What is the Utility System Construction Market Size?

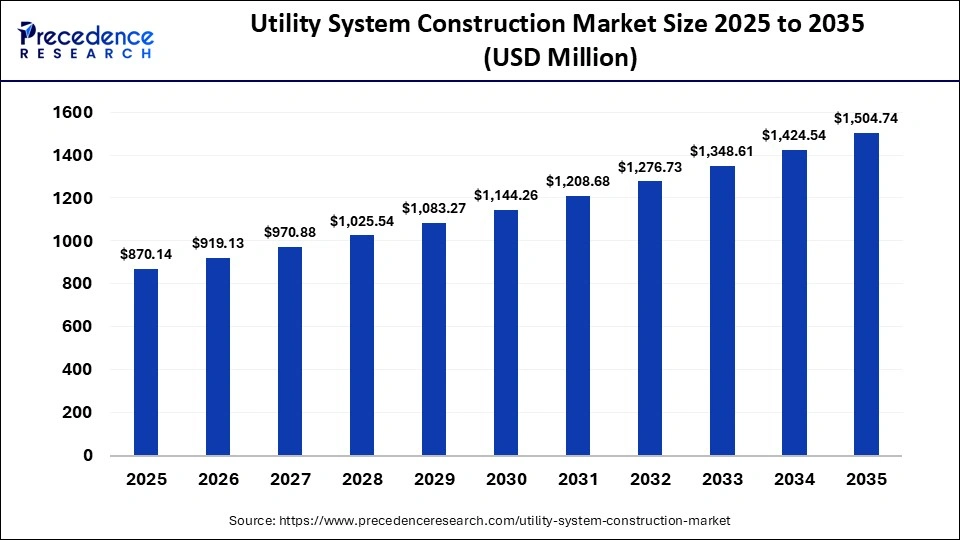

The global utility system construction market size was calculated at USD 870.14 million in 2025 and is predicted to increase from USD 919.13 billion in 2026 to approximately USD 1,504.74 million by 2035, expanding at a CAGR of 5.63% from 2026 to 2035. This market is growing due to rising investments in infrastructure development, rapid urbanization, and increasing demand for modernized water, power, and communication networks.

Market Highlights

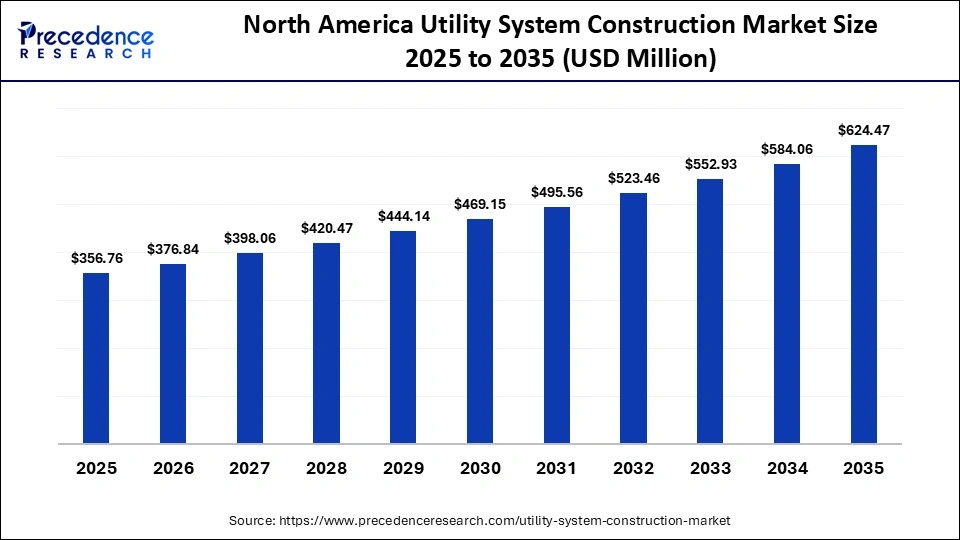

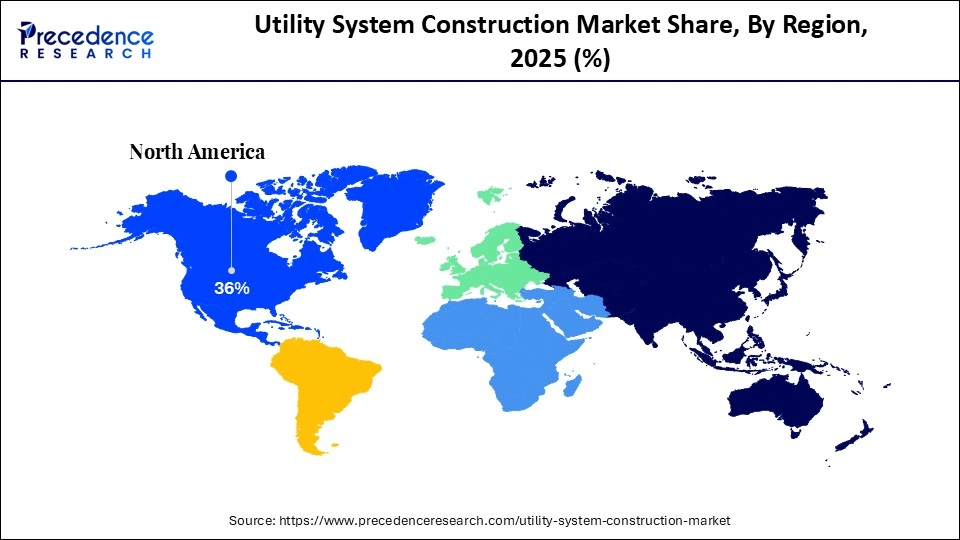

- North America dominated the global utility system construction market with a major revenue share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By type of utility, the water and sewer lines segment generated the biggest market share in 2025.

- By type of utility, the power and communication lines segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By construction type, the new construction segment contributed the highest market share in 2025.

- By construction type, the renovation and upgrading segment is expected to grow at a strong CAGR between 2026 and 2035.

- By end-user sector, the residential sector segment held a major market share in 2025.

- By end-user sector, the industrial sector segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By project size, the large-scale projects segment generated the biggest market share in 2025.

- By project size, the medium-scale projects segment is expected to expand at the fastest CAGR between 2026 and 2035.

Why is the Utility System Construction Market Gaining Momentum?

The utility system construction market is witnessing steady growth, driven by the need to modernize outdated utility networks, growing urbanization, and rising public infrastructure spending. To accommodate expanding populations and industrial activities, governments and private entities are concentrating on modernizing and expanding the water supply, sewage, electricity, and telecommunications systems. Furthermore, both developed and developing economies are seeing an increase in advanced utility construction projects due to the shift toward smart cities, the integration of renewable energy sources, and resilient infrastructure.

How is Artificial Intelligence Transforming the Utility System Construction Market?

Artificial intelligence (AI) plays a crucial role in revolutionizing the utility system construction market by enhancing design precision, project planning, and operational effectiveness. Contractors can optimize pipeline and cable route planning, forecast construction risks, and minimize delays and cost overruns by using AI-powered tools to analyze large datasets. Furthermore, real-time tracking of worker safety and equipment performance is supported by AI-driven monitoring systems, which facilitate quicker decision-making and more effective completion of challenging utility infrastructure projects.

Market Trends

- Rising development of smart utility infrastructure to enable real-time monitoring and efficient resource management.

- Increasing use of AI, IoT, and digital twins for project planning, risk assessment, and asset management.

- Growing investments in renewable energy related utility networks, such as power transmission and grid upgrades.

- Expansion of underground utility construction to reduce land use conflicts and improve urban aesthetics.

- Higher focus on sustainable construction practices, including low-impact materials and energy-efficient methods.

- Increasing public-private partnerships (PPPs) to fund large-scale utility infrastructure projects.

- Strong demand for rehabilitation and replacement of aging utility systems in developed regions.

Future Market Outlook

- Expansion of smart city projects is creating demand for advanced utility system integration.

- Rapid urbanization in emerging economies is driving the need for new water, sewage, power, and telecom infrastructure.

- Government investments in climate-resilient and disaster-proof utility networks.

- Growing need for utility infrastructure to support electric vehicle charging and renewable energy integration.

- Adoption of advanced construction technologies, such as trenchless methods and modular construction.

- Increasing demand for data-driven maintenance and predictive analytics solutions.

- Rising focus on rural electrification and water supply projects in developing regions.

How are Government Initiatives Driving Growth in the Utility System Construction Market?

Government initiatives are accelerating growth in the utility system construction market by prioritizing urban development, infrastructure modernization, and reliable public services. National and regional authorities are investing heavily in power transmission, water and wastewater systems, broadband expansion, and renewable energy grids to support population growth and economic development. Programs focused on smart cities, rural electrification, clean water access, and climate-resilient infrastructure, along with supportive policies such as public–private partnerships (PPPs), long-term funding frameworks, and mandates to upgrade aging networks, are generating sustained demand for utility construction worldwide.

How is the Utility System Construction Evolving Beyond Traditional Infrastructure?

There is a rapid shift toward smart, resilient, and technology-enabled infrastructure, driven by climate risks, energy transition goals, and rapid urbanization. Governments are prioritizing flood-resistant utilities, underground networks, and renewable-ready power systems, while digital tools such as AI, BIM, and real-time monitoring are improving project efficiency and asset lifecycle performance. In addition, labor shortages and stricter regulations are accelerating the adoption of automation, prefabrication, and trenchless construction techniques, positioning the market as a key enabler of future-ready and sustainable infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 870.14 Billion |

| Market Size in 2026 | USD 919.13 Billion |

| Market Size by 2035 | USD 1,504.74 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type of Utility, Type of Utility, End-User Sector, Project Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type of Utility Insights

What made water and sewer lines the dominant segment in the utility system construction market?

The water and sewer lines segment dominated the market with the largest share in 2025 because of ongoing investments in replacing outdated water infrastructure, growing urban populations, and stringent wastewater management regulations. To address leaks, contamination risks, and public health issues, governments gave priority to upgrading the sewage and drinking water distribution systems. Since water and sanitation services are necessary, they receive steady funding, which bolsters segmental dominance.

The power and communication lines segment is expected to grow at the fastest CAGR in the coming years, owing to the quick development of smart grids, high-speed digital connectivity, and renewable energy networks. The demand for cutting-edge utility construction solutions is rising due to the expansion of data transmission networks, 5G infrastructure, and subterranean cabling. Further enhancing the growth prospects for this segment are initiatives to modernize the grid and rising electricity consumption.

Construction Type Insights

Why did the new construction segment dominate the utility system construction market?

The new construction segment dominated the market in 2025 because of extensive urban development initiatives, growing residential neighborhoods, and the establishment of new commercial and industrial areas. In both developing and developed regions, expanding infrastructure and growing populations necessitated the installation of completely new utility networks. This led to greater capital expenditures for new utility system construction as opposed to projects that relied on repairs.

The renovation and upgrading segment is expected to grow at the fastest CAGR in the coming years, as governments and local governments prioritize updating antiquated utility systems. To increase efficiency, dependability, and adherence to environmental regulations, aging pipelines, power lines, and communication networks must be upgraded. Renovation-driven investment is also accelerating due to a growing emphasis on energy-efficient systems and smart infrastructure.

End-User Sector Insights

How does the residential sector segment dominate the utility system construction market?

The residential sector segment dominated the market by holding a major revenue share in 2025 because of significant investments in housing infrastructure, quick urbanization, and growing housing demand. New residential developments must have expanded sewage, electricity, communication, and water supply. Suburban growth and government-supported affordable housing initiatives further cemented this segment's dominance.

The industrial sector segment is expected to grow at the fastest CAGR in the coming years due to growing manufacturing infrastructure development in logistics and energy-intensive industries and industrialization. Advanced utility construction projects are in high demand because industrial facilities need reliable and large-capacity utility systems to support operations. This trend is also influenced by the expansion of special economic zones and industrial parks.

Project Size Insights

Why did the large-scale projects segment lead the utility system construction market?

The large-scale projects segment led the market in 2025 due to rising investments in nationwide infrastructure upgrades, including power grids, water supply networks, and wastewater treatment facilities. Governments and utilities prioritize large projects to meet growing urban populations, improve reliability, and support energy transition and sustainability goals. These projects also attract higher funding and long-term contracts, resulting in greater revenue contribution compared to smaller-scale developments.

The medium-scale projects segment is expected to grow at the fastest CAGR in the coming years because it offers a balanced approach between cost efficiency and infrastructure impact for regional and municipal utilities. These projects are well-suited for upgrading aging systems, expanding capacity in semi-urban areas, and supporting distributed energy and water infrastructure without the complexity of large-scale developments. Additionally, shorter project timelines, easier regulatory approvals, and flexible financing make medium-scale projects more attractive to public and private stakeholders.

Regional Insights

How Big is the North America Utility System Construction Market Size?

The North America utility system construction market size is estimated at USD 356.76 million in 2025 and is projected to reach approximately USD 624.47 million by 2035, with a 5.76% CAGR from 2026 to 2035.

What made North America the leading region in the utility system construction market?

North America led the utility system construction market in 2025 because of the continuous modernization of utility projects, aging utility networks, and high spending in infrastructure development. Regional dominance is also bolstered by large investments in digital connectivity initiatives, grid improvements, and the replacement of water pipelines. Furthermore, stringent legal requirements and cutting-edge building technologies cemented the market's dominance.

