What is Video Surveillance Market Size?

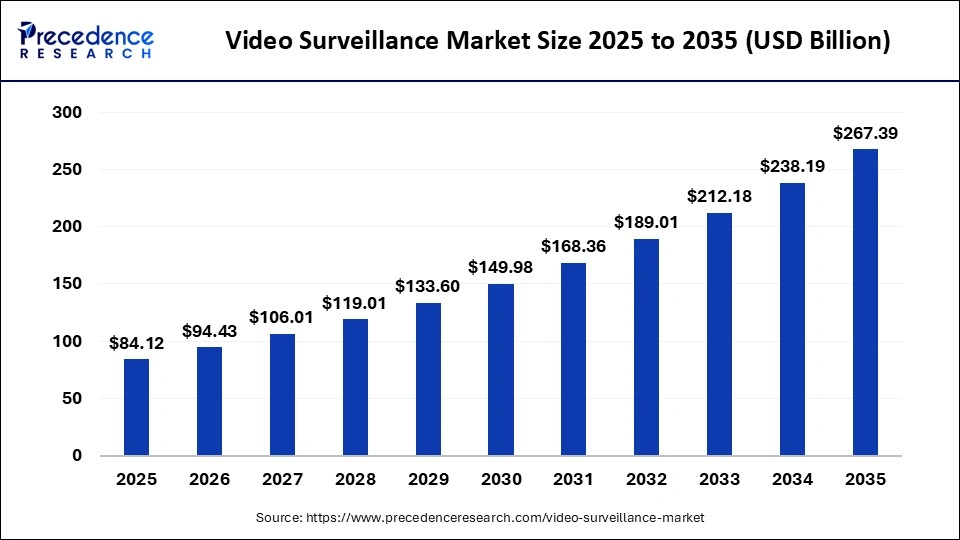

The global video surveillance market size accounted for USD 84.12 billion in 2025 and is predicted to increase from USD 94.43 billion in 2026 to approximately USD 267.39 billion by 2035, expanding at a CAGR of 12.26% from 2026 to 2035. The market is proliferating due to rapid technological advancements, such as AI/ML, cloud computing, and 5G, which can be integrated with video surveillance amid increasing safety concerns across manufacturing, industrial, public, and private spaces, driving demand for high-end security solutions.

Market Highlights

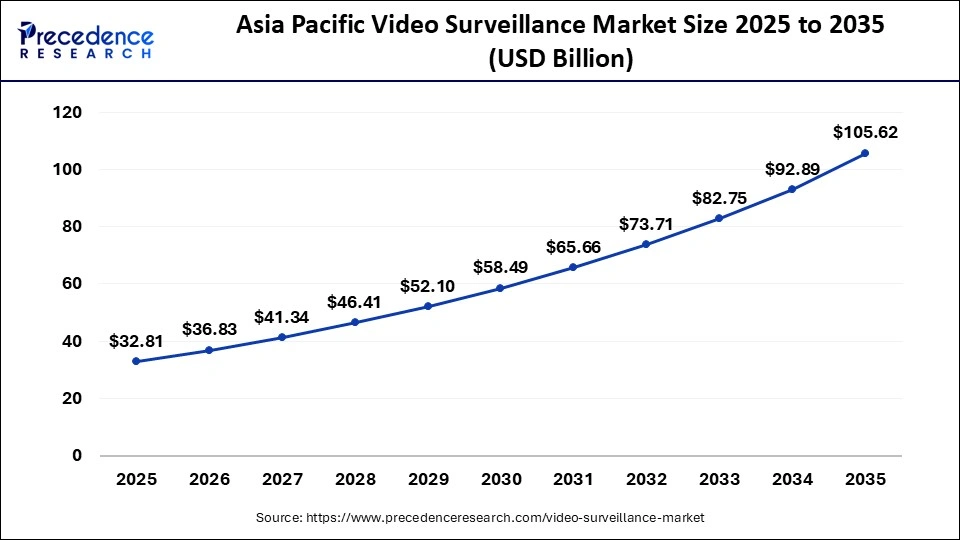

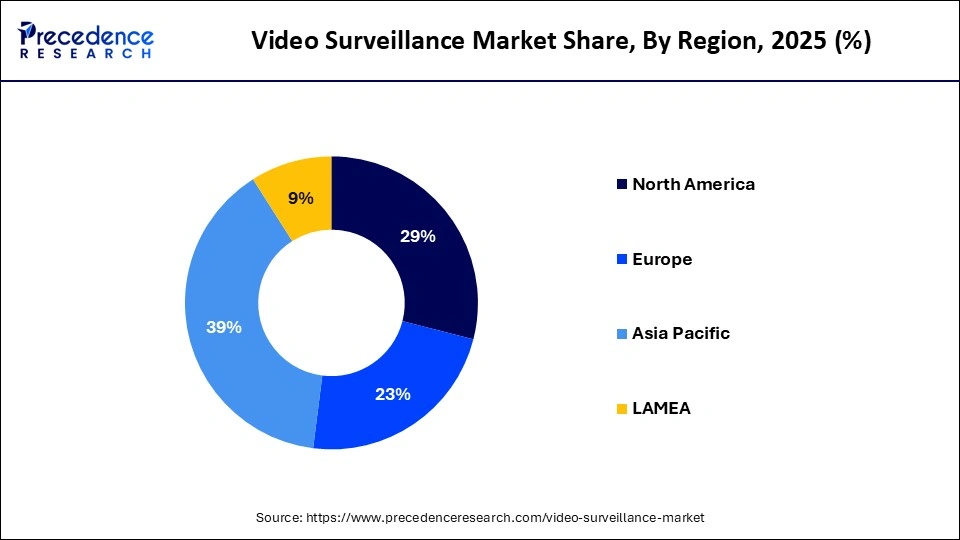

- Asia Pacific accounted for the largest market share of 39% in 2025 and is expected to witness the fastest CAGR from 2026 to 2035.

- By offering, the hardware segment held the major market share of 72% in 2025.

- By offering, the video analytics software segment is expected to grow at the fastest CAGR from 2026 to 2035.

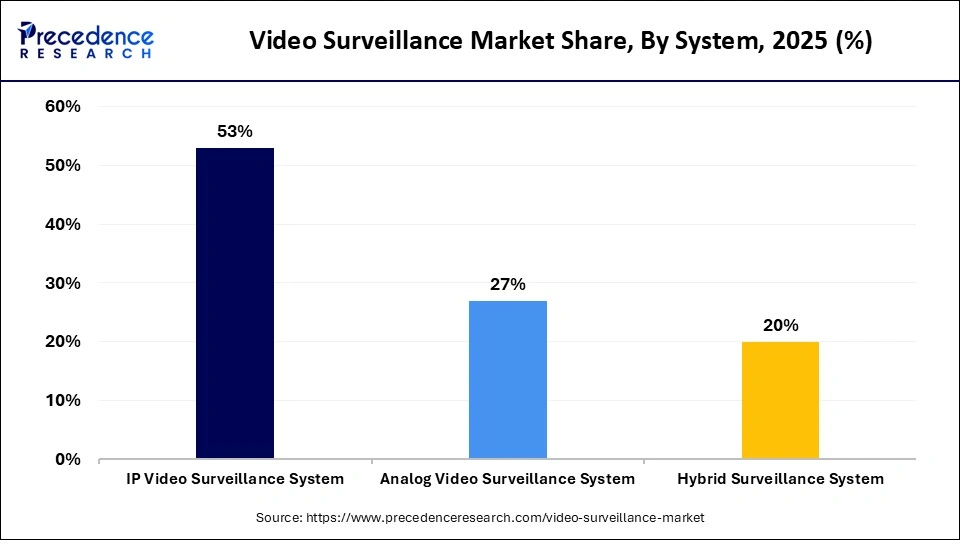

- By system type, the IP video surveillance segment generated the highest market share in 2025.

- By connectivity, the wired systems segment contributed the biggest market share in 2025.

- By connectivity, the wireless systems segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By technology, the HD & full HD surveillance segment accounted for the highest market share in 2025.

- By technology, the AI-based video surveillance segment is set to witness the fastest CAGR from 2026 to 2035.

- By application, the security & safety monitoring segment contributed the highest market share in 2025.

- By application, the operational monitoring segment is expected to grow the fastest CAGR from 2026 to 2035.

- By end-use industry, the government & public safety segment captured the largest market share in 2025.

- By end-use industry, the industrial & manufacturing segment is expected to witness the fastest CAGR from 2026 to 2035.

The Future of Video Surveillance: Intelligent, Connected, and Autonomous

The global video surveillance market comprises hardware, software and services used to monitor, record, analyse, and manage video data for security, safety, operational monitoring and analytics. The market includes IP cameras, analogue cameras, hybrid surveillance systems, NVRs and DVRs, video analytics, cloud surveillance platforms and integrated security systems deployed across commercial, industrial, residential, government, retail, transportation, banking and critical infrastructure facilities.

Modern deployments increasingly rely on high-resolution cameras, thermal imaging devices, panoramic multi-sensor units and cloud-connected platforms that support centralized management across multiple locations. Many organisations are also adopting unified security architectures that combine access control, alarms and video feeds into a single command platform.

Growth is driven by increasing security concerns, smart city development, AI-based video analytics, cloud adoption, rising crime rates, IoT integration and the need for real-time monitoring and automation across sectors. Governments are expanding citywide surveillance grids, and transportation authorities are integrating.

AI-driven traffic and incident detection systems and enterprises are investing in facial recognition, behaviour analysis and anomaly detection to strengthen safety and operational efficiency. The rise of remote monitoring, edge computing and automated alerts is further accelerating adoption, making video surveillance a critical component of both physical security and data-driven decision-making.

AI-Driven Security and Risk Detection in Digital Environments

The integration of Artificial Intelligenceis fundamentally transforming the video surveillance market from passive monitoring to proactive and intelligent security tools. This change is driven by AI's ability to automate tasks, analyze massive amounts of data in real time, and take proactive steps that significantly reduce reliance on error-prone human monitoring. AI-enabled video systems can detect unusual behaviour, identify patterns, classify objects, and trigger alerts without continuous manual supervision, helping security teams respond faster and more accurately.

A paradigm-shifting challenge in historical terms was the high rate of false alarms due to non-threatening causes such as animals, weather, or shadows while offering video surveillance security services, which can be addressed by AI algorithms with powerful video analytics capabilities. Modern AI models can differentiate between human movement and irrelevant activities, apply context-aware filtering and learn from previous events to reduce unnecessary notifications. These capabilities not only improve operational efficiency but also decrease fatigue for security personnel and lower overall response costs.

Video Surveillance Market Outlook

The global video surveillance market is majorly expanding due to the shift towards integration of advanced technologies like cloud computing, AI, and edge processing with video surveillance. And hardware like cameras are leading devices that get majorly installed for surveillance in public and private spaces, fueling the market growth globally.

Sustainable practices are gaining traction due to the increasing adoption of edge AI and cloud-based solutions to minimize latency and bandwidth usage. The market is addressing sustainability issues through innovations such as solar-powered cameras for power-scarce regions.

Major players in the market include established tech leaders like Hangzhou Hikvision Digital Technology, Dahua Technology and Honeywell International, where these companies boast diverse portfolios and extended market reach. The market is witnessing significant consolidation, such as Triton Partners' collaboration with Bosch's building technologies business and Axon's acquisition of Fusus.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 84.12 Billion |

| Market Size in 2026 | USD 94.43 Billion |

| Market Size by 2035 | USD 267.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Video Surveillance Market Segmental Insights

Offering Insights

Hardware: The segment held the largest market share in 2025 due to its fundamental role in video surveillance systems, which often include devices such as cameras, monitors, and storage systems that are essential to the system. Also, the advancements in configurations like night vision, high resolutions like more than 5MP and IP-based cameras are increasingly being adopted by many areas.

Software: The video analytics software segment is expected to witness the fastest CAGR during the foreseeable period, due to the integration of AI and ML, enabling more efficient real-time monitoring and threat detection than conventional surveillance methods. The segment's growth is further driven by rising public safety concerns, the expansion of smart cities, and the need for scalable solutions across sectors such as retail, transportation, and government.

Services: The segment is notably growing due to the reduced upfront costs, increased scalability, remote access, and constant maintenance managed by the offerors. Many businesses are shifting towards a subscription-based model rather than full ownership of hardware systems. It offers automatic updates and flexible scaling to meet evolving needs. Cloud-based video surveillance services also allow organizations to store footage securely off-site, integrate multiple locations into a single dashboard and deploy new analytics features without replacing existing infrastructure. This model is especially attractive for small and midsize enterprises, retailers and multi-site operations that need predictable monthly costs, strong cybersecurity support, and minimal IT burden.

System Type Insights

IP Video Surveillance System: The IP video surveillance segment held the largest market share in 2025 and is expected to witness the fastest CAGR over the foreseeable period, driven by superior image quality, high scalability, and integration capabilities compared to analogue systems. IP systems provide high-definition video support, advanced features such as remote access and cloud-based storage, along with AI integration for analytics.

Analog Video Surveillance System: The segment is proliferating notably due to the lowered costs, easy installation, use and its proven reliability for existing coaxial infrastructure. New HD cameras have analogue technology that offers enhanced resolution and picture quality as compared to traditional analogue cameras, making them a reliable option for surveillance systems.

Hybrid Surveillance System: The segment is growing due to offerings such as improved security via a combination of on-premises and cloud storage, which creates built-in redundancy against hardware failure or, in some cases, internet outages. They offer high-level flexibility, remote access and would be highly cost-effective for businesses with cost constraints and a need to do upgrades in their existing systems.

Connectivity Insights

Wired Systems: The wired systems segment held the largest market share in 2025. The segment is dominating due to the wired systems offering higher reliability, stability and suitability for large-scale installations, mainly in government and commercial areas. Wired systems are less susceptible to interference than wireless systems, and they provide an uninterrupted power supply, which is a basis for a high-security environment. These systems are commonly deployed in airports, data centers, correctional facilities and financial institutions where failure or downtime is unacceptable. Their ability to support higher bandwidth, handle large camera networks and maintain consistent video quality makes them the preferred choice for mission-critical surveillance infrastructures.

Wireless Systems: The wireless systems segment is expected to witness the fastest CAGR during the foreseeable period. The segment is growing due to its easy installation capabilities, greater flexibility and enhanced scalability. Wireless technology like 5G and Wi Fi 6 has increased the demand for remote access and cloud-based services. These systems enable rapid deployment in locations where cabling is difficult or costly, such as historical buildings, temporary event venues, and large outdoor environments. Improved network speeds and lower latency allow wireless cameras to support real-time video streaming, intelligent analytics, and mobile monitoring applications.

Cellular/Remote Surveillance Systems: The segment is notably growing in the global market as many cellular cameras can work from anywhere if there is a cellular signal, making it an ideal solution for remote areas or where the internet is rarely available like construction sites, rural properties and spaces reserved for events. These systems rely on 3G, 4G and increasingly 5G networks to transmit encrypted video feeds without requiring wired infrastructure or fixed broadband connections. They are widely used for mobile asset monitoring, temporary perimeter security and rapid deployment during emergencies or natural disasters where traditional networks are unavailable.

Technology Insights

HD & Full HD Surveillance: The segment held the largest share of the video surveillance market in 2025, due to the greater flexibility it offers between higher image quality and manageable data requirements. This is critical for advanced analytics and efficient data storage. It is a significant upgrade from standard definition cameras without the need for excessive storage and bandwidth for ultra-high definition cameras. HD and Full HD cameras also support clearer facial features, license plates, and movement patterns, which improve the accuracy of AI-driven analytics.

AI-Based Video Surveillance: The AI-based video surveillance segment is expected to witness the fastest CAGR during the foreseeable period. The segment is growing due to its ability to automate tasks such as real-time anomaly detection, facial recognition, and behavior analysis, thereby enhancing efficiency and reducing the frequency of false alarms. AI algorithms can classify objects, detect perimeter intrusions, recognize unauthorized access attempts, and identify suspicious behavior in crowded environments. These capabilities are increasingly used in airports, smart city control centers, banking institutions and logistics hubs to strengthen security operations.

IoT-Integrated Surveillance: The segment is growing as IoT devices are increasingly integrated with video surveillance systems to gather real-time data from various sensors and inputs, improving surveillance efficacy and user reliability. IoT-enabled cameras can connect with motion sensors, door access systems, environmental monitors and alarm devices to create a unified security network. This integration supports automated responses such as triggering lights, locking doors or sending alerts when specific events occur. Smart IoT ecosystems are especially beneficial for industrial sites, warehouses and smart buildings where surveillance footage must be correlated with machine status, occupancy data, and environmental readings.

Application Insights

Security & Safety Monitoring: The security and safety monitoring segment held the largest market share in 2025. The segment is dominating to mitigate increasing incidences of crimes, global security threats by terrorism activities and advancements in the technology like AI and ML which offer highly effective real-time monitoring and incident response. These offerings make video surveillance an invaluable asset in terms of safety and security. Modern deployments use high resolution cameras, automated intrusion detection, vehicle and person tracking, and AI-based alerting systems to identify threats faster and reduce reliance on manual supervision.

Operational Monitoring: The operational monitoring segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2035. The segment is growing due to technologies like video analytics and cloud computing along with AI integration to the video surveillance systems aiming to transform a passive security tool into an actionable business system with intelligence. Organizations are now using video feeds to optimize workflows, track equipment usage, monitor employee safety compliance and enhance overall operational efficiency. Retailers use heat mapping and footfall analytics to understand customer behavior, while manufacturing plants rely on AI-driven video systems to detect machinery faults, identify bottlenecks and ensure safe working conditions.

Remote Surveillance: The segment growth can be attributed to a couple of factors like increased security needs, real-time monitoring and cost savings by using 24/7 oversight that helps against increasing crime rates even from anywhere and irrespective of distant location to make safer places across the globe. Remote surveillance systems allow users to access live feeds through mobile apps, cloud dashboards and centralized command centers, enabling immediate responses to suspicious activity. These systems are widely deployed in construction sites, logistics yards, energy facilities and multi-location retail stores where on site security may not be feasible. Remote monitoring centers staffed by trained operators can verify alarms, dispatch security personnel and generate incident reports, significantly reducing the cost burden of physical patrols.

End-Use Industry Insights

Government & Public Safety: The government and public safety segment held the largest market share in 2025. The segment is highly dominating in the market owing to the mandates for public safety, stringent rules set by the government for national security and safety of confidential data, assets, and other powerful infrastructure, which is crucial for the governmental bodies along with the large-scale smart city projects going on recently across the globe.

Industrial & Manufacturing: The segment is expected to witness the fastest CAGR during the foreseeable period, due to the growing security issues and need to curb accidents that might turn fatal while working on the floors, along with safety reasons of the operational manufacturing process that needs constant surveillance. Modern industrial environments rely on continuous video monitoring to track machinery performance, detect unsafe behaviors and identify malfunctioning equipment before it causes injury. AI-enabled systems can automatically flag hazards such as workers entering restricted zones, missing protective gear or abnormal machine vibrations. Industries like automotive manufacturing, chemicals, oil and gas, and food processing increasingly use surveillance integrated with safety management platforms to reduce downtime, comply with regulatory requirements and prevent catastrophic incidents.

Transportation (Airports, Metro, Rail): The segment is significantly increasing due to the higher demand by the public with advanced security with AI-powered systems, which enhances security, safety, and operational efficiency. Transportation hubs require highly sophisticated solutions like thermal, cameras or HD cameras which help push the boundaries of the market's growth further.

Video Surveillance Market Regional Insights

The Asia Pacific video surveillance market size is expected to be worth USD 105.62 billion by 2035, increasing from USD 32.81 billion by 2025, growing at a CAGR of 12.40% from 2026 to 2035

Why is the Asia Pacific Video Surveillance Market Leading Across the Globe?

Asia Pacific held the largest market share in 2025, and the same region is expected to witness the fastest CAGR during the foreseeable period of 2025-2035. The region's robust growth can be attributed to a couple of leading factors like rapid urbanization and smart city projects, enhanced security concerns and safety reasons, increasing demand for surveillance by the middle class and the private sector along with the strong manufacturing base in the Asia Pacific region.

Moreover, governments are heavily investing in building smart cities that require intelligent video surveillance systems for various factors like traffic management, public safety, proper planning for urban cities to curb increasing issues related to crime rates, national security threats and cross-border disputes. Another factor is the strong industrial base for a maximum rate of manufacturing, such surveillance systems, further fueling the region's growth.

China Video Surveillance Market Trends

The China video surveillance market is majorly driven by smart city initiatives, AI integration, and 5G deployment across the region. Key trends that support market growth are a strong emphasis on hardware development, sales and deployment with short-term services, priority for higher resolution cameras along with advancements in storage technologies like hyper-converged applications and some players that are actively working to offer innovative solutions.

The North America video surveillance market is significantly expanding due the strong government support for secure smart cities development, rapid adoption of advanced technologies like AI-driven analytics and cloud storage and growing security issues in the public and private sectors that needs to work upon.

The region is a base to a leading technology players and security solutions providers. Both private and public sector in the region is heavily investing in the modernizing security infrastructure including smart cities, public transportation networks, border control and school security modernization.

The U.S. video surveillance market trends include a huge projected market expansion, the increasing adoption of cloud-based and AI-powered systems for analytics and growing inclination towards high-resolution cameras such as 4K for better security vision. The commercial and infrastructure areas are leading drivers of the market due to their strong connection with the government funding as a part of smart city development in the U.S.

The European video surveillance market is expanding due to its security concerns, governments investments and various initiatives regarding public safety and the smart city projects. Also, the rapid adoption of AI powered video analytics enables advanced systems like object tracking, facial recognition, behavioural analysis and real time threat detection which further minimizes human intervention, fuelling the market's growth in the region.

Several EU countries are deploying large scale surveillance upgrades in transportation hubs, stadiums, border control zones and city centres to strengthen situational awareness. Programs such as the EU Urban Security Initiative, Safe City pilots in France and Spain and the UK's counter terrorism modernisation efforts are increasing procurement of intelligent cameras and unified VMS platforms.

UK Video Surveillance Market Trends

The region is notably growing due to the ongoing need to address security threats in real time, technological advancements for passive recording and intelligent data gathering. The UK government is looking to develop transportation hubs, railways and public facilities and promote smart city initiative, further expanding the market's growth. Investments in modern CCTV networks across London Underground, national rail stations and major airports such as Heathrow and Manchester are increasing demand for high resolution cameras and AI assisted monitoring platforms. Local councils are upgrading legacy systems with cloud connected VMS solutions, automated incident detection and analytics that support crowd management, traffic optimisation and public safety alerts.

The Middle East and Africa video surveillance market is notably expanding owing to the government and regulatory bodies in the region such as the Security Industry Regulatory Agency have necessitate to installation of surveillance systems in several public and commercial areas. Video surveillance is a leading part of smart city initiative. Rapid urbanization and new infrastructure development like hotels, stadiums, resorts and other mega projects in the region further fuels the region's growth.

Countries such as the United Arab Emirates and Saudi Arabia are implementing mandatory CCTV policies across malls, schools, airports, residential towers and industrial zones to strengthen public safety compliance. Mega projects like NEOM, Lusail City, Dubai Expo legacy sites and new tourism districts rely heavily on AI enabled cameras, centralized command centres and cloud VMS platforms for traffic control, crowd management and security automation.

UAE Video Surveillance Market Trends

The region is experiencing significant growth rate owing to the convergence of factors like stringent government rules for security concern, leading smart city initiatives and rapid installation of security systems among public spaces to comply with stringent security laws. Also, the initiatives like the Abu Dhabi Digital Initiative and Dubai Smart City Initiative are integrating advanced AI video surveillance into urban planning.

These programs involve large scale deployments of intelligent cameras, automated number plate recognition systems, video analytics for crowd flow management and integrated command and control centers that operate city services in real time. Government authorities in GCC countries require surveillance coverage in malls, residential complexes, schools and critical infrastructure, driving widespread adoption across both public and private sectors. New projects in transport networks, mega malls, industrial zones and tourism districts are embedding AI supported monitoring for traffic optimisation, emergency response coordination and safety compliance.

Video Surveillance Market Value Chain

The stage involves the design and production of physical devices like cameras, storage components, and recorders.

Key Players-Hikvision, Dahua Tech, Axis Comunications, Panasonic, Pelco, and Hanwha Vision.

The stage involves creating an intelligent and smart software system that manages and analyzes videos and data from sources.

Key Players- Eagle Eye Networks, Genetec, Milestone Systems.

The stage involves the installation, maintenance, and offerings of cloud-based services like VSaaS.

Key Players- Eagle Eye Networks and Verkada.

Video Surveillance Market Companies

A top-tier provider of video-centric smart IoT and surveillance systems, offering AI-driven analytics, thermal imaging, and integrated security platforms. The company supports large-scale deployments across smart cities, transportation, and enterprise security.

A U.S.based global security solutions provider offering access control, intrusion detection, video systems, and integrated building security platforms. Honeywell’s portfolio emphasizes industrial-grade reliability and advanced automation.

A pioneer in IP video surveillance, supplying high-quality network cameras, video encoders, and cloud-based video management tools. Axis solutions support enterprise-level security with strong cybersecurity and system integration capabilities.

Specializes in thermal imaging cameras, night-vision systems, and intelligent sensing technologies used across industrial, defense, and security applications. FLIR integrates thermal analytics with perimeter protection and critical infrastructure monitoring.

Provides end-to-end video surveillance, intrusion alarm, access control, and integrated building security platforms. Bosch focuses strongly on AI-based video analytics and scalable enterprise-grade security infrastructure.

Known for advanced video analytics, high-resolution cameras, and the ACC video management system, all under the Motorola Solutions umbrella. Avigilon emphasizes AI-assisted threat detection and unified security ecosystems.

One of the largest global manufacturers of video surveillance equipment, offering AI-enabled cameras, NVRs, and integrated security solutions. The company supports applications from smart cities to commercial and industrial sites.

Supplies professional video surveillance cameras, recording systems, and intelligent monitoring solutions. Panasonic integrates imaging expertise with AI analytics for public safety, transportation, and enterprise environments.

A major provider of video surveillance systems, including network cameras, AI-enabled analytics, and cybersecurity-focused solutions. Hanwha is known for reliability and wide applicability across commercial and urban deployments.

Offers network cameras, video servers, VMS solutions, and end-to-end IP surveillance systems. Vivotek emphasizes interoperability, affordable scalability, and integration with global security platforms.

Recent Developments

- In June 2025, Honeywell introduces first first-ever CCTV camera portfolio, which is manufactured in India. This brings enterprise-grade cybersecurity capabilities with rich features to it. (Source: https://www.honeywell.com)

- In September 2025, a leader in the market for security solutions, Motorola Solutions, acquired mission-critical technology provider, Silvus Technology Holdings, with a $4.4 billion deal, aiming to provide support for its mobile ad hoc networks. (MANET) (Source:https://www.asisonline.org)

Video Surveillance MarketSegments Covered in the Report

By Offering

- Hardware

- Cameras (IP, analog, PTZ)

- Recorders (NVR, DVR)

- Servers & Storage

- Software

- Video Management Software (VMS)

- Video Analytics Software

- AI/Deep Learning Tools

- Services

- Installation & Integration

- Maintenance

- Managed Video Surveillance / VSaaS

By System

- IP Video Surveillance System

- Analog Video Surveillance System

- Hybrid Surveillance System

By Connectivity

- Wired Systems

- Wireless Systems

- Cellular/Remote Surveillance Systems

By Technology

- HD & Full HD Surveillance

- Ultra-HD/4K Surveillance

- AI-Based Video Surveillance

- IoT-Integrated Surveillance

- Facial Recognition / Behaviour Analytics

By Application

- Security & Safety Monitoring

- Traffic Monitoring & Transportation

- Operational Monitoring

- Access Control Integration

- Remote Surveillance

By End-Use Industry

- Commercial (offices, retail, hospitality)

- Residential

- Industrial & Manufacturing

- Government & Public Safety

- Transportation (airports, metro, rail)

- Banking & Financial Services

- Healthcare Facilities

- Education Institutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting