys and research projects are concentrated in clear water regions, further driving demand. These waters also provide favourable conditions for testing and validation of new systems. Their dominance is a reflection of both natural suitability and operational efficiency.

The turbid coastal waters are the fastest-growing in the underwater LiDAR market sector, driven by the water type segment, as demand rises for LiDAR surveys in challenging environments impacted by sedimentation, pollution, and dynamic coastal processes. Operating in such waters requires advanced receivers, filtering algorithms, and powerful laser transmitters. Growing coastal populations and industrial activities are increasing the importance of mapping turbid zones for infrastructure planning and environmental monitoring. Despite technical challenges, advancements in system design are making LiDAR viable in these conditions. The expansion into turbid waters represents the market's evolution toward resilience and adaptability.

Regional Insights

Why Does North America Dominate the Underwater LiDAR Market?

By region, North America dominated the global market for underwater LiDARs in 2024, supported by strong investments in defense, offshore energy, and marine research. The U.S. Navy and Coast Guard are among the largest adopters, using the technology for underwater surveillance, navigation safety, and mine detection. Research institutions and environmental agencies are leveraging LiDAR for studying coral reefs, monitoring fisheries, and mapping seabeds with unmatched detail. The region also benefits from strong collaborations between academic bodies and technology providers, driving innovation. The expansion of offshore wind energy projects in U.S. waters further strengthens demand. North America's robust regulatory frameworks and significant funding for oceanographic exploration ensure its continued leadership in the space.

- In June 2025, during recent French navy exercises focused on monitoring the nation's underwater resources, a crew identified an unusually large formation on the seafloor near Saint-Tropez. The sonar picked up a sizable anomaly, so we returned with the camera system, followed by an underwater robot to capture high-resolution images,” explained Arnaud Schaumasse, head of the French Ministry of Culture's Underwater Archaeology Department.

(Source: https://divemagazine.com)

Why is Asia Pacific the fastest-growing Underwater LiDAR Market?

Asia Pacific is the fastest-growing region in the underwater LiDAR sector, fueled by rapid economic expansion and growing maritime security concerns. Countries such as China, Japan, South Korea, and India are heavily investing in ocean exploration, coastal surveillance, and offshore energy development. The region's rich marine biodiversity also demands advanced conservation tools, where LiDAR plays a pivotal role in monitoring coral reefs and coastal ecosystems. Expanding shipbuilding industries and increasing investments in defense modernization further accelerate adoption. Governments across the Asia Pacific are prioritizing blue economy initiatives, supporting marine infrastructure development, and sustainable resource utilization. With a blend of industrial growth, defense priorities, and ecological awareness, the Asia Pacific is poised to be the next frontier in underwater LiDAR adoption.

- In August 2025, the Archeological Survey of India's underwater archeology wing will resume underwater exploration of submerged structures off the Mahabalipuram coast, nearly twenty years after its last major study. Previous surveys conducted in 2001 and 2004–05, which included diving expeditions, uncovered remains of significant archaeological interest. These findings comprised three walls and several intricately carved architectural fragments believed to be part of ancient temples constructed during the Pallava dynasty (7th–8th century CE).(Source: https://swarajyamag.com)

Underwater LiDAR Market Companies

- Teledyne (Optech / Teledyne Marine divisions)

- RIEGL Laser Measurement Systems GmbH

- Hexagon | Leica Geosystems

- Trimble Inc.

- L3Harris Technologies

- Kongsberg Maritime

- YellowScan

- Faro Technologies

- Norbit ASA

- Valeport Ltd.

- Teledyne CARIS (hardware partnerships within the Teledyne group)

- CGG (marine sensing hardware group)

- Aerodyne Group (bathymetric LiDAR integrations)

- R2Sonic (sonar/LiDAR integrated OEMs)

- Aerialtronics / UAV LiDAR OEMs (integrated bathy solutions)

- GeoAcoustics / subsea sensor OEMs (integrated platforms)

- Optech-qualified system integrators (OEM-branded bathy systems)

- BlueView (Teledyne BlueView branded sensors)

- Scantech (industrial LiDAR OEMs offering marine variants)

- Sentek (marine sensor OEMs with LiDAR modules)

Recent Developments

- In August 2025, India is preparing to launch its first human deep-sea exploration mission, Samdrayaan, with the deployment of the indigenously developed Matsya 6000 submersible. Engineered to dive as deep as 6000 meters, Matsya 6000 stands as a milestone in marine technology, equipped with a titanium alloy personnel sphere, an emergency life support system capable of sustaining 96 hours, and advanced innovation, including underwater acoustic communication, bio-vests, and digital twin technologies.(Source: https://www.news18.com)

- In August 2025, the Ministry of Earth Sciences (MoES) initiated the Deep Ocean Mission (DoM) to explore mineral resources in the deep seabed beyond national jurisdiction. As part of this initiative, India has secured two exploration contracts with the International Seabed Authority (ISA) in the Indian Ocean, the government informed the Lok Sabha on Wednesday.(Source: https://www.hindustantimes.com)

Segments Covered in the Report

By System Type

- bathymetric LiDAR systems

- Topographic/terrestrial LiDAR systems

- Hybrid/topo-bathy integrated systems

- Subsea/underwater profiling LiDAR

- Handheld/portable shallow-water LiDAR sondes

By Platform / Deployment Platform

- Airborne (fixed-wing aircraft)

- Airborne (helicopter)

- UAV / drone-mounted (VTOL / multirotor / fixed-wing drones)

- Ship/boat-mounted (vessel hull or pole-mounted)

- Surface vessel unmanned (USV)-mounted

- ROV-mounted (remotely operated vehicle)

- AUV-mounted (autonomous underwater vehicle/glider)

- Shore/terrestrial fixed-station (coastal monitoring masts/gantries)

- Portable shore/boat handheld deployments

By Components / Subsystems

- Laser transmitter modules (solid state/fiber / DPSS)

- Receiver and waveform digitizer modules

- GNSS (RTK/PPK) integrated positioning units

- Inertial Measurement Units (IMU) and motion compensation

- Scanning mechanisms (mirror, polygon, fiber scanner)

- Protective housings and windows (pressure rated)

- Data acquisition and recorder systems

- Post-processing / bathymetric processing software modules

- Calibration and test equipment

By Data Product / Output

- Raw point clouds (XYZ + intensity)

- Classified bathymetry (ground, seabed, vegetation)

- DEM / DTM bathymetric surfaces

- Shoreline and intertidal elevation models

- Submerged feature extraction (wrecks, pipelines)

- Time-series change detection products

- Volume calculations and dredge monitoring reports

By Application / End-use Application

- Hydrographic surveying and nautical charting

- Coastal mapping, erosion & shoreline change monitoring

- Port & harbor navigation channel surveys and dredging support

- Offshore oil & gas (seabed inspection, pipeline/platform planning)

- Offshore wind farm site survey and cable routing

- Marine construction (bridges, jetties, breakwaters)

- Coastal engineering & beach nourishment monitoring

- Environmental monitoring (habitat mapping, seagrass, coral)

- Fisheries and aquaculture site assessment

- Search, salvage, and underwater archaeology

- Subsea cable and telecom route survey

- Floodplain and estuary bathymetry for hydrodynamic modelling

- Defense, surveillance, and mine countermeasure support

- Scientific oceanography and glaciology (ice-underwater interfaces)

By Service Model / Offering

- Full system sales (OEM hardware sales)

- Turnkey system + training (hardware + integration + training)

- System rental / short-term leasing

- Survey services (data acquisition as a service)

- Software licensing (processing/analytics)

- After-sales maintenance & calibration contracts

By Water Type / Environmental Suitability

- Clear coastal waters (high optical clarity)

- Turbid coastal waters (low visibility)

- Estuarine/riverine environments (variable turbidity)

- Arctic / ice-covered coastal zones (seasonal ice)

- Tropical shallow reef environments

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa (MEA)

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content