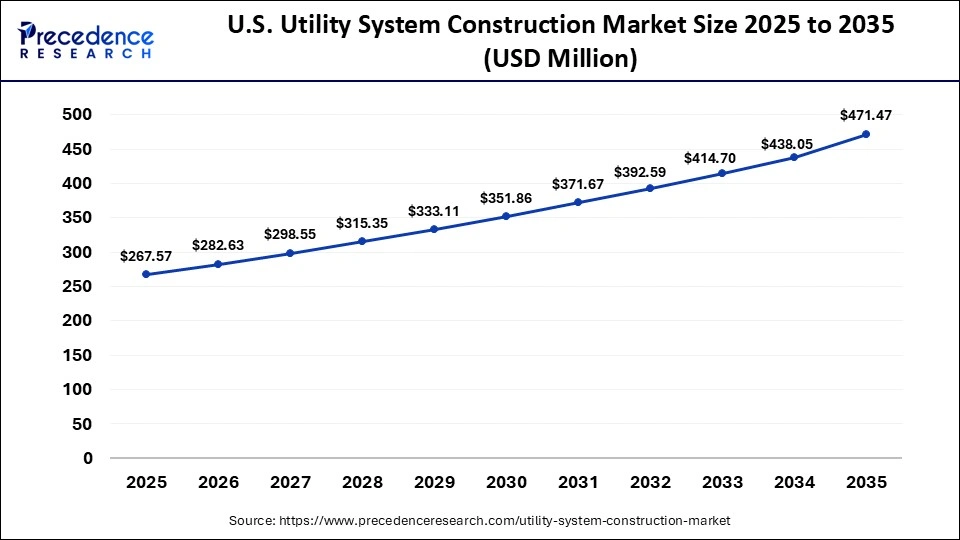

What is the Size of the U.S. Utility System Construction Market?

The U.S. utility system construction market size is calculated at USD 267.57 million in 2025 and is expected to reach nearly USD 471.47 billion in 2035, accelerating at a strong CAGR of 5.83% between 2026 and 2035.

U.S. Utility Systems Construction Market Trends

The U.S. is leading the market in North America, driven by significant expenditures for the replacement of outdated utility networks and the modernization of utility infrastructure. Federal funding programs and state-level initiatives are driving extensive upgrades of power transmission lines, water and sewer pipelines, and communication infrastructure. Advanced construction solutions are in greater demand as a result of the nation's emphasis on grid resilience, renewable energy integration, and smart utility systems. Furthermore, the existence of well-established engineering and construction companies and strict regulatory oversight support market stability and long-term growth in the U.S.

What makes Asia Pacific the fastest-growing region in the market?

Asia Pacific is expected to grow at the fastest CAGR in the coming year, driven by extensive infrastructure development, population growth, and quick urbanization in emerging economies. Utility construction projects in the region are rising due to rising investments in renewable energy infrastructure, smart cities, and industrial zones. The regional market is also driven by government-led infrastructure initiatives and growing foreign investments.

India Utility System Construction Market Trends

The market in India is growing, driven by population growth, rapid urbanization, and growing residential and industrial construction. Large-scale utility infrastructure expansion is being driven by government initiatives centered on digital connectivity, electrification, sanitation, and water supply. Construction activity is rising dramatically in the county as a result of increased investments in rural infrastructure, smart cities, and renewable power networks. Furthermore, it is anticipated that expanding public-private partnerships and foreign investment inflows will hasten the nation's utility system construction.

Who are the Major Players in the Global Utility System Construction Market?

The major players in the utility system construction market include China State Construction Engineering Corp, Vinci SA, Quanta Services Inc., Larsen & Toubro, China Communications Construction Company, Power Construction Corp of China, Bouygues SA, MasTec Inc., Bechtel Corporation, Fluor Corporation, Kiewit Corporation, Skanska AB, AECOM, Jacobs Engineering Group, Hochtief AG, Strabag SE, ACS Group, Eiffage SA, and Ferrovial SE.

Recent Developments

- In February 2026, KEC International announced new orders worth ₹1,020 crore across its global businesses. These orders include transmission and distribution projects in the Americas and India, as well as domestic orders for civil and cables businesses.(Source: https://www.epcworld.in)

- In January 2026, Aecon Group Inc. announced the successful acquisition of K.P.C. Power Electrical Ltd. and K.P.C. Energy Metering Solutions Ltd. This acquisition is expected to enhance Aecon's capabilities in high-voltage substation construction and grid modernization. Aecon states that this move strengthens its position in the energy transition and electrification markets.(Source: https://www.aecon.com)

- In January 2026, CESC Green Power Limited, a subsidiary of CESC, announced plans to invest ₹3,800 crore to develop a 3 GW solar manufacturing facility and a 60 MW solar power plant in Uttar Pradesh. The company formalized this commitment by signing a Memorandum of Understanding with the state government during the UP Global Investors Summit.(Source: https://www.cnbctv18.com)

Segments Covered in the Report

By Type of Utility

- Water and Sewer Lines

- Related Structures Construction

- Oil and Gas Pipelines

- Power and Communication Lines

- Related Structures Construction

By Construction Type

- New Construction

- Renovation and Upgrading

- Maintenance and Repair

- Decommissioning services

By End-User Sector

- Government and Municipalities

- Commercial Sector

- Industrial Sector

- Residential Sector

By Project Size

- Small Scale Projects

- Medium-Scale Projects

- Large Scale Projects

- Mega Projects

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting