What is the VMAT2 Inhibitors Market Size?

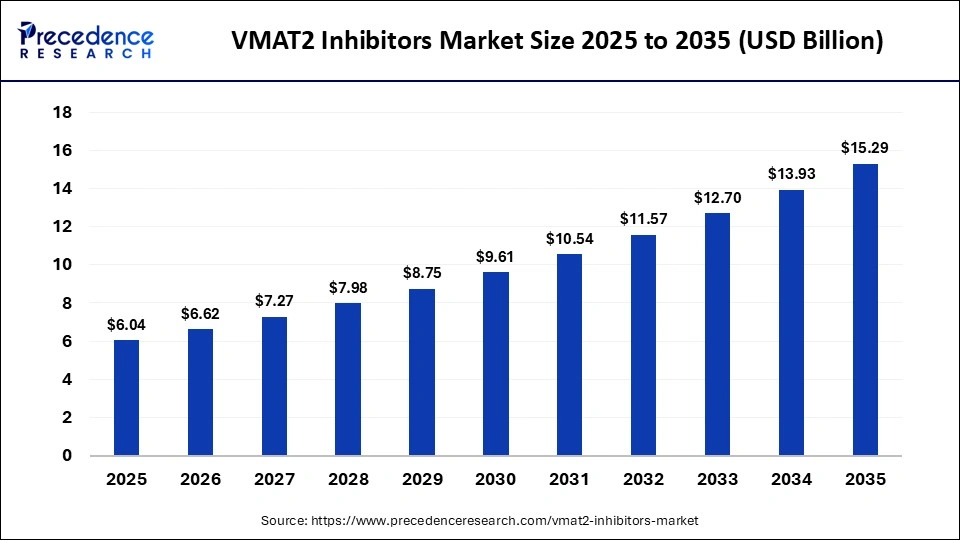

The global VMAT2 inhibitors market size was calculated at USD 6.04 billion in 2025 and is predicted to increase from USD 6.62 billion in 2026 to approximately USD 15.29 billion by 2035, expanding at a CAGR of 9.74% from 2026 to 2035. This market is growing due to the rising prevalence of movement disorders, such as tardive dyskinesia, and the increasing adoption of targeted neurological therapies.

Market Highlights

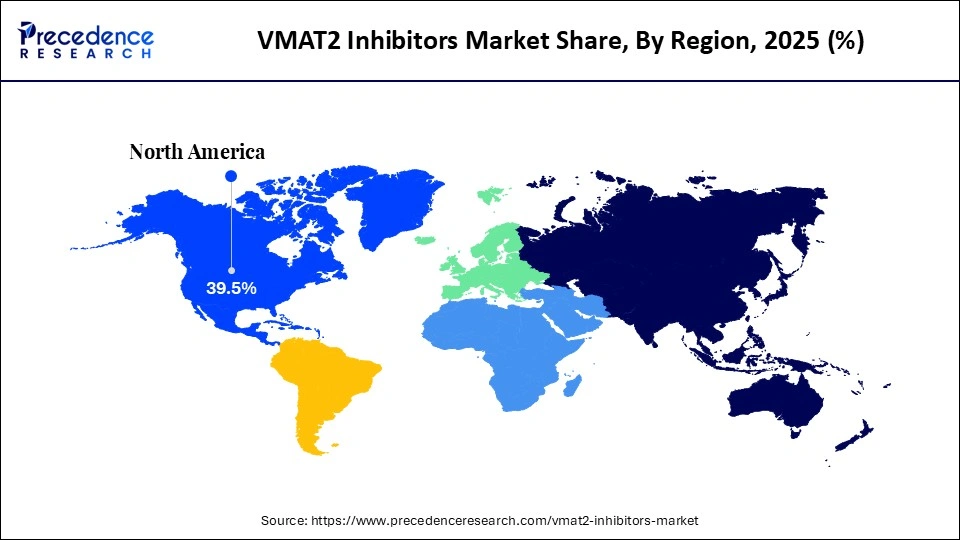

- North America dominated the global VMAT2 inhibitors market with a major revenue of approximately 39.5% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

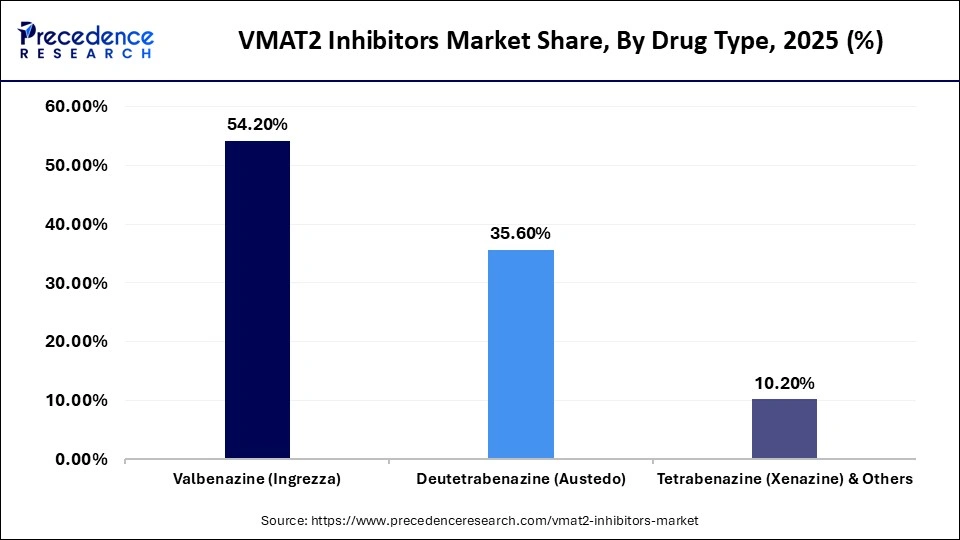

- By drug type, the valbenazine segment generated the biggest market share of approximately 54.2% in 2025

- By drug type, the deutetrabenazine segment is expected to expand at the fastest CAGR between 2026 and 2035.

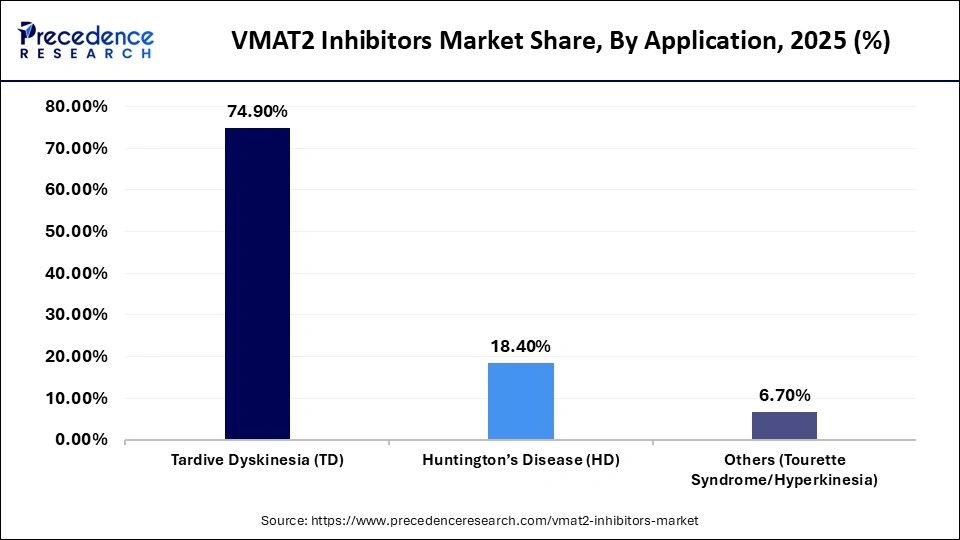

- By application, the tardive dyskinesia segment contributed the highest market share of approximately 74.9% in 2025.

- By application, the Huntington's disease segment is expected to grow at a strong CAGR between 2026 and 2035.

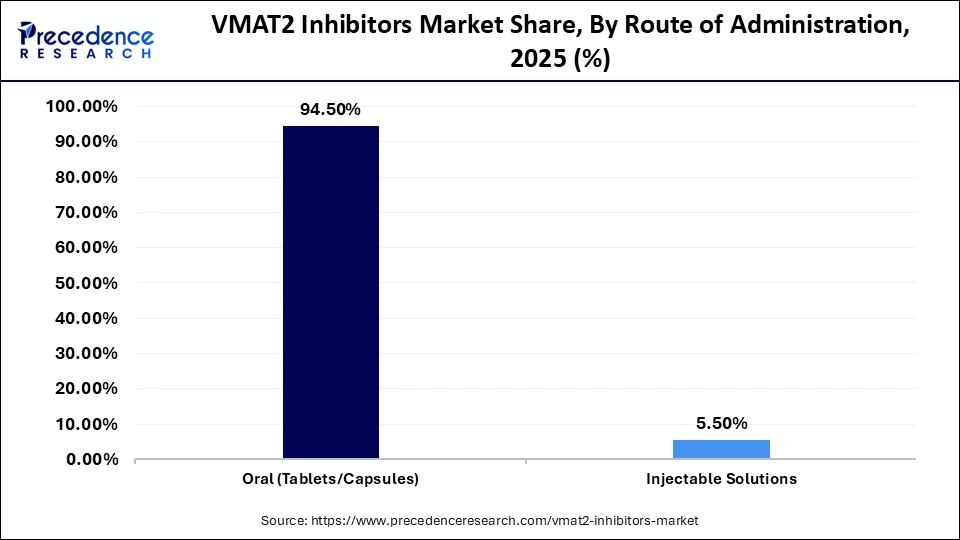

- By route of administration, the oral segment held the highest market share of approximately 94.5% in 2025.

- By route of administration, the injectable solutions segment is expected to expand at the fastest CAGR from 2026 to 2035.

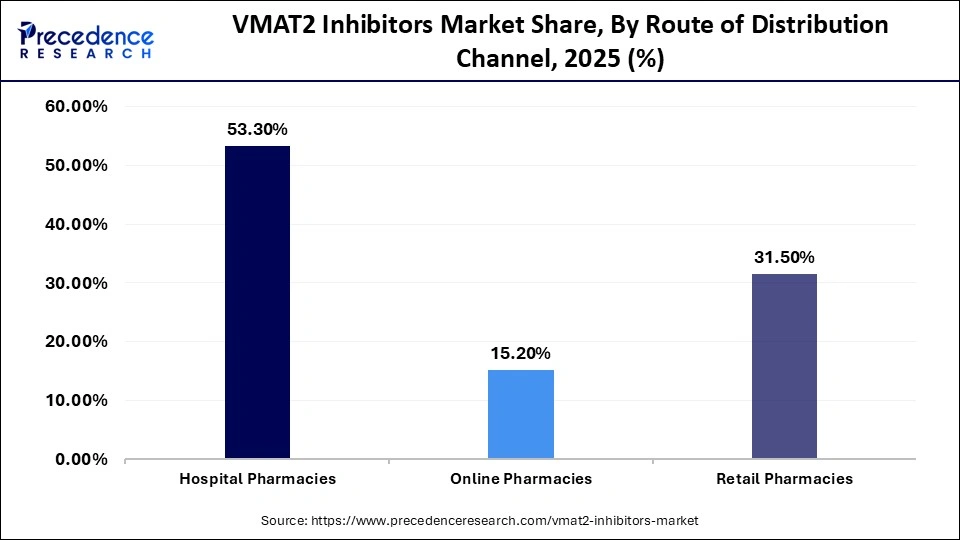

- By distribution channel, the hospital pharmacies segment generated the biggest market share of approximately 53.3% in 2025.

- By distribution channel, the online pharmacies segment is expected to expand at the fastest CAGR between 2026 and 2035.

Why is the VMAT2 Inhibitors Market Gaining Momentum?

The market comprises pharmaceutical agents that reversibly block the Vesicular Monoamine Transporter 2 (VMAT2) protein, which is responsible for loading monoamines like dopamine into synaptic vesicles. By reducing dopamine release in the motor striatum, these drugs provide symptomatic relief for hyperkinetic movement disorders such as Tardive Dyskinesia (TD) and Huntington's disease (HD) chorea.

More people are becoming aware of diagnosis and treating movement disorders, especially tardive dyskinesia and Huntington's disease. The market for VMAT2 inhibitors is growing as a result of growing healthcare spending, more approved targeted neurological medications, and easier access to specialty treatments.

Major Market Trends

- Shift Toward Targeted Neurology Therapies: Clinicians increasingly prefer VMAT2 inhibitors due to their mechanism-specific action and reduced off-target effects.

- Higher Prescription Rates in Psychiatric: Care Growing long-term use of antipsychotics is indirectly increasing demand for VMAT2 inhibitors to manage side effects.

- Focus on Real-World Evidence Studies: Companies are investing in post-marketing studies to demonstrate long-term safety and effectiveness.

- Digital Monitoring in Movement Disorders: Wearables and digital tools are being used to track symptom severity and treatment response.

- Preference for Oral Small-Molecule Drugs: Oral VMAT2 inhibitors remain favored due to ease of administration and outpatient use

- Regulatory Support for Rare Neurological Disorders: Accelerated approvals and orphan designations are shaping faster market entry.

- Increased Specialist Involvement: Greater engagement of neurologists and movement-disorder specialists is improving diagnosis accuracy.

Future Market Outlook

- Expansion into Early-Stage Disease Treatment: Opportunity to position VMAT2 inhibitors earlier in treatment pathways.

- Untapped Markets in Developing Countries: Low awareness and underdiagnosis create room for market penetration.

- Next-Generation VMAT2 Molecules: Development of drugs with improved safety, dosing flexibility, and reduced sedation.

- Combination Therapy Potential: Use alongside antipsychotics and other neurological treatments to improve patient outcomes.

- Tele-neurology Integration: Growth of remote consultations can expand patient access to VMAT2 therapies.

- Personalized Medicine Approaches: Biomarker based patient selection can enhance treatment success rates.

- Strategic Licensing and Partnerships:Collaborations between biotech firms and pharma companies can accelerate commercialization.

How is Artificial Intelligence Influencing the VMAT2 Inhibitors Market?

Artificial intelligence (AI) is significantly impacting the market for VMAT2 inhibitors by streamlining drug discovery and development processes. It helps identify potential compounds faster, optimizes clinical trial designs, and enables precise patient stratification for movement disorder therapies. AI also analyzes neurological data, predicts patient responses, and generates real-world evidence, supporting more personalized and effective treatments. This leads to improved patient outcomes, faster commercialization, and overall growth in the VMAT2 inhibitors market.

What Government Initiatives are Supporting the VMAT2 Inhibitors Market?

The VMAT2 inhibitors market is being indirectly propelled by supportive government and health authority initiatives aimed at improving the diagnosis and management of neurological disorders. Awareness campaigns, patient assistance programs, and expanded insurance coverage are helping grow the patient pool by ensuring access to essential treatments. Increased funding for clinical trials and neurological research is accelerating the development of safer, more effective VMAT2 therapies. Across both developed and emerging markets, these policies are enhancing treatment accessibility and encouraging adoption of approved medications, thereby driving market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.04 Billion |

| Market Size in 2026 | USD 6.62 Billion |

| Market Size by 2035 | USD 15.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Type, Application, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drug Type Insights

What made valbenazine the dominant segment in the VMAT2 inhibitors market?

The valbenazine segment dominated the market with a major share of 54.2% in 2025, driven by its favorable long-term safety profile and strong clinical efficacy. It is widely preferred as a first-line treatment for movement disorders requiring sustained symptom control, thanks to its once-daily oral dosage and broad physician acceptance. Valbenazine's market dominance is further strengthened by extensive empirical data and regulatory approvals, which have enhanced prescriber confidence. Additionally, the segment's continued leadership is supported by label expansions and ongoing post-marketing research, further cementing its position in the treatment of hyperkinetic disorders.

The deutetrabenazine segment is expected to grow at the fastest CAGR in the market in the coming years, driven by its superior pharmacokinetic profile and reduced dosing frequency compared to older treatments. The drug's ability to provide customized treatment plans and the growing clinical adoption for various movement disorders like Huntington's disease and tardive dyskinesia further fuels its market expansion. Additionally, the increasing patient awareness, along with improved reimbursement coverage in strategic regions, is making deutetrabenazine more accessible to patients, driving its widespread adoption in treatment plans.

Application Insights

Why did the tardive dyskinesia segment dominate the VMAT2 inhibitors market?

The tardive dyskinesia segment dominated the market while holding the largest share of 74.9% share in 2025, driven by the significant unmet need for effective long-term treatments. The widespread adoption of VMAT2 inhibitors in this segment is supported by rising diagnosis rates, increased use of antipsychotic medications, and strong clinical evidence demonstrating efficacy and safety. Long-term symptom management is a key factor, leading to repeat prescriptions and sustained market demand. Additionally, the expanding patient pool, aided by enhanced screening and awareness in psychiatric settings, further reinforces the segment's dominance.

The huntington's disease segment is expected to grow at a significant rate over the forecast period, driven by the increasing focus on rare neurological disorders and improved access to specialized treatments. Rising awareness among neurologists and ongoing clinical research are contributing to the higher adoption of VMAT2 inhibitors in managing symptoms associated with Huntington's disease. This trend reflects a growing emphasis on personalized care and targeted therapies for complex movement disorders.

Route of Administration Insights

Why did the oral segment dominate the VMAT2 inhibitors market?

The oral segment dominated the market with the highest share of 94.5% in 2025, as oral tablets and capsules are preferred for ease of use, home administration, and better patient adherence. Leading drugs like valbenazine and deutetrabenazine are available in oral formulations, supporting widespread clinical adoption and making oral administration the standard route.

The injectable solutions segment is expected to grow at a rapid pace in the coming years, fueled by the need for alternative delivery methods for patients facing adherence challenges. Growth is supported by advancements in hospital-based treatment settings and formulation technologies, which improve ease of administration and dosage control. In critical cases, injectables offer precise and controlled dosing, while ongoing clinical evaluations are expected to expand their future applications across various movement disorder treatments.

Distribution Channel Insights

Why did the hospital pharmacies segment dominate the VMAT2 inhibitors market?

The hospital pharmacies segment dominated the market with a 53.3% share in 2025 because they play a central role in the controlled initiation and management of these therapies, which are often prescribed for complex neurological conditions. Their specialist-driven prescriptions ensure accurate dosing and patient monitoring, reducing the risk of adverse effects. Additionally, strong partnerships with manufacturers allow hospitals to maintain a consistent and reliable supply of VMAT2 inhibitors, making them the preferred distribution channel for these medications.

The online pharmacies segment is expected to expand at the highest CAGR due to the increasing convenience and accessibility they offer to patients, especially those with limited mobility or living in remote areas. Telemedicine and e-prescription trends are enabling patients to obtain their medications without frequent hospital visits, improving adherence. Moreover, online platforms often provide competitive pricing, home delivery, and discreet services, which are appealing to patients managing long-term neurological conditions, driving the segment's rapid adoption.

Regional Insights

How Big is the North America VMAT2 Inhibitors Market Size?

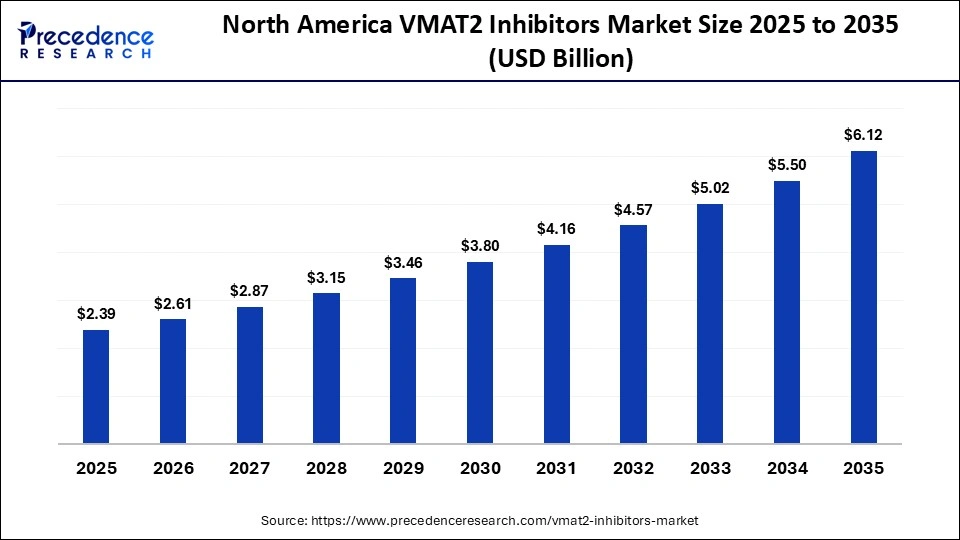

The North America VMAT2 Inhibitors market size is estimated at USD 2.39 billion in 2025 and is projected to reach approximately USD 6.12 billion by 2035, with a 9.86% CAGR from 2026 to 2035.

What made North America the dominant region in the VMAT2 inhibitors market?

North America dominated the market while holding a 39.5% share in 2025, driven by early adoption of cutting-edge neurological treatments and a keen understanding of movement disorders. Market leadership is maintained by high diagnosis rates, cutting-edge healthcare infrastructure, and advantageous reimbursement regulations. Treatment penetration is further strengthened throughout the region by ongoing clinical research and the availability of specialists. Rapid commercialization of new treatments is facilitated by the strong presence of important pharmaceutical companies. Long-term treatment confidence is also being enhanced by the generation of real-world evidence.

What is the Size of the U.S.VMAT2 Inhibitors Market?

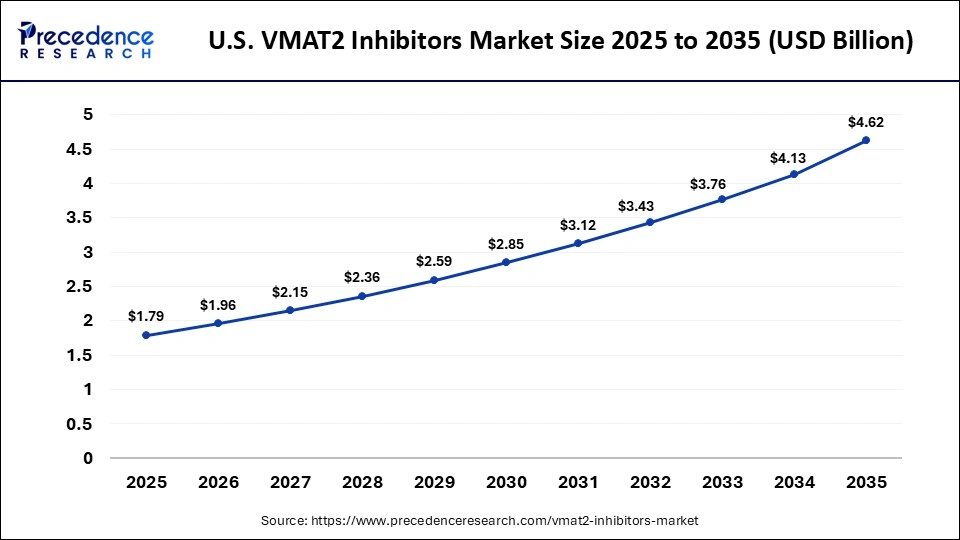

The U.S. VMAT2 Inhibitors market size is calculated at USD 1.79 billion in 2025 and is expected to reach nearly USD 4.62 billion in 2035, accelerating at a strong CAGR of 9.95% between 2026 and 2035.

U.S. VMAT2 Inhibitors Market Trends

The U.S. is a major contributor to the North American market, driven by increased awareness of movement disorders and better neurological care infrastructure. Growing investments in specialty pharmaceuticals and broadening access to branded treatments are driving market expansion. Higher treatment rates are also a result of urbanization and improved diagnostic tools. Treatment accessibility is increasing thanks to government support for managing rare diseases. Growing partnerships between regional and international pharmaceutical companies are enhancing market presence.

How is the opportunistic rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest rate in the market due to increasing awareness and diagnosis of movement disorders, coupled with improving healthcare infrastructure and rising access to specialized neurological care. Growing investments in healthcare, expanding hospital networks, and the presence of patient assistance programs are enabling greater adoption of these therapies. Additionally, an increasing geriatric population and rising use of antipsychotic medications are creating a larger patient pool, while favorable regulatory pathways and expanding reimbursement coverage further boost market growth in the region.

India VMAT2 Inhibitors Market Trends

The market in India is growing rapidly due to growing awareness of neurological conditions and increased access to specialty medications. VMAT2 inhibitor adoption is being aided by the expansion of private healthcare facilities and the increased availability of neurologists. Growing health consciousness and steady improvements in reimbursement are anticipated to further stimulate market growth, medical tourism, and specialty neurology centers, enhancing treatment reach. Adoption of appropriate therapy is also driven by increased physician education initiatives.

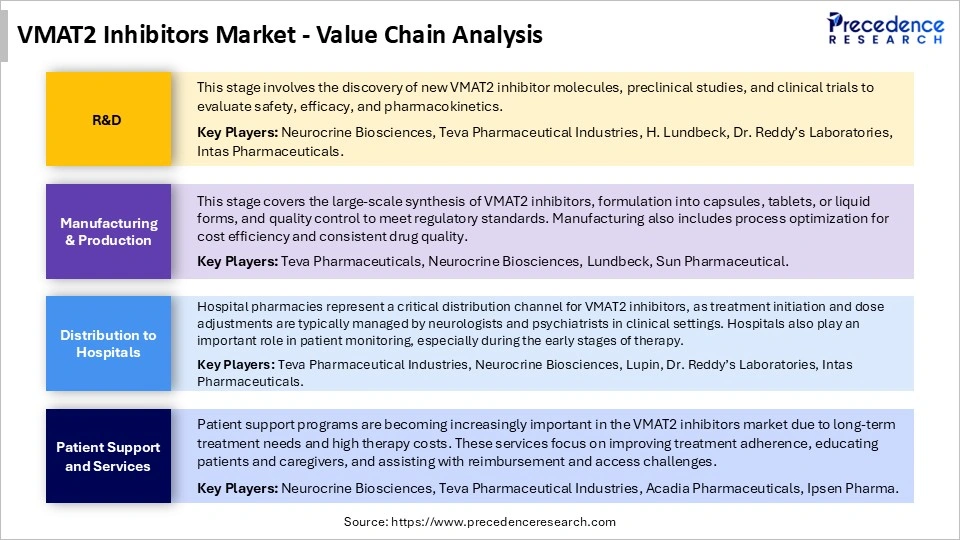

VMAT2 Inhibitors Market Value Chain Analysis

Recent Developments

- In January 2026, Neurocrine Biosciences announced the start of a Phase 2 clinical study for NBI-1065890 in adults with tardive dyskinesia. The trial is a randomized, double-blind, placebo-controlled study with approximately 100 adult participants to assess the efficacy, safety, and tolerability of the VMAT2 inhibitor over eight weeks. NBI-1065890 is an internally discovered compound designed as a potentially longer-acting treatment.(Source: https://www.prnewswire.com)

- In March 2025, Neurocrine Biosciences announced the initiation of a Phase 1 clinical study for NBI-1140675, a novel, oral, selective second-generation VMAT2 inhibitor being evaluated for its safety, tolerability, pharmacokinetics, and pharmacodynamics in healthy adult participants.(Source: https://neurocrine.gcs-web.com)

Segments Covered in the Report

By Drug Type

- Valbenazine (Ingrezza)

- Deutetrabenazine (Austedo)

- Tetrabenazine (Xenazine) & Others

By Application

- Tardive Dyskinesia (TD)

- Huntington's Disease (HD)

- Others (Tourette Syndrome/Hyperkinesia)

By Route of Administration

- Oral (Tablets/Capsules)

- Injectable Solutions

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting