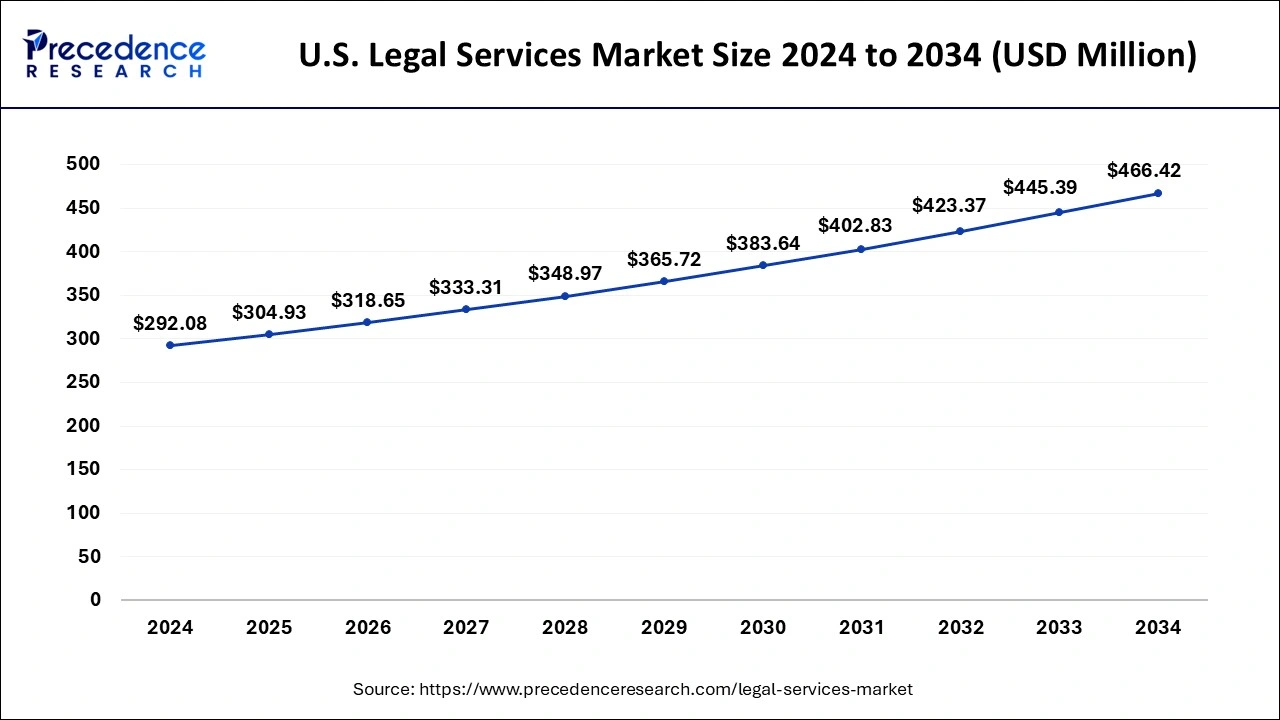

U.S. Legal Services Market Size and Forecast 2025 to 2034

The U.S. legal services market size accounted for USD 292.08 billion in 2024 and is predicted to increase from USD 304.93 billion in 2025 to approximately USD 466.42 billion by 2034, expanding at a CAGR of 4.80% from 2025 to 2034. The market growth is attributed to the increasing integration of advanced legal technologies that streamline operations, reduce costs, and enhance client service delivery.

U.S. Legal Services MarketKey Takeaways

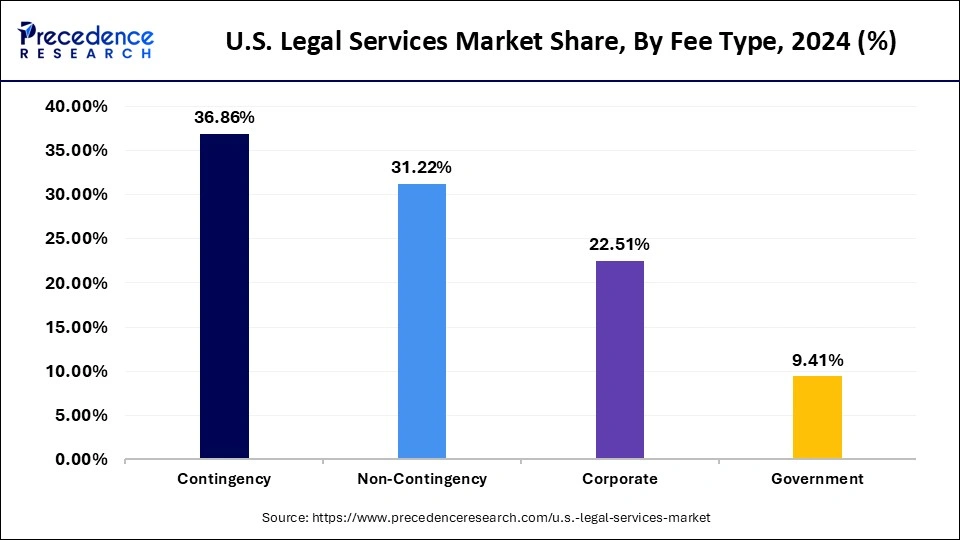

- By free type, the contingency segment held the major market share of 36.85% in 2024.

- By free type, the corporate segment is projected to grow at a CAGR of 6.9% in between 2025 and 2034.

- By size, the large firms segment contributed the biggest market share of 38.30% in 2024.

- By size, the small firms segment is expanding at a significant CAGR of 6.1% in between 2025 and 2034.

- By practice area, the civil litigation segment captured the largest market share of 32.68% in 2024.

- By practice area, the intellectual property segment is expected to grow at a significant CAGR of 7.8% over the projected period.

Impact of Artificial Intelligence on the U.S. legal services market

Artificial intelligence (AI) is changing the U.S. legal services by supporting firms to serve clients in a timely, exact, and less costly manner. High number of lawyers and law firms depend on AI to automate tasks involving e-discovery, overseeing contracts, and legal research. Lawyers use less time on everyday tasks and now work on more complex problems and interact with clients. Furthermore, the GenAI allows companies to process more legal information, and helps them create better strategies for litigation and examine risks.

Market Overview

The use of new technologies in law is encouraging healthy competition among firms in this region. Many organizations are using cloud platforms, AI in legal research, digital tools to review information, and cyber security technology to speed up work and handle administrative tasks better.Data from the 2024 Legal Technology Survey by the American Bar Association points out that 73% of litigators file in court using technology and 67% of attorneys pay to use online research services. According to the Bureau of Labor Statistics, it is expected that employment in law rise by 5% from 2023 to 2033 because law firms need more smart tech experts.They are utilizing legal services to provide their clients with fast case resolutions and enhanced service. Furthermore, the growth of digital transformation results in better efficiency at law firms and makes clients more satisfied.

U.S. legal services marketGrowth Factors

- Rising Demand for Immersive Wellness Experiences: Increasing consumer preference for gamified and virtual workout environments is driving the shift toward interactive fitness platforms.

- Boost in Smart Home Device Integration: Expanding compatibility with connected home ecosystems is fuelling adoption of AI-enabled fitness mirrors, bikes, and wearables.

- Advancement in Real-Time Biometric Feedback: Enhanced tracking of heart rate, form, and fatigue through wearable sensors is boosting user engagement and workout personalization.

- Expansion of Global Fitness Subscriptions: Growing digital infrastructure and flexible pricing models are propelling the global reach of interactive fitness programs across age groups.

- Increasing Workplace Wellness Investments: Employers are driving adoption by integrating interactive fitness into corporate health packages to improve employee productivity and retention.

- Growth in Virtual Trainer and AI Coaching Models: Sophisticated AI avatars and machine learning coaches are rising as scalable alternatives to human instructors.

- Elevated Focus on Mental-Physical Wellness Fusion: Platforms combining mindfulness, yoga, and cognitive training are boosting holistic adoption of interactive fitness among diverse users.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 466.42 Billion |

| Market Size in 2025 | USD 304.93 Billion |

| Market Size in 2024 | USD 292.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fee Type Insights,Size Insights, and Practice Area Insights |

Market Dynamics

Drivers

Why are U.S. Businesses Driving Greater Demand for Corporate Legal Advisors?

Increasing demand for corporate legal advisory services is expected to drive steady growth in the market. Higher demand for legal advice in businesses is predicted to cause continued growth in this sector. As rules and regulations in finance, health, and technology are more involved, companies rely on expert advice from lawyers to be sure they don't break any laws and to lessen their legal risks. To help with mergers and acquisitions, safety of IP, data guidelines, and the environment, businesses seek assistance from law firms. This trend facilitates legal counsel that is now more involved in making important business decisions, mainly for large companies working across national boundaries and facing close regulation. Employment for corporate and compliance attorneys was cited by the Bureau of Labor Statistics as increasing in 2024 because there had been a rise in strict agency regulation. Furthermore, the greater ESG reporting and stricter antitrust rules are fueling growth in the corporate legal advisory sector, thus further fuelling the market.

(Source: https://www.bls.gov)

Restraint

High Legal Service Costs

High legal service costs, especially for individuals and small businesses, which are expected to limit market growth. Increasing legal costs are expected to slow the growth of the market for people and small companies. Some law firms set their rates by the hour, and these may be quite expensive, depending on the level of the case's complexity and the company's reputation.

The American Bar Association stated that, many clients are mostly concerned about pricing, especially when it comes to legal work in litigation, company law, and intellectual property. Many small businesses and people with low income find it hard to receive quality representation as their budgets are usually not enough for good legal advice, which further hinders the widespread demand for legal services.

Opportunity

How Is Legal Technology Reshaping the Practice of Law in the United States?

Surging adoption of legal technology solutions is likely to create immense opportunities for the players competing in the market. More use of tech solutions in law firms is expected to improve their performance. AI-based programs, e-discovery platforms, and contract management systems are heavily bought by law firms and legal departments to make their work easier. They increase the pace of reading documents, make legal research accurate, and minimize the expenses linked to doing the same tasks over. Relying on data in decision-making makes law firms stronger in the market and able to answer clients' expectations for simpler and clearer transactions.

According to the American Bar Association's 2024 Legal Technology Survey, more than 74% of U.S. law firms embraced technology focused on automation and client portals, which meant they were adopting integrated digital approaches.

(Source: https://www.americanbar.org)

According to the 2024 predictions made by Bloomberg Law, more litigation groups using e-discovery in federal courts started using AI-based document review tools. Additionally, the shift toward data-driven decision-making helping meet client expectations further creates demand for advance legal services in the coming years.

(Source: https://pro.bloomberglaw.com)

Practice Area Insights

The personal injury law segment dominated the market with 16.50% market share in 2024. The dominance of the segment can be attributed to the increasing healthcare costs, surge in accident rates, and a greater awareness of legal rights. Also, the growing cost of rehabilitation and medical treatment after an injury affects the probable compensation sought in personal injury claims.

The technology and cyber law segment are expected to grow at the highest CAGR of 6.80% over the forecast period. The growth of the segment can be credited to the rising digital transformation across different sectors due to rapid internet penetration in the world. In addition, the ongoing investment in cutting-edge cybersecurity technologies and the development of keen cyber laws are driving the segment's growth further.

Firm Size Insights

The small law firms (2–10 attorneys) segment led the market by holding 34.20% market share in 2024, as the U.S. legal industry for being customizable, affordable, and welcoming technology in their practice. Nowadays, these firms are offering services in family law, immigration, employment disputes, real estate, and advice for small businesses since these areas are often requested by both average people and local companies. Around 68 percent of the small firms surveyed in the ABA's 2024 Solo and Small Firm Report said more clients contacted them because the practice offered low prices, was located locally, and provided services online.

The segment is expected to grow at the fastest CAGR of 5.90% over the forecast period. The growth of the segment can be linked to the surge in client expectations for digital experiences along with the increasing number of tech-savvy lawyers in the legal field. Moreover, the extensive availability of cloud-based and affordable egal technology solutions has decreased the bar for entry for solo practitioners in the market.

Service Delivery Model Insights

The traditional In-person services segment held a 57.10% share in 2024. The dominance of the segment can be driven by growing demand for face-to-face interaction in complex legal matters such as witness preparation and negotiations. Furthermore, many clients prefer the direct interaction provided by traditional in-person services, particularly for complex legal issues.

The fully virtual services segment is expected to grow at the highest CAGR of 8.10% over the forecast period. The growth of the segment is owning to the rapid innovations in technology coupled with the growing smartphone and internet technology across the globe. Virtual legal services heavily depend on digital platforms and tools such as AI-powered tools and cloud-based practice management software.

Type of Service Insights

The litigation services segment dominated the market with 28.70% market share in 2024. The dominance of the segment can be credited to the growing need for specialized services, surge in the number of legal disputes and increasing awareness among businesses about the importance of proper litigation management. Also, clients are rapidly seeking personalised service in areas such as cybersecurity, environmental law and intellectual property driving segment growth soon.

The outsourced legal process services (LPO) segment is expected to grow at the highest CAGR of 7.40% in 2024. The dominance of the segments can be attributed to the growing legal complexity, cost reduction and technological innovations. Additionally, business is turning to LPO to optimize operational costs, particularly in the face of cross-border activities and complex legal processes.

End Use Insights

The individuals segment held the largest market share of 39.60% in 2024. The dominance of the segment can be driven by growing demand for personalized legal services coupled with the surge in specialized legal needs. Furthermore, the growth in the "gig economy" and the freelance work arrangements also fuel the demand for customized counsel from independent professionals, leading to market growth soon.

The startups and tech companies' segment is expected to grow at the highest CAGR of 6.90% in 2024. The dominance of the segment can be linked to the technological innovations and changing client expectations. Moreover, clients are increasingly seeking advanced solutions, greater transparency with better accessibility from legal service providers, impacting positive segment growth further.

U.S. Legal Services Market Companies

- Cravath, Swaine & Moore LLP

- Gibson Dunn

- Kirkland & Ellis LLP

- Morgan Lewis

- Sidley Austin LLP

- Skadden, Arps, Slate, Meagher & Flom LLP

- Wachtell, Lipton, Rosen & Katz

- White & Case LLP

Latest Announcements by Industry Leaders

- In March 2025, top-tier legal AI platform Legora officially expanded into the United States with the opening of a new office in New York, marking a significant milestone in its global growth strategy. The company also announced a strategic partnership with Goodwin, the renowned international law firm known for its leadership at the intersection of capital and innovation. This move follows Legora's recent rebranding and the rollout of advanced features designed to meet the evolving needs of elite law firms worldwide. The company aims to strengthen its U.S. presence by aligning with firms at the forefront of legal innovation. “The U.S. remains the most critical market for legal technology innovation,” said Erik Junestrand, Co-Founder of Legora.

Recent Developments

- In February 2025, KPMG LLP, one of the Big Four audit, tax, and advisory firms, officially launched KPMG Law US, becoming the first Big Four-owned law firm to operate in the United States. This strategic move reflects the rapidly evolving legal services landscape, where corporate clients seek integrated solutions. KPMG Law US aims to transform legal operations by merging the firm's deep technology expertise with legal advisory services. Backed by KPMG's trusted legacy, the new entity is positioned to support legal departments in gaining competitive advantages through modern, scalable, and tech-enabled legal services.

- In January 2025, U.S. Legal Support, the nation's leading litigation support services provider, announced the acquisition of American Retrieval, a pioneer in medical record retrieval since 1993. This merger brings together American Retrieval's decades-long expertise and technology with U.S. Legal Support's extensive service offerings. The combined capabilities are expected to deliver more efficient, cost-effective, and automation-powered record retrieval solutions to clients across the legal and insurance industries. This acquisition underscores U.S. Legal Support's commitment to enhancing the speed and personalization of litigation support.

- In March 2025, Swedish-founded generative AI platform Legora officially launched its U.S. operations with the opening of a New York office. The company also signed a strategic partnership with Goodwin, a top-tier global law firm. Legora's recent rebranding and rollout of advanced features are designed to meet the needs of global, innovation-driven firms. Founded in 2023 and led by CEO Max Junestrand, Legora now serves over 250 clients across nearly 20 countries, positioning itself as a next-generation legal AI provider for complex and high-volume legal workflows.

- In August 2024, U.S. Legal Support Inc. expanded its service portfolio with the nationwide rollout of Service of Process, offering fast, professional, and accurate document delivery across the U.S. This addition strengthens the company's position as a full-service litigation support provider. Clients now benefit from a unified solution that includes court reporting, record retrieval, and process serving, all designed to streamline litigation. The expansion addresses the growing demand for seamless, technology-integrated legal support amid an increasingly complex legal landscape.

Segments covered in the report

By Practice Area

- Personal Injury Law

- Auto accidents

- Medical malpractice

- Workers' compensation

- Immigration Law

- Family-based immigration

- Employment-based visas

- Asylum & deportation Defense

- Family Law

- Divorce

- Child custody

- Adoption

- Business & Corporate Law

- Contract law

- Mergers & acquisitions

- Corporate governance

- Real Estate Law

- Residential transactions

- Commercial leasing

- Zoning & land use

- Criminal Defense

- DUI/DWI

- Drug offenses

- White-collar crimes

- Employment & Labor Law

- Wrongful termination

- Wage and hour disputes

- Discrimination cases

- Litigation and Dispute Resolution

- Intellectual Property (IP) Law

- Tax Law

- Bankruptcy and Insolvency

- Environmental Law

- Health Law

- Securities Law

- Consumer Protection Law

- Technology and Cyber Law

By Firm Size

- Solo Practitioners

- Small Law Firms (2–10 attorneys)

- Mid-Sized Law Firms (11–50 attorneys)

- Large Law Firms (50+ attorneys)

By Service Delivery Model

- Traditional In-Person Services

- Hybrid Services

- Fully Virtual Services

- Online consultations

- Virtual document sharing

- Remote case management

By Type of Service

- Advisory Services

- Litigation Services

- Document Drafting & Review

- Alternative Dispute Resolution (ADR)

- Regulatory and Compliance Services

- Outsourced Legal Process Services (LPO)

By End Use

- Individuals

- Small & Medium Enterprises (SMEs)

- Large Corporates / Multinationals

- Government and Public Sector

- Non-profits and NGOs

- Startups and Tech Companies

Get a Sample

Get a Sample

Table Of Content

Table Of Content